Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 13 April 2012

[font size=3]STOCK MARKET WATCH, Friday,13 April 2012[font color=black][/font]

SMW for 12 April 2012

AT THE CLOSING BELL ON 12 April 2012

[center][font color=green]

Dow Jones 12,986.58 +181.19 (1.41%)

S&P 500 1,387.57 +18.86 (1.38%)

Nasdaq 3,055.55 +39.09 (1.30%)

[font color=red]10 Year 2.05% +0.04 (1.99%)

30 Year 3.21% +0.03 (0.94%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,847 posts)To have seven or eight "communists" in Congress, or even a few real progressives, or even liberals!

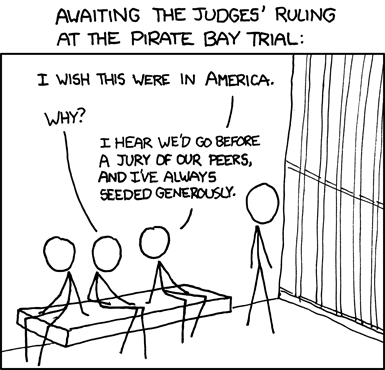

I did kinda chuckle out loud at the 'toon, though.

Demeter

(85,373 posts)and that's probably why I'm so tired all the time. It's hard and unrewarding work. There are so many. My tongue is nearly bit in half, most days.

Demeter

(85,373 posts)Partly it's feeling sick to my stomach due to the virus; partly it's seeing the enormous amount of work TPTB are investing in keeping up appearances, the Potemkin economy.

If they worked half as hard at really fixing things...but that's just crazy talk. See previous post. Besides, they'd all have to put themselves in jail, stripped of assets.

Demeter

(85,373 posts)JUST WHEN YOU THINK THEY COULDN'T DO IT ANY MORE, THEY INVENT A NEW FORM OF FRAUD...

http://www.pcmag.com/article2/0%2c2817%2c2402045%2c00.asp

AT&T is being sued by the government for allegedly turning a blind eye as scammers abused its calling service for the hearing impaired, then cashed in on the fraudulent calls, the U.S. Justice Department announced Thursday. The U.S. alleges that AT&T knowingly collected millions of dollars from the government for calls that were actually placed by Nigerian scam artists. The suit, filed yesterday in federal court in Pittsburgh, involves AT&T's IP Relay service, which is designed to assist hearing-impaired callers.

IP Relay services, offered by AT&T and other companies, allow hearing-impaired individuals to type their message while an operator reads it aloud to the recipient. Callers do not have to pay for this service, and the Federal Communications Commission (FCC) reimburses service providers at a rate of $1.30 per minute. Scammers often try to abuse the system to order goods from U.S. retailers with stolen credit card numbers. Knowing this, the FCC since 2009 has required carriers to verify each user's name and mailing address.

"The complaint alleges that, out of fears that fraudulent call volume would drop after the registration deadline, AT&T knowingly adopted a non-compliant registration system that did not verify whether the user was located within the United States," the Justice Department said. "The complaint further contends that AT&T continued to employ this system even with the knowledge that it facilitated use of IP Relay by fraudulent foreign callers, which accounted for up to 95 percent of AT&T's call volume."

AT&T improperly billed the government for these fraudulent calls, and collected more than $16 million in federal payments, the Justice Department said.

"Taxpayers must not bear the cost of abuses of the Telecommunications Relay system," David Hickton, U.S. attorney for the Western District of Pennsylvania, said in a statement. "Those who misuse funds intended to benefit the hearing- and speech-impaired must be held accountable." AT&T did not immediately respond when contacted by PCMag.com. The telecom giant, in a statement emailed to Ars Technica, said it did not break the FCC's rules. "AT&T has followed the FCC's rules for providing IP Relay services for disabled customers and for seeking reimbursement for those services," AT&T spokesperson Marty Richter told Ars Technica. "As the FCC is aware, it is always possible for an individual to misuse IP Relay services, just as someone can misuse the postal system or an email account, but FCC rules require that we complete all calls by customers who identify themselves as disabled."

AnneD

(15,774 posts)several members of his immediate family were deaf and his development of the phone was done in part to help those in the deaf community hear or communicate.

Back in the day AT&T and their Phone Pioneers did charitable works, esp for the deaf.

Mom retired from the phone company. This makes me ![]()

![]()

Demeter

(85,373 posts)AnneD

(15,774 posts)but couldn't remember. I think also a mother or aunts were deaf too. Deafness was more common then due to fevers, measles during pregnancies, etc. Thanks for the conformation.

I finally looked it up.....

Bell taught deaf students at schools for the deaf (a school in London, Boston School for Deaf Mutes, the Clarke School for the Deaf, and at the American Asylum for the Deaf). He also opened a school for deaf and hearing students together, but the school had to be closed after just two years.

Marriage and Family

Although he married a deaf woman, a former speech pupil, Mabel Hubbard, Bell strongly opposed intermarriage among deaf people. Bell feared "contamination" of the human race by the propagation of deaf people even though most deaf people statistically are born to hearing parents. In addition, Bell's mother was hard of hearing/deaf.

Organizations

In 1880, Bell won the Volta Prize from France for his invention of the telephone, and utilized the winnings to set up the Volta Bureau, a library holding information on deafness. Ten years later, in 1890, Bell set up the American Association to Promote the Teaching of Speech to the Deaf, with the objective of promoting oral communication (which later morphed into the Alexander Graham Bell Association for the Deaf and Hard of Hearing).

Other

Bell befriended Helen Keller, the deaf-blind woman famous in that era. Another major accomplishment was to conduct the first national census of the deaf, in 1890.

http://deafness.about.com/cs/featurearticles/a/alexanderbell.htm

DemReadingDU

(16,000 posts)I think the only thing that would help my hubby is this

AnneD

(15,774 posts)There is no cure for selective hearing.

Demeter

(85,373 posts)Bill Black, the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City. Cross posted from New Economic Perspectives.

****************************************************************

The plot of the movie WarGames (1983) involves a slacker hacker (played by Matthew Broderick) who starts playing the game “Global Thermonuclear War” with Joshua, a Department of Defense (DoD) supercomputer that has been given partial control by DoD of our nuclear forces. The game prompts Joshua, who has been programmed to win games, to trick DoD into authorizing Joshua to launch an attack on the Soviet Union so that Joshua can win the game. The hacker and the professor that programmed Joshua realize that the only way to prevent Joshua from attacking is to teach “him” that no one can “win” global thermonuclear war. The insanity is that the people who created the game “Global Thermonuclear War” thought it could be won. Joshua races through thousands of scenarios and ends his plan to win the “Global Thermonuclear War” game by attacking the Soviet Union when he realizes that “the only winning move is not to play.”

******************************************************************

The JOBS Act is insane on many levels. It creates an extraordinarily criminogenic environment in which securities fraud will become even more out of control.

The Dallas Fed used to object vociferously to all financial regulation because it claimed that markets were “self-correcting” absent regulation. It now warns that market “incentives often turn perverse, and self-interest can turn malevolent. That’s what happened in the years before the financial crisis.” Only effective regulatory “cops on the beat” can prevent frauds from creating a perverse “Gresham’s dynamic” (when frauds prosper, market forces become perverse and bad ethics drives good ethics out of the marketplace). Effective securities regulation has led to U.S. equities trading at a significant premium compared to other nations, which aids U.S. equity issuers. The JOBS Act threatens the continuation of that premium. Even the Dallas Fed’s most senior economist and President – and the Dallas Fed has been the leading opponent of financial regulation – now agrees that effective regulation is essential to strong financial markets. The Obama administration and Congress still worship at the temple of the faith-based economics that has caused our recurrent, intensifying financial crises. When the temple’s high priests (the Dallas Fed’s leadership) become apostate the politicians should shed their dogma.

John 3:20 – 1769 Oxford King James Bible ‘Authorized Version

Demeter

(85,373 posts)An old saying is that contracts are only as good as the parties that enter into them. And the evidence is growing that when there is a meaningful power disparity between two parties to an agreement, the odds are high that the bigger player will elect to behave badly. This blog is rife with examples: pervasive contractual and regulatory violations in securitizations and foreclosures, banks exploiting not just ordinary consumers with “tricks and traps” but even billionaire clients; debt collection abuses; routine raiding of employee pensions while CEO pay and perquisites remain sacrosanct; and, of course, the pilfering of customer accounts at MF Global.

And conditions on the ground are even worse. Hoisted from comments:

March 23, 2012 at 10:41 am

I think you are on to something, Yves.

There’s no indication of improvement either.

For an example, our firm completed work for a major corporation last month (successfully) and they will not accept the invoice for our work. While we have had to lay out cash to perform the work, they have not. Although they came to us to do the work for them, they have shut down their procurement/accounts payable dept and they have kept it shut for about 2 months now. This is a major international corporation and I believe they are treating other suppliers like this, trying to make their Q1 performance look better than it is.

I consider this to be theft of service. Until they re-open their procurement/accounts payable system, they are in effect refusing to acknowledge that they owe anything.

March 23, 2012 at 1:38 pm

(Robert Reich wrote another post mentioning the “destruction of meaning”. Why can’t I find these things when I want references?)

Wait till you see their next move. They’re going to run Accounts Payable as a Profit Center. Because they can.

March 23, 2012 at 7:43 pm

Is (isn’t) that how banks work?

As a small business person, I was shocked at the practices OF MY DEBTORS that pretended to keep me on the skids.

I was expected to be THEIR BANK, me! Someone who pulled in $50k, was fronting money to Siemans, Bard Medical and even larger, more obscure, companies whose names I now forget.

Obscene.

March 24, 2012 at 8:58 am

We saw this recently too…major corporations who don’t think they have to pay suppliers. Also, procurement officers who want 5% off the top of everything to justify their measily paper pushing jobs for profits that roll up to some Family Office somewhere.

Now LAS might have some creative routes for recourse (say drafting a press release from Concerned Big Multinational Suppliers expressing concern that the mysterious shuttering of the purchase department might be a sign that Big Multinational is in very bad financial shape because it is taking such desperate measures, faxing it to the corporate communications office from a Kinkos so as to disguise the source, with a list of financial websites and websites to whom it will be sent if checks are not forthcoming in a week. That might get their attention). But it is grotesque that we are even having to discuss taking extreme measures to get paid. LAS’s company is a victim of theft, period.

Guest blogger and author of On Value and Values Doug Smith took note of the LAS story and e-mailed:

Business used to be based on cultivating critical relationships: with customers, employees, suppliers. Capitalism has not simply abandoned a relationship orientation, but has rapidly moved through “transactions” to “options.”

Today, everything is just an option. As deleterious as transaction orientation is to relationships, at least transactions have the constraints of obligations to follow through. But in our current raging and out of control homo economicus-as-options situation, not even that exists. There are no contractual obligations whatsoever.. there are only new negotiating positions tied to option values.

When the corporation in LAS’s initial comment above refuses to accept the invoice for services, it is merely exercising its option choice — likely under the belief that any cost (whether legal or otherwise) will be less than paying the invoice.

This is the world in which William Bryan Jennings operates. The driver’s account is credible, because it reflects this new business reality. When the cab pulled into the driveway, Jennings — just out of habit, routine and practice — treated the ‘agreed upon transaction amount’ as a mere option to be exercised through a new transaction/renegotiation. What the cabbie recalled as a contract for $204 became, if I remember, an option to pay $50.

In a world of relationships, those relationships had value beyond ‘just one damn transaction after another’…. and this goes missing in a world of transactions… but, in a world where every moment is just that moment’s options … not even previous promises have any stable value, let alone relationships …. and this is the dog now, not the tail.

Now there are settings in which not having a contract can work, but those are where relationships matter. When I worked with in Japan in the 1980s, the entire society was non-contractual. You’d have a vague understanding (Japanese is a vague language, being explicit is seen as tiresome and rude) and the two parties would keep arguing about what the deal was as they worked together. But there was a well understood, well shared set of norms, and it was a shame based culture, so word getting out that one party had been abusive would have led it to be hectored and shunned by others.

With a rise in an options-based view of business, it isn’t hard to see how a pernicious dynamic sets in. It used to be that only occasional scumbags would behave this way, and you’d write it off as bad luck and a reminder to do a decent amount of due diligence on new customers. But when this sort of behavior becomes common, the cost of doing business escalates since no one can trust anyone’s commitments. You can see this now in the way many types of contracts have changed. It used to be possible to do business with a short agreement. In many fields, they’ve now become excruciatingly long, since the odds of them being litigated is correctly seen as higher, so nailing down all sorts of possible outcomes is more important. And longer agreements means more protracted negotiations. It amounts to a tax on commerce.

And this pattern is particularly devastating to small businesses. It’s comical to see the Administration talk up the need to help entrepreneurs yet gut the rule of law to help banks. The last time I had to think about suing someone (more than 10 years ago), the rule of thumb was that it didn’t make sense to litigate unless the matter at hand was at least $300,000, between the hard dollar costs (you can get to $50,000 in legal and not be very far along) as well as the management distraction and emotional toll. Adjusting for inflation alone, the number has to be even higher now.

And the power imbalance does not have to be of the big company versus small one sort. It can be informational. As we wrote in ECONNED:

If sellers cannot be presumed to be trustworthy (and the dictates of maximizing self-interest say they in fact won’t be), consumers have to either spend money and effort to validate the quality of their purchase or accept the risk of being cheated.

Consider purchasing a computer in the neoclassical paradigm. The buyer has no way of being certain that the computer lives up to the vendor’s promises. So the consumer will have to bring an expert to test the computer’s functionality at the time of purchase (does it really have the memory and chip speed promised, for instance?). The seller will need to be paid in cash, otherwise the buyer could revoke payment.

And what happens if the computer fails in a few weeks? Assuming the vendor has not fled the jurisdiction, the only remedy is litigation, or an enforcer with brass knuckles.

But even that scenario is too simplistic. It assumes the buyer can evaluate the expert. But in fact, if you aren’t a computer professional, you can’t readily assess the competence of someone who has expertise you lack. And even if the person you hired is competent, he might arrange to get a kickback from the seller for endorsing shoddy goods. The same problem holds true in any area of specialized skills, such as accounting, the law, or finance. Many people judge service quality by bedside manner, which is not necessarily a good proxy for the quality of the substantive advice. And as we will see later, one of the factors that helped create the crisis was the willingness of investors to buy complicated financial products based on the recommendation of a salesman who did not have the buyers’ best interests at heart.

We can see the damage of the breakdown of the norms of commerce. The private label securitization market, which functioned fairly well when originators and servicers acted in accordance with their agreements with investors, is now dead. The securitization market, which was 60% private label prior to the crisis, is now effectively 100% government guaranteed (there was all of one private label deal last year). Various reform proposals have been suggested; some have been well thought out enough that past investors reacted positively. But of course, the sell side nixed anything far-reaching enough to make a real difference. The investors I know say there won’t be a private label securitization market ex root and branch changes for at least ten years.

So it looks like Marx is being proven correct, that capitalism sows the seeds of its own destruction, although not by the route he envisaged, that of a worker revolt. Instead, it comes about via the capitalists turning on each other to try to secure an even better deal.

happyslug

(14,779 posts)Marx pointed out that due to the drop in return on investment sooner or later you hit a wall, Worker's wages can NOT fall any further, people will not work if they are dead do to starvation (Marx believed a revolt would occur before any mass starvation but I use it to show how bad the Situation will get).

At that point, the only way to increase profits is to squeeze the "petty bourgeoisie" i.e. Foreman and other "middle management", professionals (Doctors. Accountants, Lawyers) and small business owners (owners of the small shops and franchise etc). When these groups fall into the working class do to this demand for their money that is when a revolution occurs. Basically Marx describe what is happening, the last step before the revolution. We may be 10-20 years before such a revolt but we are heading that way.

hamerfan

(1,404 posts)Demeter

(85,373 posts)Ah, well, plot development....

Tansy_Gold

(17,847 posts)Thanks for the clip!

Demeter

(85,373 posts)Demeter

(85,373 posts)DOESN'T THAT JUST SOUND WRONG?

http://www.chicagotribune.com/features/food/stew/chi-fda-must-heed-its-own-research-on-antibiotic-use-on-livestock-20120323%2c0%2c3668440.story

Thirty five years after the Food and Drug Administration determined the routine use of antibiotics in livestock feed could pose a danger to human health, a federal court Thursday compelled the agency to act on that knowledge. The ruling, which came in response to a lawsuit filed last year by the National Resources Defense Council and others, requires the FDA to restrict the non-therapeutic use of most penicillins and tetracyclines in livestock unless manufacturers can prove their safety.

Although there is currently no timetable for action, plaintiffs believe the Federal District Court's ruling represents a massive breakthrough.

"This is a huge step forward," said Avinash Kar, NRDC health attorney. "For 35 years the FDA has done nothing on this issue and let the livestock industry police itself. In that time, the overuse of antibiotics in healthy animals has skyrocketed – contributing to the rise of antibiotic-resistant bacteria that endanger human health. Today, we take a long overdue step toward ensuring that we preserve these life-saving medicines for those who need them most – people."

Friday afternoon the FDA responded to the court's decision saying only, "We are studying the opinion and considering appropriate next steps."

The Animal Health Institute, which represents the animal pharmaceutical industry, characterized the ruling as a step back. In a prepared statement, it contended that it could "delay the process of eliminating the sub therapeutic (growth promotion) use of medically important antibiotics" by turning it into an administrative process rather than the current voluntary collaborative process that critics complain lacks sufficient teeth...FDA has said the collaborative, stakeholder process is a more efficient way of achieving these goals than the process being forced by the court," the AHI statement said. "It is unfortunate that time and resources will now be diverted to responding to the court decision."

Indeed, many had expected this "collaborative" process to produce a final set of voluntary guidelines last week. But they were never finalized or released. According to the ruling, even if the FDA does release such non-binding guidance on antibiotic use, it will not eliminate the need for safety hearings. Many who support the ruling believe that safety will be extremely difficult to prove given the mounting evidence--including that produced by FDA research--linking the routine use of antibiotics on healthy animals (for growth promotion) with deadly antibiotic resistant infections in humans. The ruling, in fact, noted that in the 35 years since the FDA presented its concerns on the issue, "the scientific evidence of the risks to human health from the widespread use of antibiotics in livestock has grown.” One of the most compelling studies demonstrating this link came out of the Translational Genomics Research Institute (TGen) last month and focused on the connection between antibiotic use in food animals and the deadly, antibiotic-resistant MRSA that can infect humans.

The court ruling said: “Research has shown that the use of antibiotics in livestock leads to the development of antibiotic-resistant bacteria that can be--and has been--transferred from animals to humans through direct contact, environmental exposure, and the consumption and handling of contaminated meat and poultry products.”

In January the FDA ruled to restrict the use of another class of antibiotics called cephalosporins from routine use in animal rearing, noting its intent to "reduce the risk of cephalosporin resistance in certain bacterial pathogens. If cephalosporins are not effective in treating these diseases, doctors may have to use drugs that are not as effective or that have greater side effects."

The new ruling would add some penicillins and most tetracyclines to the list. But U.S. Rep Louise Slaughter--who often notes that that she's the only microbiologist in Congress--believes the restrictions must go further.

“This is a good first step," she wrote in a statement, "but to really get in front of this problem we must address all classes of antibiotics in farm animals that are important to human health. That’s why I will continue to press for passage of PAMTA (Preservation of Antibiotics for Medical Treatment Act).”

The act is a bill Slaughter introduced in 2007 that would restrict the non-therapeutic use of seven medically important classes of antibiotics to humans in livestock rearing. While industrial meat producers have consistently lobbied against such legislation as unnecessary and cost prohibitive, supporters note that Denmark has enforced a non-therapeutic antibiotic ban on livestock since 1998 and it remains the largest exporter of pork in the world.

Demeter

(85,373 posts)A trove of documents released today by the Department of Homeland Security (DHS) in response to a FOIA request filed by the Partnership for Civil Justice Fund, filmmaker Michael Moore and the National Lawyers Guild Mass Defense Committee reveal that federal law enforcement agencies began their coordinated intelligence gathering and operations on the Occupy movement even before the first tent went up in Zuccotti Park on September 17, 2011. On September 17, 2011, a Secret Service intelligence entry in its Prism Demonstrations Abstract file records the opening of the Occupy Wall Street (OWS) movement. The demonstration location that the Secret Service was protecting? The “Wall Street Bull.” The name of the Protectee? The “U.S. Government.”

American taxpayers might find it odd to learn that the Secret Service was on duty to protect the Wall Street Bull in the name of protecting the U.S. Government. But there it is.

The DHS’s Game of Three Card Monte to Deflect Disclosure of Law Enforcement Operations

These documents, many of which are redacted, show that the highest officials in the Department of Homeland Security were preoccupied with the Occupy movement and have gone out of their way to project the appearance of an absence of federal involvement in the monitoring of and crackdown on Occupy.

On the street it would be called “Three Card Monte,” a swindler’s game to hide the ball -- a game of misdirection. The House always wins.

AND HERE I THOUGHT IT WAS A REMAKE OF "GASLIGHT"

Demeter

(85,373 posts)Cashiers are barred from interacting with customers until they have completed 40 hours of training. Hundreds of staffers are sent on trips around the U.S. and world to become experts in their products. The company has no mandatory retirement age and has never laid off workers. All profits are reinvested in the company or shared with employees... a $6.2 billion-a-year, 79-store-supermarket chain with cult-like loyalty among its customers. Wegmans, which operates its 79 stores in New York, Pennsylvania and four other East Coast states, shows that a business can generously train its workforce and profit handsomely.

Privately owned by the Wegman family, the chain employs 42,000 people – 20 times the number who work for Facebook – and defies quarterly-driven Wall Street wisdom. Executives say their most important resource is their workers.

“Our employees are our number one asset, period,” said Kevin Stickles, the company’s vice-president for human resources. “The first question you ask is: ‘Is this the best thing for the employee?’ That’s a totally different model.”

Yet the company is profitable. Its prices are low. And it is lauded for exemplary customer service.

“When you think about employees first, the bottom line is better,” Stickles argued. “We want our employees to extend the brand to our customers.”

The Wegmans model is simple. A happy, knowledgeable and superbly trained employee creates a better experience for customers. Extraordinary service builds tremendous loyalty. Where, though, is the profit? High volume, according to company executives. The chain’s stores are enormous – usually 80,000 to 120,000 square feet – larger than a typical Whole Foods and roughly double the size of a traditional supermarket. And they feature a dizzying array of 70,000 products, nearly twice the number available in a standard grocery store. Across the East Coast, Wegmans supermarkets have the highest average daily sales volumes in the industry. Employees are omnipresent in stores and do seem knowledgeable. With little prompting, they launch into exhaustive but friendly accounts of where the meat, fish or produce they sell hails from, what each item tastes like and how best to prepare it. A fish salesman raved about the exhausting standards of the company’s distributor in Alaska. A butcher said he had visited the ranch where a steak came from in Montana. And Maria Benjamin, a 38-year Wegmans veteran, started running a store bakery after managers loved her homemade Italian cookies.

“They let me bake whatever I want,” said Benjamin, one of 1,015 people employed at the company’s 135,000-foot flagship store in Pittsford, New York. “They’re really down-to-earth, wonderful people.”

Executives say the company is also able to invest in its employees and focus on steady, strategic growth because it is not publicly traded. They said cutting jobs or shipping them overseas was, in part, the product of having to relentlessly please the stock market.

“Some of that is that public mentality,” said Stickles, who has an MBA and once planned to be a stock broker. “The first thing they think about is the quarter. The first thing is that you cut labor.”

The Wegman family, which grants few interviews, has owned and run the company since 1916. Robert Wegman, whose father and uncle opened the first store, dramatically expanded the business in the 1970s by being one of the first chains to vastly expand store size, include pharmacies and use bar codes. Today, the chain is run by Robert’s son, Danny, 65, and his two daughters, Colleen, 41, and Nicole, 38. Mary Ellen Burris, a 78-year-old senior vice-president and family confidant, said the owners refuse to open more than three stores a year because “we cannot continue to be the best if we try to go at a faster pace.” She said the family has no interest in taking the company public....Like other companies, Wegmans has made mistakes. Over the years, it has had to close nine stores that failed to generate adequate revenues. And critics have accused it of moving stores out of poor urban neighborhoods and focusing its operations on wealthy suburbs. And while the benefits are generous, its pay rates are good, not extraordinary. Wegmans has also clearly benefited from being based in Rochester, a small but historically prosperous area in upstate New York that was the birthplace of Western Union, Kodak, Xerox, Bausch & Lomb and other companies. Wegmans treats its employees well in part to keep them from gravitating to other firms.

Competition has also forced the company to change. The arrival of Walmart-owned supermarkets caused a sharp reduction in prices in 2004.

Demeter

(85,373 posts)Flash mobs have been blamed as a factor in looting during urban riots. But now a group of online activists is harnessing social media like Twitter and Facebook to get consumers to spend at locally owned stores in cities around the world in so-called Cash Mobs...At the first International Cash Mob day on Saturday, wallet- toting activists gathered in as many as 200 mobs in the United States and Europe, with the aim of spending at least $20 a piece in locally owned businesses, according to the concept's founder, Cleveland lawyer Andrew Samtoy.

"It's my baby but I'm not a helicopter parent," Samtoy told a crowd of more than 100 people gathered Saturday at Nature's Bin, a grocery store that specializes in local and organic food, in Lakewood, an inner ring suburb of Cleveland. The 32-year-old dreamed up the Cash Mob idea last year after spending time in Britain during summer riots that unleashed looting in cities including London, Manchester and Birmingham. His first Cash Mob, in Cleveland last November, brought around 40 shoppers packing in to the Visible Voice book shop, on a welcome spree in which each of them spent on average $40 within an hour-and-a-half.

"We are kind of slow in November so I wasn't going to turn it down," said the independent book store's owner, Dave Ferrante, who estimated he made about eight times his normal take on that day.

"We have a very limited marketing budget and it brought in people who wouldn't have been here. It sounds corny but we really build a base one customer at a time," he added.

After the original Cash Mob in Cleveland, Samtoy's Facebook friends in other cities picked up on the idea and organized their own gatherings. Samtoy can rattle off a list of friends from Los Angeles to Boston who were the 'early adapters' of the Cash Mob phenomenon...

DemReadingDU

(16,000 posts)It was March 24, in a old, revitalized section of downtown, the Oregon District. Alas, I did not go.

http://www.daytondailynews.com/business/cash-mob-event-to-hit-oregon-district-saturday-1348986.html

Demeter

(85,373 posts)Katherine Porter’s book, Broke: How Debt Bankrupts the Middle Class, is a group of essays based on the 2007 Consumer Bankruptcy Project. The 2007 CBP collected basic information on substantially all Chapter 7 (liquidation) and Chapter 13 (partial repayment plans) cases filed for five consecutive weeks in early 2007, and selected 1000 cases per week for detailed study. The researchers collected data from a) the petitions filed by the debtors, which contain enormous detail about their financial condition; b) other court records; c) questionnaires from about half of the cases; and d) interviews of about 20% of the filers. That is a wonderful cross-section of Americans whose finances were destroyed just before the Great Crash.

Each chapter explores a single aspect of this study. The principal investigators on the study are experts in law, economics, political science, psychology, and sociology. The rich data provides fascinating insights into the causes and effects of bankruptcy. It confirms some expectations and raises fascinating issues that could not have surfaced in a less complete investigation. I practiced bankruptcy law for 25 years, representing corporate and individual debtors and creditors, and bankruptcy trustees, and I can say that most of the statements about individual debtors ring true to me.

Porter describes the book In Chapter 1, which you can read AT LINK

Demeter

(85,373 posts)Hope everything goes swimmingly for you. This is usually the only day that things go right for me....I wish I had planned some big-reward type project for it...

Roland99

(53,342 posts)We have 3 of them this year...all 13 weeks apart!

Maybe the Mayans *were* right!

Fuddnik

(8,846 posts)And he's not even a Democrat.

I've got one "Democratic" Senator down here. He's a conservative member of "The Family". I'd rather have a member of the Gambino Family. The only reason he beat Katherine Harris in 2006, is that she's batshit crazy. But politically, they're no different.

I did manage to get him to have a cow that year. I know him and his Chief of Staff. I told his Chief of Staff that if he didn't fillibuster Sam Alito's SCOTUS nomination, I was going to file to run against him in the primary. He didn't and I did. Talk about stirring up a shit storm!

Tansy_Gold

(17,847 posts)so the flowers didn't bloom as brilliantly as normal.

But I got a critter, too.

hamerfan

(1,404 posts)Some Americans spend their tax refunds on high-tech gadgets and long-awaited vacations. Others use the cash to file for bankruptcy.

More than 200,000 money-strapped households will use their tax refunds this year to pay for bankruptcy filing and legal fees, says a new study by the National Bureau of Economic Research.

The NBER research confirms what bankruptcy lawyers have long known: At the first part of the year, when Americans receive their tax refunds, there almost always is a spike in personal bankruptcy filings.

http://www.usatoday.com/money/perfi/taxes/story/2012-04-12/tax-refund-filing-for-bankruptcy/54227664/1

Demeter

(85,373 posts)James Giddens said he may sue officers and directors of the company to try to recover money to make up for an estimated $1.6bn shortfall

Read more >>

http://link.ft.com/r/WDI4RR/169MLY/YGZ3O/085VK8/FK8DQ1/HK/t?a1=2012&a2=4&a3=13

NO ORANGE JUMPSUITS?

xchrom

(108,903 posts)

*** she's come a long ways since the days of the Vikings.

Demeter

(85,373 posts)A day after her publisher reached a settlement that is expected to cut the price of ebooks in the US to $9.99 JK Rowling announced that her next novel would be priced at twice that sum

Read more >>

http://link.ft.com/r/WDI4RR/169MLY/YGZ3O/085VK8/U1KLGB/HK/t?a1=2012&a2=4&a3=13

SHE WAS WASHED UP AND OUT OF IDEAS BY BOOK 5...WHAT NEXT NOVEL?

Demeter

(85,373 posts)The only privately owned version of the Norwegian artist’s masterpiece ‘The Scream’ is on display at Sotheby’s in London before it is auctioned in New York

Read more >>

http://link.ft.com/r/EB8122/R358MZ/OFBYP/97QXJC/8ZU7MO/1G/t?a1=2012&a2=4&a3=13

ONE WOULD HAVE TO HAVE SERIOUS MENTAL ILLNESS TO PAINT THAT PICTURE MULTIPLE TIMES...OR BE ONTO A GOOD THING.

Demeter

(85,373 posts)We humans are animals. Whether a CEO or factory hand, we respond to rewards and punishments. In recent decades, our economy has piled rewards on executives and punishments on ordinary workers.

If a CEO says, "I won't get out of bed for less than $5 million a year," his defenders argue that you must pay large amounts to attract such prodigious talent. If a laid-off factory worker says, "I'm not giving up my unemployment check for a modestly higher pay stub," his detractors don't say, "Offer him more money." They say, "Government benefits have made him lazy." Recent stories of U.S. factories unable to fill openings have fed such negative views...Let's pose some questions, however, about the rewards and punishments that are shaping these idle workers' decisions.

Imagine you are jobless in La Crosse, Wis., and hear of good manufacturing opportunities in Cleveland. Are you going to uproot your family and move 600 miles to work in an industry that four years ago was laying off tens of thousands?

Or, laid off in Indianapolis, you are now studying to be a nurse...A factory across town has started hiring and is paying higher wages than a hospital would. Are you going to pass on the high-demand profession of nursing to rejoin an industry that experience tells you does not offer secure employment?

.....Cry class warfare, if you must, but blue-collar workers also need reasons to get out of bed.

ALSO, DEFINE "GOOD"

AnneD

(15,774 posts)I worked my way into the oil biz. Avoided one layoff but got caught up in another. In the process of being unemployed, I realized how fickle and cyclical the oil biz really was. I was young enough and had enough of a science background to do Nursing. I double checked all the government forecasts and VOILA. Steady employment til retirement and then some if I want more. Not only that, I have been known to refuse jobs that did not offer what I thought was reasonable salary.

They have to either offer higher wages to attract workers or offer guaranteed work for a certain time with a payout bonus if the contract is broken. In the end, they may regret what they did to unions. Individual workers might be more expensive to their bottom line. After all, you can only squeeze so much blood out of a turnip.

Demeter

(85,373 posts)1. Ditch the Cards

All electronic transactions siphon money out of your community to some extent, so try the human approach and bank in person. Pay in cash or, second best, write a check. If you have to use plastic, choose debit. Your local merchants lose some of their profit any time you use a card, but they pay up to seven times more in fees when it’s a credit card. And studies show people spend 12 to 18 percent more when they use cards instead of cash.

2. Move Your Debt

Already broke up with your mega-bank? From credit card balances to car loans to mortgages, mega-banks make far more money off your debt than your savings. Refinance your debt with a credit union or local bank and let your fees support your community. Be wary of “affinity credit cards,” which donate a certain amount per purchase to good-hearted organizations but often are connected with a mega-bank.

3. Spend Deliberately

Forget Internet deals; shop local and independent. Support second-hand markets by buying used, and barter and trade services when you can. Look for goods grown and made nearby.Research your purchases carefully: That organic Dagoba chocolate bar is owned by industry bad-boy Hershey. Want to give money to Coca-Cola? Buy Odwalla juice. Easy company screening at Green America’s Responsible Shopper website.

4. Shorten Loan Lengths

To get as much interest from you as possible, banks offer to stretch out terms. Avoid the 30-year mortgage or the seven-year car loan. If you’re stuck with one, change it yourself: Decide the length of term that’s best for you and pay down your principal. Calculators at sites like mtgprofessor.com can be used for any loans, not just mortgages.

MORE

AnneD

(15,774 posts)don't eat at the chains-dine local at every chance.

There were a few new ideas that I want to try. Thanks for the info.![]()

xchrom

(108,903 posts)It's a policy fierce enough to cause great suffering among Iranians - and possibly in the long run among Americans, too. It might, in the end, even deeply harm the global economy and yet, history tells us, it will fail on its own. Economic war led by Washington (and encouraged by Israel) will not take down the Iranian government or bring it to the bargaining table on its knees ready to surrender its nuclear program. It might, however, lead to actual armed conflict with incalculable consequences.

The United States is already effectively embroiled in an economic war against Iran. The Barack Obama administration has subjected the Islamic Republic to the most crippling economic sanctions applied to any country since Iraq was reduced to fourth-world status in the 1990s. And worse is on the horizon. A financial blockade is being imposed that seeks to prevent Tehran from selling petroleum, its most valuable commodity, as a way of dissuading the regime from pursuing its nuclear enrichment program.

Historical memory has never been an American strong point and few today remember that a global embargo on Iranian petroleum is hardly a new tactic in Western geopolitics; nor do many recall that the last time it was applied with such stringency, in the 1950s, it led to the overthrow of the government with disastrous long-term blowback on the United States. The tactic is just as dangerous today.

Iran's supreme theocrat, Ayatollah Ali Khamenei, has repeatedly condemned the atom bomb and nuclear weapons of all sorts as tools of the devil, weaponry that cannot be used without killing massive numbers of civilian noncombatants. In the most emphatic terms, he has, in fact, pronounced them forbidden according to Islamic law.

xchrom

(108,903 posts)About 10 years ago, at the time global markets came to grips with the significant frauds at the heart of various organizations such as Enron, WorldCom and Tyco, it was said repeatedly that accounting had become the most adventurous profession on earth, belying the general social classification of accountants as boring middle-aged men wearing glasses.

Indeed, the spectacle was unexpected by the markets to the point that some accounting firms such as Arthur Andersen and to a lesser extent Grant Thornton were pitchforked out of town as a result of these scandals.

At the heart of the accounting scandals that felled the mighty Arthur Andersen was the inherent conflict of interest between firms retained on behalf of shareholders to verify the veracity of financial statements (auditing) and firms that looked for ways and means to improve the financial performance of these very companies by effecting organizational changes, cost cutting and strategic acquisitions (consulting).

Over a period of time it became obvious for accounting firms that their consulting divisions were far more profitable - by a factor of 10 times or so - compared to the drudgery and resource intensiveness of auditing.

Boring middle-aged men wearing glasses they may have been, but accountants were also numerate enough to work out which way to lean between auditing and consulting practices; and whenever a conflict presented inevitably due to little details on the auditing side, they chose to side with the strategically more profitable consulting division, thereby allowing financial scandals to slowly fester under their very noses.

Demeter

(85,373 posts)Now that Mitt Romney is the presumed Republican candidate, it’s fair to ask how he made so much money ($21 million in 2010 alone) and paid such a low rate of taxes (only 13.9 percent). Not only fair to ask, but instructive to know. Because the magic of private equity reveals a lot about how and why our economic system has become so distorted and lopsided – why all the gains are going to the very top while the rest of us aren’t going anywhere. The magic of private equity isn’t really magic at all. It’s a magic trick – and it’s played on you and me.

Jake Kornbluth and I have made this 2 minute video that explains it all in eight simple steps. (Thanks to MoveOn.org for staking us.)

By the way, the “other people’s money” that private equity fund managers (as well as other so-called “hedge” fund managers) play with often comes from pension funds that contain the savings of millions of average Americans. The pension fund managers who dole out our savings to private equity and hedge-fund guys also take a hefty slice in bonuses. And like the others, they bear no risk if their bets later turn bad. They get their bonuses regardless. Nor are any of them — private-equity, hedge-fund, or pension-fund managers — personally liable for doing adequate due diligence. They can bet our money on the basis of no more information than what they had for breakfast. But if these funds lose, you lose. That’s what happened in 2008 and 2009. Some of the losses are also shifted to the government’s Pension Benefit Guaranty Corporation – which means taxpayers lose.

It’s a giant con game, and it continues to this day.

Here’s what has to be done to stop it:

1. End the “carried interest” loophole that allows private-equity managers like Mitt Romney to treat their income as capital gains, taxed at 15 percent, even though they don’t risk a dime of their own income. Their earnings should be treated as ordinary income.

2. Hold the managers of private-equity funds, hedge funds, and pension funds to a “due diligence” standard. So if the funds lose money and these managers didn’t exercise due diligence, the Pension Guaranty Corporation can claw back their bonuses.

3. Raise the capital-gains rate to match the tax rate on ordinary income – especially for short-term investments. Give a tax preference only to “patient capital” – that is, for investments held for, say, five years or more.

4. Resurrect Glass-Steagall.

Mitt and others like him won’t like any of these reforms. They’d eliminate the humongous profits they’ve enjoyed at the expense of the rest of us.

But these reforms are necessary if we’re to take back our economy.

Demeter

(85,373 posts)It has been widely reported that the top 1 percent of Americans control 40 percent of the nation's wealth, and the richest 400 individuals control as much as the bottom 150 million people, but what not everyone knows is how much of that wealth is inherited. Roughly half of the wealthiest Americans inherited all or much of their wealth, and the United States ranks near the bottom of rich countries in terms of intergenerational mobility. What's more, the vast majority of inherited wealth goes entirely untaxed. Under current law, heirs can inherit an estate of up to $5 million without paying a cent in federal taxes. In fact, it's likely that a sizable portion of that income was never taxed in the first place. About 56 percent of the largest estates are bequeathed in the form of unrealized capital gains, and under current law, no one pays taxes on that income - ever. The tiny portion of inherited wealth that is taxed is severely undertaxed. The average effective tax rate on inheritance is less than 3 percent, a fraction of the average rate on other kinds of income. In other words, someone who inherits his or her wealth without lifting a finger pays substantially less taxes than someone who earns the same amount through hard work.

The current estate tax is set to expire and revert to Clinton-era levels after 2012, making it a likely bargaining chip in this year's budget battles. The question is: what kind of bargain will it be? Conservatives like Mitt Romney call for the immediate and permanent repeal of the estate tax. In fact, all of the Republican candidates for President endorse the idea, and many members of Congress continue to push for it. The stakes are higher than you might think. Economists estimate that repealing the estate tax would cost the federal government $670 billion over ten years (compared to existing law), making the tax code significantly more regressive and compounding the social, political and economic harms of extreme wealth inequality.

Alternatively, a modest reform of the estate tax, like closing the loopholes that allow wealthy individuals to avoid paying it, or requiring heirs to pay capital gains taxes on the assets they inherit, would dramatically increase the amount of revenue it generates. If inheritance were simply taxed at the same average rate as other kinds of income, the ten-year yield would be trillions, rather than billions, of dollars. The additional revenue could be used to pay down the national debt, to finance infrastructure or research projects, or to offset tax cuts in other areas - something both conservative and liberal politicians claim to support. And the arguments for taxing inheritance go far beyond fiscal responsibility.

First, taxing inheritance promotes greater equality of opportunity. Most Americans are comfortable with a limited degree of outcome inequality (that is, income inequality), but giving every individual a more or less equal opportunity to succeed is a core American value, arguably implied by the declaration that "All men are created equal." Large inheritances counteract this ideal, as Jefferson himself argued....

Demeter

(85,373 posts)The recent surge in U.S. gasoline prices may be stalling thanks to a growing supply of crude oil and a retreat by speculators in the futures market. After weeks of consecutive increases, the average price of a gallon of gas in the U.S. fell more than a penny this week, from $3.94 on April 2, to $3.93 on April 9. In California, the state with the highest gas prices in the lower 48, prices fell to an average of $4.28 a gallon on April 9, down from $4.35 three weeks ago.

“I think we’re seeing the gas and diesel markets start to run out of steam,” says Ben Brockwell, director of data and pricing at Oil Price Information Service (OPIS), a New Jersey-based energy research firm. Two weeks ago, Brockwell was all but certain the price of gas would hit a national average of $4 a gallon by the end of April. Now he’s not so sure: “There’s a chance this market has peaked and that we won’t see $4 average prices at the pump.”

Gas prices haven’t fallen everywhere, though. They continue to rise along much of the East Coast, particularly in New England, where the average price rose 7¢ last week, from $3.89 to $3.96. A flurry of East Coast refinery shutdowns of late has squeezed supply chains and could continue to add to the price of gasoline this summer, particularly in the Northeast...

SURPRISE, SURPRISE! WHAT A COINCIDENCE!

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)and when the economy is dead, they will be giving it away.

Demeter

(85,373 posts)In the spring of 2011, when Libyan oil production -- over 1 million barrels a day (mpd) -- was suddenly taken offline, the world received its first real-time test of the global pricing system for oil since the crash lows of 2009. Oil prices, already at the $85 level for WTIC, bolted above $100, and eventually hit a high near $115 over the following two months. More importantly, however, is that -- save for a brief eight week period in the autumn -- oil prices have stubbornly remained over the $85 pre-Libya level ever since. Even as the debt crisis in Europe has flared.

As usual, the mainstream view on the world’s ability to make up for the loss has been wrong. How could the removal of “only” 1.3% of total global production affect the oil price in any prolonged way? was the universal view of “experts.” Answering that question requires that we modernize, effectively, our understanding of how oil's numerous price discovery mechanisms now operate. The past decade has seen a number of enormous shifts, not only in supply and demand, but in market perceptions about spare capacity. All these were very much at play last year. And, they are at play right now as oil prices rise once again as the global economy tries to strengthen.

The Subordination of Cushing

Through the dominant force of its own demand, the US economy largely controlled the oil price for many decades. For years, it was common practice therefore to gauge world demand through the weekly updates to oil storage at Cushing, Oklahoma as well as total oil storage in the United States. If the US was demanding more oil from the global market, and thus either not adding to oil inventories or drawing them down, then a signal was given, pointing to future oil price strength. But this dynamic began to break down coming into 2005-2007. That was the period when US oil demand -- because of rising prices -- began its current decline. Now that US oil demand is down over 12% from its mid-decade peak, the fluctuation of oil inventories in the US no longer drives prices.

CHART AT LINK ....What we're now seeing is that US inventories and US demand are now subordinate to numerous other factors, ranging from emerging market demand, to market perception of spare capacity.

Lessons of Libya

A useful fact learned during last year's Libyan civil war is that Saudi Arabia does not necessarily possess the 2-3 mbd of spare capacity which most have assumed for years. Moreover, Saudi Arabia ceded the position of top world oil producer to Russia over 5 years ago in 2006. Indeed, Saudi Arabia made no production response to the loss of Libyan oil last spring. Producing near 9 mbd, it was only by June that Saudi production was lifted by 600 thousand barrels a day (kbd). That is a hefty production increase to be sure, but it raised questions as to how quickly spare capacity in the world can be brought online. By the time Saudi Arabia had lifted production, the OECD countries led by the IEA in Paris had already decided to release oil from official inventories. But this, too, did little to calm oil prices -- and as I pointed out last June, only created further problems. In The Dark Side of the OECD Oil Inventory Release, I explained that, by lowering OECD inventories, the market would correctly deduce that safety buffers had been reduced further. Combined with the Saudi increase in production, this only reduced spare capacity further. The result was even stronger prices as WTIC ran back to $100 (until all global markets floundered on a flare-up in the EU financial crisis). Indeed, it is no longer US inventories of crude oil but the fluctuations in the emergency cushion of all inventories in the OECD (of which the US is part) that is now the more important factor in oil prices: CHART AT LINK..The loss of Libyan production caused a dramatic drawdown of OECD total oil stocks, which were already in a downward trend starting the previous summer in 2010. OECD inventories fell on both an absolute basis and on a comparative basis to the trailing 5-year average, as the above chart shows. Taking these inventories from a high of 2800 mbd to 2600 mbd onlysix months later, combined with unrest across the entire Middle East, was more than enough support to boost WTIC oil prices from $85 to above $100 last spring. Additionally, as we can see in the chart, the decline in OECD oil inventories was maintained into the end of 2011.

MUCH MORE AT LINK

DemReadingDU

(16,000 posts)4/12/12 Yes, Virginia, this is Obama’s JOBS Act

A number of people, many of them enthusiastic supporters of President Obama, wrote in to complain about my last piece about the JOBS Act. The gist of many of these letters was that the new deregulatory law could in no way be described as "Obama's JOBS Act."

"This was a Republican bill, birthed by Eric Cantor in the House, and driven by overwhelming Republican support," wrote in one emailer. "All Obama did was sign it. It’s totally dishonest to call it an Obama bill."

Okay, let’s talk about that. But first, a quick note on the bill itself, since I think some people misunderstand the objection to the bill.

.

.

So Obama basically sacked Volcker to appease Wall Street and renamed the Economic Recovery Advisory Board, calling it the "President’s Council on Jobs and Competitiveness." He also made a key decision at that time in putting Gene Sperling, a former adviser to both Larry Summers and Timothy Geithner, in charge of his National Economic Council.

Sperling was a key figure in one of the great deregulatory efforts in recent American history, serving as Summers’s key negotiator during the repeal of the Glass-Steagall Act in 1999. Incidentally, just before he took the key Obama post, Sperling earned $887,727 from Goldman Sachs in 2008 for his "advice." His deregulatory fervor would become another factor in the passage of the JOBS Act.

After changing the name of the Economic Recovery Committee to the Jobs Council, Obama made a radical switch of the group’s leadership. No more would it be run by a tough-on-crime curmudgeon like Volcker, who complained about the "moral hazard" of massive public assistance to banks coupled with weakened regulation and enforcement; the new council would have a different flavor.

Instead, it would be run by General Electric CEO Jeffery Immelt, a man who basically personified Volcker’s "moral hazard" concerns. Immelt collected tens of millions in salaries and bonuses for running a firm that a) came crying to the state for over a hundred billion dollars in bailouts, guarantees and surreptitious Fed support in the years after the crash, and b) was under investigation at the time of Immelt’s appointment for a variety of crimes.

Anyway, some time after the crash, as Obama’s own SEC was working out how much to fine Immelt’s own company for (among other things) accounting fraud and rigging municipal bond bids, Obama decided to put Immelt in charge of a task force that ultimately would recommend a slackening of regulatory enforcement as a means to create jobs.

.

.

So to recap: Three different Obama-created committees contributed major policy ideas to the bill. Obama himself heartily endorsed it through his Statement of Administration Policy. And the bill sailed through the Democratic-controlled Senate when someone up above decided it would be too much trouble to bother with the normal committee process of debate, testimony, and amendments.

Of course the Republicans wanted this bill, pushed for it, wrote its most piggish passages. But the Republicans always suck on these issues. The real political question, as it always is in Washington, is how much the Democrats choose to fight back and do their jobs, versus how much they choose to step aside and take Wall Street money in exchange for "letting nature take its course." And the JOBS Act is a classic example of a Democratic administration looking the other way while thieves robbed the store.

long article...

http://www.rollingstone.com/politics/blogs/taibblog/yes-virginia-this-is-obama-s-jobs-act-20120412

This video embedded in above article

Demeter

(85,373 posts)A HOW TO GUIDE TO BOOKMARK, IF YOU CAN'T USE IT RIGHT AWAY...

http://www.chrismartenson.com/blog/raising-and-harvesting-broiler-chickens/73153?utm_source=newsletter_2012-04-07&utm_medium=email_newsletter&utm_content=node_title_73153&utm_campaign=weekly_newsletter_65

DemReadingDU

(16,000 posts)Between harvesting chickens in above article, and the mechanized meat processes in this article, I am considering becoming a vegetarian.

4/12/12 And You Thought It Was Just ‘Pink’ Slime

"Lean finely textured beef," aka "pink slime," sparked an uproar when the USDA bought 7 million pounds of the stuff for school lunches. The agency maintains it's safe and healthy; critics say it's not fit to eat. But the burger filler isn't new, nor is it the only way that meat packers maximize production. Here's how it stacks up against two other mechanical processes.

more...

http://www.propublica.org/special/and-you-thought-it-was-just-pink-slime

AnneD

(15,774 posts)one or two at a time on the farm. I got pretty good at scalding and plucking. Yes I was a cotton picking chicken plucker. If people had to prepare their own meat, they would eat less of it.

xchrom

(108,903 posts)(Reuters) - Speculation that China's weakest quarter of annual economic growth since the global financial crisis will trigger a flood of policy support to fight the downturn misses a crucial point - the taps are already turned on.

The annual rate of GDP growth in the first quarter slowed to 8.1 percent from 8.9 percent in the previous three months, the National Bureau of Statistics said on Friday, below the 8.3 percent consensus forecast of economists polled by Reuters.

China's stock market rallied despite the disappointing data, on the hope that the poor first-quarter showing would be enough to spur more assistance from Beijing, perhaps easier lending terms or more government spending.

But China's fiscal policy has been firmly pro-growth since the autumn of 2011 and easier monetary policy in the form of 100 basis points of required reserve ratio (RRR) cuts has given banks some 800 billion yuan ($127 billion) of extra cash to lend.

Demeter

(85,373 posts)THE BAD GUYS?

Future generations will look back and ask themselves, 'How could they not see what was happening? Were they blind?' The Fed is not the only problem here, but a key enabler. White collar crimes and fraud flourished amongst the robber barons even in the days of the gold standard. It just was not as convenient, as easy, to defraud the people en masse through the debasement of the currency.

The Fed has merely proven to be as vulnerable as the regulators and the Congress to the power of the monied interests. If the political campaign process had not been corrupted by money, if the fairness doctrine in the media and Glass-Steagall in banking had not been overturned by the mindless impulse to cast aside the best of the laws, many of the problems we have today would not be so great.

These fellows create crises, and then 'save us' from them, while lining their own pockets and perpetuating the swindle for their less publicly visible puppet masters. There is little doubt in my own mind that Greenspan knew exactly what he was doing, and made his fateful decision after a meeting with Robert Rubin in the 1990's shortly after his famous 'irrational exuberance' speech. What was said, what was promised or threatened, I cannot say. But the change in direction became clear. It became open season on the voices of reason and restraint in Washington...What Clinton hatched, Bush brought to full fruition, particularly with his tax cuts, stock bubble, and unfunded wars. And when the Great Reformer came to Washington in the midst of the collapse, he brought back the very advisors who had helped to create the problem in the first place and betrayed the mandate of those who had elected him, prosecuting no one. And in the aftermath of the financial collapse, the first popular reform movement that rose up in anger against the bailouts, The Tea Party, was quickly turned into a corps of willing tools that turned on the weak and the least among us, the very victims of a corrupt system, in their petulant pride and misdirected anger.

I only fear that the Fed, and some of the perpetual outsiders of history, will be made the scapegoats by the real culprits when the time of reckoning comes, and that genuine reform will be thwarted once again as it has been so many times in the past. Their hypocrisy and shamelessness knows no bounds.

NYT

Who Captured the Fed?

By DARON ACEMOGLU and SIMON JOHNSON

March 29, 2012, 5:00 am

http://economix.blogs.nytimes.com/2012/03/29/who-captured-the-fed/

xchrom

(108,903 posts)(Reuters) - The world's 20 biggest economies are likely to agree to increase the resources of the International Monetary Fund by between $400 and $500 billion (250 and 313 billion pounds), rather than the $600 billion (375 billion pounds) initially sought by the IMF, Group of 20 officials have told Reuters.

The extra money is to give the IMF, which is a lender of last resort to governments, more firepower to fight the sovereign debt crisis, triggered by unsustainable policies in euro zone countries such as Greece, Portugal and Ireland.

G20 finance ministers meet next week in Washington to discuss the IMF's call for more resources from January after the euro zone increased the size of its own crisis-fighting funds in March in response to G20 pressure.

IMF Managing Director Christine Lagarde said on Thursday that reaching an agreement could take some time, a sign that next week's meeting may not be the last word.

But she also said the IMF may not need as much money as it thought just a few months ago as economic and financial risks had receded and the global lender's funding needs were now smaller.

Demeter

(85,373 posts)Demeter

(85,373 posts)Total student loan debt has topped $1 trillion ... but there's no need to panic.

Most borrowers have a reasonable amount of debt, and the total balance is not likely to cause major damage to the economy like the mortgage crisis did, experts say.

"I don't think it's a bubble," said Mark Kantrowitz, publisher of Finaid.org, a financial aid website. "Most students who graduate college are able to repay their loans."

THE USUAL SYMPTOMS OF LOOSE AND NARROW-MINDED THINKING

OF COURSE, THE INABILITY TO DISCHARGE THE DEBT THROUGH BANKRUPTCY MEANS NOTHING, EITHER...

Demeter

(85,373 posts)Watching pompous politicians, egotistical economists, arrogant investment geniuses, clueless media pundits, and self- proclaimed experts on the Great Depression predict an economic recovery and a return to normalcy would be amusing if it wasn’t so pathetic. Their lack of historical perspective does a huge disservice to the American people, as their failure to grasp the cyclical nature of history results in a broad misunderstanding of the Crisis the country is facing. The ruling class and opinion leaders are dominated by linear thinkers that believe the world progresses in a straight line. Despite all evidence of history clearly moving through cycles that repeat every eighty to one hundred years (a long human life), the present generations are always surprised by these turnings in history. I can guarantee you this country will not truly experience an economic recovery or progress for another fifteen to twenty years. If you think the last four years have been bad, you ain’t seen nothing yet.

Hope is not an option. There is too much debt, too little cash-flow, too many promises, too many lies, too little common sense, too much mass delusion, too much corruption, too little trust, too much hate, too many weapons in the hands of too many crazies, and too few visionary leaders to not create an epic worldwide implosion. Too bad. We’ve experienced horrific Crisis periods three times in the last 250 years and winter has arrived again exactly as forecasted by Strauss & Howe in 1997. The linear thinkers will continue to predict a recovery that never arrives. We have awful trials and tribulations, dreadful sacrifices of blood and treasure, and grim choices awaiting our country over the next fifteen years. Linear thinkers will scoff at such a statement as they irrationally view the world as a never ending forward progression towards a glorious future. History proves them wrong. We stand here in the year 2012 with no good options, only less worse options. Decades of foolishness, debt accumulation, and a materialistic feeding frenzy of delusion have left the world broke and out of options. And still our leaders accelerate the debt accumulation, while encouraging the masses to carry-on as if nothing has changed since 2008. Sadly, millions of lemmings want to believe they will not drown in the sea of un-payable commitments. Truth is a scarce resource on the planet today.

“Sometimes people don’t want to hear the truth because they don’t want their illusions destroyed.” – Friedrich Nietzsche

Entire populations taking comfort in their illusions transcends centuries. This is because all humans are driven by their emotions and react to events and danger in a predictable manner depending on their stage of life. Strauss & Howe in their 1997 opus – The Fourth Turning – utilized decades of studying generational dynamics to anticipate when our next Crisis would arrive and what core elements would precipitate it:

“The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II.” – Strauss & Howe - The Fourth Turning

MORE

Demeter

(85,373 posts)As other nations rise, the US is in relative economic decline – and the country’s political system is making things worse...

AN AMAZINGLY IGNORANT 1%-ORIENTED EXPLORATION OF THE TOPIC...GOOD FOR CHUCKLES

AnneD

(15,774 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Demeter

(85,373 posts)It broadens the database considerably. (And it's one less thing others have to do...)

Roland99

(53,342 posts)meaning, if I happen to have a few moments right about 8:30 and catch the reports. sometimes work precludes that. silly work! ![]()

xchrom

(108,903 posts)(Reuters) - JPMorgan Chase & Co's (JPM.N) first-quarter profit fell 3 percent as recent improvement in trading and deal-making failed to lift investment banking revenue to year-earlier levels, but results still beat Wall Street expectations.

JPMorgan is the first major U.S. bank to announce results for the quarter. Its recovery after a dismal 2011 fourth quarter bodes well for rivals such as Goldman Sachs Group Inc (GS.N), Morgan Stanley (MS.N), Bank of America Corp (BAC.N) and Citigroup Inc (C.N), which will all report results in the coming days.

"We were expecting a very good quarter and they have outshined even our very high estimates," said Gary Townsend, president and chief executive of Hill-Townsend Capital. "We're seeing good credit trends. We're seeing a snapback in capital markets operations."

The results follow a surge of investor optimism for banks that has led the stock market higher this year. The KBW index of bank stocks is up more than 23 percent this year, and JPMorgan shares have risen 35 percent.

***

Demeter

(85,373 posts)Roland99

(53,342 posts)DOW 12,880 -70.00 -0.54%

NASDAQ 2,727 -12.00 -0.44% [/font]

Demeter

(85,373 posts)See you all sometime....

xchrom

(108,903 posts)xchrom

(108,903 posts)France's economy posted no growth in the first quarter and there is no sign of a brisk recovery, according to a Bank of France survey today.

In its monthly report, the Bank of France indicated that the euro zone's second largest economy had avoided a recession and that activity was likely to remain stable in the coming months, a picture confirmed by soft manufacturing data today from the INSEE national statistics office.

INSEE had also forecast last month that France's €2 trillion economy would post no growth in the first quarter.

The Bank of France said that its business sentiment indicator for industry was unchanged in March at 95, a 3-month low it reached in February.

Demeter

(85,373 posts)EMAIL NEWSLETTER

The Royal Canadian Mint just announced it is creating its own digital currency.

It's called the MintChip.

It seems the development of this digital currency is beyond the planning stages, it is well underway. The Canadian Mint is currently running a contest for software developers to spur the development of applications that use the currency (here's the video announcing the challenge) with over $50,000 in prizes. The 500 contest slots were filled in four days...

Let's be clear. The MintChip isn't a new currency. It's a digital version of the Canadian dollar. If they wanted to create a new digital currency, the best choice would be a digital Canadian Maple Leaf, a currency backed by gold. However, even if it isn't a new currency, it can still be a digital currency. How? A digital currency that makes it possible to transact in a similar way you use cash, both online and wirelessly. What makes it different from the other types of digital transactions we have today is that a digital currency allows:

How does the system work?

You purchase a MintChip from a vendor. It's likely something that looks like a thumbnail USB or equivalent. You then plug the chip into the device you want to use. A laptop or cell phone.

Here's how you use the MintChip:

- You can load your chip with Canadian dollars from your bank's ATM or Web site.

- You can then use the device to buy things online or wirelessly from retailers and other vendors.

- You can also transfer funds between individuals that also have chips.

What Could or Will Go Wrong?

While the potential of a digital currency is exciting, there are lots of pitfalls that have tanked digital currencies in the past. These include: - Eavesdropping. Users are forced to use a MintChip with a unique ID or the chip phones home (the government) with the details of every transaction. Why would this happen? The government trots out usual legal canards of terrorism, pedophilia, and tax evasion to make the case that nobody should transact anonymously.

- Hackers might break the encryption on the chip earlier than anticipated. This hack will happen (inevitably), as it does with all systems. However, a major hack early in the currency's lifespan could make the system look unsafe.

- Other governments might make use of the currency illegal for their citizens.

What Does This Mean?

Over the longer term, it's inevitable that we will see true digital currencies. The fact that the Royal Canadian Mint is exploring it is a good sign that it will happen sooner than later.

At the global level, I'm not sure anybody realizes the incredible amount of pent up demand there is for a safe digital currency. Imagine what would happen if a TRUE digital currency emerged from a government like Singapore or Switzerland? A currency like that could become one of the world's top currencies in a few short years. That's an incredible opportunity for the first safe and stable government ready to grab it.

In our personal lives, a true digital currency would allow us a degree of freedom over our finances that we haven't had for decades. If it was backed by gold or at least a sound government, we could sleep easier knowing that the wealth we have stored in it is safe. It would also allow us to store the currency locally, on the chip, which would reduce the risk of bank failure.

Let's hope the Canadian's, or some other source, is successful sooner than later.