Detroit's Next Big Crash

By Editorial Board

Two amazing comebacks in Michigan dominated last week's news: that of Bernie Sanders, and that of the auto industry. Whether Sanders's lasts will be known soon enough. But there are already real questions about the industry's recovery, and the answers have profound implications not only for U.S. automakers but also for federal policy.

It's true, as Hillary Clinton boasted, 2015 was "the best year that the auto industry has had in a long time." Americans bought 17.5 million cars last year, breaking a 15-year record. But these rosy sales figures hide an alarming truth: The boom is being fueled by many temporary factors that could put automakers in the same vulnerable position they found themselves seven years ago.

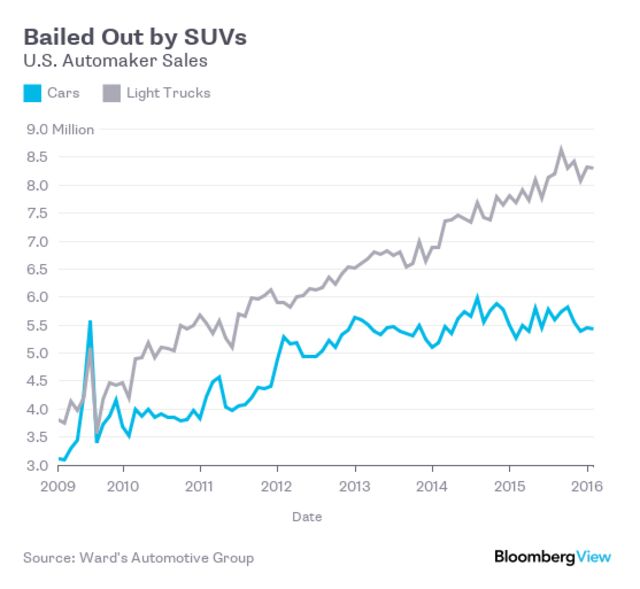

The most obvious of these is the price of oil, which dropped below $30 a barrel by the end of last year, lowering the price at the pump by nearly a dollar since 2014. While low gas prices don't necessarily lead to increased auto sales, they do influence the type of vehicles Americans buy: pickups and SUVs rather than fuel-efficient sedans. The sales boom has been driven almost entirely by such light trucks:

The three top-selling vehicles last year were Detroit's flagship pickups, while the top five non-trucks were all made by Japanese companies. When oil prices inevitably rise again, the same SUV addiction that laid U.S. carmakers low in the 2000s could threaten them again.

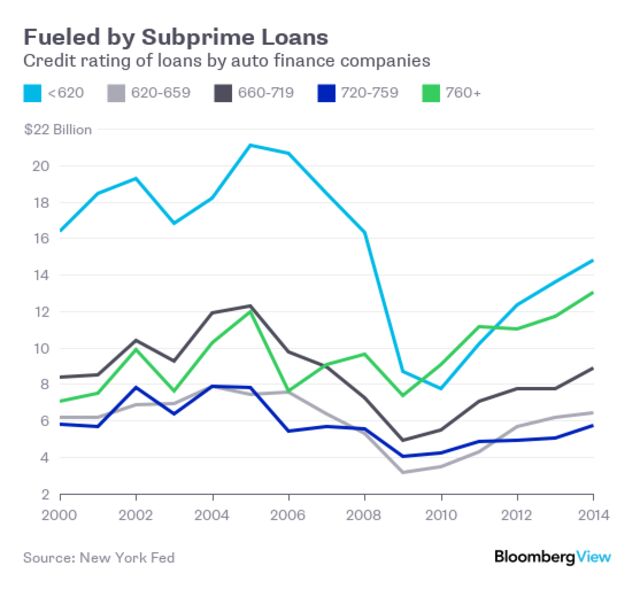

Car loans are another red flag, for two reasons: Consumers have been able to afford them largely because interest rates are low, but these rates, like oil prices, can be expected to eventually rise. And nearly one out of five new auto loans are being made to borrowers with low credit ratings. The automakers' own finance operations have become increasingly dependent on the subprime market:

more...

http://www.bloombergview.com/articles/2016-03-14/detroit-s-next-big-crash