General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsEx-CITIGROUP CEO Blames Glass-Steagall Repeal for Financial Crisis

"Yeah. See. Move on!"

From the "DU Told You So Department"...

Parsons Blames Glass-Steagall Repeal for Crisis

By Kim Chipman and Christine Harper - Apr 19, 2012 8:48 PM ET

Bloomberg

Richard Parsons, speaking two days after ending his 16-year tenure on the board of Citigroup Inc. (C) and a predecessor, said the financial crisis was partly caused by a regulatory change that permitted the company’s creation.

The 1999 repeal of the Glass-Steagall law that separated banks from investment banks and insurers made the business more complicated, Parsons said yesterday at a Rockefeller Foundation event in Washington. He served as chairman of Citigroup, the third-biggest U.S. bank by assets, from 2009 until handing off the role to Michael O’Neill at the April 17 annual meeting.

SNIP...

U.S. Bailout

“People have a sort of a notion that ‘well, we can decide that’s too big to manage,’” he said. “But it got that way because there was a market need and institutions find and follow the needs of the marketplace. So what we have to do is we have to learn how to improve our ability to manage it and manage it more effectively.”

Citigroup, which took the most government aid of any U.S. bank during the financial crisis, has lost 86 percent of its value in the past four years, twice as much as the 24-company KBW Bank Index. (BKX) Most shareholders voted this week against the bank’s compensation plan, which awarded Pandit about $15 million in total pay for 2011, when the shares fell 44 percent.

CONTINUED...

http://www.bloomberg.com/news/2012-04-19/parsons-blames-glass-steagall-repeal-for-crisis.html

Gee. If only Washington knew about this! I bet they'd do something to stop the crooks!

steve2470

(37,457 posts)Octafish

(55,745 posts)From Sen. Bernie Sanders:

Some of the largest and most profitable financial institutions in this country now pay little or nothing in federal income taxes. Last year, Bank of America received a $1.9 billion tax refund from the IRS, even though it made $4.4 billion in profits and received a bailout from the Federal Reserve and the Treasury Department of more than $1 trillion. Citigroup made more than $4 billion in profits last year but paid no federal income taxes, even though it received a $2.5 trillion bailout from the Federal Reserve and U.S. Treasury. And, in 2008, Goldman Sachs paid only 1.1 percent of its income in taxes even though it earned a profit of $2.3 billion and received a bailout of more than $800 billion from the Federal Reserve and U.S. Treasury Department

http://www.sanders.senate.gov/newsroom/news/?id=26d286ca-6ce5-4ef2-a284-85b240f4f30a

banned from Kos

(4,017 posts)He must be a Republican.

1StrongBlackMan

(31,849 posts)he blamed the lifting of glass-steagall for allowing the merging of two, disparate industries that in the vacuum grew to an unmanageable size.

At least, that's what I read.

banned from Kos

(4,017 posts)Bill Clinton did not MAKE them merge! He just let them merge.

This fucking asshole is lying.

1StrongBlackMan

(31,849 posts)Bill Clinton did not MAKE them merge; his repeal ALLOWED them to merge.

One would think people would be happy that an insider is willing to point to one of the seminal events that started the U.S. economy headed to the edge. I guess not!

banned from Kos

(4,017 posts)Its yours! You shot the heroin!

Clinton allowed Citi to shoot heroin. So its Citi's fault!

cyglet

(529 posts)Is so you, and your companies, don't die (at least in the Holland view of drug regulation, not the US view).

If the government fails in its original intent to provide for and protect people, then yes, they're at fault, or, to be mildly generous, complicit.

It's moot to me, since the corporations control what they do, so govt and industry are one and the same.

Jim Lane

(11,175 posts)Parsons understands our system when he says that "institutions find and follow the needs of the marketplace." His point is that government should always bear that in mind. Don't rely on private, for-profit institutions to act in ways that benefit society. Expect them to act in ways that maximize their profits; then, with that expectation in mind, design the regulatory structure in such a way that their selfish behavior will tend to benefit society.

He is 100% correct.

banned from Kos

(4,017 posts)did PNC? NO!

did US Bank? NO!

THEY DIDN'T LOSE MONEY EITHER!

And now this dipshit Parsons blames Clinton? FUCK HIM HARD WITH A POKER.

Lawlbringer

(550 posts)INCONCEIVABLE!

banned from Kos

(4,017 posts)Its all Bill Clinton's fault!

He is fucking GOP scum - blaming others for his BAD Decisions!

gratuitous

(82,849 posts)Yeah, letting the greediest motherfuckers on the planet regulate themselves was a real stroke of genius. Who knew they'd just grab as much as they could and let their banks and financial institutions just fall to pieces over bad debts, uncollectible loans, and overpriced commodities? Why, you'd have to be some kind of financial wizard to see that coming!

As Citibank's last president John Reed remarked: You put brakes on a car not so you can stop it, but so that you can go fast. How fast would you go in a car that you knew didn't have any brakes? Would you even get in a car without brakes? When the regulatory framework is removed, finance and capital merge, and sure as shit somebody's going to be making reckless investments because the promised returns were just too good and the window of opportunity was closing. We had to plunge or the shareholders could have sued us for not making a big enough profit!

1StrongBlackMan

(31,849 posts)and that is a far cry from saying Parson is blaming the government.

hughee99

(16,113 posts)Has such a thing ever happened? Usually, when shareholders don't think a company is making a big enough profit, they move their money elsewhere, I've never heard of them suing before.

Octafish

(55,745 posts)The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

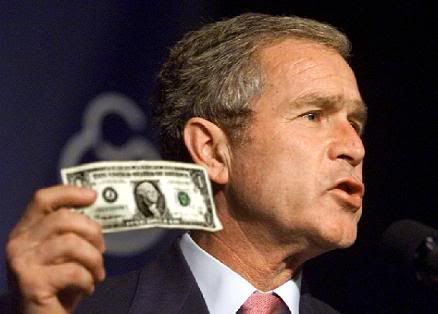

The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.

The above was posted on DU on Sept. 21, 2008. (Check out the responses, lots of info from DUers.) What's changed since then? Nothing near what I'd hoped for, certainly.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x4055207

Ruby the Liberal

(26,219 posts)Octafish

(55,745 posts)Phil Gramm, the former Republican Senator from Texas who co-wrote the act that undid Glass-Steagall, has our DQotD:

“I’ve never seen any evidence to substantiate any claim that this current financial crisis had anything to do with Gramm-Leach-Bliley. In fact, you couldn’t have had the assisted takeovers you had. More institutions would have failed.”

Thanks to The Big Picture.

Gee. That sounds familiar since the OP went up Friday evening.

Ruby the Liberal

(26,219 posts)banned from Kos

(4,017 posts)Bill Clinton!

FUCK HIM! AND FUCK THIS FUCKING STORY!

randome

(34,845 posts)I think what he said is true. Doesn't matter how rich he is or how he might have contributed. He's still right.

banned from Kos

(4,017 posts)Parsons - your fucking GOP stupidity PISSES me off!

Clinton ALLOWED you to buy an insurance company and YOU fucked up!

Octafish

(55,745 posts)Parents and institutions use it to prevent people from reading things they deem inappropriate. It helps ensure that certain content never makes the light of day. From what I've read, the software works for entire threads and websites.

So, to make certain as many people learn the truth about these so-and-so's who've dragged the nation into the toilet, I hesitate from using it these days.

hughee99

(16,113 posts)"I blame the Glass-Steagall Repeal for the crisis, because without it, we were free to do whatever we wanted. The government should have known it couldn't trust us to be responsible".

If that's the argument, I find it hard to disagree.

cyglet

(529 posts)And we are so very sorry now.

![]()

lastlib

(23,140 posts)...Senator Phil Gramm, who pushed for a provision in what became known as the Gramm-Leach-Bliley Act to de-regulate swap derivatives: bank interest rate swaps and especially credit default swaps. The overleveraging of these instruments, coupled with declines in housing values, left the major institutions with colossal balance-sheet liabilities that they couldn't cover with their available assets. Had they gone the normal route of declaring bankruptcy, their sheer size would have pulled down the entire financial system like a chain of dominoes.

Had these swaps been properly regulated (they still AREN'T, BTW) these banks would not have been so heavily exposed, and their danger would have been significantly mitigated. But thanks to that right-wing turd Gramm, who was not only helping out his banking buddies, but also HIS WIFE (who was a major player in the banking business), and thereby HIMSELF(!!), we had the greatest financial meltdown since the Great Depression.

Don't ever forget that these bastards are only out to enrich themselves, the 1%, and to hell with the rest of us!

Phil Gramm should be rotting in jail right now, along with Bush and Cheney!

Octafish

(55,745 posts)Please check out my post at #19:

http://www.democraticunderground.com/1002590111#post19

I agree wholeheartedly with your analysis and suggestions for prosecution.

I'd only add that I expect the crooks and their henchmen to pay restitution.

progressoid

(49,933 posts)And everyone that voted for it.

FWIW, Jim Leach (R - IA) is now part of the Obama Administration.

Octafish

(55,745 posts)"I think it could include thousands of financial services industry participants and other large institutions all over the world. And I think that's what happened. As the market continued to grow, with even less oversight and regulation, until it reached more than $680 trillion in notional value, an enormous potential for disaster had grown.

"What happened after I left the agency in June 1999 was the President's Working Group did come out with an over-the-counter derivatives report (PDF) to Congress that strongly suggested that ... there was no need for regulation.

"And as a result of that report, a statute was passed in 2000 called the Commodity Futures Modernization Act (CFMA) that took away all jurisdiction over over-the-counter derivatives from the CFTC. It also took away any potential jurisdiction on the part of the SEC, and in fact, forbids state regulators from interfering with the over-the-counter derivatives markets. In other words, it exempted it from all government oversight, all oversight on behalf of the public interest. And that's been the situation since 2000."

CONTINUED...

http://www.pbs.org/wgbh/pages/frontline/warning/interviews/born.html

sabrina 1

(62,325 posts)she has yet to receive an apology from the arrogant SOBs who drove her out of town BECAUSE they knew she was right and was spoiling their fun.

When, when will the rule of law be applied to these criminals? Greenspan eg, should lose every dime he has for what he did to Brooksley Born alone, let alone the country.

Octafish

(55,745 posts)Absolutely agree, sabrina1. The crew who ripped off the banks should pay in restitution of every penny.

It goes back to this:

Know your BFEE: Spawn of Wall Street and the Third Reich

Adm. Gene Laroque warned us about the Secret Government.

Secret Government is un-American.

sabrina 1

(62,325 posts)for the Meltdown?

I didn't think there was any question about it, frankly. Deregulation was like opening the vaults and leaving them unguarded and then trusting them to be honest. Riiiiight!

Still waiting for prosecutions ....

Octafish

(55,745 posts)Unbelievably, the "banks" get federal deposit insurance for the money they scam away. So, they've socialized the risk. The irrepressible banned by Kos has nothing to worry about, they've privatized the rewards.

Big Business gets a break on financial reform

WASHINGTON (CNNMoney) -- Big business scored a major win Wednesday when two regulatory boards agreed to limit the impact of tough rules to regulate the complex trades that helped spur the 2008 financial crisis.

Regulators have been struggling for months to figure out who should be included in a new crackdown of swaps or derivatives -- complex financial bets derived from other financial products such as the price of jet fuel or mortgages.

Derivatives were the key reason that American taxpayers were on the hook for the American International Group (AIG, Fortune 500) bailout in 2008. Derivatives also threatened to take down the global financial system when Lehman Brothers collapsed.

When Congress passed Wall Street reforms in 2010, lawmakers left the big decisions of how to regulate derivatives up to supervising agencies. Generally, the Democratic-controlled Congress wanted swaps to be more transparent and safer.

CONTINUED...

http://money.cnn.com/2012/04/18/news/economy/swaps-rules/

banned from Kos must be one of those pro-Conscious Capitalists types who once liked to post on DU.

PS: I can't wait to see that cancelled check.

sabrina 1

(62,325 posts)says to me, they KNEW she was right, but they were so greedy, and so unprincipled they felt entitled to profit from something they viewed, obviously, as 'brilliant'. When in reality, all of us could do what they did, it doesn't take brilliance, it takes a depraved lack of principles.

When Congress passed Wall Street reforms in 2010, lawmakers left the big decisions of how to regulate derivatives up to supervising agencies. Generally, the Democratic-controlled Congress wanted swaps to be more transparent and safer.

And they got their way again and the people will have to keep paying, until they find a way to stop them, if it's not too late.

Thanks for the links, Octafish.

xchrom

(108,903 posts)Octafish

(55,745 posts)Here's something Corporate McPravda and people banned from Kos don't want you to know about:

Geithner’s Dirty Little Secret

By F. William Engdahl, 30 March 2009

US Treasury Secretary Tim Geithner has unveiled his long-awaited plan to put the US banking system back in order. In doing so, he has refused to tell the ‘dirty little secret’ of the present financial crisis. By refusing to do so, he is trying to save de facto bankrupt US banks that threaten to bring the entire global system down in a new more devastating phase of wealth destruction.

EXCERPT...

The ‘Dirty Little Secret’

What Geithner does not want the public to understand, his ‘dirty little secret’ is that the repeal of Glass-Steagall and the passage of the Commodity Futures Modernization Act in 2000 allowed the creation of a tiny handful of banks that would virtually monopolize key parts of the global ‘off-balance sheet’ or Over-The-Counter derivatives issuance.

Today five US banks according to data in the just-released Federal Office of Comptroller of the Currency’s Quarterly Report on Bank Trading and Derivatives Activity, hold 96% of all US bank derivatives positions in terms of nominal values, and an eye-popping 81% of the total net credit risk exposure in event of default.

SNIP...

The Government bailouts of AIG to over $180 billion to date has primarily gone to pay off AIG’s Credit Default Swap obligations to counterparty gamblers Goldman Sachs, Citibank, JP Morgan Chase, Bank of America, the banks who believe they are ‘too big to fail.’ In effect, these five institutions today believe they are so large that they can dictate the policy of the Federal Government. Some have called it a bankers’ coup d’etat. It definitely is not healthy.

This is Geithner’s and Wall Street’s Dirty Little Secret that they desperately try to hide because it would focus voter attention on real solutions. The Federal Government has long had laws in place to deal with insolvent banks. The FDIC places the bank into receivership, its assets and liabilities are sorted out by independent audit. The irresponsible management is purged, stockholders lose and the purged bank is eventually split into smaller units and when healthy, sold to the public. The power of the five mega banks to blackmail the entire nation would thereby be cut down to size. Ooohh. Uh Huh?

CONTINUED...

http://www.engdahl.oilgeopolitics.net/Financial_Tsunami/Geithner_Secret/geithner_secret.html

Thanks, xchrom, for giving a damn! Means the world to me, my Friend!

xchrom

(108,903 posts)NNN0LHI

(67,190 posts)I was laid off from my job for nearly 6 years back then. Wonder what/who Mr. Parsons blames that on?

Don

Octafish

(55,745 posts)Mr. Parsons may know this, but I doubt he lets it weigh on his conscience:

The U.S. economy has been on a war footing since 1942. The combination of the secret national security state and the revolving door for decision makers from Government/Pentagon to the private sector has pretty much locked in that side of the spending equation to the detriment of civilian spending. Then, sometime in the 1970s, those outside of government with big money to invest found they could make more money through finance than manufacturing. Throw in Reaganomics and the rich getting richer exponentially, and we've got a systemic disaster unparalleled in democratic history. Of course, in the meantime, the good jobs disappeared from our shores and followed the investment money overseas.

All is not lost, though. Thankfully, one class of Americans did quite well. So, guess who founded the U.S.A. - China Chamber of Commerce?

progressoid

(49,933 posts)Leach - as in Jim Leach (Republican IA) - now serving in the Obama Administration.

![]()

Octafish

(55,745 posts)President Obama recently appointed Dr. Zelikow, the guy who talked to Karl Rove but said he didn't, to the President's Intelligence Advisory Board.

WorseBeforeBetter

(11,441 posts)jmowreader

(50,528 posts)I would say as a rough estimate--this is very rough, mind you--that 99 and 44/100 percent of all the DUers who have been really looking close at the root causes of the financial crash blame Gramm-Leach-Bliley and the Commodity Futures Modernization Act for the lion's share of the responsibility for the crash. (Throw in the American Dream Downpayment Initiative, and you've covered all the bases.)

If Citigroup hadn't played in all three parts of the financial services industry (banking, investments and insurance) because its CEO thought the merger of the three sectors would destroy the economy, as in fact happened, the CEO would have been fired and replaced with someone who would.

I'm really shocked that anyone from the financial services industry would admit repealing Glass-Steagall was a bad idea.