Economy

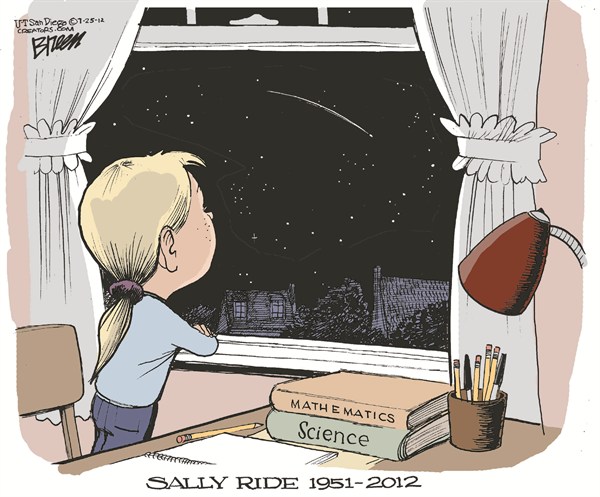

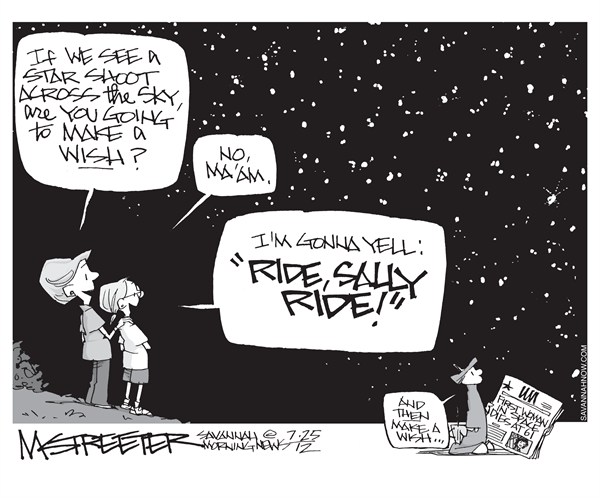

Related: About this forumWeekend Economists Ride With Sally into the Sunset July 27-29, 2012

&feature=relatedWeekend Economists salutes Sally Ride, a woman who went where very few had gone before, or since...

Sally Kristen Ride (May 26, 1951 – July 23, 2012) was an American physicist and astronaut.

Ride joined NASA in 1978, and in 1983, at the age of 32, became the first American woman to enter low Earth orbit. As of 2012, Ride also remains the youngest American astronaut to be launched into space. In 1987, she left NASA to work at Stanford University's Center for International Security and Arms Control. She served on the investigation panels for two space shuttle disasters, Challenger and Columbia, the only person to serve on both...wikipedia

She left Earth for good this week, far too young, IMO. Did her time in space lead to her cancer?

http://pathology.jhu.edu/pc/BasicCauses.php

what are the risk factors for pancreatic cancer? Some of the risk factors include:

- Cigarette smoking:illustration of person smoking Smoking doubles the risk of pancreatic cancer. Smoking is also associated with early age at diagnosis, and, very importantly, the risk of pancreatic cancer drops close to normal in people who quit smoking. Simply put, cigarette smoking is the leading preventable cause of pancreatic cancer. In fact, some scientists have estimated that one in four, or one in five cases of pancreatic cancer are caused by smoking cigarettes.

- Age: The risk of developing pancreatic cancer increases with age. Over 80% of the cases develop between the ages of 60 and 80.

- Race: Studies in the United States have shown that pancreatic cancer is more common in the African American population than it is in the white population. Some of this increased risk may be due to socioeconomic factors and to cigarette smoking.

- Gender: Cancer of the pancreas is more common in men than in women. Men are more likely to smoke than women.

- Religious background: Pancreatic cancer is proportionally more common in Ashkenazi Jews than the rest of the population. This may be because of a particular inherited mutation in the breast cancer gene (BRCA2) which runs in some Ashkenazi Jewish families.

- Chronic pancreatitis: Long-term inflammation of the pancreas (pancreatitis) has been linked to cancer of the pancreas.

- Diabetes: Diabetes is both a symptom of pancreatic cancer, and long-standing adult-onset diabetes also increases the risk of pancreatic cancer.

- Obesity: Obesity significantly increases the risk of pancreatic cancer.

- Diet: Diets high in meats, cholesterol fried foods and nitrosamines may increase risk, while diets high in fruits and vegetables reduce risk. Folate may be protective.

- Genetics: As mentioned earlier, a number of inherited cancer syndromes increase the risk of pancreatic cancer. These include inherited mutations in the BRCA2, FAMMM, PalB2 or Peutz-Jeghers genes. To learn more about familial pancreatic cancer visit the web site of the National Familial Pancreas Tumor Registry.

Sally Ride dies of pancreatic cancer: What is pancreatic cancer?

http://articles.latimes.com/2012/jul/24/news/la-heb-sally-ride-pancreatic-cancer-20120724

Pancreatic cancer is the fourth leading cause of cancer-related deaths for people in the United States. It has the lowest survival rate of any type of cancer — according to the American Cancer Society, the one-year survival rate is 20% for all stages of pancreatic cancer combined. The five-year survival rate is only 6%, and that figure has remained in the single digits for more than 40 years. The American Cancer Society estimates that in 2012, about 43,920 new cases of pancreatic cancer will be diagnosed in the U.S. and roughly 37,390 people will die of the disease...For many pancreatic cancer patients, the rapid decline in health is an unfortunate pattern. Pancreatic cancer begins in the pancreas, an organ that secretes digestive enzymes and hormones that regulate the body’s metabolism.

More than 90% of pancreatic cancer tumors have a mutation in a gene called KRAS, according to this explainer from Johns Hopkins University. The KRAS gene contains instructions for making a protein that’s important in regulating cell division, according to the National Library of Medicine’s Genetics Home Reference. But if KRAS acquired certain mutations, the growth-promoting signals can’t be turned off, ultimately causing tumors to form. Then those cells spread through the bloodstream and colonize other organs in the body. This stage is known as metastasis. Patients are usually diagnosed with pancreatic cancer only after it has spread throughout the body, when it’s extremely difficult to fight. The disease is rarely detected in its earliest stages because the symptoms are difficult to recognize.

By far, the most common form of pancreatic cancer is known as adenocarcinoma of the pancreas, which affects the cells that manufacture enzymes in the pancreas. These cells are surrounded by a tough, fibrous coat, which renders the microenvironment of the cancer cell impervious to intravenously injected chemotherapy.

Studies are underway to develop therapies that target the faulty protein and stop its out-of-control signaling. It would also be helpful to find ways to detect the cancer in its earliest stages, when it is still contained to the pancreas and could be surgically removed. Patients with pancreatic cancer can also be treated with chemotherapy, radiation and drugs designed to interfere with the tumor’s growth, according to the National Cancer Institute.

If Sally had one defective gene, all that radiation in space could have damaged the other, and that's the beginning of the end.

Tansy_Gold

(17,847 posts)and you know I don't give 'em very often.

Ride, Sally, Ride.

Ave atque vale.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Jasper Banking Company, Jasper, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Stearns Bank National Association, St. Cloud, Minnesota, to assume all of the deposits of Jasper Banking Company.

The three branches of Jasper Banking Company will reopen on Saturday as branches of Stearns Bank National Association...As of March 31, 2012, Jasper Banking Company had approximately $216.7 million in total assets and $213.1 million in total deposits. In addition to assuming all of the deposits of the failed bank, Stearns Bank National Association agreed to purchase essentially all of the assets.

The FDIC and Stearns Bank National Association entered into a loss-share transaction on $106.0 million of Jasper Banking Company's assets...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $58.1 million. Compared to other alternatives, Stearns Bank National Association's acquisition was the least costly resolution for the FDIC's DIF. Jasper Banking Company is the 39th FDIC-insured institution to fail in the nation this year, and the ninth in Georgia. The last FDIC-insured institution closed in the state was First Cherokee State Bank, Woodstock, on July 20, 2012.

Tansy_Gold

(17,847 posts)Demeter

(85,373 posts)For major intersections, that's 4 banks. It's a winnowing process.

Fuddnik

(8,846 posts)Demeter

(85,373 posts)If you're wondering whether the US drought will create a global food crisis, the answer's easy. It's yes, because there's a food crisis already. The latest year for which we have figures is 2010, when 925 million people were declared malnourished. Soon after the number was announced, the World Bank corrected it upward, and recently said that the number of hungry people is "almost 1 billion".

Make no mistake: the US drought is fierce. In June this year, out of a possible 171,442 temperature records, 2,284 were broken and 998 were tied. The London Olympic Games should be so lucky. The drought isn't merely bad because the crops are parched. Climate change has nudged the temperature more than a degree higher than the previous record-breaking US drought in the 1950s. The heat is killing natural systems, and making recovery far harder. We don't yet know what the final reckoning will be for food prices. Corn hit a record $8 a bushel on Monday (in September 2006, the price was nearer $2 a bushel). The price is driven by a demand for animal feed, high-fructose corn syrup, and an incredibly stupid US biofuels policy that mandates the transformation of food into ethanol. With the US producing over half of world corn exports, and with the price of those exports set by domestic uses of corn, the US drought will have a profound impact on prices.

Other grains aren't having a great year either. The US is a major soy exporter, and prices have soared over the past few days. Nor is America the only place to suffer extreme weather. This year, a late monsoon in India, and an ongoing southern European heatwave, add to the uncertainty about harvests and crops. Uncertainty is profitable. The Food and Agriculture Organisation is worried about price swings, even though prices are far from their 2011 peaks. Volatile prices create markets for hedge funds to trade and gamble on future trends. Traders, enabled by lax futures regulations, are perhaps the only people to see the bright side of the beating sun.

Which is why it's worth looking to history. Record-breaking weather, farmers losing crops, banks repossessing land from the poor, a president scorned by his opponents for socialism. We've seen this before. Such were the conditions of the dust bowl in the 1930s. Then, the drought stretched across most of the decade. By 1938, 80% of the Great Plains had been damaged by wind erosion. In large part, it was because farmers on small farms weren't taking care of the soil. What would bring farmers to the point of destroying the soil on which they depended? Most of them were deeply indebted to banks, and hanging on by their fingernails. Environmental destruction staved off financial oblivion. In response, the Soil Conservation Service was created to help farmers directly. But farmers' financial crises needed more than tree-planting. The dust bowl was also tackled with changes in the banking system, regulation to stop foreclosure, stabilisation policies to stop wild swings in prices, and even, as part of the New Deal, employment in the Worlds Progress Administration to help the former family farmers cast off their land for ever. These policies didn't come easily. They were the fruits of widespread organising, from the work of socialist leagues to the populism of Huey Long. All of this is worth recording, because in the wake of the 2008 food price crisis, so little has changed. The US government hasn't sufficient grain in its reserves to stabilise prices. Public grain reserves were shrugged off in the 1990s as inefficient. No sense in having mountains of grain when, in a pinch, the market could be counted on to provide. Perish the thought that governments might intervene in the banking sector, or engage in public works programmes so that the hungry, 60% of whom are women or girls, might afford to eat.

Instead, the US secretary of agriculture, Tom Vilsack, has this to offer: "I get on my knees every day, and I'm saying an extra prayer now. If I had a rain prayer or a rain dance I could do, I would do it." So politicians, parched of ideas, are supine. They chant mantras about the sparkle of the agricultural and financial innovation that will, soon, provide relief. But the heat is strong and the sun is high. Their oasis is a mirage.

Demeter

(85,373 posts)Tansy_Gold

(17,847 posts)

bread_and_roses

(6,335 posts)"We are stardust, we are golden ..."

Thank you, Sally, for being brave, for being the first, for leading the way.

Demeter

(85,373 posts)George Osborne was coming under intense pressure from business, the City and the opposition on Wednesday to rethink his hardline austerity approach after news of a deepening double-dip recession dealt a severe blow to the government's deficit reduction strategy. The Bank of England is expected to embark on further emergency measures to stimulate growth this autumn following the release of official figures showing a shock 0.7% contraction in economic activity in the three months to June. Although the decline was almost certainly exaggerated by the extra bank holiday for the Queen's diamond jubilee, the City was left stunned by the data from the Office for National Statistics.

Evidence that the economy is now smaller than when the coalition came to power in May 2010 prompted immediate calls for a change of course...The shadow chancellor, Ed Balls, said: "These shocking figures speak for themselves. As we warned two years ago, David Cameron and George Osborne's ill-judged plan has turned Britain's recovery into a flatlining economy and now a deep and deepening recession." Sterling fell sharply on the foreign exchanges as dealers took fright at the possibility that the credit rating agencies might strip Britain of its prized AAA status, after as a result of a growth performance that has seen activity declined in five of the past seven quarters and made Britain the worst performing country in the G8 group of industrialised countries, apart from Italy. After a slower recovery than following the Great Depression of the 1930s, UK output is 4.5% lower than it was when the economy peaked in early 2008. The British Chambers of Commerce and the Institute of Directors both called on the government to show "leadership", urging Osborne to take advantage of low interest rates to borrow for public investment...Although business groups and the City had been expecting a small decline in output in the three months to June, they were taken aback by news that the three main sectors of the economy – services, industrial production and construction – had all suffered falls in activity. The quarterly fall was more than three times as large as the City had been predicting and left the economy 0.8% smaller than a year earlier.

The TUC general secretary, Brendan Barber, said: "The UK is on course for a longer depression than the '30s, the tightest squeeze in living standards since the '20s and more than a million young people are currently out of work. The government must abandon self-defeating austerity and prioritise public and private investment in infrastructure and in the futures of our long-term unemployed to get Britain working again."

The UK is expected to emerge from its first double-dip recession since the 1970s in the third quarter, when a combination of the London Olympics and a bounce back from the production losses after the extra June bank holiday will provide a boost to activity. The Bank of England announced this month that it was expanding its quantitative easing programme by £50bn to £375bn in an attempt to boost the amount of credit available to households and businesses. Some City analysts believe the total could eventually reach £500bn and that Threadneedle Street may contemplate cutting the bank rate – already at a historic low of 0.5% – to 0.25% in an attempt to boost growth...

Demeter

(85,373 posts)Nomura Holdings Inc CEO Kenichi Watanabe and his top lieutenant, Takumi Shibata, will resign to take responsibility for leaks of insider information to clients of its brokerage unit, people with knowledge of the shake-up said.

The departure of the architects of Nomura's takeover of the Asian and European assets of Lehman Brothers throws open the succession at Japan's top investment bank and raises questions about the future of the global expansion strategy they pursued.

Nomura's management shake-up comes a month after the investment bank cut pay for both of its top executives in response to the third insider trading scandal since Watanabe took the helm four years ago.

"When you look at their history, the number of scandals, this was the last straw," said Jim Sinegal, an analyst with Morningstar research house...The resignation of Watanabe, 59, had been expected by many inside Nomura since signs emerged this spring that the bank's leadership was at loggerheads with Japan's financial regulators, which accused Nomura of being slow to respond to an investigation into insider trading practices that had grown rampant in the Tokyo market...

westerebus

(2,976 posts)On top of that it's down 90+% from its peak in 2008.![]()

That's a very forward-looking indicator.

It really plunged from it's peak in late 2008 and 2009.

westerebus

(2,976 posts)Given the rise in cost in foodstuffs going forward, it's no wonder they said no thanks to the EU and have gone directly to the third world to barter to keep their factories open. I'm wondering if the deal with Japan is actually a Yen carry trade swap that converts Yuan into trade-able paper. That might keep Japan going and allow the Chinese to hold their US $ reserves as a cross currency credit hedge. Interesting times.

Po_d Mainiac

(4,183 posts)On 25 December 2011, the government of Peoples Republic of China and Japan unveiled plans to promote direct exchange of their currencies. This agreement will allow firms to convert the Chinese and Japanese currencies directly into each other, thus negating the need to buy dollars. This deal between China and Japan followed agreements between China and numerous countries to trade outside the sphere of the US dollar. A few weeks earlier, China also announced a 70 billion Yuan ($11 billion) currency swap agreement with Thailand.

http://www.eurasiareview.com/27012012-china-and-japan-currency-swap-nail-in-us-dollars-coffin-oped/

westerebus

(2,976 posts)What's the trade when big red goes cultural revolution all over again? The ECB, FED, PRCB, are all swapping paper or electrons or digits and next to nothing is moving. I'm not looking forward to something going all FUBAR as this is what happens when they run out of rain and grain.

The stacks are patient, me not so much. ymmv

Po_d Mainiac

(4,183 posts)Tillable soil...ymmv

Demeter

(85,373 posts)China's solar firms warned of a trade war on Thursday, calling on the Chinese government to respond with all means to an anti-dumping complaint filed by European competitors that they said could be a fatal blow. Ratcheting up the stakes in ongoing disputes within the industry, companies led by Germany's SolarWorld (SWVG.DE) on Wednesday asked the European Union to investigate claims that Chinese firms had been selling their products below market value in Europe -- the world's biggest solar market. SolarWorld spearheaded a similar initiative in the United States, leading the world's largest economy in May to impose duties of about 31 percent on solar panel imports from China.

"If the EU were to follow the precedent of the U.S. and launch an anti-dumping investigation on Chinese solar products, the Chinese solar industry would suffer a fatal blow," Yingli Solar's (YGE.N) chief strategy officer, Wang Yiyu said.

"The investigation would also trigger a whole-scale trade war between China and the EU, which would cause huge losses to both parties," he said at a briefing by four major Chinese solar firms - Yingli, SunTech (STP.N), Trina (TSL.N) and Canadian Solar (CSIQ.O). Western solar companies have been at odds with their Chinese counterparts for years, alleging they receive lavish credit lines to offer modules at cheaper prices, while European players struggle to refinance. Trade action in Europe could prompt China to return fire by taking similar measures against western solar companies. "We call on the Chinese government to take all necessary and resolute measures to protect the legitimate interests of the Chinese solar industry," Wang said.

Close to 60 percent of China's solar exports, worth $35.8 billion, were shipped to the EU in 2011, the four Chinese companies said. Europe accounted for 74 percent of global solar installations in 2011, according to industry association EPIA.

Demeter

(85,373 posts)Dishonesty uncovered in setting Libor benchmark interest rates is now in the past and replacing them would be problematic, the head of Financial Services Authority said on Tuesday. The discovery that bankers rigged the global rates determining the value of assets worth more than $500 trillion has put regulators under fire for failing to spot the problem in 2008 and set off a debate over whether the system should be replaced.

"I think it has been pretty robust since 2009 and 2010," FSA Chairman Adair Turner told a Bloomberg News event. "People are trying to do it as honestly as they can."

Libor rates are based on interest rates that banks say they will offer rather than those they used in actual deals, meaning they depend on the honesty of the banks' submissions...Turner said that since early 2011, banks have had to attest to the quality of their Libor submission process to the regulator.

"I would be very amazed if at the moment there is anything remotely like the problems of the past in terms of deliberate manipulation," Turner said.

In the distant past it would have been harder to spot manipulation of the benchmark interest rates, which originated in the 1960s, but any rigging would also have had a smaller impact, Turner said...Because so many contracts were now linked to Libor estimates, it would create a major problem if there were an attempt to switch to a benchmark based on actual transactions, he said...Turner is seen as a possible candidate to head the Bank when the governorship falls vacant next year...

Demeter

(85,373 posts)European Union antitrust officials have gathered “quite telling” evidence in their probes related to the rigging of interbank lending rates, Competition Commissioner Joaquin Almunia said in an interview with MLex.

“The evidence we have collected is quite telling so I am pretty sure this investigation will not be closed without results,” Almunia told MLex today. Antoine Colombani, a spokesman for Almunia, confirmed the comments in an e-mail.

Confidence in Libor, a benchmark for financial products valued at $360 trillion worldwide, has been shaken by Barclays Plc (BARC)’s admission that it submitted false rates. Robert Diamond, who resigned as London-based Barclays’s chief executive officer after the bank was fined 290 million pounds ($449 million), told British lawmakers this month that other banks also lowballed Libor submissions.

Almunia has previously said that regulators are investigating the markets for derivatives linked to the euro, London and Tokyo interbank lending rates...

snot

(10,502 posts)Demeter

(85,373 posts)The ranks of America's poor are on track to climb to levels unseen in nearly half a century, erasing gains from the war on poverty in the 1960s amid a weak economy and fraying government safety net. Census figures for 2011 will be released this fall in the critical weeks ahead of the November elections. The Associated Press surveyed more than a dozen economists, think tanks and academics, both nonpartisan and those with known liberal or conservative leanings, and found a broad consensus: The official poverty rate will rise from 15.1 percent in 2010, climbing as high as 15.7 percent. Several predicted a more modest gain, but even a 0.1 percentage point increase would put poverty at the highest level since 1965.

Poverty is spreading at record levels across many groups, from underemployed workers and suburban families to the poorest poor. More discouraged workers are giving up on the job market, leaving them vulnerable as unemployment aid begins to run out. Suburbs are seeing increases in poverty, including in such political battlegrounds as Colorado, Florida and Nevada, where voters are coping with a new norm of living hand to mouth.

"I grew up going to Hawaii every summer. Now I'm here, applying for assistance because it's hard to make ends meet. It's very hard to adjust," said Laura Fritz, 27, of Wheat Ridge, Colo., describing her slide from rich to poor as she filled out aid forms at a county center. Since 2000, large swaths of Jefferson County just outside Denver have seen poverty nearly double. Fritz says she grew up wealthy in the Denver suburb of Highlands Ranch, but fortunes turned after her parents lost a significant amount of money in the housing bust. Stuck in a half-million dollar house, her parents began living off food stamps and Fritz's college money evaporated. She tried joining the Army but was injured during basic training. Now she's living on disability, with an infant daughter and a boyfriend, Garrett Goudeseune, 25, who can't find work as a landscaper. They are struggling to pay their $650 rent on his unemployment checks and don't know how they would get by without the extra help as they hope for the job market to improve. In an election year dominated by discussion of the middle class, Fritz's case highlights a dim reality for the growing group in poverty. Millions could fall through the cracks as government aid from unemployment insurance, Medicaid, welfare and food stamps diminishes.

"The issues aren't just with public benefits. We have some deep problems in the economy," said Peter Edelman, director of the Georgetown Center on Poverty, Inequality and Public Policy. He pointed to the recent recession but also longer-term changes in the economy such as globalization, automation, outsourcing, immigration, and less unionization that have pushed median household income lower. Even after strong economic growth in the 1990s, poverty never fell below a 1973 low of 11.1 percent. That low point came after President Lyndon Johnson's war on poverty, launched in 1964, that created Medicaid, Medicare and other social welfare programs.

"I'm reluctant to say that we've gone back to where we were in the 1960s. The programs we enacted make a big difference. The problem is that the tidal wave of low-wage jobs is dragging us down and the wage problem is not going to go away anytime soon," Edelman said.

Stacey Mazer of the National Association of State Budget Officers said states will be watching for poverty increases when figures are released in September as they make decisions about the Medicaid expansion. Most states generally assume poverty levels will hold mostly steady and they will hesitate if the findings show otherwise. "It's a constant tension in the budget," she said. The predictions for 2011 are based on separate AP interviews, supplemented with research on suburban poverty from Alan Berube of the Brookings Institution and an analysis of federal spending by the Congressional Research Service and Elise Gould of the Economic Policy Institute. The analysts' estimates suggest that some 47 million people in the U.S., or 1 in 6, were poor last year. An increase of one-tenth of a percentage point to 15.2 percent would tie the 1983 rate, the highest since 1965. The highest level on record was 22.4 percent in 1959, when the government began calculating poverty figures. Poverty is closely tied to joblessness. While the unemployment rate improved from 9.6 percent in 2010 to 8.9 percent in 2011, the employment-population ratio remained largely unchanged, meaning many discouraged workers simply stopped looking for work. Food stamp rolls, another indicator of poverty, also grew.

Demographers also say:

—Poverty will remain above the pre-recession level of 12.5 percent for many more years. Several predicted that peak poverty levels — 15 percent to 16 percent — will last at least until 2014, due to expiring unemployment benefits, a jobless rate persistently above 6 percent and weak wage growth.

—Suburban poverty, already at a record level of 11.8 percent, will increase again in 2011.

—Part-time or underemployed workers, who saw a record 15 percent poverty in 2010, will rise to a new high.

—Poverty among people 65 and older will remain at historically low levels, buoyed by Social Security cash payments.

—Child poverty will increase from its 22 percent level in 2010.

Analysts also believe that the poorest poor, defined as those at 50 percent or less of the poverty level, will remain near its peak level of 6.7 percent...The 2010 poverty level was $22,314 for a family of four, and $11,139 for an individual, based on an official government calculation that includes only cash income, before tax deductions. It excludes capital gains or accumulated wealth, such as home ownership, as well as noncash aid such as food stamps and tax credits, which were expanded substantially under President Barack Obama's stimulus package. An additional 9 million people in 2010 would have been counted above the poverty line if food stamps and tax credits were taken into account.

MORE AT LINK

Demeter

(85,373 posts)There are a tremendous number of brand new babies and late-term pregnant women in Ann Arbor. In my observation, women get pregnant when they see no hope of work or any improvement financially. Since childbearing years are limited, and earlier is better for mother and child, this makes efficient use of time that would otherwise be wasted beating one's head on closed doors...

Demeter

(85,373 posts)A new report from the Pew Economic Mobility Project has some observers celebrating how well Americans are doing compared to their parents. But the report’s figures, upon closer inspection, give little cause for celebration...The latest report from the Pew Economic Mobility Project unambiguously concludes that the “vast majority of Americans have higher family incomes than their parents did.”

The report, entitled Pursuing the American Dream: Economic Mobility Across Generations, finds that “84 percent of Americans have higher family incomes than their parents did” when incomes are adjusted for changes in prices and family size. The Pew findings seem to give some cause for cheer. The problem is that they don’t square with Census Bureau statistics that show steep declines in men’s wages over the past forty years at every age level.

Families today are making more money than families did thirty or forty years ago for two basic reasons. First, families have more people working, especially women. Second, working people are working more hours, especially women. These two factors don’t necessarily make for better-off families. Yes, families today have higher incomes, but they earn those higher incomes by working more. All the while, in per-hour terms, they’re actually making less...

Worse, the Pew study only compares the family wealth of men and their fathers. Given the rise in single-parent female-headed households, it’s very likely that women’s median family has declined. The report is silent on this...

Demeter

(85,373 posts)For years, politicians have used targeted tax breaks to try to influence corporate behavior, offering lower tax bills as an incentive to hire more workers, boost energy efficiency and buy more equipment, among other things.

But executives, particularly at small and medium-size companies, complain that many of the tax deductions are either too cumbersome or too confusing. In some cases, the cost of obtaining the tax benefit is greater than the benefit itself—a wrinkle that has helped spawn a cottage industry of tax-credit consultants. Also problematic is the threat of pushback from the Internal Revenue Service...

WHEN IS A TAX BREAK NOT A TAX BREAK? WHEN IT'S DISHONEST.

Demeter

(85,373 posts)– “Markets are so rigged by policymakers that I have no meaningful insights to offer.”

That’s what Nomura International’s Investment Strategist, Bob Janjuah, griped five months ago. Since then, policymakers have stepped up their market-rigging, while new revelations of past market-rigging have also come to light.

It’s starting to feel like the financial markets are all rigging and no ship.

“I am simply stunned that our policymakers seem so one-dimensional, so short-termist, and so utterly bereft of courage or ideas,” Janjuah remarked last February. “It now seems obvious that in response to the financial crisis that has been with us for five years and counting, we are being told to double up on these same policy decisions [that have failed]. The crisis was caused by central bankers mispricing the cost of capital, which forced a misallocation of capital, driven by debt/leverage, which was ultimately exposed as a hideous asset bubble which then collapsed, destroying the lives and livelihoods of tens of millions of relatively innocent people.”

When Mr. Janjuah voiced these concerns a few months back, the European Central Bank (ECB) had barely started rigging the sovereign credit markets of Europe by providing hundred-billion-euro bailouts to the central banks of Spain, Italy and others.

Read more: Market-Rigging and Price-Fixing http://dailyreckoning.com/market-rigging-and-price-fixing/#ixzz21taqAuvB

Demeter

(85,373 posts)

Demeter

(85,373 posts)Eileen Foster was an investigator in charge of Fraud Risk Management at Countrywide when the ticking time bomb of its bad loans detonated. The practices she discovered shocked her and have also shocked those who've heard her story—including the producers of “60 Minutes,” who asked her on the program last December to discuss the lack of prosecutions of any of the bankers responsible for the crisis. But instead of cleaning house and admitting guilt, Bank of America—which purchased Countrywide as the financial crisis grew, in what the Wall Street Journal calls “one of the worst deals ever struck in corporate America”--drove Foster out and tried to discredit her findings.

In 2011, the Department of Labor ruled that Foster had been illegally fired. It said that her firing was retaliation for her whistle-blowing and ordered that she be reinstated and paid compensation. There have still been no prosecutions, and no officials have asked to hear Foster's story—so she's taking it public. Earlier this year, she was honored with a Ridenhour prize for truth-telling from the Nation Institute and the Fertel Foundation, and this week she spoke with AlterNet in an exclusive interview discussing what she saw at Countrywide—and what happened to her as a result...

HAIR-RAISING SPECIFICS AT LINK

Demeter

(85,373 posts)Bankers and regulators may be called to appear at European Parliament hearings into the scandal engulfing interbank lending rates as lawmakers seek to prevent any repeat of such market manipulation. Arlene McCarthy, the legislator leading the parliament’s work on draft market-abuse rules, said hearings should shed light on how bankers were able to rig lending rates and why regulators failed to act. The move comes as the assembly and Michel Barnier, the 27 nation EU’s financial services chief, prepare legal measures to punish illicit interest-rate fixing.

“The culture of the banking industry has not changed and this culture was aided and abetted by regulatory failures,” McCarthy, who sits on the parliament’s economic and monetary affairs committee, said in an e-mailed statement today. “The more information that comes to light on the extent and gravity of this scandal the more urgent it is for the ECON committee to call in the banks and regulators to answer for their failures and manipulation.”

Market Abuse

Both the parliament and the European Commission, the EU’s executive arm, are seeking to make abuse of interbank rates punishable by criminal sanctions. The commission will next week publish plans for how EU market-abuse rules should be amended in response to the Libor scandal, Stefaan De Rynck, a spokesman for Barnier, told reporters today in Brussels.

“We’re going to propose that manipulation of these reference indices should be penalized, should be deemed market abuse,” De Rynck said. The measures, to be published July 25, would amend a draft law presented by Barnier last year.

The plans would need approval from the parliament and by national governments before they can take effect. Barnier is seeking an agreement “by the end of the year,” De Rynck said.

Demeter

(85,373 posts)Regulators from Stockholm to Seoul are re-examining how benchmark borrowing costs are set amid concern they are just as vulnerable to manipulation as the London interbank offered rate.

Stibor, Sweden’s main interbank rate, Sibor, the leading rate in Singapore, and Tibor in Japan are among rates facing fresh scrutiny because, like Libor, they are based on banks’ estimated borrowing costs rather than real trades. In some cases they may be easier to rig than Libor as fewer banks contribute to their calculation, according to academics and analysts.

“Many of the ingredients which would make it easy to manipulate Libor and collude are common in other benchmarks,” said Rosa Abrantes-Metz, an economist with consulting firm Global Economics Group and an associate professor at New York University’s Stern School of Business. “Regulatory agencies are starting to take a look at those and there is a growing sense they need to change.”

...With 18 banks on the panel for U.S. dollar Libor and 43 banks for Euribor, only small moves can be achieved by making deliberately high or low submissions. Manipulation becomes easier when fewer banks are contributing, according to Abrantes- Metz at Global Economics. ...

Demeter

(85,373 posts)Central bankers and regulators will hold talks in September on whether the troubled global Libor interest rate can be reformed or whether it is so damaged that the benchmark of borrowing costs should be scrapped.

Bank of England Governor Mervyn King told fellow central bankers in a letter that it was "very clear that radical reforms of the Libor system are needed". Fed Chairman Ben Bernanke and global financial regulator Mark Carney, who is also governor of the Bank of Canada, on Wednesday floated possible alternatives to the London interbank offered rate, which some bankers manipulated in the 2007-09 financial crisis.

"There are different alternatives if Libor cannot be fixed," Carney told a news conference in Ottawa.

"If it's structurally flawed and can't be fixed -- which is a possibility -- there may need to be different types of approaches, and we need to think that through."

King put the Libor issue on the agenda of the Economic Consultative Committee of global central bankers that will meet in Basel, Switzerland, on September 9, a central bank source said. The discussions will continue there the following week at the Financial Stability Board's steering committee, which is chaired by Carney and which also includes financial regulators...

..The Australian Bank Bill Swaps Reference Rates, for example, are based on where paper is actually traded on the market...

hamerfan

(1,404 posts)Demeter

(85,373 posts)The trustee liquidating Peregrine Financial Group Inc. said only about 11 of 24,000 futures customers have “specifically identifiable property” eligible to be returned to them...The trustee, Ira Bodenstein, said the assets he is seeking to return are defined as securities, warehouse receipts, cash and other assets that are registered in customers’ names and aren’t transferable. The 11 eligible customers mostly hold warehouse receipts for precious metals, he said in a court filing in U.S. Bankruptcy Court in Chicago...

According to U.S. rules for liquidating a futures brokerage, other customer property must be distributed pro rata based on net equity claims. Commodity contracts that can’t be traced to a particular customer will be liquidated, along with securities and other assets held by the firm’s estate that don’t fit the definition of specifically identifiable property.

Metals Receipts

As a result, customers of the futures brokerage who have a right to return of property won’t necessarily get 100 percent of their assets, Bodenstein said...Customers with returnable metals warehouse receipts may have to post a deposit to receive the receipts, he said. Notices letting eligible customers know they must request return of property will be sent in writing to those customers, he said...

Demeter

(85,373 posts)Peregrine Financial Group CEO Russell Wasendorf Sr., who last week confessed to bilking futures traders of more than $100 million, returns to criminal court on Wednesday, JULY 18, as his receiver prepares to sell his jet, extensive wine collection and other assets that may have been bought with stolen money.

Wasendorf, the 64-year-old owner and founder of the failed Iowa-based brokerage, is to appear in federal court in Cedar Rapids for a bail hearing on Wednesday afternoon...In court Wednesday, Wasendorf will be represented by a public defender, according to Tom Breen, a Chicago lawyer that Wasendorf said he planned to hire. Breen did not take the job because Wasendorf's assets have been frozen.

CONDO, WINE FOR SALE

Meanwhile, Michael Eidelman, the receiver for Wasendorf in the bankruptcy of PFGBest, as his firm is known, is moving to secure the CEO's personal assets, including a $100,000 personal wine collection stored at myVerona, Wasendorf's high-end Italian restaurant in Cedar Falls, Iowa, Eidelman said in an interview. Other assets include a jet -- valued by brokers at $7 million to $10 million -- that is now parked at an airport in Waterloo, Iowa, and a condominium near downtown Chicago, valued by the county's property tax assessor at about $1 million. The condo will "go on the market pretty soon," Eidelman said. Wasendorf also owns a house just outside Cedar Falls worth close to $1 million, property records show.

"Upon information and belief, the assets owned by the Wasendorf Entities are diversified and include a restaurant, publishing company, aircraft and a construction company," Eidelman said in a motion Tuesday requesting that the court give him more power and funding to pursue and secure those assets.

"It is possible assets owned by the Wasendorf Entities may have been procured with funds embezzled from PFG," he said.

Eidelman asked the court for permission to employ the jet's pilot and myVerona's manager, as well as the chief financial officer at Wasendorf & Associates, which runs Wasendorf's now-closed publishing arm, to help him "identify, locate, secure, and take custody of the assets owned and controlled by Wasendorf Sr. and the Wasendorf entities."

Demeter

(85,373 posts)DIDN'T FIND ANY RECORD OF THIS HAPPENING...

http://www.bloomberg.com/news/2012-07-18/peregrine-collapse-set-for-july-25-u-s-house-agriculture-probe.html

Demeter

(85,373 posts)

Peregrine Financial Group Inc.'s founder said he spent most of the money allegedly embezzled from customers to cushion his trading firm's capital, fund a new corporate headquarters—and even to pay regulatory fines and fees, according to previously undisclosed parts of letters left when he attempted suicide...One of the notes, which was a general statement describing Mr. Wasendorf's alleged fraud and signed by him, says regulators first examined Peregrine's use of client funds as far back as 1993, triggering Mr. Wasendorf to start his alleged fraud. Deceiving the regulators was "relatively simple," said the statement.

...Mr. Wasendorf's failed suicide attempt last week triggered probes by regulators and the Federal Bureau of Investigation that uncovered $215 million in allegedly missing customer funds. Mr. Wasendorf was arrested and criminally charged Friday with lying to regulators. The Commodity Futures Trading Commission and the National Futures Association have filed separate enforcement actions against him and Peregrine, which is now in liquidation.

...Portions of Mr. Wasendorf's signed statement were contained in a criminal complaint unsealed in federal court Friday. The remainder of the statement—as well as the contents of a separate note to his son, Russell Wasendorf Jr.—haven't previously been reported. That note asked for the son's forgiveness, and informed him that Mr. Wasendorf already had married his fiancée in secret, weeks before a scheduled wedding in Iowa. Mr. Wasendorf also left a note for his wife, according to federal authorities.

"Most of the misappropriated funds went to maintain the increasing levels of Regulatory Capital to keep [Peregrine] in business and to pay business [losses]," said the signed statement. It said the funds also were used to build Peregrine's $18 million headquarters in Cedar Falls, Iowa, and to "pay Fines and Fees charged by the regulators."

Demeter

(85,373 posts)U.S. futures market regulators scrambled on Tuesday to take new steps to prevent another broker from dipping into client funds, while it emerged that the founder of Peregrine Financial Group had already spent the more than $100 million he took from clients to keep his firm afloat.

As the chief of the Commodity Futures Trading Commission acknowledged that the regulatory system had failed to protect customers of PFGBest, as Peregrine is known, new details from Russell Wasendorf Sr.'s confession and suicide note showed a man embittered by "mean spirited" regulators and distraught over deceiving his own son..."I know you will be shocked to discover my crimes," Wasendorf, 64, wrote to his son, Russell Wasendorf Jr., in the suicide note, a copy of which was read to Reuters by a source close to the situation. "I never wanted you to know the kind of guy I really was"...In his suicide note to his son, Wasendorf said: "I beg your forgiveness ... Your mistake was trusting your father, nothing more." Wasendorf Jr. was chief financial officer of Peregrine. But he had no sympathy for regulators: "I have to say I don't feel bad about deceiving the regulators," the note said. "They made the decision to be my enemy."

Regulators including the Commodity Futures Trading Commission have been criticized for failing to catch the deceit. Wasendorf blamed them for driving him to commit fraud by undermining his company in 1993, just a year after it was formed, the Wall Street Journal reported.

In a signed letter found with his suicide note last Monday, Wasendorf said that his scheme began around 1993, when a CFTC investigator in Kansas City sought to fine his firm for a violation involving customer funds, according to the Journal. The CFTC "harassed" him by conducting six on-site audits over five months, he wrote. He said a "technical violation" then raised his capital requirements...

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)He's a first-class weasel, that one. I bet he can't even walk a straight line.

Demeter

(85,373 posts)ANY EXCUSE FOR A PARTY--

http://www.bloomberg.com/news/2012-07-27/u-s-stock-futures-advance-before-gdp-report.html

The Dow Jones Industrial Average (INDU) climbed above 13,000, capping its longest weekly advance since January, amid speculation the European Central Bank will buy bonds to help lower borrowing costs and preserve the euro.

Alcoa Inc. (AA) and Caterpillar (CAT) Inc. rose more than 3.1 percent to pace gains in the biggest companies. Merck & Co. (MRK) and Amgen Inc. (AMGN) added at least 4 percent, driving health-care shares higher, as earnings beat estimates. Expedia Inc. (EXPE) surged 20 percent as the online-travel company raised its dividend. Facebook Inc. (FB) fell 12 percent to a record low after its results.

About nine stocks rose for every two falling on U.S. exchanges at 4 p.m. New York time. The Standard & Poor’s 500 Index advanced 1.9 percent to 1,385.97. The Dow average rallied 187.73 points, or 1.5 percent, to 13,075.66. Both climbed to the highest levels since May and completed three straight weeks of gains. Volume for exchange-listed stocks in the U.S. was 7.9 billion shares, or 18 percent above the three-month average. MORE

Demeter

(85,373 posts)About 14% of U.S. companies surveyed by a Massachusetts Institute of Technology professor definitely plan to move some of their manufacturing back home—the latest sign of growing interest among executives in a strategy known as "reshoring."

David Simchi-Levi, an engineering professor at MIT who runs a program for supply-chain executives, said he surveyed 108 U.S.-based manufacturing companies with multinational operations over the past two months. The companies range in size from annual sales of about $20 million to more than $25 billion, and most of them are over $1 billion, Dr. Simchi-Levi said.

MORE, BUT I CAN'T GET AT IT

DemReadingDU

(16,000 posts)7/27/12 Six ways big banks screwed Grandma

Grandma's finances will almost certainly never recover from the Libor scandal that's rocking the world

By Alexander Arapoglou and Jerri-Lynn Scofield

Who lost out, big time, from fixing these rates? Grandma, that’s who! The multiyear pattern of setting LIBOR too low screwed her in six ways. Her finances will almost certainly never recover from the experience. And, needless to say, she never asked for it.

1. Lower LIBOR reduced rates of return on prudent investments.

2. Lower LIBOR squeezed pension yields.

3. Finagling LIBOR is securities fraud, which ultimately spanks bank profits and harms shareholders.

4. Artificially low LIBOR prevented bank problems from being nipped in the bud.

5. Low LIBOR helped foreclosure rates to skyrocket for the elderly.

6. Lower LIBOR devastated state and municipal budgets.

Conclusion: Grandma lost out, big time. And the likelihood is that she’ll never recover her losses. No, it’s not a victimless crime. The banks screwed Grandma, and they’ll likely get away with it because too big to fail also means too big to nail, except for a slap on the wrist.

much more at link...

http://www.salon.com/2012/07/27/six_ways_big_banks_screwed_grandma/

Po_d Mainiac

(4,183 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)Demeter

(85,373 posts)I did the first run for the paper route, and watered everything, and now....breakfast! Then Farmer's Market, then....cooking or mending, depending, then shopping, then....

Arg! I can't think about it!

Food. Must have food.

xchrom

(108,903 posts)But then I got no sleep - & I have no coffee in the house.

I gotta go to the store & get some.

Hotler

(11,394 posts)As most of you know by now there are times when I have no hope and see no future. I have no fight left in me. I am physically tired, mentally tired, emotionally tired and spirtually tired. One the the things that makes my heart feel heavy and hurt the most is the feeling that I have lost touch with my spiriturality. Sometimes a good gospel helps me fell grounded again. Thanks again for posting that beautiful song. P.S. Did you see the post in GD with Burt Lancaster sing it fro Elmer Gantry????

xchrom

(108,903 posts)xchrom

(108,903 posts)U.S. Treasury Secretary Timothy F. Geithner will meet with German Finance Minister Wolfgang Schaeuble and European Central Bank President Mario Draghi in separate sessions on July 30.

The meeting with Schaeuble will take place on the German island of Sylt in the afternoon of July 30, and the session with Draghi will be held that evening in Frankfurt, the Treasury Department said in a statement today.

The Treasury said the meetings will be closed to the press, with a photo opportunity before the Schaeuble meeting. A Treasury official with knowledge of the matter said that Geithner and Schaeuble won’t hold a news conference after the meeting.

European stocks rose for an eighth week as German Chancellor Angela Merkel and French President Francois Hollande joined Draghi in promising to do everything to protect the euro.

Demeter

(85,373 posts)and that's where the Elite's Best and Brightest have found themselves...they thought they were the Smartest Guys in the Room; turns out, they were just Wiseguys, if you know what I mean....

Demeter

(85,373 posts)The top banking regulator at the Financial Services Authority has accused Barclays of having a "culture of gaming" in testimony to MPs that laid bare the difficult relationship between the bank and its regulator. Andrew Bailey described this month's evidence of former Barclays boss Bob Diamond to the Treasury select committee of MPs as "highly selective" and said there was "a problem with the institution and that came from the tone at the top". As the FSA revealed it was investigating another seven institutions for attempting to manipulate interest rates, Lord Turner, the regulator's chairman, also indicated that he had dropped broad hints two days after Barclays was fined for Libor rigging that Diamond should leave the bank. Diamond quit on 3 July – six days after a record £290m fine was levied on the bank – following pressure from the Bank of England governor Sir Mervyn King. Turner was asked by MPs on the Treasury select committee about a letter he had sent to Marcus Agius, Barclays' chairman, in April raising concerns about the culture at the bank. The FSA chairman said he had never had to send such a letter to any other bank chairman.

The appearances of Diamond and Agius before the committee had already raised concerns about the bank, but Bailey said "there was a culture of gaming – and gaming us". He stressed that his own relationship with Diamond was not antagonistic. Diamond's deputy, Jerry del Missier, revealed to MPs that the bank's compliance department had been informed internally about the decision to reduce Libor submissions during the financial crisis. When the fine was announced, the FSA did not take any action against Diamond, and Agius has admitted to being shocked when told by King that his chief executive had "lost the confidence of his regulators".

The admission by the FSA that seven firms were still being investigated came as the authorities in the US stepped up their inquiry. The New York and Connecticut attorneys general have joined forces to investigate alleged manipulation of the rates. New York state's Martin Act gives its attorney general the most wide-ranging investigative powers of any state. Eliot Spitzer used the act to force a huge settlement out of Wall Street following the analyst scandal of the early 2000s.

In Britain the Serious Fraud Office is examining any potential cases for fraud while the row over whether there should be a full public inquiry into the banking industry – rather than a parliamentary one led by Andrew Tyrie who chairs the Treasury select committee – continues to rumble on. David Cameron was dealt a blow when the clerk of the house, one of the most senior parliamentary officials, raised questions about one of the prime minister's central arguments in favour of holding a parliamentary inquiry into banking – that the latter would be able to examine witnesses under oath. Robert Rogers wrote: "The debate on 5 July on the method of investigating Libor rate fixing and related matters demonstrated in some quarters a confidence that the taking of evidence on oath in parliamentary proceedings avoids all the difficulties I have so far touched upon. It does not." He said a parliamentary committee would suffer a "damaging and very public setback if the authorities reject a recommendation to prosecute a witness". It would face embarrassment if the prosecuting authorities decide it has harassed or badgered a witness. Rogers wrote: "These considerations may have been factors in there having been no prosecutions for perjury in respect of parliamentary proceedings since the passing of the 1911 Perjury Act."

xchrom

(108,903 posts)America's first woman in space blazed a trail for equality in the sciences thanks to her sex and her sexuality

My girlfriend was the one who pointed out to me that Sally Ride had a female partner.

I was a mess on Monday when I learned that Ride, who became the first American woman to fly in space in 1983, had died. I had no idea she was even sick – at her request, NASA had kept her 17-month battle with pancreatic cancer secret.

Ride was one of my childhood heroes. I dressed as her for Halloween when I was aged eight and my lifelong passion for space was first budding. Ride's legacy is mostly one of inclusion: bringing more women into science, encouraging girls to think they can do anything. She was a living example of how to crush gender stereotypes, even as she dodged sexist questions from the media. Her first flight on the space shuttle Challenger was before I was born. Thanks to her, I grew up in a world where my sex was not a barrier to the stars.

It runs even deeper for me, as a science writer. When I found out she had double majored in physics and English in college, I felt an intense feeling of identification – she was like me. I too loved both science and words, and felt a bit of tension about it – but if the first American woman in space could cross that line, I could too.

xchrom

(108,903 posts)A GROUP of French Socialist Party deputies has threatened to vote against the EU fiscal treaty in parliament, revealing the first sign of dissent in the party over Europe since François Hollande won the presidency.

The deputies, representing the ruling party’s left wing, have criticised the treaty’s focus on austerity and plan to table a document outlining their concerns at the party’s annual congress in October.

Mr Hollande pledged during the presidential campaign earlier this year to reject the treaty, which sets tight limits on national deficits and debts, unless measures to spur economic growth were added to it. He has since said a growth pact agreed by EU leaders in June meets his demands, and the treaty is due to be put to parliament in September.

“We’re discussing it among ourselves,” said Barbara Romagnan, a socialist member of the lower house, “but if it remains underlaid by the same logic, which will bring us to a policy of austerity, I don’t think we’ll be able to vote for it.”

DemReadingDU

(16,000 posts)We couldn't outsmart the dogs, so we moved the chickens to the other side of the fence, so the dogs can't see them to bark!

previous posting

http://www.democraticunderground.com/?com=view_post&forum=1116&pid=19285

Demeter

(85,373 posts)Why is doing the right thing so hard?

DemReadingDU

(16,000 posts)The harder it is, the more I learn!

riverbendviewgal

(4,252 posts)Sally was an amazing woman...

PS: Loved that commitment audio ...I fell in love with them when I watched the movie...One of my favorite movies and favorite songs. My grandmother was named Sally....

Demeter

(85,373 posts)We are here every weekend, and there's the Stock Market Watch during business days. Stop by any time. We love to see newcomers.

Demeter

(85,373 posts)Also, look for Auroras this Sunday night!

Demeter

(85,373 posts)Europe could suffer a dangerous bout of deflation if regional officials, including those at the European Central Bank, do not move quickly to support the continent’s banks and the wider economy, the International Monetary Fund warned Wednesday.

Using some of its most ominous language yet, the usually understated IMF called the euro zone “unsustainable” in its current form. The agency said the 17-nation currency union is a “half-finished” project and could disintegrate as banks and other nervous investors shelter money in their home countries rather than letting it flow across the euro zone.

The currency union was created in an effort to integrate the economies and financial markets of European countries. But the two-year-old financial crisis “has created de-integrating forces” that have put the euro in jeopardy, IMF fund officials wrote.

“Financial markets in parts of the region remain under acute stress, raising questions about the viability of the monetary union itself,” they wrote...

THIS IS WHAT COMES OF "ENGINEERING" SOCIAL STRUCTURES. YOU WOULD THINK EUROPE, WITH THEIR INTIMATE KNOWLEDGE OF THE NAZIS AND THE BOLSHEVIKS, WOULD BE A LITTLE LESS GULLIBLE...

DemReadingDU

(16,000 posts)The U.S. is too, mostly likely the entire world. This is because of the bubble Ponzi we are living in. All Ponzis burst, it is only a matter of time.

We are witnessing the biggest fraud bubble Ponzi in history which will be followed by the biggest kaboom when it bursts. It will be epic.

Demeter

(85,373 posts)But Uncle Ben is a prodigious source of hot air.

I wonder if the current regulators and Administration have even two civic brain cells to rub together, or if they are purely driven by personal greed and fear.

DemReadingDU

(16,000 posts)6/5/12 Fragility and Collapse: Slowly at first, then all at once by Dmitry Orlov

I have been predicting collapse for over five years now. My prediction is that the USA will collapse financially, economically and politically within the foreseeable future... and this hasn’t happened yet. And so, inevitably, I am asked the same question over and over again: “When?” And, inevitably, I answer that I don’t make predictions as to timing. This leaves my questioners dissatisfied, and so I thought that I should try to explain why it is that I don’t make predictions as to timing. I will also try to explain how one might go about creating such predictions, understanding full well that the result is highly subjective.

You see, predicting that something is going to happen is a lot easier than predicting when something will happen. Suppose you have an old bridge: the concrete is cracked, chunks of it are missing with rusty rebar showing through. An inspector declares it “structurally deficient.” This bridge is definitely going to collapse at some point, but on what date? That is something that nobody can tell you. If you push for an answer, you might hear something like this: If it doesn’t collapse within a year, then it might stay up for another two. And if it stays up that long, then it might stay up for another decade. But if it stays up for an entire decade, then it will probably collapse within a year or two of that, because, given its rate of deterioration, at that point it will be entirely unclear what is holding it up.

.

.

To summarize: it is possible to predict that something will happen with uncanny accuracy. For example, all empires eventually collapse, with no exceptions; therefore, the USA will collapse. There, I did it. But it is not possible to predict when something will happen because of the problem of missing information: we have a mental model of how something continues to exist, not of how it unexpectedly ceases to exist. However, by watching the rate of deterioration, or divergence from our mental model, we can sometimes tell when the date is drawing near. The first type of prediction—that something will collapse—is extremely useful, because it tells you how to avoid putting at risk that which you cannot afford to lose. But there are situations when you have no choice; for instance, you were born into an empire that’s about to collapse. And that is where the second type of prediction—that something will collapse real soon—comes in very handy, because it tells you that it’s time to pull your bacon out of the fire.

.

.

Lots more...

http://cluborlov.blogspot.com/2012/06/fragility-and-collapse-slowly-at-first.html

snot

(10,502 posts)explanations welcome!

Wages deflating? Absolutely.

The things I need to buy – mostly food and gas? Inflating.

The retirement assets I carefully saved, need to live on, and am probably too old to add much to? – not sure but I think inflation's hurting me more than deflation.

DemReadingDU

(16,000 posts)Inflation is a period of time when people can buy most anything using credit card and can easily get a loan for just about anything.

Deflation is a period of time when there is a lack of credit. People buy things with cash and find it harder to get a loan.

With either inflation or deflation, there are always things that can increase or decrease in price, some which is due to supply and demand, some due to greed, or whatever.

As the world further deflates, we will find that the things we need the most, will become expensive to buy. In other words, if one has no job, no income, no savings, no credit cards, then even a gallon of milk will seem expensive even it it costs only $1.00. Probably better to have a cow to get your own milk.

This is one of my reasons for learning about chickens to get fresh eggs for food. If I can't get to the store because it is too far away, then I can at least have eggs to eat.

And if the trucks that deliver the food, cannot get credit to buy gas to fill their tanks, then food will not be delivered to the store, even if I were able to ride my bicycle to the store.

edit: typo

Demeter

(85,373 posts)Two of the world's financial capitals are hurting. London, Europe's trading hub, and Chicago, America's bridge between the farm and the global commodity markets, have been rocked by scandals. The controversy over the London interbank offered rate, or Libor, and the unraveling of the brokerage Peregrine Financial Group Inc. share only their timing. But their collision in the headlines is deepening investors' antipathy toward the financial industry, capital markets and regulators.

My question to regulators, bankers and denizens of the trading world: Is this just a blip or are we at a breaking point that calls for a wholesale change in attitudes and rules? The first answer, from a longtime Chicago-based executive, was a long silence and a sigh. And then: "It's very bad. Peregrine Financial's collapse undermines the cornerstone of any market: trust between buyers and sellers. The trading community here is in state of shock." Another executive refused to talk other than to quote the 65-year-old independent trader and Peregrine Financial customer Peter Brandt, who went from escaping the Colorado fires into the frying pan of the scandal. Last week, he told The Wall Street Journal: "There's not supposed to be that much excitement in life when you get to be my age."

But excitement, mostly of the wrong kind, is what investors of all stripes have been getting, starting with the 2008 financial crisis, via the Madoff scandal, the bankruptcy of MF Global Holdings Ltd. and other assorted messes (R. Allen Stanford's Ponzi scheme, the mortgage settlement by U.S. banks and so on). With news like this, it is no wonder that ordinary savers have been deserting the stock market, yanking hundreds of billions of dollars from equity mutual funds (see table). Many bank stocks trade at a fraction of their liquidation value. Investors and politicians seem to view the glass as half-empty. Few in the press or in Washington, for example, have mentioned the fact that failures among the thousands of small brokerages are relatively rare.

In Britain, the action against Barclays BARC.LN +8.72% PLC—the first of many banks likely to be dinged over Libor manipulation—could have been seen as a sign that, sooner or later, the bad guys get caught. Instead, George Osborne, the U.K. Treasury chief, branded it "the epitaph to an age of irresponsibility" for the financial sector. In this feverish environment, some financial chiefs are getting worried. A top Wall Street banker likened the Libor probe to the 1998 tobacco settlement—a regulatory crackdown that could change the industry forever. In his view, the furor will lead to the overhaul in banks' practices and attitudes that was expected after the financial crisis but never fully materialized. "It will take a generation or two, but the industry has to regain its moral compass," he said....Perhaps the right answer came from the banker who wished me happy Bastille Day on July 14th: "We are at a 1792 moment," he said. "Remember, the French Revolution was in 1789 but it took three years to proclaim a Republic."

THEY ARE SUCH TEASES....ALL THIS TALK OF"OVERHAUL" AND "REFORMATION" AND REVOLUTION"

IT'S NOT LIKE THEY INTEND TO DO ANYTHING LIKE THAT....BUT THE WORLD IS FULL OF THWARTED INTENTIONS...AND THE BANKSTERS HAVE BEEN THWARTING EVERY PERSON'S NORMAL INTENTION.

Demeter

(85,373 posts)JPMorgan Chase & Co. (JPM)’s assertion that traders at its London chief investment office may have intentionally mismarked trades, masking losses that total at least $5.8 billion, makes little sense, according to former executives with direct knowledge of the unit’s operation. The bank restated first-quarter results, paring profit by $459 million, in part because an internal review revealed that U.K. traders had priced their books “aggressively,” Mike Cavanagh, head of Treasury & Securities Services, said in a July 13 meeting with analysts. The mispricing made losses on a portfolio of credit derivatives look smaller than they were, and executives concluded that traders may have sought to hide the “full amount of losses,” JPMorgan said in a presentation.

JPMorgan requires traders to mark their positions daily so the firm can track their profits, losses and risk. An internal control group double-checks the marks against market prices monthly and at the end of each quarter, said three former executives from the CIO and a senior executive in market risk. The firm uses the control group’s prices, not what individual traders submit, to calculate earnings, making it difficult for one trader or trading desk to rig prices, the people said.

“We just have questions about whether the traders were doing what they need to do for accounting, which is put a mark on their positions where they think they can exit,” Cavanagh, who led the internal review, said on a conference call with reporters. “Instead, it felt more like they were pricing their marks a little bit more aggressively, but generally inside the bid-ask spread.” The spread is the difference between what an investor would pay to buy a security and the price at which someone is willing to sell the same asset.

Bruno Iksil, known as the London Whale because his positions became so large, ran the credit derivatives book that generated the losses. He personally apologized in recent weeks to almost everyone in the London unit for causing turbulence within the group, according to one of the former CIO executives who had been told about it by two people in the unit...JPMorgan, led by Chief Executive Officer Jamie Dimon, has seen its market value plunge $36 billion since April 5, when Bloomberg News first reported the London unit’s illiquid bets on credit derivatives were big enough to move markets. The trade, a wrong-way bet on credit derivatives, cost the bank $5.8 billion in the first six months of this year and the tab could climb by $1.7 billion, the bank said...JPMorgan, the largest U.S. lender by assets, shut down all synthetic trading at the chief investment office and transferred the rest of the position to the investment bank. The CIO has retained an $11 billion short position in “basically liquid indexes” to hedge other credit assets, Dimon, 56, said during the meeting with analysts. Positions in Series 9 of the Markit CDX North America Investment Grade Index, a credit-swaps benchmark known as IG9 that’s at the heart of much of the loss, were cut by 70 percent, he said. The investment bank has the expertise to manage it, Dimon said. The bank transferred about $30 billion of risk-weighted assets to the investment bank, an amount that is “down substantially” from an earlier peak and back to levels at the end of 2011, he said.

Federal Investigations

The stock jumped 6 percent on July 13 as investors expressed “relief that it wasn’t worse,” said Gary Townsend, head of Hill-Townsend Capital LLC, said of the trading loss. It was “substantially better than many of the estimates that I was hearing,” he said. Agencies scrutinizing the bank’s handling of the loss include the Securities and Exchange Commission, U.S. Justice Department and Federal Bureau of Investigation...Ohio Attorney General Mike DeWine said July 14 that he is seeking to lead a proposed class-action lawsuit against JPMorgan after state pension funds lost more than $27.5 million due to the “alleged fraud.” Two funds for state employees held about 10.2 million JPMorgan shares as of March 31, data compiled by Bloomberg show.

“Pension-fund managers acting on behalf of Ohio retirees were given false and misleading information by JPMorgan Chase that hid the true nature of the bank’s risky trades, causing Ohio teachers, school employees and public employees to lose tens of millions of hard-earned retirement dollars,” DeWine said in a statement.

Demeter

(85,373 posts)Barclays Plc (BARC)’s ex-chief executive officer, Robert Diamond, was contradicted by his former chief operating officer and criticized by regulators investigating the Libor-rigging scandal. Jerry del Missier told lawmakers yesterday his former boss instructed him to submit artificially low Libor rates, and blamed compliance managers for failing to act. Less than an hour later, Financial Services Authority Chairman Adair Turner told the committee Barclays had been “gaming the system.” Del Missier, 50, said he took Diamond’s direction to have come from the Bank of England. He said he then “passed the instruction along” to Mark Dearlove, head of the bank’s money- markets desk, to lower its contributions for the London interbank offered rate.

“It did not seem an inappropriate action given it was coming from the Bank of England,” del Missier told Parliament’s Treasury Select Committee in London. “The government were calling the shots.”

His comments contradicted Diamond, who told lawmakers he wasn’t directed by the Bank of England to lower the firm’s submissions and gave no such instruction. Del Missier also embroiled more executives in the inquiry, saying compliance chief Stephen Morse was told by the bank’s money-markets desk about the request to lower Libor rates, and failed to act. The desk “informed compliance of the request,” del Missier said. “There was no closing of the loop.”

Barclays fell 4.5 percent to 157.70 pence, the lowest in almost eight months, in London trading yesterday. The stock has declined 10 percent this year, making it the worst performer in the six-member FTSE 350 Banks index. Simon Eaton, a Barclays spokesman, and Daniel Yea, Diamond’s spokesman, declined to comment on del Missier’s remarks. Del Missier resigned from Britain’s second-largest bank by assets on July 3, the same day as Diamond after the lender was fined 290 million pounds ($453 million) by regulators for attempting to manipulate Libor, a benchmark for $500 trillion of financial products...

MORE GOSSIP AT LINK

Demeter

(85,373 posts)Jerry del Missier, former chief operating officer at Barclays, told the Treasury Select Committee that Mr Diamond had clearly told him in October 2008 to “get our Libor rates down”.

The disclosure came as the former Barclays boss was branded as being “less than candid” with MPs over the Libor scandal.

Mr Diamond’s testimony from last week - that Mr del Missier asked traders to lower Libor in October 2008 after “misinterpreting” an email - was crushed by Mr del Missier’s claims that the order was relayed to him in a telephone conversation.

Mr del Missier, the third of the three senior directors ejected from Barclays to be grilled by MPs over the scandal that cost the bank £290m in fines, confirmed that he had given the low-balling orders. MORE

Demeter

(85,373 posts)The United States may have to give up its seat on a top global accounting body if it continues to drag its feet over the adoption of international book-keeping rules, the European Union's executive said on Wednesday.

Discussions over whether the United States would adopt the International Financial Reporting Standards (IFRS) have been going on for a "very long time and, despite repeatedly expressed commitments from the U.S., things are advancing very slowly", European Commission spokesman Stefaan De Rynck said.

The rules, compiled by the London-based International Accounting Standards Board (IASB), are used in more than 100 countries and are monitored by an IASB committee on which the U.S. sits.

"The lack of a clear vision from the U.S. creates uncertainty and hampers the IFRS from becoming a truly global accounting language," said De Rynck, who speaks on behalf of Michel Barnier, the EU commissioner responsible for financial services...

I WISH I KNEW IF THIS WAS GOOD OR BAD. IF THE RULES ARE GARBAGE, BETTER TO IGNORE THEM. IF THEY ARE NOT, THEN THE US DESERVES TO BE KICKED OUT.

snot

(10,502 posts)he probably doesn't know but I'll let you know if he comments.

snot

(10,502 posts)Demeter

(85,373 posts)

Demeter

(85,373 posts)Royal Bank of Scotland has paid more than €30m (£25m) to a businessman who claimed the bank mis-sold him an interest rate swap... The case could open the floodgates to hundreds of millions and even billions of pounds in claims against the taxpayer-backed lender and other banks.

RBS’s Irish subsidiary last week agreed a settlement with Dublin-based businessman David Agar that will see it write-off swaps and loans worth €30m as well as covering Mr Agar’s legal costs, which are believed to total about €1m.

The bank is expected to say it made a £1.2bn pre-tax loss in the first six months of the year when it announces its results on Friday. It continues to be hit by the cost of toxic assets, as well as lower investment banking revenues.

Demeter

(85,373 posts)On 20th August, the Greek government will have to borrow 3.2 billion from one arm of the Eurozone (from the EFSF) in order to repay another (the ECB). Yet Greece is insolvent. The very idea of an insolvent entity borrowing more from a community, like the Eurozone, in order to repay that same community is obscene. All it does is to shift the burden from the Central Bank to the taxpayers of Germany, Holland, Austria and Finland. This is not an act of solidarity with Greece. It is an act of irresponsible kicking-the-can-up-a-steep-hill. The simple point I have been trying to drive home for a long while now is that the Eurozone must make a simple decision: Either to give Greece a proper chance of exiting its current death spiral. Or to dump Greece now, before the Greek state loses all its remaining assets and before it gets deeper into debt. And if our Eurozone partners are not prepared to make up their minds (caught up in their own short term concerns and shenanigans), then Athens must force their hand to decide within the next 23 days. How? By announcing that Greece will NOT be borrowing on 20th August monies it cannot repay under the present scheme of things.