Goldman EToys Settlement Approved as Judge Refuses to Seal Terms

Last edited Fri Sep 20, 2013, 06:54 PM - Edit history (1)

Source: Bloomberg Business Week

Goldman Sachs Group Inc. (GS:US), this year’s biggest underwriter of U.S. equity offerings, received court approval of a $7.5 million settlement with creditors of defunct EToys Inc., according to an attorney for the creditors.

U.S. Bankruptcy Judge Mary Walrath in Wilmington, Delaware, today also denied a request to seal terms of the accord, which ends more than a decade of litigation, Julia B. Klein, a lawyer for the creditors, confirmed in an e-mail. The creditors claimed the bank botched the online toy retailer’s initial public offering by pricing the shares too low.

Goldman, based in New York, denied any wrongdoing or liability and settled to “avoid further expense and distraction,” according to court documents. The settlement was reported earlier by Reuters.

Both sides sought to keep the terms undisclosed, claiming they contained “confidential and sensitive” material. The U.S. Trustee, an arm of the Justice Department that monitors bankruptcy cases, argued that the terms should be made public.

Read more: http://www.businessweek.com/news/2013-09-19/goldman-etoys-settlement-approved-as-judge-refuses-to-seal-terms

PLEASE TAKE NOTE - Mitt ROMNEY "retroactively" seeks to bury the eToys case/story!

- - Democratic Underground is blessed with the fact that yours truly trusts this realm completely. Sad to say that this is the only place I feel this way. The blessing for DU, on this particular story, is the fact that yours truly is the wrench in the works of Goldman Sachs and Bain Capital's efforts in organized crime.

It is a fact of public docket record that my company - Collateral Logistics, Inc., ("CLI"

Mitt Romney lied on his Office of Government Ethics 278 Form Addendum - to bury the eToys case.

- -

Goldman Sachs and Bain Capital are engaged in Racketeering, to destroy eToys.com

- - It really is a simple story of organized crime being able to get away with it due to federal corruption to benefit a POTUS wannabe. The proof of bad faith is already in the public docket record and discussed by the media everywhere. The "Disgorge Motion" of Traub, Bonacquist & Fox ("TBF"

That's BANKRUPTCY FRAUD!

- - You can see the Wall Street Journal story of July 2005 "eToys investors claim conflict at law firm". Then jump forward to Newt Gingrich's "King of Bain" documentary (which was a 'Red Herring' decoy funded by Sheldon Adelson & Produced by a Romney aid). King of Bain notes that Romney/ Bain Capital is ruthless in the cases of Stage Stores and Kay Bee; but skips the all important eToys case.

Additional information can be found in the September 2012 Rolling Stone cover story "Greed and Debt". That article is written by activist Matt Taibbi of his detailing the "True Story of Mitt Romney and Bain Capital".

- - Matt Taibbi also goes into the cases of Stage Stores and Kay Bee; and details the more specious issues of how Romney got his funding of Stage Stores from junk bond fraudster Michael Milken - because the judge presiding over Milken's case had a wife who was profiting from Romney's Stage Stores deals. Then Taibbi goes into how Michael Glazer as CEO of Kay Bee paid himself $18 million and Bain Capital $83 million; before filing bankruptcy of Kay Bee.

Taibbi missed the fact Michael Glazer was also a Director at Stage Stores (who is now CEO).

Working as director's assistant in Stage Stores is Barry Gold who then hired Paul Traub's TBF law firm. Mr. Traub failed to disclose many conflicts of interest to the court of Stage Stores and got caught. He was forced to file a Bankruptcy Rule 2014/2016 Affidavit as a Supplemental Disclosure.

- - Paul Traub admitted he knew Barry Gold and Jack Bush (co-Director with Michael Glazer); but Paul Traub kept his mouth sealed about other Conflict of Interest issues and got away with fraud. The Bankruptcy Code & Rules, as written by Congress - mandated that the court expunge Paul Traub's TBF firm from the case.

Instead they punished the stock holder Dov Avni for blowing the whistle (with a $380,000 fine).

[br][hr][br]

eToys case provides proof of Federal Racketeering by Goldman Sachs & Bain Capital.

- - In 1999, the Morris Nichols Arsht & Tunnell ("MNAT"

Also in 1999, eToys initial public offering ("I.P.O."

But journalist Joe Nocera found Proof of Goldman Sachs knowledge eToys stock was worth $80.

--- In 2005, MNAT confessed it lied about knowing Goldman Sachs, in order to become the Delaware Bankruptcy Court approved counsel for the eToys Debtor. Paul Traub also confessed his firm lied about being connected to Barry Gold, when MNAT and Traub placed Barry Gold inside eToys as the CEO.

These schemes allowed Goldman Sachs to Destroy eToys and Bain Capital to steal eToys for pennies.

- - When yours truly turned down a bribe by the bandits and reported them, that is when Mitt Romney (purportedly) RESIGNED as CEO of Bain Capital in August 2001 and "retroactively" retired back to February 11, 1999. At the same time, the pirates upped the ante in Kay Bee Toys. As is reported Michael Glazer paid himself $18 million and Bain Capital $83 million, then Glazer filed bankruptcy of Kay Bee Toys.

MNAT represents Bain Capital concerning the $83 million fraud and Paul Traub (believe it or not) actually had the unmitigated gall to ask the court over the Kay Bee case, to be the one to prosecute Glazer and Bain Capital. As par for the course, Paul Traub fails to inform the Delaware Bankruptcy Court of his direct connections (conflict of interest) with Bain Capital and Michael Glazer. You know these are crimes; but why aren't there any arrests? That is because of Mitt Romney's other (vastly more important) "retroactive" secret. As remarked above, Mitt Romney claims he resigned "retroactively" from Bain Capital as CEO in August 2001; back to February 11, 1999. That is not only - Coincidentally - the same exact time of The Learning Company, Stage Stores, Kay Bee and eToys frauds. It is also the same period of time that Colm Connolly was partner of MNAT.

On August 2, 2001, Colm Connolly became the United States Attorney in Delaware;

who then buried (for 7 years) any investigation/ prosecutions of the massive Perjury & Frauds.

[br][hr][br]

Reuters Reports that Goldman Sachs FINALLY settles eToys case for $7 million.

- - As is obvious from the facts in the public docket record, there are many issues of Perjury, Fraud and Federal Corruption in these cases. Because Al Capone seeks to settle with Frank Nitti on how much they can keep from the hundreds of millions of dollars they stole and how much they will give back (settle) - this is obviously a BOGUS deal.

Reuters story is "Goldman Sachs finally ends litigation over 1999 eToys IPO"

- - The Bloomberg BusinessWeek and Reuters stories detail the fact that Judge Mary F Walrath said NO to sealing the documents and Yes to paying the law firms (Pomerantz and Wachtel) that did the Settlements. Don't know why the judge is now deciding to be half ass about the affair. All along before, her Honor {sic} has not gone by the law. She actually ruled that 34 acts of lying under oath is not Perjury and that MNAT's forgery stating yours truly waived his CLI rights to be paid $3.7 million is valid.

Be that as it may, Reuters chose a poor wording for the title. It ain't over tills it's over - and yours truly has a birthday on October 31, 2013. Will see who gets spooked about what - at that time! Not everyone in the federal system of justice is corrupt. It only takes one Eliot Ness "Untouchable" to bring down a tax cheat Capone.

Yeah, I know - apropos!

[br][hr][br]

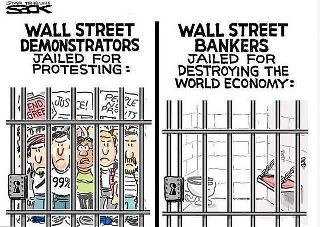

These bandits think they are Too Big To Fail

and

Too Big to Jail

but I'm going to try to change all of that - and makes this photo reverse the story.

[br][hr][br]

[br]

Laser's Petters-Fraud website has court documents LINKS providing PROOF of DOJ Cover Ups )

Dustlawyer

(10,494 posts)down their case to a misdemeanor and got 3 years probation and a $200,000 fine for destroying the evidence that their experimental cement NEVER PASSED THEIR OWN TESTS. I don't even have time to go into BP, Ken Feinberg, Eric Holder et Al., it's time for bed!

We now have American Exceptionalism in corruption!

laserhaas

(7,805 posts)I'm better versed than most in the BP issues;

including the fact that Halliburton acquired the "Clean up" company

weeks before the accident happened!

Dustlawyer

(10,494 posts)referred to as the "Dust Dockets." We were against the same 35-40 defense attorneys on 10's of thousands of cases. When I was trying to find a screen name I figured I would be the only one to claim it and I was right, who else would want it, lol.

By the way, 3/23/2005 was the day that BP Texas City blew up killing 15 and injuring 6,000. The media still use BP's figure of a couple of hundred. I guess BP still never learned to count considering the problems with how much oil leaked. Look up "Eva Rowe" the young lady I signed up that lost both her mom and dad in the explosion. She was on 60 Minutes and numerous other shows. That woman was made of steel even though she was only 20 when it happened. One day I will get the time to write the book and screen play (she wants me to do it for some reason). They are the coldest company I have come across and that is saying something considering all the asbestos companies knew in 1932 what their products were doing to their own workers and the end users!

laserhaas

(7,805 posts)NO - 1

Where are you licensed to practice?

laserhaas

(7,805 posts)This case is Romney and Paul Traub.

They are much more expendable.

Especially since they are doing SO much - TOO often;

putting the entire "good ole boys" network at risk

GREATLY!

![]()

PuraVidaDreamin

(4,099 posts)That is some Sweet Stuff right there!

May they all start tumbling down!

laserhaas

(7,805 posts)Congress designed the "civil" Racketeering Influenced Corrupt Organizations ("RICO"![]() ACT of 1970 to help handle situations such as Al Capone's Racketeering over Chicago. Who was (coincidentally) brought down concerning Tax evasion.

ACT of 1970 to help handle situations such as Al Capone's Racketeering over Chicago. Who was (coincidentally) brought down concerning Tax evasion.

How apropos is that?

Only only needs two felony violations within a protracted period of time (usually more than 2 years, less than 10) - to make a successful case for Civil Racketeering. Fortunately for our case, we have confessions to a plethora of "Predicate Acts" - as is required for RICO. However, the admittance's were never properly addressed; because all the bandits and despots thoroughly "believed" Romney was going to become President of the United States.

But he Didn't Make it!

laserhaas

(7,805 posts)Under billionaire power, influence and obfuscating banter,

Romney is going to twist things to get his way - and clear the public off "his" beach.

It is a shame that money & power can buy just about anything...

laserhaas

(7,805 posts)NY Times DealB%k (purportedly having a former relationship with Goldman SAchs) - reports on the recent settlement

(NOTE: DEALBOOK refused to permit yours truly from commenting on the story)

http://dealbook.nytimes.com/2013/09/19/goldman-settles-lawsuit-over-etoys-i-p-o/

Firedoglake has this story

"Mistakenly Released Documents Reveal Goldman Sachs Screwed IPO Clients"

Now Joe Nocera has obtained, due to a clerical error, documents detailing Goldman Sachs screwing its IPO clients. Goldman’s clients, eToys, are in the midst of a lawsuit against Goldman. eToys is claiming Goldman conspired to keep the price of the IPO low to benefit their investment bank clients who gave Goldman a kickback in return. eToys later went out of business partly due to lacking capital that it could have raised in a more honest IPO.

Recently, however, I came across a cache of documents related to the eToys litigation that seem to tilt the argument in favor of the skeptics. Although the documents were supposed to be under seal, they were sitting in a file at the New York County Clerk’s Office, available to anyone who asked for them. I asked..

What they clearly show is that Goldman knew exactly what it was doing when it underpriced the eToys I.P.O. — and many others as well. (According to the lawsuit, Fitt led around a dozen underwritings in 1999, several of which were also woefully underpriced.) Taken in their entirety, the e-mails and internal reports show Goldman took advantage of naïve Internet start-ups to fatten its own bottom line