General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums10 Straight Quarters of GDP Growth

cached at: http://bureaucountydems.blogspot.com/2012/02/gross-domestic-product-chart.html

&width=600?

After inheriting the sharpest economic decline since 1929, President Obama 's economic policies and stimulus reversed the slide and within two quarters had America back in postive territory and has thus far produced 10 straight quarters of growth in the GDP.

source: http://maddowblog.msnbc.msn.com/_news/2012/02/29/10539230-signs-of-economic-life

CAPHAVOC

(1,138 posts)10 quarters of weaker dollars.

unblock

(52,185 posts)remember that other economies have weakened, and china continues to manipulate their currency.

Selatius

(20,441 posts)Otherwise, you have inflation, but we're already seeing inflation in the form of higher gas and food prices.

unblock

(52,185 posts)the inflation we're seeing is not a result of the usual too much money chasing too few GOODS, which is typically brought about by heavy demand and insufficient supply.

instead, we're seeing very little demand but instead, too much investment money chasing too few investment opportunities. it's actually a shortage of demand that's leaving no good place to invest. consequently, investors are chasing commodities largely because they've got nothing better to do with their money.

among the differences is that this form of inflation is highly self-regulating (compared to the traditional form which can cause a viscious cycle). push prices up enough, and demand goes down even more, pushing the economy back toward recession. very quickly, chasing commodities up doesn't look like a fun game anymore, so prices come back down.

the bottom line is that our economy's biggest problem is structurally weak demand due to over-indebted households and lower housing prices, and they're just tinkering at the edges unless and until they do something major to stimulate demand.

girl gone mad

(20,634 posts)"push prices up enough, and demand goes down even more, pushing the economy back toward recession. very quickly, chasing commodities up doesn't look like a fun game anymore, so prices come back down. "

In the mean time, people are forced to pay entirely too much for gas and food or go without. Those bubbles will burst, but they've done irreparable harm.

unblock

(52,185 posts)at the margin, yes, the government's stimulus efforts have largely served to increase the overabundance of investment capital, but there would have been too much investment capital regardless. as long as there's insufficient demand and therefore insufficient business opportunity, unless the government really taxed the crap out of wealth (hah!) there was always going to be too much investment capital sloshing about with too few good places to put it.

in other words, the qe policies may have made things a bit worse, but the problem was really caused by the policies that brought about the hamstrung consumers and homeowners, and the ongoing policies that do next to nothing to resolve that real problem.

Selatius

(20,441 posts)Once the US moved from an industrial economy to a service-based economy over the last thirty years, people have been replacing lost union wages and manufacturing jobs with cheap credit and borrowing against their homes to maintain a standard of living. This was all pushed by board members and chairmen on the boards of directors of major corporations looking for ways to squeeze out more profit from workers. They did it by pitting workers in different countries against each other.

We need massive infrastructure reinvestment, a WPA/PWA-style jobs program, a renegotiation of trade deals, and a change in tax code to favor domestic production for domestic consumption instead of foreign production for domestic consumption.

unblock

(52,185 posts)combined with overly easy consumer credit all-around, there are many, MANY households that are really strapped, even if they have decent income. so much is going to mortgage and other debt service that they act like much poorer consumers.

i agree with your solutions. sadly, a major works project is just way to obvious, simple, and wise for washington to even consider.

JDPriestly

(57,936 posts)For example, an item that was 98 cents just a couple of months ago cost $1.28.

A lot of prices were higher than they have been.

CAPHAVOC

(1,138 posts)But food and energy prices are left out of the way they calculate inflation. When the easing stops, if it ever does, we will know if the economy is getting better, or just propped up with free money. They may have already waited too long to raise the rates.

DCBob

(24,689 posts)The Republicans did all they could to destroy the economy but they have uttery failed. Pathetic partisan pukes.

mikekohr

(2,312 posts)The blue line is tracking jobless claims. Job loss was skyrocketing under the previous administration's policies, and has been steadily declining since President Obama's economic policies took place. The next time you hear that the President's stimulus failed, call bullshit, call it out loudly.

Then think of how much more successful the President's efforts to increase job creation could have been had we had even a little co-operation from the other side of the political divide.

Cached At: http://bureaucountydems.blogspot.com/2012/02/look-what-happened-when-president.html

Fumesucker

(45,851 posts)

CAPHAVOC

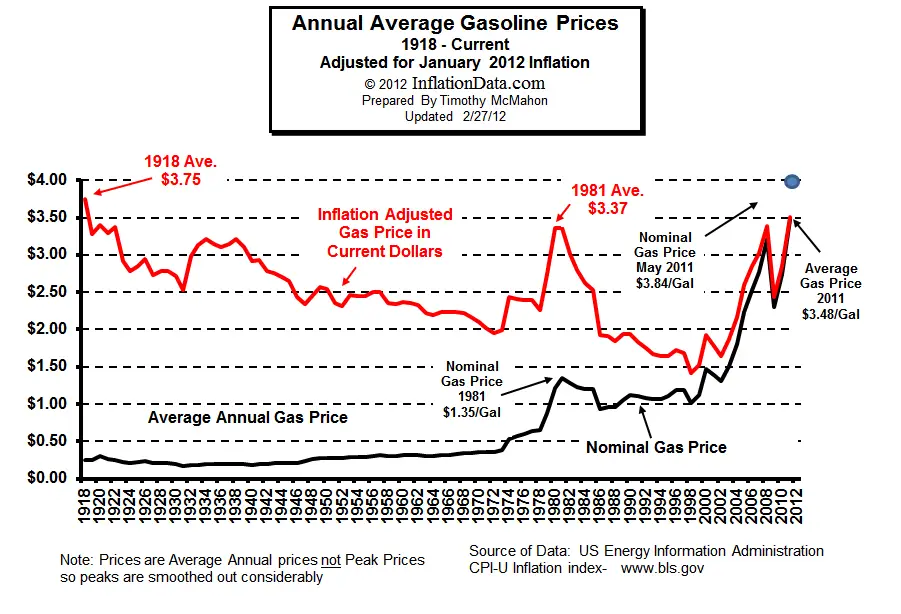

(1,138 posts)I think it is a little off though. But according to that we are at the highest price ever. But the way inflation rate is calculated has changed over time. Look at 2000 through now. exact tracking of nominal and IA. WTF! What if the Black line passes the Red? What would that mean?

cthulu2016

(10,960 posts)and the chart has to get closer and closer as we approach the present -- no matter what time frame we look at the red and black lines wil always be indentical on the last day of the chart. (The black cannot pass the red, by definition. Since the black is the price of gas in today's dollars it will always be the same as the red today.)

The two lines really sync up in 2008, which is what we'd expect. That's when the economy turned down and inflation has been under 3% (and often under 2%) throughout this downturn.

I was thinking about this the other day. When I first was driving in 1965 Gas was about 15 to 20 cents. But Silver was a Dollar. Now Gas is about 3.70 but Silver is about 33 bucks. You could get a Silver dollar at the bank for a paper one. Not now. But we only got about 10 miles a gallon. Now we get about 20 miles a gallon. So we are not so bad off when you add it all up. Then I had my first job and it was 1. 75 an hour. I do not think that the wage has kept up. All I was doing was helping to make Pizza. It might be harder for the kids to get Gas than it was for us.

Earth_First

(14,910 posts)and not on how to squeeze out another 0.01% increase in GDP which effectively benefits very few?

In closing, why do we need growth? Do we?