Economy

Related: About this forumSTOCKMARKET WATCH -- Wednesday, 11 July 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 11 July 2012[font color=black][/font]

SMW for 10 July 2012

AT THE CLOSING BELL ON 10 July 2012

[center][font color=red]

Dow Jones 12,653.12 -83.17 (-0.65%)

S&P 500 1,341.47 -10.99 (-0.81%)

Nasdaq 2,902.33 -29.44 (-1.00%)

[font color=green]10 Year 1.50% -0.02 (-1.32%)

30 Year 2.60% -0.02 (-0.76%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

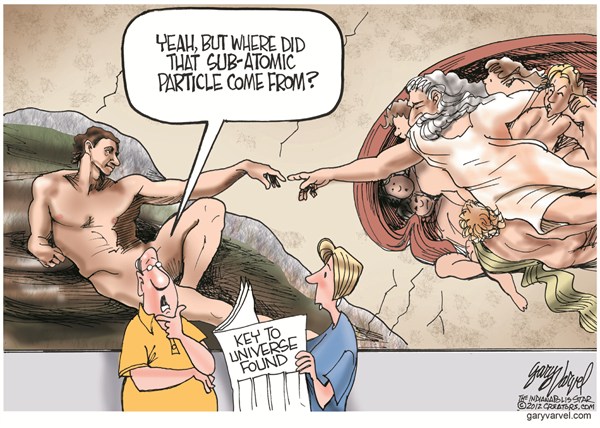

(17,847 posts)I couldn't resist.

And yes, I noticed the nose. . . . .

For further reading. . . .

http://blogs.scientificamerican.com/guest-blog/2010/05/27/michelangelos-secret-message-in-the-sistine-chapel-a-juxtaposition-of-god-and-the-human-brain/

http://emp.byui.edu/DAVISR/202/CreationOfAdamBrain.htm

Fuddnik

(8,846 posts)Talk about sub-atomic particles.

Tansy_Gold

(17,847 posts)in these trying times. . . .

(I have a dog whose emanations are radioactive. . . . . . )

I am missing a lot of something, obviously.

Pretend I've been on a desert island for a few decades....

Fuddnik

(8,846 posts)Tansy_Gold

(17,847 posts)I must have a really warped imagination, if YOU didn't get it, Fudd. ![]()

Look at the guy who's speaking in the cartoon.

Look at his nose.

Now step back a bit and look at where his head is placed.

Demeter

(85,373 posts)Miss Tansy, you have a lewd mind

Fuddnik

(8,846 posts)tclambert

(11,084 posts)Judge Valkenheiser of Valkenvania. Here's a short clip:

Demeter

(85,373 posts)YEAH, YOU GET A BETTER CLASS OF CRIMINAL....THE "CURSE" OF "ADVANCED ECONOMIES" IS THE CRONYISM!

OF COURSE, THE IMF CAN'T SAY THAT....SINCE THEY ARE ALL CRONIES, TOO....

http://www.voxeu.org/article/curse-advanced-economies-resolving-banking-crises

Countries typically resort to a mix of policies to contain and resolve banking crises, ranging from macroeconomic stabilisation to financial sector restructuring policies and institutional reforms. However, despite many commonalities in the origins of crises (Reinhart and Rogoff 2009), existing crisis management strategies have been met with mixed success. Successful crisis resolutions have been characterised by transparency and resoluteness in terms of resolving insolvent institutions, thus removing uncertainty surrounding the viability of financial institutions. This requires a triage of strong and weak institutions, with full disclosure of bad assets and recognition of losses, followed by the recapitalisation of viable institutions and the removal of bad assets and unviable institutions from the system (Honohan and Laeven 2005).

Sweden’s experience during its banking crisis in the early 1990’s is often hailed as an example of successful crisis resolution. The Swedish government moved swiftly to liquidate failing banks, recapitalise viable institutions, and remove bad assets from the system, avoiding large-scale forbearance and evergreening of assets. As a result, Sweden avoided prolonged stagnation that lingering bad assets would have entailed, achieving a quick recovery from the crisis, supported by external demand...Yet, not all countries achieve Sweden’s rate of success. Japan is a case in point. Instead of acknowledging the true extent of losses at troubled banks early on, authorities allowed insolvent institutions to continue to operate as “zombie” banks, evergreening bad credits, and using deferred tax accounting to bolster their regulatory capital positions (Caballero et al. 2008). The reluctance of these banks to resolve bad assets contributed to the Japanese lost decade.

While conventional wisdom would have it that advanced economies with their stronger macroeconomic frameworks and institutional setting would have an edge in crisis resolution, the record thus far supports the opposite: advanced economies have been slow to resolve banking crises, with the average crisis lasting about twice as long as in developing and emerging market economies (Table 1). While differences in initial shocks and financial system size surely contribute to these different outcomes, in a recent working paper (Laeven and Valencia 2012), we suggest that the greater reliance by advanced economies on macroeconomic policies as crisis management tools may delay financial restructuring, with the risk of prolonging the crisis. We refer to this as the ‘curse’ of advanced economies.

This is not to say that macroeconomic policies should not be used to support the broader economy during a crisis. Macroeconomic policies should be the first line of defence. They stimulate aggregate demand and sustain asset prices, thus supporting output and employment, and indirectly a country’s financial system. This helps prevent a disorderly deleveraging and gives way for balance sheet repair, buying time to address solvency problems head on. However, by masking balance sheet problems of financial institutions, they may also reduce incentives for financial restructuring, with the risk of dampening growth and prolonging the crisis. A similar point is made in BIS (2012). Indeed, crisis responses to date in advanced economies have favoured accommodative monetary and fiscal policy, with the increase in public debt and monetary expansion amounting to about 21% and 8% of GDP, respectively – compared with about 10% and 1% of GDP, respectively, in developing and emerging market economies (see Table 1 below). In this context, monetary expansion, measured as the percentage increase in reserve money, should not be understood narrowly as conventional monetary policy, but also as capturing central bank liquidity support and unconventional measures to the extent that they increase reserve money.

Table 1. Banking crises outcomes, 1970–2011 (median values across countries)

Country Output loss Increase in debt Monetary expansion Fiscal costs Duration

In % of GDP In years

All 23.0 12.1 1.7 6.8 2.0

Advanced 32.9 21.4 8.3 3.8 3.0

Emerging 26.0 9.1 1.3 10.0 2.0

Developing 1.6 10.9 1.2 10.0 1.0

Source: Laeven and Valencia (2012)

--EDIT---

Table 2. Crises Outcomes and Resolution in the Euro Area and the US since 2007

Country Output loss Increase in debt Monetary expansion Fiscal costs Peak liquidity Liquidity support Peak NPLs

In % of GDP In percent of profits and foreign liabilities In percent of total loans

Euro area 23.0 19.9 8.3 3.9 19.3 13.3 3.8

US 31.0 23.6 7.9 4.5 4.7 4.7 3.9

Source: Laeven and Valencia (2012).

*****************************************************************************************

While the authors of this note are staff members of the International Monetary Fund, the views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

Demeter

(85,373 posts)In a potential setback for large financial firms, regulators are expected to vote Tuesday on a rule requiring banks with more than $10 billion in assets to trade swaps through a central clearinghouse, according to a person familiar with the rule. The vote will be accompanied by a separate ruling on the precise definition of swaps, the financial contracts at the heart of the 2008 credit crisis. That definition will set in motion a series of other rules affecting trillions of dollars of financial contracts.

The voting at the Commodity Futures Trading Commission "starts the scramble to the finish line," said Joel Telpner, a lawyer at Jones Day who specializes in derivatives. "It's the trigger for moving forward with the next phase" of the Dodd-Frank financial overhaul passed by Congress in 2010. The CFTC's proposed clearinghouse rule would force banks with more than $10 billion to post extra cash to back their swaps deals, a requirement for all clearinghouse clients. Critics of the requirement have said it would hurt the economy by forcing firms to tie up cash they could use for retail or business loans, and banks have pushed for a wider set of exemptions.

The rule's backers say it will provide a cushion for firms that could suffer big losses on their swaps deals, as well as to the firms' counterparties. Most banks in the past traded swaps on the so-called over-the-counter market and often didn't post collateral to back their deals. The CFTC, which regulates a large portion of the derivatives market, will also propose exempting cooperatives such as farm credit unions from the clearinghouse requirement, as long as their members meet certain financial requirements, according to the person close to the agency. Lawyers and analysts said Monday that they expect the commission to approve the proposals. The Securities and Exchange Commission unanimously approved a similar set of rules for swaps on Friday...The exemptions aren't a surprise. Still, the $10 billion limit was the subject of fierce debate. Some banks had pushed regulators to raise the limit on assets to $50 billion, which would have drastically reduced the number of firms covered by the law. Others said that all banks should be required to clear their swaps trades.

MORE DETAIL

Demeter

(85,373 posts)A set piece of Voltaire’s 18th century masterpiece, “Candide,” is a scene in which the British, after losing a battle, execute one of their own admirals “pour encourager les autres.”

The analogy may be a bit heavy-handed, yet in many ways it fits what Finra -- the Financial Industry Regulatory Authority, Wall Street’s self-regulatory organization -- did to three arbitrators who, in May 2011, had the temerity to find in favor of a customer in a securities arbitration against Merrill Lynch, the nation’s largest brokerage and a unit of Bank of America Corp. After awarding the estate of the customer more than $520,000 -- a large amount by arbitration standards --Finra heard from unhappy Merrill executives and fired the arbitrators, two of whom had many years of experience.

“You mete out justice, and then you get slapped in the face,” one of the fired arbitrators, Fred Pinckney, told me in an interview.

The matter began in December 2009, after Robert C. Postell, of Alpharetta, Georgia, and his wife, Joan, filed an arbitration claim against Merrill Lynch for more than $640,000 plus attorney’s fees. Postell, who had a successful automotive- safety-equipment business, claimed that his Merrill broker failed “to adequately monitor” his accounts, according to a publicly available copy of the Finra arbitration summary. The Postells also asserted claims of “breach of contract” and “breach of fiduciary duty” against Merrill. Not surprisingly, the brokerage, through its attorney, Terry Weiss, of Greenberg Traurig LLP, in Atlanta, denied the Postells’ claims.

Finra Waiver

Anyone who works on Wall Street or has a brokerage account must agree, from the outset, that any financial claims made against their employer or broker will be adjudicated not in the courts but in an arbitration process overseen by Finra, a private organization that derives the bulk of its $1 billion in revenue from the Wall Street companies that are its members. This upfront agreement by millions of Americans to submit to a Finra arbitration process -- which I experienced first hand in 2003-2004 -- constitutes one of the largest ongoing abdications of legal rights in the U.S., and nobody seems to be bothered enough to rectify it. (To make matters worse, Mary Schapiro, the chairman of the Securities and Exchange Commission, was previously head of Finra, whose board awarded her a $9 million bonus when she left that post in January 2009.)

MORE

Response to Tansy_Gold (Original post)

westerebus This message was self-deleted by its author.

Demeter

(85,373 posts)Peregrine Financial Group Inc, the regulated unit of the brokerage PFGBest, has filed to liquidate under Chapter 7 of the U.S. bankruptcy code, a court filing shows.

Tuesday's filing with the U.S. bankruptcy court shows that Peregrine has between $500 million and $1 billion of assets, between $100 million and $500 million of liabilities, and between 10,000 and 25,000 creditors.

A board resolution authorizing the bankruptcy was signed by President Russell Wasendorf Jr, who also signed on behalf of Chairman Russell Wasendorf Sr.

The resolution said Russell Wasendorf Jr was empowered to act for Russell Wasendorf Sr in the event the latter became incapacitated, under a power of attorney dated July 3.

Russell Wasendorf Sr attempted suicide on July 9.

Demeter

(85,373 posts)There are few counties in America in as rough shape as San Bernardino County in California. During the housing bubble, the good times were very good. But then came the bust. Today, San Bernardino County has one of the highest unemployment rates in the nation: 11.9 percent. Home prices have collapsed. Astonishingly, every second home is underwater, meaning the homeowner owes more on the mortgage than the house is worth. It is well documented that underwater mortgages have a high likelihood of defaulting — and, eventually, being foreclosed on. It has also been clear for some time that the best way to keep troubled homeowners in their homes is by reducing the principal on their mortgages, thus lowering their debt burden and more closely aligning their mortgage with the actual value of the home.

Which is why Greg Devereaux, the county’s chief executive officer, found himself listening intently when the folks from Mortgage Resolution Partners came knocking on his door. They had spent the previous year kicking around an intriguing idea: have localities buy underwater mortgages using their power of eminent domain — and then write the homeowner a new, reduced mortgage. It’s principal reduction using a stick instead of a carrot. I know. When you first hear this idea, it sounds a little crazy. Eminent domain to take a mortgage? But the more closely you look at it, the more sense it starts to make. It would be a way to break the logjam that keeps mortgages in mortgage-backed bonds — securitizations — from being modified. It could prevent foreclosures. And it could finally stabilize housing prices. The core issue that Mortgage Resolution Partners is trying to solve is what might be called the securitization problem. Bundling mortgages into securities and selling them to investors was, initially, a wonderful idea because it greatly expanded the amount of capital available for homeownership. But the people who wound up owning the mortgages — investors — were diffuse, often with conflicting interests, while the mortgages were managed by servicers or trustees who didn’t actually own them. And the securitization contracts never anticipated that people might need to modify. So it has been nearly impossible to modify mortgages stuck in securitizations.

It turns out, however, that there is nothing to prevent a government entity from using eminent domain to acquire a mortgage. “Eminent domain has existed for centuries,” said Robert Hockett, a law professor at Cornell who has served as an adviser to Mortgage Resolution Partners. “And it is applicable to any kind of property, including a mortgage.” What matters, Hockett continued, is two things: is the entity paying fair value for the property, and is it for a legitimate public purpose? Can there be any doubt that keeping people in their homes constitutes a legitimate public purpose? “This is a yoke around the American economy,” said Steven Gluckstern, an entrepreneur with a varied career in insurance and finance who is the chairman of Mortgage Resolution Partners. “When people are underwater, their behavior changes. They stop spending. There are 12 million homes that are underwater,” he added. “Is the answer to really just let them get foreclosed on? Or wait for housing prices to rise?” According to Gluckstern, the fact that the foreclosure crisis is continuing is precisely why housing prices aren’t rising — despite some of the lowest interest rates in history....As for fair value, since the home has dropped dramatically in value, the mortgage is worth a lot less than its face value. On Wall Street, in fact, traders are buying securitized mortgage bonds at a steep discount — reflecting the true value of the mortgages they’re buying. Yet the homeowner remains saddled with a mortgage that is unrealistically high. The plan calls for the county to buy mortgages at a steep, but fair, discount to its face value, and then to offer the homeowner a new mortgage that reflects much, though not all, of that discount. (Fees and costs would be paid for by the spread.) The money to buy the mortgages would come from investors; indeed, Mortgage Resolution Partners is in the process of raising money.

The securitization industry is up in arms about this proposal. In late June, after the plan was leaked to Reuters, some 18 organizations, including the Association of Mortgage Investors, wrote a threatening letter to the San Bernardino board of supervisors claiming that the plan would inflict “significant harm” to homeowners in the county. For his part, Devereaux insists that no final decision has been made. But, he says, “this is the first idea that anyone has approached us with that has the potential to have a real impact on our economy.” Other cities are watching closely to see what happens in San Bernardino. We’re four years into a housing crisis. Nothing has yet worked to stem the terrible tide of foreclosures. It’s time to give eminent domain a try.

AH, YES! BUT WOULDN'T THAT MEAN PRIVATIZING THE LOSSES, AND SOCIALIZING THE GAINS?

Demeter

(85,373 posts)A report from a consumer group released today says that vulnerable owners are losing their homes for owing as little as $400 in back taxes.

The AP reports:

"Local governments can seize and sell a home if the owner falls behind on property taxes and fees. The process helps governments make ends meet at a time when low property values and the weak economy are squeezing tax revenue.

"But tax debts as small as $400 can cause people to lose their homes because of arcane laws and misinformation among consumers, says John Rao, the report's author and an attorney with NCLC."

The report details how the process works. In most cases, companies like JPMorgan Chase and Bank of America buy tax liens from the city and eventually evict the original owners. The investors then resell the house for a hefty profit. A $200,000 home, for example, might be sold on tax lien sale for $1,200.

Nationally, NCLC reports annual tax lien sales total $15 billion and the elderly and disabled are the most vulnerable.

In its report, NCLC recommends that states revisit their laws by, for example, limiting the profits of investors and limiting the kinds of fees they can charge for owners to get their house back. NCLC also recommends that a court authorize the final sale of the property.

westerebus

(2,976 posts)Sorry, I didn't read past Barnhardt's posting re: PFGBEST = MFGLOBAL. Didn't know it was full of puke. My apologies.

Fuddnik

(8,846 posts)I found the first part interesting, and then every other paragraph after that was "Our father who art in heaven......"

Who the fuck is Art, anyway?

westerebus

(2,976 posts)DemReadingDU

(16,000 posts)That way, you can bypass those father posts, and get directly to her posting on 7/9/12 at 11:22 pm. There was a lot of truth to it, but no way to link to it.

Demeter

(85,373 posts)My computer had a major fail--just winked out of existence, and it doesn't appear that we had a power blink...unless it was a surge that didn't set all the clocks to flashing...I was afraid it was the major trojan that everyone's warning about...but it looks like maybe it was an update failure...

DemReadingDU

(16,000 posts)DemReadingDU

(16,000 posts)7/10/12 PFG is MF Global all Over Again...

Welcome to Capital Account. More than $200 million in customer money is allegedly missing from the accounts of one of the largest, non-clearing, US futures commission merchants, PFG Best. That's according to regulators. The money was supposed to be in segregated customer accounts. Customers have been told their money is frozen. Does this sound oddly familiar? We will hear from two PFG Best customers, Christopher Olson and Mohamed Hawary.

And there is evidence PFG Best may have been committing fraud with falsified statements for years, according to regulators. The FBI is investigating, the CFTC is alleging fraud, but why did regulators miss this? We'll talk about what this shortfall means for investor confidence when a regulated broker can get away with this undetected for years.

And this is not the first time sacrosanct segregated customer funds have gone missing. MF Global went bankrupt less than a year ago taking $1.6 billion in customer money with it. We talk to a man fighting for MF Global customers about why he is having deja vu in the wake of this PFG news. John Roe, co-founder of the Commodity Customer Coalition, joins us.

As for some of the details into the PFG complaint, the National Futures Association (NFA), the broker's first line regulator, discovered during an audit that a US bank account PFG reported was holding $225 million in customer accounts contained only $5. The NFA also alleges the $207 million balance reported in February 2010 and the $208 million balance reported in March 2011, were falsified. PFG's actual balances at those times was less than $10 million for each of the months.

The CFTC, the Commodities Future Trading Commission, filed a complaint against Peregrine Financial Group (or PFG) and its owner Russell Wasendorf. The CFTC alleges fraud by misappropriating customer funds, violating customer segregation laws, and making false statements in financial statements.

appx 28 minutes

xchrom

(108,903 posts)

Demeter

(85,373 posts)xchrom

(108,903 posts)Demeter

(85,373 posts)We are much cooler, but dry as dust and it's supposed to get hotter as the week goes on.

Not a drop of rain in sight. Everybody south of the Mason-Dixon is doing fine.

xchrom

(108,903 posts)in and out of air conditioned environments -- i could feel this coming for days.

hopefully -- it's not infected.

Demeter

(85,373 posts)I had frequent bouts of sinusitis most of my life. Three changes made a difference:

1. I left a smoke-filled environment. That helped, but any time I caught a whiff, my sinuses reacted as if an allergy was triggered.

2. I started regular, serious singing. All that extra breathing, in the proper manner, opens the airways and keeps them open. Classical singing (for women especially, but men, too) develops "head voice" which resonates in all the sinus cavities and passages, forcing them open gradually and usually, painlessly.

3. I got to spend a lot of time in the open air (paper route work). Not only avoiding people and their germs, but also the accumulated germs/allergens/whatever of interior living. If you have to stay indoors, a serious air purifier works wonders, too.

When all else fails, chewable zinc lozenges will take most viruses out of the body quickly.

xchrom

(108,903 posts)My sinuses gave me much less trouble.

Similar, rigorous discipline re: breathing.

It was worse living in the bay area - going from lots of high & low pressure systems to one a little more stable.

I might get a de- humidifier for the bedroom & maybe an air purifier too.

dixiegrrrrl

(60,010 posts)is based on the Neti pot idea, but I do it much more simply.

I inhale ( snort) drops of lightly salted ( boiled and cooled) water up each nostril, several times a day,

whenever I feel the sinus issue coming on. Our barometric pressure yo-yoes several times a day.

It works. Apparently the water washes away all bacteria, plus "undries" the sinus cavity.

Haven't had a cold or flu in decades.

i can't take sinus meds because of blood pressure issues.

xchrom

(108,903 posts)at the market.

i like those.

xchrom

(108,903 posts)JPMorgan reports earnings on Friday, and all attention will be paid to what, if any, new details there are from the London Whale losses reporter in the quarter.

Monica Langley and Dan Fitzpatrick at WSJ have what sound like the definitive details.

Losses will be about $5 billion.

Up to another $1 billion in losses is possible.

The bank will attempt to claw back some money from the executives who left in the wake of the trading blunder.

Among them: Former CIO chief Ina Drew, and the London Whale himself Bruno Iksil.

80%-90% of the botched bet has been totally unwound.

Read more: http://www.businessinsider.com/report-jpmorgan-to-claw-back-money-from-executives-associated-with-london-whale-loss-2012-7#ixzz20JBOsFn8

Demeter

(85,373 posts)J.P. Morgan Chase & Co. plans to reclaim millions of dollars in stock from executives at the center of the trading blunder that shocked Wall Street and tarnished the reputation of Chief Executive James Dimon...The bank could disclose the plans as early as Friday when it announces earnings, these people said. The clawback amounts were still being determined this week because of the complicated formulas and conditions for imposition, according to one person familiar with the situation.

J.P. Morgan's plan is the most prominent instance of a major U.S. bank seeking to recover pay from a high-ranking executive since the financial crisis. Other members of the CIO, including Bruno Iksil, the London-based trader known as the "London whale" for his outsize bets on certain corporate credit indexes, and his bosses Achilles Macris and Javier Martin-Artajo also are expected to face clawbacks, the people said.

...J.P. Morgan has so far sidestepped some of the worst possible repercussions, with no calls for Mr. Dimon's resignation or signs that regulators are preparing a fresh crackdown on big U.S. banks. "Black eyes heal," said Jason Goldberg, a banking analyst with Barclays Capital. "To the extent that they have worked down the majority of the position, we could start to put this issue behind us."

But banking analyst Michael Mayo of CLSA said it would take until the end of the year for investors to be confident that any risk-management weaknesses have been fixed and the losses are under control. The bank has lost about $25 billion in market value since it disclosed the trading losses May 10.

MORE

xchrom

(108,903 posts)Demeter

(85,373 posts)I mean, what do shareholders want, anyway? ![]()

xchrom

(108,903 posts)One of the outperforming markets this morning is Spain. That's something you don't typically hear.

Spain's Prime Minister Mariano Rajoy announced a fresh round of spending cuts and tax increases for the debt laden country.

Cuts are expected to total $80 billion.

Spain's IBEX 35 index is up 0.5 percent.

And the government's borrowing costs are down modestly. Here's a chart of the Spanish 10-year yield which is at 6.77 percent.

xchrom

(108,903 posts)

This morning, the Spanish government announced new austerity measures.

Stocks are a bit higher and yields are a bit lower, so that's good.

According to Reuters, the cuts will involve 65 billion in spending cuts, a 3% increase in the VAT, plus other taxes on other areas.

Note that Spain is in the middle of its worst recession ever.

There is an impulse, still, to believe that in a time of budgetary crisis the solution is to cut... but Spain is now actively weakening its economy when it can least afford to do so.

How long until the market decides that Spain is only exacerbating what's killing it, rather than doing anything that actually will make it more solvent?

Read more: http://www.businessinsider.com/spanish-austerity-2012-7#ixzz20JCkeaqE

xchrom

(108,903 posts)WASHINGTON (AP) -- U.S. companies likely kept adding to their wholesale stockpiles in May, but not quickly enough to spur the kind of growth that would make a dent in the unemployment rate.

Sales at the wholesale level rose 1.1 percent in April, sparking a 0.6 percent rise in inventories that month that likely continued into May. Economists expect sales at the wholesale level may have slipped 0.1 percent in May, however.

Greater restocking means companies ordered more goods, which increases factory production. But the broader economic benefits from faster restocking could be offset by weaker consumer purchases.

Stockpiles at the wholesale level stood at $483.5 billion in April. That's nearly 26 percent above the post-recession low of $384.9 billion in September 2009.

xchrom

(108,903 posts)The eurozone could lose 4.5 million more jobs in the next four years unless the region shifts away from austerity, the International Labour Organization (ILO) has warned.

That rise would take unemployment in the 17-nation bloc to 22 million.

The ILO said a concerted policy shift away from austerity towards job creation was needed.

"It's not only the eurozone that's in trouble, the entire global economy is at risk of contagion," it said.

xchrom

(108,903 posts)The United States said "significant progress" was made in talks aimed at creating an ambitious trade agreement with eight other Pacific Rim countries.

US officials said areas discussed included customs, telecommunications, cross-border services and government procurement.

Negotiators for the Trans-Pacific Partnership (TPP) ended a round of discussions on Tuesday in San Deigo.

The US has said boosting trade with the Asia Pacific region is a priority.

Demeter

(85,373 posts)Safe haven. It is fine combination of words which, rather like private bank, or members only, should have a certain cachet about it. It suggests a currency, bank, company, asset or institution that is rock-solid, reliable, dependable, and has probably been around since Noah was first learning carpentry. It was something you might aspire to. But now no one wants to be a safe haven any more. The Swiss and the Danes are already battling against it — and the other “havens” that remain are becoming ridiculously overvalued. That creates an acute problem for investors. As soon as they flee to a safe haven, the authorities slam the door in their face — or else it turns into a crazy bubble. It does, however, create an opportunity as well — if you can work out what the next safe haven will be, you can ride it as it soars in value.

...Amid the turmoil in the euro zone, and its unending succession of “30 seconds to save the currency” summits, investors have been searching for anywhere they can park their money that keeps them away from Merkel, Hollande, Monti or any of the others in charge of the world’s biggest economic bloc. After all, you don’t want to leave much cash at the mercy of a group of politicians who understand about as much about the markets as you and I do about the Higgs boson particle....

The Icelandic krona looks like good value. It is close to the euro zone but safely outside it. The economy is recovering fast from the financial crisis. And its banks have probably learned their lesson about taking crazy risks. In fact any currency starting with a K looks a good deal right now — the Swedish krona is hitting daily highs, while the Estonian kroon and the Czech koruna look like good bets as well (you might want to give the Papua New Guinea kina a miss though)...So do Polish equities. It is a low-debt, fast-growth economy right next to the main European economies. And the Israeli shekel could easily become the next refuge currency. A strong, well-managed economy, with a tough central bank, it has the potential to become another Switzerland. True, it has a few enemies, but it is hardly as high risk as most of the euro zone.

...In a long-running crisis, there is no better place to park your money than cash in dollars. The U.S. economy may have plenty of problems of its own. It has big debts and growth that is nothing like as fast as it used to be. But compared with the rest of the world, it’s a genuine safe haven — and it is big enough not to be completely overwhelmed by hot money.

NO MENTION OF HARD METALS, I SEE

Demeter

(85,373 posts)WE are prisoners of the metaphors we use, even when they are wildly misleading. Consider how political candidates talk about the economy. Last month President Obama praised immigrants as “the greatest economic engine the world has ever known.” Mitt Romney says that extending the Bush-era tax cuts will “fuel” a recovery. Others fear a “stall” in job growth. Call it the “Machinebrain” picture of the world: markets are perfectly efficient, humans perfectly rational, incentives perfectly clear and outcomes perfectly appropriate. From this a series of other truths necessarily follows: regulation and taxes are inherently regrettable because they impede the machine’s optimal workings. Government fiscal stimulus is wasteful. The rich by definition deserve to be so and the poor as well.

This self-enclosed metaphor is the gospel of market fundamentalists. But there is simply no evidence for it. Empirically, trickle-down economics has failed. Tax cuts for the rich have never once yielded more net revenue for the country. The 2008 crash and the Great Recession prove irrefutably how inefficient and irrational markets truly are.

What we require now is a new framework for thinking and talking about the economy, grounded in modern understandings of how things actually work. Economies, as social scientists now understand, aren’t simple, linear and predictable, but complex, nonlinear and ecosystemic. An economy isn’t a machine; it’s a garden. It can be fruitful if well tended, but will be overrun by noxious weeds if not...Gardenbrain allows us to see that an economy cannot self-correct any more than a garden can self-tend. And regulation — the creation of standards to raise the quality of economic life — is the work of seeding useful activity and weeding harmful activity....Gardenbrain, in contrast, allows us to recognize taxes as basic nutrients that sustain the garden. A well-designed tax system — in which everyone contributes and benefits — ensures that nutrients are circulated widely to fertilize and foster growth. Reducing taxes on the very wealthiest on the idea that they are “job creators” is folly. Jobs are the consequence of an organic feedback loop between consumers and businesses, and it’s the demand from a thriving middle class that truly creates jobs. The problem with today’s severe concentration of wealth, then, isn’t that it’s unfair, though it might be; it’s that it kills middle-class demand. Lasting growth doesn’t trickle down; it emerges from the middle out...

***************************************************************************************

Eric Liu and Nick Hanauer are the authors of “The Gardens of Democracy: A New American Story of Citizenship, the Economy and the Role of Government.”

Demeter

(85,373 posts)The European Union summit in June was clearly an upside surprise: in effect, the Latin bloc forced German Chancellor Angela Merkel to bend, at least slightly. But was it good enough?...The main substantive thing was the agreement in principle to set up something more or less like a European version of the Troubled Asset Relief Program in the United States, in which funds for bank recapitalization will be supplied by a consortium rather than lent to governments already overburdened with debt. Good move, and Irish bond buyers are especially happy. But even this doesn't take effect right away. (Also some bond purchases, but not by the European Central Bank, so they're limited in size. So think of this as a very small version of quantitative easing.)

What we know, even for the United States, is that T.A.R.P. and quantitative easing were perhaps enough to forestall disaster, but not to produce recovery — and Europe has the additional problem of huge needed realignments in competitiveness, which would be much easier if the E.C.B. announced a dramatic loosening — which it didn't...I guess you can argue that this was sort of a down payment — that it is the harbinger of bigger policy changes to come. I hope so. But like Mr. Wyplosz, I suspect that we're overreacting to the simple if admittedly surprising failure to achieve disaster.

Demeter

(85,373 posts)Last edited Wed Jul 11, 2012, 11:02 AM - Edit history (1)

http://truth-out.org/news/item/10259-bank-scandal-turns-spotlight-to-regulators...Politicians in both London and Washington are questioning whether regulators allowed banks to report false rates in the run-up to the 2008 financial crisis and afterward. On Monday, Congress stepped into the fray, requesting information about the role of the Federal Reserve Bank of New York, according to people close to the matter. The Senate Banking Committee on Tuesday also announced it was looking into the issue....On Monday, the oversight panel of the House Financial Services Committee sent a letter to the New York Fed seeking transcripts from at least a dozen phone calls in 2007 and 2008 between central bank officials and executives at Barclays.

Authorities around the world are now considering action against more than 10 big banks, including UBS, JPMorgan and Citigroup. The banks also face a raft of civil litigation from municipalities, investors and other financial firms that claim they lost money from the misreporting of rates. These lawsuits could end up costing the banking industry tens of billions of dollars, according to analysts...

NOT ANYWHERE NEAR COMPENSATION FOR DAMAGES INFLICTED

DemReadingDU

(16,000 posts)7/11/12 3rd Calif. city to file for bankruptcy in 1 month

SAN BERNARDINO, Calif. - The Southern California city of San Bernardino has voted to declare bankruptcy.

The City Council in the city of 210,000 people decided to seek Chapter 9 protection Tuesday night, making it the third California city - after Mammoth Lakes and Stockton - in less than two weeks to make the rare move. It would also become among the largest in the nation ever to declare bankruptcy. Stockton, the northern California city of nearly 300,000, became the biggest when it filed for bankruptcy June 28.

The Los Angeles Times says the City Council made the decision during a meeting where Interim City Manager Andrea Miller told them San Bernardino "has an immediate cash flow issue" and may not be able to make payroll with a budget shortfall of more than $45 million in the next fiscal year.

Stockton filed for bankruptcy after officials were unable to reach a deal with the city's creditors to restructure hundreds of millions of dollars of debt under a new state law designed to help municipalities avoid bankruptcy. The city had been facing a $26 million deficit in next year's budget.

The ski town of Mammoth Lakes sought bankruptcy protection because it is facing a $43 million judgment that's more than twice the town's budget.

Before Stockton filed for bankruptcy Thursday, Peter Navarro, a professor of economics at the University of California, Irvine, told "CBS This Morning" there is "a long queue out there of cities like Stockton that are going to be doing the same thing."

Stockton, a river port of 290,000 in Central California, had been one of less than a half-dozen larger governments to seek Chapter 9 protection in U.S. history, according to James Spiotto, a Chicago bankruptcy attorney who tracks municipal bankruptcies.

http://www.cbsnews.com/8301-201_162-57469953/3rd-calif-city-to-file-for-bankruptcy-in-1-month/

DemReadingDU

(16,000 posts)7/10/12 Unions, Scranton, PA, clash over minimum wage pay cuts

Amid a dispute with the City Council about raising funds for their cash-strapped Pennsylvania city, the mayor of Scranton faces a lawsuit from union workers after he cut their pay to minimum wage.

The attorney for three unions, including firefighters and police, said he expects to file several legal actions, including a motion to hold Mayor Chris Doherty in contempt of court for violating a judge's order to pay full wages.

"We've been busy," attorney Thomas Jennings told CBS News. "So much nonsense. [It's] really, really silly that we have to do something like this just to get paid."

Doherty last week cut the pay for about 400 employees to the federal minimum wage of $7.25 per hour. He says it was the only way for the cash-strapped city to pay bills, and promises to restore pay once finances are stabilized.

On Friday Lackawanna County Judge Michael Barrasse held a hearing and ordered an injunction to unions challenging Doherty's decision. Jennings said one firefighter who testified was juggling three jobs just to support his kids. "You can make more money flipping burgers at McDonald's" than saving people's lives, Jennings said.

more...

http://www.cbsnews.com/8301-201_162-57469479/unions-scranton-clash-over-minimum-wage-pay-cuts/

Demeter

(85,373 posts)Oh joy.

Demeter

(85,373 posts)What Are the Potential Benefits of an FTT?

An FTT accomplishes two goals. Most importantly, it raises money. Unlike most taxes, however, it does so in a way that is arguably beneficial to the economy as a whole. While most taxes involve some sacrifice from taxpayers in order to promote the common good, the FTT promotes the common good directly through the "positive externalities" it generates for the economy. Positive externalities are improvements to economic efficiency that result from changes in behavior. A well-designed FTT would discourage speculation and computer-driven high frequency trading in financial instruments. That would reduce market volatility and increase access to capital markets for ordinary borrowers and investors. Even if an FTT raised no money, it would still improve the economy.

What Are the Potential Drawbacks?

For bankers, brokers and high-frequency traders, there are many potential drawbacks to an FTT. Many of them might lose their bonuses and some of them might lose their jobs. Investment banking and financial trading in general would likely become less profitable. Some ultra-luxury industries that depend on huge bankers' bonuses, like yacht-building, fine watches, auctioneering and exotic travel could also suffer.

How Much Money Would Be Raised by an FTT?

It depends on the rate of the tax and what financial instruments are covered by the tax. In the United Kingdom, the FTT (called "stamp duty"

How Hard Would It Be to Collect Taxes Through an FTT?

The FTT is one of the easiest kinds of taxes to collect because it is collected centrally by large banks instead of taxpayer by taxpayer like most other taxes. According to the Economist magazine, it costs just 3 cents in administrative expenses for every $100 raised through the UK stamp duty, versus $1.42 for the personal income tax and $1.25 for the corporate income tax. "Stamp duty is one of the easiest taxes to administer," according to the LowTax.net web site based in the British Virgin Islands. Of course, LowTax.net views that as a problem: they think the British government will never give up its FTT because it is too easy to collect.

Wouldn't Banks Just Move Trading Overseas to Avoid Paying the Tax?

It depends how the tax is set up. A well-designed tax won't allow trading to be moved overseas, though banks are sure to lobby for a tax that would allow this....

Demeter

(85,373 posts)... Big banks were caught lying about interest rates in order to make big profits. For the most part the victims were other high-rollers who were taking the other side of bets on complex financial derivatives. However there were also pension funds and even governmental units such as school districts and park services that were persuaded by their financial advisers to get into this high-stakes game. These folks were among those who lost because of the LIBOR liars. While there should be a thorough investigation that results in the guilty parties being severely punished, this incident sheds light on the fundamental problem with the modern financial industry. There is enormous money to be made by shaving a small fraction of a penny here or there. When this shaving is done on trades that can run into the hundreds of billions or even trillions of dollars, those fractions of a penny can run into really big bucks. And when we give people enormous incentive to lie and steal, it is likely that many will take advantage of the opportunity.

There is an obvious answer to this problem and a simple way to do it. The answer is to take the money away. If bankers didn't have the opportunity to make hundreds of millions or billions of dollars by manipulating the market, they wouldn't do it. And the simplest way to take away this opportunity is to reduce the size of these markets with a modest tax. A small tax on flipping stock, options, credit default swaps and other derivative instruments would drastically reduce the size of these markets, thereby reducing the opportunities for market manipulation. Such a tax could also raise a substantial amount of money. The Joint Tax Committee of Congress calculated that a 0.03 percent tax on all trades, as was proposed by Iowa Senator Tom Harkin and Oregon Representative Peter DeFazio, could raise more than $350 billion in the first nine years that it was in place. This is almost ten times the sum at stake with the Buffet rule and more than 10 times the amount of money that would be saved by ending subsidies for the oil industry.

A Targeted Tax

The great thing is that almost all of this tax would come out of the hide of the Wall Street crew. While many of us hold some stock either directly or through a mutual fund in a retirement account, there is a considerable amount of evidence that shows people respond to higher trading costs by trading less. This means, for example, that if this tax doubled the typical cost of a trade (it doesn't), then most people will cut back their trading by roughly 50 percent. That means that a typical investor will pay little or nothing as a result of this sort of tax. They may pay more money on each trade, but they will make fewer trades, leaving their total trading costs pretty much unchanged. It's also important to remember that trading costs have been falling rapidly as a result of the advance of computer technology. While the financial industry's lobbyists have been claiming that the Harkin-DeFazio tax would be the end of the world, in reality it would just raise trading costs back to where they were 5-10 years ago.

Shrink the Financial Sector

In addition to be being less corrupt, a smaller financial sector is likely to better serve the economy. Finance is an intermediate good, like trucking. We need the financial sector to allocate money from lenders to borrowers, just like we need trucking to move goods from point A to point B. But the financial sector doesn't directly produce items we consume, like food, housing or health care. In principle, the smaller the financial sector, the better. Recent research indicates that countries with large financial sectors have slower growth. It appears that a bloated financial sector pulls highly skilled people away from research intensive sectors of the economy such as computers and biotechnology. The sort of financial shenanigans we saw with the manipulation of the LIBOR rate also seems to pull capital away from start-ups that need to borrow to finance investment.

In short, there are some very good reasons to want a smaller, more efficient financial sector. And a tax on financial speculation is a great way to get there.

Demeter

(85,373 posts)...the unfolding business agreement among the US and eight Pacific nations -the Trans-Pacific Partnership (TPP) - should cause every US citizen, from the Sierra Club to the Tea Party to get their pitch forks and torches out of the closet and prepare to "storm the Bastille."

The TPP negotiations have been going on for two years under extreme secrecy, no information has been made available to either the press or Congress about the US position. But on June 12, a document was leaked to the watchdog group, Public Citizen, revealing the current US position and the reason for the secrecy. The contents are surreal, shocking and prima facia evidence for how corporations have become the master puppeteers of our government.

The leaked document reveals that the trade agreement would give unprecedented political authority and legal protection to foreign corporations. Specifically, TPP would (1) severely limit regulation of foreign corporations operating within US boundaries, giving them greater rights than domestic firms; (2) extend incentives for US firms to move investments and jobs to lower-wage countries; and (3) establish an alternative legal system that gives foreign corporations and investors new rights to circumvent US courts and laws, allowing them to sue the US government before foreign tribunals and demand compensation for lost revenue due to US laws they claim undermine their TPP privileges or their investment "expectations."

Despite the North American Free Trade Agreement's (NAFTA) failures, corporations are arm-twisting the federal government to pursue trade agreements as inevitable and necessary for economic progress. But 26 of the 28 chapters of this agreement have nothing to do with trade. TPP was drafted with the oversight of 600 representatives of multinational corporations, who essentially gave themselves whatever they wanted; the environment, public health, worker safety, further domestic job losses be damned...

xchrom

(108,903 posts)In yesterday’s column, in fact, when arguing that light volume was not something to worry about, I mentioned a far more legitimate cause for concern: The excessive levels of bullishness that prevail currently among investment advisers. ( Read my July 10 column, “Should you sell a dull market short?” )

In falling sharply Tuesday on higher volume, the stock market dutifully illustrated my point.

Unfortunately for stocks, the market has more to worry about than just too-high-levels of bullishness. Another thing that’s far more worrisome than the to-be-expected light summer trading volume is the recent behavior of corporate insiders. Last week, for example, they sold more of their companies’ shares, relative to their purchases, than in any week since the early May bull market high.

That means that the insiders, who presumably know more about their companies' prospects than do the rest of us, are betting that stocks have gotten as far ahead of themselves now as they were at the bull market’s high.

Demeter

(85,373 posts)...On Thursday, the ECB took its benchmark rate down to a record low of 0.75 percent and its deposit rate to zero. JPMorgan Chase (JPM), Goldman Sachs (GS), and Blackrock responded not by lapping up supposedly free investor cash—but by closing their European money market funds to new investments. Surprise: It’s actually costly to warehouse clients’ short-term, liquid cash, what with all the administrative expenses involved. Throw in the relentlessly stingy interest-rate environment, and you’d be hard-pressed not to lose money in that line of work. Morgan, the world’s top money-market fund provider, posted an explanatory FAQ and memo to clients. Goldman wrote a notice to fundholders: “The European market environment is in unchartered territory with such historically low—or even negative—yields for high-quality issuance. It is not currently feasible for our portfolio managers to deploy capital without substantially diluting the yield for the existing base of shareholders.”

With global interest rates at or near record lows—some are outright negative—money funds have been struggling to skim a living wage (and pay the Keurig bill) from what used to be the business of investing client cash assets. The U.S. Federal Reserve has been at a zero interest rate policy for three and a half years. Managers who have remained in the $2.5 trillion U.S. money fund business have had to resort to cutting their fees to keep customer returns above water. According to Crane Data, money-market manager revenue has tumbled from about $12.5 billion in 2008 to $4.7 billion now—as yields that hit 5 percent in 2007 now average 0.06 percent.

It’s all part of a battle of wills between central banks and risk-averse masses that have been clinging ever harder to their cash as the U.S. and Europe continue to post scary economic news. Monetary policy makers desperately want that cash to be put to constructive use: Eat out; buy a lawnmower or family sedan; expand your business; take out a mortgage; plunk down a couple of grand on stock ETFs. Do something—anything—but hoard cash that desperately needs to circulate around the system.

The banking system, which strains under the weight of trillions in short-term deposits, has been crying uncle for quite some time now. A year ago, Bank of New York Mellon, the world’s largest custody bank, announced plans to start charging clients for cash balances above $50 million “to pass on costs incurred from sudden and significant increases in U.S. dollar deposits.”

THANK YOU, BEN BERNANKE, YOU PUTZ

dixiegrrrrl

(60,010 posts)"yields that hit 5 percent in 2007 now average 0.06 percent."

xchrom

(108,903 posts)Early on Tuesday morning the club of euro-zone nations signed an agreement that will mark both the Spanish economy and the country’s politics for a number of years to come. The Eurogroup meeting of economy and finance ministers agreed in Brussels to accord Spain the rescue package it requested last month for its banking sector (with the first 30-billion-euro tranche of the loan to be released before the end of July) and allowed Madrid an extra year to bring its budget deficit back within the terms of the Growth and Stability Pact.

Spain now has until 2014 to bring the shortfall in its books back within the 3-percent ceiling set by the EU, while the target for this year has been eased to 6.3 percent from 5.3 percent and to 4.5 percent in 2013 when it was originally due to hit the 3-percent limit.

But there were big strings attached, in particular stringent fiscal demands and complete oversight of Spain’s financial sector. In other words, Spain is the object of a bailout, in the full sense of the word, but one that is softer in its terms and scope than those of the three euro-zone nations intervened previously: Greece, Portugal and Ireland.

The so-called “troika,” comprising the European Commission (EC), European Central Bank (ECB) and the International Monetary Fund (IMF), will send inspectors to Spain every three months, and together these organizations assume de facto powers over the financial supervision of Spain’s banks. On top of this, Brussels has demanded “new fiscal measures” from Spain’s government on an immediate basis to ensure that Madrid can comply with its deficit-cutting obligations.

dixiegrrrrl

(60,010 posts)Greece, Portugal and Ireland having been turned over to control of a non-sovereign group, now Spain.

coming soon: Italy, France and Britain, most likely.

USA is being taken over by the The Trans Pacific Partnership:

http://www.democraticunderground.com/101740114

Demeter

(85,373 posts)NOTHING THIS MAN DOES SURPRISES ME ANY MORE...EMPHASIS MINE

Obama is not proposing that families making up to $250,000 a year keep their tax cuts while families making more than that don't. He's proposing that every family keep their tax cuts on their first $250,000 of taxable income (which is not the same as "income" or "earnings," by the way).

That includes families with taxable income of $260,000, $1 million, $5 billion, $3 trillion, or whatever Jay-Z and Beyonce make in a year. Everyone would continue to pay a lower tax rate on their first $250,000 of taxable income under Obama's plan. To report that Obama only wants to maintain tax cuts for families making less than $250,000 is simply false.

If you're wondering how literally the entire media could get this story wrong, look no further than Obama himself, who is framing his own tax proposal inaccurately. "I’m calling on Congress to extend the tax cuts for the 98 percent of Americans who make less than $250,000 for another year," he said in an East Room speech earlier this afternoon.

Normally, a president would want to publicize that he's trying to cut taxes for everyone in the country. But Obama actually has an incentive this time to downplay the number of Americans who would benefit from his tax plan. His proposal is, at its heart, a political maneuver meant to force Mitt Romney to defend tax cuts for the wealthy. It's more effective, then, for it to be seen as a cut solely for the middle class. The reality is that Obama's proposal would also keep Warren Buffett's taxes lower, if only a little bit.

xchrom

(108,903 posts)BERLIN (AP) -- German prosecutors say they've opened an investigation of the head of U.S. investment bank Morgan Stanley's German branch and a former German state governor in connection with the sale of shares in a local power company.

Prosecutors said Wednesday that both Dirk Notheis, who has been on indefinite leave from Morgan Stanley since last month, and former Baden-Wuerttemberg governor Steffen Mappus are being investigated on suspicion of breach of trust and accessory to breach of trust. Ten apartments and businesses were searched in eight cities, including Morgan Stanley's office in Frankfurt.

Morgan Stanley says it's cooperating with the investigation.

In 2010 Notheis helped his long-time friend Mappus, then governor, buy a 45 percent stake in EnBW on behalf of the state. A Parliamentary inquiry into the deal is ongoing.

xchrom

(108,903 posts) ?1341939583

?1341939583

Fancy savouring the fresh air of the Aegean Sea from your own private island? If you have the money, it’s time to start exploring the option. The crisis has led to a doubling in the supply of private islands in Greek waters (the islands owned by the state are not for sale). Idyllic beaches, dream views and an exceptional temperature throughout the year are just some of their attractions.

“Before the crisis we always had between six and ten islands on offer, but now we have almost 20,” says Chris Krolow, director of Private Islands, a Canada-based Internet company specialised in selling islands all around the world. Their website lists a good number of Greek islands for sale, ranging in price from one and a half million euros, for the small island of St. Athanasios, to the 150 million euros asked for Patroclos. This majestic island of 260 hectares, very near Athens, boasts beaches that are “large and sandy, with unpolluted waters rich in fish,” according to the website.

Although experts say that the prices have not fallen far, good buys can still be found. “We’ve seen properties going for four million fall to two,” says Nicolas Mugni, broker at the top-tier Grece Demeures agency. The economic crisis, which is keeping almost 28 percent of Greeks below the poverty line, has also hit property landowners.

Tough negotiators

One of the factors forcing some owners to sell more cheaply – either the entire island, or plots of land or buildings on it, such as recreational luxury villas – is Greece’s new property tax. “Most of those landowners have money invested in other assets or land, and the new taxes that have been approved under the austerity pact for Greece means the wealthy will have to pay a lot. The percentage varies, but if you own an island or a large villa it could come to a small fortune. For an expert buyer it’s easier to haggle with such sellers,” says Mugni.

Demeter

(85,373 posts)Being young and European right now can be pretty bleak, with the average EU youth unemployment rate standing at 22.4% — and rates in Spain verging on a Great Depression-like 51%. Unsurprisingly, a lot of young Europeans want to move abroad, but moving abroad isn't always easy — or even legal.

This report in Brazilian newspaper Fohla De S. Paulo shows the lengths young Europeans are going to to get a Visa — marriage, temporary apartment moves, a few thousand dollars payment to a bride.

It's not easy but it's the best option for many of those who want to get a permanent visa for Brazil, and it seems like a lot of people want to work in Brazil, where unemployment rates sit currently at 5.8%.

"I’m a bit afraid, but I know three Germans in Rio and an American in São Paulo who did the same," 31-year-old Spanish student tells Fohla De S.Paulo. "I could look for a job in Germany, where I was before I lost my job. But Europe is getting worse and worse, while the situation here is just the opposite.”

Read more: http://www.businessinsider.com/desperate-europeans-are-entering-sham-marriages-to-get-brazilian-visas-2012-7#ixzz20JlwFGIA

bread_and_roses

(6,335 posts)Honest to effing goddess every day it's something. E-mail from "Color of Change" in my mailbox - from their website

http://colorofchange.org/campaign/tell-congress-protect-food-stamps-and-family-farms/

Please join us in calling on Congress to put human health and livelihoods first by fully funding those portions of the Farm Bill that protect critical nutritional assistance programs and secure the continued existence of Black family farms.

(emphasis added)

You can sign a petition here http://act.colorofchange.org/sign/farmbill_house/?source=coc_website

Not that I put any faith in our endless internet petitions - but what else to do? I'll call my Troglodyte R Congresscritter too on this one, but that won't do any good either. Nothing does.

From the longer e-mail that was sent to me:

46 million people, or more than one in seven Americans, have signed up for SNAP so far in 2012 — which is in keeping with the percentage of the U.S. workforce experiencing unemployment or underemployment.4 Of that number, 22.5% are Black folks,5 with as many as 9 in 10 Black children receiving food stamps before reaching the age of 20.6 Yet, in spite of the staggering levels of American poverty and hunger these numbers represent, proposals continually roll in to eviscerate SNAP, a vital element of our rapidly-fraying social safety net.

And SNAP isn't just necessary to make sure that no one goes hungry — the program also reliably generates significant economic growth. For every dollar invested in the food stamp program, $1.71 is pumped back into the economy, helping to pay the wages of producers, grocers, truck drivers, and any number of other people who help move our food from farm to table.7 In this way, SNAP is key to the economic stability of some of our poorest states.

Preserving livelihoods for Black family farmers

Protecting access to healthy and affordable food through SNAP is only half the battle. Also on the chopping block is a program dedicated to redressing the generations of disparate land loss experienced by so-called "socially disadvantaged" producers — meaning Black, Latino, Native American, and other minority farmers and ranchers historically discriminated against by the US Department of Agriculture.

For decades, USDA officials systematically denied Black farmers loans and subsidies that they routinely made available to white farmers.8 At best, this state-sponsored discrimination retarded the growth of many Black farms, but in practice it resulted in many simply going under — causing devastating losses of land, income, and intergenerational vocational knowledge. In 1920, Blacks made up about 15 percent of the nation's farmers, but today that number is just one percent.

xchrom

(108,903 posts)He would not be Heinz Fischer if he didn’t have at least two opinions on the question of "more direct democracy?" In Pressestunde am Sonntag (“News Hour on Sunday)", yes, the President could well imagine the people getting more involved in important decisions in the future.

Just as he could well imagine being against such a thing, too. More emphasis on direct democracy, that is to say, must not lead to the elimination of the National Council. The President is also deeply concerned that in the wake of the increased use of referenda, issues might become sensationalised – “taken to the tabloids”. Complex issues such as the Fiscal Pact and the setting up of the permanent European Security Mechanism bailout fund would therefore also not be suitable matters for referenda. Explaining them to the public, you see, could just get too folksy.

Interesting, that. Almost simultaneously, Fischer’s counterpart in Germany, Joachim Gauck, has been urging Chancellor Angela Merkel to once again describe more precisely to the people the controversial measures to save the euro. It would also help the voters grasp what they’ll have to deal with. Mr. Gauck, of course, is absolutely right in that: a decision of this gravity should not be made behind the voters’ backs – at least not if one wants to keep the people from heading over in droves to the camp of those who bitterly oppose the EU.

Our neighbours in Switzerland

The Austrian people deserve such a declaration. And what exactly should be so hard about telling them in straightforward sentences that bringing in the ESM means that all the states become liable for all the debts of the other states? And what exactly could be “taking it to the tabloids" about explaining to the population that not only the debts of states will be pooled in the Community, but that money for public assistance will be used to bail out private banks – instead of letting the shareholders absorb the losses, which is what should happen.

Demeter

(85,373 posts)They really don't believe in democracy, traditionally, culturally. Nor in sharing the wealth. I wouldn't hold my breath.

Demeter

(85,373 posts)In 2012, the Greeks cannot pay back 245 billion euros they borrowed from European and American banks. But instead of extending a helping hand to member country Greece, the EU, and Germany in particular, act like taskmasters. The EU even invited the International Monetary Fund (IMF) to jointly deal with Greece. The IMF - whatever its putative mandate and formal structure - is an American institution designed to wreck economies that are interfering with capitalism's business as usual - especially American business. Strictly speaking, the EU and IMF have been on a collision path with Greece in order to extract every penny the banks claim they lent that country.

Moneylenders Undermining Greek Sovereignty

The EU and IMF "convinced" Greek politicians (who were presented with zero alternatives) to sign on to demands tantamount to giving up Greek sovereignty. Under the Memorandum of May 2010, the Greek government abandoned all rights under international and Greek law to protect Greece from the claims of moneylenders. In addition, under the Memorandum, all Greek public property - in fact, all of Greece - could become the property of the moneylenders...

GOOD VIEW ON THE GROUND

In May 2012, Mikis Theodorakis, the internationally known music composer, described the Memorandum as treason, and those who signed it - members of the New Democracy and Pasok parties - as traitors and criminals. Putting the banks' earnings above the well-being and sovereignty of the Greek people recalls 1840s England, when the country sold Irish corn within its own borders while the Irish were dying from famine.

Theodorakis is right, however. The agreement of May 2010 between the troika - the European Commission, the European Central Bank (ECB) and the IMF - and Greece was an act of war against the dignity, independence and well-being of the Greek people. But instead of describing things by their real names, we invent euphemisms like "structural reforms" or "austerity."

Demeter

(85,373 posts)Norway's government ordered on Monday a last-minute settlement in a dispute between striking oil workers and employers in a move to alleviate market fears over a full closure of its oil industry and a steep cut in Europe's supplies.

The strike over pensions had kept crude prices on the boil with analysts expecting far quicker action by the government to stop the oil industry from locking out all offshore staff from their workplaces from midnight (2200 GMT) on Monday.

Oil markets breathed a sigh of relief on news of the intervention and crude prices dropped in early Asian trade.

Under Norwegian law, the government can force the striking workers back to duty and has done so in the past to protect the industry on which much of the country's economy depends...MORE

Roland99

(53,342 posts)And, moments ago after the wholesale Inventories was released, Goldman came out with this:

Luckily there aren't another 13 releases today or we may be in recession right now.

Demeter

(85,373 posts)Demeter

(85,373 posts)Fuddnik

(8,846 posts)Sunday night's episode (#3) was awesome!

It's what news should look like.

Jane Fonda: "When you go after the Koch Brothers, they drop an armored car on you! I have business before this Congress!"

Demeter

(85,373 posts)...When Brown decided to dispose of almost 400 tonnes of gold between 1999 and 2002, he did two distinctly odd things:

It seemed almost as if the Treasury was trying to achieve the lowest price possible for the public’s gold. It was...

One of the most popular trading plays of the late 1990s was the carry trade, particularly the gold carry trade. In this a bank would borrow gold from another financial institution for a set period, and pay a token sum relative to the overall value of that gold for the privilege. Once control of the gold had been passed over, the bank would then immediately sell it for its full market value. The proceeds would be invested in an alternative product which was predicted to generate a better return over the period than gold which was enduring a spell of relative price stability, even decline. At the end of the allotted period, the bank would sell its investment and use the proceeds to buy back the amount of gold it had originally borrowed. This gold would be returned to the lender. The borrowing bank would trouser the difference between the two prices. This plan worked brilliantly when gold fell and the other asset – for the bank at the heart of this case, yen-backed securities – rose. When the prices moved the other way, the banks were in trouble.

This is what had happened on an enormous scale by early 1999. One globally significant US bank in particular is understood to have been heavily short on two tonnes of gold, enough to call into question its solvency if redemption occurred at the prevailing price...Faced with the prospect of a global collapse in the banking system, the Chancellor took the decision to bail out the banks by dumping Britain’s gold, forcing the price down and allowing the banks to buy back gold at a profit, thus meeting their borrowing obligations...

Demeter

(85,373 posts)(The American bank with a huge short gold position in 1999 – in addition to Goldman and JP Morgan – was Citi.)

...Many other governmental sources have confirmed gold manipulation as well...

...And raiding so-called “allocated” gold accounts is another form of manipulation.

MUST BE READ TO BE BELIEVED...AND YET, IT'S STILL UNBELIEVABLE

dixiegrrrrl

(60,010 posts)Is there nothing these guys do not control and manipulate?

Roland99

(53,342 posts)2 members in favor of more easing.

2 more willing to consider it.

Roland99

(53,342 posts)DemReadingDU

(16,000 posts)7/11/12 BaNZaI7'S New aND IMPRoVeD PeRioDiC TaBLe oF WaLL STReeT CRiMiNaL ELeMeNTS...

It has now been slightly more than two years since I did the original version of this table. It was one of the first Banzai7 works reposted by Tyler Durden. Much has happened since then. Unfortunately, things have only gotten worse. The blatant pattern of organized criminal fraud on Wall Street has continued unabated.

The Banksta perps and their reckless, feeble and/or complicit executive managers have not been brought to justice by the incumbant clown circus and nothing leads us to believe that this state of affairs will somehow be reversed until the next economic collapse is truly upon us.

http://www.zerohedge.com/contributed/2012-07-11/banzai7s-new-and-improved-periodic-table-wall-street-criminal-elements