General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsStudent Debt In Disguise: How Employers are Using Predatory Debt to Hurt Workers...

Link to tweet

Student Borrower Protection Center

@theSBPC

New evidence shows that employers nationwide are using forms of student debt to trap workers in unfair contracts and substandard working conditions. Our new blog post exposes these unfair, anticompetitive bait-and-switch tactics.

Read our blog post:

Student Debt In Disguise: How Employers are Using Predatory Debt to Hurt Workers and Hold Back...

New evidence indicates that employers nationwide are increasingly leveraging shadow student debt to trap workers into unfair contracts and substandard working conditions. In particular, a growing...

protectborrowers.org

9:47 AM · Aug 4, 2021

Dialogue surrounding America’s student debt crisis usually focuses on the $1.7 trillion balance of federal student loans, and sometimes on the additional $140 billion balance of outstanding private student loans. These headlines typically conjure up the image of a simple and straightforward student loan product—one with a formal billing statement and promissory note explaining the fees and terms. But as the Student Borrower Protection Center has documented before, there is also a “shadow” student debt market that extends beyond brand-name private student loan companies and sometimes even from the legal definition of a private education loan. This shadow student debt market consists of various expensive, misleadingly marketed, and lightly underwritten credit products ranging from certain private student loans to personal loans, open-ended revolving credit, income share agreements, unpaid balances owed directly to schools, and more. These types of credit often operate under law enforcement’s radar, but they are nevertheless pervasive, predatory, and opaque.

New evidence indicates that employers nationwide are increasingly leveraging shadow student debt to trap workers into unfair contracts and substandard working conditions. In particular, a growing number of industries and employers are using bait-and-switch tactics to force workers to take on loans and debt through nefarious “training repayment agreements” (TRAs). Buried deep inside employment contracts, these agreements require workers who receive on-the-job training—often of dubious quality or necessity—to pay back the “cost” of this training to their employer if they try to leave their job. This cost often involves massive interest, hugely inflated fees, and little or no disclosure of its existence at the time the “training” in question is delivered, thereby creating a debt that is likely to hang over workers’ heads for years if they do in fact move on to another job.

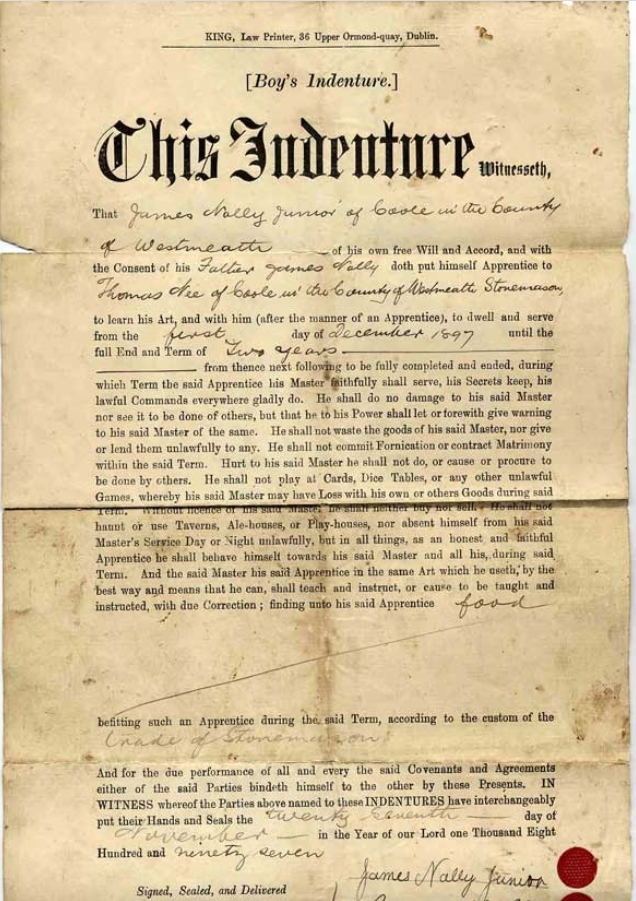

TRAs are abusive and anticompetitive. It’s time to call TRAs what they are—21st century indentured servitude made possible through shadow student debt. Consumer watchdogs and policymakers at all levels must act to protect borrowers before TRAs and other predatory contract terms like them become even more widespread.

Training Repayment Agreements turn the promise of on-the-job training into a debt trap for workers

Opportunities for workers to improve their marketable skills through on-the-job training programs such as upskilling courses are a key pathway toward career advancement and job stability. But it is increasingly clear that employers are abusing purported opportunities for learning and employee training requirements to make leaving a given job literally unaffordable.

*snip*

dalton99a

(81,443 posts)malthaussen

(17,186 posts)Johnny2X2X

(19,037 posts)My company has a retention agreement for grad school only. They paid for my Masters and if I leave of my own volition within 4 years I have to pay back what they paid. I went into it with eyes wide open and the way I see it is that they have incentive not to lay me off as they've invested $40,000 into my graduate degree.

Celerity

(43,299 posts)

fescuerescue

(4,448 posts)this was for a Fortune 500 company.

It was quite legitimate. just that if I left within 6 months I would have to repay the money back. I think it was around $5k. It was very high quality training though.

There was no interest or fees etc. Just pay back the money if I bolt.

This sounds like an abuse of what is otherwise a legitimate practice.

I wish they gave a few examples though.

Igel

(35,296 posts)He worked summers and semesters off for a corporation with a juicy DOD contract.

He'd take 5 years to finish his engineering degree. That meant 4 summers as well as 2 semesters he'd take off during the 5 years. When working, he'd make tolerable money--not quite entry level for an engineer, but closing in on it as he completed more school and became more competent.

The corporation paid for his tuition and fees, basic room and board (or equivalent), and a stipend for textbooks. This was at a danged good private school in Pennsy. During the time he was on the job, he'd also be brought up to speed on industry practices, including the math/science/engineering he needed for his job that he might not be taught in school.

In other words, he had a kind of corporate apprenticeship for the equivalent of 2 years' work coupled with 4 years of private engineering education. More was paid to the school and to him for room/board when he wasn't working than actual gross pay when he was working, and when he was working they probably overpaid him. They invested in him, rather heavily.

After 5 years, he was on the hook for 3 years. If he bailed before that, it was only fair that he reimburse the school for the money they invested in him, plus interest--they saved him student loan interest. And they added an extra penalty for having invested in *him* instead of in somebody who would honor the completely voluntary agreement. I think the terms for repayment were fairly harsh because of that--it wasn't just the money wasted on him, it would also be the fact that they'd paid for him for 5 years with the expectation of a return, and instead tied up the money on somebody that didn't repay the investment. He laughed when he told me about the terms for leaving early because his basic attitude was straightforward: Practically, there was no way he'd be able to get the degree without massive student loans, so he was grateful; his summer jobs wouldn't have been as sweet, so he was grateful; he wouldn't have had that kind of on-the-job training, so he was grateful; and, there was no guarantee he'd get a job he loved that close to his family, and now it was guaranteed. Ethnically, gratitude aside, he was not about to break his word because being the son of a working class family he was raised to take his commitments dead seriously.

At the end of 8 years' duty, 5 pre-BEng and 3 after--he was a free agent, with 4 years' engineering experience in developing UAV technology before drones were even a thing, and with a 4-year EE degree (plus a few graduate courses in EE and business that the corporation sprung for as part of their continuing education program for their engineering staff). He did have a funny non-compete sort of clause in his contract, because I only knew a little of what he did--most of it was classified.

These arrangements can be a good deal. Now, my friend only got his deal because the previous guy quit during his senior year of college, thinking he rooked the company. The company policy was that if he had a potential employer contact them to say that he was untrustworthy and broke his contract with them--basically just say the truth; my friend knew this because he put not his main boss as contact but colleagues. They all said the same thing--a selfish SOB that was happy to have people invest in him, but had no intention of keeping his commitments. Oh, and the guy was sued for breach of contract, during which they investigated whether he had leaked classified information. He was radioactive, since no employer could know ahead of time what was classified and what wasn't. He was radioactive. (My friend found this hilarious, to be honest: A freshman in college he was given an important lesson in professional ethics, on the one hand--and the downside to messing with a well-connected DOD research contractor.)