General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat Recovery? You Probably Became Poorer In the Last 10 Years

http://www.alternet.org/economy/what-recovery-you-probably-became-poorer-last-10-years

You sense it when you look at your retirement account. You feel it when the bills come in. According to new research supported by the Russell Sage Foundation, your instinct is right: you are very likely getting poorer.

For the study, researchers gathered information on families in the middle of the wealth distribution continuum. What they found is that in 2003, the inflation-adjusted net worth for the typical household was $87,992. Fast-forward 10 years: that figure is down to a mere $56,335.

Ordinary Americans got 36 percent poorer in just a decade.

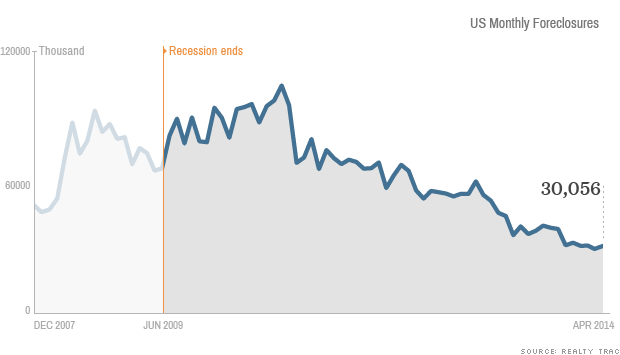

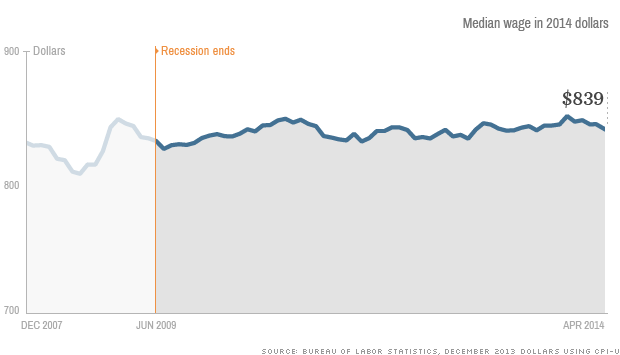

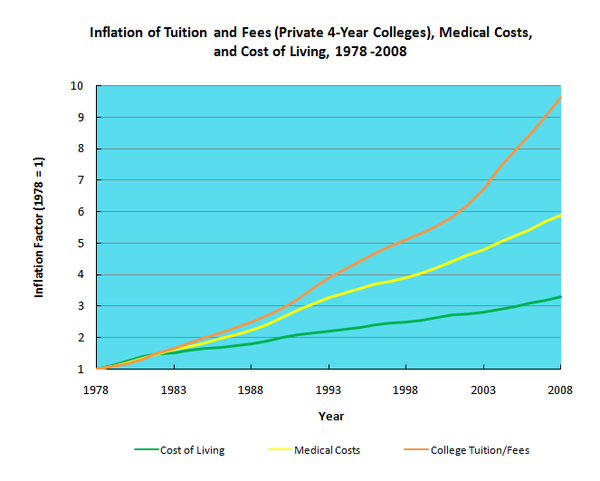

The Great Recession and the bursting of the housing bubble did their damage, but a long list of additional factors have helped funnel money out of the hands of regular Americans and into the pockets of the rich, including deregulation, high unemployment and job insecurity, the shareholder value trend in which corporations focus on manipulating stock prices while throwing workers under the bus, the reduced influence of unions, the shredding of the social safety net, privatization, and tax structures which favor the rich.

And once the inequality train leaves the station, it only gathers speed until something stops it. As Thomas Piketty has recently emphasized, the rich get richer faster than you and me because of the rate of return on their wealth.

Laelth

(32,017 posts)-Laelth

LiberalElite

(14,691 posts)hobbit709

(41,694 posts)yuiyoshida

(41,817 posts)I certainly have...

PeoViejo

(2,178 posts)The Fed creating Money out of thin air dilutes the purchasing power of everyone's Money. That money you were saving for retirement is worth about a third of what it was prior to the Recession, based on projected M3 figures. (Money in circulation) M3 isn't published anymore because the Fed doesn't want you to see how we have all been screwed.

As far as Rate of Return goes: What Rate of Return?

Erich Bloodaxe BSN

(14,733 posts)We've seen how the policies used by the administration have resulted in '93%' of the recovery going to the top 1%.

Artificially low interest lending rates for banks are probably more to blame than the actual creation of money to allow them to occur. The money created out of thin air actually has to go into circulation to have any effect on purchasing power. The Fed could make that $20trillion dollar platinum coin without seriously affecting purchasing power, because it could never be 'spent'. It wouldn't go into circulation. But keep letting banks 'borrow' money from the government at essentially 0% interest, and you're pulling money from everyone and handing it over to the 1%.

1StrongBlackMan

(31,849 posts)But I suspect the title of this piece is misleading.

Erich Bloodaxe BSN

(14,733 posts)Certainly everything I've seen anecdotally agrees with the results of the studies discussed.

There will obviously be exceptions, people who have gotten better off, but there have been multiple studies even beyond these that show that net worth has dropped and not recovered for most people since the recession started. Especially in minority populations, who often lost a generation or more of gains. Before the recession, I'd read that the net worth of minority households was as low as 1/10th that of white households on average, but after, had dropped to 1/20th.

Poverty rates are up, 1/3 of Americans are being hounded by debt collection agencies. The recovery was for the rich, not the rest.

1StrongBlackMan

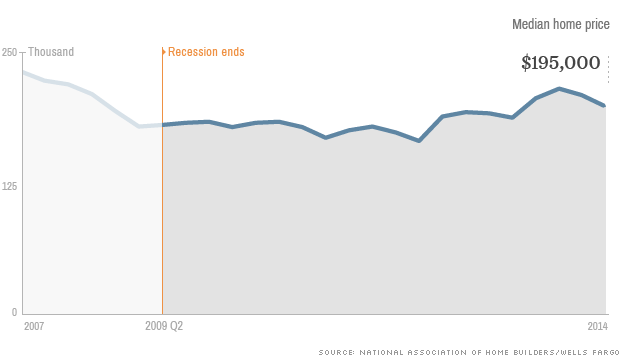

(31,849 posts)I suspect the drop is largely attributable to the "wealth" that was held in housing. This figure is misleading, as a house is/was never an investment; it has always been an expense, until paid off, and maybe, an appreciating asset.

The mentality that a house is an "investment" was the marketing tool that ultimately led to the crashing of the economy, as people drew down the equity in order to make up for 30+ years of stagnant wages.

Erich Bloodaxe BSN

(14,733 posts)Personally, I've always treated a house as a means of minimizing ongoing recurring expenses. In the decade I've lived in my house, the monthly rental costs of a tiny half-duplex rental in town has gone from being about 80% of my mortgage payments to more than 160% of my mortgage payments. So people renting locally are now paying $300 more a month to live in a space 1/5th as big. Even when you factor in property taxes and repair work, I can lose money on selling my house and end up having paid far less to live in a much larger space than folks who are stuck renting. The 'investment' is in paying less all along for housing. Taking out loans against any built up equity is a scam.

noiretextatique

(27,275 posts)Just the reality for most people. Neocons, D or R, have mostly enriched the haves and mostly fucked the have nots. And the trend continues.

Thespian2

(2,741 posts)seem to be getting poorer faster than the speed of light. I have been retired for some time. When my wife died in 2010, I lost most of her Social Security. Over time, prices have continued to increase. Except for work I have to do, my income has been relatively stagnate. I am fortunately enough to be able to sink into poverty slowly, but the American administration has made sure that I will be below the poverty line very soon. USA, number one in not caring for its citizens.

Erich Bloodaxe BSN

(14,733 posts)that lags behind the real increases in expenses.

ctsnowman

(1,903 posts)whatthehey

(3,660 posts)Seems like a metric chosen with the end in mind.

AngryAmish

(25,704 posts)Divorce, immigration etc?

hfojvt

(37,573 posts)In 2002, white non hispanic households were 74% of all households. By 2011 that was down to 69.2%.

And those WNH households were generally wealthier, with only 20.5% having less than $5,000 in net worth, compared to 27.2% of all households and with 32% having over $250,000 compared to just 26.1% of all households.

llmart

(15,527 posts)Remember - the baby boomers who lost full time jobs during the recession (depression more like it) will probably never find a full time job with benefits again due to their age.

Also, we are fast becoming if we're not already there, a part time economy where people are working two or more part time jobs, none with benefits.

stillwaiting

(3,795 posts)hfojvt

(37,573 posts)And it could just be me, the oddball exception to the trend.

Funny though, because I spent much of that decade in the bottom quintile for income. The last three years, I have perhaps risen to the 37th percentile for income, but that still leaves over 60% of households making more money than I do.

Let me look at two censuses of wealth that I have seen and saved to my computer, for 2002 and 2011. Not quite the same years, but things were better in 2011 than they were in 2009 on the job front and they have only gotten better since then.

So - 110 million households in 2002

16.9% with zero or negative net worth

9.3% with less than $5,000

11.1% with over $250,000 (not including the next group)

8.5% with over $500,000

118.7 million households in 2011

18.1% with zero or negative

9.1% with less than $5,000

so the bottom has increased by 1%

12.6% with over $250,000

13.5% with over $500,000

so the top has increased by 6.5%

some of that perhaps because of inflation as $250,000 in 2011 was only equivalent of $200,000 in 2002, or going the other way $250,000 in 2002 is equivalent to $312,000 in 2011.

Looking at the middle, in 2002 12.9% had over 50K but less than 100, and 20.3% had between $100,000 and $250,000

In 2011, 10.4% had over 50K and 17.9% had between 100 and 250.

So there's quite a bit of slippage there, especially if you take inflation into account. A loss of 4.9%. But that loss is stil less than the 6.5% who moved into the top two groups.

And for the lower middle groups

5-10 - 4.8% to 4.8%

10-25 - 7.6% to 6.6%

25-50 - 8.5% to 6.9%

So, except for the growth at the top (the top 26% though and not so much the top 0.01% some people like to talk about) I am seeing slippage from 2002 to 2011.

Mind-boggling to me, because since 2002, I have only worked full time 5 years out of the 12, and I have added about $70,000 to my net worth.

I must be one of the few who is not blowing all my money on tattoos ![]()

xchrom

(108,903 posts)hfojvt

(37,573 posts)if they are curious

http://www.census.gov/people/wealth/data/dtables.html

but ooh, I should pull the data from 1993.

bhikkhu

(10,711 posts)Especially when the argument begins by conflating income and net worth. The two are related, but not very directly. My income has been relatively stable over the years - a little lower during the recession, a good amount higher now - always varying a bit above or below the actual cost of living. My net worth, on the other hand, has varied wildly. Owning a house and a property, I was worth a bundle before the recession. Then I was worth significantly less than nothing for 4 years or so. Now its trending up. All it means to me is that perhaps I will be able to retire someday without relying solely on Social Security. Net worth isn't the best way to compare most people - income is a much better measure.

I never had enough money for tattoes anyway...

hfojvt

(37,573 posts)If I make $15,000 a year, then I can save a certain amount of money.

If I make $60,000 a year, then I can save a lot more.

Since going from part-time to full time work in September 2011, I have added a lot to my net worth.

And it works for other people too.

People in the lowest quintile - 31% of them have negative net worth and only 4.2% have over $500,000.

For those in the highest quintile only 8% have negative net worth whereas 33.8% of them have over $500,000.

If somebody who makes less than 60% of Americans can add to his net worth, then why can't people who make more money?

noiretextatique

(27,275 posts)+assets- liability equals net worth. If you lost as asset, e.g., a house or a 401k, which many people have in the past ten years, that would negatively impact net worth. Your simplistic analysis makes me doubt you have the finance and economic knowledge you claim.

hfojvt

(37,573 posts)"guessing about a thing, I really ought to know"

How many people lost an asset over the past ten years? And why should that asset loss be larger than the simple expedient of saving $5,000 a year over ten years?

And I didn't think the discussion was supposed to be about my finance and economic knowledge.

cascadiance

(19,537 posts)Had been trying to avoid that, but the moment finally came after the savings and every other source of money went down the toilet.

bhikkhu

(10,711 posts)That's generally true for all but the top 5% or so. The great majority of Americans aren't very good at on saving money, for better or worse.

There are two things that greatly affect the net worth picture, then. First is use of credit cards, which commonly tip people down into negative net worth. I don't think its that big of a deal necessarily; if you can make the payment, why not enjoy the use of money that you haven't earned yet? Credit can get you into trouble if your income isn't secure, but a little moderation and its no big deal. Adults are expected to be able to do the math and figure those things out, and for the most part they do ok.

The second thing is property. If you rent, you're still likely to have a negative net worth - spending what you earn and having some credit debt. If you buy a house, depending on what you owe and how the values change, then you probably wind up with a positive net worth. It doesn't change a person's lifestyle especially, and the big fluctuations over the past few years (typically from positive to negative and back to positive) are mostly just changes on paper. I was wealthy when my house was worth $200k, then I was in the hole when it went down to $70k, and now I'm back in positive territory. It made no difference; income is what makes a difference.

In the long term, a positive net worth makes it easier to think about retiring someday, but I could easily die of something or other before that happens. In the meantime, life with a positive net worth is the same as life with a negative net worth - I spend what I earn, by necessity, same as most everybody else.

hfojvt

(37,573 posts)A person may be better off if they do spend what they earn, but it seems kinda absurd to CHOOSE to spend all that you earn and then to cry "I don't have any wealth".

There may be some in the bottom 30%, who knows how many, who cannot live decently without spending all that they earn, for a variety of reasons.

As for credit. The reason to NOT enjoy the money that you haven't already earned, is because you pay far too much in interest charges by doing so, and ultimately are worse off. At least that is why I never do it.

Autumn

(44,958 posts)Autumn

(44,958 posts)Rec

clarice

(5,504 posts)marions ghost

(19,841 posts)you have to acknowledge that there is a problem with Capitalism.

clarice

(5,504 posts)marions ghost

(19,841 posts)extreme vampire capitalism is working for America these days?

I imagine it works well for you-- if you can even contend that there's nothing better.

But look around...it's not working for a lot of Americans. It's a failure in many ways at this point.

clarice

(5,504 posts)Consider Socialism.... a system that sucks out the best parts of people and drains them

until they are dry.

Kingofalldems

(38,408 posts)What do you like about the Democratic party? You seem to tilt to the republican side. And not just a little bit either, IMO. RW talking points on a regular basis.

clarice

(5,504 posts)Please do me a favor.....can you hold all of the "you might be a Republican" rhetoric?

It's very unbecoming. Now, to your points,

1. I have never voted for a Repub in my life.

2. I consider myself socially liberal, and fiscally moderate/rightish

3. What I like about the Democratic Party

A. inclusiveness

B. slanted toward working folks (or used to be)

C. Absence of Religious craziness (for the most part)

D. Woman's right to choose

As for right wing talking points, I guess that you mean anyone who doesn't agree with your world view.

I took you off of ignore...please be nice.

Kingofalldems

(38,408 posts)marions ghost

(19,841 posts)they really don't want to see the ugly truth about the ruthless exploitative brand of capitalism practiced in America....

Rex

(65,616 posts)Some people only care about themselves and are part of the problem.

marions ghost

(19,841 posts)--working against us while posing as "socially liberal." With friends like that, who needs enemies?

Enthusiast

(50,983 posts)The deficit soared because of Bush's unnecessary wars and huge tax cuts for the wealthy. But they prop up the illusion and insist it is true. In reality those fiscal moderates are entirely responsible for this crushing debt.

Sad to read it on DU.

clarice

(5,504 posts)marions ghost

(19,841 posts)Where is this happening? That bad "socialist" place (I presume we're not talking about ye olde communism).

You don't see that the American economic system is working only for the few? Sucking the best parts of people and draining them dry? Honestly you DON'T see this?

Enthusiast

(50,983 posts)Since 2000 we have been under a system that isn't exactly your father's capitalism. Some have described it as disaster capitalism, an apt description.

clarice

(5,504 posts)and I don't apologize for it. It took a lot of hard work and sacrifice.

Kingofalldems

(38,408 posts)Answer: No one.

clarice

(5,504 posts)raouldukelives

(5,178 posts)Feels more like corporate socialism to me. I think capitalism could be worth a shot if we wanted to try it.

Yo_Mama_Been_Loggin

(107,646 posts)marions ghost

(19,841 posts)whatever it is--it's not working...

Enthusiast

(50,983 posts)The most profitable industries in all of history are receiving government subsidies-tax breaks.

DeSwiss

(27,137 posts)Adrahil

(13,340 posts)Both myself and my wife have done much better over the last 10 years, but it's largely because we've come into the maturity of our careers. I've moved into a management position, and my wife got a tenure track position, made tenure and promotion to Associate Professor. All that naturally lead to some significant gains, but for most people, I don't see that happening. Middle class skilled and semi-skilled jobs are being replaced by unskilled service jobs. It's a major economic disaster.

dmosh42

(2,217 posts)Clinton did a little adjustments for tax fairness, which Bush quickly discarded. But all allowed trade imbalances to grow, especially pitting our labor against slave labor or close to it in third world nations.

KG

(28,749 posts)underemployment.

clarice

(5,504 posts)marions ghost

(19,841 posts)---

clarice

(5,504 posts)edhopper

(33,445 posts)100 people in a room, one has $999,901 the other 99 each have $1.

Their average worth is $10,000.

A Year later that one person has $1,999,901 and the rest still have $1.

Oh look, their average worth is has doubled!

elias49

(4,259 posts)The rich get richer. Most of the rest of us keep going deeper and deeper into debt.

n2doc

(47,953 posts)Past 30 years

http://www.democraticunderground.com/10025306932

conservaphobe

(1,284 posts)

progressoid

(49,917 posts)

Paper Roses

(7,469 posts)progressoid

(49,917 posts)Definitely.

grahamhgreen

(15,741 posts)sendero

(28,552 posts).... you are delusional or retarded. Sorry, but that is a FACT.

Rex

(65,616 posts)Sadly, we don't live in any kind of economic system that resembles classical capitalism. The 1% turned it into a plutocracy and now have local criers to do their bidding, they don't even have to work anymore! Just sit back and watch their machine of destruction do their will.

IOW, back in the day a robber baron might have to get his hands dirty in his own 'success'...now they can just sit back and pay a law firm to do it for them! Or 10 law firms. Whatever it takes to stay out of court and impossibly rich.

historylovr

(1,557 posts)daleanime

(17,796 posts)blkmusclmachine

(16,149 posts)Sherman A1

(38,958 posts)Well Said!

ReRe

(10,597 posts)... she should have left the word "Probably" out of the title.

So much for "family values." No telling how many divorces the "pooring-down" of America has caused over the last 20-30 years. I used to blame my husband for being a lousy provider. He asked me once "How do people who start out with nothing end up with something? I almost beaned him. But now, I see that no matter what he did, or what anyone did, to try and keep up, it was predestined by something beyond our control.

And it's so ironic that Ronald Reagan asked that immortal question: "Are you better off than you were 4 years ago?"