Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

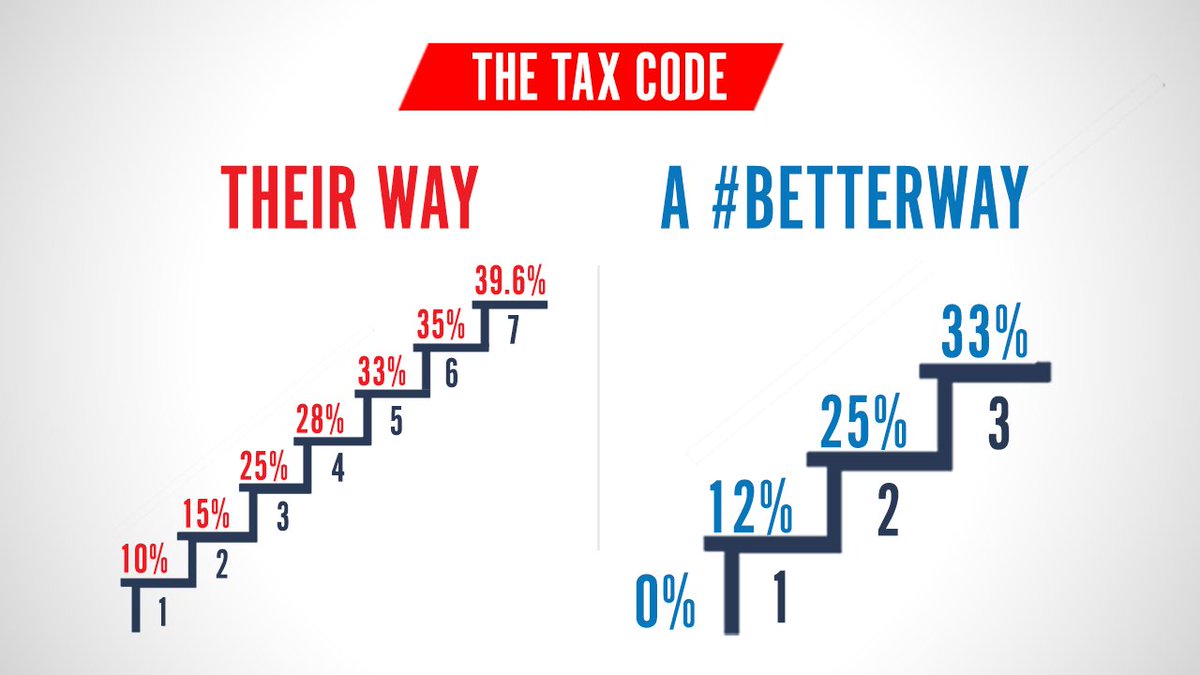

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTax Reform Is Coming! Watch Out for Nonsense Like This Chart From Paul Ryan.

By Jim NewellIn his year-end press conference Monday morning, Senate Majority Leader Mitch McConnell laid out the plan for 2017. Congress will pass two budget resolutions, one for the remainder of the current fiscal year and one for the next, that include reconciliation vehicles—i.e., bills that can be passed without threat of Senate filibuster. The first, as we are all aware, will be used to repeal much, most, or all of the Affordable Care Act, with replacement pending. The second will “largely be dedicated to tax reform,” he said.

Tax reform is House Speaker Paul Ryan’s baby. It was what he wanted to do when he became the chairman of the Ways and Means Committee, before he replaced John Boehner as speaker. There is a lengthy section on tax reform in Ryan’s policy agenda, “A Better Way.” Tax reform is what gets his socks rolling up and down.

Tax reform is also among the more difficult things to legislate. The stakeholders include, well, every person, both corporeal and corporate. The benefits for the latter in “A Better Way” are fairly clear, like a large reduction in the corporate tax rate and a switch to a territorial system in which only domestic income is taxed. “It represents the largest corporate tax rate cut in U.S. history,” the paper says. The tax reform benefits for wealthier Americans are also clear: They will get massive tax cuts, with a lowering of the top income tax rate, a lowering of capital gains and dividend taxes—including repeal of the net investment tax in the ACA—as well as repeal of the estate tax. For starters.

That leaves the question of what’s in tax reform for everyone else, aside from the eleventy billion jobs that will trickleth down upon thee. Well! There will be a beefed-up standard tax deduction and an expanded earned income tax credit. A lot of the pitch, though, will be summed up with the word simplicity. No one likes spending all that time doing his or her taxes; and there are certainly plenty of ways that tax reform can and will simplify and shorten the tax code.

This, however, is not one of them:

Paul Ryan

@SpeakerRyan

The U.S. tax code is too complicated. ← Retweet if you agree. #BetterWay

more

http://www.slate.com/blogs/the_slatest/2016/12/12/this_is_not_why_the_tax_code_is_complicated_paul_ryan.html?wpsrc=newsletter_slatest&sid=5388f1c6dd52b8e4110003de

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

1 replies, 1142 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (2)

ReplyReply to this post

1 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Tax Reform Is Coming! Watch Out for Nonsense Like This Chart From Paul Ryan. (Original Post)

DonViejo

Dec 2016

OP

taught_me_patience

(5,477 posts)1. It's not the number of tax brackets that makes the code complex

a computer can calculate the tax you owe in .001 seconds or, if you still do taxes by hand, you can look up a table and find what you owe in 30 seconds. What makes the tax code complex is figuring out what constitutes income.