General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNeed advice re: student loan repayment options

I have a friend who just called me and who sounds well and truly screwed; I want to help him but don't know how, so I'm hoping DU collective wisdom might.

My friend is in his early 50s. He lived overseas on the local economy for decades after college, returning to the US in his late 40s with minimal savings, no immediate family, and a back condition that would ultimate require surgery and get him classified as disabled. Because he also returned without any real marketable skills, he decided to pursue master's degree that would allow him to get a job. The degree did lead to a job, but also left him saddled with six-figure student loan debt. These loans have been in forbearance, but it's time to pay.

The problem is that his income is ok, but ok doesn't get you very far in DC. His rent eats up about half his take-home pay, and cost of living and medical bills (and old credit card debt from his student days) does the rest. Even using a program that pegs his repayment to his income AND forgives the loan in 10 years if he remains employed by the federal government the whole time, he's still having to pay 25% of his take-home pay to he loans, and he has no idea how he'll manage that.

Some other factors to note:

- His job is not one he can do easily outside DC.

- His rent is already pretty cheap by DC standards; he could bring it down a bit by moving farther away from a metro (subway) stop, but with his inability to walk long distances that's not really practical. Nor is buying a car in his straits, obviously.

- He could increase his take-home pay by cutting the amount he's putting into his retirement account but, because he did not paid into Social Security for the first 25 years of his working life, he is unlikely to have much SS and so wants to at least save something.

- He's already looked into the program that provides a subsidy for federal employees who are repaying loans, and been denied access to it by his agency because they only use that for higher-level employees (which is some seriously outrageous bullshit, but totally permissible under the rules of the program).

- He's thought about getting a weekend job, but is unlikely to find anything that doesn't require either heavy lifting or long hours on his feet, neither of which are possible with his back condition.

So my question is: what are the other options out there when you can't afford student loan repayment? I want to help (I'm one of his only friends in town) but I have no idea how this works these days. Or is it really down to living in a boarding house and eating ramen every day?

DU, can you advise? Many thanks in advance.

kiva

(4,373 posts)The income based repayment plan cut my payments almost 75% in the beginning - I'm making more money now, so payments have risen. There are several other options: https://studentaid.ed.gov/sa/repay-loans/understand/plans

Edited to add that the most important thing is to stay in contact with the company holding the loan - they tend to be pretty reasonable but if you blow them off they can get ugly.

2naSalit

(86,575 posts)Check out the payment programs, there are several. I had to go through a rehab program where I paid a minimal amount for a given length of time to get out of default after a back injury. They were really nice about it and I was given yet more deferment due to my impoverished income. I have to reapply every year but it's better than sweating a credit problem, not being able to get jobs, and having a bill I can't address.

Use the link kiva posted above... I'm just giving testimonial to back it up.

Proud Public Servant

(2,097 posts)I'm not sure if he's exhausted every option; I'd assume so, but honestly he can seem kind of bewildered by these things (he's more like a 22 year old than a 52 year old that way, which I chalk up to his long stint overseas without a support network). I also don't know if all the loans are federally guaranteed; some may be private. But I'll pass this on; thanks!

handmade34

(22,756 posts)doable if they are gov't student loans... some programs have you pay 10-15% of discretionary income... if they are private, it is difficult.

people do all sorts of things to manage...

I am aware of one person who planned, paid off student loans, put all other expenses on Credits cards and then filed for bankruptcy... for him it worked. Not so easy for others.

my loans will die with me because I spent so many of my working years caring for my terminally ill husband and (and another relative) and the loans tripled with fees, interest, etc...

good luck to your friend...

PowerToThePeople

(9,610 posts)Recurring monthly payments such as rent are what you need to minimize. Just have to do the math if you take a salary hit and see how the numbers add up.

I do not eat ramen every day, but it is in my diet. I do do a fair bit of meal substitution eating protein workout bars that I load up on when on sale. I think this does save me a fair amount on my food budget.

Stay home, do not eat out. Thrift store shop instead of buying new. There is an art of sorts to frugal living. You do not have to appear as poor as you are.

Proud Public Servant

(2,097 posts)No one will ever pay him more for it than the Federal govt will. Of that I'm certain.

hunter

(38,311 posts)... and expecting to end up homeless, or optimistically, sofa surfing.

Been that way before, will be that way again.

The difference from then and now being that I hurt all the time. (Arthritis mostly.)

One of my brother's is already living the "no fixed address" lifestyle.

I don't know what the end game is for big money in the U.S.A., but I've got to wonder what they are going to do when nobody gives a shit anymore, and they have to be suspicious of anyone and everyone of pissing in their coffee.

The only solution I see is to tax the uber-wealthy out of existence, so there is no one left who's able to buy the political process.

I don't mean there should be no wealthy people, only that nobody should be so wealthy that their vote counts more than anyone else's vote in the eyes of the politicians.

I figure the maximum income possible ought to be no more than twenty times the minimum income, and it ought to be accomplished by steeply progressive taxes and some kind of "national dividend" that affords everyone safe comfortable housing, good food, appropriate medical care, and continuing education.

shadowrider

(4,941 posts)Once the "uber-wealthy" have been taxed out of existence to pay for "safe comfortable housing, good food, appropriate medical care, and continuing education.", who, exactly, will pick up the bill at that point, to pay for all that stuff, since there are no more rich?

I'm curious about your solution.

Like I said, I'm NOT arguing, just that's there's a flip side to every coin (to play devils advocate).

hunter

(38,311 posts)Or maybe they leave the country?

That would be nice, actually. They go away, we keep their stuff.

Imagine the Koch brothers living in Dubai, having to register as foreign agents, etc...

What would actually happen is that the super ambitious who wanted more for themselves would have to fight for a higher minimum income for everyone. They'd have to pay their own employees living wages and more. A rising tide really would lift all ships.

And if they didn't want to pay extreme taxes, they'd have to reinvest their money in ways that improve the standard of living for all.

As things are now, it's often the sociopathic scum who rise to the top, not the people who are truly making the world a better place with their innovations.

Most wealthy people in the U.S.A. inherited their wealth, or got it by screwing others and gaming the system, especially the political system.

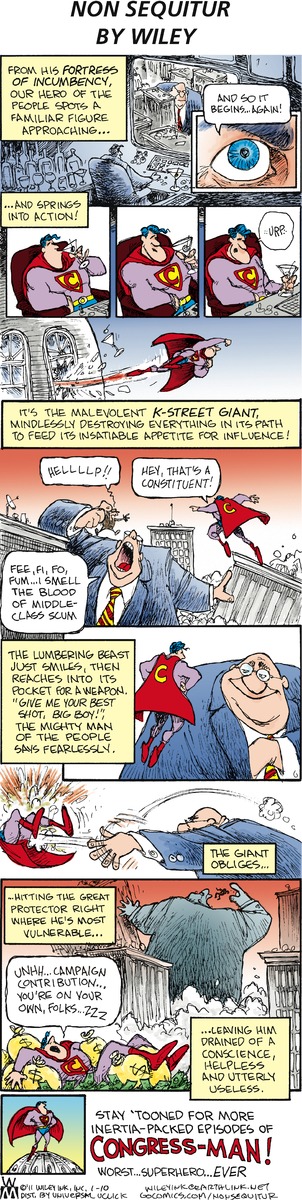

Today's Non Sequiter nails it...

Our elected representatives seem powerless against the soft money.

http://www.gocomics.com/nonsequitur/2016/01/10

hat tip to annabanana:

http://www.democraticunderground.com/10027516258

elias49

(4,259 posts)Could your friend return to - wherever he was 'overseas'?

What's his passport/visa situation?

Dropping into the US after 'decades away' must be like immigrating. Messy stuff!

Proud Public Servant

(2,097 posts)Returning overseas wouldn't work for him right now; that window seems to have closed.

YOHABLO

(7,358 posts)shadowrider

(4,941 posts)That said, I believe it takes an attorney to fight the red tape which costs money.