General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBreaking - 5 Banks to Pay Billions and Plead Guilty in Currency and Interest Rate Case

http://www.nytimes.com/2015/05/21/business/dealbook/5-big-banks-to-pay-billions-and-plead-guilty-in-currency-and-interest-rate-cases.html?_r=0<snip>

Adding another entry to Wall Street’s growing rap sheet, five big banks have agreed to pay more than $5 billion and plead guilty to multiple crimes related to manipulating foreign currencies and interest rates, federal and state authorities announced on Wednesday.

The Justice Department forced four of the banks — Citigroup, JPMorgan Chase, Barclays and the Royal Bank of Scotland — to plead guilty to antitrust violations in the foreign exchange market as part of a scheme that padded the banks’ profits and enriched the traders who carried out the plot. The traders were supposed to be competitors, but much like companies that rigged the price of vitamins and automotive parts, they colluded to manipulate the largest and yet least regulated market in the financial world, where some $5 trillion changes hands every day, prosecutors said.

Underscoring the collusive nature of their contact, which often occurred in online chat rooms, one group of traders called themselves “the cartel,” an invitation-only club where stakes were so high that a newcomer was warned, “Mess this up and sleep with one eye open.” To carry out the scheme, one trader would typically build a huge position in a currency and then unload it at a crucial moment, hoping to move prices. Traders at the other banks agreed to, as New York State’s financial regulator put it, “stay out of each other’s way.”

By Channon Hodge, Aaron Byrd and David Gillen 2:30

The banks also misled their clients about the price of currencies, the federal and state authorities said, imposing “hard mark-ups,” which one Barclays employee described as the “worst price I can put on this where the customers decision to trade with me or give me future business doesn’t change.” Or, to put their mission in the starkest of terms, the employee said: “If you ain’t cheating, you ain’t trying.”

As part of the criminal deal with the Justice Department, a fifth bank, UBS, will plead guilty to manipulating the London Interbank Offered Rate, or Libor, a benchmark rate that underpins the cost of trillions of dollars in credit cards and other loans. Federal prosecutors had previously agreed not to prosecute the Swiss bank over the Libor scheme. But in a rare stand against corporate recidivism, the Justice Department voided that non-prosecution agreement after UBS was accused of taking part in the effort to manipulate currency prices.

The guilty pleas, which the banks are expected to enter in federal court later on Wednesday, represent a first in a financial industry that has been dogged by numerous scandals and investigations since the 2008 financial crisis. Until now, banks have either had their biggest banking units or small subsidiaries plead guilty.

--------------------------

That useless Obama Administration NOT

This is huge.

el_bryanto

(11,804 posts)That said it does underscore the attitude of criminality that seems prevalent on Wall Street. The truth is that Wall Street and the related industries do play a pivotal role in our economy, and the failure to punish wrong doers and to set stricter regulations in the aftermath of the 2008-2009 issues has contributed to that. “if you aint cheating, you aint trying.”

This is a good development but much more needs to be done.

Bryant

malaise

(268,846 posts)ChisolmTrailDem

(9,463 posts)Faux pas

(14,657 posts)except for the no jail time. WTF?

dixiegrrrrl

(60,010 posts)The banks have plead guilty to dozens of fraud charges over the past 10 years, they get fined what amounts to 1% of their lucre,

then continue finding ways to fraud.

They NEED to be charged under RICO, for actual criminal disposition.

But the WH has no will to do this.

hifiguy

(33,688 posts)The banksters can just set aside money to cover if they get caught; for them it's just a cost of doing business. I am sure that the bg banks have dedicated departments whose only mission is to invent new kinds of fraud.

Unless individuals start doing serious hard time for this kind of shit it will just pop up again, like mushrooms after a rain storm.

BrotherIvan

(9,126 posts)Jamie Dimon gets to keep his $20 mill pay so that's good.

http://qz.com/407994/jp-morgan-ceo-jamie-dimon-gets-to-keep-his-megamillions-despite-some-serious-investor-pushback/

hifiguy

(33,688 posts)They have gamed every part of the system so completely that they can never actually lose money on anything but their own pyramid/;everage schemes. See 2008. And then they go running to the Fed and the taxpayers to bail them out.

No BIG bank ever loses money. Ever.

Faux pas

(14,657 posts)huh? Crazy!

Sanity Claws

(21,846 posts)Interesting. I wonder whether that guilty plea is sufficient to start breaking up the fucking banks.

1939

(1,683 posts)The other three are chartered in other countries. If we cut them off from business in the US, our banks would be restricted overseas in retaliation.

malaise

(268,846 posts)WillyT

(72,631 posts)tridim

(45,358 posts)I wonder how many will admit they were wrong, again?

Thank you President Obama.

johnnyreb

(915 posts)Quoting a commenter in an earlier piece:

Moostache

(9,895 posts)No offense, but slaps on the wrist are not blowing up my skirt.

The CEOs of each of these companies in chains and sentenced to life sentences; the shareholders taking a total bath in retracted profits for every year of the crimes is hardly fair (especially the mutual funds and pooled investment dollars); but the salaries and bonuses paid to all involved should be forfeit; and the loss of licenses and lifetime bans on every single person involved in the scam - from CEO to clerk filing the fraudulent paperwork would be real enforcement.

This is like telling someone that they will have to serve a year of house arrest after killing a dozen people.

The banks manipulated not just interest rates, to believe that is moving deck chairs on Titanic.

The fines, no matter how nominally large, do not hit where they should - the greasy scumbag bankers themselves.

I am glad that SOMETHING was done.

But I can't get too excited about this unless someone can tell me exactly how this slows down the corruption already rampant on Wall Street and in our campaign financing.

Kudos for doing the minimum Mr. President. You could have acted decisively to break up "too big to fail", you could have used that as a wedge to break the GOP financing machine, but I guess we just have to be happy with a fine of 1/5 of 1/4's profits instead...

mrdmk

(2,943 posts)It is a Break-Even proposition, nothing more, nothing less...

Break-even (or break even) is the point of balance between making either a profit or a loss. The term originates in finance, but the concept has been applied widely since.

link: http://en.wikipedia.org/wiki/Break-even

F4lconF16

(3,747 posts)n2doc

(47,953 posts)That useless Obama administration- yes. Without jail this will do nothing to stop future crimes. The people who carried out these crimes have no penalty applied to themselves.

malaise

(268,846 posts)

JUMP

n2doc

(47,953 posts)Although I profess a desire for the public humiliation that a trial would bring.

hifiguy

(33,688 posts)There's a fortune to be made in selling rotten fruit and vegetables with which to pelt these evil greedhead fucks. THEN off to jail for a nice long vacation in the Big House.

hifiguy

(33,688 posts)of the decade. Maybe the century.

FlatBaroque

(3,160 posts)they can always get a 0% interest loan from the FED.

Shamash

(597 posts)TBF

(32,029 posts)closeupready

(29,503 posts)Very modest penalty, IMHO.

This is the heart of the problem.

Mojorabbit

(16,020 posts)Marr

(20,317 posts)They were rigging the global economy, day by day, to benefit their investments at that moment.

Dustlawyer

(10,494 posts)If you want to impress me, start prosecuting the individuals involved and this shit will stop. How many plea deals by banks have we seen in the last few years for huge financial crimes?

There are people above the law in the country, a class of people if you will. They include big bankers and current and/or former political operatives and politicians. Cheney, Bush, David Petraeus, Rumsfeld, Rice,...

Glassunion

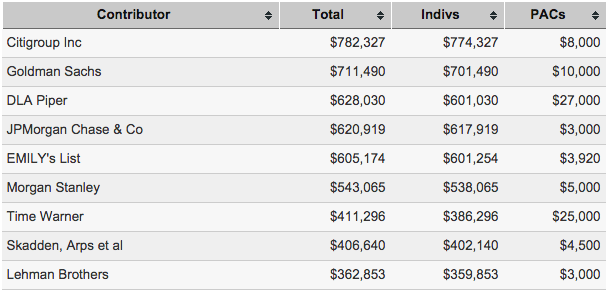

(10,201 posts)From the Center for Responsive Politics - donations received (Hillary Clinton) - 1999 to 2015

malaise

(268,846 posts)The bankers were all hiding when Glass-Steagall was introduced in 1933. In those days men had shame. Now they own the media and buy the politicians. Remember she has loads of company.

Glassunion

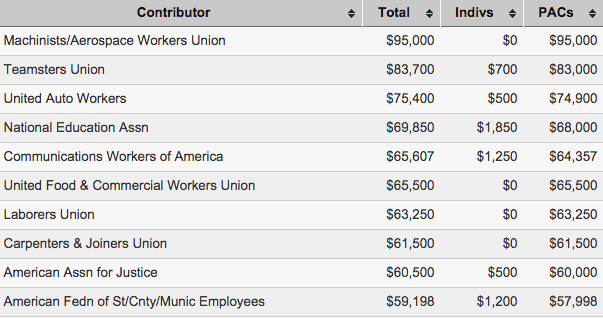

(10,201 posts)Bernie Sanders, from 1989-2015

malaise

(268,846 posts)but I don't have a vote

malthaussen

(17,183 posts)... do they have to admit wrongdoing, or just pay the fines with the stipulation that they don't have to admit they did anything wrong? The latter has been the way of things for recent such decisions.

-- Mal

okaawhatever

(9,461 posts)http://www.huffingtonpost.com/2015/05/20/big-banks-guilty-fined_n_7342808.html?ir=Business

malthaussen

(17,183 posts)Should set them up for some nice lawsuits.

-- Mal

Dont call me Shirley

(10,998 posts)hifiguy

(33,688 posts)Costs like this are factored in when they begin the fraud. Just part of doing business in the best Mafia style.

Dont call me Shirley

(10,998 posts)Triple grr: one for the their brazen crime, one for no jail time for the crooks, one for no penalty actually paid

hifiguy

(33,688 posts)hunt it down. Prins worked at a couple of investment banks, including Goldman, and her insider's dissection of the 2008 meltdown and the trillions - yes TRILLIONS - the banksters walked away with is enough to scare the hair off a gorilla.

Just started her All The Presidents' Bankers. She really knows her stuff.

Dont call me Shirley

(10,998 posts)colleagues!

MisterP

(23,730 posts)the article could've stood on its own--the WH is doing something praiseworthy and we can all argue over how praiseworthy

but you just HAD to toss in a slam at WH critics that in fact makes you look silly by denying that Obama could ever be friendly to Wall Street: it's almost like a compulsion; you debunk yourself and then take a victory lap

$6B isn't "huge" given what these banks go through every week

onethatcares

(16,165 posts)that's what I want to know. Which of the banksters are going to be on the news tonight with cuffs and orange jumpsuits?

which are going to Rikers Island or Attica.

When that happens I'll be a happy man.

PowerToThePeople

(9,610 posts)colsohlibgal

(5,275 posts)Millions, whatever, it's nothing to these people, it's chump change for them.

So many of them should be spending quality time with the Bubbas in the Big House. Then maybe they would quit screwing the 99%.

moondust

(19,966 posts)Drop in the bucket relative to quarterly profits.

Nobody goes to jail.

No real punishment means nothing likely to change.

I can hear champagne corks popping from my house.

![]()

Oilwellian

(12,647 posts)malaise

(268,846 posts)Jesus Malverde

(10,274 posts)hatrack

(59,583 posts)And I'll bet they never do it again, right?

![]()

jwirr

(39,215 posts)spanone

(135,803 posts)Orsino

(37,428 posts)"Banks" please guilty? Spare me. Were any people charged? Will the executives who profited most even notice the fines?

LondonReign2

(5,213 posts)No one is going to jail for this. Again. Instead, shareholders are left holding the bag while the banksters are free to do it again and again.

So, no, this is not huge, and the Obama administration really does not deserve props.

You wanna know exactly how NOT HUGE this is? The stock of one of the banks went up over 3% yesterday because the fine is smaller than expected.