Study: 35 percent in US facing debt collectors

Source: AP-Excite

By JOSH BOAK

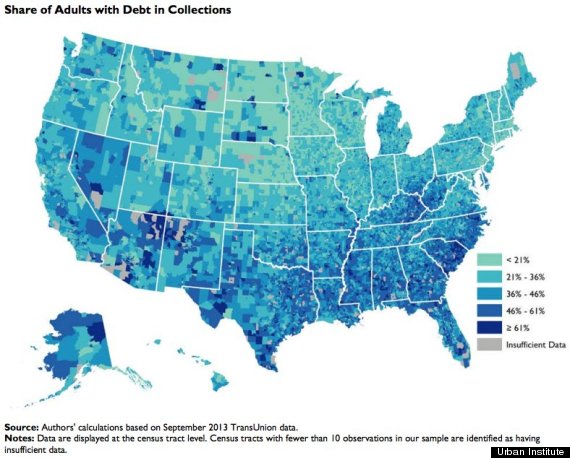

WASHINGTON (AP) — More than 35 percent of Americans have debts and unpaid bills that have been reported to collection agencies, according to a study released Tuesday by the Urban Institute.

These consumers fall behind on credit cards or hospital bills. Their mortgages, auto loans or student debt pile up, unpaid. Even past-due gym membership fees or cellphone contracts can end up with a collection agency, potentially hurting credit scores and job prospects, said Caroline Ratcliffe, a senior fellow at the Washington-based think tank.

"Roughly, every third person you pass on the street is going to have debt in collections," Ratcliffe said. "It can tip employers' hiring decisions, or whether or not you get that apartment."

The study found that 35.1 percent of people with credit records had been reported to collections for debt that averaged $5,178, based on September 2013 records. The study points to a disturbing trend: The share of Americans in collections has remained relatively constant, even as the country as a whole has whittled down the size of its credit card debt since the official end of the Great Recession in the middle of 2009.

FULL story at link.

FILE - In this May 9, 2012 file photo, a Visa credit card is tendered at the opening of the Superdry store in New York's Times Square. More than 35 percent of Americans have debts and unpaid bills that have been reported to collection agencies, according to a study released Tuesday, July 29, 2014, by the Urban Institute. (AP Photo/Richard Drew, File)

Read more: http://apnews.excite.com/article/20140729/us--debt_study-a299222eb2.html

randys1

(16,286 posts)JESUS H CHRIST

if this is true, dear god, when are people going to wake up

you are being ROBBED!!!!!!!!!!!!!

DeSwiss

(27,137 posts) - And it is the holder's stated value that counts in-trade.

- And it is the holder's stated value that counts in-trade.

For instance, I just hit the ATM machine in this hotel for forty bucks. And in doing so I joined the Manhattan book editor, the black Carib village fisherman in Dangriga, Central America and the taxi driver in Capetown, South Africa in performing the same activity. We all stand submissively before the global ATM machine network like trained chickens pecking the correct colored buttons to release our grains of corn. Freedom, and to a large extent joy, as we understand it in our common technoculture, is mostly just the grid's monetized consumer offerings, each with its own type of packaging, its own technologically produced overlay of commercial skin.''

~By Joe Bageant, April 04, 2008

The Audacity of Depression

Warren Stupidity

(48,181 posts)Basically it is the same sad story we've been learning over and over again: the victims of reagonomics are the Republican voting base. They vote over and over again to screw themselves, then angry and disaffected from society, they are victimized by religious and political (and combined theocratic) leaders who manipulate them to vote against their own best interests again. Rinse and repeat. No end in sight.

LynneSin

(95,337 posts)

nolabels

(13,133 posts)Like are they sure some of those regions even have populations ![]()

Just think about all those Mojave desert tortoises with slow pays on their credit report

LynneSin

(95,337 posts)and thus alot of poverty.

Same thing with the south - areas where poverty is common place.

And, btw, those places are probably overrun by poverty businesses like Pay-Day Loans, Title Loans and Rent-to-Own businesses.

santamargarita

(3,170 posts)packman

(16,296 posts)low wages, poverty, low education and being in debt. A new form of slavery for both the blacks and whites. Hey, keep electing your slavemasters.

BUT- if one wanted a true economic revolution then stop paying on your unsecured credit card. If 1/3 of Americans stopped paying, you would see some change rather quickly.

C Moon

(12,210 posts)closeupready

(29,503 posts)Prohibiting debtor's prisons in the US?

I'm not a lawyer, but sometimes you read in various places, "you can't be jailed for debt" - and yet, this is precisely what is happening in places like Minnesota or Missouri where courts are jailing people for failing to appear in court in cases relating to ... DEBT!

Seems to me that if a community consumer finance organization could show that courts are singling out debtors in jailing them for nonappearance, then if there IS a federal law against debtors' prisons, then a lawsuit could help reverse some of the damage that Republicans have wrought over the last 30 years.

C Moon

(12,210 posts)So, maybe there is still a chance of a revival...gulp.

I did find this that closely resembles what your are referring to...

http://usnews.nbcnews.com/_news/2013/04/05/17615662-modern-day-debtors-prison-alleged-in-ohio?lite

Modern-day debtors' prison alleged in Ohio

Several courts in Ohio are illegally jailing people because they are too poor to pay their debts and often deny defendants a hearing to determine if they're financially capable of paying what they owe, according to an investigation released Thursday by the Ohio chapter of the American Civil Liberties Union.

The ACLU likens the problem to modern-day debtors' prisons. Jailing people for debt pushes poor defendants farther into poverty and costs counties more than the actual debt because of the cost of arresting and incarcerating individuals, the report said.

"The use of debtors' prison is an outdated and destructive practice that has wreaked havoc upon the lives of those profiled in this report and thousands of others throughout Ohio," the report said.

closeupready

(29,503 posts)that:

>>courts had to hold a hearing to determine why people are unable to pay before sentencing them to incarceration.<<

If respondents in any US jurisdiction are being incarcerated because they failed to appear in court in response to a summons on a case relating to consumer debt (particularly if it can be shown that respondents in other types of civil cases are being allowed to ignore similar types of summons with impunity), then it seems to me that right there, you've got all you need to show that courts are violating this 1983 US Supreme Court ruling.

Then again, as I said, I'm not a lawyer, but can lawyers here tell me how my reasoning is not sound, if not?

C Moon

(12,210 posts)Adrahil

(13,340 posts)... if my local hospital has some issue with my insurance (in this case, a data entry error for my insurance number), they don;t even both calling me. They send it right to their collection agency.