General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsAusterity 2.0 Greek workers are being forced to work for free, give back past pay.

"It's being called the "negative salary": Due to austerity measures in Greece, it's being reported that up to 64,000 Greeks will go without pay this month, and some will have to pay for having a job. Numbers in austerity reports have usually reflected figures in the millions, since they reflect industry-wide cuts (i.e. a 537-million euro cut to health and pension funds). And plans of cutting minimum wage by up to 32% is all but a given in the country. Today's "negative salary" deal—which could have government employees returning funds— reveals the real human impact of the austerity measures.

As Zero Hedge and the Press Project report:

Salary cutbacks (called "unified payroll"![]() for contract workers at the public sector set to be finalized today. Cuts to be valid retroactively since november 2011. Expected result: Up to 64.000 people will work without salary this month, or even be asked to return money. Amongst them 21.000 teachers, 13.000 municipal employees and 30.000 civil servants."

for contract workers at the public sector set to be finalized today. Cuts to be valid retroactively since november 2011. Expected result: Up to 64.000 people will work without salary this month, or even be asked to return money. Amongst them 21.000 teachers, 13.000 municipal employees and 30.000 civil servants."

As if we needed any more proof that its time to abolish capitalism. This is beyond insane, making people pay for the privilege of working.

http://www.theatlanticwire.com/global/2012/02/some-greeks-might-have-pay-their-jobs/49023/

Rex

(65,616 posts)Or is that reverse vampire capitalism?

white_wolf

(6,238 posts)I'm really not sure how much longer this rotten system can last. The limitations are becoming clear to everyone.

Rex

(65,616 posts)Then probably sell the bones.

white_wolf

(6,238 posts)Dracula would be proud.

Rex

(65,616 posts)They would find a way to kill and sell off parts of Dracula as some sort of sex drug to ultra rich friends.

white_wolf

(6,238 posts)TBF

(32,050 posts)as it is designed to do.

Good point.

Zalatix

(8,994 posts)white_wolf

(6,238 posts)I don't think deal is final yet, so we will probably have to wait and see once they try to implement these measures. Based on how militant the working class is in Greece right now, I would expect at least a few strikes.

nanabugg

(2,198 posts)glorified and allowed to run rampant. Sound familiar? No tax enforcement was worn as a badge of honor among most Greeks for years. The fat cats rolled the Greek economy by making sure there were little, if any regulation of business and where there was regulation there was no enforcement.

Zalatix

(8,994 posts)badtoworse

(5,957 posts)That would have forced the Greek government to live within what its tax revenues or deal with its lax enforcement policy. Had the Greeks been cut off from borrowing sooner, they wouldn't be under such a crushing debt burden now.

That is the banker's culpability? Expecting that the Greek government will make good on its bonds? The banks didn't give away the store; the Greek government did.

Zalatix

(8,994 posts)badtoworse

(5,957 posts)and anyone who can, does it, not just the Uber-rich.

http://www.newyorker.com/talk/financial/2011/07/11/110711ta_talk_surowiecki

badtoworse

(5,957 posts)How does that let the government off the hook? I'm not defending what Goldman did, but ultimately, the obligation to deal honestly with the purchasers of sovereign debt is the government's and the government's alone.

I don't see the relevance of the WSJ piece - no one disputes that there is a huge liquidity problem in Greece.

sabrina 1

(62,325 posts)an economic collapse, Goldman Sachs seems to be involved. Including here. And derivatives, legal at the time, as GS claims, but it was never moral, are at the core of the collapse.

Way back during the Clinton Administration, Brooksley Born warned about derivatives and swaps. Exactly what eventually contributed to the Global Economic Meltdown, including in Greece. For her trouble, she was run out of DC by Greenspan, Ruben and Summers et al. There was way too much money to be made for them to worry about the consequences or morality of what they were about to do, and they were in charge, she wasn't.

The world has paid dearly for what they did to Born. Elizabeth Warren and Born have a lot in common, and Warren, like Born has been opposed at every turn, by the current Treasury Sec and the rest of the Goldman Sachs alumni embedded in our Government.

The only reason Warren has survived, while Born did not, is because Born's predictions have come true and it is a bit more difficult to shut her up than it was before anyone could determine how correct Born was back in the '90s.

But there is no doubt that Greenspan et al, even though he has tried to claim he 'made mistakes' (hard to believe considering the way he treated Born) knew the risks they were taking with this country's economy.

All of them belong in jail, imho. And the ultimate outrage is that all these weasels, using the rightwing noise machine, have tried to blame teachers and fire fighters et al for the huge Global Financial Meltdown, while they profited so greatly (don't know any Firemen who did though) in order to distract from the crimes they committed.

badtoworse

(5,957 posts)Derivatives are an issue, but what does that have to do with a fiscally irresponsible government?

sabrina 1

(62,325 posts)and Governments went along with it. Had there been proper laws in place, the Banks could not have done what they did.

I'm not saying Governments were not irresponsible, I don't know enough about Greece's laws, although I have read that the kind of deregulation that occurred here, occurred there and elsewhere also. That makes elected officials responsible. Just as happened here, when our irresponsible Government ended Glass/Steagal with the majority of Reps in both parties signed on. Only seven Dems and one Repub in the Senate refused to sign the Gramm/Sliley Act. That is where it all began.

If the same thing happened in Greece, then their Government too was complicit, and from what I recall, they were and the Greek people voted them out, only to have the next Government betray them also.

Iceland also threw out its Government and elected a new one once they realized what had happened. So, I agree with you, all these Governments betrayed their people for their own selfish reasons. Which is why there are movements like OWS, who want accountability for all of this.

girl gone mad

(20,634 posts)Leftist Agitator

(2,759 posts)That the Greek people have always been a nation comprised of tax cheats.

Your statement is ignorant in the extreme.

badtoworse

(5,957 posts)lunatica

(53,410 posts)So glad you're enlightening us.

![]()

fasttense

(17,301 posts)The working people paid their taxes because audits on them increased. And now they are coming for the working people's pay.

If you are forced to work without pay isn't that called slavery?

Do these look like folks who want to be slaves? The only thing they have left to withhold is their labor, and I'd be very surprised if they didn't do just that.

Feb 12, 2012

abelenkpe

(9,933 posts)Cause if work asked me to pay to work I'd laugh as I walked out the door.

white_wolf

(6,238 posts)and you'll never get paid again, but I think at this point I'd take my chances.

Zalatix

(8,994 posts)Like you, I would walk.

abelenkpe

(9,933 posts)It's clear the government has no intention of doing anything to help the people. I imagine many Greeks will be packing up and leaving the country.

MNBrewer

(8,462 posts)Scootaloo

(25,699 posts)Laughing and walking out would be the least of what I would do.

they are not putting up with this - they've been protesting and given this I wouldn't be surprised to see much more action. They are not afraid to resist.

dipsydoodle

(42,239 posts)to the fact that over the past 10 years public sector wages in Greece are alleged to have actually doubled. That was made possible by the lower interest loans Greece was able to obtain as a result of joining the Euro.

For comparison - did public sector wages double in the US during that period ? I'm asking out of curiousity. I don't believe that to be the case in the UK for example.

Be aware that in reference to their pensions that Greece has what is acknowledged to be the world's most generous pension scheme for public sector workers @ over 90% of final salary added to which a single unmarried daughter is eligible to inherit the pension on the death of her parent.

girl gone mad

(20,634 posts)as a percentage of total employment, public sector employment in Greece has remained below average for Europe. Wages did not double, they remained stable. Greeks do not get to retire with 90% salary. A minority of Greek workers might get pensions in the 80% range, which is a few percentage points high for Europe, but Greece also has far fewer benefits that the rest of Europe. Greeks do not benefit from the kind of broad social programs that are available in Germany, France and the UK. Rather than fund social spending, the Greek government focused on those pensions. Greeks get minimal welfare, unemployment benefits, etc.

To demonstrate the fallacy of your argument, one only needs point to China. China's public sector as a percentage of its overall economy is 3 times that of Greece, and many public sector wages have actually doubled over the past 10 years. Yet China remains a competitive economy while Greece languishes.

dipsydoodle

(42,239 posts)Greece went on a spending spree, allowing public sector workers' wages to nearly double over the last decade, while it continued to fund one of the most generous pension systems in the world. Workers when they come to retire usually receive a pension equating to 92 per cent of their pre-retirement salary. As Greece has one of the fastest ageing populations in Europe, the bill to fund these pensions kept on mounting.

http://www.telegraph.co.uk/news/worldnews/europe/greece/7646320/Greece-why-did-its-economy-fall-so-hard.html

girl gone mad

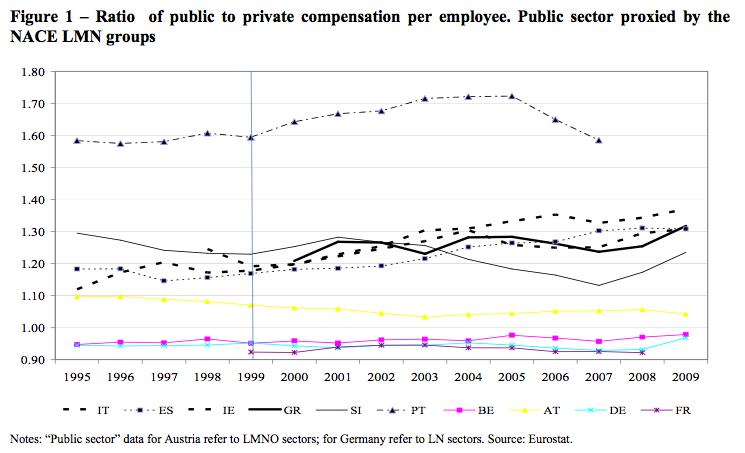

(20,634 posts)Here are the actual statistics that I could find.

]

Greece does not stand out drastically from most of the rest of Europe w/ respect to public sector wages vs. private sector wages. There was no sharp rise in this ratio over the past decade. There is nothing in this data which would lead me to conclude that growth in public sector wages was the cause of the current crisis.

dipsydoodle

(42,239 posts)notwithstanding the fact I didn't mention public : private anyway. The general reluctance of the Greeks to pay tax not helping either.

btw - you did this other day. There's no point is quoting data in that form which doesn't include 2011. The graphs you published before

conveniently ignored the fact that debt : GDP is now 160%.

Overall what is your solution then assuming that if they do nothing they get no further funds whatsoever ? Wouldn't bother me none if they simply legged it from all their debt , left the Euro went back to the Drachma whatever and then simply managed in future in the absense of any further loans. You may be happy with that too as the ensuant CDS debacle would take out some of your major banks completely.

girl gone mad

(20,634 posts)Austerity is not the solution because government spending was not the problem.

The crisis began in 2007, not 2011. To determine the cause of the crisis, you need to look at data from the time it began.

Greece was locked in to a deeply uncompetitive exchange rate when it joined the Euro, which primarily benefited their trade partners France and Germany. The ECB refuses to act like a true central bank, so Greece would be better of exiting the Euro.

Sherman A1

(38,958 posts)is called slavery. Although I cannot quote the particulars, I suspect that there are laws in Greece against such a condition and that there are international conventions that also prohibit slavery.

R.Blue

(35 posts)Is this not a case of pushing the burden onto their people for the failure of their bankers and lawmakers?

dipsydoodle

(42,239 posts)but that's being corrected.

Their constitution is now being changed so that by law debt repayments must receive priority for payment above all other government expenditure.

If it had been so before they might not have got into this mess.

Owlet

(1,248 posts)Well, OK. You're certainly entitled to that viewpoint. Here's a little history to ponder, however.

"Wall Street did not create Europe’s debt problem. But bankers enabled Greece and others to borrow beyond their means, in deals that were perfectly legal. Few rules govern how nations can borrow the money they need for expenses like the military and health care. The market for sovereign debt — the Wall Street term for loans to governments — is as unfettered as it is vast."

https://www.nytimes.com/2010/02/14/business/global/14debt.html?pagewanted=all

-------------

"Goldman Sachs helped the Greek government to mask the true extent of its deficit with the help of a derivatives deal that legally circumvented the EU Maastricht deficit rules. At some point the so-called cross currency swaps will mature, and swell the country's already bloated deficit."

http://www.spiegel.de/international/europe/0,1518,676634,00.html

----------

It's called 'enabling', much as giving an alcoholic money to buy a drink. Sure, you can deride the person for being a drunk and not knowing his own limits, bt doesn't the enabler bear some responsibility? In any case, it would appear that the other shoe has yet to fall, and the banksters may have less call to celebrate their rewrite of the Greek constitution in a few weeks.

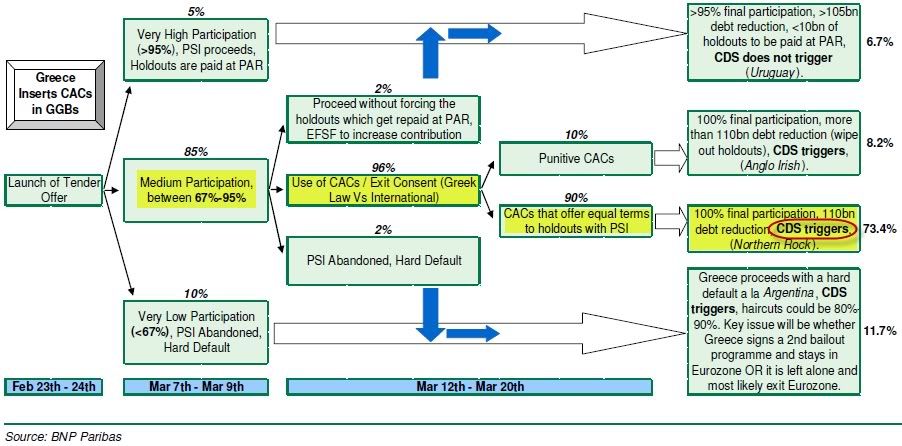

http://soberlook.com/2012/02/greek-psi-probability-tree-credit-event.html

dipsydoodle

(42,239 posts)but its a simple fact fact of life that a condition of the current bailout is guaranteed repayments as due. They can please themselves whether or not they accept that condition but in its absense no further funds. It can't be lip service either - its going to be monitored.

Aside from the loans are now covered by English law : not Greek law. That means they're secured against all state assets.

They should never have been encouraged to borrow beyond their means and in that respect yes the banks are responsible.

To cover the event of complete default I understand the Greeks are stocking up on dry food and gold. Might make sense for other to do so too.

sudopod

(5,019 posts)You carry on with the classic Puritan "they had it coming" schitck, you ignored poster above who showed that your right-wing talking points about Greek public workers being over-paid was baloney, you throw in a BUY GOLD at the end, just for good measure.

The Che avatar is a nice touch. ![]()

dipsydoodle

(42,239 posts).

sudopod

(5,019 posts)How quaint! Maybe if we all hold hands and vote hard enough, we can make the Republicans go away.

Seriously, those people do not deserve this. They had no seat at the table where these decisions were being made, on the Greek government side but especially on the EU side. They will, however, be the ones who by-god pay in order to insure that Deutche Bank doesn't get bit too hard.

If all those unelected party leaders think that they can bind the entire country into a suicide pact regardless of the outcome of the next election, they will have another thing coming.

dipsydoodle

(42,239 posts)other than their reluctance to pay tax having contributed to this mess. The rest of the mess derives originally from those they voted for.

Its anticipated that in the event of a complete default it won't be loans they get but foreign aid which isn't repayable.

sudopod

(5,019 posts)Hint: it ain't the god damn garbage man.

dipsydoodle

(42,239 posts).

sudopod

(5,019 posts)badtoworse

(5,957 posts)It appears that anyone who can evade taxes, does so and of course the rich owe more; they make more. Saying the problem is with the rich is just ignoring reality.

Greece is a corrupt country, with a terrible tax collection system that has overspent for years. Stop blaming the rich and deal with it.

sudopod

(5,019 posts)Look out, we've got a badass over here!

Also, way to ignore getting schooled by Zalatix, girl gone mad, and owlet.

Maybe we'd all understand if we just accepted Ron Paul as our Lord and Savior, lol.

badtoworse

(5,957 posts)and that the Greek people voted to join the EU. I was also under the impression that the elected representatives of the Greek people have the legal authority to bind the country (i.e. guarantee the repayment of a loan). Where am I wrong?

I see your view on DU a lot: When someone borrows money (a student, a homeowner or even a country), it's never their responsibility to repay the loan if things don't turn out as planned. The lender is always the bad guy for expecting the loan to be repaid anyway. Greece can walk away from its debt, but they would not be able to borrow another dime and the government would be flat broke in a few weeks. Do you think things would be better under that scenario? All of their suppliers would demand payment in euros which they would not have. Print drachmas? How much purchasing power would they have? (None in my opinion).

The situation in Greec is very unfortunate, but there is no solution that doesn't involve a lot of pain for the people. That is the fault of the government, not the banks.

sudopod

(5,019 posts)Got it.

badtoworse

(5,957 posts)sudopod

(5,019 posts)badtoworse

(5,957 posts)I would not lend if the borrower would not guarantee I have first call on revenues; would you? There is such a thing as subordinated debt, but the interest rates on it are quite high.

I don't buy the "enabler" argument either. By your own post, the Greek government was deceiving the purchasers of its sovereign debt and it doesn't matter if they had help. The word for that is fraud.

CAPHAVOC

(1,138 posts)Are the source of this mess. And Obama is right in the bed with them. So is the GOP. OWS is right.

libtodeath

(2,888 posts)long enough to see the day when people get sanity and rationality and will finally admit that Socialism truly is the way to go.

Marrah_G

(28,581 posts)I can't imagine having to work for free for a month. Things are going to get really bad over there.

FarCenter

(19,429 posts)dipsydoodle

(42,239 posts)being paid an extra month at Xmas, another half a month at Easter and another half in the summer/autumn. The same applied to pensions.

Not sure if that applied to the private sector or not.

Javaman

(62,521 posts)and the EU looks the other way for their admission to the union.

Guess who pays?

girl gone mad

(20,634 posts)Whether or not Goldman had conspired with politicians to mask debt, they would have been admitted.

Javaman

(62,521 posts)It has been long known that Greece cooked up their accounting. This isn't "late breaking news" or from "secret third party source". This is well known.

It's so well known that providing a link would be insulting google.

But if you are interested, just google, "Greece accounting".

girl gone mad

(20,634 posts)In the 2005 OECD report for Greece (p.47) it was clearly stated that “the impact of new accounting rules on the fiscal figures for the years 1997 to 1999 ranged from 0.7 to 1 percentage point of GDP; this retroactive change of methodology was responsible for the revised deficit exceeding 3% in 1999, the year of EMU membership qualification”. The above has lead the Greek minister of finance to clarify that the 1999 budget deficit was below the prescribed 3% limit when calculated with the ESA79 methodology in force at the time of Greece's application, and thus, since the remaining criteria had also been met, was properly accepted into the Eurozone. ESA79 was also the methodology employed to calculate the deficits of all other Eurozone members at the time of their applications.

The original accounting practice for military expenses was later restored in line with Eurostat recommendations, theoretically lowering even the ESA95-calculated 1999 Greek budget deficit to below 3% (an official Eurostat calculation is still pending for 1999).

An error very frequently made in press reports, is the confusion of the discussion regarding Greece’s Eurozone entry with the controversy regarding usage of derivatives’ deals with U.S. Banks by Greece and other Eurozone countries to artificially reduce their reported budget deficits. A currency swap arranged with Goldman Sachs allowed Greece to “hide” $1 billion of debt, however, this affected deficit values after 2001 (when Greece had already been admitted into the Eurozone) and is not related to Greece’s Eurozone entry.

Several arguments have been expressed about the implications of the audit. Some commentators talked about data falsification. Others, though, held a completely different viewpoint. "Irregularities" (the word falsification never officially used) in deficit reporting were also revealed for other Eurozone members, most notably Italy and Portugal, with significant revisions imposed. Also, there were arguments about massive "creative accounting" employed by many states in order to meet the deficit criterion for entry into the Eurozone.

Even the practice of one-off measures by so many states has been criticised, since in several cases their deficits rose back over 3% soon after the reference year, while big economies like Germany and France seem to defy the rules for years. Last but not least, changes in accounting method often seriously affected the deficit numbers (Spain and Portugal had, like Greece, marginally exceeded 3% in their reference year for entry, when their deficit was revised according to ESA95). It was argued that New Democracy government simply miscalculated the consequences of its actions, which brought a strong reaction by Eurostat - stronger than that for other violators.

There was nothing particularly unique about Greece's entry into the Eurozone, though they have been far more harshly criticized over their accounting than EMU countries with indistinguishable deficit numbers using identical accounting techniques.

Javaman

(62,521 posts)http://www.nytimes.com/2010/02/14/business/global/14debt.html?pagewanted=all

The Greek Accounting Tragedy

http://www.forbes.com/sites/richardmurphy/2011/06/20/the-greek-accounting-tragedy/

Creative accounting in small advancing countries: The Greek case

http://www.emeraldinsight.com/journals.htm?articleid=868692&show=html

How Goldman Sachs Helped Greece to Mask its True Debt

http://www.spiegel.de/international/europe/0,1518,676634,00.html

Greek ‘reprofiling’ and Orwellian accounting

http://ftalphaville.ft.com/blog/2011/06/02/583031/greek-reprofiling-and-orwellian-accounting/

Greece not alone in exploiting EU accounting flaws

http://www.reuters.com/article/2010/02/22/us-derivatives-europe-bankers-analysis-idUSTRE61L3EB20100222

Taverner

(55,476 posts)Since most Americans think "austerity" just means less food stamps for those "lazy greeks"

pa28

(6,145 posts)Lucas Papademos is definitely going to be Goldman Sachs employee of the month.

hack89

(39,171 posts)Germany does pretty well with it as well.