General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHow rich is Buffett's Secretary?

Buffett said she pays a tax rate of 35.8%. Back off 7.65% for payroll taxes and she pays about 28% in income taxes. Lets back off another 5% for Nebraska income taxes (a 7% rate, less the impact of reducing federal taxes for deduction of state income taxes) and she is paying an effective rate of around 23% in Federal income taxes. Of course, I need to reduce the taxes over the SS limit by 6.2%.

Now, I consider myself fortunate and I had AGI of $105,000 (as prepared last night). If I remove child personal exemptions/child tax credit (as I assume she has no kids under 17) and claim the standard deduction (as itemizing would make my rate even lower) and I am paying a tax rate of 13%. By plugging in the Federal income brackets, I estimate she is making around $457,000 assuming NO capital gains or qualified dividends.

While I agree 100% with the sentiment, don't think for a second Buffett's seceretary is in the 99%.

FourScore

(9,704 posts)And how the hell are you paying 13?

joeglow3

(6,228 posts)When look at everyone's rates (Romney, Buffett, Obama, etc.) we are looking at taxes as a percentage of AGI.

Keep in mind that after AGI, you reduce it by personal exemptions (slightly over $7,000) and the standard deduction (almost $12,000) before arriving at taxable income. Also keep in mind that everyone pays every tax bracket (i.e. someone making $70,000 still pays the 10% and 15% brackets).

Honeycombe8

(37,648 posts)If that's true, that is normal middle class for a single person. If she's single. Singles pay the highest rate.

As for YOU paying 13% after deductions, I guess it's because you're married & get a tax break? I make considerably less than you do and pay about 19% after deductions, including some charity deductions (not enuf of those, I admit).

Hey, I pay about the same rate as Buffet's secretary!

I have NEVER paid a rate as low as 13% after deductions, except when I was barely above poverty level. I remember I paid about 10% in federal taxes then, which was a hardship, since that 10% came out of necessary funds, not expendible income.

joeglow3

(6,228 posts)Now, Buffett's secretary is married, so I used married filing joint rates.

Given personal exemptions, the standard deduction (I am ignoring itemizing deductions, as this method is MORE conservative) & progressive tax schedules, there is absolutely no way you paid a marginal rate that high and were ANYWHERE near the poverty level.

If you paid that much, you need to sue the shit out of whoever prepared your taxes.

Atman

(31,464 posts)Not speculative. This was mentioned when this story first came up over a year ago, but you never see it mentioned anymore. Probably because it goes against the narrative. We're supposed to the "secretary," like a low-paid employee who greets people at the front desk, books plane flights for the boss and answers the phones. At the level Buffett is working, "secretary" is a misnomer. She is very well paid.

Honeycombe8

(37,648 posts)I think you are skued because of your situaton, which is bizarre. I've never heard of anyone other than poor people and capital gains wealthy Romney type people paying only 13% after deductions.

I've earned everywhere from almost nothing to $105,000 a year myself...and never, but never, have I paid only 13% after taxes. (The $105k year was an anomaly where I was required to work tons of overtime...it wasn't worth the money....almost killed me.)

joeglow3

(6,228 posts)As you can see, I excluded payroll taxes from both MY taxes AND Buffett's secretary's taxes. Thus, I am comparing my 13% in Federal income taxes to her 23% in Federal income taxes. In order for her to get to the level Buffett is citing, she HAS to be over $450,000.

Now, I have a Masters in Accounting, have been a CPA for 13 years and have been preparing income taxes for people at all income levels ($40,000-$85,000,000) at a Big 4 firm for 10+ years. What are your credentials?

Honeycombe8

(37,648 posts)that you are taking as fact.

You haven't cited a source (an objective source) for your assumptons...the 35%, the 23%. You didn't cite her age, marital status, adn whether the % Buffett supposedly said she paid included p/r taxes & other federal taxes on one's federal income taxes. Most people include the federal taxes that are based on income (all those taxes on a federal return) as part of the % of federal income taxes.

See my post below....the secretary earned $60,000 in 2007. Buffett has said more recently that she doesn't earn anywhere near the $200K to $400K that he's seen people guessing lately.

So you need to go back to your drawing board, get away from your tax expert rules, enter the real world, and come up with a middle class income based on facts.

As I said, I have never paid as low as 13% to the federal govt for taxes based on income, except when I was barely above the poverty level. So you have some special deals there that you may not understand don't apply to most workers. A lot of capital gains income, maybe?

joeglow3

(6,228 posts)"You didn't cite her age"

- I assumed she is under 65%. If she is older, the facts work in my favor (as she would qualify for a greater deduction).

"marital status"

-I used married filing joint rates, as she is married

"adn whether the % Buffett supposedly said she paid included p/r taxes & other federal taxes on one's federal income taxes. Most people include the federal taxes that are based on income (all those taxes on a federal return) as part of the % of federal income taxes."

-I included those as well.

"Buffett has said more recently that she doesn't earn anywhere near the $200K to $400K that he's seen people guessing lately. "

-She may be making that much, but her rates are that way because of her JOINT income. Thus, her husband must be making a shit ton.

"So you need to go back to your drawing board, get away from your tax expert rules, enter the real world, and come up with a middle class income based on facts. "

-So, when people are talking about tax rules, I need to ignore tax rules. Sorry, but that is NOT the real world.

"As I said, I have never paid as low as 13% to the federal govt for taxes based on income, except when I was barely above the poverty level. So you have some special deals there that you may not understand don't apply to most workers. A lot of capital gains income, maybe? "

-You are probably thinking of marginal rates without the standard deduction or personal exemptions. However, that is NOT have we have been calculating rates in the media for all people involved. We have been dividing taxes into AGI, which is what I did.

Sorry if you don't like facts.

hfojvt

(37,573 posts)As the chart there shows, even those in the 90th-95th percentile only pay an average income tax rate of 12.44%. Even back in 1986, 90% of taxpayers paid, on average, less than 13% in taxes.

Of course, the average tax rate for the 75th to 90th percentile being 12.83% in 1986 would mean that some in that group are paying less than that, and some are paying more. But if the standard deviation is 1%, then, if I remember my Chebyshev, at least 75% are withing two standard deviations of the mean, meaning most of that group would be paying 14.83% or less.

Pulling a tax form out for 2010. A person with $30,000 in income who was single and childless (and thus paying the highest taxes) and not itemizing deductions, would pay

let's see

$30,000 less

$5,700 standard deduction less

$3,650 personal exemption equals

$20,650 in taxable income equals

$2,683 in taxes

a tax rate of 8.94%

The poverty line for a single person is $10,890 so $30,000 is 275% of the poverty level.

The whole Buffett hypothesis only works if one includes not only payroll taxes but also the employer portion of payroll taxes, which may or may not be fair. The government forces most people to put away 15.3% for their retirement and for insurance against disability.

Now that insurance program could be funded by income taxes instead of by more regressive payroll taxes, but some argue that that would make it politically much more vulnerable.

Snake Alchemist

(3,318 posts)I think the estimate that she makes about 400K a year is about right.

Honeycombe8

(37,648 posts)That's a thing going around the Republican blogs.

She pays about 18% to about 20% after deductions, Buffett said last year. She earned $60k in 2007.

Snake Alchemist

(3,318 posts)Atman

(31,464 posts)Same kind of word games Romney played when said he "guesses" he paid "somewhere close to the 15% range." turned out it was less than 14%, but the media keeps quoting him as saying he pays 15%.

I repeat, when this first came out, it was disclosed the his secretary made $400,000. It is absurd to think the assistant to one of the richest me on Earth makes only $60,000. Absolutely absurd.

hfojvt

(37,573 posts)would only pay a tax rate of 14.75%.

Perhaps her spouse makes $60,000 as well, but $120,000 in income would put them in the top 10%. Which is not my idea of middle class.

MattBaggins

(7,897 posts)"Well we discount this tax"

"Well we don't include that tax"

"Well we minus the other taxes just because"

"Well we don't consider this, that or the other thing to be income"

The rest of us say "I made X dollars. Someone took Y dollars from me and that is my tax rate.". If you use this method you don't "understand" the complexities.

joeglow3

(6,228 posts)While you ignorantly think you post is a commentary on me, it is actually a commentary on our complex tax code. However, nice try. Here is your consolitation prize.

MattBaggins

(7,897 posts)joeglow3

(6,228 posts)What are your credentials?

MattBaggins

(7,897 posts)I bring home a pay check

I see how much I was paid

I see how much was taken

Not very difficult.

joeglow3

(6,228 posts)That has NOTHING to do with your tax return and what is ultimately paid/owed to the government.

hfojvt

(37,573 posts)First time that has happened since I moved here. I think they may have increased the with-holding rates without publicizing it very much.

Honeycombe8

(37,648 posts)The secretary is 55 years old, married with kids (grown? don't know), and earned $60,000 in 2007.

Mr Buffett said that he was taxed at 17.7 per cent on the $46 million he made last year, without trying to avoid paying higher taxes, while his secretary, who earned $60,000, was taxed at 30 per cent. Mr Buffett told his audience, which included John Mack, the chairman of Morgan Stanley, and Alan Patricof, the founder of the US branch of Apax Partners, that US government policy had accentuated a disparity of wealth that hurt the economy by stifling opportunity and motivation.

http://tusb.stanford.edu/2007/07/warren_buffet_has_a_lower_tax.html

That she is not one of the 99% and makes a lot of $$$ is going around the Republican blogs and National Review & other Republican mags. Is that why you didn't cite the source of your "information"?

joeglow3

(6,228 posts)I looked at married filing join with NOT children (as she is married). If that is true, pays a rate of what she because her husband makes a shit ton of money. Unless, he is looking at MARGINAL rates, which is dishonest, as he is using EFFECTIVE rates when looking at everyone else's rates.

NutmegYankee

(16,197 posts)I pay a payroll tax on all of my income. Romney doesn't.

joeglow3

(6,228 posts)You might want to read before commenting.

NutmegYankee

(16,197 posts)I paid 15% for income tax myself. On top of that is the payroll tax, with 4.2% SS and 1.45 medicare, so 5.65%. So now I've paid 20.65% to the Federal Government. 20.65% and I make less than 100k a year as an engineer. With state and local taxes, it hits 29%, and that doesn't include the state sales tax.

But on federal income tax , I do hit (barely) the 28% bracket. So I paid 28% on a little bit of my income. So I can claim I got taxed at 28%. My overall effective rate dropped to 15%, no doubt helped by 401K deductions and the mortgage interest deduction, but I'm not lying when I say I paid 28% on some of my income.

And that's the point. Why do I have to pay 28% on some of my income but an oxygen thief like Romney gets to pay 15%?

joeglow3

(6,228 posts)There is a HUGE difference.

NutmegYankee

(16,197 posts)Kellerfeller

(397 posts)Romney's marginal rate was at least 33% due to speaking fees.

oldhippie

(3,249 posts)... but remember, this is DU. Never misunderestimate the legal or economic ignorance here.

Even worse, many here will purposely redefine or misdefine terms to suit their purpose. To the unsophisticated, gross income - take home income = "tax". Don't confuse them with 1%er terms like AGI or deductions or exemptions or effective federal income tax rate. They won't get it.

former9thward

(31,913 posts)If she is taxed at 30% she would be making hundreds of thousands of dollars. Just look at the IRS tax tables. So either the claim of 60k is false or the claim of 30% is false. They both can't be true.

TBF

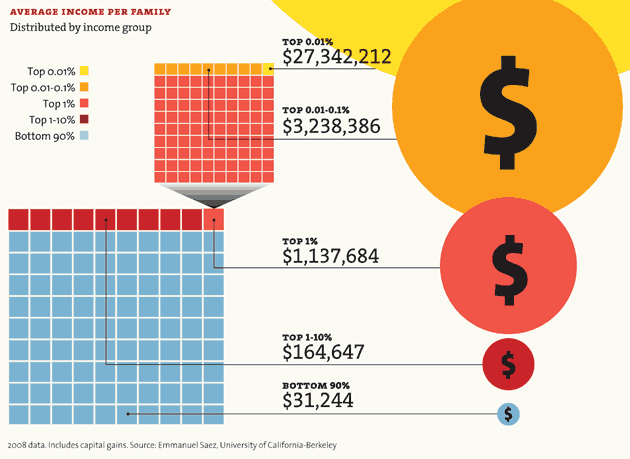

(31,990 posts)Focusing on any one person is not the point, although FAUX news is certainly going to try to make you think that. This is what you need to look at:

http://motherjones.com/politics/2011/02/income-inequality-in-america-chart-graph

As long as the top 10% controls 2/3 of the nation's wealth we are doing something wrong.

joeglow3

(6,228 posts)I agree 100% with you. We are going about this all wrong.

TBF

(31,990 posts)it seems that redistribution is the way to accomplish this, but as someone who hides from numbers (I barely made it through cost accounting) I'm at a loss as to how the tax code should be changed. You seem to have a better handle on that end of it and I wondered if you had thoughts on that. Would raising rates be preferable? Focusing on capital gains instead (I know GWB lowered taxes here which made rich folks happy)? Or some other way?

Snake Alchemist

(3,318 posts)joeglow3

(6,228 posts)Instead, give everyone a personal exemption of $25,000 to $30,000. Couple that with very low rates for the first $100,000 and those making $150,000 and under would pay next to nothing.

Next, ramp up tax rates and increase the brackets by a few points. Finally, remove the cap on payroll taxes and adjust the down to the rate needed to be collect on all income to fund the system.

CreekDog

(46,192 posts)which is why you've posted and keep posting on this one instead.

![]()

Skinner

(63,645 posts)In your opinion, should Warren Buffett pay a greater percentage of his income in taxes than his secretary pays?

A simple yes-or-no answer will suffice.

fascisthunter

(29,381 posts)Gothmog

(144,833 posts)Here are some facts to use to debunk this crap.

First, the analysis is based on pure speculation using the tax tables and the idiot who made these claims is wrong. Here is an analysis from another blogger on Forbes http://www.forbes.com/sites/joshbarro/2012/01/25/no-you-dont-have-to-make-200000-to-have-a-higher-tax-rate-than-buffett/

Second, Buffett has personally debunked this crap http://www.omaha.com/article/20120127/NEWS01/301279949/672

These attacks are really stupid.

joeglow3

(6,228 posts)It states that Buffett is including what the company pays in payroll taxes as a tax paid by the employee. However, nowhere in the article does it cite this claim (the quote it has says NOTHING of this). I agree that that would change the answer, but the logic behind doing that makes zero sense and is extremely dishonest.

dsc

(52,147 posts)it is the exact way that conservative critics of Buffets count the ss tax.

Gormy Cuss

(30,884 posts)His calculation includes payroll taxes paid by employer. Buffett doesn't explain his logic in doing so but self-employed people pay both portions so it's not much of a stretch to consider the mandated employer portion as a one-off tax on employees (that is, the employer contribution is a tax on wages of the employee but they're just not categorized that way on the pay stub.)

Rather than being dishonest, Buffett made it clear that he was including it. Dishonest is the way the Forbes blogger Gregory ignored that when he tried to reconstruct the secretary's income using rate tables.

CreekDog

(46,192 posts)why would the OP use conservative critics as a source (and end up getting things wrong as a result) when the primary source is easily available?

RB TexLa

(17,003 posts)joeglow3

(6,228 posts)RB TexLa

(17,003 posts)joeglow3

(6,228 posts)oldhippie

(3,249 posts)..... he put her in his family box and specifically brought it up in the SOTU address? Or was he trying to be subtle and had a massive fail? Nobody was supposed to notice?

obamanut2012

(26,027 posts)Plus, she is a SECRETARY. She gets a paycheck. Anyone who gets a regular paycheck is not wealthy. She is probably middle class, with a nice retirement fund. God for her.

What does she have to do with Warren Buffett's argument that he should pay more taxes? WB isn't perfect, but I give him credit for at least having a clue.

Snake Alchemist

(3,318 posts)Berkshire Hathaway? What's good for the goose is good for the gander.

obamanut2012

(26,027 posts)If she's worked there long enough.

Snake Alchemist

(3,318 posts)PragmaticLiberal

(904 posts)I believe Mr. Buffet has given his secretary shares.

fascisthunter

(29,381 posts)with him.... WTF?!

muriel_volestrangler

(101,257 posts)Buffett himself said "35.8" right at the end of an interview.

Atman

(31,464 posts)"Buffet himself declares that he pays a 17.4 percent rate on taxable income. His staff, like Bosanek, pay an average of 34 percent. The IRS publishes detailed tax tables by income level. The 2009 results show that the average taxpayer paying Buffet’s 17.4 rate earns an adjusted gross income between $100,000 and $200,000. But an average taxpayer in Bosaneck’s rate (after downward adjustment for payroll taxes) earns an adjusted gross income of $200,000 to $500,000. Therefore Buffett must pay Debbie Bosanke a salary well above two hundred thousand."

jwirr

(39,215 posts)GoCubsGo

(32,069 posts)She is likely making 6 figures. So what? But, her boss is a billionaire, yet he still pays a far smaller percentage than she does. THAT is the issue, not that she is "rich". The nutters have to find a way to twist this into their "wealth envy" meme, and this is their sorry attempt at it.

mdmc

(29,038 posts)14 million?

Dokkie

(1,688 posts)There's no way this secretary pays 35.8% of her income in federal income tax. The top tax bracket is only 35%, and that applies only to the portion of your income over $379,150. Her rate isn't possible even if she took no deductions or credits.

Also this a man who gave all his money to charity which would mean that the gov gets nothing from estate tax when he dies.

Incitatus

(5,317 posts)That means more of that money will be used for good.

AngryAmish

(25,704 posts)Dokkie

(1,688 posts)stop paying taxes since the govt would use it to buy bombs? How about medicare, SS and welfare? And the debt can only be paid back by taxing the rich. Just that Warren Buffett has no credibility in this debate as long as he is going to shield his vast wealth from US taxes. But then again, its not too late for him to change course. The US govt needs every penny it can get his hands on

Demonaut

(8,911 posts)joeglow3

(6,228 posts)Just a pet peeve...

Demonaut

(8,911 posts)lol