U.S. Economy Grew 1.4% in Fourth Quarter, Supported by Consumers

Source: Bloomberg

March 25, 2016 — 8:30 AM EDT

The U.S. economy grew in the fourth quarter at a faster pace than previously estimated, supported by stronger household spending that’s helping cushion the expansion from weakness overseas.

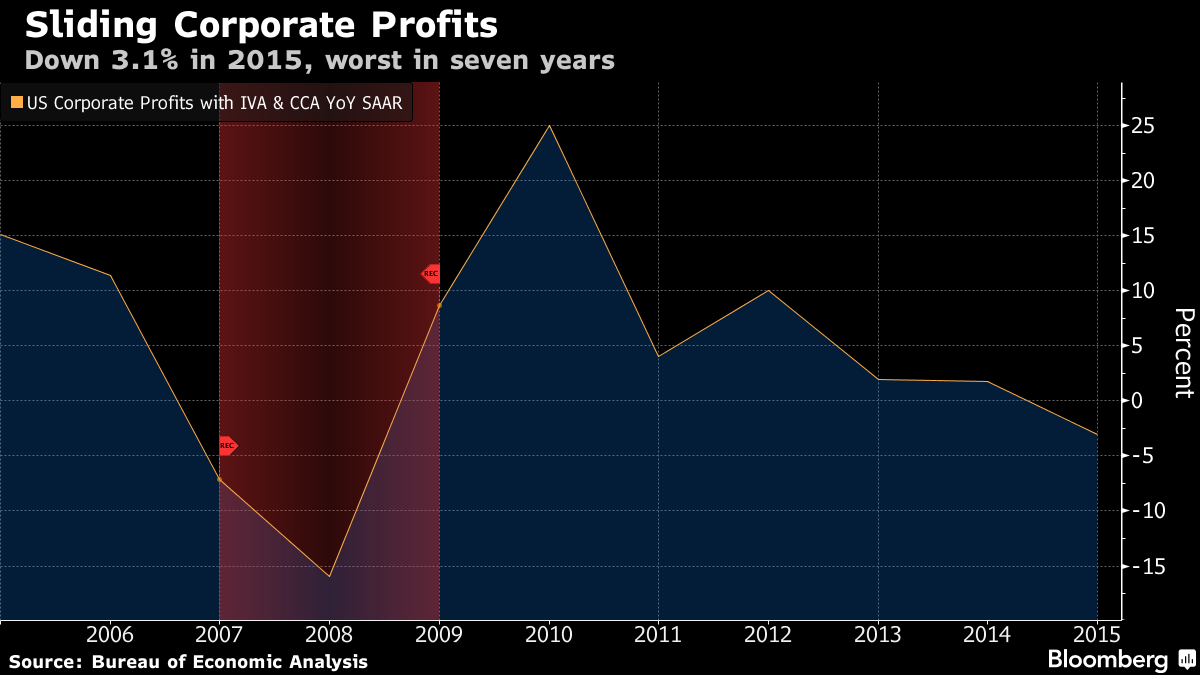

The revised 1.4 percent increase in gross domestic product, the value of all goods and services produced, compares with the Commerce Department’s previous estimate of 1 percent, according to figures issued Friday. The economy grew 2 percent in the third quarter. The report also showed that corporate profits dropped in 2015 by the most in seven years.

The earnings slump illustrates the limits of an economy struggling to gather steam at the start of this year. Some companies, encumbered by low commodities prices and sluggish foreign markets, are cutting back on investment while a firm labor market and low inflation encourage households to keep shopping.

“It’s really U.S. consumers who are powering the global economy forward at this point,” said Gus Faucher, an economist at PNC Financial Services Group Inc. in Pittsburgh. At the same time, “there are pressures on businesses in terms of the stronger dollar, rising labor costs and slowing productivity growth” even as a rise in energy prices will help ease that drag for oil producers.

Read more: http://www.bloomberg.com/news/articles/2016-03-25/u-s-economy-grew-1-4-in-fourth-quarter-supported-by-consumers

forest444

(5,902 posts)"If you want to live like a Republican, you should vote for a Democrat."

SoLeftIAmRight

(4,883 posts)no more third way

forest444

(5,902 posts)When Clinton caved to that cretin Phil Gramm and the money laundry lobby in 1999 by dismantling Glass-Steagall, he set in motion the very events that cost the average U.S. household 40% of their net worth.

We all make bad calls, sure (though he was warned not to sign it); but here we are, all these years later, and his wife's still at it. I hope she can still find it in herself to reconsider if she she's actually elected.

cstanleytech

(26,273 posts)atleast thats what this article claims http://www.politifact.com/truth-o-meter/statements/2015/aug/19/bill-clinton/bill-clinton-glass-steagall-had-nothing-do-financi/

forest444

(5,902 posts)There's no question that Gramm-Leach-Bliley facilitated the crisis by allowing banks to return to the 1929 model of using their assets (mostly deposits) to effectively gamble. But then, it's been pointed out that they were already doing that.

While technically true, if you look at the value of derivatives contracts outstanding (the main and most destructive instrument by which banks gambled in the Dubya years), you'll see that it was a steady yet controlled uphill climb until 2004 - and then a veritable boom until, of course, the derivatives bubble popped.

There's no question Gramm-Leach-Bliley paved the way for that. What it did not do, is to make it absolutely inevitable (which is where I'm with you).

Bush SEC director (and major congressional whore) Chris Cox's decision to shutter the SEC office that oversaw the derivatives trade in 2004 was what really made it inevitable (as the data in fact shows).

cstanleytech

(26,273 posts)to abolish the remaining pieces of Glass–Steagall didnt hurt anywhere nearly as much as the whittling away that had been done to the law over the decades prior to when Clinton assumed office.

RATM435

(392 posts)This Theory Explains Why the U.S. Economy Might Never Get Better.

http://time.com/4269733/secular-stagnation-larry-summers/