General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums401(k)s Are a Negligible Source of Income for Seniors

http://www.epi.org/publication/401ks-are-a-negligible-source-of-income-for-seniors/401(k)s have largely displaced traditional defined benefit pensions among private-sector workers, but they are not a major source of retirement income for seniors. New data show that in 2014, distributions from 401(k)s and similar accounts (including Individual Retirement Accounts (IRA), which are mostly rolled over from 401(k)s) came to less than $1,000 per year per person aged 65 and older. On the other hand, seniors received nearly $6,000 annually on average from traditional pensions. Pension benefits and retirement account distributions are both concentrated among upper income seniors, but far more seniors rely on pensions as a significant source of retirement income.

Though 401(k) and IRA distributions will grow in importance in coming years, the amounts saved to date are inadequate and unequally distributed, and it is unlikely that distributions from these accounts will be enough to replace bygone pensions for most retirees, who will continue to rely on Social Security for the bulk of their incomes.

Adrahil

(13,340 posts)Mine are doing OK, and I'm likely to generate a livable retirement income form them. However, their voluntary nature means that folks living paycheck to paycheck rarely prioritize retirement, and many contribute nothing to their accounts,and many businesses do not have an automatic contribution until,employee matching funds are put in. I think we need a required employer contribution and an required employee contribution, with voluntary contributions above that. And the default investement should be in government bonds, for those who don't want to mess with invest,ent options.

fasttense

(17,301 posts)To prevent corpotate CEOs and bankruptcy judges from raiding the plans? Congress forced the US post office to fund pension plans for the next 75 years. Bankruptcy judges can't discharge student loans and in some states houses so restricting dispersal of pension funds is possible.

What you described is forcing the poor to use up what little pay they get for something way in their future. It's not going to be a priority for them unless you pay them more. And in the end a pension is merely delayed wages which the corporation can raid.

Adrahil

(13,340 posts)Pensions aren't free. Pension contributions ARE, in fact, part of compensation. Just becuase they aren;t included as "income" doesn't mean that it isn't costing the employee something. It certainly does.

AS for defined pension plans... I personally don't trust them. And it's not just bankruptcy judges raiding pensions (though that is a problem), Part of the problem is demographics. Not matter how you slice it, most defined pension plans depend on a pretty high proportion of active workers supporting retirees. I personally would rather see an expansion of Social Security benefits, rather than depending upon corporate pension programs, which often screw workers. How many stories do we hear of pension benefits being cut because the pension itself is distressed?

hollysmom

(5,946 posts)My my how the company keeps sending us stuff to vote on to get rid of it! They want to value it out to a cash settlement and we ex employees keep fighting it.

Let's see a monthly amount or one big taxed amount that can disappear in the general fund. Nope. The lump sum seems way too low. I am sure their actuaries are using the most depressing statistics. I plan on living get over 10 more years. Ha ha. I also have a decent 401k. Need error earned much higher but I did put a lot in it. Born saver.

Adrahil

(13,340 posts)Eventually the pension went away. They all got a lump sum plus 2.5% annual interest. Yeah, that's a TERRIBLE deal. I'm glad I went with the 401K company.

hollysmom

(5,946 posts)The first one invested all the money In privately held company stock. No longer legal since color tile went bankrupt and took the 401k with it. Any way when I left they made up a low figure for the value. The next year when they went out of business the people left got valued 100 times more.

The second rip off was working for a consulting firm that gave our 401k to their client who then kept losing money in a bull market i.e. used us as a lower fund. I dropped out while stil. Employed because the constant losses did not were greater than the tax benefits. I think we should have had a class a ton suit but no one wanted to do that.

GummyBearz

(2,931 posts)Unless you are leaving out some details? If other people are investing YOUR money how they choose, that is not a 401k. 401k's give YOU control of your money. And if the company offers only 1 or 2 crappy investments through their system, you are also legally allowed to have your 401k money put into a Schwab (or other brokerage account), in which you can directly choose your investments in any stock, bond, mutual fund, ETF, or commodity that is traded on the open market.

hollysmom

(5,946 posts)First, these are old stories

the first one where the whole amount was invested in company stock is no longer allowed since color tile and Enron. Where every employee lost everything, their jobs, their savings.

the second one, was assigned to Meryll Lynch where they gave us a choice of 10 investments - all of them losers. I think you get more choices now but have not kept up, But I only have one 401K left I have not rolled over and that one actually is doing well, so I leave it alone. This occurred in the first 10 years of 401Ks. O hve been retired for the last 12 years an don't know what the current rules are. But, trust me, Companies really tried to rip off employees with this when it first started.

Warpy

(111,233 posts)because they offered a fixed income at retirement. Even a modest 3-4% rate would eat into them year after year and if the pensioner had the bad judgment to live into his 80s or beyond, he found himself relying on Social Security for the bulk of his income. Also, too many of those plans died with the pensioner, leaving the survivor destitute.

What would be nice is a defined income that would cover all of us whenever we needed it. Puritannical, stingy right wingers would hate that and multibillionaires would fight it tooth and nail, it might cost them something. However, it's really what we've always needed.

7962

(11,841 posts)Which is likely to help many start a fund at a young age, because they wont go thru the paperwork to get OUT of the 401. Its still the best thing going over the long haul

I have a friend who has been a supervisor for about 20 years. He has always signed up new employees for the 401 without asking. He just says "I'm signing you up for this and you need to put in at least what the match is, because its FREE MONEY". When they understand that, they stay. And several of his original guys, who have moved on to other areas not under him, have come back and thanked him for doing it, saying they likely wouldve never signed up on their own.

I was just as bad, and I try to educate myself on financial stuff. But even though, I STILL didnt sign up until 3 years after I was eligible. Thats why I like the new rule saying you're in, unless you fill out paperwork to get out

fasttense

(17,301 posts)And defined pesion plans always worked fine before, why not continue to have them? 401s are dependent on some form of market that can lose money as well as earn money. So merely restrict CEOs and bankruptcy judges and force defined pension plans onto corporations, instead of forcing the poor to pay into risky 401s.

7962

(11,841 posts)I guess you could pass a law to force them to do it though.

Your 401 balance is YOUR money and not subject to be seized in a bankruptcy

fasttense

(17,301 posts)And there use to be laws governing pension plans. Laws use to prevent bankruptcy judges and CEOs from raiding their employees pension funds. But since deregulation and the destruction of most Unions, corporations do what they want. If a wealthy corporation really, really wants to raid your 401, I'm sure they can convince a RepubliCON to allow it and pass a law making it so. Obama is all about free trade so I'm sure he would go for it.

In fact, I'm kind of surprised they haven't figured out how to raid their employee's 401K plans yet. I'm sure it's just a minor oversight and that will change soon. Of course some of the huge fees attached to the 401s are almost equal to a raid what with corporations NOT matching anything over 6% of an employee's salary.

doc03

(35,324 posts)your behave can be taken in a bankruptcy.

7962

(11,841 posts)The Employee Retirement Income Security Act protects any money from the employee & employer from creditors. And if you're not vested you become vested if the company lays off 20% or more workers.

The money that may be at risk is whatever money hasnt been deposited into your acct yet

http://www.401khelpcenter.com/401k_education/bankruptcy_and_401k.html#.ViWAILRViko

CountAllVotes

(20,868 posts)n/t

![]()

![]()

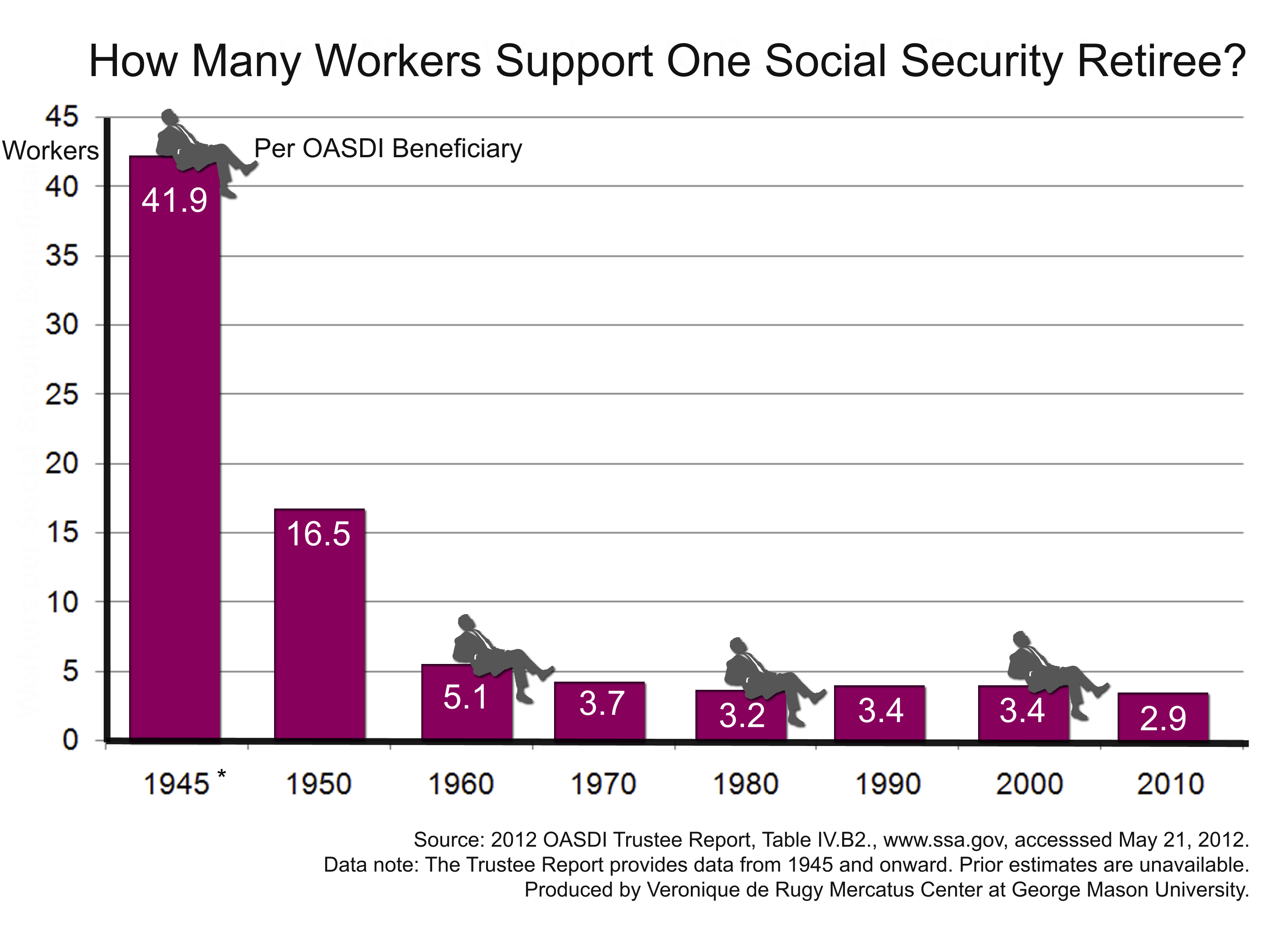

Adrahil

(13,340 posts)Defined pensions assumed retirees that lived maybe 5-15 years post retirement and large active worker to retiree ratio. That demographic model no longer exists. Many retirees live 20+ years beyond retirement, and the population is aging, meaning we have fewer workers supporting each retiree. It's just math.

I personally PREFER a generous 401K to a defined benefit plan. In fact, I chose my last job based largely on that choice.

MillennialDem

(2,367 posts)years.

The idea that workers dropped dead 5 years after retiring 100 years ago but are living 25 years after retiring now is quite bluntly utterly false.

https://www.ssa.gov/history/lifeexpect.html

I'm not sure what the female 1940 anomaly is about, but look at the others in table 1.

Adrahil

(13,340 posts)That's undeniable. There are fewer young workers supporting more older workers. Most pensions are not structured to work in such an environment. I think that model is dead. I certainly won't risk my retirement on it.

MillennialDem

(2,367 posts)will fix the problems for the most part...

fasttense

(17,301 posts)In 1983, Raygun and Greenspin got congress to change the Social Security tax. They doubled the Social Security Tax on my generation, the Baby Boom generation, so that for the 1st time in history Baby Boomers not only paid for our parent's Social Security, but we paid for our own Social Security. Our Social Security money went into the Social Security Trust Fund to wait for us to get old enough to use it.

So many people act like Raygun never doubled our Social Security taxes. I was there. I remember.

The children of the Baby Boomers do NOT need to pay for our Social Security. We have already paid it forward. If our children were smart, they should insist on a tax reduction in Social Security. There is NO Need to continue to pay double taxes on Social Security anymore since they are merely funding their own retirements.

MillennialDem

(2,367 posts)We should cut ss taxes even more by removing the cap and subjecting capital gains to the tax too.

fasttense

(17,301 posts)Most pension plans are based on how much you earned while you worked there and how many years you put in at that corporation. They are basically delayed wages that you receive later in life.

That CEOs designed some pension plans to take the salaries from the young is kind of sad.

my dad gets $30 for every month he worked in his career,35 years/420 months comes to $12,600 a month pension.

I was in a diff Union,but it works much the same.

shanti

(21,675 posts)that's a damn good pension!! what kind of work did he do?

Go Vols

(5,902 posts)I know a few Union Ironworkers that get a little more.

i was a union member before i retired early at 55 after 21 years with the state. had a pretty responsible position when i left too, but i don't know anyone getting anything close to 12 large a month in retirement, even managers. sounds like your father had a great union, like the longshoremen here in cali.

doc03

(35,324 posts)a month in pension. I received $40 per each year of service for 33 years and get $1320 a month. To make that much pension you would get $360 for each year of service. Oh and we went on strike for 10 1/2 months to keep that $40 per each year of service pension.

fasttense

(17,301 posts)Life span for the rich have increased. For a farmer or other worker their life spans have actually declined. Most defined pension plans went to factory workers, miners, lower paid workers in other heavy industries. People in those jobs do NOT live the life span of bankers and executives.

I'm glad you like your 401. I hope RepubliCONS never figure out how to raid them.

GummyBearz

(2,931 posts)I think you need to do a bit more research. Pensions aren't some magical box that poops out money. They all have underlying investments in the stock market (and other things). Yes, that same market that goes down for 401k's also goes down for pension funds. That is how pension funds run out of money, and that "magic money" just stops showing up.

fasttense

(17,301 posts)So, that they are diverse and large enough to take a minor hit. True when the entire economy takes a hit so does the pension fund. But before deregulation and the destruction of Unions, there were laws on how risky an investment pension funds could be put into. Most pension funds didn't get wiped out like 401s during this last crash. And that is why judges and CEOs are raiding the funds today.

GummyBearz

(2,931 posts)Everyone who didn't panic has a higher 401k today than they did in 2006. Pension funds should also be well covered... yet we hear constantly they are going broke, because they depend on a huge base of young workers to support the retirees. Yes these bubbles and crashes are shitty and wall street needs to have heads roll down the pavement, not get a "I told you to knock it off!!" policy. As for me, I have a pension from an old employer. It is already starting to get scaled back and I am 30 years away from retiring. I can't count on getting a cent from that pension, even though I contributed to it. My 401k's on the other hand are all in my account and doing just fine.

Kang Colby

(1,941 posts)Pension plans can go up in smoke or have benefits cut. The magic of pensions is just a myth. If the investment options have low expenses, and the employer match is good....I'll take a 401k any day of the week.

DrDan

(20,411 posts)Sixty-eight years old and retired since 2007, the Town of Merton man is about to have about $20,000 taken away from his annual pension — money he earned, money that was promised him, money guaranteed in contracts negotiated by one of the country's strongest labor unions.

"I'm going to make it through this, but it's just not right," he said. "It's just not right."

Which probably sums up the feelings of more than 270,000 people, including thousands in Wisconsin, who have been told by the financially troubled Central States Pension Fund that their pension payments must be cut, in some cases by 50% or more.

SoCalDem

(103,856 posts)IF..the market is intact when it's time for him to collect. He's 42 and has close to $2M in his 401-k..His wife has about the same..of course they make $300K a year, so their demand will be higher by the time they retire.

If we live too long, they may have to support us for a while.. we are SS and our savings. so we may run out ![]()

7962

(11,841 posts)DrDan

(20,411 posts)and it also seems to apply to younger generations.

Knowing this, we need to insure some level of protection is there - something like . . . . oh . . . say, a strong Social Security safety net. A voluntary savings program will fail - we just like to spend money.

Erich Bloodaxe BSN

(14,733 posts)With flatlined wages for the last 40 years or so, and ever rising cost of living, there's just nothing let to save for most folks. People would save more if they had more. 'Voluntary' doesn't even enter the picture.

DrDan

(20,411 posts)We have been programmed to head to the malls, get a new car, get a bigger TV, take more trips.

Spending is our pastime.

daleanime

(17,796 posts)for too many the question is which late bill to pay first, not how much to set aside for retirement. But let's just blame the poor souls stuck in that situation, it's easier then addressing the problem.

Ed Suspicious

(8,879 posts)Ed Suspicious

(8,879 posts)President of the United States of America.

DrDan

(20,411 posts)fasttense

(17,301 posts)How do you think most people save? Most don't have millions, yet they manage to save. Everyone saves to some extent. The poor just save less because they barely have enough to survive. This spend, spend, spend mentality is what capitalism pushes as a reward for having to endure the horrors of a capitalist job. We all save to some extent because most employers don't pay us daily or even weekly. So for the convenience of the empolyer we are all forced to save to some extent.

But there is a threshold of earnings for most people that all needs are met and the remains all go to savings. I think for the majority of people it was $70,000.00. But it varied between people.

So no, higher wages does Not mean just more spending necessarily.

Dawgs

(14,755 posts)DrDan

(20,411 posts)and not because we are a nation of savers

MillennialDem

(2,367 posts)than that the increase in my salary in recent years went towards a modest home and saving. I drive an ancient car and when that finally goes from rust, I'll get another version of the same one.

If you gave me a significant amount of more money, I'd put it into mutual funds, paying off my student loans, or my mortgage. Of course the tricky part is would I say the same if my paycheck was increased $12? I probably wouldn't even notice.

DrDan

(20,411 posts)Holiday spending was over $750 per person last year. Black Friday gets longer each year. Christmas products hit the shelves earlier and earlier.

This is not indicative of a saving society.

60% have savings of less than $25K.

We are encouraged to spend - and we make spending easy to encourage more and more.

marions ghost

(19,841 posts)This (heavy buying on Xmas sales and Black Friday) is indicative of a nation reduced to scrabbling and scrounging for everything. A nation where people suck back tears at the checkout if a store coupon they counted on is not valid. A nation where everyone must religiously compare prices for the most ordinary consumer goods, spend hours researching the most mundane products. And that is the way Corporate likes it.

You are really out of touch. The majority of the 60% have no savings because they cannot afford to save.

DrDan

(20,411 posts)No money for saving? How many of those 60% have cell phones, cable and internet service?

an average of over $750 for holiday spending

average of $71 for cell service

average of $65 for cable

average of internet access charges - $20-$45

Nope . . . not buying it.

Out of touch? I know of folks who have custom t-shirts made for their Black Friday excusions for the families. Certainly far from the anguish and despair you seem to be describing. Blatant consumerism.

MillennialDem

(2,367 posts)Unless you only work a mcjob, but then you need a phone. Cable/satellite can and should be cut though, TV is garbage. Netflix or amazon prime = much better.

azmom

(5,208 posts)marions ghost

(19,841 posts)SoCalDem

(103,856 posts)PAY OFF YOUR HOME ASAP...

PAY OFF ALL DEBTS AND PAY CASH FOR EVERYTHING

Try to remain as healthy as possible.

save as much as you can before you retire

pay cash for used cars (decent ones)

stay away from fast foods/restaurants as much as possible

spend as little as possible

If you can manage to start this regimen at least 10 years before retirement, you might be okay ![]()

DrDan

(20,411 posts)get out of debt - to include housing and autos

stay away from credit cards - unless paid off COMPLETELY monthly

save save save

restaurants - staying away is good for your fitness as well as bank balance.

autos - let someone else take the initial hit. There are many who trade annually so very good used cars are available in all makes. These are often better than new as the kinks have been worked out under warranty.

I would add - plan for retirement carefully. Have a multi-year history of expenses - so future expenses can be planned-for.

forest444

(5,902 posts)From 1933 to 1973, real wages rose around three fold; since 1973, as we all know, they've actually declined slightly. Some progress.

magical thyme

(14,881 posts)and even if you are among the predator class, sooner or later you will meet with a bigger, stronger predator and they will steal at least some of it.

That is a fact.

Savers are not predators. Savers are food for predators.

Ilsa

(61,692 posts)Our savings are the funds with which Wall Street gambles.

DrDan

(20,411 posts)sorry to be so naïve . . . . but . . . you need to speak s-l-o-w-l-y and clearly

KentuckyWoman

(6,679 posts)jtuck004

(15,882 posts)DrDan

(20,411 posts)there seems to be enough for cell phones with unlimited capabilities, cable, internet, $5 starbucks, etc

jtuck004

(15,882 posts)that can work, are.

You probably don't see them from up there.

DrDan

(20,411 posts)there are also those who are capable of saving but have every excuse imaginable no to do so.

jtuck004

(15,882 posts)turbinetree

(24,688 posts)And just think your lively hood is predicated by a wall street scheme called 401k's , remember the firms bet against you and they bet for you.

I think of it as a tail you lose and heads I win.

Lost my entire retirement when it was in a employee stock ownership 401k's, with United after 9/11 2001--------------------

Give me a defined benefit any day, it's insured and it's protected by the last resort through the PGBC, even if it is cut

Honk--------------------------for a political revolution Bernie 2016

DhhD

(4,695 posts)goes to someplace like Wall Street or goes back to the employer. Now that 50% distribution is worth less now than when earned. It is sad all around.

7962

(11,841 posts)GummyBearz

(2,931 posts)I've had 3. I see exactly what is deducted from each of my pay checks, I see the employer kicking in a 50% match, I see the money show up in my 401k account without a cent missing. I don't use money managers (which charge fees - but 50% is a joke. More like 2% at worst).

Every dollar that goes into my account is used to buy stocks in companies which make products I use. Every last cent is accounted for and no, 50% of my value has NOT gone back to my employer, or "some place on wall street". The last time I went to a new company had a pretty huge cashier's check in my wallet, which was for the exact amount of my 401k (they didn't take 50% - You must be shocked!).

I could have cashed that check at a bank, but I took it to a Schwab branch, they setup a new roll over account for me, transferred the money into it, etc. Amazing how it works that way... I keep all the money I save plus I get 50% matched from the employer! Its works out to about a 4% pay increase. And I don't have to worry about a company going bankrupt and ending their pension checks 40 years from now! yay!

DrDan

(20,411 posts)I have had 401Ks from two large corporations. My experience is NOWHERE near what you describe.

Have you actually had a 401K of your own?

SickOfTheOnePct

(7,290 posts)One of my neighbors is a longtime UAL pilot who lost everything in his 401(k); poof! And his pension lost 90% of its value at the same time. Heartbreaking. I always thought ERISA insured employee pensions. Turns out they only MANAGE what's left after the carnage.

turbinetree

(24,688 posts)the mechanics group and the pilots group were the owners, we took over to get rid of Steve Wolf.

We gave up one of our breaks, and part of pay increase to buy the company on the aircraft mechanics side, if you worked overtime you applied that money to the stock.

When 9/11 happened people were going around and saying don't worry, I looked over at my lead and told him he was nuts, 30 days later the lay-offs started, the first of over 2000 plus, 1 year later, the stock was at 1.45, when we were told we could unload the stock, they, Wall Street had put a hold on the sale.

Wall street would not honor the certificates, they just wouldn't, and this one of many of why I do not like Wall Street.

They did not want to give the pilot and the mechanic owners any funds to keep the company operating, they started selling off assets for collateral-----------------it was amazing to watch in horror.

When you are a employee owner you need 50+ 1 majority to sell

I know a man on the mechanic side that lost over 750,000 dollars, I lost around 100,000.

People do not know what the consequences of what happened on that day, besides the death and the outright ineptness of willfulness of the Bush administration and what they caused, the absolute long term ramifications.

At American the mechanics gave the company ideas to keep cash flowing, taking a pay freezes, but they also filed for bankruptcy-------------the power of the shell game with wall street sitting in the back ground always looking at what they can do, just like vultures looking for a meal.

If you make a certain amount of money it determines what you get in the PBGC plan, of the defined benefit, when they take over the account, this is one reason why people should have a defined benefit instead of a 401k, the defined is protected, even if it is a small amount

Honk--------------------for a political revolution Bernie 2016

![]()

![]()

Adrahil

(13,340 posts)Most 401K's do have a bond fund.

turbinetree

(24,688 posts)prior to yours

It was not wise on my part and on many at the time to take anymore of the money from the pay to buy bonds, I know you can get 25 and 50 and 100 dollars bonds, but at that time when your pay has been cut and you lose a some benefits to cover your costs of the employee stock ownership, you are then robbing peter to pay paul.

Employee stock ownership with UAL was geared to the stock and not the bonds, the assets from which the employee groups pilots and mechanics had with wall street.

That money would have to had come out from your paycheck through you separately, which meant another pay cut.

I know the bonds are protected, and I know that is what should have been offered but it was not.

Steven Wolf and his cronies made out like bandits on the sale, wall street had restrictions on those stocks, you could not convert them to bonds, they just wouldn't let us do that -------------they wouldn't, they would have lost money

Adrahil

(13,340 posts)I personally would rather control the money myself. But even in a collective pension fund, we need to get the money OUT of the company's hands and ownership. That money should belong to vested employees and former employees.

turbinetree

(24,688 posts)because we were the company at that time and the money was in a trust fund :

But we had to continue to put the money back into the company,

http://www.nytimes.com/2005/07/31/business/yourmoney/how-wall-street-wrecked-uniteds-pension.html?_r=0

http://corporate.findlaw.com/contracts/compensation/employee-stock-ownership-plan-ual-corp.html

raouldukelives

(5,178 posts)Invest away in the most heinous corporations, think tanks and people on the face of the earth. Doing all one can to assure that our nation and the world at large will continue down its current path unimpeded.

Then go to rallies, go online and pretend to care about leaving a better world, about human rights, about climate change, about black lives, about perpetual war, about the least.

There are none so blind as those that refuse to see. We live in the most reality Wall St shareholders cannot they themselves fund the blocking of.

Ed Suspicious

(8,879 posts)corporate efficiencies meaning job cuts and offshoring. It is THE great hoodwinking of the American public.

marions ghost

(19,841 posts)ProfessorGAC

(64,988 posts)The money has to be invested somehow. It would be unproductive for pension money to be buried in someone's back yard. Lots and lots of people adding amounts to the same mutual plan is essentially the same as investing money from a pension fund.

Now, i think pensions were a fair and reliable system until we went on a deregulation rampage in the 80's and 90's. To me, 401k's should be "extra" savings above and beyond pensions as an inflationary hedge come retirement time.

SmittynMo

(3,544 posts)almost non existent anymore. Corporate greed has removed that. So what are your children going to rely on decades from now?

shraby

(21,946 posts)of good downturns, turned ours from almost 100,000 into less then 50,000 almost overnight. 401s are not reliable enough for retirement savings.

A HERETIC I AM

(24,365 posts)Did you liquidate at the bottom?

If your 401(k) was at $100,000 in September of 2007, it should be back to that and above now if you did nothing. Provided, of course that you were invested wisely, with a broad portfolio appropriate for you.

You didn't lose a penny unless you sold, and if it was at 100K when the market was at the 14,000 level in '07, where is it now that the market is at the 17,000 level?

enid602

(8,610 posts)The case you cite is only true if the funds are invested in diverse mutual funds, not specific stocks. My own lost 15% in 2008, but reached their pre-bust level within a year. Nice returns until this year, which has mostly been flat.

A HERETIC I AM

(24,365 posts)The poster I asked the question to hasn't responded, but your statement is not applicable to 401(k)'s

If you had a hundred grand in a money market fund (which virtually ALL 401(k) plans offer, in one guise or another) in 2007 you would STILL be ahead of where you were 8 years ago.

The overwhelming majority of 401(k) plans do NOT offer the participant the option of individual stock purchases. Some offer company stock, but those that do are mostly privately held companies, ie: firms not publicly traded (Publix Markets and Penske Truck Leasing are two perfect examples). Mutual Funds are the investment vehicle most common in these plans as you probably know, and a participant is diversified even if he only uses a single fund in which to invest.

If the stocks you own pay dividends then your growth may have been flat but your income is still there, right? And with that income you can buy more shares.

enid602

(8,610 posts)I'm agreeing with you. 15% decrease in my mutual '08, and sold gains since. My 401(k) has since rolled over to an IRA, but I will always keep everything I don't want to lose in mutuals. I believe that forcing participants to put everything in company stock was more prevalent pre-Enron.

7962

(11,841 posts)I had two friends who moved the bulk of their 401 balance into the "safe" fund when the market was 6900. I knew right then, if I had any cash it was time to buy because the "capitulation" had begun.

As you said, if you left it alone and were still contributing, you were getting 3x the shares you usually got, and by now you're balance shouldbe WAY above 100k.

If you were retired already and still heavy into stocks, you had already screwed up. The older you get the less exposure you should have to those big corrections. Too many get greedy and dont like seeing everyone else getting 12% while they're getting 3, and they keep the risk. They shouldnt

shraby

(21,946 posts)contributions, as the market bounced up and down enough we never gained it back. It was gone.

A HERETIC I AM

(24,365 posts)I don't doubt that you are telling me the truth as you see it, but something is wrong if you did nothing and had growth before the crash (did you?).

I know many plans have really...and I mean REALLY crappy funds to choose from. My company is a good example. But what mutual fund are you in that went down but didn't recover at all?

That is very curious indeed.

closeupready

(29,503 posts)during the market boom after the GHWB recession ended (during Bill Clinton's first few years), my 401(k) went down, down, down. It was scandalous and infuriating. And I found out later that there was fraud going on at that particular fund. ![]()

1) If you are depending on the money for income anytime soon, it should NOT be in stocks.

2) I have my 401K in stocks in 2008. $75K dropped for $48K. Care to guess where that is now? Well over $100K. And I haven't invested a single new dime in that account (it was an account from an old job that I did not roll over).

You sound like my sister who always complains that she can't get ahead and can;t save for retirement, and then complains when I talk tyo her about how to invest, and how my savings are doing.

Just a note, but there is no magic money. If you want decent returns there are risks. If you are seriously risk averse (such as retirement is imminent, or you are actually retired) there are much safer ways to invest than the market.

doc03

(35,324 posts)do sell at the bottom?

shraby

(21,946 posts)LittleGirl

(8,282 posts)If you work for a mom and pop small business most of your life, you'll only have SS to rely on in retirement. And that's a fact.

csziggy

(34,135 posts)Before my husband started working for a corporation that offered a 401k with matching contributions we both put as much as we could afford into Roth IRAs. While that money is not as much as in his 401k the Roth IRAs still accumulate value and will be available for retirement income later on. With his Social Security, his 401k, and our Roth IRAs we can survive retirement. it will be tight but the money is there when needed.

Whether or not an IRA of this sort is advisable for you will depend on various factors that you will have to evaluate for yourself but they are one possible way to prepare for retirement.

LittleGirl

(8,282 posts)but for those that don't make much, don't work for a company that offers them, sometimes there just isn't money left over to put in a Roth but I get your idea.

I didn't start a Roth or 401k until I was over 40 so I got a late start because of the lack of working with those benefits.

csziggy

(34,135 posts)Mostly because with our farm every penny went back into the business and we didn't pay ourselves salaries, even on paper. It wasn't until I could work on the farm, we leased the facilities and my husband got a job in town that we were able to save. When he started his job he maximized his contributions to his 401k. his employment matched most of what he contributed until 2009 when they stopped matching at all. Just before he retired they started back but only up to 5 - 10%.

We always figured that the farm was our retirement fund - if we have to we can sell it and live off the proceeds. I'd hate to have to do that since I want to die and to be buried on my farm but it has always been my option. I've never paid enough into SS to have anything other than a spousal benefit so the farm is it for my "savings".

B Calm

(28,762 posts)knew all along it was designed to do away with company pensions.

SoapBox

(18,791 posts)I do have a problem with calling them virtually worthless.

I have contributed to mine for at least 20 years, when my company started them (and really made it that there was no choice but to save on your own). Investments are at Fidelity...you can manage your own or pay for an Independant management service (which I started about 5 years ago, when I couldn't attend to it myself due to taking care of my Mom).

I could have contributed more but have increased my withholding now to 10%...I MUST increase that withholding and I actually need to work more, now that Mom has passed. Many people I work with have gotten a lot smarter and are even putting in the Max, around 28% of their gross pay.

I would say it all starts a lot earlier, that people must plan for retirement...I also have old IRA's that I started many years ago.

Pensions are dead overall...people have no choice but to save on their own. If there is no 401K available, there are multiple other savings vehicles. Wages can be a problem...but saving just small amounts can grow over time.

People need to reign in spending on dumb stuff and save for the rainy AND retirement.

Just my take...and, no, I don't make all that much.

Ed Suspicious

(8,879 posts)to withhold 10% of your income without beginning to sink. This is not a testament to your great moral fiber. It is a testament to the good fortune of having an income that allows you to begin to accumulate your own small fortune.

B Calm

(28,762 posts)I could afford it.

I read somewhere that only 1 in 7 are covered by a defined benefit pension at any particular time. And with the way people are forced to change jobs all the time, lack of portability is an issue if you're not at a job for 5 years. I imagine most of the people with defined pensions are government workers, and so many states have been tinkering with those as of late. 401(K)'s are fine, but the tax advantages (lower taxable income and the middle income savers' credit) don't apply to those making at or near minimum wage.

My personal experience is closer to yours; I was lucky to have been able to save 20% over a 25 year period. But the statistics cited by the OP are heartbreaking.

7962

(11,841 posts)And money management should be a required course for high school students.

jeff47

(26,549 posts)I had a 401k 20 years ago. Then the company exploded and I had to liquidate it to keep a roof over my head and keep eating.

Then I had a 401k 15 years ago. Then that company exploded.

Repeat a few more times, and I don't have much savings. Because very often when I finish digging myself out of the hole, it's time for some "restructuring".

This "modern" version of a career is very exciting! ![]()

haele

(12,646 posts)Right now it's 1% because of the cost of living where I still have a job and my spouse's chronic disability.

We aren't talking having expenditures "we go out to eat every night, bought a vacation time-share we go to every summer, got a contractor to remodel our kitchen with high end appliances, and got a 70" TV, and a third lease vehicle, and an X-Box for the kids" type of spending.

We're talking "is there enough food in the pantry to last for everyone when we get to the end of last week's paycheck so we can maybe take the car in for the long over-due alignment and tire rotation so we don't have to buy a new set of tires this year." We're talking doing all the home repairs ourselves - and it's f'n hard crawling under the double-wide to fix 50-year old plumbing and wiring and doing the yearly maintenance on the support piers when you're a 56 year old woman with a bad back, knees, and only 65% use of her right leg doing it pretty much all by herself. Saves a ton of money, though $10 of supplies on the maintenance and 4 hours vice paying someone $600 a year to do it for you.

Now, our "dumb stuff" spending is insuring that we pay the bills that keep the roof over our heads and the $250 a month Student Loan (under the 10 year payment); that my husband gets the type of food he needs (no cheap junk food or just "rice and beans and water"![]() - and can get to his therapy sessions and doctor's appointments to keep from getting worse; and that my pregnant stepdaughter (still under our insurance, and having a lot of problems) and the grand-daughter we had to get guardianship of for insurance purposes have enough healthy food to eat and adequate medical coverage because son-in-law frankly can't get his act together and seems to think that they can both make it working full-time for allowance money at his tea-bagger family business (BTW - he doesn't have insurance, because his dad doesn't believe in "Obummer-Care" and won't get it for him; since he also works pretty much under the table, there is no federal or state tax record for him to be able to apply for Covered CA by himself).

- and can get to his therapy sessions and doctor's appointments to keep from getting worse; and that my pregnant stepdaughter (still under our insurance, and having a lot of problems) and the grand-daughter we had to get guardianship of for insurance purposes have enough healthy food to eat and adequate medical coverage because son-in-law frankly can't get his act together and seems to think that they can both make it working full-time for allowance money at his tea-bagger family business (BTW - he doesn't have insurance, because his dad doesn't believe in "Obummer-Care" and won't get it for him; since he also works pretty much under the table, there is no federal or state tax record for him to be able to apply for Covered CA by himself).

Well, those things and the cable bundle that includes internet and phone (we still need a land-line for the gate in the complex where our double-wide is located), the cell phone account where half is paid by my employer because I also use it for work, and basic Netflix.

The situation is not unusual for a lot of older workers with adult kids who don't seem to be able to get decent jobs in this area. I'm certainly not alone.

The 5% of the pay I could possibly save is going to an HSA that pays for the medical expenses for everyone under my insurance; it covers the deductible and has enough carry-over that we don't get hit out of pocket at the beginning of the year for doctor's visits, expensive therapies and medications - or for the upcoming birth of grand-child #2, which unless the other grandmother decides to apply for guardianship to cover under her insurance, we'll have to also shell out $800+ to do so again next year.

So, where will I be able to come up with money to save more for a 401K that would never have gotten over $150K even if I had maxed out all my investments during my civilian working life? I can do the compound interest figures- there were only two years I could have put in the (at the time) max of $8K fully matched by an employer before I had to roll that munificent $26K in the 401K from that employer into a IRA, which now has a whopping ~$46K in it; unless interest rates go up significantly before I retire around 70 (if I can keep working that long), I might end up with a whole $70K in it.

I have two other IRAs that were 401Ks from two other employers that have currently have around $18K and $22K respectively. My current 401K has ~$20K in it, still recovering from the $12K loss the company experienced 2008/2009. In fact, my employer just split the company stock; they halved the amount it was worth during the split instead of dropping it only by 1/3 when they split, so there is absolutely no change other than perhaps an increase if the company stock has the potential to continue it's slight improvement; which looks less promising as they lost two major customer contracts and didn't pick up enough to make up for that loss. In all actuality, I'm probably going to be getting notice to find another employer in around 6 months; the contract I'm tasked under goes into re-compete next year, and it's probably going SBA, which means it's going bye-bye. I've worked here 10 years. So, it will go into another IRA with no chance to get matching funds for the next 14/15 years I might have been able to work with this employer. And I'm certainly not going to "qualified" enough be an executive any time soon, so my chances of getting a 6 figure job where I can live frugally and save the max are getting smaller and smaller the older I get.

Fact is, most people no longer work for the same employer for more than 5 - 10 years. That means most 401Ks do not provide the return rate that is advertised, because the advertised benefit still assumes 25 years of employment with wages that increase on a yearly basis and no significant life changes that might impact the amount of money an employee may require to spend for even the basics. Just tell someone they can't buy a house, or get married (or divorced and have to pay child support or maintain two households) 5 years after they start a 401K.

Just inform people they have to concentrate less on doing good work, and more on the competition with their peers; to kiss up to the boss and his/her buddies or learn to "network" properly, so that they can get a higher paying job and live well enough so they can retire without worries.

Look, I've seen how the shell game with 401Ks is played.

In 1991, when my first company (after active duty military service) went to a 401K vice a pension system, it was sold as "12% return with full matching dollar for dollar after 5 years vesting- and you have control over your investments, so you can get the plan you need". That we didn't have to worry about the failure of Social Security and those corrupt and failing Union-run Pensions, or if we were eligible for military benefits that might not be there as the "Peace Dividend" took affect and people would get together singing "Kumbaya" in this new Flat World.

That we could could retire at 65 with up to well over two Million in our account if we maxed out our investment every year with that company match. We could "own" our future. Sounds great, doesn't it?

That is:

- If you could manage to work your way into one of the increasingly rare recognized management or supervisory positions.

- If you could stay with an employer for over 5 years and not find yourself in the group that got the pink slip after the company holiday party because "our stockholders need us to cut expenses".

- If you remained working full-time - and didn't have to take a month or two worth of "temporary lay-off" between billable tasks.

- If you got regular wage increases - and didn't end up working 4 years without a raise with the added financial burden of an increase "personal responsibility" for your benefits - as health insurance premiums went up and up with less coverage available.

- If your company didn't cheat and not match funds because the owners are using it as a personal ATM, and plan to bankrupt it before people notice they haven't been paying premiums or matching funds...

So, since I'm not the owner of my own business, or independently wealthy, or a trust-fund baby - what "dumb expenses" should I stop paying to throw more good money for a potentially poor return?

BTW, my pre-tax HSA - which I am maxing out on at $425 a month - has been doing better than my 401K - 3.85% return in interest over 2 years since I began it, vice a total 2.75% return from my 401K over the same time.

And the HSA account, as limited in use as it is, is far more portable and can potentially last me longer than a 401K, which I'd have to stop putting into and start removing from when I'm 72.

Also, unlike the 401K, I'm not going to be charged any fees when I or my dependents use it . Because we all reached the ACA personal deductions, I'm maintaining an average of $3K -$4K in it now, barring the occasional nickel/dime co-pay and a dip at the beginning of each year after starting out with the $500 the company seeded it with back in January 2013 when they started it. By the end of next year, barring an ambulance ride or other such emergency, and even after paying for the birth my next grand-daughter, I should be able to maintain between $4K - $5K in it. Enough to save up for braces, dentures, or other medical issues as time goes on.

Haele

shrike

(3,817 posts)I don't know if I'd be able to hold up under that kind of pressure, frankly.

I, too, remember the hard sell on 401ks. Everyone was going to retire a millionaire. But the 401k was meant as a tax-shelter/saving tool for high income earners. Which is great if you're a high income earner. Not so much if you're not.

Best of luck to you.

haele

(12,646 posts)The trick is, even if you complain about it here, is to deal with what you can deal with, keep an eye on what you can't so it doesn't come as a surprise and do more damage than expected when it boils over.

I've been through worse times before, doing okay now, and things are looking up (so long as I can keep working four more years!), but still, I've learned how to deal.

If we're a bit late paying a bill, call them up and make arrangements for a late payment or spread out payments. Try not to get the utilities turned off, make a fair effort at paying them something. If we have to float checks or depend on overdraft protection, so be it. If our credit is in the tank (and it still is - thank you, insurance companies!), so be it. If we go bankrupt (knock on wood, not yet...), so be it. If I have to live off a large tin of oatmeal and the kindness of co-workers for a month so everyone else in the house can eat, so be it - my parents have done that and I've done that in the past.

It can all be dealt with, so long as one's expectations are to survive. We understand that we're going to have to pay the fees and the penalties for being "less financially competent", but above all, we need to keep out of the eviction process and do whatever we can to keep working, because there's no safety net if you look to be a healthy adult who can work, even if there's no jobs available for you to work at that pays a wage you can pay your basic bills and rent on.

As it is, in three years, I'll be eligible for my military retirement pension and Tricare which will help the financial situation immensely (like, use the pension to pay off the student loan before ten years I've agreed to) - and then ten years after that if I can keep working, I can start collecting a maxed-out income on Social Security. The IRAs and the 401K won't ever be enough for us to "retire on", but they can be used for a "rainy day" emergency fund and/or trust funds for the grandkids.

I know what my needs (and my husband's) are, and the primary ones will always be: a roof over my head, utilities, food in the pantry, and health care. We've got some of that already taken care of; we own our own double-wide free and clear, even though we pay rent on the lot, and we're close to a major public transportation center. Lot rental is not bad at all; managed rates with a 10 year lease that are still half the cost of a 20 year mortgage on a much smaller sq. house with the same sized lot that we could afford in our area - plus we get security, a swimming pool, sauna, large picnic area, club house with full kitchen, and a Jacuzzi! And it's a family park, so if something happens to the kids, we can keep the grandkids with us.

Anything else else in life - eh...travel would be nice, but if we can't afford it, we can't.

That's why maxing out the HSA is far more important now than maxing out the 401K. Medical will be the big expenditure in the future, and this is a pre-tax/fee-free account with no tax liabilities for withdrawal, even on any interest accrued so long as we keep using it for medical expenses. So long as I've got what's considered high-deductible insurance, I can keep adding to it as part of a pre-tax arrangement. Brings my taxable income down and ends up saving me around $1100 a year in total taxes and fees owed.

Unlike the 401K, which becomes income and gets taxed as such as soon as we start using it.

So, I run the opportunity costs model, and deal with what I can deal with.

Anyway, thanks for the best wishes. And may you experience a relatively stress-free time dealing with your finances over the next couple years, yourself.

Haele

Baitball Blogger

(46,698 posts)Someone should be held responsible for this.

GummyBearz

(2,931 posts)You can be sure if she is elected president and they do it again, she will send them all to their corner offices for a 10 minute time-out

Helen Borg

(3,963 posts)PatrickforO

(14,569 posts)Every person for themselves doesn't work.

whatthehey

(3,660 posts)It's certainly not irrelevant that anyone currently called a senior a) almost certainly had a pension if they had access to a 401k and b) only had a 401k for part of their career.

So they didn't need to use one as much as most do now, and lacked the advantage of career-long cumulative DCA that we have now.

But hey keep up the FUD, doomers. I'll keep taking the free money and tax savings. I'm sure you'll find someone other than yourselves to blame for the lack of savings in retirement.

MichMan

(11,900 posts)Defined benefit plans were fine when people got a job after HS and stayed there for 30 plus years. Those days are long gone. People today usually don't work someplace long enough to get vested in a defined benefit pension even if one existed.

The one huge advantage of a 401k is portability

haele

(12,646 posts)Since 1991, I've had 4 different 401Ks, and only one of them didn't have a company stock option (which I wasn't able to vest in, didn't last the two years necessary required that company). I have had to roll three 401ks into IRAs managed by the three different financial organizations that had run them; Lincoln Mutual, Vanguard, Fidelity. My current company uses Vanguard, but my previous Vanguard account was with a different company over 7 years prior, so the rules for those accounts aren't the same. My current employer, like two prior employers, used to be an employee-owned company, so a managed company share fund (max of 20% investment) was included as part of the 401K fund menu separate from whatever stock may be available in a different account for additional retirement investing (or public investing, once the company decided to go public). In my experience, managed company shares in the 401Ks tended to be a good pick through the mid 2000's; they usually tended to have a better return over the short run, which worked well in technical fields where people jumped companies every 3 - 5 years. I've got about $7K in managed company funds in my 401K, down from $9K six years ago before we went public. Just in time for the stock market bust (sigh).

Now, I might be able to roll the amount less the embedded company shares that I have in this account into another 401k as some sort of seed, should I have to find a new employer, but then again - it's company shares. I'm not up on the tax implications, but I don't think company stock is portable; I am under the impression that from what my company rules are that you need to buy them back or roll them into a money market fund in your 401K account, which is safer, but does not have a good a return as the stock may have originally had.

Haele

BeyondGeography

(39,367 posts)I've been working for over 30 years and never had a hint of a chance of a defined benefit pension. Believe me, I'd prefer one to a 401k, as you need seven figures worth of savings to match what a pension offers over 20-30 years of retirement. However, this is NOT AN OPTION for the vast majority of Americans. The new mix for most people is SS, 401k/savings plus some income-producing activity until you drop/can't work anymore. Defined benefit pensions have been on the way out for decades and they ain't coming back.

Octafish

(55,745 posts)Scam worked great, a diversion corps used to dump employee pension plans.

Pension plans for CEO and top executive-level officials, of course, remained.

librechik

(30,674 posts)It was a major factor in my decision. For a couple of years both my husband (union baker) and me had pensions to look forward to. Then my company switched to 401ks. Mine went away in about 9 months after the 08 crash and never recovered.I retired with about $11,000 after 15 years of saving.

Hubby still has a pension! Thank goodness! But our situation is vanishingly rare. I feel so bad for our kids and their kids.

Omaha Steve

(99,572 posts)Marta has 2 pensions & a 401K.

I have a pension and a 457 (government employee like a 401K) account.

I have a relative that sold out a great forever pension for up front $. Had to keep working at another job until old enough for SS. Lucked out with an employer that stopped putting $ in her 401K and instead put in stock that just hit the open market: http://www.omaha.com/money/biggest-winners-in-first-data-s-ipo-the-workers/article_7f586f87-d051-51c7-b5f6-ca3464da86a2.html

KamaAina

(78,249 posts)Mom had one right up until the outfit handling it went belly-up.

daredtowork

(3,732 posts)Between student loans, high rents and mortgages, family costs (children, elders), and ongoing underemployment/unemployment for millennials, no one is saving for retirement. Republicans try to wave both hands and both feet to warn people that Social Security won't be there for them. However, it seems like people are voting with their feet, and Social Security had better be there. In fact, it better be increased. Despite the propaganda, people need Social Security - it's the only way to reliably and equitably support people who have aged out of the workforce.

Response to eridani (Original post)

Corruption Inc This message was self-deleted by its author.

Liberal_in_LA

(44,397 posts)Kang Colby

(1,941 posts)I'm part of a crusade to give ordinary investors a fair shake.

1) Pay off debts aside from your mortgage.

2) Spend less than you make, save and invest the difference.

3) Have an emergency fund of 3-6 months of living expenses. (Use judgement, a tenured professor needs less than a temporary employee.)

4) Utilize tax advantaged accounts, 401ks, IRAs, Roth IRA, and HSAs

5) Maximize tax advantaged space before worrying about taxable accounts

6) Be mindful of tax efficiency with respect to investments...e.g. Don't place REIT funds in taxable accounts

7) Make sure your asset allocation aligns with your risk profile...e.g. dont have 100% of your retirement invested in equities (stock) ten years prior to your planned retirement. Most of the problems in this thread would have been mitigated if people followed this simple rule. A good rule of thumb is "age in bonds"...so a 45 year old would be 55% stock funds and 45 fixed income (bonds)

8) Don't pick stocks, invest in *low cost passively managed index mutual funds or ETFs that track the entire market

9) Never try to time the market, set your asset allocation to align with your risk profile and forget about it...periodically rebalancece back to your set asset allocation

10) read more at https://www.bogleheads.org/wiki/Getting_started

*Low cost index funds should generally never have an expense ratio above .30%. Usually, US Total Market index funds run .04-.18%, international funds are a little higher as are funds focusing on specific size companies and or style, small cap value for example.

eridani

(51,907 posts)gopiscrap

(23,733 posts)ronnie raygun to both try to kill social security and enrich is greedy friends

HeiressofBickworth

(2,682 posts)She got the job the day after she graduated high school and worked there for 45 years. The employer consulted its magic Oracle and came up with a dollar amount she should have to live on after retirement. The employer paid the difference between her social security income and that number. When social security payments were increased, the employer DEcreased the amount paid to her. Talk about a "fixed income"! Any changes in pension plan laws didn't help her. She retired about 1980 and died in 1990.

RandySF

(58,706 posts)And he is not upper-middle class.