General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsKentucky showcases Paul Ryan's wrong-way war on poverty

by Jon Perr

That Paul Ryan's one-man crusade against poverty has gotten off to a laughably bad start should have surprised no one. After all, his various "roadmaps" and GOP budgets have called for giving massive tax cuts for the rich, slashing non-defense discretionary spending to its lowest share of the U.S. economy in generations, privatizing Social Security and turning Medicare into an underfunded voucher scheme, all measures certain to make poverty in America worse. Ryan's claim that LBJ's War on Poverty exacerbated the problem was thoroughly debunked and mocked by many of the same experts whose research he cited. And with his jeremiads about "makers and takers" and turning "the safety net into a hammock," Congressman Ryan displayed his disdain for the very people he pretends to want to help.

But with his "inarticulate" comment this week about lazy men "in our inner cities," Paul Ryan tried to put a face—a black face—on American poverty. As it turns out, Ryan's dog-whistle to the GOP's right-wing base wasn't merely cynical, it was also wrong.

After all, about two-thirds of the nation's 46.5 million people living in poverty are white. The U.S. Census Bureau also informs us that the 17.7 percent poverty rate in rural areas is almost three points higher than the national average. (Poverty is highest in the South, which in 2012 was the only part of the country where it increased.) In many cities and across the countryside, tectonic structural changes in regional economies, and not Paul Ryan's "tailspin of culture," are wiping out good paying jobs. The result is that many communities are sustained by a patchwork of federal and state programs helping to provide food assistance, income support, unemployment benefits, health care and more.

To put it another way, the faces of American poverty can be found in Rust Belt cities, in the Mississippi Delta and in Appalachia. And now—just as it did when LBJ launched his War on Poverty 50 years ago—Kentucky shows why.

<...>

At 19.4 percent (823,000 people), the Bluegrass State has the fifth highest poverty rate in the nation. But as dismal as those numbers are, there has been real improvement since President Johnson made Martin County ground zero in his War on Poverty in 1964. There, as NPR recently documented, a poverty rate double the national average represents progress:

"In this south-central mountain country, over a third of the population is faced with chronic unemployment," says a government film on Johnson's visit. "Typical of this group is Tom Fletcher, his wife and eight children. Fletcher, an unemployed sawmill operator, earned only $400 last year and has been able to find little employment in the last two years."

At the time, the poverty rate in this coal-mining area was more than 60 percent...Today, the roads here are well-paved. People say the schools and hospitals are much better than they used to be. Still, Martin County remains one of the poorest counties in the country. Its poverty rate is 35 percent, more than twice the national average. Unemployment remains high. Only 9 percent of the adults have a college degree.

And for many in this part of the state, federal poverty-fighting measures make all the difference. For Norma Moore and her ill 8-year-old grandson, food stamps, energy assistance to heat her home and his Supplemental Security Income (SSI) means a roof over their heads:

"I would be homeless. I would be the one living on the street if it wasn't for that," she says. She looks down at her grandson on the floor. "He would probably be in a home somewhere."

Thousands of her neighbors in eastern Kentucky doubtless share Moore's sentiment. By almost every measure, but for the LBJ-era federal safety net including Medicaid, Medicare, Head Start, food stamps, more spending on education, and tax cuts to help create jobs, Kentucky would be facing a human catastrophe of mammoth proportions.

Consider, for example, the Supplemental Nutrition Assistance Program (SNAP), otherwise known as food stamps. Last fall, all five Republican House members voted for steep cuts to SNAP, despite the fact that 800,000 Kentuckians are enrolled in the program, 60 percent of whom live below the federal poverty line—an income of $22,000 for a family of four. Despite representing the second-poorest district in America, GOP Congressman Hal Roger (KY-5) nevertheless claimed, "I didn't think it will have an adverse impact on my district." In Owsley County, half of the 4,700 residents—98.5 percent of them white—received food stamps in 2011.

<...>

Paul Ryan should try to explain that to the good men and women of eastern Kentucky. As the Lexington Herald-Ledger pointed out in November 2013, "As an austerity-minded Congress continues to cut food stamps, Head Start and other anti-poverty measures, it's not clear what will sustain them." Certainly not Paul Ryan's Republican Party:

Martin County nonetheless voted for Romney by a nearly 6-to-1 ratio over Democratic President Barack Obama.

http://www.dailykos.com/story/2014/03/16/1284613/-Kentucky-showcases-Paul-Ryan-s-wrong-way-war-on-poverty

Yes! Oregon becomes fourth state to block food stamp cuts and restore all funding (updated)

http://www.democraticunderground.com/10024656119

Note:

ProSense

(116,464 posts)hfojvt

(37,573 posts)"tax cuts to help create jobs"

Are we talking about Johnson or Reagan-Clinton-Obama?

Yep, there are our weapons to fight poverty

medicaid

medicare

head start

food stamps

more spending on education

tax cuts for the rich

![]()

ProSense

(116,464 posts)Out of that entire piece, you cherry pick a few words to support your outrage.

Your outrage is especially ironic since you have been twisting the tax cuts. http://www.democraticunderground.com/10024391415

hfojvt

(37,573 posts)of our times.

You disagree, since your man Obama has embraced Reaganomics.

That's your right.

Pun intended.

"You disagree, since your man Obama has embraced Reaganomics."

...with the nonsense. As I said before, you clearly don't know what "Reaganomics" is.

http://www.democraticunderground.com/10024518236#post19

hfojvt

(37,573 posts)1. Tax cuts create jobs

2. My tax cut plan does not favor the rich.

That's the bullsh*t they use to sell Reaganomics. Tax cuts, most of which benefit the rich, which they claim are supposed to "create jobs".

I could quote Bush from 2003 making those claims for his tax cut proposal, but what would be the point?

ProSense

(116,464 posts)"I could quote Bush from 2003 making those claims for his tax cut proposal, but what would be the point?"

The only point you would make is an attempt to justify nonsensical spin, not only about Reaganomics, but also about tax cuts.

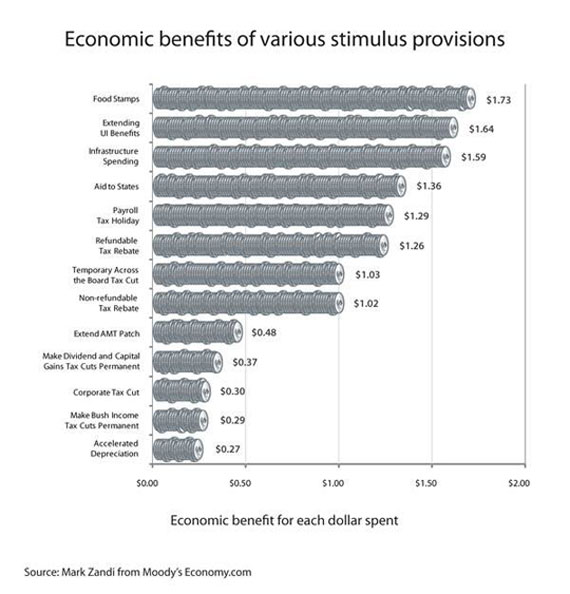

Increasing taxes on low-income Americans (Reaganomics) is not stimulative. Cutting taxes on the rich (Reaganomics) is not stimulative.

Tax cuts for low-income Americans is stimulative.

hfojvt

(37,573 posts)Reaganomics began with "across the board tax cuts".

Reaganomics II - the Bush version, also CUT taxes for most Americans.

Reaganomics is NOT about "increasing taxes on the poor".

And THIS is a perfect example of the insidious lies from defenders of Reaganomics.

"Tax cuts for low-income Americans is stimulative."

Yeah, it is just too bad, isn't it, that the accursed payroll tax cut, is NOT a 'tax cut for low-income Americans'.

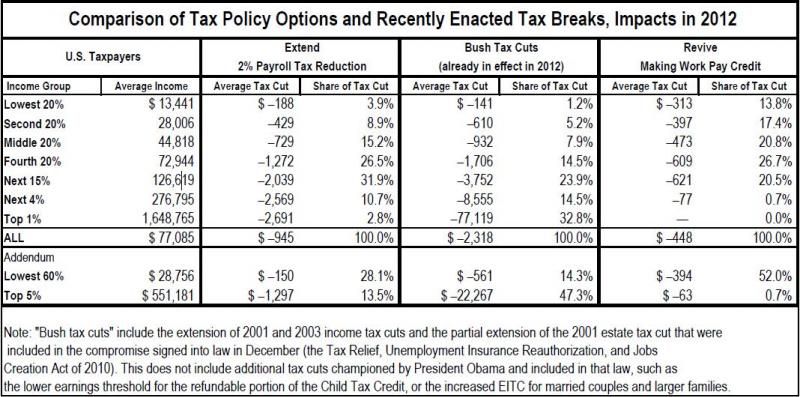

As I have told you ad nauseum, most of the benefits went to the richest 20% and NOT to "low income Americans" many of whom were actually hit with a tax increase (wait, what did you say about 'increasing taxes on low income Americans' again?) as the accursed payroll tax cut replaced the Making Work Pay Credit.

But the spinmeisters ALWAYS try to sell their tax cuts for the rich as "middle class tax cuts". See for example Chapter 35 of Al Franken's book "Lies and the lying liars who tell them".

But it's cool when Obama does it, right? RIGHT?

Pun intended.

ProSense

(116,464 posts)"Reaganomics is NOT about 'increasing taxes on the poor.'"

...and denial.

http://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

hfojvt

(37,573 posts)the tax reform act of 1986 is NOT Reaganomics.

Reaganomics is ERTA, from 1981.

And you should damned well know that.

You keep throwing 1986 out there like 1981 never happened, like 1981 was NOT the whole point of the 1980 Presidential Campaign of Reagan, where Reaganomics began, unlike 1986, which was some "bi-partisan compromise" that was supposed to be revenue neutral.

the tax reform act of 1986 is NOT Reaganomics.

Reaganomics is ERTA, from 1981.

...you have no idea what Reaganomics is.

The four pillars of Reagan's economic policy were to reduce the growth of government spending, reduce the federal income tax and capital gains tax, reduce government regulation, and tighten the money supply in order to reduce inflation.[2]

http://en.wikipedia.org/wiki/Reaganomics

hfojvt

(37,573 posts)"The four pillars of Reagan's economic policy were to reduce the growth of government spending, reduce the federal income tax and capital gains tax, reduce government regulation, and tighten the money supply in order to reduce inflation."

"reduce the federal income tax and capital gains tax"

"reduce the federal income tax and capital gains tax"

"reduce the federal income tax and capital gains tax"

(Maybe if I copy/paste it three times, it will sink in. "What I tell you three times, is true."![]()

Note well what is NOT said

Anything about "increasing taxes on the poor". Which you insist, for some reason, is fundamental to Reaganomics.

I have no idea, eh? So ERTA was NOT part of Reaganomics? 1986 was more TRUE Reaganomics than the victory of 1981. The compromise of 1986 (although I really have to wonder what Democrats thought THEY were getting from this 'compromise' (other than more corporate campaign cash, that is))

"reduce the federal income tax and capital gains tax"

"reduce the federal income tax and capital gains tax"

Yes, there it is: "reduce federal income tax and capital gains tax" for the wealthy. That's why it's called trickle-down economics.

http://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

AgingAmerican

(12,958 posts)Tax cuts have never created jobs. They are responsible for most of our national debt. They are the least stimulative thing that can be done for the economy.

ProSense

(116,464 posts)"It's hard to believe that some Democrats have started buying into RW economics

Tax cuts have never created jobs. They are responsible for most of our national debt. They are the least stimulative thing that can be done for the economy. "

...and not all tax cuts are equal. Tax cuts for low-income Americans are highly stimulative. That is why programs like the EITC are supported by progressive economists and why many of those same economists often advocate lowering the tax rate by excluding up to as much as $50,000 in income.

AgingAmerican

(12,958 posts)nt

ProSense

(116,464 posts)"Seventh, earned income tax credits should be continued to help the working poor. "

http://www.presidency.ucsb.edu/ws/?pid=7434

http://en.wikipedia.org/wiki/Revenue_Act_of_1978

AgingAmerican

(12,958 posts)Tax cuts = massive debt

Tax cuts = GOP wet dream.

ProSense

(116,464 posts)AgingAmerican

(12,958 posts)are the ultimate rebuttal.

Good luck pushing your RW talking point.

![]()

hfojvt

(37,573 posts)Mondale said "I am gonna raise taxes"

and he went down in flames.

Clinton promised a "middle class tax cut" and attacked Bush for increasing taxes.

and he won!!

Thus party leadership and ambitious politicians got the message - it is easier and more effective to embrace the lies than it is to explain things to the public.

Plus, let's face it, most of the donations - for both parties, are coming from members of the top 20% - and those people want to pay less in taxes. Promise to increase their taxes, or even NOT cut them, and you lose some of your campaign money.

As such, it becomes even harder to fight the lies when everybody who has a microphone is saying "hurrah for tax cuts".

AgingAmerican

(12,958 posts)Creeping fascism.

"Plus, let's face it, most of the donations - for both parties, are coming from members of the top 20% - and those people want to pay less in taxes. Promise to increase their taxes, or even NOT cut them, and you lose some of your campaign money. "

Simply absurd. You're advocating tax increases on people making about $60,000? Why not start railing against the top 30 percent?

No one is going to advocate raising income taxes on any group outside the top one or two percent. The point of the debate is that high-income earners are not paying their fair share.

The only proposal that makes sense with respect to the top 5 percent and up is increasing the Social Security cap.

hfojvt

(37,573 posts)and Congressional Democrats have as well.

You make the typical Republican argument.

"Omigosh, you are talking about increasing taxes on people making $60,000 a year."

Except for ONE thing, I am not even talking about INCREASES. It is just ROLLING BACK the evil Bush tax cuts.

You remember how horrible things were in the 90s when those darn taxes were so high. (Before Clinton cut them for the rich in 1997, and raised them on the poor.) http://www.democraticunderground.com/?com=view_post&forum=1002&pid=2665533

And second, suppose the Bush tax cuts were eliminated for incomes over $60,000. That amounts to a 3% marginal increase on taxable income over $60,000. So somebody making $61,000 pays a whole $30 more in taxes. Somebody making $70,000 in TAXABLE income, pays less than $1 a day in more taxes.

Oh noes, how will they ever survive??? Surely that is the end of the world.

But people making $110,000 a year have a vested interest in stirring up people who make $60,000. "YOUR taxes are gonna go up!!" They will shout at those people. So some gullible fools will get all stirred up about $30 or $60 or $300 tax increases. Which is the way the $110,000 and the $150,000 and the $190,000 set likes it, because their tax increases, like their income, would be much larger.

"High income earners" to me, also includes the top 10%. You know, they make more money than 90% of the rest of the population. Amazing, isn't it. And they make one hell of a lot more money than those in the bottom 20%.

They also have a larger share of the national income than the infamous 1% does. Top 1% has about 20%, the top 9% has about 30%. http://www.democraticunderground.com/10023937994

But of course, as they drive their nice cars, live in their nice houses, and take their fancy vacations, they always want to tell the working class "I'm NOT rich." Sure, because only Bill Gates is rich. Everybody else is just barely getting by.

<...>

And second, suppose the Bush tax cuts were eliminated for incomes over $60,000. That amounts to a 3% marginal increase on taxable income over $60,000. So somebody making $61,000 pays a whole $30 more in taxes. Somebody making $70,000 in TAXABLE income, pays less than $1 a day in more taxes.

...hilarious, especially since you considered eliminating the payroll tax cut an increase on the poor. Regardless of the spin, it's a tax increase.

"'High income earners' to me, also includes the top 10%."

The debate isn't about your definition of high-income earners. I mean, some people think high-income is the top .1 percent.

hfojvt

(37,573 posts)I get a voice in "the debate" too, irregardless of my inabilty to even be heard over Obama's bullsh*t and that of his cheerleaders.

And I considered eliminating the Making Work Pay tax cut an increase on the poor. Not eliminating the accursed payroll tax cut.

Because it was, and it was sold by Obama, and catapaulted by his cheerleaders as a "middle class tax cut" to institute the accursed payroll tax cut.

"regardless of the spin, it is a tax increase".

Yep, and THAT is exactly what people who wanted the Bush tax cuts to be permanent always said.

Me, on the other hand, my vote was to never even PASS the Bush tax cuts and to undo them on 8 June 2001 at the latest. With sooner being bettter as far as getting rid of them.

"I get a voice in "the debate" too, irregardless of my inabilty to even be heard over Obama's bullsh*t and that of his cheerleaders."

...you are entitled to your opinion, even though it doesn't resemble a single actual policy debate by anyone.

Even when you tried to use the Citzens for Tax Justice to support your claims, it produced a chart rebutting the spin. The chart shows that the top one percent got 2. 8 percent vs. 97.1 percent for the 99 percent. The top 5 pecent got 13.5 percent vs. 86.4 percent for the bottom 80 percent. Also notice that the max benefit was $2,691? You know why? It's friggin capped at income of about $113,000.

Do you think $2,691 is significant for someone earning more than $1.6 million dollars? You can best believe that by comparison, $1,000 dollars mean a lot more to someone earning $50,000.

While you're at it, who was responsible for the Making Work Pay Credit?

http://www.ctj.org/pdf/payrolltaxholiday.pdf

hfojvt

(37,573 posts)it's not really all about the 1%.

That was one of their big mistakes.

Try comparing the top 10% to the bottom 40%.

Oh, but of course, those people in the top 10% are NOT really rich. ![]()

So because the "policy debate" in controlled by the rich, then everybody else should just shut up and ride along with their own screwing? And join in the great debate - should the top 20% get 40% of the benefits or 60% of the benefits? Those are, after all, the only real choices.

Who was responsible for the Making Work Pay Credit.

That would be Campaign Obama - before he sold out or was threatened or something.

"in spite of the fools at Occupy Wall Street it's not really all about the 1%."

...you're calling people who protested and had an impact "fools" while you debate non-existing policy with yourself on the Internet?

"So because the 'policy debate' in controlled by the rich, then everybody else should just shut up and ride along with their own screwing? And join in the great debate - should the top 20% get 40% of the benefits or 60% of the benefits? Those are, after all, the only real choices."

You're basically dismissing everyone who isn't you as "the rich."

"Who was responsible for the Making Work Pay Credit.

That would be Campaign Obama - before he sold out or was threatened or something."

Wrong, that was President Obama, and it was in effect for two years.

Johonny

(20,829 posts)hfojvt

(37,573 posts)has a 99.999% chance of being re-elected in 2014.

But as high as food stamp usage is in his district, it still in NOT a majority of the voters. And a majority of the voters probably do NOT mind that some of the bozos that they know are getting less free food, even if that DOES hurt the economy of the entire region.

loudsue

(14,087 posts)Make it viral! ![]()

ProSense

(116,464 posts)tooeyeten

(1,074 posts)Ryan's faux war on "entitlements" I mean, poverty, is to appeal to the far right wing Southern voter who becomes incensed and on board like a Salem brigade against the very bad people who are the "inner cities" and nothing like them.

Thinkingabout

(30,058 posts)nets, Voting againsr themselves.

hfojvt

(37,573 posts)because in spite of the large number of people on assistance in those counties and regions

the people on assistance are probably NOT a majority of the population, much less a majority of the voters. (because those in the top 20% are probably 30% of voters whereas voters in the bottom 20% are perhaps 10% of the voters. Higher income = more likely to actually vote, and also more likely to be eligible to vote)

pansypoo53219

(20,969 posts)Thinkingabout

(30,058 posts)There are a lot of companies on the take, Walmart was telling their employees to go and get services because they qualified on their salaries.

Dirty Socialist

(3,252 posts)It is a "crusade" against poor people.