Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Latin America

Related: About this forumNY-21: Pay-To-Play? Rep. Stefanik's Largest Donor is New York City Hedge Fund Elliott Management

Community (This content is not subject to review by Daily Kos staff prior to publication.)

Monday January 29, 2018 · 6:21 PM CST

Congresswoman Elise Stefanik (R) of New York State's North Country region has received $191,132 in contributions throughout her career from individuals associated with Elliott Management, the Manhattan hedge fund firm founded by vulture capitalist Paul Singer.

Throughout her tenure in Congress, Elise Stefanik, the Republican who represents most of New York State’s North Country region, has received $191,132 in campaign contributions from individuals associated with Elliott Management, the Manhattan hedge fund firm founded by “vulture capitalist” Paul Singer, according to data obtained from OpenSecrets.org. Thanks to Elliott Management and Paul Singer, during the 2014 election cycle, when Stefanik ran for the first time, she actually was the second-highest recipient of campaign contributions from hedge funds out of all 435 members of Congress that were elected that year, even topping now-House Speaker Paul Ryan. In 2016, Stefanik ranked third in hedge fund contributions in the House, trailing just Ryan and John Faso from the neighboring 19th Congressional District. Overall, over the past three cycles (2014, 2016, 2018), Stefanik is the second highest recipient of hedge fund contributions in the House, receiving $311,582, behind House Speaker Paul Ryan’s $311,582.

More:

https://www.dailykos.com/stories/2018/1/29/1736672/-NY-21-Pay-To-Play-Rep-Stefanik-s-Largest-Donor-is-New-York-City-Hedge-Fund-Elliott-Management

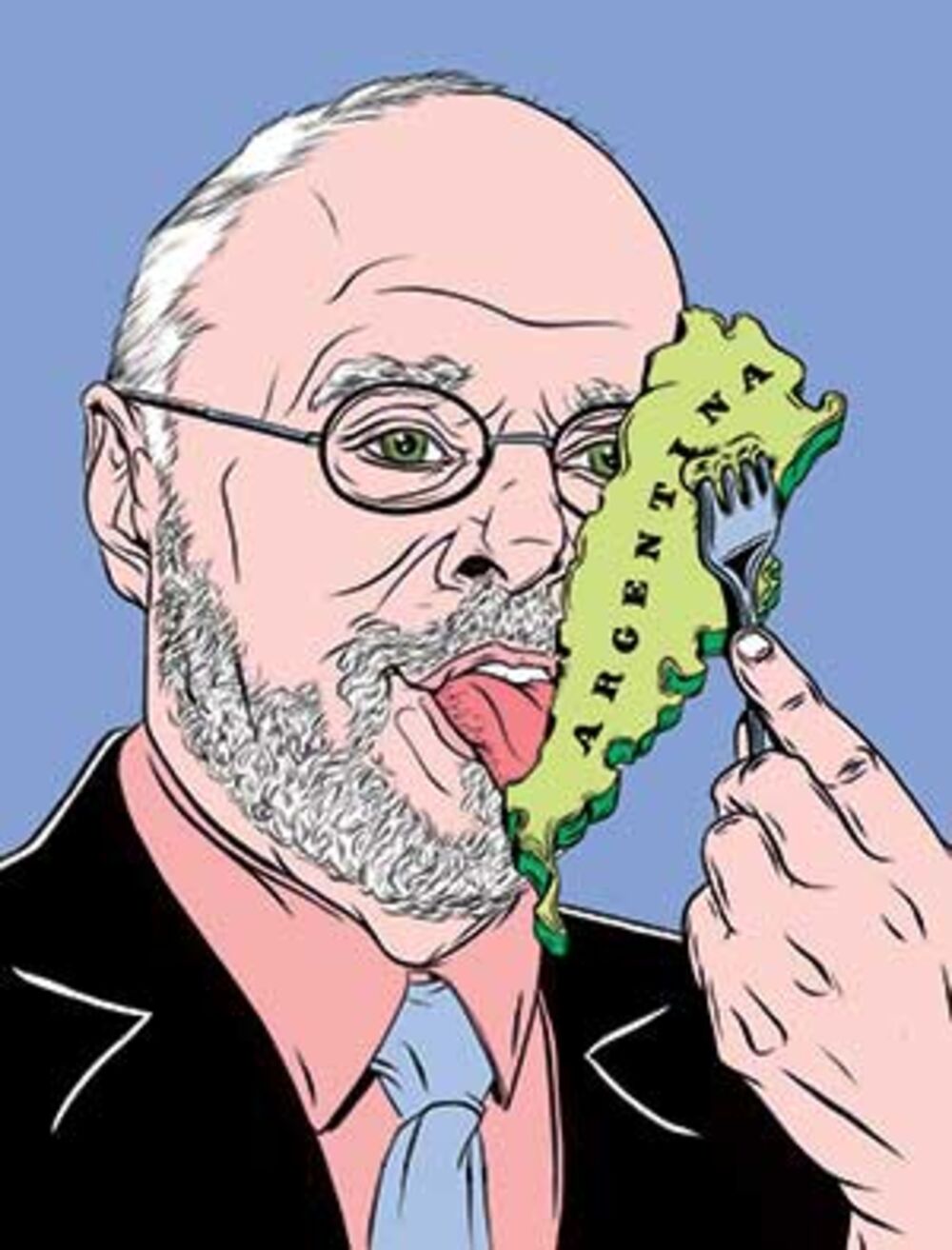

As you may recall, Paul Singer brought Argentina to its knees, infuriated the majority of sane Argentinian people, and used up all the oxygen a lot during the Presidency of Christina Fernandez de Kirchner.

His Wikipedia:

Paul Elliott Singer (born August 22, 1944) is an American billionaire hedge fund manager, activist, investor, vulture capitalist, and philanthropist, with a net worth of $3.5 billion according to Forbes.[2][3][4][5][6] His hedge fund, Elliott Management Corporation (EMC), specializes in distressed debt acquisitions.[7]:301[8] Singer is also the founder and CEO of NML Capital Limited, a Cayman Islands-based offshore unit of Elliott Management Corporation.[9]

Singer's philanthropic activities include financial support for LGBTQ rights.[10][11][12] He has provided funding to the Manhattan Institute for Policy Research,[13] is a strong opponent of raising taxes for the wealthiest 1% of taxpayers and opposes aspects of the Dodd-Frank Act.[13] Singer is active in Republican Party politics and Singer and others affiliated with Elliott Management are collectively "the top source of contributions" to the National Republican Senatorial Committee.[14]

Fortune magazine described Singer as one of the "smartest and toughest money managers" in the hedge fund industry.[13] A number of sources have branded him a "vulture capitalist", largely on account of his role at EMC, which has been called a vulture fund.[4][15][16][17] The Independent has described him as "a pioneer in the business of buying up sovereign bonds on the cheap, and then going after countries for unpaid debts."[9] In 1996 Singer began using the strategy of purchasing sovereign debt from nations in or near default—such as Argentina,[13][18][19][20] and Peru[9][21][22]—through his NML Capital Limited[9] and Congo-Brazzaville through Kensington International Inc.[17] Singer's practice of purchasing distressed debt from companies and sovereign states and pursuing full payment through the courts has led to criticism.[20][23] Singer and EMC defend their model[4] as "a fight against charlatans who refuse to play by the market's rules",[18] and supporters of the practice have said it "help[s] keep kleptocratic governments in check."[24]

Sovereign debt

In 1996 Elliott bought defaulted Peruvian debt for $11.4 million.[22] Elliott won a $58 million judgment[18] and Peru had to repay the sum in full under the pari passu rule.[21] When former president of Peru Alberto Fujimori was attempting to flee the country due to human rights abuses and corruption, Singer confiscated his jet and offered to let him leave the country in exchange for the $58 million payment from the treasury. Fujimori accepted.[19][41][32] In the 1990s the Kensington International division of EMC purchased US$30 million (£18m) of "Congolese sovereign debt... allegedly for less than $20m." Kensington subsequently spent years trying to be paid in full through the courts.[16] In 2008 Kensington and the Republic of Congo settled for an undisclosed amount.[32]

After Argentina defaulted on its debt in 2002, the Elliott-owned company NML Capital Limited refused to accept the Argentine offer to pay less than 30 cents per dollar of debt.[13] Elliott sued Argentina for the debt's value,[42] and the lower UK courts found that Argentina had state immunity. Elliott successfully appealed the case to the UK Supreme Court, which ruled that Elliott had the right to attempt to seize Argentine property in the United Kingdom, and on October 2, 2012, Singer arranged for a Ghanaian Court order to detain an Argentine naval vessel in a Ghanaian port in an effort to force Argentina to pay the debt, but was rebuffed when the seizure was barred by the International Tribunal for the Law of the Sea.[43][44][45][46][47][48] In February 2013 the U.S. appeals court heard Argentina's appeal in the case of its default and debt to NML.[49] In March 2013 Argentina offered a new plan,[50] which was dismissed first by the lower courts and then the United States Court of Appeals for the Second Circuit on August 23, 2013, and then again in June 2014 in the U.S. Supreme Court.[51][52] In March 2014 NML Capital unsuccessfully attempted to satisfy court awards by suing SpaceX, seeking the rights to two satellite-launch contracts bought by Argentina valued at $113 million.[18]:2[53][54][55][56] In early 2016 US courts ruled that Argentina must make full payments to holdout bondholders by February 29.[57] In February 2016 Argentina reached an agreement with Singer.[58][59][60][61][62]

More:

https://en.wikipedia.org/wiki/Paul_Singer_(businessman)

~ ~ ~

This fund made an 800% return on Argentina debt

by Patrick Gillespie @CNNMoney

March 2, 2016: 5:15 PM ET

American hedge funds are cashing in on Argentina.

Argentina and four hedge funds ended a 15-year debt battle on Sunday night. Argentina -- South America's second largest economy -- agreed to pay $4.65 billion altogether.

As the dust settles, details are emerging about how much cash each hedge fund is going to take to the bank.

One fund, Bracebridge Capital from Boston, will make about $950 million return on its original principal amount of $120 million. That's about an 800% return.

Billionaire Paul Singer and his firm NML Capital -- the leading firm in the case -- will rake in $2.28 billion on principal and interest payments. That's a huge payday considering NML's original amount of only $617 million. That's a 370% return, according to the terms of the agreement and a court document filed by Argentina's undersecretary of finance, Santiago Bausili.

. . .

Singer and Argentina battled for 15 years. By 2010, Argentina had settled its debt problems with 92% of its creditors. But Singer and other funds -- representing the bulk of the other 8% -- held out. And a New York judge, Thomas Griesa, agreed with them. He ordered that Argentina couldn't pay any creditors until it paid Singer and other holdouts.

https://money.cnn.com/2016/03/02/news/economy/hedge-funds-argentina-debt/

~ ~ ~

Vulture Capitalists Are the Real Winners of Argentina’s Elections

November 27, 2015

Economist James Henry explains how the new conservative president will make vulture capitalists like Paul Singer turn a $43 million loan into a $1.5 billion return

https://therealnews.com/stories/jhenry1124vulture

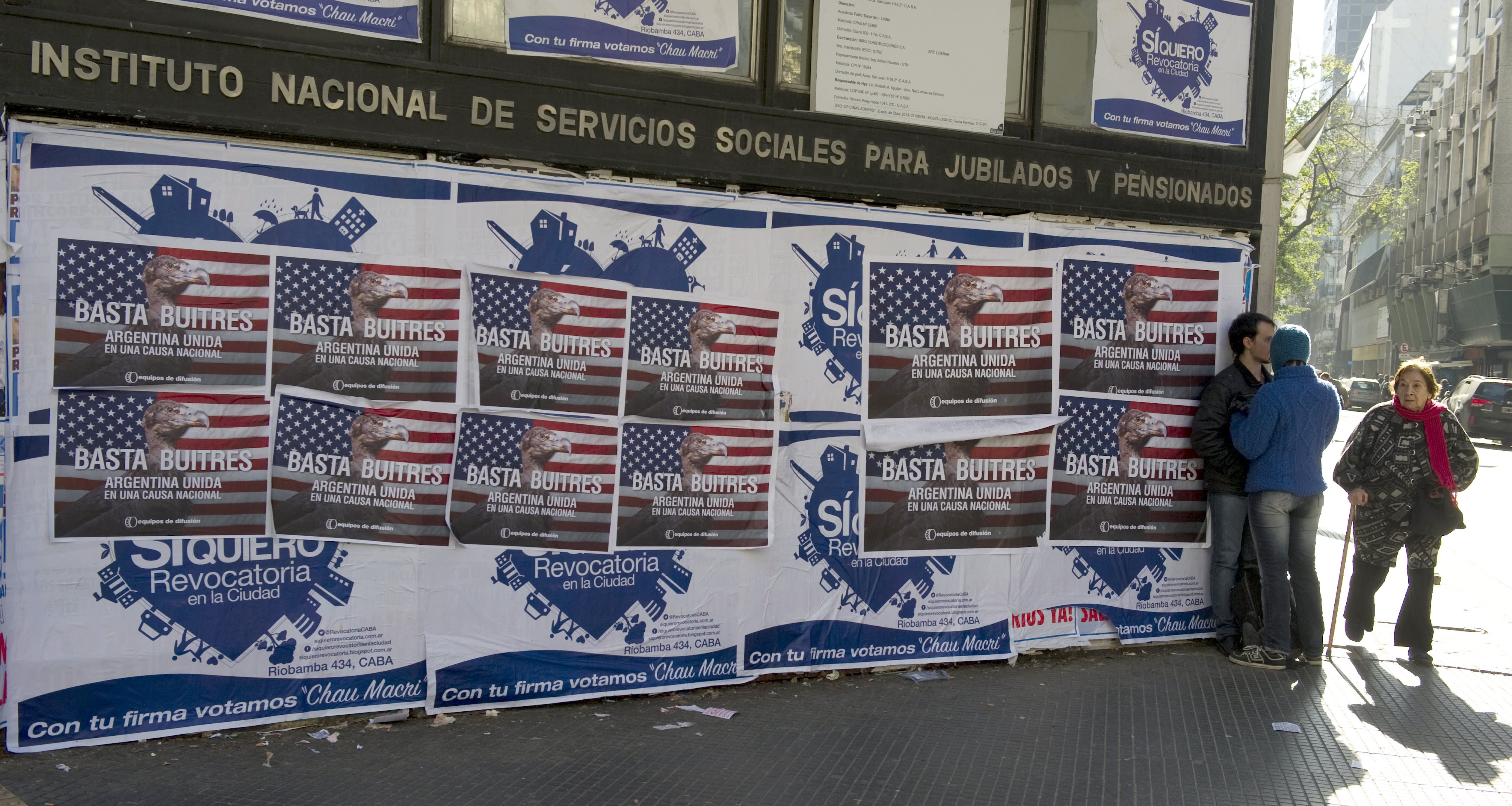

Political cartoons:

Seized Argentina navy ship Libertad leaves Ghana

19 December 2012

An Argentine navy ship detained in Ghana since October has been released and has now left the country.

The Libertad set sail from Ghana's main port of Tema after a United Nations court last week ordered its release.

Argentina sent almost 100 navy personnel to man the three-masted training ship.

It was impounded after a financial fund said it was owed money by Argentina's government as a result of a debt default a decade ago.

. . .

https://www.bbc.com/news/world-latin-america-20790567

~ ~ ~

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

0 replies, 1077 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (10)

ReplyReply to this post