General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhy Are Some People So Upset About Canceling Student Debt?

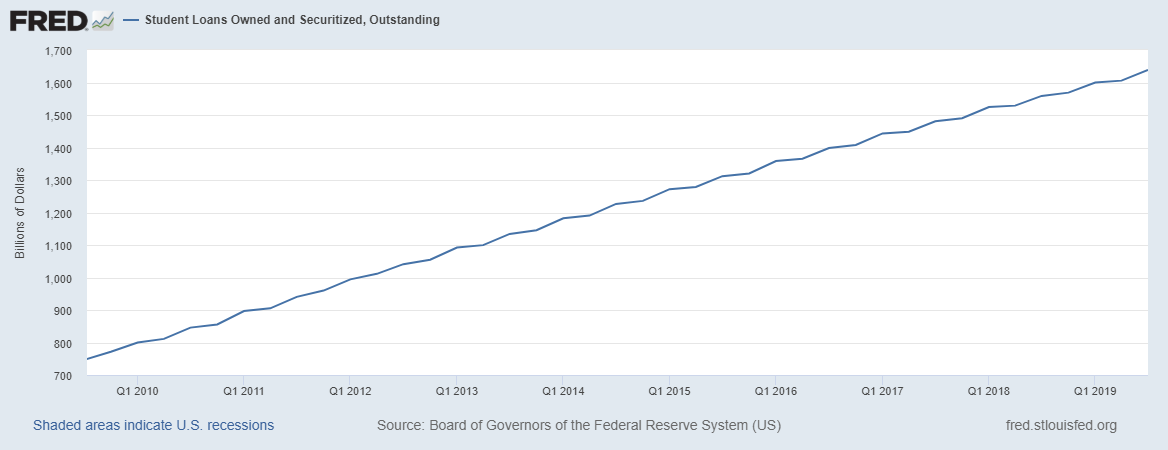

President-Elect Joe Biden will not take office until January 20th, but people are already discussing what will and won’t change once he’s sworn in. One possible agenda item for Biden’s first day involves the student loan debt crisis. With student loan debt currently standing at over $1.7 trillion nationally, it’s no wonder that Biden and his team have been discussing ways to ease the burden of student debt. During a recent interview, Senate Minority Leader Chuck Schumer suggested that Biden could cancel up to $50,000 of student loan debt per borrower — and do it very quickly, through an executive order.

But rather than sparking unanimous joy, the notion that countless Americans could suddenly be relieved of crippling debt was controversial, and #CancelStudentDebt began trending on Twitter. Not everyone was thrilled with the idea that people who currently have student debt wouldn’t have to pay all of it.

Link to tweet

?s=20

Those opposed to canceling student debt claim that doing so would create resentment in people who spent a long time paying off their own college debt, who might have prioritized jobs that pay well over jobs they’d enjoy, or delayed milestones like home ownership, marriage, or having a child because of their debt. They had to sacrifice and suffer, and it rankles them that current and future college grads might not have to sacrifice and suffer in the same way.

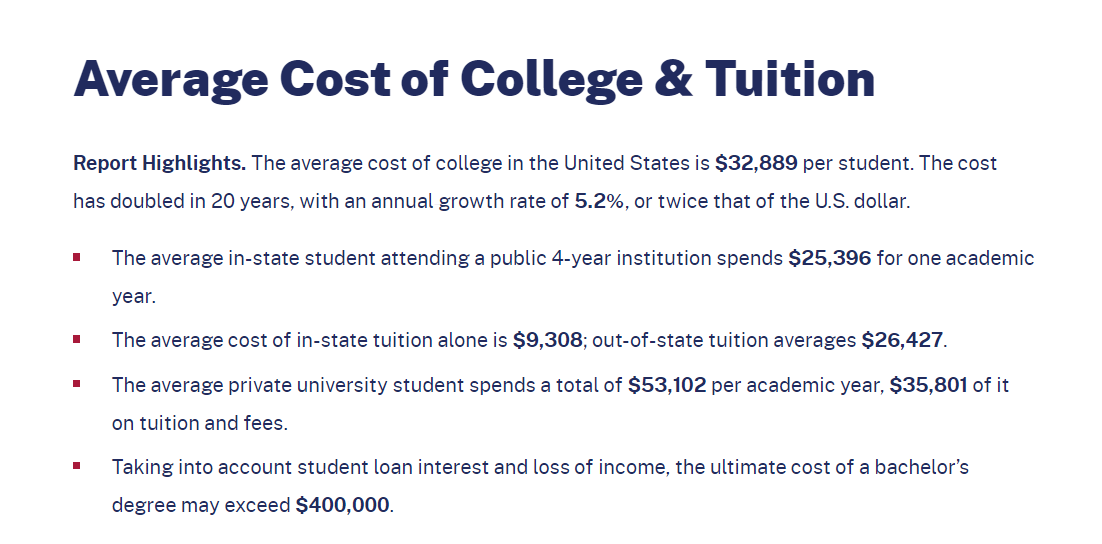

Something those people should keep in mind, though, is that their experience of massive student loan debt is not one shared by every generation of students. From 1988 to 2018, the cost of college increased by 213%. Wages, unsurprisingly, did not increase by 213% in that period — in fact, they’ve pretty much remained stagnant since the 1970s. In 2019, for the first time ever, the average amount of debt that students who borrowed money graduated with was over $30,000. In addition, currently about 11% of student loans are in default or are over 90 days delinquent. While federal student loan interest rates are currently set to 0% because of the pandemic, this expires after December 31st, 2020 unless Congress extends it, and expected interest rates aren’t exactly low. For federal undergraduate loans disbursed between July 1st 2019 and June 30th 2020, the interest rate is 4.53%. For federal graduate or professional school loans taken out during this period, it’s 6.08%. If someone leaves school with $30,000 of debt, the typical repayment plan would have them making their last payment 20 years later. And even if a person literally can’t pay them off, student loans are also extremely hard to discharge in a bankruptcy filing; the public service loan forgiveness program is extremely difficult to get into. It’s far more likely someone would lose their house then lose their student loan responsibilities. It’s no wonder carrying student loan debt is also a huge psychological burden.

https://www.yahoo.com/lifestyle/why-people-upset-canceling-student-225744246.html

Skittles

(153,147 posts)would just prefer stuff to be priced FAIRLY / AFFORDABLE

Boogiemack

(1,406 posts)That seems to be the real reason for hating forgiving student debt.

But then just think about the huge debts that are forgiven people like Trump and his rich buddies. They know how to work the financial system to get all kinds of subsidies to forgive their debts.

Skittles

(153,147 posts)they'll always find an excuse for they themselves to get..... "free stuff"

Sherman A1

(38,958 posts)paid my own way (back when it was affordable to do so), helped pay for my step-daughter to go to college and believe college debt needs to be cancelled or radically adjusted. Our society cannot move forward if young people are starting out with crushing debt.

unblock

(52,195 posts)former9thward

(31,974 posts)A poor analogy.

unblock

(52,195 posts)They shouldn't be allowed to pay for them either!

They should have every inconvenience I had when I was their age!

No one should ever have a better life than I have had!

DBoon

(22,354 posts)because that's all we could afford 50 years ago.

raccoon

(31,110 posts)I didn’t, I had to share one with a mean hateful sister.

Raven123

(4,823 posts)former9thward

(31,974 posts)T Ruth Phairy

(25 posts)I'm paid off recently.

Do I get my 50,000 back?

PTWB

(4,131 posts)Thinking like that will make sure our country can never progress.

You are not aware of my dire financial situation.

I need it.

How do you decide who is worthy and who are not?

PTWB

(4,131 posts)I’m a big fan of other progressive social platforms like UBI. Still, I’m not sure why your reaction to helping others who may be in equally dire financial straights is to reject the help they need instead of try to secure the help you need.

KWR65

(1,098 posts)We could just set the interest rate at 0% and let the student pay off the loan over time. There is no ballooning of interest on the debt that makes it twice as expensive over twenty years. There could be a monthly fee to pay the loan service company.

AVG student debt is $30k. 30k divided by 20 years is $1500 per year. That would be $125 per month with no interest plus a monthly servicing fee.

The biggest problem with Federal student loans is the Interest rates that raise the cost for the borrower.

Autumn

(45,049 posts)Last edited Tue Nov 17, 2020, 11:51 AM - Edit history (1)

The money you used to pay them off is no longer coming out of your cash flow. Perhaps you have another problem like too much other debt or no job so it's doubtful student loan forgiveness would have made a difference in your situation.

lagomorph777

(30,613 posts)A reasonable compromise would be to reduce the interest to zero, and take the debt away from the banksters.

gratuitous

(82,849 posts)There will always be an inequity anytime something like this occurs. People who ate beans for 20 years to retire that loan debt watching as others get a pass on their debt. I think a five year graduated "rebate" for people who paid off their loans might be in order, say, $500 a year. It's not going to make people whole, but who would turn down a nice tidy little check?

The alternative is that we can never, ever make people whole from the loan vultures who have invaded the student loan system, and we have to keep gouging generation after generation because people suffered in the past from this system.

roamer65

(36,745 posts)Luciferous

(6,078 posts)their debts paid off. Student loan debt is crushing an entire generation of people and I think that some kind of relief should be passed. At the very least, they should reduce or eliminate interest. They should also make them easier to discharge in bankruptcy.

Ms. Toad

(34,060 posts)Who continue to insist that after successfully completing 3-5 years of law school, it is critical for these JDs to take a pointless bar exam - even in the middle of a pandemic that requires them to consent to AI reviewing a tape of their entire exam to permit remote examination - because it's always been done that way.

They are the same people who continue to insist that medical residents put in 24-hour work shifts endangering their patients (and fellow drivers when they finally head home) becuase it's always been done that way.

It somehow seems unfair not to put the next generation through the hazing rituals we went through. See post #5.

(In the interest of transparency: I am actively trying to work myself out of a job. 75% of my role at the law school where I teach is helping students make it through the post graduation hazing ritual. This year's hazing was particularly horrendous. I plan to work for 8 more years. But I would not cry if my job vanished before then.

obamanut2012

(26,068 posts)NAL but have worked in law in another way, including with students, and have many good friends who are attorneys. They also see the bar as not needed any longer, and especially right now.

I have relatives who are in healthcare, and they agree about the 24+ hour shifts for interns and residents, too. All is does is make the young doctors exhausted and mistake prone.

Both of these, as you said, have a huge amount of, "We had to suffer, so now you g=have to."

Bantamfancier

(366 posts)Why are we charging kids 8% interest on their loans?

Run it like an investment strategy. 0.5% simple interest.

And wipe the books clean of all student loan debt on July 4th 2021.

Put the money back into the elementary and high schools.

Let’s start over and do it right this time.

Withywindle

(9,988 posts)I paid off my student loans - but I'm in my early 50s and student loans were a LOT less onerous for Gen X.

I have friends in their 30s who will NEVER pay them off even though they have good jobs - the interest is so brutal they can pay off the amount of the original loan several times over and STILL owe twice as much. It's unconscionable, and it's wrecking the lives of two generations younger than me.

I'm not resentful.

Response to Withywindle (Reply #10)

Chin music This message was self-deleted by its author.

unitedwethrive

(1,997 posts)and ran up their loan amounts. It was a choice I made to have less of a social life, even though I desperately wanted the traditional college experience. It would be hurtful to see some of the people who made poor choices (in my opinion) be rewarded. I think a better approach is a case by case review, which would cumbersome, but at least gives off a feeling of fairness.

I also feel for those who didn't go to college because of the expense, but will feel cheated. I have no problem with instituting tuition help or loan forgiveness for certain careers going forward, but that is a different situation where people have the choice to decide their own future.

grantcart

(53,061 posts)My father died my freshman year and I ended up having to pay most of my tuition working. While I was Student Body President I got up at 6 to clean toilets.

Never went to a drinking party in my 7 years of college. In order to finish at the top of my class I frequently studied thru the night while others partied on the same schedule.

Some forgiveness is reasonable but complete elimination is unfair.

The most egregious abuse is using public money for student loans on for profit private schools with atrocious graduation rates. If it were up to me none of these schools would get a penny of public loans.

LisaM

(27,801 posts)I don't want everyone under 40 to be struggling under crushing debt, but I also don't think it's a one-size fits all. I'm all for debt relief, but on the other hand, some students pick "name" colleges just to monetize their degree and ignore more affordable options.

It's like everything else, not as simple as it sounds on paper, but overall, I support debt relief. I'd have to think more deeply about just wiping every slate clean.

Claustrum

(4,845 posts)someone who is taking a public sector/non-profit or a public school teacher job. The problem is the one size fit all approach. It should be based on their starting salary and how many years they have worked. I have no problem forgiving someone who is 50+ who still has student loan, vs. someone who is just starting out with a high potential for salary growth.

Instead of wiping it out or take 50k off, it should be based on their financial situation. They made a commitment to the loan, make them pay a reasonable amount (proportional to their salary) for 10 or 20 years and then forgive the rest.

mr_lebowski

(33,643 posts)1) Keep the interest rate at 0% across the board, say for 2 years, and

2) Wipe off any existing penalties, and

3) Create a simple program that puts payments on hold if people are unemployed (and reduces them if they're underemployed).

4) Make sure that loans for ANY kind of education are included, not just college/university.

Ferrets are Cool

(21,105 posts)WhiskeyGrinder

(22,323 posts)something. You see it on all sides.

Response to Yo_Mama_Been_Loggin (Original post)

Chin music This message was self-deleted by its author.

Jspur

(578 posts)90's in Raleigh, NC. Raleigh back then was not a progressive place like is today. Back then it was super conservative and backwards. If you told me during the 90's one day a black man would run for president and win Wake County the County Raleigh is located in I wouldn't believe you. Keep in mind I'm Indian American so I dealt with a lot of racist bs and not being accepted in middle school or hschool by kids. Today the area has done 180 and has become progressive and I see a large community of Indian kids around here that are accepted along with having socially a good quality of life. I'm not jealous that they have it a lot better than I did as a kid because I'm glad they don't have to go through the bs and pain I went through.

Same type of empathy should apply to people who were able to pay their loans off. It's a bs racket system that harms a lot of people who are below the age of 40. To the ones who paid off their debts so you really believe that people should suffer for the rest of their lives and be miserable simply because it eats at you they will get their debt wiped off.

My cousin and her husband who she married recently both have a combined 600K in debt. They majored in the right field considering they are both Doctors who are now in residency. I talked to them recently and they told me they don't know if they will have kids any time soon or ever because of the debt they have. They don't even believe they will ever pay it off in their lifetime. Stuff like this really angers me.

pecosbob

(7,534 posts)Fake money created in a ledger...

When your bank loans you fifty thousand dollars for a new car, that money instantly materializes in your account. No one printed it or made it. They simply change a number in a computer and the world now has fifty thousand more 'dollars' in circulation. No one ever invested that money that was given to students to pay for school. It never came out of someone's pocket...it was created by fiat. No one is 'owed' anything.

calguy

(5,305 posts)Celerity

(43,299 posts)but it only existed for entity taking your money (also fiat btw) on paper.

The loans (or costs if you paid cash) could have been double what you paid or they could have been half what you paid (or any other amount). It is all a paper debt. The interest charged is the same, and even more of created debt, as you received nothing in exchange for that further expense.

ProfessorGAC

(64,993 posts)I was on the board of a community bank for 20 years.

Assets & liquidity are measured against outstanding cash & investments. Regulators require certain ratios of loan values to asset. Banks cannot lend money they don't have.

That money doesn't just materialize. Only the fed can do that.

The money for loans come from deposits & certificates (my money/your money) and dollars borrowed from short term funds from the fed.

I was executive secretary, so I got every audit report & financial statements monthly.

Bank loans don't work as you suggest.

What you suggest is against the law.

calguy

(5,305 posts)I came a lower income family and could not afford to get a full college education. I worked my butt off all my life and am proud to have been able to pay for a college education for both of my kids. It wasn't easy and we made a lot of sacrifices to be able to do it.

And now, all of a sudden, everyone will have their education debt forgiven? OK, I can see a lot of benefits for those whose loans are forgiven, but those of us who sacrificed so much, we're gonna feel more than just a little bit screwed.

Claustrum

(4,845 posts)I was accepted to an Ivy League school but I had to pay in full and a local engineering school with 3/4 scholarship. I chose the latter because my family is a low income first generation immigrant family. I made the best decision based on my financial situation and now you tell me I could go to the better school and get my loans forgiven?

Once again, I think some people do need the debt forgiveness and help. I am all for it. But it shouldn't be a one size fit all where everyone gets 50k taken off. An entry level engineer has a higher ability to pay off a 100k loan than someone who works for a non-profit or public sector job or someone who is in their 50s. The debt forgiveness should scale with the ability to pay. That's not to say we shouldn't provide help to said engineers, we can still lower or cap their interest rate, just that it shouldn't be all forgiven or a 50k off for everyone.

calguy

(5,305 posts)But free college for all is not something that would go over big with a lot of people. It would also be used against us in upcoming elections.

Those who took out those loans knew what they were signing up for. Making them easier to pay off with low interest is one thing, forgiving them all together is quite another.

Claustrum

(4,845 posts)Then drastically reduce interest rates for everyone. But loan forgiveness for everyone is just not a good idea imo.

If you decide to take on 200k loan to attend an Ivy League school, that's on you. You are responsible for the loan you signed, even when you were 18 at the time.

calguy

(5,305 posts)Not to mention the political fallout we'd suffer in the next election.

GeorgeGist

(25,319 posts)when Lincoln freed the young ones too.

calguy

(5,305 posts)Dem2

(8,168 posts)But it's nearly impossible not to have them still take out some loans - school is so expensive these days! I would appreciate if they could have their loans paid off early.

![]()

Celerity

(43,299 posts)8 or so years ago it crossed 1 trillion USD. Now it is 1.7 trillion USD.

The average total cost for room, tuition, boards and all expenses for a 4 year, in-state public uni bachelors degree is now well over 100,000 USD.

For a private uni 4 year degree it is over 200,000 USD.

It cannot be sustained, and many of the people most against this paid incredibly less money for their college education.

https://educationdata.org/average-cost-of-college

pecosbob

(7,534 posts)Celerity

(43,299 posts)in fact I am paid for my post grad work).

I did attend UCLA Anderson for my MBA and I have many American friends from my time there who have well over 200K USD in student loans.

One woman (she is almost 10 years older than me) had over 350K the last time we chatted (she is going to be a surgeon, so she can pay it off I assume) and that was over 2 years ago, so she might be even deeper in debt as of now.

it is madness

The cost of a medical degree in the US is one of the reasons for the explosive growth in healthcare costs, as many of the physicians simply have to be paid to an extremely high degree just to pay back the education costs (plus the insane cost of medical malpractice insurance due to the ultra litigious nature of the American legal system).

I just had this conversation yesterday (it is now early Tuesday here) with a Swedish doctor (my wife and I are in a COVID-19 antibody study at Karolinska Universitetssjukhus). He is Swedish, but worked for 10 years in the Bay Area in Northern California. He and his wife decided to have children and moved back to Sweden due to quality of life issues. He said he took a huge salary cut but with all the welfare state benefits they receive as basic citizens here, it really was not a tremendous net reduction. He said he also left do to the byzantine nightmare that was the private insurance, for profit model, and the fact he was prevented by his hospitals from adequately caring for people once their insurance was maxed out.

I said he should go testify at a US healthcare hearing once this COVID-19 nightmare is finally quashed. He said he might consider it, if they paid his airfare, lol. He then said something chilling. He said that he also might not be able to go to the US as he can see the US pandemic continuing on well past its ending in most other advanced nations as enough people in the US might refuse to take the vaccines and also refuse to do the other measures needed to stamp it out. He said he can see violent mass resistance once Biden is sworn in and attempts to take the needed actions.

![]()

sorry for the digression and long reply

![]()

Initech

(100,062 posts)Student loans, home loans, car loans, credit loans - so much of that industry is based on pure, Grade A, FDA certified bullshit.

If you do the research, it affects a disproportionate number of people, and it's usually those who are in the bottom tier of society. I would be totally OK with a lot of this industry collapsing.

mtnsnake

(22,236 posts)unless he figures out a way to compensate every person in this country who isn't a student but who also feel that they could use compensation of some sort for their own financial difficulties.

Cancelling student debt would set off a monstrous firestorm and divide this country even more than it's divided right now. A better choice would be to push for free college tuition and free trade school tuition.

Calculating

(2,955 posts)And they think it's unfair for others to not have to.

Celerity

(43,299 posts)The RWers scream and whinge about food stamps and Medicaid, and other transfer payments.

They say, 'I never used them, and those people made poor life choices (which is 99% bullshit) and therefore fuck them!'

Before you say that it is different because uni is optional, ask yourself why you went to uni, and also look at how many jobs require at least some uni, if not a full 4 year degree (or more).

Calculating

(2,955 posts)Basically for other people to get richer, it's like they're getting poorer in comparison. In order to maintain their own lifestyle they believe they need to hold everyone else down. I guess it's not 'entirely' wrong, if the government was to print enough money to send every American $100K, the resulting inflation would take a big toll on somebody who already had millions saved up.

Celerity

(43,299 posts)There is no sustainable increase in prosperity when the global economy keeps producing winners and losers, but solutions should go beyond redistribution

https://www.handelsblatt.com/english/opinion/prized-mentality-the-economy-is-not-a-zero-sum-game/23566026.html?ticket=ST-13968588-mw23nKcwmdgbKa2ZJQc3-ap1

Seldom has the discourse over economic policy been painted in such broad, simplistic strokes as today. Populists, both on the left and on the right, describe economics, as well as the entire global economy, as a system in which one player winning means another loses. The new U.S. president, Donald Trump, is guilty of this. He calls for punitive tariffs to forcibly ensure that products consumed by Americans are mostly produced in the United States like in the olden days.

But this is also true of leftist politicians in Europe, who believe the solution to all economic problems is stronger redistribution by the state. Behind such approaches to problem solving is the notion that a nation’s economy is a pie the government can divide up, like the head of a family, among all the family members at the table, cutting off a bigger or smaller slice for each citizen or section of the population. When, say, the underprivileged are to receive a bigger slice of the pie, it has to be taken from the rich. Alternatively, immigrants looking for work are to be deported so that those remaining behind can keep more to themselves.

But the economy isn’t a zero-sum game. The sum of the gains and losses of all players does not consistently equal zero. If that were the case, the significant increase in prosperity that has taken place around the world in past decades wouldn’t have happened. On the contrary, China’s unprecedented growth would have resulted in the impoverishment of other countries. No matter how forcefully Mr. Trump painted the United States as a devastated country in his inaugural address, the U.S. economy has, in fact, expanded robustly in the past 25 years, as well. It must be admitted, however, that the gains from globalization have been divided extremely unevenly in the population.

sip

The economy isn’t a zero-sum game – the pie that is to be divided up grows larger almost every year.

hatrack

(59,583 posts)Do we want entire generations of debt slaves unable to start families, businesses, careers because of debt that can never be eliminated, 'cuz TEH BANKS!!?

What the hell kind of society would that be? Miserable, unproductive, cramped and depressed. Who the hell wants that?

And we're about halfway there (if not farther) already.

genxlib

(5,524 posts)It can be the right thing to do

and

It could be widely unpopular.

I don't have an answer for it but I think it is being realistic to understand that it won't be popular for people who don't benefit from it.

kcr

(15,315 posts)dansolo

(5,376 posts)Do about the high cost of colleg? Cancelling debt is only a temporary solution that is not sustainable. College should be cheaper to afford. Cancelling student debt does nothing to lower the cost of higher education.

Freethinker65

(10,009 posts)Forgive interest payments, or allow refinancing to decrease the rate, Ok. But the principle of the loan should be repaid. That still potentially saves students a ton of money.

calguy

(5,305 posts)Charge a low interest rates of maybe 2-3% to cover the cost of running the program seems like a good solution to me. Allowing all student loans to be re-financed thru the program would save people a lot of money, be a great investment in our future and boost the economy.

LakeArenal

(28,816 posts)Progress isn’t retroactive.

My dad paid for my education. I’m lucky.

But it cost him a lot of savings. He would never resent anyone getting help to get an education. I hope they dissolve all debt and make the first two years of college free.

Or the last two college for free.

Bettie

(16,089 posts)"No one should get something I don't."

They generally move on to "I should get all things".

I've heard that same argument over and over.

For AFDC (or whatever it is called now), Disability, SNAP, Educational Grants, Single payer health care, Medicaid, and pretty much anything that benefits human people.

There are people who are so stuck in "I alone am hard working and deserving" mind set that they will rebel at even the suggestion that someone be given so much as a hand up.

In my (granted, worthless to anyone but me) opinion, it is better for our society and our economy if people have the income to have places to live, buy food, and goods and services rather than giving banks every penny they make to service loans.

Next, we need to work on making education affordable.

And still, that same chorus of people will be angry because they alone deserve everything.

The thing that always gets me about these people is that they are generally speaking, A-OK with any benefit of our society that goes to the ultra-wealthy and to huge corporations.

Excellent post Bettie!

"No one should get something I don't."

OneGrassRoot

(22,920 posts)PufPuf23

(8,764 posts)is to benefit the financial services industry that makes and packages and resells the loans.

The victims are individuals whose parents cannot afford paying for their children's education.

The social and individual benefits of higher education should not be tied 1:1 on the financial return of subsequent jobs nor the economic providence of one's birth.

I find it disgusting how many Americans base their opinions on personal selfshness and greed.

The system of financing higher educatiuons needs to be revamped.

Klaralven

(7,510 posts)OneBro

(1,159 posts)This issue isn't new and the potential resentment will come from the left and from the right, most of it boiling down to the idea that "I paid mine off with sweat and belt tightening, while others who sat next to me in college either deferred their loans or paid the minimum due so they could buy expensive cars to park in their mcmansion."

Suggesting that such resentment is based solely on selfishness is a sure fire way of turning that resentment into red-hot anger that will surely come back to bite us in the ass the next election season.

Celerity

(43,299 posts)They are so willing to pay a shedload of money (that they can afford) in order to keep the cost barriers high, and thus massively reduce the overall competition for their offspring. Yet another class weapon.

Recursion

(56,582 posts)In fact I only see a push for this from people who went to college, which, again, is a minority of the country and better off than the majority that didn't go.

Erasing student debt would significantly increase inequality. I don't think it's a good opening move, particularly in the context of an election from which we were hemorrhaging Hispanic votes (only 11% of Hispanic Americans went to college).

Celerity

(43,299 posts)said he wanted after he left the VP, but then switched to 2 years when he started to run for POTUS.)

The debt load now on the under 40 crowd is madness, and if we are talking about my age or younger (I am 24) it is downright ruinous, as I laid out in other posts on this thread.

That said, I am going to assume nothing much will get done, and the same for most of the other big ticket items. Even if we take the Senate at 50-50 (in fact, like I have been saying for a year, even if we had taken it to a 53-47 or 54-46 Dem majority) I expect nothing will be done on college debt, lowering the cost of the first 2 years to zero tuition, the Public Option, Scoutus and lower court expansion, DC Statehood, etc etc. There are too many centrist or moderate conservative (what Manchin calls himself) Dem Senators for much of that to pass, especially at 50-50. Unless Biden can make the national minimum wage 15 USD per hour by Executive Order (I admit I do not know if he can), that is not happening either.

In a way, not having the Senate at least gives a built in excuse/rationale for those fails (if they occur, which is highly likely now). If we had indeed had a 53-47 or 54-46 majority and failed on most or all of them, the backlash would be immense. The left half to left 2/3rds of the party would have went bonkers. We would have likely been crushed in 2022 (hopefully we avoid this now) and Biden likely would be staring at only one term, depending on what monster the Rethugs run against him.

Recursion

(56,582 posts)There will be some complaining by people who went to college and didn't take on debt, or paid it off, but we can deal with that.

What will be harder to deal with is the majority of the country that never went to college, which is significantly poorer than the minority of the country who did, who will feel left behind by this.

Hekate

(90,642 posts)...never meant it to become the metastatic life-damaging horror it has become.

Anything Joe can do to ameliorate the problem will be to the good.

DBoon

(22,354 posts)with part time minimum wage jobs

Not any longer.

BusyBeingBest

(8,052 posts)Ishoutandscream2

(6,661 posts)Take a larger look and see how this could benefit the economy. Maybe help a young couple buy a home. A new car that is desperately needed, etc. etc.

mvd

(65,173 posts)People that go to college to help with their chosen careers shouldn’t be saddled with crushing debt. And those with hurt feelings would still benefit if it helps the economy.

In order to make this not be a necessity over and over, we need to make sure all have opportunity to attend free public college. And look into other ways to reduce the cost of college.

MissB

(15,805 posts)I wouldn’t have been able to go to college without them. I literally had like $500 from my parents to help pay for my first term. Dad reluctantly wrote another check for my second term.

I borrowed the max that I could. I had a hella good interest rate when I was paying them back.

They’ve been paid off for more than a decade. I’m making great money as an engineer.

I begrudge *no one* that gets their student loans wiped out. NO ONE. It’s a good leg up in an uneven world.

In some cases, people that never go to college come out much better financially than folks that do. (Plumbers, electricians- I’m looking at you vs those history majors).

We need all types in this world. In a better country, we wouldn’t need to go into fucking hock to get a secondary education.

(And unfair? Both my kids got their undergrads for nada. I’d still feel the same way if I owed a bunch of $$$$$ for their educations)

Tink41

(537 posts)rants on SM. Why should other people get off scott free when they had to pay it back. For myself if I could make someones life easier

I'm all in! My adult child has a reasonable amount of student debt, I'd be thrilled if that burden was gone. I raised them with the thought I wanted them to have a better life than myself. Many people do not see it that way. I can't figure it out.

qanda

(10,422 posts)No way to get ahead when you can never catch up. 😔

roamer65

(36,745 posts)roamer65

(36,745 posts)So are we going to create more money to do it?

YoY, M1 money supply is already up by over 40 pct.

https://fred.stlouisfed.org/series/M1

GaYellowDawg

(4,446 posts)Is the degree to which public colleges and universities were subsidized by the Federal government in the past. Because of that funding, a higher education was much more affordable. If past generations benefitted from having the cost of college subsidized on the front end, why object so vociferously when the current generation’s college cost is subsidized on the back end with reductions in student loans?

I think that all payments should be income-sensitive, and there should be a set limit on how many payments that have to be made (say, 120).

raccoon

(31,110 posts)I worked for years at a community college.

Over the years, the amount of funds they got from the state lowered considerably.

UTUSN

(70,680 posts)Last edited Tue Nov 17, 2020, 03:08 AM - Edit history (1)

it just went over my head. Years later it finally dawned on me that I had "sold" four years of my life in the military and had gotten G.I. Bill, which is why everybody's debt didn't register. And the thought has crossed my mind, hey you took on debt, piled UP debt. I don't let it fester. I didn't volunteer for the G.I. Bill as a motive.

roamer65

(36,745 posts)So are we going to write that off, too?

That will tick off the millions who during the Great Recession had mortgages forgiven then had to pay income tax on it.

Celerity

(43,299 posts)marlakay

(11,448 posts)But don't want loans canceled because they worked and struggled to pay their way thru college picking lesser colleges to save money. My daughter said she has a friend who has lots of loan debt that went to expensive school, and wants loan forgiveness. Her response was, I would have liked to go to a better school too.

So yes there will be lots of those people. Maybe give a tax credit to people who paid off college.

renate

(13,776 posts)And some of that came from our retirement savings because of a long period of zero income.

Two questions: Would our savings be replenished? No? Okay, that’s fine. In the long run we’ll be okay. Not as okay as we’d have been if we could have kept that money in our savings, but we’ll be warm and dry and fed. But for a lot of families, that loss of savings is the difference between aging with comfort and dignity and aging without.

And will our kids be compensated for the $100,000 each that we could have given them instead to put towards a down payment on a house? That difference would have repercussions worth millions of dollars by the time they retire.

Still, I wouldn’t be upset about forgiving all student loans. Sometimes life is tremendously affected by events totally out of our control. My kids weren’t drafted. They never had to fight in a war they didn’t start. So I personally would be fine with forgiving student loans.

But I think it could backfire terribly on a wide scale. It’s not selfish to be a little bitter about this policy. People have made long-term life decisions based on college debt; someone who picked getting an associate’s degree at a community college for financial reasons in 2018 is going to be at a lifetime disadvantage compared to someone who in 2016 decided to get a four-year degree and suddenly gets an enormous windfall that the associate’s degree person, already at a disadvantage, does not.

In the long term, college tuition should be free. I believe that 100%. But in the short term, if it’s not handled carefully, it will create a ton of economic disparity.

Roisin Ni Fiachra

(2,574 posts)cbdo2007

(9,213 posts)Yes there are tons of stories out there about someone with a useless degree and is $100,000 in student loan debt, usually because of a tons of bad choices on their part, but MOST people enter the workforce with a chunk of student loan debt and then work to pay it off and have no trouble with that. It took my wife and I each about 8 years after college to pay off our student loan debt, but it was extremely rewarding to do that and to finally be free and to get ahead. Erasing student loan debt, especially for the probably 70% of those people who have decent paying jobs and are able to pay it down over 8-10 years or so, would be stupid.

Instead, they should be working on the front end to make it more affordable for everyone. For future students, regardless of income, they should guarantee an undergraduate degree for 4 years for less than $30,000 at the state college or university of their choice, in their home state. Then, at least it is capped at a certain amount, their parents may be able to contribute some of that, they can work to pay for some of it, etc. But it isn't just free and the slate wiped clean. At least if they DO have to take out a loan, it is never more than $30,000 and is reasonable for them to pay off at typical post college employment.

Keth

(184 posts)I graduated with a creative writing degree with about $500 in debt thanks to Pell Grants (my folks didn't have money) and the work study program. Of course, I went to a small state school in Missouri and it was back in the day. I know things have changed and college is way more expensive.

I always wonder why public education stops after high school. Shouldn't we continue to pay for higher education regardless of income? Maybe, using tax dollars, the government should invest more in their citizen's education. Yep, my heart bleeds here.

I don't know - interesting thoughts about this topic.

LetMyPeopleVote

(145,124 posts)President Biden does not have the power to cancel student debt

Link to tweet

But as financial aid expert Mark Kantrowitz notes, another part of the statute limits the secretary’s authority. He only has the power to cancel obligations owed to the U.S. government “in the performance of, and with respect to, the functions, powers, and duties, vested in him by this part.”

In other words, the Secretary of Education only has the power to forgive student debt when Congress gives it to him.

When President Biden has canceled student debt, it has always been under the authority of a specific program authorized by Congress. Borrower defense is one example: Congress gives the Secretary of Education authority to cancel debt after instances of outright fraud. Congress also allows the secretary to cancel debt when borrowers experience a total and permanent disability. Borrowers who work in public service for ten years can also receive a loan discharge.

In each of these circumstances, Congress created a specific provision for loan cancelation, and required borrowers to meet certain conditions before receiving forgiveness. If the Secretary really had the broad authority to cancel student loans whenever he saw fit, Congress wouldn’t need to create specific programs such as Public Service Loan Forgiveness. The very existence of those programs proves the limits of the executive branch’s authority.....

The debate over whether the President Biden can cancel student debt with the flick of his pen is a distraction. He can’t, but there are better solutions on the table. Congress and the Department of Education should work together to put them into practice.