Subprime Auto Bond Delinquencies Highest in 20 Years, Says Fitch

Source: Bloomberg

March 14, 2016 — 4:21 PM EDT

Delinquencies on subprime auto debt packaged into securities reached a high not seen since October 1996, as late payments continued to worsen in February, according to Fitch Ratings.

The number of car borrowers who were more than 60 days late on their bills in February rose 11.6 percent from the same period a year ago, bringing the delinquency rate to 5.16 percent, Fitch wrote Monday in a report. During the financial crisis delinquencies peaked at 5.04 percent, Fitch wrote.

“This isn’t an issue of whether the bonds will be repaid in full,” Kevin Duignan, global head of Fitch’s securitization group, said in an interview. Rather, it’s a question of whether investors will be faced with uncertainty that is inconsistent with high investment-grade ratings, he said.

Access to the securitization market is vital for small and mid-sized subprime lenders. If that’s blocked because of investor concerns, it could become difficult for these firms to fund themselves and finance their servicing operations.

Read more: http://www.bloomberg.com/news/articles/2016-03-14/subprime-auto-bond-delinquencies-highest-in-20-years-says-fitch

dixiegrrrrl

(60,010 posts)which showed us the collapsing economy soon afterward.

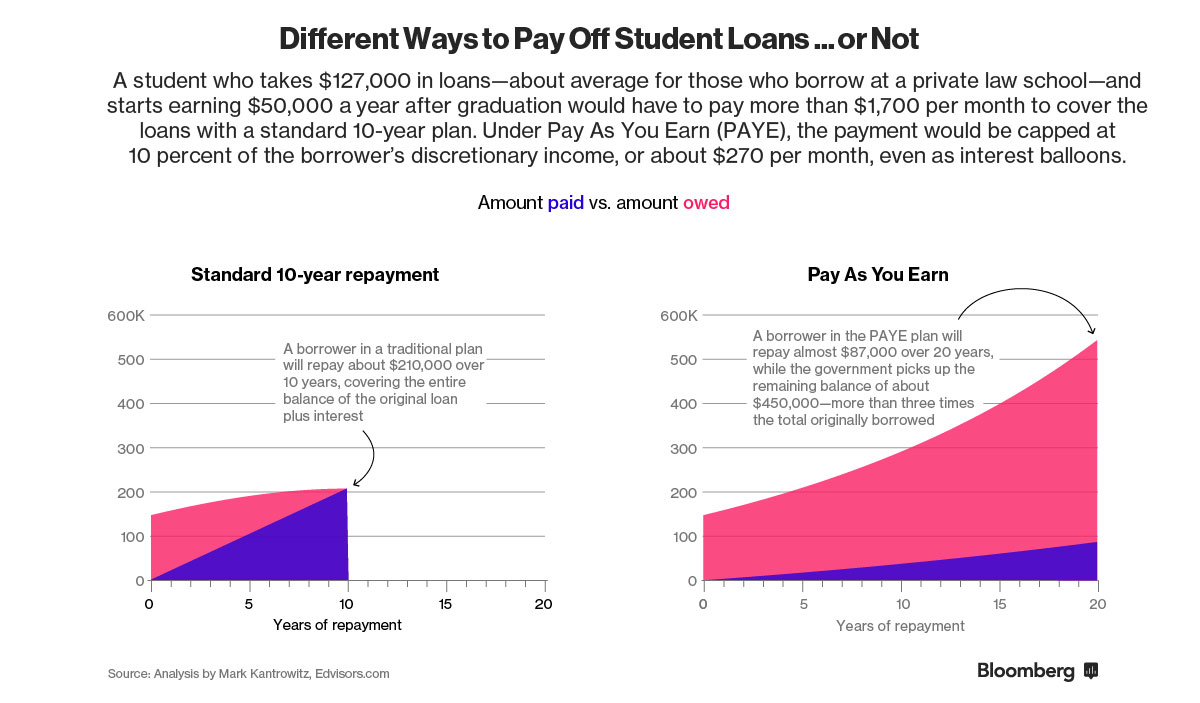

Student debts are also securitized and defaults rising.

Yo_Mama

(8,303 posts)will be borne by the taxpayers.

dixiegrrrrl

(60,010 posts)because the securitized bonds will fail?

Yo_Mama

(8,303 posts)If you will scroll down to this economic release from the federal reserve (G.19) to where it says "Consumer Credit Outstanding (Levels)", you will see a line for Federal Government. As of January 2016, the federal government, i.e. the taxpayers owned 972.5 billion, just shy of 1 trillion, of consumer credit, which is student debt. Somewhere around 25-30% of it will not be repaid.

A surprising number of the income-based payers aren't even paying the interest, and very many will not repay principal plus interest. The taxpayers are due to shoulder all those losses.

This spring the total will rise to over 1 trillion.

People have no idea how many of these loans will be written off:

http://www.bloomberg.com/news/features/2015-08-06/asking-everyone-s-rich-uncle-to-pay-for-school

valerief

(53,235 posts)couldn't exploit it to get richer. Tranche bespoke opportunities, anyone?

http://theeconomicsavant.org/2016/01/27/betting-against-the-auto-loan-market/

Xolodno

(6,390 posts)...this will also collapse car prices.

cstanleytech

(26,280 posts)now cannot afford a decent 2nd car even though we need one especially since we live out in the sticks and if we dont have a car we are completely screwed in getting anyone to work since there is no bus or rail service in this area at all and taxis cost an arm and a leg.

Xolodno

(6,390 posts)If you can get a car loan, yes. But in a situation where car value drops like a lead brick, they are less likely to do so. They probably won't even look at you unless you have a significant down payment.

If you work in the auto industry, no. Less demand will force the industry to cut production which will result in layoffs. Dealerships will close as well, which will also reduce the taxes local municipalities collect.

With less people on the road, less fuel consumption (which is a plus) but reduced excise tax money collected for the federal government, which is used for upkeep on our roads....which means, less highway maintenance/construction contracts....and road construction companies also dialing back and laying off.

mahatmakanejeeves

(57,379 posts)In a nutshell, the plan amounted to buying running cars and destroying the engines.

The result: used cars became a scarce commodity, and the prices of the remaining cars on the market went up. Some people were priced out of the market. Tough luck, people who didn't want to spend a lot of money on a used car. The walking will do you good.

Edited from original title: "Cash for Clunkers": Worst. Gummint. Plan. Ever.

Xolodno

(6,390 posts)Government takes a stake in GM, then subsidizes new car purchases by buying out old cars (and selling the scrap), government then exits GM with a profit.

If you were planning to buy a new car already, it was a "win".

Given that the average age of a car is 11.5 years, it did effectively wipe out the inventory of the used car market. Had to buy another car recently (I hate doing that, feels like I'm throwing money away)...the price wasn't that much lower than a new one. Was actually considering it for awhile, but I was buying via "no haggle" and the thought of spending 6-10 hours at a dealership haggling made me decide it wasn't worth it.

Yo_Mama

(8,303 posts)The low loss rates on some very crappy loans have been the result of high recoveries, and if second hand auto prices begin to fall, then recoveries will worsen.

http://www.cargurus.com/Cars/price-trends/

Yo_Mama

(8,303 posts)Defaults have mounted very quickly, and credit at the dealers will have to be tightened to deal with it.

houston16revival

(953 posts)and repair them mostly myself, no engine or tranny work.

Wouldn't trade them for a car loan.

litlbilly

(2,227 posts)the barrel anyway. Wow, they ran out of bad housing subprimes, student loan subprimes, now bad car loans. We are so screwed cause we never recovered from 08 and its now much, much worse.

LiberalArkie

(15,708 posts)instead of the government doing it.

litlbilly

(2,227 posts)Igel

(35,296 posts)Bundling really ramped up because small banks following government suggestions loaned out money. But, being small banks, they quickly loaned their cash and had a lot of mortgages to sit on.

By bundling them in tranches they could sell them off and get more money to loan. It was a way of siphoning money from the bond market, flush with liquidity, into the lending market, which had less.

Now a lot of banks and companies have a lot of liquidity, but aren't making these loans. instead, car finance companies are. They have shallower pockets and use the same siphon mortgage companies used.

It's not just subprimes that are subprime that undergo this. In fact, often the tranches can be subprime on decent loans. payments go to the top ranked tranches first, and the bottom ones are the last to be paid.

Subprimes fail more often for a few reasons. They're high risk, so subprime. Or they're people who might qualify for better loans and are offered subprimes instead--they pay higher interest for no good reason, but aren't savvy enough to know better. Etc.

PSPS

(13,588 posts)Trust Buster

(7,299 posts).

shadowmayor

(1,325 posts)Lather, rinse, repeat as Greenspan might say. The real question is why are these loans allowed to be securitized and bundled and sold again in the first place? Personal responsibility? How about structural responsibility. WTF - do we learn anything from our previous mistakes?