General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWealth Gap. It's been a thing since USA began, but it's WORSE

I am still looking for the earliest information, but I know these things changed a bit in the 1950's and that is when we got a middle class.

But corporate welfare has given those at the top so much more of the share of wealth and it's been TAKEN from the rest of US and they dodge taxes, hide their money off shore, pass it on via family wealth. So much of that WE NEVER GET BACK.

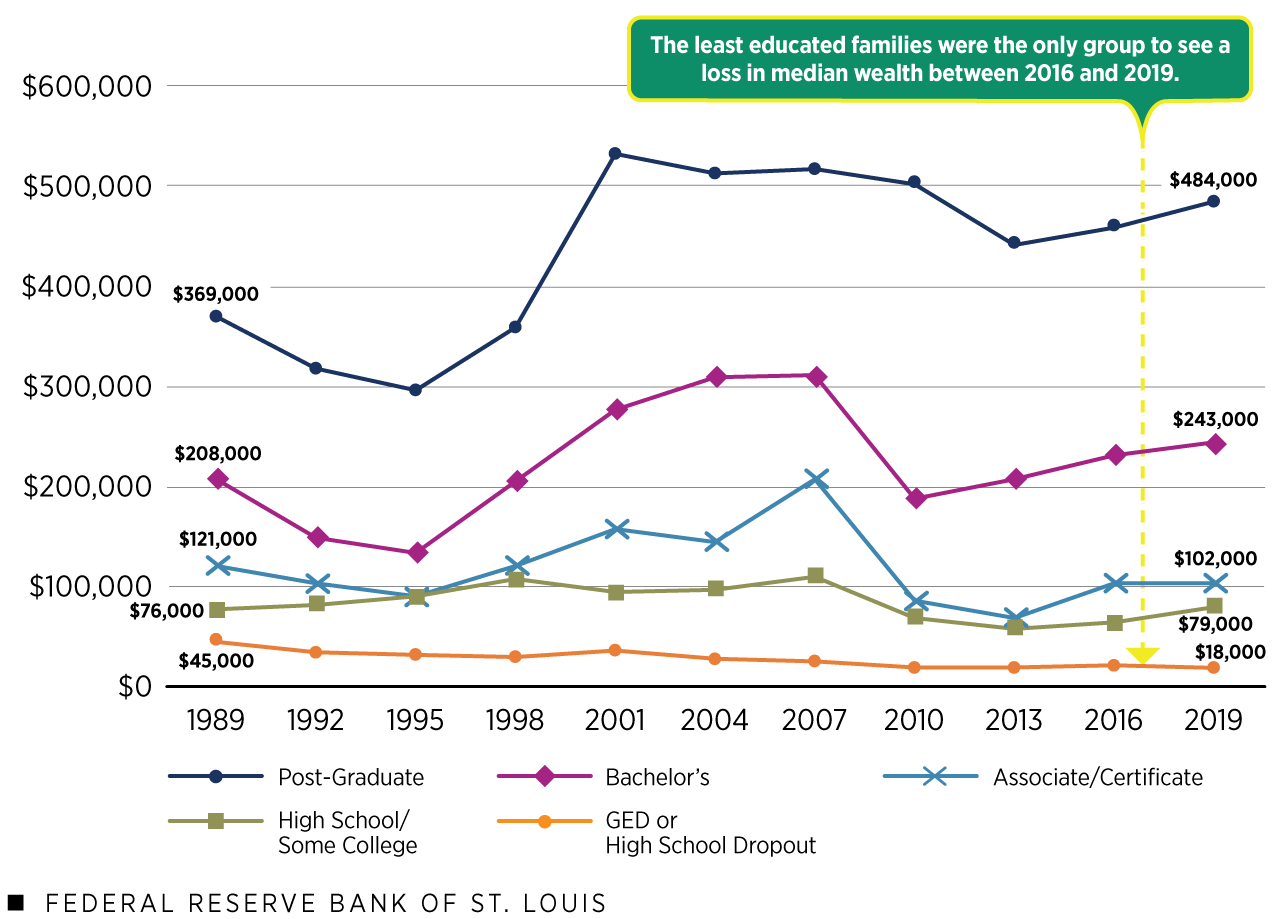

EARNINGS BY Education 1989 - 2019

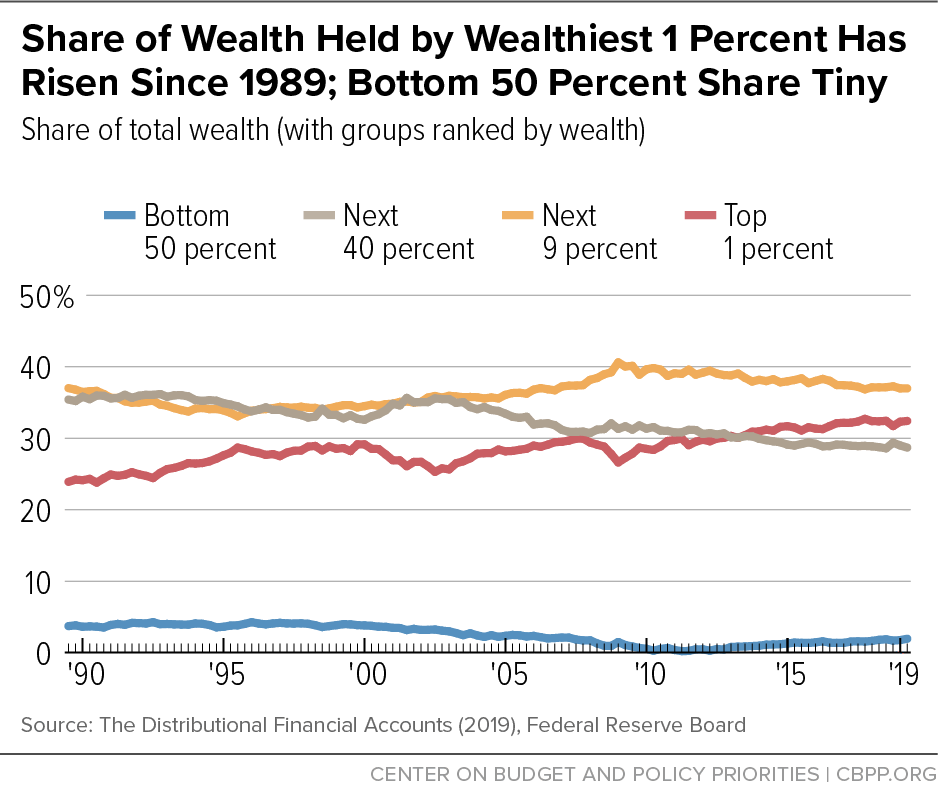

RICHEST OF THE WEALTHY DON'T EARN THEIR WEALTH.

They inheretit it.

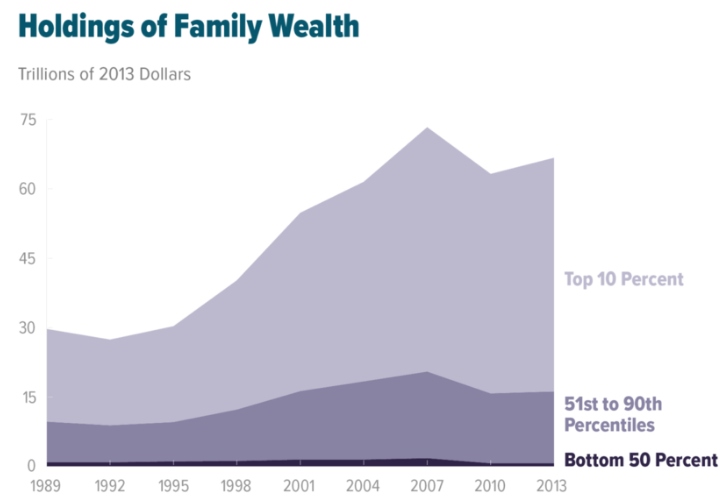

SEE THAT TINY BIT OF SLUDGE AT THE BOTTOM?

THAT'S MOST OF US. The bottom 50%

MORE INFO

https://www.qcc.cuny.edu/socialsciences/ppecorino/intro_text/Chapter%2010%20Political%20Philosophy/Inequality.htm

ck4829

(35,037 posts)TigressDem

(5,125 posts)LaMouffette

(2,019 posts)more effective:

[link:

Or it might just make them hungry for pie.

At any rate, I think this video should be broadcast on every possible media platform to get it through people's heads that the working class, who are the true wealth creators, is being screwed over royally by the corporate/donor/Citizens United class.

TigressDem

(5,125 posts)LaMouffette

(2,019 posts)People need to see this.

vanlassie

(5,663 posts)TigressDem

(5,125 posts)Sorry I did not respond right away.

Working all day long. New job lot of training etc...

Demovictory9

(32,419 posts)TigressDem

(5,125 posts)Kid Berwyn

(14,789 posts)How economists have misunderstood inequality: An interview with James Galbraith

Posted by Brad Plumer at 11:37 AM ET, 05/03/2012

The Washington Post

Before 1980, few academics in the United States gave much thought to the idea of economic inequality. It just wasn’t a glaring concern. But in the last 30 years, the incomes of the nation’s wealthiest 1 percent have surged, and more and more economists have been paying attention.

Occupy Wall Street protests in Los Angeles (LUCY NICHOLSON - REUTERS) Yet there’s still plenty about economic inequality that’s not well understood. What’s actually driving the gap between the richest and poorest? Does it hurt economic growth, or is it largely benign? Should it be reversed? Can it be reversed? Surprisingly, there’s little consensus on how to answer these questions — in part because good data on the topic is hard to come by.

In his fascinating new book, “Inequality and Instability,” James K. Galbraith, an economics professor at the University of Texas at Austin, takes a more detailed look at inequality by assembling a wealth of new data on the phenomenon. Among other things, he finds that economic inequality has been rising in roughly similar ways around the world since 1980. And this rise appears to be driven, in large part, by the financial sector — and the changes that modern finance has forced in the global economy. We talked by phone recently about his book.

Brad Plumer: You bring together a lot of new data on inequality in the book across a variety of countries, from the United States to Europe to China to Latin America. What’s different about what your book discovers?

James Galbraith: One thing we found is that there are common global patterns in economic inequality across different countries that appear to be very strongly related to major events affecting the world economy as a whole. The most important have been changes in financial regimes and changes in systems of financial governance. It made a big difference when the Bretton Woods system ended in 1971. The debt crisis of the 1980s made a big difference. The debt crisis of the 1980s made a big difference. It made a big difference in 2000 when the NASDAQ crashed and interest rates were reduced These things all had global repercussions, and they affected inequality around the entire world in different ways.

BP: And this isn’t how many economists have looked at inequality, correct?

JG: No. The most unconventional thing in this book is about how inequality relates to macroeconomic performance and financial factors. The discussion of inequality tends to be heavily dominated by a marketplace perspective that stresses individual-level characteristics like the demand for skill. Economists have always classified this as a microeconomic problem. ... But when something’s happening at the same time around the world, in different countries that are widely separated, that’s a macro issue. There was a global movement toward higher inequality as a result of the financial stresses that the world is under.

CONTINUED...

http://www.washingtonpost.com/blogs/ezra-klein/post/how-economists-have-misunderstood-inequality/2012/05/03/gIQAOZf5yT_blog.html

More from Dr. Galbraith: University of Texas Inequality Project:

http://utip.gov.utexas.edu/papers.html