Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNYT Op Ed "The Picture of a Broken Tax System"

https://www.nytimes.com/2020/09/28/opinion/trump-tax-code.html?action=click&module=Opinion&pgtype=HomepageDonald Trump’s tax returns illustrate the profound inequities of the tax code and the shambolic state of federal enforcement.

By The Editorial Board

In the years before he became president, Donald Trump lived lavishly while paying little in federal income taxes. The Times reported on Sunday that Mr. Trump paid no taxes in 10 of the 15 years immediately preceding his run for the White House. In each of the following two years, 2016 and 2017, he paid the token sum of $750.

Remove Mr. Trump’s current job from the picture, and what remains is a story that still demands attention. The portrait of a man who earned hundreds of millions of dollars, lived a life of comic excess and yet, in many years, paid nothing in federal income taxes is an indictment of the federal income tax system. It illustrates the profound inequities of the tax code and the shambolic state of enforcement.

The government has sharply reduced the share of income that it collects in taxes from the wealthiest Americans. One recent study found that the 400 wealthiest households paid 70 percent of their total income in federal, state and local taxes in 1950, 47 percent in 1980 and 23 percent in 2018. The cuts in tax rates have come mostly at the federal level.

The government allows income to be sheltered from taxation for hundreds of different reasons, but real estate investors have long enjoyed a particularly sweet set of loopholes. A homeowner can write off the interest payments on a mortgage loan, but the owners of commercial buildings get a host of other benefits, too. It’s relatively easy for real estate investors to use past losses to offset income, to defer income and to avoid reporting some kinds of income. Best of all, the law lets investors claim a building is depreciating in value — a theoretical loss of money — even as the actual value increases.

snip

Paying taxes is a civic duty, and the government needs the money. Most Americans try to pay what they owe, even if they wish they owed less, and they take comfort in the assumption that most of their neighbors are conducting themselves in the same way.

Americans deserve to know that the president has paid his taxes, too.

_________________________

sorry about the paywall. The comments are well worth reading. People are PISSED OFF Bigly.

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

5 replies, 539 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (16)

ReplyReply to this post

5 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

NYT Op Ed "The Picture of a Broken Tax System" (Original Post)

NRaleighLiberal

Sep 2020

OP

There needs to be serious consequences. Especially when it involves big money.

LiberalFighter

Sep 2020

#2

FakeNoose

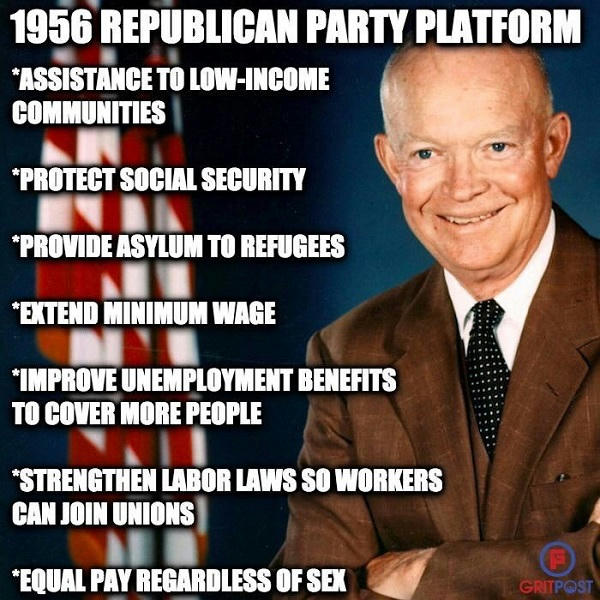

(32,579 posts)1. This should be our mantra:

FUCK THE ONE-PER-CENTERS!

And don't forget this one:

![]()

![]()

![]()

AllaN01Bear

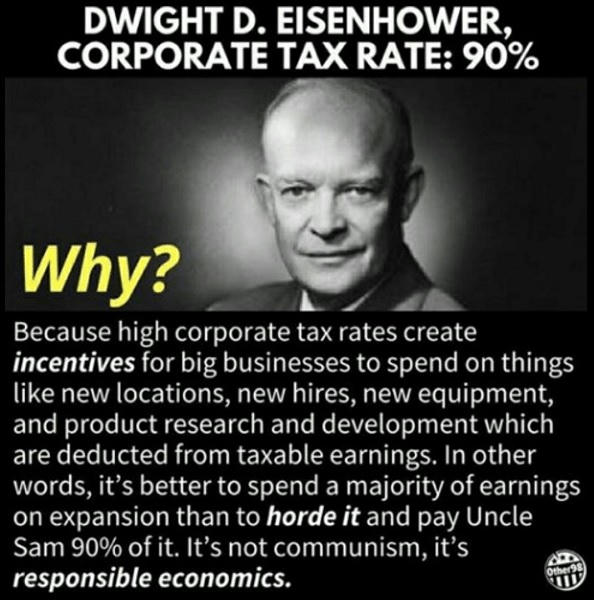

(17,987 posts)3. that republican party no longer exists,except in pockets .

i am waiting for the chickens to come home to roost and collect what is owed them

Earthshine2

(3,949 posts)5. I like Ike!

That was his campaign slogan.

Was he the last decent republican president?

LiberalFighter

(50,783 posts)2. There needs to be serious consequences. Especially when it involves big money.

Prison is not enough in my opinion.

TexasBushwhacker

(20,142 posts)4. FWIW, a commercial building does depreciate over 39 years

but the LAND does not depreciate. It is generally the land that goes up in value. Properly maintained, the building itself will probably go up in value too.

IMHO, we need to have a fairly aggressive Alternative Minimum Tax for households AND corporations. No free lunch.