Fed Delays Volcker Rule, Giving Wall Street Another Holiday Gift

Source: Huffington Post

WASHINGTON -- Christmas came early for Wall Street this year. The Federal Reserve on Thursday granted banks an extra year to comply with a key provision of the Volcker Rule, a move that gives financial lobbyists more time to kill the new regulation before it goes into effect.

The Volcker Rule is a key element of the 2010 Dodd-Frank financial reform law that bans banks from engaging in proprietary trading -- speculative deals that are designed only to benefit the bank itself, rather than its clients. Thursday's move by the Fed gives banks an additional year to unwind investments in private equity firms, hedge funds and specialty securities projects. The central bank also said it plans to extend the deadline by another 12 months next year, which would give Wall Street a two-year reprieve through the 2016 presidential election.

The Fed's delay comes less than a week after Congress granted Wall Street a reprieve from another reform that had been mandated by the 2010 Dodd-Frank financial reform law. The measure, known as the swaps push-out rule had eliminated federal subsidies for trading in risky derivatives -- the complex contracts at the heart of the 2008 banking meltdown. Bank watchdogs say the Volcker Rule delay adds insult to injury.

"Swaps pushout was a club," said Marcus Stanley, policy director for Americans for Financial Reform. "This is a stiletto."

Read more: www.huffingtonpost.com/2014/12/18/volcker-rule-federal-reserve_n_6351190.html

Goddamn the sons of bitches who continue to punch working families in the face.

Turbineguy

(37,313 posts)"Goddamn the sons of bitches who continue to punch working families in the face."

That's all they can do. They possess no useful skills.They are parasites who will kill the host.

salib

(2,116 posts)I suspect the Fed does not have this authority.

... the Fed is a private bank. It does not overrule Congress.

joshcryer

(62,269 posts)It must be modified thusly.

ozone_man

(4,825 posts)This whole slimy mess should be washed out to sea some day, the FED and the too big to fail banks.

jtuck004

(15,882 posts)

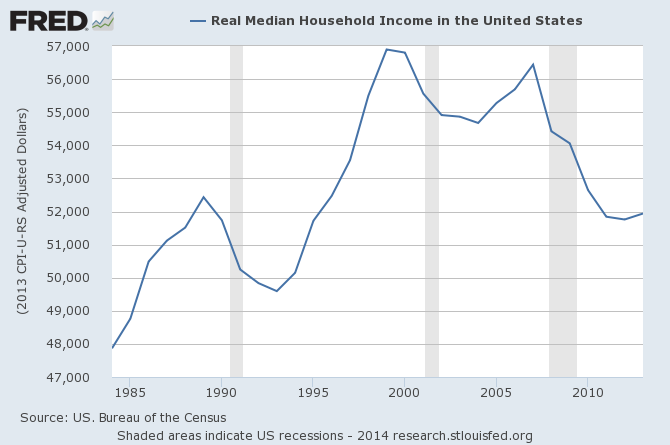

Trying to pay 2014 bills with 1996 income. More jobs that paid a living wage replaced with part-time jobs that don't than in any previous period, 10 million people dropped into poverty in the same period. Most, and their children, will be there the rest of their lives.

Banks reporting record profits. Must have someone on the inside.

RiverLover

(7,830 posts)From linked article~

"Six years after the fact, we have taken no significant action to reduce the Wall Street gambling or 'too big to fail' concentration that caused the 2008 crash.

If we can’t even implement the Volcker Rule, an extremely modest effort to stave off total disaster, then total disaster is exactly what we can expect."

http://www.huffingtonpost.com/2014/12/18/volcker-rule-federal-reserve_n_6351190.html

IronLionZion

(45,411 posts)Why punish their success? ![]()

Some regulators started monitoring financial firms for Volcker rule compliance already, even though they don't have teeth to enforce it yet they would at least be watching them I guess.