General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWe are winning.

Trump and his band traitors are being investigated.

It looks like we will keep the Senate, which is a big deal. We now have an outside chance to keep the house which is almost unheard of in a midterm election.

It looks like Biden will get a major bill passed before the election.

The Republicans are winning nothing unless you call taking peoples rights away, supporting a coup, winning.

kentuck

(111,079 posts)To let them know that he had absolute immunity and that any crimes he committed while he was president could only be handled by impeachment and he was victorious in his impeachment trial.

My opinion, and my hope, is that the Democrats will maintain control of the House and win a two or three-seat majority in the Senate. The Committee will be re-affirmed and they will continue their work after the new Congress convenes.

malaise

(268,943 posts)He’s terrified.

He’ll have to explain how a coup was part of his presidential duties.

Lock him up!

Response to kentuck (Reply #1)

Chin music This message was self-deleted by its author.

thesquanderer

(11,986 posts)...at least if you're talking about the article reported at https://www.democraticunderground.com/100216977463

That's not to say he won't try the same tactic if he were to be indicted for something. Bt I don't think there's any legal ground to go to court to prevent a law enforcement agency from investigating you. This legal challenge was not a response to the news of his being investigated, rather it was a response to the lawsuits filed against him.

Johnny2X2X

(19,043 posts)Women's body autonomy rights are going to drive a massive wave of people to the polls, and we're going to take over some states too because of it.

Inflation is starting to ease, the next number we see will be much lower. Jobs market is still strong.

And if we pass this major climate change bill, it will be 3 massive bills Biden has gotten done, the American Rescue Plan, the bipartisan infrastructure bill, and this climate change/deficit reduction bill. Each of them will be the largest legislative achievements for a President since the ACA was passed in the early Obama administration. Trump got nothing approaching any of these 3 bills done.

GDP shrinking for the 2nd straight quarter is the only thing working against us.

Response to Johnny2X2X (Reply #2)

Chin music This message was self-deleted by its author.

karynnj

(59,501 posts)which will eventually create jobs and leave the US less vulnerable to foreign countries playing games with chip deliveries. Consider the problems when it is just supply chains.

As to Trump, he got the huge, unsustainable tax cut bill and the three right wing scj. All negative from our point of view, but positives to his base.

Sky Jewels

(7,069 posts)CrispyQ

(36,457 posts)calimary

(81,220 posts)Of course with an individual like him, I’d prefer “roast”.

I'd forgotten about that saying. Let's GOTV & make it happen! ![]()

![]()

![]()

gab13by13

(21,312 posts)liberalla

(9,239 posts)Maine Abu El Banat

(3,479 posts)Has taking away a woman's right to her own body, and are trying to take away SS from the Baby boomers. Not exactly a winning combo.

BonnieJW

(2,263 posts)Everyone. I worry for my middle aged kids. What safety net will they have??? Companies don't offer pensions anymore. Everyone says 401k will take care of retirement, but that's crap, unless you're a millionaire. You need an income until you die, not until the money is gone.

Shermann

(7,412 posts)It takes decades of sacrifice, but the path is open to all income groups. Pensions are generally a more valuable benefit than 401k matches, but they are a bit too costly to employers and historically relied too much on endless growth. So, employers have largely handed the retirement problem back to the employees. I don't see them ever taking it back.

Anti-tCON

(22 posts)👍

GP6971

(31,141 posts)Snackshack

(2,541 posts)Does not look as stacked against us as it did but I certainly do not think we are winning. We had 1 good news day out of 800 bad news days so…

ColinC

(8,290 posts)ColinC

(8,290 posts)Still more than 3 months away until the election.

usonian

(9,776 posts)Let me count the ways.

YOU, TOO.

GOTV Resources. MONDAY JULY 25 UPDATE.

https://www.democraticunderground.com/100216969633

Yes, updated.

Trueblue Texan

(2,426 posts)...might have influenced Manchin's support of the bill.

tavernier

(12,380 posts)The shifting sands of the present political climate is creating some interesting dance steps.

former9thward

(31,984 posts)The original BBB Bill was $3 trillion. This bill is $430 billion over 10 years. Only about 15% the size of the original bill. Manchin had always complained the BBB was too big. In addition he gets shale oil production infrastructure in the bill.

WinstonSmith4740

(3,056 posts)We all need to take a breath. A lot of us here are old enough to remember the 1998 off year election. The Republicans were beating the Lewinsky scandal to death, and ALL the pundits were predicting a Republican tidal wave. I seem to remember they were saying the Rethugs would end up with an 80 seat lead in The House. Newt Gingrich looked like the Cheshire Cat when he was interviewed, which was constantly.

Well, seems they were all wrong. Dems picked up 8 seats in The House, and I think 2 in The Senate. Didn't change control of either house, but Newt resigned his seat and slunk away, and Rethugs got knocked backwards. As usual, they over reached like they always do when you hand them power, and (again of course), underestimated the anger of the people when they do.

Personally, I think they're gonna get their asses handed to them in November.

BumRushDaShow

(128,868 posts)because many of us working in the federal sector were frustrated at the administration for not following the Pay Comparability Act of 1990 formula to provide wage increases to bring the federal salaries closer to that in private industry for the same positions, citing all kinds of things including "economic issues" (that were non-existent) -

August 29, 1997

THE DAILY FED

President Clinton will authorize a 2.8 percent average pay increase for federal workers, The Washington Post reported Friday.

The raise will be divided between a 2.3 percent base pay increase and locality pay raises that will average 0.5 percent.

Under the Federal Employees Pay Comparability Act (FEPCA), which requires the Federal Salary Council to close the gap between federal and nonfederal pay rates, white-collar executive branch employees would have received a 10 percent average pay raise. However, the Clinton administration has rejected the law's formulas as based on flawed methodology.

(snip)

https://www.govexec.com/federal-news/1997/08/clinton-to-ok-pay-raise/3999/

But then come that 1998 election year, a few things "changed"

August 20, 1998

President Clinton Thursday approved a 3.6 percent average pay raise for federal civilian employees and military personnel next year, and will propose a 4.4 percent increase for the following year. "Today, the government operates more efficiently and better serves the American people," Clinton said in announcing the raise. "This success would not have been possible without government employees who have been called upon to work harder and to do more with less."

Federal employee organizations, who had asked Clinton to endorse a 5.8 percent raise for next year, were quick to denounce the President's proposal. "Rather than honestly addressing the growing pay inequity between the federal and private sectors, President Clinton has thumbed his nose at the federal work force by urging Congress to approve a pay raise that actually worsens the current pay gap," American Federation of Government Employees President Bobby Harnage said Wednesday.

In an effort to mute such criticism, Clinton not only announced next year's raise, but also recommended a 4.4 percent average increase for the year 2000 well in advance of when such proposals are typically announced.

The two increases together would amount to the largest federal pay increase in nearly two decades, administration officials told the Washington Post. "We wanted to keep [federal employees] even with inflation," a senior administration official told the paper. "They've done a good job."

(snip)

https://www.govexec.com/federal-news/1998/08/clinton-approves-36-percent-pay-raise/4047/

(this was the period of that damn "do more with less"

But to your point -

By Alison Mitchell and Eric Schmitt

Nov. 5, 1998

Stunned by the Democratic resurgence in the midterm elections, Congressional Republicans tore into one another yesterday over who was to blame for their failure to make the traditional opposition party gains in an off-year election.

The soul-searching and recriminations -- and a possibility of Congressional leadership challenges -- came as election results showed that Republicans had been unable to increase their 55-to-45-vote margin in the Senate and that Democrats had picked up five seats in the House.

The Democratic surge was the first time since 1934 that the President's party had gained seats in a midterm election and it whittled the Republican lead in the House down to 12 votes and the majority to 6. The Democratic victories were even more remarkable in a year marked by the monthslong scandal over President Clinton's affair with Monica S. Lewinsky.

The Republicans' new 223-to-211 majority (assuming a Democrat leading in Oregon holds on to win), with one independent, amounted to the smallest Congressional majority since the Republican-led Congress of 1953, the last time Republicans controlled the House until they captured it again in 1994.

(snip)

https://www.nytimes.com/1998/11/05/us/1998-elections-congress-overview-gop-scramble-over-blame-for-poor-showing-polls.html

So YES it can be done when there is a GOP overreach (and in 1998, they were in the midst of their impeachment of Clinton).

cilla4progress

(24,726 posts)baby!!!

Anti-tCON

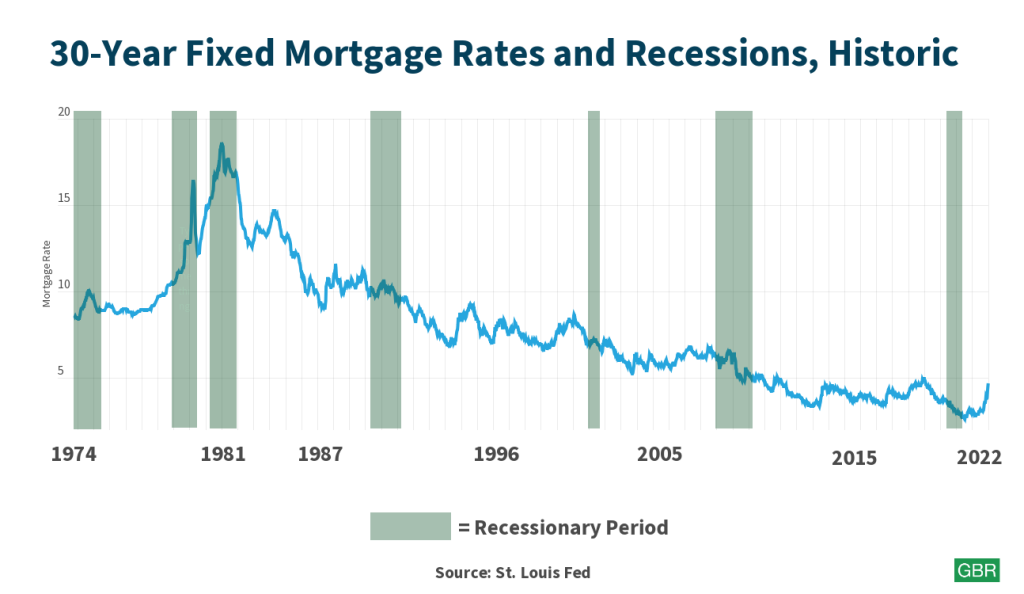

(22 posts)Supply chain issues can't be fixed by raising interest rates that will only make it more difficult for new businesses to borrow & create more competitive supply.

Jacking up interest rates rapidly will only cause stagflation.

The Fed did this to President Carter in the 1970s, & Republican Federal Reserve Governors always push for higher rates during Democrat presidential administrations.

I only had a couple of 300 level Economic classes in the late 1960s & a Bachelor of Science in Political Science, but I have a lifetime of voting Democrat & studying economics & politics.

I respectfully believe President Biden needs to make the point & explain that raising interest rates will only create even more of a supply chain problem, & replace Republican Jay Powell with a Democrat who understands this.

marble falls

(57,077 posts)Anti-tCON

(22 posts)Raising interest rates any at all when an economy is already showing signs of falling into a recession is only overshooting. There was much more justification in the 1st 3 years of the 🍊 🐖's administration.

Eliminating his flat tax tariffs would make way more sense to address supply chain shortages causing inflation.

BumRushDaShow

(128,868 posts)First - When these tariffs were put in place by the previous administration, there were a whole shitload of them and I was following the list and discussions about it on DU. China retaliated with their own tariffs against U.S. exports that they were receiving. So the full list needs to be evaluated in order to make an intelligent vs a knee-jerk decision on what to roll back and what to leave in place.

Second - here is the latest -

A reversal of Trump-era tariffs should help improve the strained ties between the world’s two-biggest economies.

Bloomberg News

July 28, 2022 at 4:15 AM EDT

Tariffs on Chinese goods by the US hit markets with shock waves in 2018, but as they look to be rolled back, the move may barely make a ripple. Expectation is building that President Joe Biden may scrap some of the tariffs imposed on roughly $350 billion in Chinese imports following a highly-anticipated conversation with Chinese leader Xi Jinping on Thursday.

A reversal of Trump-era tariffs should help improve the strained ties between the world’s two-biggest economies. But with other global headwinds building from higher US interest rates to a still-raging pandemic, strategists say any positive impact on Chinese markets and beyond will be modest.

That would be a sharp contrast to 2018, when a trade war with the US pushed Chinese stock benchmarks into bear markets and triggered a slump in the yuan, as traders shuddered at the thought of an economic slowdown from higher tariffs and any further reprisals from the Trump administration.

(snip)

https://www.bloomberg.com/news/articles/2022-07-28/china-markets-are-long-past-caring-about-a-us-tariff-rollback

And also some background on the decision-making process (as of a couple weeks ago) regarding what are probably the biggest set of tariffs in place (on China) - https://www.reuters.com/world/us/biden-meet-with-advisers-china-tariffs-decision-timing-unclear-sources-2022-07-08/

The deliberative process of dealing with tariffs needs to be done in order to determine effects in the midst of competing interests. E.g., many labor unions for U.S. manufactured goods WANT the tariffs in order to make American-made products more competitive price-wise, and thus throw that business their way.

I would rather have "the smartest people in the room" look at this than just wholesale "swinging at solutions" that might ultimately "miss" because the potential end results weren't carefully thought out (in other words, do what they call a "risk/benefit analysis" ).

And remember the supply chain thing was triggered by a PANDEMIC that has NOT gone away. China's "zero COVID" policy has meant complete lockdowns in major cities on a rolling basis because they know with over 1 billion people there, it would be a nightmare if COVID was ravaging the populace (although they need to find a balance).

Similarly, the pandemic KILLED and/or sickened many in the transportation industry right here in the U.S. and replacing those people takes time. People forget that over 1 million people have died from COVID-19 in the U.S. alone over the past 2.5 years.

The Raygun deregulation started the offshoring of the manufacturing of many products to chase the cheapest labor and maximize profits. But that was a setup for a single point of failure if something happened to that "shipping" (weather, worker shortages).

And you also have a hot war going on between 2 countries - Ukraine and Russia (and a proxy war alongside that which includes us) and that has further exacerbated the availability of commodities.

So bottom line, there is no "magic" single solution. There needs to be series of things done to halt the bleeding and then stabilize the environment.

Anti-tCON

(22 posts)...inflation & Republicans, are effectively regressive taxes that hit the working poor & middle class & barely rich small business owners the hardest.

BumRushDaShow

(128,868 posts)that is definitely not going to be solved to the satisfaction of anyone not in the top 1%.

I think a case in point is the debate going on right now between those who live in high-cost states with high property taxes (most of them "blue" states like NJ, NY, and CA) versus everyone else, with respect to what is abbreviated as "SALT" (State and Local Tax) and the cap on deductions for that being something like $10,000 (enacted with the 2017 tax breaks for the wealth legislation).

This cap has effectively impacted a group of "middle class" who now have found themselves penalized because they are told that they are the same as "millionaires and billionaires" by many "progressives" who are fighting against changing the current SALT provision. And that has now set up a divisive flashpoint of those (who I just read about) who WANT the SALT increased, who are even looking at torpedoing this upcoming reconciliation package because of this rigid viewpoint against making some adjustment in deductions.

If anything, there should be some kind of carve-out list of states that fit this criteria, and an update made to the SALT to provide allowances for a higher level of deductions in high-cost states. This would not negatively impact the lower rungs.

So when it comes to "progressive (non-regressive) taxation", let alone any taxation at all, there really needs to be some reconciliation within our own policies on dealing with this and we need to accept the fact that "Democrats are not all the 'poor and downtrodden'" but also aren't all the "wealthy beyond imagination" either.

Anti-tCON

(22 posts)and off the backs of the working middle class & barely rich small business owners "raising taxes?"

$628,300 for a "top" is WAY TOO LOW, when there are 22 million millionaires & 614 billionaires in the United States.

John Stankey, AT&T CEO, received total compensation of $24,820,879, representing an 18 percent increase from the prior year. May 13, 2022

In its latest regulatory filing, Comcast also disclosed nearly $34.0 million in 2021 compensation for its chairman and CEO Brian Roberts, up 4 percent from $32.7 million in 2020. He had made $36.4 million in 2019, $35.0 million in 2018 and $32.5 million in 2017. Apr 22, 2022

Exxon paid CEO Darren Woods $23.6 million last year, up from $15.6 million in 2020. Woods also received a $3.1 million cash bonus, the filing showed. Chevron CEO Michael Wirth was paid $22.6 million in 2021, according to Thursday's filing. Apr 7, 2022

& this problem with FLAT TAXES exists ALL OVER THE 🌎 , even in the most socialist of nations.

It is time for people all over our 🌎 to force corporate media to acknowledge the unfairness of FLAT TAXES, which are effectively REGRESSIVE taxes.

BumRushDaShow

(128,868 posts)particularly the "top" nominal tax rate. Since 1981, there has been a veritable soap opera of tax changes, little for the good -

The original overhaul of the tax code that sent us down the rabbit hole -

H.R.4242 - Economic Recovery Tax Act of 1981

And that started the ball rolling and lead to this -

H.R.3838 - Tax Reform Act of 1986

and then these -

H.R.5835 - Omnibus Budget Reconciliation Act of 1990

H.R.2264 - Omnibus Budget Reconciliation Act of 1993

Ed. top marginal rate to 39.6%

H.R.1836 - Economic Growth and Tax Relief Reconciliation Act of 2001

Phases in reductions, beginning in 2001, of the 28 percent, 31 percent, 36 percent, and 39.6 percent brackets. Reduces each rate by one percentage point annually (with an additional 1.6 percent decrease for the 39.6 percent category), so that for years 2006 and thereafter the rates for each category will be, respectively, 25 percent, 28 percent, 33 percent, and 35 percent.

H.R.2 - Jobs and Growth Tax Relief Reconciliation Act of 2003

Provides for advance payment for 2003.

Ed. had a sunset provision of 10 years

H.R.8 - American Taxpayer Relief Act of 2012

Amends the Internal Revenue Code to: (1) revise income tax rates for individual taxpayers whose taxable income is at or below the $400,000 threshold amount ($450,000 for married couples filing a joint return) and increase the rate to 39.6% for taxpayers whose taxable income exceeds the threshold, (2) set the threshold for the phaseout of personal tax exemptions and itemized deductions at $250,000 for individual taxpayers ($300,000 for married couples filing a joint return), and (3) increase the top marginal estate tax rate from 35% to 40%.

H.R.1 - An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018

(Unless otherwise specified, provisions referred to in this summary as temporary or as a suspension of an existing provision apply for taxable years beginning after December 31, 2017, and before January 1, 2026.)

TITLE I

Subtitle A-- Individual Tax Reform

Part I--Tax Rate Reform

(Sec. 11001) This section temporarily replaces the existing tax brackets (10%, 15%, 25%, 28%, 33%, 35%, and 39.6%) with new brackets (10%, 12%, 22%, 24%, 32%, 35% , 37%) and specifies the income levels that apply for each bracket.

(I will add this link for a table of all these changes because it is a good source of what changed what to what - https://taxfoundation.org/historical-income-tax-rates-brackets/)

The below is from here (leading up to what was the 2017 tax cuts legislation rammed through by the previous administration) - https://www.usatoday.com/story/money/personalfinance/2017/03/21/if-you-think-taxes-are-too-high-you-need-to-read-this/99380398/

However none of this would be something that would necessarily relate to the OP or the Federal Reserve.

If you look historically, this nation has gone through a whiplash of concepts and acrimonious debate, regarding establishing a "National Bank". I used to work near the original "First Bank" (1791) and "Second Bank" (1816) of the U.S. (both headquarters buildings are still here in Philly, used for other purposes now). With poor decisions in both cases, and a charter lapse of the latter bank, this eventually lead to the establishment of the current Federal Reserve system in 1913 (with 12 "Regions" that are headed up by 12 Presidential-appointed "Governors" who manage the money supply). And this system has been in effect for what will be 110 years as of next year.

ETA - this sums up where things were "back in the day"

Demsrule86

(68,552 posts)Anti-tCON

(22 posts)FLAT TAX TARIFFS raised the price of imports to the point that they became unaffordable for all but the wealthy, and it dramatically decreased the amount of exported goods, thus contributing to bank failures, particularly in agricultural regions. Jun 10, 2022

The 1st time Republicans wrecked our economy with flat tax tariffs.

https://www.investopedia.com/terms/s/smoot-hawley-tariff-act.asp#:~:text=The%20Smoot%2DHawley%20Tariff%20Act%20did%20not%20cause%20the%20Great,by%20imposing%20their%20own%20tariffs.

Too many Americans forget that import-export businesses create a LOT OF JOBS FOR AMERICANS!

marble falls

(57,077 posts)... that over supply which makes for inflation.

Artificial shortages in the product supply chain raises prices. Making money a little scarcer will lower those artificially high pieces. There's a lot of hankypankery going on about "supply chain shortage".

BumRushDaShow

(128,868 posts)The interest rates in the '70s were not the current 1.58% that is in place as the fed lending rate to the banks.

Shows the daily level of the federal funds rate back to 1954. The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. The current federal funds rate as of July 27, 2022 is 1.58%.

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

I.e., in 2022, we are nowhere near even the lowest of the low fed interest rates in existence in the mid-late '70s, which were in the 4% - 5% range. If you look at the booming economy under Clinton in the '80s, the fed funds rates were in the 5% - 6% range.

People forget that after the crash of 2007, the fed basically took the borrowing rate down to at or near 0%, and only started really kicking it back up again just before the pandemic, when back down it went.

They are trying to get it into the 2% - 3% range (for fed funds rates) and then as we know, the retail banks will add additional on top of that. But it is not going to be the 10% - 20% rates that existed in the '70s.

Anti-tCON

(22 posts)Last edited Fri Jul 29, 2022, 12:30 PM - Edit history (1)

https://www.investopedia.com/fed-raises-rates-at-july-2022-meeting-6279110#:~:text=Fed%20funds%20target%20range%20is%20now%20at%202.25%25%20to%202.50%25.Not good for our economy, or Democrats this Fall Election, if it shoves US into a recession that the Republicans & media all seem to be predicting.

Prices are already beginning to decline since President Biden ordered a release of roughly a million barrels of oil a day from our Strategic Oil Reserves for six months beginning in May, & also pressed oil companies to quit gouging Americans as they wallow in record profits & their ceos pay themselves outrageous raises, all as working Americans suffered too much inflation.

Gasoline has dropped $0.80/gal. down the street from us since the week before July 4th. Still too high, but definitely headed in the right direction.

NewsCenter28

(1,835 posts)Check out 538. The GOP lead on the generic has vanished. It's gone poof. Disappeared. Been shredded. No question that if the election was held today, it'd be a major Democratic sweep.

Of course, good ole Rasmussen will be coming out with a poll in mere hours that will probably show the GOP +30 points for the November election, in an attempt to game the average. GOQ pollsters are apparently well known for trying to game the average.

BumRushDaShow

(128,868 posts)WaPo just issued one of those this morning (gotta do the horse race) -

A Washington Post-Schar School poll finds 65 percent of Americans view the Supreme Court’s abortion ruling as a major loss of women’s rights, while 35 percent say it is not

By Hannah Knowles, Emily Guskin and Scott Clement

July 29, 2022 at 6:00 a.m. EDT

Nearly two-thirds of Americans say the end of Roe v. Wade represents a “major loss of rights” for women, a Washington Post-Schar School poll finds, but those who support abortion access are less certain they will vote this fall — a sign of the challenges facing Democrats who hope the issue will motivate their base in the midterms.

(snip)

https://www.washingtonpost.com/politics/2022/07/29/abortion-roe-midterms-poll/

Sky Jewels

(7,069 posts)BumRushDaShow

(128,868 posts)I know that I have heard similar for states that have only started having primaries AFTER Roe was overturned and the turnouts have been brisk - even for a primary. I know here in PA, our primary was back in May and I think even just the leaked copy of the decision was enough to wake people up. I think there is some grasping at straws and pretzel twisting and cherry picking what certain numbers "mean".

Sky Jewels

(7,069 posts)I don't think the pundits are grasping how powerfully the end of Roe has hit most American women, and how unrelentingly infuriated we are. And the issue won't go away. It's not like inflation. Women of child-bearing age will be reminded of the status of their reproductive rights every single month.

Anti-tCON

(22 posts)Not a winning strategy, nor ethically moral, & must be emphasized by all of US.

Sky Jewels

(7,069 posts)It's absolutely monstrous.

👏

BumRushDaShow

(128,868 posts)This is what your link says -

Fed funds target range is now at 2.25% to 2.50%.

Which is what I posted above. They are TARGETING that 2% - 3% range and want to keep it in that range, and we are CURRENTLY at "1.58%" (again "fed funds rate" and then retail banks add a couple percent on for lending to customer).

There is a bizarre amnesia, with the media feeding it, where for some reason, people believe "interest rates" have always been at 0% (consumer rates have never been that in modern lending history).

This economic situation is NOT the same as the 1970s. Don't believe the hype. Right now -

The one thing with the interest rates is that at a slightly higher rate, it encourages SAVING and that pulls currency "out of circulation" to reduce all the dollars pumped out there during the periods of "quantitative easing" when the crash of 2007 happened and over the 15 year since (making the environment inflationary) and the slightly higher rates benefit the non-stock market trading consumer (which is the vast majority) by getting a bit more off their money as they build up a cushion.

When you see business media whining - "Why are people saving????? They have to buy buy buy for the GDP!!!" and then will come back around again the next day and say "Why AREN'T people saving????? They have to have put something away in case of a downturn!!!!!", this is when I just walk away from the nonsense. .

"Americans aren't spending!!!111!!!" / "Americans aren't saving!!11!!11".

Tastes great!!1!! No, less filling!!1!!

It's idiotic.

Anti-tCON

(22 posts)Our Federal Reserve is virtually guaranteed a return on their loans to member banks at any rate, & higher rates only push up costs to all of US in a ripple effect.

And unfortunately, the media are all looking in the rear view mirror when the data finally hits the streets.

BumRushDaShow

(128,868 posts)but somewhere along the line, that has gone the way of the dodo.

The "deregulation" of the '80s has caused this sort of nonsense where, for example, many banks that offer credit cards, can "squat" in states that allow upwards of 25% interest rates on credit card purchases, so these banks will setup a presence there, and then that is what they will charge consumers, even when the fed rate is 0%. The credit card interest rates are probably the biggest and closest thing that the average consumer may have to deal with that has a major impact.

THAT is something that needs to be changed. But it's not something that is associated with the fed because outside of those supposed "0% introductory-move-your-card-balances-to-us" offers that get floated out there, ultimately that reverts to the same high interest rate after some "x" period of time (except when someone pays off their balance every month - which is something I do and have thankfully been able to do for years now).

GoodRaisin

(8,922 posts)by the interest rate increases and the decrease in demand for related materials allows the supply chain a chance to catch up with demand.

Sky Jewels

(7,069 posts)People are furious about Roe being destroyed.

https://www.dailykos.com/stories/2022/7/27/2113049/-News-About-Early-Voter-Turnout-In-Kansas-Over-Amendment-Banning-Abortion-Democrats-Are-Showing-Up