General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhy Americans Are Drowning in Medical Debt

Because for actual sick people, insurance is a totally useless product. Most of the bankrupted Americans had it, to no avail.

http://www.healthcare-now.org/why-americans-are-drowning-in-medical-debt

After his recent herniated-disk surgery, Peter Drier was ready for the $56,000 hospital charge, the $4,300 anesthesiologist bill, and the $133,000 fee for orthopedist. All were either in-network under his insurance or had been previously negotiated. But as Elisabeth Rosenthal recently explained in her great New York Times piece, he wasn’t quite prepared for a $117,000 bill from an “assistant surgeon”—an out-of-network doctor that the hospital tacked on at the last minute.

It’s practices like these that contribute to Americans’ widespread medical-debt woes. Roughly 40 percent of Americans owe collectors money for times they were sick. U.S. adults are likelier than those in other developed countries to struggle to pay their medical bills or to forgo care because of cost.

California patients paid more than $291,000 for the procedure, while those in Arkansas paid just $5,400.

Earlier this year, the financial-advice company NerdWallet found that medical bankruptcy is the number-one cause of personal bankruptcy in the U.S. With a new report out today, the company dug into how, exactly, medical treatment leaves so many Americans broke.

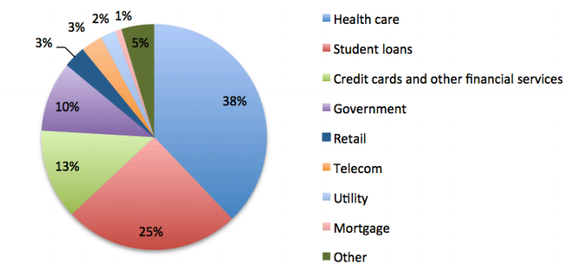

Americans pay three times more for medical debt than they do for bank and credit-card debt combined, the report found. Nearly a fifth of us will hear from medical-debt collectors this year, and they’ll gather $21 billion from us, collectively.

Doctor_J

(36,392 posts)It did two things to wreck any chance of reform: locked big insurance in to the system, with guaranteed profits of hundreds of billions of dollars per year, and got a lot of dinos/kool aid drinker/tiger beat to cheer for yet another republican policy. Sickening.

jamzrockz

(1,333 posts)is the fact that they did not aggressively address cost of medicine in this country. At the present cost of healthcare, I don't think there is enough money in the US to take care of everybody who needed help. Is it no wonder people are still filing for medical related bankruptcies.

davidn3600

(6,342 posts)Many of these insurance plans that people have are useless. They can't use them because of massive deductibles. They might as well not even have insurance.

Doctor_J

(36,392 posts)They're now being forced to buy policies that are useless to them. I have to grudgingly tip my hat to the insurance and drug industries for pulling off the biggest robbery in history.

Recursion

(56,582 posts)You pay higher taxes of you don't have insurance, just like if you rent. I still don't see why people are fine with the one but not the other.

Bluenorthwest

(45,319 posts)insurance is like trying to end homelessness by mandating that everyone has to buy a house.

And by way of reality, you get a deduction not for owning a house, but for having a mortgage on a house. A renter and a deed holder have the same tax situation, housing wise. A mortgage holder gets a deduction on the interest, not on the property.

Seeking Serenity

(2,840 posts)still does get to deduct his property tax, something renters don't get.

Zorra

(27,670 posts)(for a benign growth that is somewhat painful at times) turned out to be $8,000. My deductible is totally paid. I am responsible for 20% of the total cost, which would have been around $1600 out of pocket.

The surgeon's fee was separate, and was only a bit more than $750.00, and that would have only been $156 out of pocket, totally affordable for me.

Combined with testing and other expenses related to the procedure, my total out of pocket expenses would have been over $2000.

And I had to spend many hours just trying to find out how much it was all going to cost. Hospitals and other medical facilities don't like to let people find out how much services cost, because they don't want people comparison shopping and causing competition among facilities that would cause them to lose profit. And the hospital was really nasty to me because I was trying to find out these costs, and made it difficult for me to get an answer.

They don't tell people what everything is going to cost so they don't lose business, and then people go into sticker shock when they get their bill.

I had to cancel the surgery (because the hospital costs, the middleman, made the procedure way too expensive).

We need a system like Canada has, end of story. The privatized healthcare and healthcare insurance industry must die.

Crunchy Frog

(26,578 posts)and should be prosecuted, or at least not reimbursed.

Maybe the system should be further reformed by banning the in network/out of network distinction.

xchrom

(108,903 posts)UglyGreed

(7,661 posts)through her work, but we are still in debt because of my many troubles. I try not to go to the doctor because I feel guilty adding more stress and financial problems.

woo me with science

(32,139 posts)http://www.pnhp.org/news/2013/june/medical-debt-a-curable-affliction-health-reform-won%E2%80%99t-fix

The high frequency of medical bankruptcy was often cited by advocates of health reform during the debate over the ACA. Yet the debate largely ignored the fact that most medical debtors actually have coverage. In order to protect Americans from bankruptcy, coverage must be truly comprehensive, that is, it must cover virtually 100 percent of all needed medical care. Unfortunately, the insurance policies mandated under ACA are required to cover only 60 percent of expected health-care costs.

56 MILLION Americans under age 65 will have trouble paying medical bills.

Over 35 MILLION American adults (ages 19-64) will be contacted by collections agencies for unpaid medical bills.

Nearly 17 MILLION American adults (ages 19-64) will receive a lower credit rating on account of their high medical bills.

Over 15 MILLION American adults (ages 19-64) will use up all their savings to pay medical bills.

Over 11 MILLION American adults (ages 19-64) will take on credit card debt to pay off their hospital bills.

Nearly 10 MILLION American adults (ages 19-64) will be unable to pay for basic necessities like rent, food, and heat due to their medical bills.

Over 16 MILLION children live in households struggling with medical bills.

Despite having year-round insurance coverage, 10 MILLION insured Americans ages 19-64 will face bills they are unable to pay.

1.7 MILLION Americans live in households that will declare bankruptcy due to their inability to pay their medical bills.

Three states will account for over one-quarter of those living in medical-related bankruptcy: California (248,002), Illinois (113,524), and Florida (99,780).

To save costs, over 25 MILLION adults (ages 19-64) will not take their prescription drugs as indicated, including skipping doses, taking less medicine than prescribed or delaying a refill.

[font size=5]CORPORATE MONEY OUT OF OUR PARTY[/font size]

eridani

(51,907 posts)What people think they know about the insurance that they have is like what they think they know about whether their fire extinguishers are any good. The 85% who account for 15% of all health care costs are never going to know.

truedelphi

(32,324 posts)A privately hired, home health aide taught me that most people don't criticize the hospital care they receive even if it is killing them.

A large percentage of the people who hired me were doctors or nurses. Believe me, they know when they are getting the wrong medicine combinations.

Or the wrong procedure suggested. (Assuming they are conscious, of course.)

But the average Joe Schmoe and his family, as long as the nurses' aides are freiendly and outgoing and cheerful, they just assume that the fate the family member may suffer is their fate. And not related to he fact that

One) before Hospitials in California became all-Corporatized, for-profit insitutions, circa 1994 or so, there were more nurses per floor. They had far more training than a nurses' aide.

Two) Although state laws came about and dictated that hospitals must now have X amount of nurses on a floor, hospitals hire nursing agencies to supply those workers, so they can keep the costs down. And believe me, a travelling nurse who doesn't know where the medicine cabinet for the floor is, or where the keys are to it, spends a lot of her time looking for things rather than daling with patients. And she won't be there tomorrow, so even if she does manage to get to know some patients, she will be at a different facility the next day!

Three) The vaguaries of health insurance. For instance, your policy may let you have a needed quad bypass for yr heart, but that same insurance may force you to pay for the anti infection anti biotics that are needed post op out of pocket. If you don't have that $ 6,000, you may die. But oh well, at least the heart surgeon got to have that $ 80,000 for the heart procedure. Gives new meaning to "The operation was a success, byut the patient didn't live to tell about it."

eridani

(51,907 posts)Saw an artivle about it last wwek, but can't find it now.

Recursion

(56,582 posts)Even with the bronze plan you can't end up owing more than $6k in a single year.

eridani

(51,907 posts)scarystuffyo

(733 posts)They can swing it

I think the biggest problem is finding doctors who accept many of the insurances .

When you find the closet one he's a hour drive away

Recursion

(56,582 posts)that $6k won't drive you to bankruptcy.

It's possible the formula needs to be tweaked, but that's explicitly the logic behind it. Bronze plans are there to prevent bankruptcy by limiting single-year liability.

eridani

(51,907 posts)Recursion

(56,582 posts)And only coinsures for non-hospital treatments.

Are you really sure giving everybody that is better?

eridani

(51,907 posts)When I went on old unimproved Medicare, my health care expenses dropped 80%.

Recursion

(56,582 posts)How did the patient in your OP get more than $6k in debt in a single year? You still haven't explained that.

eridani

(51,907 posts)Recursion

(56,582 posts)Sigh

Lars39

(26,107 posts)What can easily be dismissed as just $6,000 has grown to $12,000 to $15,000, including previous medical debt. This is the reality a lot of people are facing.

Recursion

(56,582 posts)Before 2010, the yearly limit your condition could cost you was infinity.

Now it's $6000 (or actually $6600 I think).

If you're regularly spending that year after year, a bronze plan is a bad idea for you. You'll save money with a silver or better plan.

truedelphi

(32,324 posts)An operation was approved, by the Big Insurer that the patient had as their Insurer.

The doctor was approved. But the doctor had some assisting doctor come along to particpate and that assisting doctor was not part of the network, but had a price tag of over 100K as part of their charges for participating in the operation.

So the patient now has over 100K of debt to deal with.

Now many middle class people would not be bankrupt - they would simply have to empty out the retirement savings in order to cover that cost. (I was just reading about a week back that most people oover 55 have an average of 45K in retiremnet. Why? Well, this is a group of people who have lost out big time in terms of the housing crisis of 2006, and then the stock down turn and economic implosion of 2008. )

But the next time it happens to them, they will be bankrupt.

Recursion

(56,582 posts)Yes, criminals are irritating, but that charge won't actually make it through any legal challenge.

truedelphi

(32,324 posts)The Big Insurers have a gazillion laws on the books that allow them to operate as racketeers.

And sure, if the person who is afflicted like this is a lawyer or has a close family member who is a lawyer and the family member handle the case for them, fine.

But usually, you cannot in this day and age get anyone in the nation with the proper legal credentials to get you through court if your lawsuit involves going up against the Big guys (Banks, Big Insurance etc.)

Bluenorthwest

(45,319 posts)Where do you get 800?

Recursion

(56,582 posts)Most seniors (practically all for Part A) receive a subsidy from the Trust Fund they paid into, but younger hypothetical enrollees wouldn't.

Humanist_Activist

(7,670 posts)dollars is paid to Medicare a month. Due to her disability, we are accumulating the bills, the only saving grace being that the hospitals/etc. can't really do much more than go to collections, and they can never touch her disability, so medicare pays 80%, we are supposed to pay 20%, and sometimes we make arrangements to try to pay off the bills, but when you are making 10 dollar a month payments, but getting hit with 100 dollar bill doctor visits at least 3 times a year, the point becomes kinda moot. So we ignore most of the bills, because we have to eat. :shrugs:

Technically she is covered by both Medicare and Medicaid, but, because the expansion never took place here, there's a spenddown of about 300 a month on Medicaid for her.

Humanist_Activist

(7,670 posts)condition are fucked, because their debts from the previous year, even if only 6 grand, will carry to the next year, where they get hit with another 6 grand of debt. And so the cycle continues.

lumberjack_jeff

(33,224 posts)... this might be a valid point.

This entire thread is overstated. Yes, $6000 is a nontrivial amount of money to come up with for that open heart surgery. Yes, the ACA isn't perfect because of the overlapping profusion of medical plans drive up the odds that a given doctor won't be in your network.

But claims that it's worse than before, or that it does nothing for costs are hyperbolic nonsense.

Recursion

(56,582 posts)They're intended for young healthy single people in case they catch on fire or get hit by a bus. People with chronic health conditions will pretty much always save money with a silver or higher plan.

Humanist_Activist

(7,670 posts)or they are in one of those states that have yet to expand medicaid.

Recursion

(56,582 posts)Give me an example of an income level where the subsidy makes silver unaffordable.

(I'll grant you people under the raised Medicaid limit in states that refused to expand Medicaid; that was clearly contrary to the intent of the law.)

EDIT: -aid, not -are, obviously...

Humanist_Activist

(7,670 posts)Well, OK, technically I am, but we will use me as an example, my work offers a silver equivalent plan for me, so I'm required to use it, since the premium(for an individual) barely squeaks under the limit allowing me to go on the exchange, its affordable for me, barely, as far as premiums and regular doctor visits go, as long as you only go to a few. But at 12 bucks an hour, I cannot afford to pay a lot more if something happened to me, medical-wise.

I have a potentially acute condition that could theoretically get worse, a pinched nerve in my shoulder, but it requires surgery to fix, I work an office job, so don't need to lift things, so I just deal with the pain. At my pay, I simply can't afford the surgery, considering much of my pay already goes to help my fiancee's medical problems, and no, adding her to my plan would triple the premium, which is already 70 dollars a paycheck, 140 dollars a month.

Am I saying my plan is useless? No, its awesome for preventative care, standard checkups, vaccinations, etc.

I just hope I don't get sick.

PasadenaTrudy

(3,998 posts)Time to look for another plan! This one meets the ACA requirements and is basically a Platinum level plan. I turned 50 this year, so things are going to really get pricey now I guess. Time to downsize ![]()

SomethingFishy

(4,876 posts)and we are racking up the bills. Damn shame too because we have no mortgage, we own our car, we have no credit cards and no credit card debt..

She's on Medicare/Medicade but it pays only 80%. Now 20% wouldn't be a lot if we lived somewhere where they didn't charge $80 for a box of Kleenex, but there you have it. She had chest pains awhile back, we rushed her to the emergency room, 4 hours later they figured out it was a bad gas attack. The bill, including all the tests and everything was over $20,000. The Doctor told me to make sure I went through the bill with a fine tooth comb because they were going to try to stick me. That's when I found the $80 box of Kleenex. It was listed on the bill as M.R.S. $80 Yeah.. M.R.S. Mucous Removal System, fucking tissues.

But hey, we have the greatest health care system in the galaxy!