General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNYT: Mitt and Newt Hate Fannie and Freddie

Mitt and Newt Hate Fannie and Freddie

By DAVID FIRESTONE

Newt Gingrich and Mitt Romney talk during a commercial break at the Republican presidential candidates debate in Jacksonville, Fla., Thursday, Jan. 26, 2012.

That was made clear in the report last year from the Financial Crisis Inquiry Commission, which found that Fannie and Freddie participated in risky mortgages only by following rather than leading Wall Street and other lenders.

“We conclude that these two entities contributed to the crisis, but were not a primary cause,” the commission wrote. And it said the two agencies’ bonds – which Mr. Romney and Mr. Gingrich were accusing each other of owning through mutual funds – “did not contribute to the significant financial firm losses that were central to the financial crisis.”

Republicans would love for voters to believe that the government, through the dark arts practiced by Fannie and Freddie, brought on the crisis by encouraging irresponsible people to buy houses. This is just an effort to distract from the real perpetrators: the banks and lenders that dreamed up and pushed subprime loans, and the Wall Street firms that packaged them into toxic securities.

If the presidential candidates were serious and not feigning outrage about Florida’s foreclosures, they would acknowledge what really happened. But that would require admitting that the Dodd-Frank law to reduce private-sector abuses is potentially useful, and that President Obama and the Democrats took an important step in passing it.

more...

JohnnyRingo

(18,614 posts)The largest majority were on private lenders like Countrywide Finance that weren't regulated into granting those subprime loans. They were manipulated into doing it by Wall Street greed and paid a heavy price to Goldman Sachs in the end.

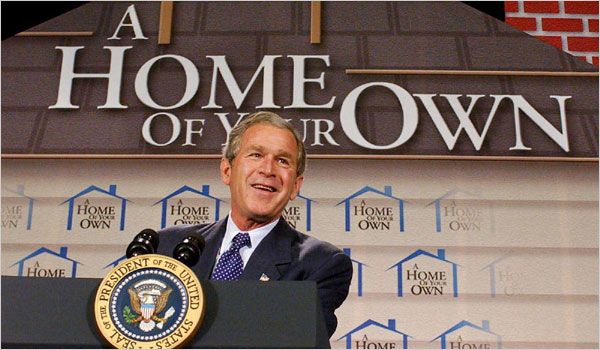

No one ever mentions the "American Dream Downpayment Initiative" of 2003. Signed by GW Bush in that year and enacted in early 2004, it demanded that government lenders grant loans to first time homeowners with no downpayment and no interest if the buyer lived in the home for six years.

When those borrowers lost their jobs in 2007, they found themselves in a bad situation: Their home was worth les than they paid, and selling it would put them on the hook for the downpayment and back interest.

This is Bush after the signing where he proclaimed himself "The Homeownership President":

ADDI:

http://www.hud.gov/offices/cpd/affordablehousing/programs/home/addi/index.cfm

flpoljunkie

(26,184 posts)Private sector loans, not Fannie or Freddie, triggered crisis

David Goldstein and Kevin G. Hall | McClatchy Newspapers

last updated: November 24, 2010 01:49:33 PM

Subprime lending offered high-cost loans to the weakest borrowers during the housing boom that lasted from 2001 to 2007. Subprime lending was at its height from 2004 to 2006.

Federal Reserve Board data show that:

More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions.

Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that's being lambasted by conservative critics.

The "turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007," the President's Working Group on Financial Markets reported Friday.

"Most of the loans made by depository institutions examined under the CRA have not been higher-priced loans," she said. "The CRA has increased the volume of responsible lending to low- and moderate-income households."

In a book on the sub-prime lending collapse published in June 2007, the late Federal Reserve Governor Ed Gramlich wrote that only one-third of all CRA loans had interest rates high enough to be considered sub-prime and that to the pleasant surprise of commercial banks there were low default rates. Banks that participated in CRA lending had found, he wrote, "that this new lending is good business."

McClatchy Newspapers 2008

http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html

JohnnyRingo

(18,614 posts)Since the nearest Democrat to the scene of the accident was Barney Frank, the GOP directed 100% of the blame to him and the dept he was overseeing at the time.

Just like all their points, it holds little water because one has to believe Barney Frank wrested control of the federal government from the republican White House, Senate, and Congress during the mid-2000s and began handing out federal money without the approval of the majority party like some crazed renegade. Certanly that's one mean trick during a time when democrats had to ask permission to use the Capital bathrooms.

The other problem they have is who Republicans see as beneficiaries of the low cost loans.