Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 8 August 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 8 August 2012[font color=black][/font]

SMW for 7 August 2012

AT THE CLOSING BELL ON 7 August 2012

[center][font color=green]

Dow Jones 13,168.60 +51.09 (0.39%)

S&P 500 1,401.35 +7.12 (0.51%)

Nasdaq 3,015.86 +25.95 (0.87%)

[font color=red]10 Year 1.63% +0.02 (1.24%)

30 Year 2.72% +0.01 (0.37%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

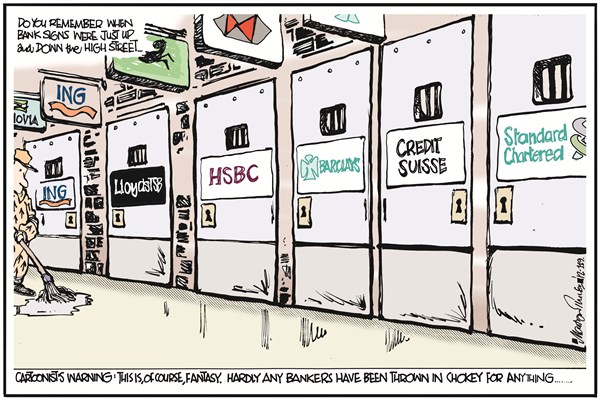

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

AnneD

(15,774 posts)By Jason Zweig

(this guy is am apologist for WS but this has been making the rounds)

Associated Press

Overheard in midtown Manhattan at the lunch hour:

“Another day, another financial scandal. New regulations, prosecution, getting hauled up in front of Congressional hearings – nothing seems to stop it.”

“Maybe we need to try something more drastic.”

Overheard in midtown Manhattan at the lunch hour:

“Another day, another financial scandal. New regulations, prosecution, getting hauled up in front of Congressional hearings – nothing seems to stop it.”

“Maybe we need to try something more drastic.”

“Like what?”

“Well, there’s always the death penalty.”

(snip)

The history of drastic punishment for financial crimes may be nearly as old as wealth itself.

The Code of Hammurabi, more than 3,700 years ago, stipulated that any Mesopotamian who violated the terms of a financial contract – including the futures contracts that were commonly used in commodities trading in Babylon – “shall be put to death as a thief.” The severe penalty doesn’t seem to have eradicated such cheating, however.

In medieval Catalonia, a banker who went bust wasn’t merely humiliated by town criers who declaimed his failure in public squares throughout the land; he had to live on nothing but bread and water until he paid off his depositors in full. If, after a year, he was unable to repay, he would be executed – as in the case of banker Francesch Castello, who was beheaded in 1360. Bankers who lied about their books could also be subject to the death penalty.

Fuddnik

(8,846 posts)AnneD

(15,774 posts)I was up listening to Max Keiser before I caught up with the SWT. Serves me right for not coming here first.

Max was wanting to thread Jamie Diamond's entrails on a wheel and roll it down Wall Street. Who knows what the tipping point will be or when it will come, but I fear for the extinction of great numbers of our species from this foolishness. And these WS types are the first ones I would like to make extinct. No magical thinking involved, just routine pest control.

Fuddnik

(8,846 posts)Denis Diderot:

'Man will never be free until the last king is strangled with the entrails of the last priest.'

Switch the subjects to Banksters and politicians.

AnneD

(15,774 posts)I would include Multinational CEOS to the list.

xchrom

(108,903 posts)

xchrom

(108,903 posts)

Shares in Standard Chartered have bounced back by 6% this morning as the bank fighting accusations of money laundering recovered slightly from one of its worst ever one-day falls.

The group's shares plunged by 16% on Tuesday - to follow a 6% drop in the last few minutes of trading Monday - on the news that New York's State Department of Financial Services had accused the bank of laundering as much as $250bn (£161bn) for US-sanctioned Iran. The regulator also threatened to revoke Standard Chartered's banking licence.

However, Standard Chartered strenuously denied the allegations, arguing that it had already been conducting a review of its operations and had voluntarily contacted US regulators to share its findings. It also said that transactions that may have breached US rules only equated to a fraction of the $250bn outlined by the DFS.

Standard Chartered said: "The group does not believe the order issued by the DFS presents a full and accurate picture of the facts. The analysis, that the group shared with all the US agencies, demonstrates that throughout the period the group acted to comply, and overwhelmingly did comply, with US sanctions and the regulations relating to U-turn payments [that allow US banks to process payments involving Iran that begin and end with a non-Iranian foreign bank]. As we have disclosed to the authorities, well over 99.9% of the transactions relating to Iran complied with the U-turn regulations. The total value of transactions which did not follow the U-turn was under $14m".

xchrom

(108,903 posts)

Indian passengers wait on the platform of Sealdah train station, Kolkata, for the resumption of services during a power failure. Photograph: Dibyangshu Sarkar/AFP/Getty Images

n the centre of Delhi, one of the world's biggest, dirtiest, noisiest cities, is an island of calm. Here, government ministers live in vast, state-owned villas; judges, generals and senior bureaucrats walk their dogs across well-watered lawns as servants scrub their government cars; top politicians confer in compounds and the wives of unimaginably wealthy industrialists hold lunch parties catered by top chefs. You live here and visit India.

Last week, India visited this island in the shape of a giant power cut.

Such outages are a daily occurrence for the rest of the population – or at least the two-thirds of India's 1.2bn inhabitants who actually have any electricity supply. But they are not for India's elite. For the latter, power guarantees power. The bureaucrats in charge of Delhi's grids switch off the supply to hospitals before they plunge the homes of top politicians into darkness. But this time the lights did go off. And so the residents of the most upmarket parts of the city – so confident of their power supplies that they do not have generators – had to sit in the fetid monsoon temperatures of 35 degrees like everyone else.

The north Indian outage, possibly the biggest in the history of mankind, affected an estimated 700m people. It was a global news story. It revealed the parlous state of Indian infrastructure and provided a dramatic example of how public institutions have failed to keep pace with economic growth. And it also revealed quite to what degree the conclusion, so deeply rooted in the west, that India is not only "shining" but will only get progressively shinier, is complacent in the extreme.

All things are relative and the "India Shining" slogan, coined for a marketing campaign in heady boom days almost a decade ago, can easily be justified when the current situation of the country is compared to the old days of famine, political instability, riots and disease. India's wealth, though more and more unequally distributed, has grown very substantially in the last 20 years. If the environment has suffered hugely, at the proportion of Indians living in poverty has dropped. A whole world of top-class hotels, coffee chains serving cappuccino, glitzy domestic airlines, shiny new airports, information technology companies, quality private clinics, art galleries and the odd mass urban transit system has been dropped on top of the old India and partly obscures the heat, the crowds, the filth and the misery, as well as the cultural riches, for which this extraordinarily varied country has long been known.

xchrom

(108,903 posts)

If Peter Sands is to survive as chief executive of Standard Chartered he needs to be vindicated in full over the Iran claims. Photograph: Felix Clay for the Guardian

Which is it? Is Standard Chartered a "rogue institution", as the New York state department of financial services alleges? Or is the new US body a rogue regulator led by a lawyer, Benjamin Lawsky, seeking to make his name in the style of Eliot Spitzer, one-time scourge of Wall Street before his downfall?

It has to be one or the other because the positions of the two sides are miles apart. The New York DFS alleges that Standard Chartered hid $250bn (£160bn) of transactions with the Iranian government by falsifying records.

The bank maintains Lawsky is talking rubbish. It says 99.9% of the transactions disclosed to regulators complied with the rules and that the infringements involve the relatively modest sum of $14m.

Further, Standard Chartered asserts that the DFS's interpretation "is incorrect as a matter of law".

tclambert

(11,085 posts)Poor, innocent banks. Victimized by the little people again. How dare they try to enforce their silly, little laws?

xchrom

(108,903 posts)LOS ANGELES (AP) -- U.S. homeowners are getting better about keeping up with their mortgage payments, driving the percentage of borrowers who have fallen behind to a three-year low, according to a new report.

Still, the rate of decline remains slow, credit reporting agency TransUnion said Wednesday. The percentage of mortgages going unpaid is unlikely to return anytime soon to where it was before the housing market crashed.

Some 5.49 percent of the nation's mortgage holders were behind on their payments by 60 days or more in the April-to-June period, the agency said. That's the lowest level since the first quarter of 2009.

The second-quarter delinquency rate is down from 5.82 percent in the same period last year, and below the 5.78 percent rate for the first three months of 2012.

xchrom

(108,903 posts)The Charlotte Business Journal's John Downey reports on emails suggesting the CEO of America's largest power utility lasted merely hours on the job because he was known for disrespecting female employees.

Bill Johnson, the former CEO of Ohio-based Progress Energy, ended up resigning on the day he nominally became head of Duke Energy after the two companies' merger was approved in July.

E-mails from current Duke Energy CEO Jim Rogers to members of the company's board of directors in March and May say two female executives "left in part because they had 'disheartening conversations with their new bosses from Progress' and 'sensed they could not succeed in the new company,' " Downey writes.

The emails were part of court documents submitted in the current regulatory review of the merger.

Read more: http://www.businessinsider.com/emails-duke-energy-ceo-2012-8#ixzz22x36VQpM

xchrom

(108,903 posts)KINGSTON, Jamaica (AP) — The Cayman Islands is scrapping a plan to impose a direct income tax on thousands of expatriates working in the British Caribbean territory that is famed as a no-tax financial center.

Premier McKeeva Bush issued a terse statement late Monday saying that his proposed tax was "off the table and will not be implemented." He did not say what alternative revenues might replace it.

The islands' leader said only that his administration was "satisfied that many of the commitments from the private sector" will meet his demands for a new source of revenue for the government that won't hit the poorest citizens. He has been huddling with business leaders in recent days.

Zero direct taxation, friendly regulations and the global money they lured have transformed the tiny British territory into the world's sixth largest financial center, with $1.6 trillion officially booked international assets.

Read more: http://www.businessinsider.com/ex-pats-have-killed-the-cayman-islands-first-direct-income-tax-2012-8#ixzz22x4Qx3SV

xchrom

(108,903 posts)The Fed announced the action Tuesday against the largest U.S. life insurer. MetLife Bank was among 16 major mortgage lenders and servicers cited by the Fed and other U.S. regulators in April 2011 for improperly foreclosing upon homeowners in 2009 and 2010.The Fed said at that time it planned to impose fines in the future.

The Fed said its action Tuesday was similar to the $25 billion settlement on foreclosure practices reached in February by the federal government and 49 states with the five biggest mortgage lenders.

New York-based MetLife said Tuesday it has gotten out of the home loan business and is also exiting retail banking.

Roland99

(53,342 posts)DOW -0.4%

NASDAQ -0.2% [/font]

Roland99

(53,342 posts)Roland99

(53,342 posts)Hours worked up 0.4% in second quarter

Unit-labor costs increase 1.7% in second quarter

First-quarter productivity revised to 0.5% decline

Output climbs 2.0% in second quarter

U.S. productivity rises 1.6% in second quarter

DemReadingDU

(16,000 posts)8/7/12 GAP's Radack & NSA Whistleblower Drake Appear on 'The Daily Show'

We here at GAP are big fans of both whistleblower rights and funny things, though, for better or worse, they don't often cross paths. Until now! We were unimaginably delighted when The Daily Show with Jon Stewart aired a segment on whistleblowers last night. GAP National Security & Human Rights Director Jesselyn Radack and NSA whistleblower/GAP client Thomas Drake appeared on The Daily Show to talk to correspondent Jason Jones about how Drake was prosecuted as a spy (under the Espionage Act) for revealing massive waste, fraud and abuse at the agency.

Radack, herself a Department of Justice whistleblower before becoming a whistleblower advocate, and Drake talked about his case, highlighting the absurdity of Drake being charged as a spy. For more on Drake's case and how it eventually backfired on the government, click here. Radack's whistleblowing was the subject of her recent book, Traitor: The Whistleblower and the 'American Taliban', which you can learn more about here.

video at link, appx 6 minutes

http://www.whistleblower.org/blog/42-2012/2160-gaps-radack-a-nsa-whistleblower-drake-appear-on-the-daily-show

direct link

http://www.thedailyshow.com/watch/mon-august-6-2012/a-leak-of-their-own---license-to-spill

edit to add link for additional info on Thomas Drake

http://www.whistleblower.org/action-center/save-tom-drake

and add link for additional info on Jesselyn Radack

http://www.whistleblower.org/about/gap-staff/86-jesselyn-radack

DemReadingDU

(16,000 posts)8/7/12

The Not Daily Show Interview With NSA Whistle Blower Thomas Drake That Isn't So Funny

Last night the Daily Show offered us a comical segment about the trials and tribulations of NSA whistleblower Thomas Drake. Below is the not so funny interview version that my daughter did with Drake in July during a break in the on going Bradley Manning Court-Martial that she has been covering for WLCentral at Fort Mead, Maryland.

Drake's experiences demonstrate just how out of control the massive U.S. self perpetuating security state apparatus has become since 9/11 under both the Bush/Cheney and Obama/Holder administrations and how it is now beyond question become a major threat to everyone's constitutional rights and civil liberties.

Which is not really funny at all.

It is ironic that the only way someone can get this type of 'news' is from a comedy show where the general tendency would be to not take it that seriously. It's also a further indication of the mainstream fourth estate's incompetence and how much they have been compromised by the powers to be working in collusion with their corporate masters.

video at link, appx 20 minutes

http://artistdogboy.blogspot.com.au/2012/08/the-not-daily-show-interview-with-nsa.html?m=1

direct link

&feature=player_embedded#!

Fuddnik

(8,846 posts)McDonald's reports July sales were worst in 9 years

By Lisa Baertlein, Reuters

McDonald's Corp reported flat sales in July at established restaurants around the world, its worst performance in more than nine years and a sign that a weakening global economy was hitting discretionary spending on the lower end.

Analysts polled by Consensus Metrix expected a gain of 2.3 percent at restaurants open at least 13 months.

Shares of the world's largest hamburger chain fell 3.2 percent in premarket trading on Wednesday.

The results marked the first time since April, 2003, that same-restaurant sales did not rise.

"We've grown used to seeing McDonald's weather bad economies, so this is a bit of a surprise," RBC Capital analyst Larry Miller said.

(snip)

http://marketday.nbcnews.com/_news/2012/08/08/13182678-mcdonalds-reports-july-sales-were-worst-in-9-years?lite

Po_d Mainiac

(4,183 posts)seein McDonald's and restaurant used in the same sentence.

Kinda like calling Dumpster diving 'Dining Out'

Fuddnik

(8,846 posts)AnneD

(15,774 posts)when mold or anything organic will not decompose their french fries. I just had my van deep cleaned and I discover a fossilized fry from God knows when. No mold or anything, and I live in a subtropical environment. It may be suitable for building material, but not to eat (I am thinking of Lisa Douglas's hot cakes).

Fuddnik

(8,846 posts)Bloomin' Brands IPO raises less money than expected

Times wires

Posted: Aug 08, 2012 11:21 AM

Early reports indicate that the initial public offering for Bloomin' Brands did not raise as much money as initially expected.

Bloomin' Brands, formerly OSI, sold 40 percent fewer shares than expected and priced it 15 percent below the low end of its expected range, the Wall Street Journal and Bloomberg News reported.

The offering wound up pricing at $11, raising just $176 million. The previous high-end of its range could have created a $315 million IPO. Shares rose $1.19, or 10.8 percent, to $12.18 in early trading today.

Bloomin' Brands, the Tampa-based parent of Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill and other chains, operates more than 1,400 restaurants in 48 states and 20 countries.

(snip)

The offering comes amid a rush of restaurant IPOs, and Bloomin' Brands' offerings fit right in the middle of the previous two offerings, low-budget Mexican chain Chuy's Holdings which jumped 16 percent on its debut and is now up 47 percent, and New York's expensive steak house Del Frisco's Restaurant Group, which was flat.

http://www.tampabay.com/news/business/article1244796.ece

![]()

![]()

![]()

![]()

![]()