General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsReal Dollars

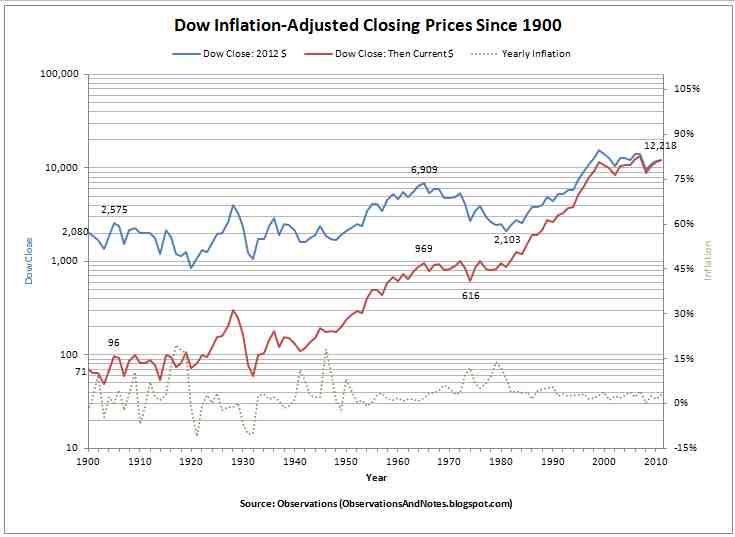

In real dollars (inflation adjusted) the Dow did not hit a high in 2000, hit it again in 2007 and blow past it in 2013.

The Dow peaked in 2000 and then crashed.

It then struggled back to a point substantially below the 2000 high, then crashed.

It then struggled to a point below the 2007 high, and way below the 2000 high, which was described in the media as an all time high.

It is not.

(The NYSE, versus the Dow, did exceed the 2000 highs by a lot in 2007, but is currently waaaaay below those '07 highs. We had a housing AND smaller-cap stock bubble.)

In real dollars we are in a bear market that began in 2000 and has featured a series of swings in a stair-step down, with lower highs and lower lows.

That's what a bear market is. A long-term downward trend.

(There are definitions of bear market that came from God knows where about percentages and stuff, but a bear market is a big-picture down-trend, and any definition that tries to describe a series of lower highs and lower lows over a decade as anything other than a bear market is up to no good.)

Stocks may zoom up from today and never look back. I am not predcting anything.

Just noting that the blue line here shows a bull market 1980ish-2000 and a bear market 2000-present, and that is what it is.

cthulu2016

(10,960 posts)bluestate10

(10,942 posts)President Obama. Manufacturing had been declining in the USA since the first oil shock of 1973, that period marked the apex of the once powerful US steel industry. Industrial decline continued under Ford, Carter, Reagan (badly due to his policies), Bush I, Clinton, Bush II. Under President Obama, net manufacturing has grown successive years since 1973, yes, from a lower base, but manufacturing has grown. In addition, younger industrialists have studied the failures of those before them and decided that employing americans by providing good wages and benefits is good business.

BTW. Your observation of a bull rally within a larger longterm bear market is right on target. That has happened because of economic policies put in place over most of the last 4 decades.