General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHow Detroit Benefits from NAFTA

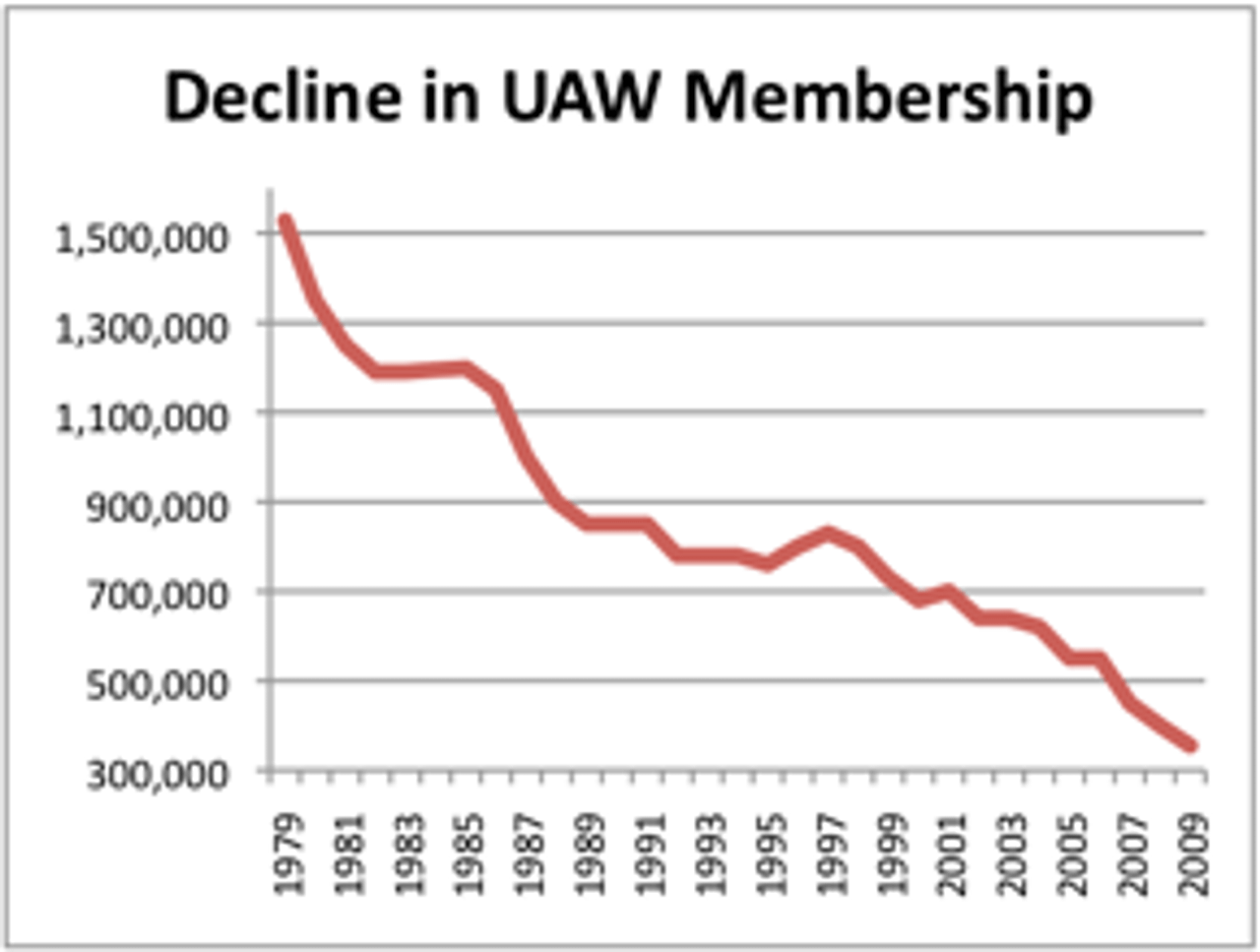

Here in Michigan, there aren't as many UAW members as when NAFTA got passed. A lot less. NAFTA went into effect on Jan. 1, 1994.

It's not all bad, though. What were once-bankrupt car makers and car suppliers are doing great, hiring like crazy. The problem for U.S. workers is that most of the hiring is for new plants overseas.

Consider the case of DELPHI Automotive, a parts maker spun-off when General Motors couldn't make it sufficiently profitable:

Talk about a turnaround. Delphi's epic 2005 bankruptcy exacted high costs on communities, unions and the pensions of salaried retirees. Yet the creative destruction of the four-year ordeal, shaped by management, private equity investors and the demands of the Obama auto task force, produced a global supplier that now offers 33 product lines from 141 manufacturing sites in 33 countries and employs 160,000 worldwide — only 5,000 of which work inside the United States.

-- Daniel Howes, Detroit News

http://www.detroitnews.com/story/business/columnists/daniel-howes/2015/02/18/howes-delphi-surges-quietly-one-regret/23655511/

The above is from a business columnist describing the good work of DELPHI's then-president in turning the company around. "Good work" is, of course, defined in maximizing shareholder value. "Shareholder," seems to me, is defined as "Owner."

ScreamingMeemie

(68,918 posts)Octafish

(55,745 posts)Back in the day...

What came next...

http://www.mlive.com/business/west-michigan/index.ssf/2009/05/ausco_rebrands_and_revives.html

Hoyt

(54,770 posts)GeorgeGist

(25,307 posts)Hoyt

(54,770 posts)He would be glad people in even poorer countries had jobs, and hope with more investment their standard of living would improve.

He wasn't a Nationalist, America First and screw everyone else type.

brentspeak

(18,290 posts)No one here said anything about "screwing everyone else", but you've been spamming it on these boards to promulgate your pro-Wall Street-written-trade-deal B.S.

Do us all a favor: publicly identify yourself on these boards, offer to give up your livelihood to some poor person living overseas, and then maybe we'll take you seriously.

GoneFishin

(5,217 posts)Hoyt

(54,770 posts)That was at it's worst in the Depression, when there was little investment in our country and little spending/demand.

Why don't you tell us what corporation you work for?

Not all corporations are bad -- Woody Guthrie Coalition, Inc., is an example.

appalachiablue

(41,102 posts)Octafish

(55,745 posts)General Motors employed a lot of Americans -- and a lot of people in the industries supporting General Motors. Now, it's good for...shareholders. Period.

* Back story: http://www.crossingwallstreet.com/archives/2009/06/whats-good-for-general-motors-is-good-for-america.html

Hoyt

(54,770 posts)Octafish

(55,745 posts)How many Banksters went to jail? How many are in President Obama's cabinet?

Hoyt

(54,770 posts)I would, however, try to simplify it and make it more responsive to the people. Doing that would take finesse to avoid another severe recession, an ax approach would create more issues for the people.

What I would really like to see -- and this is a pipe dream right now -- is a partnership between government and corporations. Corporations can raise money in ways the government can't. They are a bit more nimble and stable than governments too.

We definitely need more socially conscious managers and investors.

nashville_brook

(20,958 posts)we need "more socially conscious manager and investors" -- if only they were more socially responsible, this whole free market fantasy would be perrrrrrfect.

is this supposed to be less offensive and problematic b/c a Dem is saying it?

Octafish

(55,745 posts)"I'd like to promote something called Conscious Capitalism."

http://upload.democraticunderground.com/discuss/duboard.php?az=view_all&address=439x749313

More louder:

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=439x1310349

nashville_brook

(20,958 posts)Octafish

(55,745 posts)and the Secret "End-Game" Memo

By Greg Palast, August 22, 2013

EXCERPT...

The year was 1997. US Treasury Secretary Robert Rubin was pushing hard to de-regulate banks. That required, first, repeal of the Glass-Steagall Act to dismantle the barrier between commercial banks and investment banks. It was like replacing bank vaults with roulette wheels.

Second, the banks wanted the right to play a new high-risk game: "derivatives trading." JP Morgan alone would soon carry $88 trillion of these pseudo-securities on its books as "assets."

Deputy Treasury Secretary Summers (soon to replace Rubin as Secretary) body-blocked any attempt to control derivatives.

But what was the use of turning US banks into derivatives casinos if money would flee to nations with safer banking laws?

[font color="green"]The answer conceived by the Big Bank Five: eliminate controls on banks in every nation on the planet – in one single move. It was as brilliant as it was insanely dangerous. [/font color]

CONTINUED...

http://www.gregpalast.com/larry-summers-and-the-secret-end-game-memo/

Once they're gone, the Laws aren't coming back.

appalachiablue

(41,102 posts)Octafish

(55,745 posts)From DU2 in 2008, when the trail was fresh and the Statute of Limitations six years off.

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.

The above was posted on DU on Sept. 21, 2008. (Check out the responses, lots of info from DUers.) What's changed since then? Nothing near what I'd hoped for, certainly.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x4055207

Octafish

(55,745 posts)by The Center for Michigan

Bridge Magazine on September 25, 2014

EXCERPT...

Twenty years after passage of the North American Free Trade Agreement, known as NAFTA, the auto industry’s rising presence in Mexico has helped bring many of the totems of middle class life to growing manufacturing cities like Saltillo, which are now often described as little Detroits, for better or worse.

Inside the state-run university labs, students use equipment donated by the plants operated by U.S. automakers, who are betting these students will one day work for them. Students like Ernesto Gonzalez, 22, of Saltillo, who said he is about to start an internship with Magna.

SNIP...

Since NAFTA’s passage, vehicle production in Mexico has tripled, from 1.1 million in 1994 to a projected 3.2 million vehicles this year. Increased exports mean the industry now accounts for more than 20 percent of foreign receipts. Mexico’s auto growth is not just from NAFTA, far from it. Mexico now has trade agreements with more than 40 countries, with European and Asian manufacturers building auto plants across Mexico.

Autos booming

Mexico’s rising auto fortunes were solidified earlier this year when its production surpassed that of Latin American rival Brazil. Auto industry analysts predict the trend to continue after manufacturers like BMW announced plans to invest $1 billion in a plant in the central Mexican city of San Luis Potosi that will build 150,000 new vehicles a year starting in 2019. The German automaker follows Honda and Mazda, both of which opened plants in the south central Mexican state of Guanajuato earlier this year.

“The auto industry in Mexico is just booming, it´s taking off right now and it´s probably the industry in which Mexico is the most competitive,” said Christopher Wilson, a senior associate with the Mexico Center at the Woodrow Wilson International Center for Scholars in Washington, D.C.

CONTINUED...

http://www.mlive.com/business/index.ssf/2014/09/twenty_years_after_nafta_a_min.html

Tierra y Libertad!... for the Ownership Class.

Hoyt

(54,770 posts)Octafish

(55,745 posts)Hoyt

(54,770 posts)as well, unless greedy Americans close the borders to jobs and corporate investment.

okaawhatever

(9,457 posts)Mexico’s auto growth is not just from NAFTA, far from it. Mexico now has trade agreements with more than 40 countries, with European and Asian manufacturers building auto plants across Mexico.

So the trade agreements helped bring jobs to Mexico.

Also what some people are ignoring is that the TPP will allow US manufacturers into their market.

Octafish

(55,745 posts)The point I made in the OP and, as far as I can see elsewhere in the thread, is NAFTA has hurt Detroit manufacturing workers and the people who depend on them making a fair wage.

As for NAFTA bringing jobs to Mexico, that's great, but they don't pay taxes in the United States, nor, increasingly, do their companies' owners, the billionaires who offshore their loot. From what I can tell, it's also where a lot of the money "lost" in the great Bankster Bailout has gone.

Check Out Who's Hiding $32 Trillion in Offshore Tax Haven Accounts

EXCERPT...

Some $32 trillion has been hidden in small island banking hubs which host a bevy of trust funds, shell corporations and other tax havens, the Tax Justice Network estimates.

SNIP...

The information is still being sifted through, even as it's being released to the public, but here's some of what's been found so far:

■American Denise Rich, ex-wife of pardoned tax cheat Marc Rich, has been uncovered as the settlor and beneficiary of two large trusts based in the tiny Cook Islands. The ICIJ found that Denise Rich gave up her American citizenship in 2012. Her citizenship was convenient enough when President Clinton had the authority to pardon her ex-husband.

■French President Francois Hollande, ardent socialist and tireless champion of the 75% marginal tax rate, appears in these documents, mostly by association. His campaign co-treasurer, Jean-Jacques Augier, has been forced to reveal the name of his Chinese business partner in a Caymans-based distribution company. Augier says he used his offshore company to make a large investment in China.

■Australian actor Paul Hogan, of "Crocodile Dundee" fame, has lost about $35.3 million from an account that he used to offshore his "bonza" film royalties. His once-trusted tax adviser Philip Egglishaw ran off with Hogan's sizeable hidden offshore stash.

■French banking scion Elie de Rothschild, of the famous banking family, has been named in the leaks. He was instrumental in setting up some 20 trusts and 10 holding companies in the Cook Islands, all extremely opaque in nature. His heirs have, not surprisingly, refused comment.

■Brigitte Bardot's third ex-husband, Gunter Sachs, a millionaire industrialist, has been revealed as the owner of a huge, obscure wealth-masking machine: trust upon shell company upon holding company, almost ad infinitum, mostly based in the Cook Islands. The ICIJ has constructed an interactive map of Sachs' extensive offshore holdings and business networks. The network is fairly representative of the steps that many on this list have taken to hide their wealth away. You can marvel at its imponderable complexity here.

And these names are barely the tip of the iceberg. The shockwaves have already begun to spread through the corridors of wealth and power all over the world.

How Much is $32 Trillion?

It bears repeating: $32 trillion has been stashed away, off the books, by corporations and wealthy individuals.

CONTINUED...

http://www.marketoracle.co.uk/Article40250.html

Offshore loot also represents money made from trafficking in drugs, guns and people. So...what can we do about it?

On My Mind

Tax Offshore Wealth Sitting In First World Banks

James S. Henry

07.01.10, 09:00 AM EDT

Forbes Magazine dated July 19, 2010

Let's tax offshore private wealth.

How can we get the world's wealthiest scoundrels--arms dealers, dictators, drug barons, tax evaders--to help us pay for the soaring costs of deficits, disaster relief, climate change and development? Simple: Levy a modest withholding tax on untaxed private offshore loot.

Many aboveground economies around the world are struggling, but the economic underground is booming. By my estimate, there is $15 trillion to $20 trillion in private wealth sitting offshore in bank accounts, brokerage accounts and hedge fund portfolios, completely untaxed.

SNIP...

This wealth is concentrated. Nearly half of it is owned by 91,000 people--[font color="green"]0.001% of the world's population[/font color]. Ninety-five percent is owned by the planet's wealthiest 10 million people.

SNIP...

Is it feasible? Yes. The majority of offshore wealth is managed by 50 banks. As of September 2009 these banks accounted for $10.8 trillion of offshore assets--72% of the industry's total. The busiest 10 of them manage 40%.

CONTINUED....

http://www.forbes.com/forbes/2010/0719/opinions-taxation-tax-havens-banking-on-my-mind.html

Not only would that money balance the budget, erase the debt and fix the nation and world's problems from hunger and homeless to energy and education; it would free humanity to do better things than make war all the time. Thanks for the reminder, okaawhatever.

Hoyt

(54,770 posts)Worldwide the estimates from the same person quoted in one of your articles is only about $190 Billion if income taxed at 30%. That's significant for sure, but doesn't solve all our issues. A wealth tax would help as well, but still doesn't solve the world's issues.

http://www.forbes.com/sites/frederickallen/2012/07/23/super-rich-hide-21-trillion-offshore-study-says/

liberal_at_heart

(12,081 posts)Octafish

(55,745 posts)Details from a decade back...

What Wal-Mart Wants from the WTO

At the dawn of what may be the end of the 'free-trade' movement, here's a look at what the world's biggest globalization profiteer hopes to achieve from this week's meeting.

By Antonia Juhasz / AlterNet December 12, 2005

EXCERPT...

The North American Free Trade Agreement (NAFTA) and the WTO have paved the way for Wal-Mart to become the world's largest corporation. These agreements have enabled Wal-Mart to enter and dominate markets with its stores and for it to use those suppliers most willing to pick up, close shop, and scour the planet for the cheapest places to make products.

Wal-Mart did not open a single store outside of the United States until 1991 in Mexico. As late as 1995, the store reports that imports accounted for no more than six percent of the products sold in its U.S. stores. While some dispute that figure as far too low, there is no debate over the dramatic changes in Wal-Mart's operations following the passage of the NAFTA in 1994 and China's entry into the WTO in 2001. Today, Wal-Mart has more than 2,400 stores in fifteen countries outside of the United States. In 2003, consulting firm Retail Forward estimated that 50 to 60 percent of the merchandise sold in Wal-Mart's U.S. stores was made overseas.

And Wal-Mart just keeps growing. Wal-Mart's international sales reached $56.3 billion in 2005, an 18.3 percent increase over the previous year, and international profits rose to nearly $3 billion, an increase of more than 26 percent. In fact, Wal-Mart's overall economic growth rate is almost four times that of the United States (3.9 percent) and the world (4 percent).

Wal-Mart and NAFTA

In 1994, the U.S., Mexico and Canada signed the most far-reaching multilateral trade and investment agreement of its time. NAFTA investment and market access rules eliminated many of the existing government restrictions on how and where Wal-Mart could operate, clearing the way for Wal-Mart to become the largest retailer in all three NAFTA countries. Today, Wal-Mart is the largest private employer in Mexico. It has nearly 700 stores and does more business than the entire tourism industry. It sells six billion dollars worth of food a year, more than any other Mexican retailer.

NAFTA eliminated tariffs and other import controls on goods moving between the three countries. This meant that Wal-Mart's suppliers could send products to be assembled in Mexico, where labor is cheap, environmental protections weak, taxes low and protections from further regulation and government oversight even greater than in the U.S., and then send the finished products back home to sell at prices far cheaper than if the goods were produced in the United States. These factories, called maquiladoras, more than doubled in number between 1990 and 2001, from 1700 to 3600 plants.

CONTINUED...

http://www.alternet.org/story/29464/what_wal-mart_wants_from_the_wto

And the Waltons and their bankers and lawyers lived large and happily, while the rest of the Have-Nots became sadder and poorer.

Enthusiast

(50,983 posts)Octafish

(55,745 posts)JAMES MORELAND

MARCH 22, 2015

Detroit was once a manufacturing giant—the 4th largest city in the United States, with a high employment rate and brimming with blue collar jobs. Now its unemployment rate hovers above 16 percent, and its population has shrunk so now it is only the 18th largest city. This quick erosion of the tax base has left Detroit with $18 billion in debt and no hope of recovery in sight. This caused the city of Detroit to declare bankruptcy.

For over five years our economy has struggled to regain strength lost due to the “great recession.” Unemployment remains high while workers’ wages remain low. Concerns about pensions and retirement savings have driven retirees back into the workplace and encourage workers to put off their retirement.

The cause of our economic stability has been decades of failed “free trade” policies which decimate our manufacturing base and continue to lead us down the wrong track. The U.S. must begin to reconsider its trade policies in order to be competitive and strengthen our manufacturing in order to regain our economic strength. We must encourage our elected officials in Congress and the White House to amend or eliminate detrimental trade policies.

The first of the trade policies that needs to be reconsidered is the North American Free Trade Agreement, or NAFTA, which took effect on Jan. 1, 1994. At the time, President Bill Clinton assured Americans it would be a way to secure American jobs in the future. “NAFTA means jobs, American jobs and good-paying American jobs,” Clinton said on the day he signed the agreement. Since then, however, it has created massive trade deficits and encourages companies to move jobs across the border.

In 1994 Michigan had 288,700 people working in auto manufacturing. Now, according to the most recent data available from the Bureau of Labor Statistics, approximately 150,500 people have auto jobs in Michigan. That is a loss of over 130,000 jobs in 18 years. Even since 2004, automotive manufacturing jobs dropped from 1.1 million to around 700,000 jobs in the U.S.

[font color="red"]What NAFTA has done is benefit the 1% at the expense of everyone else. Companies will invest where they believe they can make the most profit, and even though American manufacturing is at its highest efficiency ever, it can’t compare to the profits made south of the border where the cost per hour is far less than in the U.S.[/font color]

CONTINUED...

http://economyincrisis.org/content/nafta-has-decimated-detroit

Enthusiast

(50,983 posts)Art_from_Ark

(27,247 posts)It's helped Wal-Mart, of course, but since NAFTA a lot of Arkansas manufacturing has left the state for Mexico-- including Whirlpool, Emerson Electric, and Levi Strauss.

Octafish

(55,745 posts)Harvard University Press Blog

April 26, 2012

(Electronically reproduced from To Serve God and Wal-Mart: The Making of Christian Free Enterprise, by Bethany Moreton, Cambridge, Mass.: Harvard University Press. Copyright © 2009 by the President and Fellows of Harvard College. All rights reserved.)

EXCERPT...

By far the most robust line of defense against NAFTA came from labor, galvanized by the ten-to-one wage differential between the United States and Mexico. The AFL-CIO began organizing against the fast-track status back in 1990, even before business coalesced around supporting it. The unions gained high-profile help from an unexpected quarter when Ross Perot, a third-party presidential candidate in 1992, made his opposition to NAFTA a cornerstone of his campaign. A year after the election, as debate over NAFTA heated up in the House of Representatives, the Texas billionaire’s warning of the “giant sucking sound” from the south was reinvigorated. Thus by the fall of 1993, when the new Wal-Mart opened in Mexico City, the two major camps had staked out their positions: Was Mexico a vast reservoir of low-wage workers, willing to sell themselves to American companies for pennies on the dollar? Or was it an enormous untapped market, full of the same shop-happy rubes who roamed discount aisles in Arkansas and Texas?

Wal-Mart discovered which notes to hit for free trade’s domestic American audience. Late in the summer of 1993, the company had sent representatives to Washington for the International Mass Retailers Association lobbying trip. The trip had been intended to reiterate the industry’s support in terms long familiar to the hosts. “NAFTA is a real key opportunity to bolster U.S. manufacturing,” explained Bobby Martin, executive vice president and Wal-Mart’s man on the NAFTA excursion. The Clinton administration, of course, was receptive to this line of argument. The White House arranged meetings for the delegation with Secretary of the Treasury Lloyd Bentsen and U.S. trade representative Mickey Kantor that a participant described as “something of a pep rally.”

But in meetings with congressional representatives, the discount delegation awoke to the very real danger of NAFTA’s failure. Congressmen told the merchants that their constituent mail ran nine-to-one against ratification. NAFTA, the retailers learned, was “in deep trouble.” The message from Capitol Hill was clear: If the retailers wanted to see NAFTA passed, it was up to them to persuade the Americans in their stores. “We’ll have to fight every step of the way,” warned Democratic senator Bill Bradley, the upper house’s quarterback for NAFTA. “You will have to let everyone you employ know why this is important and get them involved in the process too.” But these efforts alone would not be enough. In contrast to all other trade agreements since World War II, the NAFTA fight was being carried out in public, with significant grassroots involvement—mostly against its passage. Convincing employees had always been part of business’s contribution. Now it would need to mobilize its customers, too.

Back in Bentonville, the company wasted no time. CEO David Glass wrote to all of Wal-Mart’s suppliers—the manufacturers of its products—encouraging them to “write or visit your member of Congress” and “become involved” in the fight to secure NAFTA’s passage. Glass offered his assistance and asked to be updated on their activities. Now the pro-NAFTA forces were back in the game. In mid-September, President Clinton himself reopened the offensive with a fiery speech that convened most of the state governors and three former presidents to demonstrate the bipartisan support for free trade. With the Cold War won, Americans faced a changing geography of “blocs.” Asia and Europe would consolidate, so Americans needed to act fast to secure their leadership of the Western hemisphere. NAFTA had the potential to put Americans in the driver’s seat of “a free trade zone stretching from the Arctic to the tropics, the largest in the world.”

A week later the International Mass Retail Association was back in Washington. Wal-Mart’s corporate counsel Ralph Carter, under the title “director of Wal-Mart trade policy,” spoke for the entire retail group in its testimony before the Trade Subcommittee of the House Ways and Means Committee on September 21, 1993. NAFTA, he assured the congressional panel, was “right for America and especially right for American workers.”

CONTINUED...

http://harvardpress.typepad.com/hup_publicity/2012/04/wal-mart-in-mexico-bethany-moreton.html

Understand why Walton billionaires luv NAFTA, but Bill Bradley?

JohnnyRingo

(18,614 posts)Back in the '80s Packard Electric Division of General Motors decided it didn't want to remain a part of the company so it could pursue business from global customers like BMW and Honda without fear that the wiring company would share tech secrets with GM. The result of this corporate divorce was the new Delphi, born in the mid '90s.

GM remained a major part of Delphi's business, but Delphi was still the first to financially stumble in the late '90s. Since having GM take over benefits in case of failure was part of the IUE contract to allow the spin-off, GM assumed pension checks and insurance coverage for union workers. When GM fell on troubled times amid the Great Recession, retirees who were now folded into the UAW, faced cut off of all benefits.

Armed with inked contracts, the union and the Automobile Task Force went to bankruptcy court to fight for continued support from the New GM. Judge Drain allowed that the union would have a seat at the table along with other debt collectors in the reconstruction.

I was one of those who walked into Packard Electric in 1972 for a $6.50 job. I was 19 and retired at 49 with full a pension that included a stipend to carry me over until SS kicked in at 65. Now as a Delphi retiree, I thank the president every 1st of the month for bailing out the company and keeping those union contracts intact.

As for NAFTA and Delphi, the trade deal allowed the company to shift production south to Mexico and close the Warren Ohio operation. Delphi promised that every one of the 14,000 workers would have a chance to finish 30 years, or transfer to another plant and held true to their word under contract. Still, those are 14,000 good union jobs that are gone forever.

Octafish

(55,745 posts)I wanted to make clear that DELPHI in its current form helps the Ownership Class big time. American workers, not so much.

Current (when DetNews article printed Feb 18, 2015)

DELPHI global employees = 160,000

DELPHI U.S. employees = 5,000

AwakeAtLast

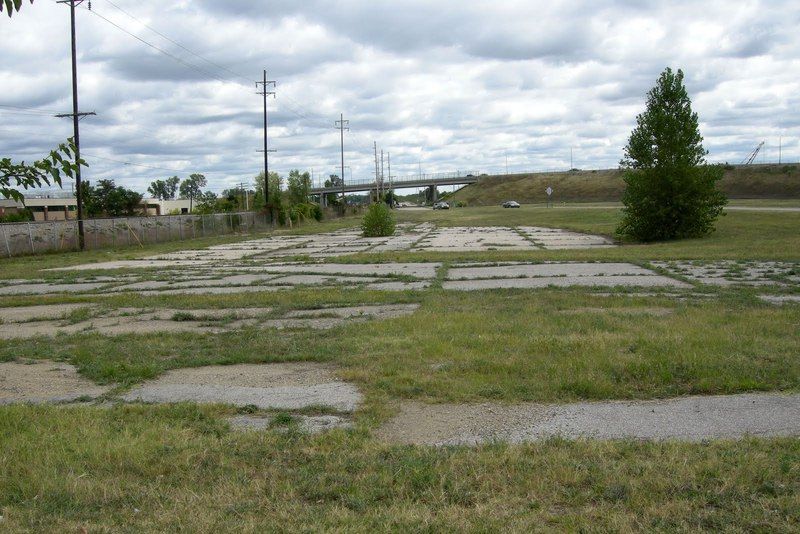

(14,120 posts)Now it is zero. Most of those were production parts (lighting, bumpers, horns, etc.)

How Anderson is not bankrupt is beyond me. It looks like it has seen better days, but it isn't bankrupt.

99th_Monkey

(19,326 posts)The Tooth Fairy will see to it. Trust us.

Octafish

(55,745 posts)Miracles do happen, just not when it comes to actually advancing the standard of living of the average person -- at least since deregulation and Reaganomics.

Obama Doesn’t Plan to Reopen Nafta Talks

By BRIAN KNOWLTON

The New York Times, April 20, 2009

WASHINGTON — The administration has no present plans to reopen negotiations on the North American Free Trade Agreement to add labor and environmental protections, as President Obama vowed to do during his campaign, the top trade official said on Monday.

“The president has said we will look at all of our options, but I think they can be addressed without having to reopen the agreement,” said the official, Ronald Kirk, the United States trade representative. It was perhaps the clearest indication yet of the administration’s thinking on whether to reopen the core agreement to add labor and environmental rules.

Mr. Kirk spoke in a conference call with reporters after returning from a regional summit meeting that Mr. Obama attended over the weekend in Trinidad. He said that Mr. Obama had conferred with the leaders of Mexico and Canada — the other parties to the trade agreement — and that “they are all of the mind we should look for opportunities to strengthen Nafta.”

But while he said that a formal review of the 1992 pact had yet to be completed, Mr. Kirk noted that both Mr. Obama and President Felipe Calderon of Mexico had said that “they don’t believe we have to reopen the agreement now.”

Mexico in particular, whose exports have exploded under Nafta, has little interest in such a renegotiation.

Not only Mr. Obama but also one of his rivals for the presidency, Hillary Rodham Clinton, had promised during their campaigns to renegotiate the accord — a politically popular position in some electorally important Midwestern states that have lost thousands of manufacturing jobs.

CONTINUED...

http://www.nytimes.com/2009/04/21/business/21nafta.html?_r=0

Sorry to sound so facetious, 99th_Monkey. Please know that I love you.

stillwaiting

(3,795 posts)corkhead

(6,119 posts)

The insert is 2008 and the larger pic is 2011

Octafish

(55,745 posts)By Margaret Kimberley

Global Research, April 24, 2014

A new (Princeton) study confirms the obvious: the will of the people carries no weight in the United States. Within the nation’s borders democracy is everywhere proclaimed but nowhere to be found. These truths we hold to be self-evident: “ordinary citizens have virtually no influence over what their government does in the United States.”

SNIP...

While this study has however briefly changed public discourse, it is important to note that the disregard of popular will is obvious for all to see. If this were not true, the minimum wage would be higher, there would be no cuts to entitlement programs, and Americans would have a single payer health care system. There would be no NAFTA or TPP free trade agreements which force a race to the bottom for workers, destroy entire eco-systems and violate national and popular sovereignty. If this country were truly democratic, the city of Detroit would not have filed for bankruptcy for the simple reason that voters in Detroit and in the state of Michigan voted to repeal the emergency manager law which brought bankruptcy into being.

CONTINUED...

http://www.globalresearch.ca/the-myth-of-american-democracy-money-talks-and-those-without-money-have-no-voice/5379097?print=1

Thank you for the reminder, corkhead. I've driven on North Dort Highway. Michigan's my home. People who once worked for GM and Delphi -- and Ford and Chrysler -- and the other auto suppliers are my neighbors and friends and family.

AzDar

(14,023 posts)Octafish

(55,745 posts)By Vi Ransel

Global Research, January 28, 2010

Corporations have been a successful means to minority rule because they are a stunningly efficient means of accumulating and concentrating wealth and property, which can then be translated into political power. As long as the ownership of property determined eligibility to vote, minority rule remained intact, but as more people got the right to vote the threat of real democracy hung over minority rule like the Sword of Damocles.

Under the Constitution, corporations had no rights. They had only the privileges granted them by the people of their chartering states, because there are only two parties to the Constitution, the people, who are sovereign and have constitutional rights, and the government, which is accountable to the people, and has duties it must perform to their satisfaction.

The word “corporation” appears nowhere in the Constitution. Corporations are a creation of government, and government must perform to the satisfaction of the people. This meant that property – corporations – would have to discontinue being a creation of government – which serves the people - and, in effect, become people, entitled to the rights of the sovereign under the Constitution, if wealthy corporate shareholders were to continue minority rule.

Within 100 years of the ratification of the Constitution, corporate shareholders had animated a lifeless business arrangement into the legal equivalent of a living human being by using the Supreme Court as a scalpel to excise the protections and immunities of the Fourteenth Amendment from human beings and transplant them into their property – corporations. That operation allowed shareholder property to begin assuming control of the United States government by exercising the constitutional rights of United States citizens, and further, to assume the protections and immunities of the entire Bill of Rights under the mantle of “corporate personhood.”

The doctrine of “corporate personhood” is based on a legally meaningless “obiter dictum,” or offhand remark, made by Chief Justice Morrison Remick Waite before the decision was read in Santa Clara County v. Southern Pacific Railroad (1886). It was not the decision. It was not part of the decision. But it subsequently found its way into the court reporter’s summary, of the case.

Just three years later, in Minneapolis & St. Louis Railroad v. Beckwith (1889), Justice Stephen Field cited Santa Clara as precedent, giving it the force of law when the Court ruled that a corporation is a “person” for both due process and equal protection under the Fourteenth Amendment. But Justice Field knew that he was lying as he cited the obiter dictum that corporations were “persons” for the purposes of the Fourteenth Amendment, because he was there when Justice Waite made the offhand remark. Nevertheless, this fallacious precedent is still cited as if it were the law of the land.

And as shareholders secured more constitutional “rights” for their property, they used their accumulated wealth to infiltrate the people’s legislatures, where they lobbied for, and often wrote, laws to strip citizens of their right to regulate the businesses they brought into being by granting corporate charters. States’ governments found their attempts to regulate corporations struck down by Supreme Court decisions based on a series of new legal doctrines and practices that protected the corporate “person,” such as “substantive due process” and “liberty of contract.”

Under “substantive due process,” the Court recognizes rights that do not appear in the plain text of the Constitution. What these implicit rights are is often unclear, but once recognized, laws that infringe on them are either unenforceable or very limited. Substantive due process was often used to shield railroads and trusts from government regulation.

CONTINUED...

http://www.globalresearch.ca/cold-case-democracy-and-the-doctrine-of-corporate-personhood/17201

More on corporate power, money and propaganda, and how they work to stop democracy from Maria Galardin's TUC (Time of Useful Consciousness) Radio:

Alex Carey: Corporations and Propaganda

The Attack on Democracy

The 20th century, said Carey, is marked by three historic developments: the growth of democracy via the expansion of the franchise, the growth of corporations, and the growth of propaganda to protect corporations from democracy. Carey wrote that the people of the US have been subjected to an unparalleled, expensive, 3/4 century long propaganda effort designed to expand corporate rights by undermining democracy and destroying the unions. And, in his manuscript, unpublished during his life time, he described that history, going back to World War I and ending with the Reagan era. Carey covers the little known role of the US Chamber of Commerce in the McCarthy witch hunts of post WWII and shows how the continued campaign against "Big Government" plays an important role in bringing Reagan to power.

John Pilger called Carey "a second Orwell", Noam Chomsky dedicated his book, Manufacturing Consent, to him. And even though TUC Radio runs our documentary based on Carey's manuscript at least every two years and draws a huge response each time, Alex Carey is still unknown.

Given today's spotlight on corporations that may change. It is not only the Occupy movement that inspired me to present this program again at this time. By an amazing historic coincidence Bill Moyers and Charlie Cray of Greenpeace have just added the missing chapter to Carey's analysis. Carey's manuscript ends in 1988 when he committed suicide. Moyers and Cray begin with 1971 and bring the corporate propaganda project up to date.

This is a fairly complex production with many voices, historic sound clips, and source material. The program has been used by writers and students of history and propaganda. Alex Carey: Taking the Risk out of Democracy, Corporate Propaganda VS Freedom and Liberty with a foreword by Noam Chomsky was published by the University of Illinois Press in 1995.

SOURCE: http://tucradio.org/new.html

If you find a moment, here's the first part (scroll down at the link for the second part) on Carey.

http://tucradio.org/AlexCarey_ONE.mp3

I know that's old hat to you, AzDar. The stuff is news to most of the USA.

hanon

(8 posts)I will reread it.

appalachiablue

(41,102 posts)changing world of global corporate rule. Most humans have no place, just 1%ers and the hacks and parasites doing their work, living off (generous) scraps tossed their way.