Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 5 April 2012

[font size=3]STOCK MARKET WATCH, Thursday, 5 April 2012[font color=black][/font]

SMW for 4 April 2012

AT THE CLOSING BELL ON 4 April 2012

[center][font color=red]

Dow Jones 13,074.75 -124.80 (-0.95%)

S&P 500 1,398.96 -14.42 (-1.02%)

Nasdaq 3,068.09 -45.48 (-1.46%)

[font color=green]10 Year 2.22% -0.01 (-0.45%)

30 Year 3.36% -0.01 (-0.30%)

[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

rfranklin

(13,200 posts)This is better than winning the NCAA basketball crown!

Tansy_Gold

(17,855 posts)We should enjoy them to the fullest.

![]()

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)Matt Stoller is a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller

If you ask a homeowner who has tried to get a government-certified mortgage modification from a bank, half the time you’ll hear a story of lost paperwork, incompetence, and interminable phone calls to call centers with unhelpful staffers. Recent foreclosure mitigation programs designed by the government are not merely poorly conceived, they are poorly implemented. In discussing principal write-downs, one must take this into account. Who is going to do the writing down? Who will be eligible? What about homes with second mortgages? Most importantly, is there a good database that can match those second mortgages to first mortgages?

The Government Accountability Office has shown, as recently as March of 2011 that there are serious operational problems with the second lien write-down program implemented by Treasury to date. Bluntly speaking, the GAO reports, Fannie doesn’t have the computer systems and quality databases to match second mortgages with first mortgages.

The administration, the banks, and Fannie/Freddie have an impressive track record of operational failure when it comes to implementing mortgage modification programs in the mortgage market. HAMP, the administration’s major housing initiative, bombed not just because of program design, but because of severe operational problems. These kinds of loan modification programs have created bitter mistrust; debtors often send in papers, are given inconsistent instructions, and never hear back on pending loan modifications. Sometimes, debtors will get a loan modification, and after nine months or so of paying on-time, they’ll get a foreclosure notification out the blue. Some of this is because of misaligned incentives in the bank servicing model, but some is a simple lack of operational competence in the form of inadequate record-keeping, staffing and training, and quality assurance.

These same operational competence problems plague the regulatory community. A lack of good data has made it difficult to police programs implemented by banks. The Congressional Oversight Panel came out with a report years ago documenting the glaring absence of a central and complete source of data on foreclosures and mortgages. Regulators must rely on self-reported data by the servicers, or on private foreclosure or mortgage tracking companies...

more wonk

Demeter

(85,373 posts)Last edited Wed Apr 4, 2012, 11:06 PM - Edit history (1)

full of ads for Easter shopping...bah, humbug

Well, they weren't big and ugly....just late for no discernible reason.

Fuddnik

(8,846 posts)Hang Seng down over 300 (1.4%)

Nikkei down over 100 (1.0%)

girl gone mad

(20,634 posts)girl gone mad

(20,634 posts)What this means also is that America's record shadow housing inventory, which is far greater than any fabricated number the NAR reports on a monthly basis, is about to get unleashed on buyers, shifting the supply curve much further to the right, as up to 9 million new properties slowly but surely appear on the market. And while many will no longer be able to live mortgage free, forcing them to go out and rent (and no longer be able to afford incremental iGizmos), it also means that the prevalent price of homes is about to take another major tumble, making buffoons out of all those who, once again, called for a housing bottom in early 2012. Here's the simply math: there will be no housing bottom until the 9 million excess homes clear. Period. Until then it is a buyer's market, even if said buyer is unable to obtain bank financing, as ultimately it will be the seller who is forced to monetize (or vacate if underwater) their home in a world of ever diminishing cashflows. The fear of the supply onslaught will only make the dumpage that much faster.

As a reminder, this is what America's recover shadow inventory looked like recently (read more here):

For those curious how much more foreclosed properties are about to hit the market, we have the answer. Courtesy of RealtyTrac we know how many homes were foreclosed upon in the period until November 2010, when robosigning became a prevalent, if short-lived issue, or roughly 330,000 a month. In the aftermath, this average has dropped to 227,000 a month: a roughly 100,000 difference in less foreclosures each month! Which means that in the deferred amount of foreclosures, over and above the already endogenous deterioration in home prices and declining household income, means that there is at least 1.6 million in homes that are just waiting for a green light to be foreclosed upon, sending shadow inventory in the double digit millions, and unleashing a selling wave unlike any seen before....

read more: http://www.zerohedge.com/news/second-foreclosure-tsunami-coming-and-about-kill-any-hopes-housing-bottom

Fuddnik

(8,846 posts)New foreclosure wave to hit 'everyday' borrowers

Subprime loans caused first, now job losses, economy will cause a bigger run

By Nick Carey

updated 4/4/2012 5:45:59 PM ET

Print

Font:

Half a decade into the deepest U.S. housing crisis since the 1930s, many Americans are hoping the crisis is finally nearing its end.

House sales are picking up across most of the country, the plunge in prices is slowing and attempts by lenders to claim back properties from struggling borrowers dropped by more than a third in 2011, hitting a four-year low.

But a painful part two of the slump looks set to unfold: Many more U.S. homeowners face the prospect of losing their homes this year as banks pick up the pace of foreclosures.

"We are right back where we were two years ago. I would put money on 2012 being a bigger year for foreclosures than 2010," said Mark Seifert, executive director of Empowering & Strengthening Ohio's People (ESOP), a counseling group with 10 offices in Ohio.

"Last year was an anomaly, and not in a good way," he said.

http://www.msnbc.msn.com/id/46957243/ns/business-real_estate/#.T30cYdnhe-A

Po_d Mainiac

(4,183 posts)As Gilda wood say, "Never mind"

Demeter

(85,373 posts)That's a terrifying post.

xchrom

(108,903 posts)

Demeter

(85,373 posts)I never used to know anyone besides me born in April. Congrats! ![]()

xchrom

(108,903 posts)Roland99

(53,342 posts)xchrom

(108,903 posts)DemReadingDU

(16,000 posts)Hope you had a wonderful day!

xchrom

(108,903 posts)

xchrom

(108,903 posts)Tansy_Gold

(17,855 posts)Especially on our birthdays!

xchrom

(108,903 posts)

Roland99

(53,342 posts)We saw that at the Musee du Moyen Age.

I know you all are dying for me to get the pics up...I am, too!

xchrom

(108,903 posts)Demeter

(85,373 posts)

The Munchkins called in their note on the Wizard...

Demeter

(85,373 posts)EMAIL PRESS RELEASE

Hello Chicago-area comedy/economics fans! Here's the latest on my comedy tour, cartoon book, and comedy video:

* I'd love to stop by in the fall or beyond, so let me know ( http://www.standupeconomist.com/contact/ ) if you want to hire me to visit your school or corporate event! (Right now my 2012 "Gold Standard" World Tour includes gigs in Idaho, Utah, Europe, Florida, Kansas City, Texas, Phoenix, San Francisco, and the Pacific Northwest.) And as always I try to squeeze in free shows for public high schools, community colleges, and the armed forces.

* Volume 2 (macro!) of the Cartoon Introduction to Economics is now out, complete with this awesome excerpt. And if you're a teacher, your class can get Cartoon Micro and/or Cartoon Macro for free (!) as part of a package deal with textbooks by Krugman/Wells, Cowen/Tabarrok, or Stone.

* My latest comedy video---filmed in Chicago in January!---has a bit of (unavoidable) foul language in it, but if you're okay with that then here it is: "S*** happens: the economics version".

PS. In more serious news, here's the complete set of China video blogs I did with PBS NewsHour, here's a working paper on climate change "fat tails" (with UW climate scientist Gerard Roe), and of course I'm still banging the drum for revenue-neutral carbon taxes (as in British Columbia).

Happy spring and summer,

yoram bauman phd, standupeconomist.com

“the world’s first and only stand-up economist”

VARIOUS LINKS FROM EMAIL:

http://www.standupeconomist.com/

http://maps.google.com/maps/ms?hl=en&ie=UTF8&msa=0&msid=105671143500574054659.0004786dbc3058294a8f5&ll=34.307144%2c-62.753906&spn=69.793541%2c158.027344&z=3

http://www.standupeconomist.com/books/cartoon-macro/#excerpts

http://www.standupeconomist.com/blog/package-cartoon-economics-with-your-favorite-worth-publishers-textbook/

http://www.standupeconomist.com/blog/follow-me-in-china-on-pbs-and-facebook/

http://www.economist.com/node/18989175

http://www.standupeconomist.com/blog/economics/climate-change-fat-tails-my-paper-with-gerard-roe/

girl gone mad

(20,634 posts)Cocktails on me. ![]()

xchrom

(108,903 posts)hamerfan

(1,404 posts)Nice pic. It suits you. Get it? Birthday? Suit? Birthday suit? ![]()

Aaaah, nevermind....

thank you!

xchrom

(108,903 posts)LONDON (AP) -- European stock markets failed to hold on to their early gains Thursday as investors fretted about Spain's debt problems, and reduced their potential exposure to upcoming U.S. jobs figures in the run-up to the long Easter weekend.

A disappointing set of Spanish bond auctions on Wednesday contributed to a big rout on global stock markets alongside waning expectations of another monetary stimulus from the U.S. Federal Reserve.

Spain has become the latest point of concern in Europe's debt crisis as investors are concerned over the ability of the government to push through its big austerity program at a time when its economy is heading for a return to recession and unemployment is standing at around 23 percent. The yield on the country's 10-year bond pushed up a further 0.07 percentage point to 5.73 percent, a sign that investors are wary of Spain's ability to avoid suffering the same bailout fate as Greece, Ireland and Portugal.

"The eurozone crisis remains unresolved and Spain remains in the spotlight with bond yields moving higher after yesterday's disappointing bond auction," said Neil MacKinnon, global macro strategist at VTB Capital.

xchrom

(108,903 posts)NEW YORK (AP) -- JPMorgan Chase paid its chief executive, Jamie Dimon, compensation valued at $23 million last year, up 11 percent from the year before.

The largest U.S. bank by assets said in a regulatory filing Wednesday that Dimon's compensation included a salary of $1.4 million, a bonus of $4.5 million, stock awards worth $12 million and stock options worth $5 million.

Dimon also received about $143,000 for air and car travel and home security.

The bank shelled out $21,375 to secure Dimon's home. It was the first time the bank had included the expense in a regulatory filing and reflected concerns over protesters that have targeted CEOs in recent months.

Demeter

(85,373 posts)Demeter

(85,373 posts)JPMorgan Chase & Co. (JPM), the largest U.S. bank, will pay $20 million to resolve a U.S. regulator’s claims that the firm mishandled customer funds from Lehman Brothers Holdings Inc. (LEHMQ) from 2006 to 2008.

JPMorgan, serving as Lehman’s main clearing bank, counted client money as belonging to the firm itself while extending loans that let Lehman bet on markets, the Commodity Futures Trading Commission said today in a statement. When Lehman filed for bankruptcy in September 2008, JPMorgan refused to release the money for two weeks until CFTC officials insisted, the watchdog said.

Collapses of Wall Street firms including MF Global Holdings Ltd. (MFGLQ) have spawned customer claims that their money was frozen or lost after companies improperly used their holdings. Lehman at times had more than $1 billion of clients’ funds deposited with JPMorgan, which improperly counted segregated customer funds in extending credit over a 22-month period, according to the CFTC.

“The laws applying to customer segregated accounts impose critical restrictions on how financial institutions can treat customer funds, and prohibit these institutions from standing in the way of immediate withdrawal,” CFTC Enforcement Director David Meister said in the agency’s statement. “These laws must be strictly observed at all times, whether the markets are calm or in crisis.”

AND JAMIE GETS MORE THAN THAT FINE, JUST FOR PULLING OFF THE HEIST OF THE CENTURY...THREE TIMES, DEPENDING ON WHEN YOU START COUNTING....

ANOTHER VERSION AT: http://www.reuters.com/article/2012/04/04/us-jpmorgan-cftc-idUSBRE8330NM20120404

Demeter

(85,373 posts)JPMorgan Chase & Co. (NYSE: JPM) announced today that it reached a settlement with the U.S. Commodity Futures Trading Commission (CFTC) to resolve the CFTC's investigation into JPMorgan Chase's extension of credit to Lehman Brothers Inc. (LBI) based in part on the misclassification of a customer-segregated account from November 2006 to September 2008, as well as the firm's delayed release of customer assets when requested by the court-appointed trustee during a 10-day period following the initiation of LBI's liquidation proceedings in September 2008.

The investigation focused on two accounts that contained assets belonging to LBI's customers and that were subject to CFTC segregation requirements. With respect to one of those accounts, JPMorgan mistakenly factored the balance in the account into a daily calculation of LBI assets to determine the amount of credit the firm was willing to extend to LBI. The size of this customer account was small relative to the overall relationship between JPMorgan and Lehman, as was any additional credit extended by JPMorgan to Lehman as a result of the account's inclusion in the calculation of credit that would be made available to Lehman. With respect to both accounts, JPMorgan did not release the assets in those accounts until 10 days after LBI's liquidation proceedings.

No customer funds were ever used to satisfy any LBI debt to JPMorgan, nor were any customer funds in these accounts lost. The CFTC does not claim that JPMorgan Chase intentionally violated the Commodity Exchange Act or CFTC regulations.

As part of the terms of the settlement, JPMorgan Chase will pay a sum of $20 million to the CFTC.

The firm cooperated with the investigation and is pleased to have resolved this matter with the CFTC.

THIS IS THE OFFICIAL PRESS RELEASE...MORE AT LINK

Demeter

(85,373 posts)William Lazonick, professor of economics and director of the UMass Center for Industrial Competitiveness. His book, “Sustainable Prosperity in the New Economy? Business Organization and High-Tech Employment in the United States” (Upjohn Institute, 2009) won the 2010 Schumpeter Prize. Cross posted from Alternet

****************************************************************************************

Corporations are not working for the 99 percent. But this wasn’t always the case. In a special five-part series, William Lazonick, professor at UMass, president of the Academic-Industry Research Network, and a leading expert on the business corporation, along with journalist Ken Jacobson and AlterNet’s Lynn Parramore, will examine the foundations, history and purpose of the corporation to answer this vital question: How can the public take control of the business corporation and make it work for the real economy?

*****************************************************************************************

While most Americans struggle to make ends meet, the CEOs of major U.S. business corporations are pulling eight-figure, and sometimes even nine-figure, compensation packages. When they win, the 99 percent lose. We rely on these executives to allocate corporate resources to investments in new products and processes that, in a world of global competition, can provide us with good jobs. Yet the ways in which we permit top corporate executives to be paid actually gives them a strong disincentive to invest in innovation and training. The proper function of the executive is to figure out how to develop and use the corporation’s productive capabilities (business schools call it “competitive strategy”). But that’s not happening.

In effect, U.S. top executives rake in obscene sums by not doing their jobs.

The Runaway Compensation Train

When all the data from corporate proxy statements are in within the next month or so, they will show that 2011 was another banner year for top executive pay. Over the previous three years the average annual compensation of the top 500 executives named on corporate proxy statements was “only” $17.8 million, compared with an annual average of $27.3 million for 2005 through 2007. Yet even in these recent “down” years, the compensation of these named top executives was more than double in real terms their counterparts’ pay in the years 1992 through 1994.

It might surprise you to learn that in the early 1990s, executive pay was already widely viewed as out of line with what average workers got paid. In 1991 Graef Crystal, a prominent executive pay consultant, published a best-selling book, In Search of Excess: The Overcompensation of American Executives, in which he calculated that over the course of the 1970s and ’80s, the real after-tax earnings of the average manufacturing worker had declined by about 13 percent. During the same period, that of the average CEO of a major US corporation had quadrupled! Bill Clinton took up the issue in his 1992 presidential campaign, and immediately upon taking office had Congress pass a law that forbade companies from recording as tax-deductible expenses executive salaries plus bonuses in excess of $1 million.

Unfortunately Clinton chose the wrong pay target. In 1992 salaries and bonuses represented only 23 percent of the total compensation of the top 500 executives named on proxy statements. The largest single component of executive compensation was gains from exercising stock options, representing 59 percent of the total. The Clinton administration left this so-called “performance pay” unregulated. Perversely, one reaction of corporate boards to the Clinton legislation was to take $1 million in salary plus bonus as the “government-approved minimum wage” for top executives, and therefore to raise these components of executive pay if they fell short of that minimum. The number of named executives with salaries plus bonuses that totaled $1 million or more increased from 529 in 1992 to 703 in 1993 and 922 in 1994. The other reaction of corporate boards was to lavish more stock options on their top executives. When the stock market boomed in the late 1990s, these executives cashed in. The average annual compensation of the top 500 named executives reached $21 million in 1999 with gains from exercising stock options representing 71 percent of the total, and $32 million in 2000 with option gains now 80 percent of the total. From 1982 to 2000 the U.S. experienced the longest stock market boom in its history. Average annual stock-price yields of S&P 500 companies were 13 percent in the 1980s and 16 percent in the 1990s. So it didn’t require any great genius to make money from stock options. In fact, it became a no-brainer. In 1991, the Securities and Exchange Commission waived the longstanding rule that, as corporate insiders, top executives had to hold stock acquired through exercising their options for six months to prevent “short-swing” profit-taking. As before, executives did not have to put any of their own money at risk in being granted stock options. But now they could also pick the opportune moment to exercise their options without any risk that the value of the company’s stock would subsequently decline before they could sell the stock and lock in the gains....AND IT GETS MUCH WORSE LATER...SEE LINK...It is about time that we took control of exploding executive pay. It is not just that the sums involved are unfair, and as history has shown, will only become more obscene. These executives control the allocation of resources that represent the well-being of the 99 percent, and the ways in which they bank their booty is doing severe damage to the U.S. economy. The investment strategies of business corporations are too important to be left under the control of those who gain when the 99 percent lose.

xchrom

(108,903 posts)PARIS (AP) -- France saw its borrowing costs rise slightly as it sold (EURO)8.44 billion ($11 billion) in a long-term bond auction.

Borrowing costs - also known as the yield and an indication of risk - edged up on most of the bonds issued by France Thursday, though demand was healthy and the sale brought in close to the high end of the French Treasury's goal.

The largest issue was of 10-year bonds, for which the yield rose from 2.91 percent to 2.98 percent when it was sold last month.

France has occasionally been hit by investor concerns that its levels of debt are unsustainable. That concern became more acute when Standard & Poor's stripped it of its AAA-rating.

xchrom

(108,903 posts)UPDATE: Scratch that optimism. European markets just fell across the board, moving into negative territory. Bond yields in Italy and Spain have begun to climb.

This development appeared to follow a French bond auction. According to Bloomberg's Linda Yueh, the country sold €8.439 billion in bonds—near the top end of its target range. Yields on ten-year bonds rose from 2.91 percent in March to 2.98 percent today. Yields on five-year issues also rose, but those on 15- and 30-year bonds fell.

Still to come at 7 AM EST is an important decision from the Bank of England, which will decide whether or not to continue quantitative easing as its current asset purchase program winds down.

Read more: http://www.businessinsider.com/morning-markets-april-5-2012-2012-4#ixzz1rAG4DqXk

xchrom

(108,903 posts)# Asian markets sold off in overnight trading, with Japan's Nikkei off 0.5 percent. Shares in Europe are also trending lower and U.S. futures point to a negative open.

# The Chinese service sector expanded in March with business confidence heading towards a one year high. The HSBC Services Purchasing Managers Index fell slightly from February, reading at 53.3 for the month. A figure above 50 represents expansion. This is what a real hard landing would look like >

# German industrial production fell 1.3 percent in February, well below expectations for a 0.5 percent contraction. The number was negatively impacted by poor weather which took a toll on the construction sector.

# Yields on Spanish long-term debt continued to head higher after yesterday's jump, with the 10-year topping 5.840 percent earlier today. That is the highest borrowing cost since December 14, before the ECB's two three-year LTROs flooded the market with liquidity. Here's why Spain is the new Greece.

Read more: http://www.businessinsider.com/10-things-april-5-2012-4#ixzz1rAIi4qGr

xchrom

(108,903 posts)Following yesterday's tragic suicide in the middle of Athens, Syntagma Square saw both protests and violence.

The BBC reports hundreds of protesters gathered in the square just hours after the suicide of Dimitris Christoulas, with petrol bombs thrown at police and tear gas fired in return.

Athens News reports that the demonstrators had organized themselves with social media, appearing under a banner that read "Let's not get used to death".

At the site of Christoulas' suicide sit many tributes, with flowers and one note reading "enough is enough".

The head of the Attica Pharmacists' Association Kostas Lourantos (of which Christoulas was formerly a member) released a statement that read:

"The way he chose is a statement of a political position and stance. If this man had killed himself at home there would not have been such a stir, as there had not been for the previous 1900 suicides. It is an incident that we must look at among many other incidents of suicide in our country, the country of sun and laughter."

Read more: http://www.businessinsider.com/greece-athens-suicide-2012-4#ixzz1rAJtCnFL

AnneD

(15,774 posts)to start the Arab spring. Maybe this is a spark Europe needs. I heard the story yesterday on BBC. It is so sad.

xchrom

(108,903 posts)DemReadingDU

(16,000 posts)Demeter

(85,373 posts)...We have been living in a world predominated by floating exchange rates and currency non-convertibility for forty years now. Nevertheless, most of economics world seems to take a fixed exchange rate, Bretton Woods, or gold standard view of money and banking. In that world, as Warren Mosler quipped, bank lending is reserve constrained with the interest rate an endogenous variable via bank competition for reserves.

I put it this way in December [emphasis added]:

Today the release valve is always the currency because there is no gold tether. So the currency gives way, not interest rates.

Bond vigilantes and the currency relief valve

What this in effect means for the domestic banking system is that in a nonconvertible floating exchange rate system, lending is not reserve constrained as banks can create reserves by making a loan that creates a deposit. Any one institution can always borrow reserves from other banks or from the Fed itself if it finds itself short of reserves (See this BIS paper from 2010 for further discussion LINK IN OP).

The US government, as monopoly issuer of its own sovereign currency, has given the Fed monopoly power in the market for base money. The Fed then exercises this monopoly power by targeting the overnight rate for money, the fed funds rate. That is to say, the Fed targets a rate or a price, not a quantity. Almost all modern central banks of today operate with explicit interest rate targets, allowing the overnight rate to fluctuate within a range. Any monopolist can only control either price or quantity, not both. Now, central banks could target something else like reserves to transmit monetary policy into the economy; and they have done in the past. The Fed targeted reserves from 1979-1982. What the Fed found was that it had only a controlling influence on base money because targeting the monetary base meant volatility in interest rates (see this 2004 ECB paper for further discussion). But, more importantly, because bank loans create deposits that actually need reserves to maintain the integrity of the payments system, the Fed is forced to supply them according to its legal mandate. In short, reserves are about helping set interest rates, not about pyramiding money on a reserve base.

Under present institutional arrangements, the Fed Funds rate is dependent on the Fed’s supplying the required amount of reserves at any given reserve ratio to keep the interest rate at its target or within its target band. The Fed can’t target a rate unless it supplies banks with all the reserves that the banks need to make loans at that rate. This means that central banks must be committed to supplying as many reserves as banks want/need in accordance with the lending that they do subject to their capital constraints. Failure to supply the reserves means failure to hit the interest rate target. So in practice, if a banking system as a whole is at the reserve limit, central banks always increase the level of reserves desired by the system in order to maintain the interest rate. Not doing so means at once that the Fed cannot hit its target or that transactions fail as the payments system breaks down. In sum: In a nonconvertible. floating exchange rate system, the amount of credit in the system is determined by the risk-reward calculations of banks in granting loans and the demand for those loans. Banks are not reserve constrained. They are capital constrained. Financial institutions grant credit based on the capital they have to deal with losses associated with that activity.

MUCH MORE AT LINK...TIES INTO THE KRUGMAN-KEEN SQUABBLE

girl gone mad

(20,634 posts)As to why it matters so much, the neoclassical models pretty much ignore the banks and the role of banking in the crisis. For a long time, Keen has been one of the very few economists pointing out the significance of private sector debt in driving this recession.

Demeter

(85,373 posts)A ruling in the Retirement Board of the Policemen’s Annuity and Benefit Fund of the City of Chicago et al v. Bank of New York Mellon is a game-changer in mortgage investor litigation. Readers may recall that we’ve moaned about the failure of investors to sue originators, servicers, and trustees for their grotesque violations of contractual and other duties. Generally, the reluctance to take action is the consequence of terrible incentives. The “investors” are often fee whores agents, meaning fund managers who are hired by the parties that actually have money, such as pension funds. The fund managers don’t want to devote time and money to suing, even though they have a fiduciary duty to their investors, nor do they want to jeopardize their relationships with bank that they think they need for market intelligence and trade execution. But the fund managers had an excuse. For them to sue under the pooling & servicing agreement, they needed to have 25% of the investors in a particular trust. It was difficult to find the other investors, and even then, hard to get them to act.

But I never really bought the 25% excuse. There were other legal theories that didn’t require having 25% because you wouldn’t be suing on the basis of a violation of the PSA. For instance, it looks to be blindingly obvious that the trustees in these deals made multiple false certifications, which are SEC filings. That sort of action would not be subject to a procedural hurdle. But a ruling on Tuesday by Judge William Pauley against Bank of New York on 26 Countrywide securitizations may have opened the floodgates to trustee litigation. Heretofore, trustees have effectively told investors to pound sand when they’ve petitioned them to take action against servicers, relying on their belief that it would be unlikely that they’d be able to get a day in court, thanks to the barriers built into the PSA.

But four pension funds which are investors in $30 billion of Countrywide trusts, sued under the Trust Indenture Act of 1939. I haven’t seen the actual original filing or Pauley’s ruling, but here is the background, per Alison Frankel:

The bondholders said Bank of New York Mellon failed to take possession of loan files, including the original mortgage notes, or require Countrywide to fix or buy back defective loans.

Such failures “created considerable uncertainty” and should make the bank responsible for bondholder losses, regardless of the fairness of the $8.5 billion settlement, the complaint said.

Pauley said the bondholders could pursue claims that Bank of New York Mellon did not properly notify them that Countrywide had defaulted on some obligations, whether as a servicer or as a mortgage lender.

The judge nonetheless said the bondholders could sue only on the basis of the 26 trusts in which they invested, not all 530 trusts covered by the $8.5 billion settlement.

This is extremely significant. This lawsuit provides a road map for any investor unhappy with the Bank of America settlement to take action against Bank of New York and Countrywide. As we noted in earlier posts, the 22 investors that Kathy Patrick of Gibbs & Bruns rounded up to act as a Trojan horse for the deal don’t have 25% of the 530 trusts involved in the settlement. Not even close. There are many trusts in which they own no bonds at all.

So now any investors who are unhappy with the settlement don’t have to go through the effort of trying to intervene in the settlement in New York court, where the deck is very much stacked against them. I am told the judge is very much out of her league on the settlement, and her inclination is to rubber stamp what the banks put before her (which she can pretend isn’t unreasonable if she follows the bank line that an Article 77 hearing is appropriate, since the bar for refusing a trustee’s request in that procedure is very high). And of course, this decision opens up an entirely new front for other relatively small investors (pension funds, endowments, foundations) to take action. If other parties follow the lead of these four pension funds against Countrywide trusts, you could see enough holes shot in the settlement deal so as to render it useless to Bank of America (indeed, worse than useless: the deal provides for expanded indemnification for Bank of New York Mellon, so if angry investors saddle up to sue BoNY and BofA, it might find itself worse off, depending on the nature and level of damages awarded against BoNY). Moreover, this action also threatens the Federal/state mortgage settlement. As we have discussed at some length, the Administration has repeatedly trotted out the canard that it has investor consent for principal modifications of securitized mortgages. We’ve explained that’s bogus: most deals have a cap on mods (all Countrywide deals appear to) and to exceed the cap, “consent” doesn’t cut it. You need an amendment to the PSA. That takes a minimum of 51% of the investors (in some deals, of each tranche, in some, as much as 2/3 of each tranche). But the Administration appears to be trying to pull the wool over the eyes of the public and investors. It has repeatedly told journalists (as well as the Association for Mortgage Investors) that the investor mods will be coming mainly out of Countrywide deals, and that it has consent for that via the Bank of America settlement. Nothing in that deal provides consent of any sort, plus it seems awfully reckless even if that were true to pin one part of a major initiative on a pact that has not yet been sealed. But having the BofA deal fall apart, and that might be the eventual consequence of this action, would also remove the the smokescreen the Administration relied on to legitimate its actions in the Federal/state settlement.

So let’s hope that this important ruling emboldens other investors. They’ve been complacent for much too long.

westerebus

(2,976 posts)When the Congress forced the private debt of the 1% onto We the Citizens, the rule of law gave way.

The proverbial straw that broke the camel's back.

I hope the current fraud of a settlement to settle the biggest fraud in history will go down in flames.

The old adage, you can fool some of the people some of the time, you can't fool all the people all the time; may have met its match with the current political parties corruption.

Demeter

(85,373 posts)Morgan Stanley’s chief executive, has been meeting with Moody’s in an attempt to maintain its credit ratings and stave off a downgrade

Read more >>

http://link.ft.com/r/TWK799/TU4EFF/06MUC/7AY6KI/AM1JKB/PJ/t?a1=2012&a2=4&a3=5

Demeter

(85,373 posts)The JPMorgan Chase chief earned an 11% rise in compensation over 2011, a higher level than the heads of the other large US lenders

Read more >>

http://link.ft.com/r/TWK799/TU4EFF/06MUC/7AY6KI/8ZP9WO/PJ/t?a1=2012&a2=4&a3=5

Demeter

(85,373 posts)The family plans to secure ‘long-term control’ over its international banking empire by merging its French and British assets into a single entity

Read more >>

http://link.ft.com/r/TWK799/TU4EFF/06MUC/7AY6KI/4CRY7N/PJ/t?a1=2012&a2=4&a3=5

PUTTING ALL THE EGGS IN ONE BASKET....WHOOOPS!

Fuddnik

(8,846 posts)Or, in my personal opinion, it's all contrived bullshit!

------------------------------------------------------------------------

By John W. Schoen, Senior Producer

Something in Friday’s employment data won't add up.

For the past 50 years, it’s been widely assumed that the jobless rate can’t fall much unless the economy expands faster than its normal pace. Anything less only creates enough jobs to keep up with the growth of the labor force -- not absorb the millions left unemployed by the latest downturn.

But over the past six months, the U.S. unemployment rate has surprised economists by rapidly falling to 8.3 percent from 9.1 percent even as the economy has yet to get back up to pre-recession speed. According to the textbooks, that’s not supposed to happen.

The unexplained drop has touched off a debate among dismal scientists, who have gone back to their chalkboards to try to figure out what is happening.

Federal Reserve Chairman Ben Bernanke recently sought to reassure his fellow forecasters that their textbooks weren’t out of date. In a widely followed speech, Bernanke argued that the unexpected, sudden drop in the jobless rate may simply represent the flip side of an equally extraordinary surge in layoffs in 2008 and 2009, as employers hunkered down after the worst financial collapse since the Great Depression.

http://economywatch.msnbc.msn.com/_news/2012/04/05/11006026-sharp-drop-in-jobless-rate-raises-questions-for-economists?lite

DemReadingDU

(16,000 posts)This was posted a couple weeks ago

Making 9 Million Jobless "Vanish": How The Government Manipulates Unemployment Statistics

http://danielamerman.com/articles/2012/WorkC.html

link back to Demeter's original posting on 3/21/12

http://www.democraticunderground.com/?com=view_post&forum=1116&pid=8979

DemReadingDU

(16,000 posts)4/4/12 Saw this on twitter...

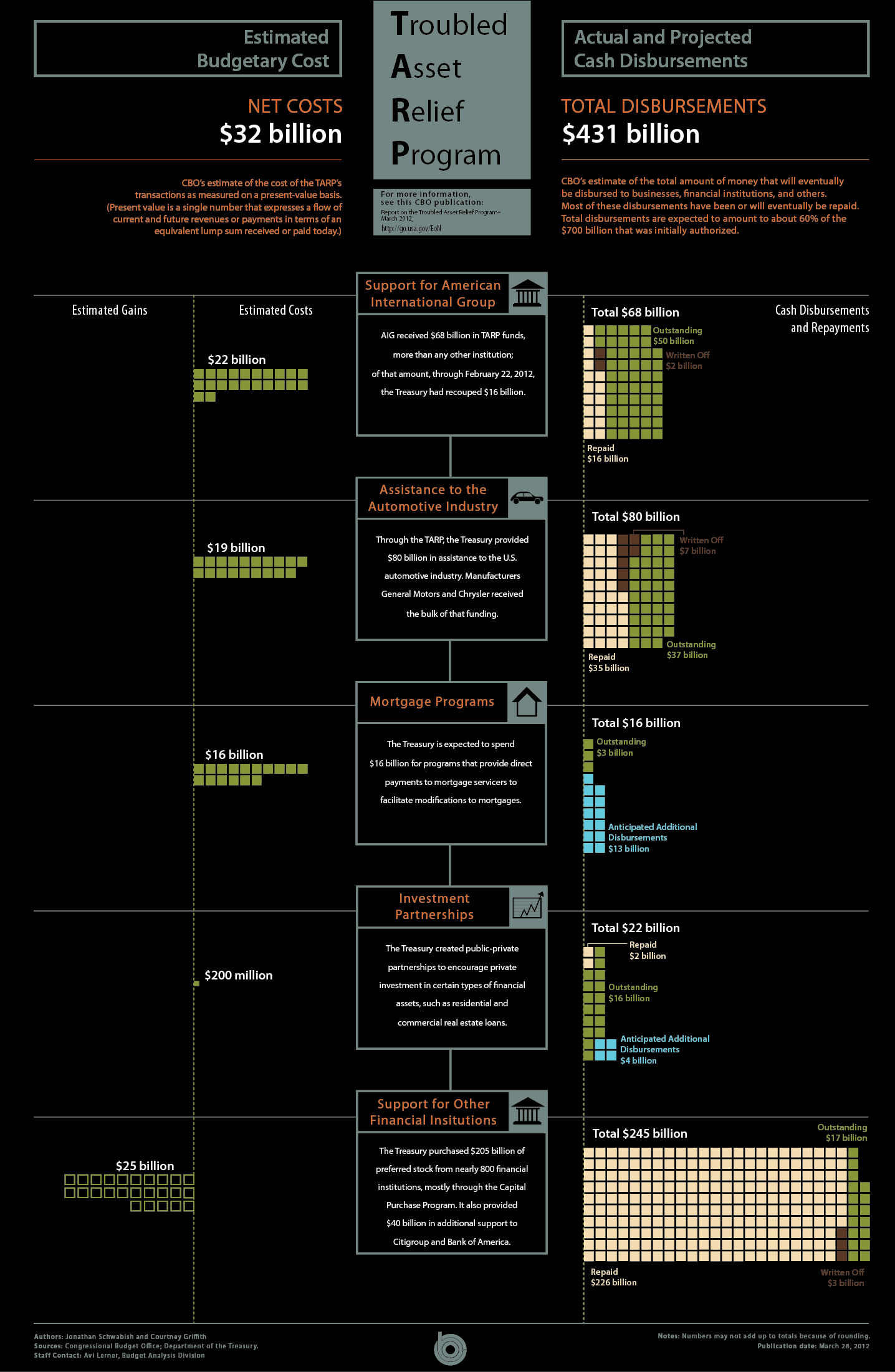

Neil Barofsky @neilbarofsky So remember how crazy wrong I've been about TARP AIG losses? http://1.usa.gov/HfcKMe. h/t @ObsoleteDogma

3/28/12

In October 2008, the Emergency Economic Stabilization Act of 2008 (Division A of Public Law 110-343) established the Troubled Asset Relief Program (TARP) to enable the Department of the Treasury to promote stability in financial markets through the purchase and guarantee of "troubled assets." Section 202 of that legislation requires the Office of Management and Budget (OMB) to submit semiannual reports on the costs of the Treasury's purchases and guarantees of troubled assets. The law also requires the Congressional Budget Office (CBO) to prepare an assessment of each OMB report within 45 days of its issuance. That assessment must discuss three elements:

* The costs of purchases and guarantees of troubled assets,

* The information and valuation methods used to calculate those costs, and

* The impact on the federal budget deficit and debt.

http://cbo.gov/publication/43139

Demeter

(85,373 posts)....Large insurers, hedge funds and other financial firms are hoping to avoid the systemic designation and have been trying to convince regulators to leave them alone. BlackRock Inc (BLK.N), General Electric's (GE.N) GE Capital unit and MetLife Inc (MET.N) are among the companies that have written to regulators trying to avoid making the list.

The final rule was approved at a public meeting by the Financial Stability Oversight Council (FSOC), headed by the Treasury secretary and counts all the major financial regulators among its members. The rule lays out broad measures the council will use to decide which companies should be given a once over but it does not significantly narrow the field of who could be picked, something that will ensure anxiety levels will remain high among executives at firms worried they will be designated. The ability to keep a closer eye on financial giants other than banks is a major aspect of the 2010 Dodd-Frank reform law and is supposed to prevent the chaos that occurred after the government was caught flat-footed in late 2008 when insurer American International Group Inc (AIG.N) ran into trouble. Ultimately the government rescued AIG with $182 billion in government funds. Fed oversight could be costly for companies as it involves maintaining higher capital reserves, having a plan for liquidation in the event of a failure and other regulatory requirements laid out in the law.

Companies trying to avoid the systemic designation have also expressed concerns about how a bank regulator such as the Fed would oversee industries outside its area of expertise. Under Dodd-Frank, banks with more than $50 billion in assets are automatically subject to greater scrutiny by the Fed.

MORE

xchrom

(108,903 posts)&width=500

You worked hard for that money you’re about to send to the IRS in less than two weeks. Like many tax filers you're probably asking yourself where all that money goes when the state and federal governments get their hands on it.

If you have trouble balancing your checkbook, imagine trying to keep track of where $3.6 trillion goes every year. That’s roughly what Uncle Sam spent last year.

For the complete, gory details, you can check the latest estimates from the official budget at the Government Printing Office, where you’ll find the government’s finances sliced and diced — by agency, department, function and source. But we’re going to skip reading the 250-page version and get our numbers from a summary analysis from the Center on Budget and Policy Priorities.

A $3.6 trillion budget has a lot of large numbers. To make it a little easier to imagine which of those tax dollars is yours, here’s roughly how the federal budget compares to your budget and mine. Picture Uncle Sam, sitting at the kitchen table, trying to make ends meet.

*** i think more is spent on defense than this pie indicates.

DemReadingDU

(16,000 posts)Maybe parts of defense are put into other categories to make it appear defense is just 20%.

xchrom

(108,903 posts)what about all the CIA spending or dept of homeland security?

DemReadingDU

(16,000 posts)xchrom

(108,903 posts)DemReadingDU

(16,000 posts)from AlterNet...

If no one knows if our security-industrial complex is making us safer, why have we built it? Why are we still building it, at breakneck speed?

April 3, 2012 The following is an excerpt from Rachel Maddow's new book, "Drift: The Unmooring of American Military Power," published by Crown Publishers, an imprint of the Crown Publishing Group, a division of Random House, Inc.

In the little town where I live in Hampshire County, Massachusetts, we now have a “Public Safety Complex” around the corner from what used to be our hokey Andy Griffith–esque fire station. In the cascade of post-9/11 Homeland Security money in the first term of the George W. Bush administration, our town’s share of the loot bought us a new fire truck—one that turned out to be a few feet longer than the garage where the town kept our old fire truck. So then we got some more Homeland money to build something big enough to house the new truck. In homage to the origin of the funding, the local auto detailer airbrushed on the side of the new truck a patriotic tableau of a billowing flaglike banner, a really big bald eagle, and the burning World Trade Center towers.

The American taxpayers’ investment in my town’s security didn’t stop at the new safety complex. I can see further fruit of those Homeland dollars just beyond my neighbor’s back fence. While most of us in town depend on well water, there are a few houses that for the past decade or so have been hooked up to a municipal water supply. And when I say “a few,” I mean a few: I think there are seven houses on municipal water. Around the time we got our awesome giant new fire truck, we also got a serious security upgrade to that town water system. Its tiny pump house is about the size of two phone booths and accessible by a dirt driveway behind my neighbor’s back lot. Or at least it used to be. The entire half-acre parcel of land around that pump house is now ringed by an eight-foot-tall chain-link fence topped with barbed wire, and fronted with a motion-sensitive electronically controlled motorized gate. On our side of town we call it “Little Guantánamo.” Mostly it’s funny, but there is some neighborly consternation over how frowsy Little Guantánamo gets every summer. Even though it’s town-owned land, access to Little Guantánamo is apparently above the security clearance of the guy paid to mow and brush-hog. Right up to the fence, it’s my neighbors’ land and they keep everything trim and tidy. But inside that fence, the grass gets eye-high. It’s going feral in there.

more...

http://www.alternet.org/world/154836/Rachel_Maddow%3A_How_America%27s_Security-Industrial_Complex_Went_Insane_/?page=entire

I wonder which category of tax money paid for all this extra 'security'

xchrom

(108,903 posts)and i don't know if you can get it from a FOI.

AnneD

(15,774 posts)there was some flack about how the wars were being funded 'off the books' when the Iraq war started. I can't look it up now but I think that is a pie chart of the on the book budget. I think what is happening is the off the books expenses are eating up more of our money than politicians want to admit. Remember, we have been waging this war without raising money or taxes....something unheard of in the history of civilization. And as far as I know, we did not extract any thing (oil, land, treasures) in return to pay for it.

AnneD

(15,774 posts)but maybe the pie chart at this site is more accurate.

http://www.warresisters.org/pages/piechart.htm

TalkingDog

(9,001 posts)

AnneD

(15,774 posts)now to my way of thinking, this is a far more accurate graph than the smoke they keep trying to blow up my skirt.

Fuddnik

(8,846 posts)DemReadingDU

(16,000 posts)54% for all of military

xchrom

(108,903 posts)Market confidence in Spain’s ability to meet its deficit-reduction target when the economy is in recession waned on Wednesday after the weak outcome of a government bond auction.

Spain’s risk premium rose to its highest level since November of last year, while the stock market fell sharply for the second session in a row, pulling other European bourses lower in what could shape up to be the next phase of the euro zone crisis. Market operators reported that the Spanish bond auction had caused the euro to slide against the dollar.

Prime Minister Mariano Rajoy again defended the draconian state budget, details of which were revealed on Tuesday, as Navarre said it may join Basque provinces in not applying the amnesty for tax dodgers included in it.

“The budget is hard, disagreeable and uncomfortable; no one likes it but the alternative is infinitely worse,” Rajoy said. “The situation is definitely very difficult, and even more difficult when in the short term, the reforms won't produce the desired effects neither outside or inside Spain, but I assure you they will produce them in the medium and longer term.”

Demeter

(85,373 posts)It's like playing with the flatworms in biology class....

Demeter

(85,373 posts)Corporations are not working for the 99 percent. But this wasn’t always the case. In a special five-part series, William Lazonick, professor at UMass, president of the Academic-Industry Research Network, and a leading expert on the business corporation, along with journalist Ken Jacobson and AlterNet’s Lynn Parramore, will examine the foundations, history and purpose of the corporation to answer this vital question: How can the public take control of the business corporation and make it work for the real economy?

************************************************************************

For the last four decades, U.S. corporations have been sinking our economy through the off-shoring of jobs, the squeezing of wages, and a magician’s hat full of bluffs and tricks designed to extort subsidies and sweetheart deals from local and state governments that often result in mass layoffs and empty treasuries. We keep hearing that corporations would put Americans back to work if they could just get rid of all those pesky encumbrances – things like taxes, safety regulations, and unions. But what happens when we buy that line? The more we let the corporations run wild, the worse things get for the 99 percent, and the scarcer the solid jobs seem to be. Yet the U.S. Chamber of Commerce wants us to think that corporations – preferably unregulated! – are the patriotic job creators in our economy. They want us to think it so much that in 2009, after the financial crash, they launched a $100 million campaign, which, among other things, draped their Washington, DC building with an enormous banner proclaiming “Jobs: Brought to you by the free market system.”

But the truth is that unfettered corporations are just about the worst thing for creating decent jobs. Here’s a look at why, and where the good jobs really come from...The U.S. Department of Commerce found that from 2000 to 2009, U.S. transnational corporations, which employ about 20 percent of all American workers, cut their domestic employment by 2.9 million even as they boosted their overseas workforce by 2.4 million. The result was an enormous loss of jobs nationally, as well as a net loss globally. In the 1990s, these companies added more jobs at home than abroad. What changed? 1) The rise of India and China, with 37 percent of the world’s population, as hotspots for off-shoring; and 2) the availability of tens of millions of workers in these places, many with college degrees, to do the jobs previously done by American workers...And yet Big Business still trumpets itself as the American Job Creator Fairy. Apple has released a report claiming to have created half a million domestic jobs – a highly dubious number which takes credit for everything from the app industry to FedEx delivery jobs (never mind that drivers would be hauling someone else’s gadgets if Apple went out of business). It’s true that in the U.S. managers, engineers and other professionals have found good jobs at Apple. But the non-professional employees are just barely scraping by. A study of the iPod value chain in 2006 calculated that among Apple’s domestic employees, professionals earned around $85,000, not counting stock options, but the retail workers in Apple’s stores earned only $26,000. This is troubling because as Apple has grown in size, most of the employees it has hired in the U.S. work in retail. Are these jobs paths to long-term, stable careers? Quite likely they are not. While a company like Apple whistles "God Bless America", executives are not going to talk about the job losses induced by off-shoring, nor the horrifically abused foreign workforce that moving jobs to China has produced. And they’re not going to tell us about Apple’s preference for hiring part-time employees who can’t afford to buy health insurance. When such uninsured people have health emergencies, someone has to pay, and the burden falls on the taxpayers. Here is what Apple executives tell us instead: “We don’t have an obligation to solve America’s problems.”

(IF YOU AREN'T PART OF THE SOLUTION, APPLE, YOU ARE PART OF THE PROBLEM---DEMETER)

The Real Deal

Corporate executives have lost the sense that they owe anything to the public. They have forgotten that the 99 percent, as taxpayers, have made huge investments in them. They fight to lower taxes as if all the money “belongs” to the companies. They fight regulations as if the public doesn’t have the right to interfere in their business.

All nonsense.

Despite the anti-government rhetoric from conservative leaders, the truth is that the government, elected by the people, plays a critical role in creating the conditions in which companies can succeed and good jobs can flourish. The government is able to invest in human capital through key services like education. What’s the point of a job if you don’t have an educated worker to fill it? The government also creates job-friendly conditions by investing in infrastructure. How can you get to work if your roads and bridges are falling apart? And it boosts job creation through investing in technology. How could Google create its amazing search engine without state investment in the creation of the Internet? When the government invests in the knowledge infrastructure, businesses can then employ and train people who can, in turn, engage in the kind of organizational learning that leads to that wondrous thing called "innovation." We learned this once before. After Wall Street financiers ran amok to cause the Great Depression in the 1930s, the government responded by putting in place regulations on banks and corporations, a highly progressive tax system, and a robust social safety net. President Franklin D. Roosevelt created the conditions in which good jobs were possible with programs like the Civilian Conservation Corps and other New Deal initiatives. He focused on the development of highways, railways, airports and parks, investing in the future rather than focusing solely on short-term profits. The GI Bill, rather than leaving graduates with big debts, left them well educated and therefore with a chance of to provide a middle-class life for their families and to retire with dignity. After victory in World War II, America was able to emerge as the world’s most powerful nation because it had a large middle-class and a strong industrial and technological base. The horses of Big Business were tamed, and they could be harnessed to do useful things for society. Then came the Reagan Revolution and Big Business freed itself from the regulations, unions and taxes that had curbed its worst instincts and it began to shred the nation’s economic and social safety net. The gap in income inequality grew, and jobs were eliminated and outsourced. Long-term investment in innovation and human capital slowed down, while fraud and financial speculation took off....

That’s why the best way to unleash America’s job-creating potential is to support rights and protections for ordinary people. A climate friendly to the 99 percent is not just fair, it makes the best sense for the economy. We need to remember the complementary roles that government and business have to play in creating well-paid, stable employment opportunities and then ensuring that people can access these opportunities over the course of their careers. To get corporations working for the 99 percent on the job front, we have three major challenges:

1) Education: Young people from low-income groups (especially blacks and Hispanics) need schooling and training to move to good career jobs.

2) Incentives: Corporations must have incentives to retain educated and experienced workers instead of laying them off or off-shoring their jobs. (To do so forces valuable workers into low-skill jobs and wastes their human capital, which was expensive to acquire.)

3) Investment: Executives of financialized corporations who want the government to invest in the knowledge base have to make complementary investments in people that can keep the U.S. economy innovative and generate good jobs. That would mean changing the single-minded focus on boosting company stock prices through buybacks and other financial manipulations that serve the 1 percent but no one else.

Demeter

(85,373 posts)The U.S. regulator that launched a lawsuit against Royal Bank of Canada (RY-T57.190.090.16%) this week is now coming under scrutiny after facing criticism in recent months over its handling of a high profile case in the United States.

A few months prior to launching a lawsuit against RBC over alleged improper stock trading, the Commodity Futures Trading Commission in Washington faced intense criticism from the U.S. government over the job it did leading up to the collapse of investing firm MF Global.

The Washington-based CFTC is one of the key regulators in charge of overseeing the derivatives market in the U.S., and was the regulator in charge of MF Global, which fell apart in a scandal that saw as much as $1.2-billion worth of money belonging to its clients go missing.

After the CFTC was grilled by U.S. Senators in December over whether it did enough to police the market, and whether it was too cozy with executives at MF Financial. That has prompted observers to question whether the regulator is now looking to send a strong message that it is getting tough on alleged improprieties in the derivatives market, and whether the RBC case is a step in that direction....

MORE LIKE KICKING THE DOG WHEN YOU GET HOME, AFTER BEING CHEWED OUT AT WORK BY THE BOSS...

RBC has called the claims “absurd” and said it will vigorously defend its reputation.

Demeter

(85,373 posts)The lawyer representing Royal Bank of Canada as it defends itself against allegations of improper stock trading says the bank would not be willing to accept a settlement deal.

“In serious matters people dialogue with each other, but unequivocally our position is that we didn’t do anything wrong here,” Arthur Hahn, a partner at Katten Muchin Rosenman LLP in Chicago said in an interview Wednesday.

RBC, Canada’s largest bank, has been slapped with a lawsuit by the Commodity Futures Trading Commission alleging that a small group of bank executives operated a massive wash trading scheme, where various subsidiaries located in Europe, Toronto, the Bahamas, and Cayman Islands traded large blocks of shares among themselves at set times and at set prices, in order to reap Canadian tax credits. The CFTC also alleges that RBC executives gave misleading and false statements when exchange officials asked about the trades.

RBC has called the allegations “absurd” and “meritless.” On Tuesday, chief executive officer Gord Nixon weighed in, saying the bank will vigorously defend itself from the “unwarranted” allegations.

Sources familiar with the proceedings say that RBC was offered a chance to settle and pay a cash penalty, but declined, saying it did nothing wrong.

“We have a strong case here and look forward to presenting it to the judge,” Bart Chilton, commission with the CFTC, told the Star.

Demeter

(85,373 posts)AND IF IT ISN'T, WE WILL JUST KEEP TINKERING WITH IT UNTIL IT IS...

http://www.bloomberg.com/news/2012-04-04/fed-s-lacker-says-volcker-rule-may-be-impossible-to-implement.html

BRING BACK GLASS-STEAGAL!

Demeter

(85,373 posts)International co-operation...it's such a blessing....

AnneD

(15,774 posts)It looks like they are trying awfully hard to suppress it but they keep meeting resistance. The manipulation is not working.

Roland99

(53,342 posts)A major potential negative catalyst for financials globally is rapidly approaching as 114 banks are on review-for-downgrade by Moody's across 16 countries. Why do we care so much about ratings given their historical credibility? Ask James 'Jimmy-boy' Gorman of Morgan Stanley who is currently begging cap-in-hand to Moodys not to downgrade his empire bank, since he knows (and so it seems does the CDS market) that, as the FT notes, a downgrade could also force the bank to provide additional collateral to back its vast derivatives business - where it acts as one of the largest counterparties. In Europe, the fun heats up in the next few weeks as first Italian banks (4/16), then Spanish banks (4/23) and then Austrian (4/30) face from 1 to 4 notch downgrades and the potential to lose their short-term (funding-/CP-related) Prime-1 top rating, implicitly raising funding costs (and liquidity concerns) even further.

DemReadingDU

(16,000 posts)4/5/12 Egan Jones Downgrades USA From AA+ To AA, Outlook Negative

A few weeks ago when discussing the imminent debt ceiling breach, and the progression of US debt/GDP into the 100%+ ballpark, we reminded readers that in February S&P said it could downgrade the US again in as soon as 6 months if there was no budget plan. Not only is there no budget plan, but the US is about to have its debt ceiling fiasco repeat all over as soon in as September. Which means another downgrade from S&P is imminent, and continuing the theme of deja vu 2011, the late summer is shaping up for a major market sell off. Minutes ago, Egan Jones just reminded us of all of this, after the only rating agency that matters, just downgraded the US from AA+ to AA, with a negative outlook.

http://www.zerohedge.com/news/egan-jones-downgrades-us-aa-aa-outlook-negative