US Home Sales Slide 4.8 Percent In August As Higher Prices, Limited Supply Discourage Buyers

Source: Associated Press

By CHRISTOPHER S. RUGABER Associated Press

September 21, 2015 — 9:25am

WASHINGTON — U.S. home sales slid in August by the most since January as tight supplies and rising prices discouraged potential buyers.

The National Association of Realtors said Monday that sales of existing homes fell 4.8 percent from the previous month to a seasonally adjusted annual rate of 5.31 million, the lowest level since April. That's down from 5.58 million in July, which was the highest in more than eight years.

Solid job growth and low mortgage rates have boosted sales 6.2 percent in the past year. But the median home price has increased 4.7 percent during that time, more than double the increase in average hourly pay. That is likely pushing more homes out of reach for many buyers.

Americans looking to purchase a home also have fewer to choose from: The number of available homes has fallen 1.7 percent in the past 12 months to just 2.29 million. That is equivalent to 5.2 months of supply at the current sales pace, below the six months that is typical of a balanced market.

Read more: http://www.startribune.com/us-home-sales-slide-in-august-after-3-months-of-solid-gains/328501441/

FreakinDJ

(17,644 posts)bucolic_frolic

(43,058 posts)Buyers are supposed to PAYUP and borrow as much as possible.

That's what this demand surge meme has been pounding the table on

for 6 months.

oh. i get it. This was pent up demand, and now that's spent, so the

rest of the buying public either is prudent or doesn't have the credit

rating to borrow more and more.

So the buyers of the last 6 months bought at the top of the surge and

will be underwater the next 30 years. Suckers!

titaniumsalute

(4,742 posts)I bought in the past six months and got a great deal. The house was on the market by an older lady who wanted "out" fairly quickly. I offered a fairly low deal and she took it. (In Ohio.) I sold me house in FL and made some decent scratch from my purchase in 2009. Used most for a down payment and now owe less than 20 years on a 30 year mortgage. Plus I pay an additional principal of about $200/month so the 20 years left will go down to about 15 years with the extra principal.

bucolic_frolic

(43,058 posts)You didn't buy in the California markets where prices are up 30% and

demand is juiced with Asian buyers seeking investments. When you

spend carefully, you get value. When you buy a McMansion in a hot

market you risk having overpaid, and the profits go to lenders, the RE

industry, and builders. Only increased demand and wage growth can bail

you out of that situation with a profit. No different than the stock market.

jtuck004

(15,882 posts)People have no money to buy. The bill for letting things devolve to this is going to be higher than anyone imagines.

...

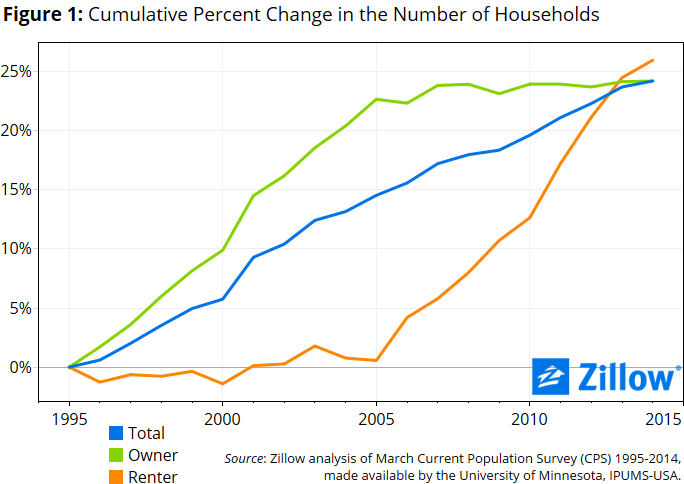

What a difference a decade can make. Over the last two decades the number of U.S. households has grown by 25 percent. But the growth has come in two distinctive waves. Between 1995 and 2005 nearly all of this growth came in the form of new homeowners. However, the subsequent decade saw something very different. Most of household growth between 2005 and 2015 has come in the form of renter households. It should come as no surprise that new home buying still remains weak. With this new trend unfolding, it shouldn’t come as a shock that multi-unit permits are surging as builders place their bets on rental Armageddon. While a few people can’t wait to dive into mega debt for a crap shack, others are simply renting either out of necessity or by choice. In fact, renting over the last decade has been the choice many have made (out of necessity or free will) contrary to the crap shack enthusiasts trying to talk up their poorly built piece of junk as some kind of diamond in the rough. Builders with deep pockets are betting on a continuation of the rental trend. It should also be no surprise that this decade saw a major surge of the “single family home” as rental unit.

...

http://www.doctorhousingbubble.com/nation-of-renters-household-us-formation-renters-home-owners/

And, of course, "down" is relative:

http://www.doctorhousingbubble.com/san-francisco-real-estate-median-price-new-record-tech-wealth-down-payment-sf-real-estate/

Lychee2

(405 posts)Financial writing is like that.

Response to Purveyor (Original post)

Skittles This message was self-deleted by its author.