General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsPotemkin Housing Recovery?

from Dollars & Sense:

BY DARWIN BONDGRAHAM | March/April 2013

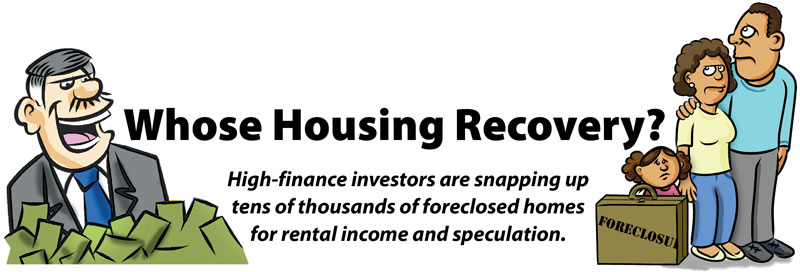

The business press has been reporting a “recovery” of the U.S. housing market for over a year now, as the average prices of single-family homes rise across the country. Implied in these stories is the return of a healthy real-estate market, in which the average American family has the resources—in terms of income, savings, and access to credit—to purchase its own slice of the American dream.

The housing recovery we are seeing right now, however, is anything but indicative of broader gains—increased wages, falling unemployment, or renewed access to credit for consumers—being shared across the economy. The biggest buyers of single-family homes today are not new owner-occupants, but investors. While most of these investors are so-called “mom-and-pop” buyers who own an extra rental house or two in their hometowns, large private investors are also increasingly buying up homes.

These investors are especially focusing on foreclosed properties in the “sun” and “sand” belts—from Florida and Georgia to Arizona, Nevada, and California. Private-equity firms, investment banks, and other high-finance investors are gobbling up housing stocks in these markets by the tens of thousands of units. They have taken to calling single-family rental homes a “new asset class,” alongside corporate debt, government bonds, currencies, and financial derivatives.

From Owners to Renters

Under the so-called housing recovery, the foreclosed homeowner is being relegated to the status of renter. Increasingly, the new renters’ role will be to pay their new high-finance landlords for shelter, all in order to secure big returns for the millionaire clients and institutional partners who are backing foreclosure purchases with billions of dollars. ..........(more)

The complete piece is at: http://www.dollarsandsense.org/archives/2013/0313bondgraham.html

niyad

(113,259 posts)Dragonfli

(10,622 posts)Re-enforced by the same recovery model used by his successor that paid off the banks debts rather than the homeowners debts even tho giving them the money instead with the stipulation that they pay down their bank created and exacerbated exponentially grown and planned "housing debt" would have required less money, avoided foreclosures and future fraud committed by banks that made large cash building the problem, made large cash as the solution to the problem and made and are making large cash off of the foreclosure and fraud problems they were responsible for it in the first place.

If it were not the plan why was this scam such a bi-partisan success story that is perpetuating economic growth shared exclusively by the very wealthy while the rest of us are basically told to go pound salt?

Not meaning to denigrate this very good post or the OP that posted it, just blowin' off steam I guess.

Egalitarian Thug

(12,448 posts)onethatcares

(16,166 posts)here in sunny west coast Florida the Blackstone group has been picking up the short sales, foreclosures and everything in between.

Last month they purchased something like 8 million dollars worth of housing in one day in Hillsborough/Pinellas counties. That's a lot of renters coming our way.

quaker bill

(8,224 posts)can be had for $.35 to $.40 of the peak dollar value. I like St. Pete and have been looking at them as a way to secure an affordable place to retire. The data suggests that there are still quite a few more foreclosures in the pipeline. However, at some point the market works through this and the price rebounds. Even if the price only rebounds to say 70% of peak dollar value, the investors will make a killing flipping them. The market I live in now has worked through the foreclosure volume and prices are beginning to rebound (5+% a year) and new homes are being constructed. It will take another year or two in Tampa - St. Pete. I hope to take advantage of the momentary opportunity to quickly secure a paid off house.

onethatcares

(16,166 posts)there are plenty around. Remember to add your property taxes and homeowners insurance rates in with that. I'm in St Pete.

quaker bill

(8,224 posts)and can get more if needed. I live simply. Some of the homes north of central and a bit west of downtown seem adequate and within my reach. I will probably rent it out for a few years until I can take my pension at full benefits. I am pretty good with tools.

quaker bill

(8,224 posts)regular folks are buying them too. However, what I actually see around is that new homes are also being built again. The big players in that industry which survived are back, note full bore yet, but they are back in the building business. These aren't going to investors. It takes three years to roll a foreclosure off your credit record, and for a growing group, those three years have passed.

Glitterati

(3,182 posts)is being bought up by investors. They're offering cash deals, 10 day close. There's no way in hell a family searching for a home to buy can compete with these deals.

Ask me - I just bought a home in this area and I know what I dealt with for a year. I got beat out on every single offer because of investors, over and over. I only eventually bought a home because I went to listings over 100K and then lowballed my offer.

Half the time, the house comes back on the market 45 days later, but that's because the investors backed out of the deal when the house wouldn't pass inspection, which means a family buyer can't get it through at any price.

edit to add:

The only building around here is apartments and senior assisted living homes.