Cash-Strapped Connecticut Wants to Tax Yale Endowments

Source: Bloomberg

March 23, 2016 — 1:28 PM EDT

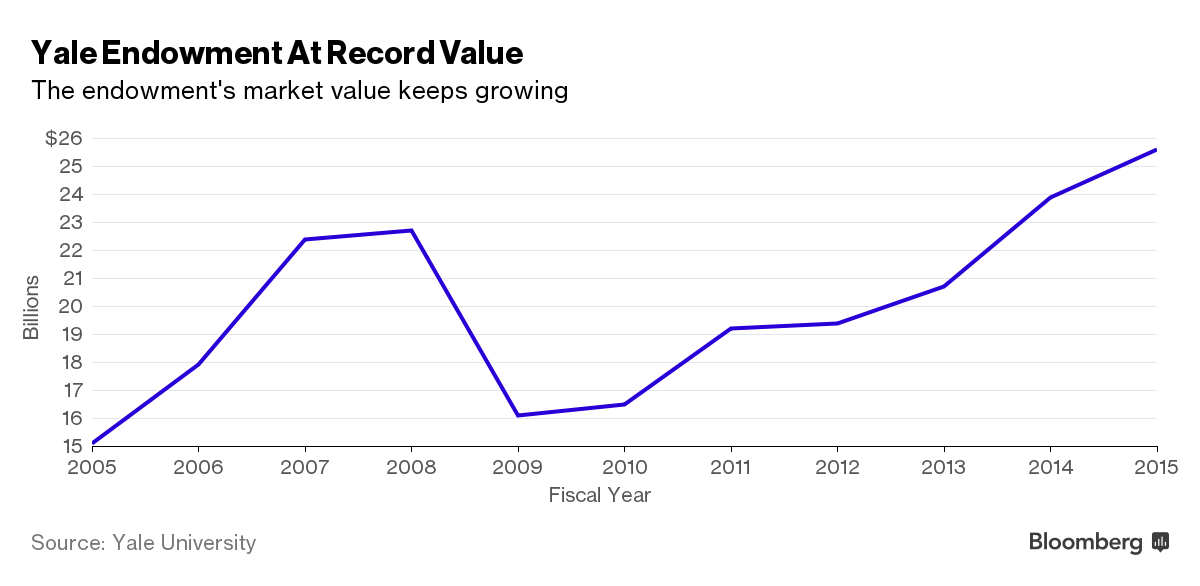

*School fund posted 11.5 percent gain in 2015 fiscal year

*New Haven school endowment is second biggest behind Harvard

Yale University’s endowment earned $2.6 billion in investment gains in fiscal 2015. A proposed bill in the Ivy League school’s home state of Connecticut is eyeing a share of the bounty as a source of revenue.

Schools with funds of $10 billion or more -- affecting Yale only -- could face a tax on endowment income, according to legislation introduced this month. Yale’s record $25.6 billion fund is the second largest in U.S. higher education, behind Harvard University’s $37.6 billion.

The richest college endowments, many at their highest values ever, also have drawn scrutiny from federal lawmakers. Last month, the U.S. Senate Finance and House Ways and Means committees sent a joint inquiry to the richest 56 private schools about endowments, seeking to understand the impact of their tax-exempt status on the price tag of higher education, among other issues.

Connecticut is facing a $266 million shortfall for fiscal 2016, according to the state Office of Fiscal Analysis, and taxing the endowment’s earnings could help close the gap.

Read more: http://www.bloomberg.com/news/articles/2016-03-23/yale-endowment-tax-proposal-eyed-by-cash-strapped-connecticut

mrmpa

(4,033 posts)I've a few private colleges here in western Pennsylvania. One in particular is constantly in the news with its start ups, lawsuits (where they win) in regard to patent infringements. A lot of these lawsuits have been over 35m won by the university. I just have difficulty in seeing a private non-profit as being non-profit when it's starting companies, gaining income from patents, etc.

I don't see a lot of their money going toward tuition abatement for its students, it just seems to keep accumulating it.

SoapBox

(18,791 posts)Isn't Conneticut one of those places that has banks and/or credit card companies? Or am I dreaming of another state?

...if they are there, how about taxing their worthless asses.

mnhtnbb

(31,384 posts)SoapBox

(18,791 posts)From Wilipedia:

https://en.m.wikipedia.org/wiki/Connecticut

Manufacturing, the third biggest industry at 11.9% of GDP, is dominated by Hartford-based United Technologies Corporation or UTC, which employs more than 22,000 people in Connecticut.[153] Lockheed Martin subsidiary Sikorsky Aircraft operates Connecticut's single largest manufacturing plant in Stratford,[152] where it makes helicopters. Other UTC divisions include UTC Propulsion and Aerospace Systems, including the jet-engine maker Pratt & Whitney, and UTC Building and Industrial Systems.[154]

Other major manufacturers include the Electric Boat subsidiary of General Dynamics, which makes submarines in Groton;[155] and Boehringer Ingelheim, a pharmaceuticals manufacturer with its U.S. headquarters in Ridgefield.[152]

Connecticut was an historical center of gun manufacturing, and, as of December 2012, four gun-manufacturing firms, Colt, Stag, Ruger, and Mossberg, employing 2,000 people, continued to operate in the state.[156] Marlin, by then owned by Remington, closed in April 2011.[157]

A report issued by the Connecticut Commission on Culture & Tourism on December 7, 2006, demonstrated that the economic impact of the arts, film, history and tourism generated more than $14 billion in economic activity and 170,000 jobs annually. This provides $9 billion in personal income for Connecticut residents and $1.7 billion in state and local revenue.[158] Two casinos, Foxwoods Resort Casino and Mohegan Sun, number among the state's largest employers;[159] both are located on Native American reservations in the eastern part of Connecticut.

Nonprofit organizations register in Connecticut under the local statutory provisions and therefore affect taxation and governance mechanisms. For instance, the headquarters of the Connecticut Food Bank, now located in Wallingford, were previously located in New Haven, where the non-profit was established in the early 1980s.[160]

Connecticut's agricultural sector employed about 12,000 people as of 2010; with more than a quarter of that number involved in nursery stock production. Other agricultural products include dairy products and eggs; tobacco; fish and shellfish; and fruit.[161]

Oyster harvesting was historically an important source of income to towns along the Connecticut coastline. In the 19th century, oystering boomed in New Haven, Bridgeport and Norwalk and achieved modest success in neighboring towns. In 1911, Connecticut's oyster production reached its peak at nearly 25 million pounds of oyster meats. This was, at the time, higher than production in New York, Rhode Island, or Massachusetts.[162] During this time, the Connecticut coast was known, in the shellfishing industry, as the oyster capital of the world. Until 1969, Connecticut laws enacted before World War I restricted the harvesting of oysters in state-owned beds to vessels under sail. These laws prompted the construction of the oyster sloop style vessel to last well into the 20th century.[163] The sloop Hope, completed in Greenwich in 1948, is believed to be the last oyster sloop built in Connecticut.

djg21

(1,803 posts)Is owned by Yale and is tax exempt. This poses real difficulties for the city. The University should contribute to the tax base.

mnhtnbb

(31,384 posts)financial aid package at Yale School of Drama for his three year Master's program. He would never have been able

to afford it, otherwise. As it is, we help with his living expenses and because his

income from work/study was over the threshold this year for someone to be

a dependent, we were unable to deduct on our federal taxes any of the support we give him

for his living expenses. Yale's financial aid pays most of his tuition.

He has one more year to finish his master's.

marble falls

(57,079 posts)Lurks Often

(5,455 posts)GE Capital picked up and left CT for Boston after the CT Legislature passed some bill that would have impacted GE Capital.

Many of the gun companies have their manufacturing either partially or entirely in other states, the same applies to Pratt & Whitney. The insurance companies have also grown outside of CT and have made noises about moving more or all operations out of CT if their taxes are raised anymore.

madville

(7,408 posts)last I read.

Lurks Often

(5,455 posts)the CEO made some comments to the effect that Aetna would keep all options open if further state legislation impacted operations in CT.

Casino revenues are down, more people and more companies are leaving then coming into the state and those companies in CT generally are doing any expanding in other states.

CT is also going to layoff a large number of state employees. A couple of more elections cycles like this and the Republicans might even the state house and governorship.