Economy

Related: About this forumWeekend Economists Reminisce: Black Monday October 19, 1987-2012

It's that time of year, when ghoulies and ghosties and things go bump in the dark, and little children like to terrify each other with scary stories and pranks.

But there are adult horrors associated with October, also. One happened 25 years ago today. Since this was 1987, it was a Monday, Black Monday.

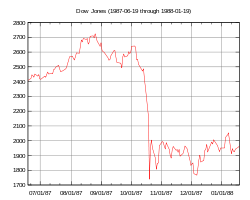

Stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) dropped by 508 points to 1738.74 (22.61%).

By the end of October, stock markets in Hong Kong had fallen 45.5%, Australia 41.8%, Spain 31%, the United Kingdom 26.45%, the United States 22.68%, and Canada 22.5%. New Zealand's market was hit especially hard, falling about 60% from its 1987 peak, and taking several years to recover.

(The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929. In Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference.)

The Black Monday decline was the largest one-day percentage decline in the Dow Jones. (Saturday, December 12, 1914, is sometimes erroneously cited as the largest one-day percentage decline of the DJIA. In reality, the ostensible decline of 24.39% was created retroactively by a redefinition of the DJIA in 1916.)

Following the stock market crash, a group of 33 eminent economists from various nations met in Washington, D.C. in December, 1987, and collectively predicted that “the next few years could be the most troubled since the 1930s”. However, the DJIA was positive for the 1987 calendar year. It opened on January 2, 1987 at 1,897 points and closed on December 31, 1987 at 1,939 points. The DJIA did not regain its August 25, 1987 closing high of 2,722 points until almost two years later.

Is it deja vu yet?

Demeter

(85,373 posts)The four branches of GulfSouth Private Bank will reopen on Monday as branches of SmartBank...As of June 30, 2012, GulfSouth Private Bank had approximately $159.1 million in total assets and $151.1 million in total deposits. In addition to assuming all of the deposits of the failed bank, SmartBank agreed to purchase essentially all of the assets...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $36.1 million. Compared to other alternatives, SmartBank's acquisition was the least costly resolution for the FDIC's DIF. GulfSouth Private Bank is the 44th FDIC-insured institution to fail in the nation this year, and the sixth in Florida. The last FDIC-insured institution closed in the state was The Royal Palm Bank of Florida, Naples, on July 20, 2012.

First East Side Savings Bank, Tamarac, Florida, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Stearns Bank National Association, St. Cloud, Minnesota, to assume all of the deposits of First East Side Savings Bank.

The sole branch of First East Side Savings Bank will reopen on Saturday as a branch of Stearns Bank...As of June 30, 2012, First East Side Savings Bank had approximately $67.2 million in total assets and $65.9 million in total deposits. In addition to assuming all of the deposits of the failed bank, Stearns Bank agreed to purchase essentially all of the assets...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.1 million. Compared to other alternatives, Stearns Bank's acquisition was the least costly resolution for the FDIC's DIF. First East Side Savings Bank is the 45th FDIC-insured institution to fail in the nation this year, and the seventh in Florida. The last FDIC-insured institution closed in the state was GulfSouth Private Bank, Destin, earlier today.

Demeter

(85,373 posts)The four branches of Excel Bank will reopen during their normal business hours beginning Saturday as branches of Simmons First National Bank...As of June 30, 2012, Excel Bank had approximately $200.6 million in total assets and $187.4 million in total deposits. In addition to assuming all of the deposits of the failed bank, Simmons First National Bank agreed to purchase essentially all of the assets.

The FDIC and Simmons First National Bank entered into a loss-share transaction on $126.6 million of Excel Bank's assets...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $40.9 million. Compared to other alternatives, Simmons First National Bank's acquisition was the least costly resolution for the FDIC's DIF. Excel Bank is the 46th FDIC-insured institution to fail in the nation this year, and the third in Missouri. The last FDIC-insured institution closed in the state was Truman Bank, St. Louis, on September 14, 2012.

Demeter

(85,373 posts)no big deal

Demeter

(85,373 posts)Potential causes for the decline include program trading, overvaluation, illiquidity, and market psychology.

The most popular explanation for the 1987 crash was selling by program traders.[ U.S. Congressman Edward J. Markey, who had been warning about the possibility of a crash, stated that "Program trading was the principal cause." In program trading, computers perform rapid stock executions based on external inputs, such as the price of related securities. Common strategies implemented by program trading involve an attempt to engage in arbitrage and portfolio insurance strategies. The trader Paul Tudor Jones predicted and profited from the crash, attributing it to portfolio insurance derivatives which were "an accident waiting to happen" and that the "crash was something that was eminently forecastable". Once the market started going down, the writers of the derivatives were "forced to sell on every down-tick" so the "selling would actually cascade instead of dry up".

As computer technology became more available, the use of program trading grew dramatically within Wall Street firms. After the crash, many blamed program trading strategies for blindly selling stocks as markets fell, exacerbating the decline. Some economists theorized the speculative boom leading up to October was caused by program trading, and that the crash was merely a return to normalcy. Either way, program trading ended up taking the majority of the blame in the public eye for the 1987 stock market crash.

New York University's Richard Sylla divides the causes into macroeconomic and internal reasons. Macroeconomic causes included international disputes about foreign exchange and interest rates, and fears about inflation.

Economist Richard Roll believes the international nature of the stock market decline contradicts the argument that program trading was to blame. Program trading strategies were used primarily in the United States, Roll writes. Markets where program trading was not prevalent, such as Australia and Hong Kong, would not have declined as well, if program trading was the cause. These markets might have been reacting to excessive program trading in the United States, but Roll indicates otherwise. The crash began on October 19 in Hong Kong, spread west to Europe, and hit the United States only after Hong Kong and other markets had already declined by a significant margin.

Another common theory states that the crash was a result of a dispute in monetary policy between the G7 industrialized nations, in which the United States, wanting to prop up the dollar and restrict inflation, tightened policy faster than the Europeans. U.S. pressure on Germany to change its monetary policy was one of the factors that unnerved investors in the run-up to the crash. The crash, in this view, was caused when the dollar-backed Hong Kong stock exchange collapsed, and this caused a crisis in confidence.

Some technical analysts claim that the cause was the collapse of the US and European bond markets, which caused interest-sensitive stock groups like savings & loans and money center banks to plunge as well. This is a well documented inter-market relationship: turns in bond markets affect interest-rate-sensitive stocks, which in turn lead the general stock market turns.

http://en.wikipedia.org/wiki/Black_Monday_%281987%29

Demeter

(85,373 posts)The precise causes of Black Monday are still disputed, but one key factor was the great storm that hit Britain the previous Friday. Only a few traders managed to struggle to work. The rest spent the weekend worrying about positions they had left open, following a drop on Wall Street. The crash began in Hong Kong and Tokyo, followed by a wave of panic selling when the markets opened in London on the morning of Monday October 19.

At one stage the FTSE 100 index was down by over 13%. It closed at 2,052.3, down 249.6, a fall of 10.8%. This was its biggest one-day fall ever, and destroyed £50bn of market value. City traders were shocked by the scale of the sell-off, with some fearing that the financial system would shut down under the pressure.

The crash put the electronic systems of the time under huge pressure. So many sell orders flooded in that the computers were unable to keep up. Brokers later blamed program trading for fuelling the crash, as early share price falls triggered automatic sell options which exacerbated the decline.

This was the decade of privatisation and widespread share ownership, and the public was gripped by the unfolding crisis. The great bull run of the 1980s was coming to a close in spectacular style.

In America, some US traders found that orders they had placed the week before had still not been processed. For hours, attempts to trade on most Dow stocks were fruitless.

The Dow Jones Industrial Average lost over $500bn. These traders at the Chicago Stock exchange watched in horror as the full scale of Wall Street's losses became clear.

The Dow's 22.6% fall was bigger than during the Wall Street crash of 1929, which brought on the Great Depression and left millions out of work.

The Federal Reserve, and central banks around the world, stepped in with interest rate cuts. The medicine proved remarkably effective. In Britain, the fall from July's peak on the FTSE 100 of 2443 to November's low of 1565 was 36% - but the main index still ended the year higher than it started it...The events of October 1987 felt like the end of the world at the time, but look back at the charts now: the crash looks like a minor blip within bull market that can be said to be have run from the early 1980s to the dotcom excitement at the end of the century.

Demeter

(85,373 posts)Today, for the first time, I am officially notifying the honchos of Bain Capital, Blackstone Group, Carlyle Group, Kohlberg Kravis Roberts and other big-time private equity funds that I am available. My little company, Saddle Burr Productions, can be had. For a price. I publish this notice in response to a recent news item revealing that these firms have a unique and perplexing problem: They have too much money on hand. In all, they're holding a cool trillion dollars that super-rich speculators, banks and others have entrusted to them. Private equity funds are corporate predators that borrow huge sums from these richies, using the cash to buy out targeted corporations, dismantle them and sell off the parts to make a fat profit for the investors and themselves. However, in these iffy economic times, these flush funds have hesitated to do big takeovers, so they've just been sitting on all that money (which the predators refer to as "dry powder"

So, using Wall Street's macho lingo, the big players have announced that they're now ready to go "elephant hunting" and are prepared to fire big bucks to bag some companies. To which I say: Fire away at Saddle Burr Productions! OK, my company is hardly an elephant. But maybe it could be what the equity hucksters refer to as a "hot potato." That's what they call it when one fund grabs a company just to sell it to another fund, which might pass it off to yet another. This year, equity firms are expected to spend more than $22 billion this year selling hot potatoes to each other -- in part, just to move cash out the door so they don't have to give it back.

This is what passes for good business sense in the truly screwy world of private equity. It's just churning money, producing absolutely nothing -- except, of course, huge fees for the churners. But if that's the game, hey, put me in the mix. A billion dollars sounds about right.

Executives in private equity firms -- such as Mitt Romney of Bain Capital and Henry Kravis of Kohlberg Kravis Roberts -- tend to be peacocks who think quite highly of themselves. Fanning their splendid tail feathers, they unabashedly claim to be the ultimate free-enterprise risk-takers -- worth every dime of the multimillion-dollar paychecks they award themselves each year. Excuse me, but the risks by these self-anointed "heroes of the market" are actually taken with other people's money, not their own. That's quite a bit short of heroic. But here's a revelation that really ruffles their feathers: It seems they've been hauling in their massive profits not by bold and savvy competition in the marketplace, but through old-fashioned financial collusion with each other...

Demeter

(85,373 posts)Yves here. Wolf Richter’s latest post may seem a bit breathless, but my assumption is that this rhetorical choice is an effort to try to penetrate Eurocrisis fatigue. The continuing decay, the ongoing last minute patch-ups, the Punch and Judy show between Germany and anyone who dares say anything bad about its perverse creditor moralism, is feeling so stale that it’s easy to tune out.

Yet even though the headlines all seem to be of a muchness, they mask an ongoing deterioration that at some point will produce a state change. For instance, the data Wolf cites points to an acceleration of a bad trajectory in Spain, both on the political and economic front. And even though Spain mavens may discount the number of people who demonstrated in favor of independence for Catalonia (it’s a perennially popular cause), what I found more disturbing was the thuggish threat by Supreme Court Justice Ruiz-Gallardón recounted in Wolf’s piece.

While Spain implodes, things are not looking much better in its neighbor Portugal. As Delusional Economics recounts in a quietly grim post, “IMF ambulance too late for Portugese suicide.” Even though Christine Lagarde last week said it would be better to give countries who had made “reforms” more time if they were missing their austerity targets, Portugal apparently did not get the memo on time and instead is doubling down. As he explains (emphasis mine):

The problem is that Greece, Spain and Portugal certainly appear to be reaching the upper limits of what their citizens will endure but these countries are yet to reach external surpluses because there existing debt burdens are still too large. In other words the EZ has spent the last 2-3 years dismantling their existing economic structures but so far they have little to show for it. In fact by most macro-economic metrics these nations are far worse off, and therefore by definition so are their creditors.

As I have explained before what we tend to see when a nation reaches these limits is an attempt to implement even stricter fiscal tightening in the misguided belief that the problem has been that they’re just not trying hard enough….

Last month I noted that Spain had reached the point where it had begun to once again increase taxes which signaled to me it was about to take another leg down based on the dynamic I explained above.

Unfortunately overnight I read that we are about to see the same from Portugal:

MORE

Demeter

(85,373 posts)The following passage from the transcript of Governor Romney’s secretly videotaped May 17, 2012 fundraiser has not received any attention in the media. It is a fascinating passage, however, from the perspective of Modern Monetary Theory (MMT). Here is the full context of the passage:

........................................................................................................................

MITT ROMNEY: Yes.

MALE VOICE: The debates are gonna be coming and I hope at the right moment you can turn to President Obama, look at the American people and say, “If you vote to reelect President Obama you’re voting to bankrupt the United States.” I hope you keep that in your quiver, because that’s what’s gonna happen. And I think it’s gonna be very effective. In some (UNINTEL).

MITT ROMNEY: Yeah. Yeah. It’s– it’s interesting. There’s– the former head of– Goldman Sachs, John Whitehead– was also the former head of the New York Federal Reserve and– and I met with him and he said, “As soon as the Fed stops buying all the debt that we’re issuing–” which they’ve been doing. The Feds buy like 3/4 of the debt that America issues.

He said, “Once– once that over– that’s over,” he said, “we’re gonna have a failed Treasury option. Interest rates are gonna have to go up. You know, we’re– we’re– we’re living in this borrowed– fantasy world where– where the government keeps on borrowing money.” You know, we– we borrow this extra trillion a year. We wonder, “Well, who’s– who’s loaning against the Treasury? The Chinese aren’t loaning to us anymore. The Russians aren’t loaning it to us anymore. So who’s giving us a trillion?”

And the answer is we’re just making it up. The Federal Reserve is– is just taking it and saying, “Here, we’re– we’re giving–” it’s just made up money. And– and this– this does not augur well– for– for our economic future. No. I mean I– you know, some of these things are– are complex enough it’s not easy for people to understand, but your– your point of saying bankruptcy usually concentrates the money. Yeah, George?

....................................................................................................................

There is one important error in the transcription of Romney’s remarks, which I confirmed by listening to the videotape. Romney quotes John Whitehead as saying “we’re gonna have a failed Treasury option.” That phrase does not make any sense. What Romney actually stated when he was quoting Whitehead was “we’re gonna have a failed Treasury auction.” Romney was endorsing Whitehead’s claim that investors will stop buying Treasury bonds.

Let’s begin with who Whitehead is. He was in fact the head of Goldman Sachs before joining the Reagan administration as a senior official. He was also the Chairman of the Board of the Federal Reserve Bank of New York (FRBNY). Note that Romney considers him to have been the “head” of the FRBNY. That demonstrates why the regional Fed banks should have no governmental function – the banking interests run the regional Fed banks if Romney is correct. The regional Fed banks are the primary examiners and supervisors of the Federal Reserve System – an obvious and untenable conflict of interest. Whitehead is also an old-fashioned “liquidator” – a not very modern incarnation of President Hoover’s Treasury Secretary, Andrew Mellon. Paul Krugman cites the key passage in Mellon’s rant.

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.

Whitehead believes that the budget deficit and Social Security, Medicare, and Medicaid are the great threats and that our nation could be forced to default on its debts. Hyper-inflation is just around the corner. He wants a firm regime of austerity. That should pose two insurmountable problems for Romney. First, Romney is on record stating that austerity would “throw us into recession or depression.” Second, Whitehead says that what the nation desperately needs to avoid a debt collapse is elected officials who will champion and vote for higher taxes. Romney is promising very large tax cuts (supposedly offset by ending a handful of tax deductions used primarily by the wealthy – a mathematical impossibility). Naturally, Romney did not tell his wealthy donors that Whitehead was warning that America’s survival depended on them paying much higher taxes. Romney did not tell his donors or voters that he rejects both of Whitehead’s primary policy recommendations despite the fact that Whitehead warns that rejection of his policies will lead to an inevitable, catastrophic U.S. economic collapse.

With the Whitehead preliminaries out of the way we can now discuss Romney’s unintentional endorsement of MMT. Let us assume for purposes of analysis that Whitehead is correct that “The Feds buy like 3/4 of the debt that America issues.” Whitehead and Romney treat this asserted fact as proof that the U.S. is about to suffer an inability to auction debt. They imply that the Fed is buying U.S. debt issuances because the rest of the world has ceased doing so. They imply that the asserted Fed purchases of “3/4” of U.S. debt issuances must be a last gasp measure that can only briefly delay an inevitable default. Whitehead and Romney have made public these asserted facts and analytics for many months. The purported Fed last gap strategy for delaying the inevitable bond default is so crude and so large that Whitehead and Romney believe it must be on the verge of collapse. The U.S. bond markets – the broadest, most efficient, and most sophisticated in the world must have reacted to this “proof” of an inevitable, near-term default by pricing this risk of inevitable, catastrophic default. After all, the presumed one-quarter of U.S. debt issuances still purchased by investors other than the Fed represents a massive amount of money and those investors would suffer catastrophic losses in the event of default so they have every financial incentive to demand a premium interest rate to compensate for that default risk.

We can examine Whitehead and Romney’s analytics by observing the surging interest rates on U.S. debt issuances, which should be extremely high given Whitehead’s claims about the near inevitability of a U.S. default. It was with the greatest trepidation that I just looked up that raging rate. The two-year U.S. note has reached the perilous yield of 0.274 and the 10-year note has skyrocketed to 1.658. Clearly, professional investors believe that we have already passed the precipice and have only delayed briefly our plunge into the bottomless pit of default by a fingernail grip on the lip of that pit.

Several other important points about MMT also arise from Whitehead’s and Romney’s claims about money. First, the whole “the U.S. deficit is a disaster because we owe a debt to China” blows up. We’re now supposed to panic because we “owe” “ourselves” an “extra trillion dollars.”

Second, if the Fed is buying our debt, then it is not in fact debt. It is simply an accounting game. If Division A of Corporation Z “sells” bonds to Division B of Corporation Z there is no change in Corporation Z’s debt levels. That fact should have led Whitehead and Romney to ask why Treasury was bothering to “sell” U.S. debt to the Fed. The Fed’s surplus goes to the Treasury, so the Whitehead and Romney theory cannot be that Treasury has “run out of money” and the Fed has a trillion dollars in “extra” “money” that it is lending to the Treasury as a last gap effort to delay the inevitable default on U.S. bonds. The Fed could simply send its hypothetical $1 trillion in “extra” “money” to the Treasury as a component of its annual “distribution” to the Treasury. There is also the small matter that on any accounting basis the Fed does not have remotely a trillion dollars of “capital.” If Whitehead and Romney think that the Fed is “buying” a trillion dollars in Treasury bonds how do they think the Fed got the money to buy the bonds? It is in attempting to answer this question that Whitehead and Romney began to stumble unintentionally into how money is actually often created by a nation with a sovereign currency. Their problem is that they cannot believe the truth. Indeed, they boggle at the very concept. You can see it in the transcript of Romney’s meeting with his donors.

Yes, the Federal Reserve “just made up money” by making keystrokes on a computer. Romney thinks this is unheard of and unimaginable. In reality, it is the day-to-day reality in central banks around the world. Whitehead has to know this. None of this means that the world is about to end; it in fact does “augur well … for our economic future.” Banks created money long before computers were invented. Sovereign, freely-floating currencies are the norm in much of the world because they have proven superior. The gold standard was a superb device for producing periodic depressions...

MORE

Demeter

(85,373 posts)

Demeter

(85,373 posts)

Demeter

(85,373 posts)Many people remember the events leading up to October 19, 1987. Unfortunately, very few of them recall the specifics. When many people talk about the dramatic drop in the overall stock market, they either blame a single cause (portfolio insurance) or treat the market fall as if it were something that came from out of the blue. Far from being a lightning strike or an act of God, the crash was a single event caused by a complex series of interconnected events. Hopefully after perusing the timeline we have constructed to review the events leading up to the crash, you will come to the same conclusion.

January 1, 1987

The year opens with bond yields near their lowest levels in nine years. Corporate treasurers have been issuing debt like it is going out of style, coining more than $200 billion in notes during all of 1986 -- two times the level of debt issued in 1985. A healthy market for junk bonds -- bonds issued that are considered below "investment grade" -- has helped tremendously. "With bond rates expected to remain at low levels, investment bankers predict that corporations will continue to flock." (New York Times, Jan. 2, 1987)

January 8, 1987

The Dow Jones Industrial Average closes at 2,002.25, breaking the 2,000 level for the first time. Trading volume swells to 194.5 million shares and most other stock indices set records as well. Optimism abounds that the string of records will bolster investor confidence and bring new investors into the market.

January 22-23, 1987

The Dow Jones Industrial Average leaps 51.60 points to 2145.67 on January 22, making its largest one-day point rise ever. Although well below any record for a percentage gain, the news is taken as another indicator that demand for stocks remains strong. The euphoria is slightly eroded the next day when the Dow plunges 114 points in 71 minutes on January 23. Program trading based on the difference between the value of stock futures and the cash market is blamed for the swing. Treasury Secretary James Baker expresses concern about the "excess" volatility....

MORE DETAIL THAN YOU CAN SHAKE A STICK AT AT LINK

Demeter

(85,373 posts)If I return, I will bring back a report Saturday. Have at it, Marketeers and WEE folk!

Demeter

(85,373 posts)I went to sub for a route...but it's not for two weeks...of course, since he never said the date, I assumed it was immediate...at least that's one less strain on this weekend.

Demeter

(85,373 posts)...You can defend President Obama’s jobs record — recovery from a severe financial crisis is always difficult, and especially so when the opposition party does its best to block every policy initiative you propose. And things have definitely improved over the past year. Still, unemployment remains high after all these years, and a candidate with a real plan to make things better could make a strong case for his election.

But Mr. Romney, it turns out, doesn’t have a plan; he’s just faking it. In saying that, I don’t mean that I disagree with his economic philosophy; I do, but that’s a separate point. I mean, instead, that Mr. Romney’s campaign is telling lies: claiming that its numbers add up when they don’t, claiming that independent studies support its position when those studies do no such thing.

Before I get there, however, let me take a minute to talk about Mr. Romney’s claim that he knows how to fix the economy because he’s been a successful businessman. That would be a dubious claim even if he were honestly representing his business career, because the skills needed to run a business and those needed to manage economic policy are very different. In any case, however, his portrait of his own experience is so misleading that it takes your breath away. For Mr. Romney, who started as a business consultant and then moved into the heady world of private equity, insists on portraying himself as a plucky small businessman. I am not making this up. In Tuesday’s debate, he declared, “I came through small business. I understand how hard it is to start a small business.” In his speech at the Republican convention, he declared, “When I was 37, I helped start a small company.” Ahem. It’s true that when Bain Capital started, it had only a handful of employees. But it had $37 million in funds, raised from sources that included wealthy Europeans investing through Panamanian shell companies and Central American oligarchs living in Miami while death squads associated with their families ravaged their home nations. Hey, doesn’t every plucky little start-up have access to that kind of financing?

...So when the (ROMNEY) campaign says that these three studies support its claims about jobs, it is, to use the technical term, lying — just as it is when it says that six independent studies support its claims about taxes (they don’t)...What do Mr. Romney’s economic advisers actually believe? As best as I can tell, they’re placing their faith in the confidence fairy, in the belief that their candidate’s victory would inspire an employment boom without the need for any real change in policy. In fact, in his infamous Boca Raton “47 percent” remarks, Mr. Romney himself asserted that he would give a big boost to the economy simply by being elected, “without actually doing anything.” And what about the overwhelming evidence that our weak economy isn’t about confidence, it’s about the hangover from a terrible financial crisis? Never mind. To summarize, then, the true Romney plan is to create an economic boom through the sheer power of Mr. Romney’s personal awesomeness. But the campaign doesn’t dare say that, for fear that voters would (rightly) consider it ridiculous. So what we’re getting instead is an attempt to brazen it out with nakedly false claims. There’s no jobs plan; just a plan for a snow job on the American people.

Demeter

(85,373 posts)Mark the name of R. Glenn Hubbard, the man who will make your life miserable if Mitt Romney is elected president. Unless, that is, you happen to be one of the swindlers who has profited mightily from the nation’s economic pain. Hubbard is the ideological hit man instrumental in justifying the mortgage derivatives bubble that caused the Great Recession during the George W. Bush years. He now serves as Romney’s key economic adviser and is the front-runner to be the next Treasury secretary should the Republican win. “Romney’s Go-To Economist” read the headline on a New York Timesprofile of the dean of Columbia University’s Business School, which notes that “During a stint as chairman of the Council of Economic Advisers for President George W. Bush, from 2001 to 2003, Mr. Hubbard was known as the principal architect of the Bush tax cuts.” In that capacity, and after returning to Columbia, Hubbard was also the chief cheerleader for a runaway derivatives market that spiraled out of control and left the Great Recession in its wake.

While pocketing millions in fees from the financial industry that he was ostensibly studying as a neutral academic, Hubbard was an enthusiastic backer of the virtues of a burgeoning unregulated capital market that sold toxic derivatives to the world. In a landmark paper that he co-wrote in November 2004 with William C. Dudley, at the time the chief U.S. economist at Goldman Sachs, it was asserted, “The capital markets have helped facilitate a major transformation of the U.S. mortgage financing system over the past 25 years. … The result has been a dramatic decline in the cyclical volatility of housing activity.” Their study was published by the Global Markets Institute of Goldman Sachs at the very time that Goldman, a leader in the capital market, was packaging and selling some of the toxic mortgage-based derivatives that would come close to destroying the world’s economy.

Hubbard’s article celebrated this “revolution in housing finance (that) has led to a large increase in mortgage equity withdrawal.” It extolled the madcap equity lending as “one reason why consumer spending held up well during the 2001-2003 period, even as employment and investment spending faltered.” That’s the housing bubble that was destined to pop and left the Bush and Obama administrations running up huge deficits to contain the damage. Hubbard’s co-author knows this well, for Dudley left Goldman in 2007 to work for Timothy Geithner, then the head of the New York Fed that led the charge to rescue Goldman and other banks in the aftermath of the crisis they caused. As evidence of the bipartisan spirit informing the banking bailout, when Geithner was appointed Obama’s Treasury secretary, Dudley replaced him as president of the New York Fed.

But this is a crisis first enabled by the Bush administration’s policy of mindlessly celebrating the mortgage industry’s wild irresponsibility. As Hubbard and Dudley bragged: “The revolution in mortgage finance has increased the ability of households to purchase their own homes. The closing costs associated with obtaining a residential mortgage have fallen, and the terms (for example, the loan-to-value ratio) have become less stringent. At times homeowners can obtain 100 percent financing to purchase a home.”

In the paper published by Goldman, the authors take issue with Warren Buffett who as early as 2002 had warned that these “derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.” Buffett argued that "… huge–scale frauds and near frauds have been facilitated by derivatives trades.” Not so, said Hubbard and Dudley, siding with then-Fed Chairman Alan Greenspan. “This use of derivatives leads to improved economic performance,” they wrote, insisting, “The capital markets have also acted to reduce the volatility of the economy. Recessions are less frequent and milder when they occur.” MORE

***********************************************************

Robert Scheer is Editor in Chief of Truthdig, where he publishes a weekly column, and author of a new book, The Pornography of Power: How Defense Hawks Hijacked 9/11 and Weakened America.

Demeter

(85,373 posts)Billy Koehler died on March 7, 2009, for lack of health insurance. Mitt Romney said on Oct. 10, 2012, that’s impossible.

The Republican nominee for President told The Columbus Dispatch newspaper last week:

“We don’t have people that become ill, who die in their apartment because they don’t have insurance.”

Technically, that’s true of Billy Koehler. He didn’t die in his apartment. He died in his car. Koehler suffered cardiac arrest and perished slumped over his steering wheel at a stop sign in Pittsburgh because he didn’t have health insurance and didn’t have $60,000 to replace his implanted defibrillator.

Romney, a quarter-billionaire born with a silver foot in his mouth, has shielded himself from the world in which America’s many Billy Koehlers exist. Their paths don’t naturally cross. Billy Koehlers don’t hang out with Romney’s NASCAR owner pals. Billy Koehlers don’t disparage the nation’s elderly and impoverished at fundraisers in the homes of private equity moguls . FDR and JFK made an effort to understand the joys and hardships of the non-rich. But Romney hasn’t. And that’s why he so carelessly called America’s Billy Koehlers a deliberately dependent underclass, albeit one comprising 47 percent of all citizens. Because Romney knows nothing of the lives of the nation’s Billy Koehlers, the Republican nominee can dismiss their medical predicaments as nonexistent and assure wealthy donors he won’t “worry about those people.”

Romney told the Columbus newspaper that no one needs to worry about those lacking health insurance because federal law requires hospitals to treat emergency cases:

“We don’t have a setting across this country where if you don’t have insurance, we say to you, ‘Tough luck, you’re going to die when you have your heart attack.”

He continued:

“No, you go to the hospital; you get treated; you get care, and it’s paid for, either by charity, the government or by the hospital.”

Logically, then, the solution would be for no one to buy insurance. Why bother? Hospitals must treat and bill someone else, according to Romney.

But it doesn’t work that way. The late Billy Koehler is an example of how it actually operates – how it fails to work for 26,100 to 45,000 Americans who die each year for lack of insurance...

Demeter

(85,373 posts)Stocks ended the week on Friday with their worst day since late June after Dow components General Electric and McDonald's, both barometers of the overall economy's health, added to a disappointing earnings season.

Technology shares kept up a pattern of recent weakness, hurt by anemic results from Microsoft and another losing day for Google . The Nasdaq closed down 2.2 percent.

For the Dow, Friday's slide marked its biggest loss since June 21 - with the sell-off coming on the 25th anniversary of Black Monday, when the Dow plunged 22.6 percent in its worst single-day percentage drop ever.

For the week, though, the Dow still managed to squeak out a gain of 0.1 percent, while the S&P 500 gained 0.3 percent despite Friday's losses. Wall Street's mood was sour, given that a large number of companies have fallen short of top-line expectations. Of the 116 S&P 500 companies that have reported results so far, 58 percent have missed on revenue expectations, according to Thomson Reuters data...

LOCALLY, GAS WAS $3.29, A STUNNING DROP IN A WEEK. REASONS? BLAME IT ON THE UPCOMING ELECTION, MY MECHANIC SAYS. I RATHER THINK IT WAS THE REPORT THAT MICHIGAN'S UNEMPLOYMENT RATE INCREASED...

bread_and_roses

(6,335 posts)A small ray of hope. I bet the Rand-Bots were slavering over this one - their dream ready to come true.

http://www.commondreams.org/headline/2012/10/19-9

Legislation that had approved the privatized cities was passed in January 2011 in a bid to draw foreign investors into the country. The move was championed by Honduran President Porfirio Lobo—who came to power in a military coup in 2009.

(did US support him? I can't remember - but since we seem to support every other Right-Wing movement in SA I would not be surprised)

In the subsequent Supreme Court hearing the justices voted 13-2, stating that the legislation was unconstitutional because it exempted the privatized cities from Honduran law.

Prior to the ruling a US investment group was poised to dump $15 million into the infrastructure of the first model city near Puerto Castilla.

My emphasis added

edit to fix quote boxes

Demeter

(85,373 posts)“Fiat” is money with no intrinsic value beyond whatever an issuing government is able to enforce. When it enjoys a monopoly as currency, fiat inevitably turns the free market functions of money inside out. Instead of being a store of value, the currency becomes a point of plunder through monetary policies such as quantitative easing. Instead of greasing society as a medium of exchange, the currency acts as a powerful tool of social control. The second harm is far less frequently discussed than inflation, but it is devastating. The personal freedoms that we know as “civil liberties” rest upon sound money. In his classic book The Theory of Money and Credit (1912), the Austrian economist Ludwig von Mises argues, “It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically, it belongs in the same class with political constitutions and bills of rights.”

Yet the best solution to the harms caused by fiat is often dismissed even by staunch free market advocates; namely, allow the private issuance of money that freely competes with fiat as currency. This would involve removing all prohibitions, other than fraud, abandoning monetary controls such as legal tender laws and all reporting requirements. In turn, this might well eliminate the Federal Reserve, although people would be free to accept whatever money they wished.

In his invaluable book What Has Government Done to Our Money? the Austrian economist Murray Rothbard addresses the strange reluctance to consider private currencies, “Many people, many economists, usually devoted to the free market, stop short at money. Money, they insist, is different; it must be supplied by government and regulated by government.” (Note: Technically, the currency is generated through a banking cartel with government support.) History frowns upon that theory. Before the United States Mint issued its first coin in 1793, the 13 colonies were awash with an assortment of currencies that included both private and government-issued ones. Current fiscal reality also frowns on this. Privatizing zealot Martin Durkin calls the idea of government guaranteeing the quality of money “the sickest joke in economic history. Governments have always robbed their subjects by debasing the currency, but this abuse, in recent years, has burst all bounds of decency and sanity.”

But focusing upon economics and efficiency can miss the reality of how a currency monopoly is intimately connected with the violation of traditional civil liberties. A key reason Mises viewed sound money as a necessary protection of civil liberties is that it reins in the growth of government. When a government prints money without the restraint of competing currencies — even if the restraining “competition” is a gold standard — runaway bureaucracy results. Wars are financed; indeed, it is difficult to imagine the extended horrors of World War II without governments’ monopoly on currency. A white-hot printing press can finance the soaring numbers of prisons and law enforcement officers required to impose a police state. Floods of currency can prop up unpopular policies like Obamacare or the War on Drugs. That is why government holds onto its monopoly with a death grip. In The Theory of Money and Credit, Mises observes, “The gold standard did not collapse. Governments abolished it in order to pave the way for inflation. The whole grim apparatus of oppression and coercion, policemen, customs guards, penal courts, prisons, in some countries even executioners, had to be put into action in order to destroy the gold standard." (Note: Mises addresses “sound money,” which is distinct from private money, but both forms of currency would serve the function of putting a severe brake on a government’s ability to swell.) Another way a currency monopoly threatens civil liberties is by permitting government to monitor virtually all transactions through the financial institutions with whom it maintains an intimate partnership. Total surveillance is a prerequisite to total control, which is what the government wants to establish as quickly as possible. For example, prior to establishing the Suspicious Activity Report (SAR) in 1996 — a form that financial institutions submit to the U.S. Treasury — banks were required to automatically report any transaction over $10,000. Now any activity deemed “suspicious” is vulnerable.

MORE FUMBLING IN THE DARK TOWARDS TRUTHS AT LINK

**********************************************************

Wendy McElroy is a Research Fellow at The Independent Institute. Her books include the Independent Institute volumes, Liberty for Women: Freedom and Feminism in the 21st Century, and Freedom, Feminism, and the State.

A contributor to numerous books, Ms. McElroy was Series Editor for Knowledge Products’ audio-tape series, The World of Philosophy, The World’s Political Hot Spots, The United States at War, and The United States Constitution, and she authored the scripts for Vindication of the Rights of Woman, The Liberator, Civil Disobedience, and Discourse on Voluntary Servitude in the Audio Classics Series. Her scripts have been narrated by George C. Scott, Harry Reasoner and Walter Cronkite. She is a contributing editor to the magazines, the Freeman, Free Inquiry, and Liberty, and the author of numerous articles in The Independent Review, Journal of Libertarian Studies, Literature of Liberty, National Review, Reason, SpinTech, Freedom Daily, Maire Claire, Penthouse, and Toronto Globe and Mail.

Demeter

(85,373 posts)The International Monetary Fund and others say that income inequality represses economic growth, and is not simply a byproduct of growth.

To expand the economy, should the United States enact policies to address inequality? And if so, what initiatives would promote growth and reduce the income gap?

DISCUSSION AT LINK

Demeter

(85,373 posts)The One Percent is not only increasing their share of wealth — they’re using it to spread millions among political candidates who serve their interests. Example: Goldman Sachs, which gave more money than any other major American corporation to Barack Obama in 2008, is switching alliances this year; their employees have given $900,000 both to Mitt Romney’s campaign and to the pro-Romney super PAC Restore Our Future. Why?

Because, says the Wall Street Journal, the Goldman Sachs gang felt betrayed by President Obama’s modest attempts at financial reform. To discuss how the super-rich have willfully confused their self-interest with America’s interest, Bill is joined by Rolling Stone magazine’s Matt Taibbi, who regularly shines his spotlight on scandals involving big business and government, and journalist Chrystia Freeland, author of the new book Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else .

Full transcript of the interview below the video: AT LINK

DemReadingDU

(16,000 posts)This election should be the 99% vs the 1%. But it's not. It is a horse race between Rmoney and Obama, of who is ahead in the polls, of who has the sillies gaffes, etc.

DemReadingDU

(16,000 posts)gazillions and gazillions

click link to see list of who contributed

http://www.oldelmtree.com/showthread.php?tid=23835

Demeter

(85,373 posts)Higher education is not what it used to be, and that's no accident...A few years back, Paul E. Lingenfelter began his report on the defunding of public education by saying,

In the last few years, conversations have been growing like gathering storm clouds about the ways in which our universities are failing. There is talk about the poor educational outcomes apparent in our graduates, the out-of-control tuitions and crippling student loan debt. Attention is finally being paid to the enormous salaries for presidents and sports coaches, and the migrant worker status of the low-wage majority faculty. There are movements to control tuition, to forgive student debt, to create more powerful “assessment” tools, to offer “free” university materials online, to combat adjunct faculty exploitation. But each of these movements focuses on a narrow aspect of a much wider problem, and no amount of “fix” for these aspects individually will address the real reason that universities in America are dying.

To explain my perspective here, I need to go back in time. Let’s go back to post-World War II, 1950s when the GI bill, and the affordability – and sometimes free access – to universities created an upsurge of college students across the country. This surge continued through the ’60s, when universities were the very heart of intense public discourse, passionate learning, and vocal citizen involvement in the issues of the times. It was during this time, too, when colleges had a thriving professoriate, and when students were given access to a variety of subject areas, and the possibility of broad learning. The liberal arts stood at the center of a college education, and students were exposed to philosophy, anthropology, literature, history, sociology, world religions, foreign languages and cultures. Of course, something else happened, beginning in the late '50s into the '60s — the uprisings and growing numbers of citizens taking part in popular dissent — against the Vietnam War, against racism, against destruction of the environment in a growing corporatized culture, against misogyny, against homophobia. Where did much of that revolt incubate? Where did large numbers of well-educated, intellectual, and vocal people congregate? On college campuses. Who didn’t like the outcome of the '60s? The corporations, the war-mongers, those in our society who would keep us divided based on our race, our gender, our sexual orientation.

I suspect that, given the opportunity, those groups would have liked nothing more than to shut down the universities. Destroy them outright. But a country claiming to have democratic values can’t just shut down its universities. That would reveal something about that country which would not support the image they are determined to portray – that of a country of freedom, justice, opportunity for all. So, how do you kill the universities of the country without showing your hand? As a child growing up during the Cold War, I was taught that the communist countries in the first half of the 20th century put their scholars, intellectuals and artists into prison camps, called “re-education camps.” What I’ve come to realize as an adult is that American corporatism despises those same individuals as much as we were told communism did. But instead of doing anything so obvious as throwing them into prison, here those same people are thrown into dire poverty. The outcome is the same. Desperate poverty controls and ultimately breaks people as effectively as prison…..and some research says that it works even more powerfully.

MORE

Demeter

(85,373 posts)Step I: Defund public higher education.

Step II: Deprofessionalize and impoverish the professors (and continue to create a surplus of underemployed and unemployed Ph.D.s).

Step III: Move in a managerial/administrative class that takes over governance of the university.

Step IV: Move in corporate culture and corporate money.

Step V: Destroy the students.

So, there you have it.

Within one generation, in five easy steps, not only have the scholars and intellectuals of the country been silenced and nearly wiped out, but the entire institution has been hijacked, and recreated as a machine through which future generations will all be impoverished, indebted and silenced. Now, low wage migrant professors teach repetitive courses they did not design to students who travel through on a kind of conveyor belt, only to be spit out, indebted and desperate into a jobless economy. The only people immediately benefitting inside this system are the administrative class – whores to the corporatized colonizers, earning money in this system in order to oversee this travesty. But the most important thing to keep in mind is this: The real winners, the only people truly benefitting from the big-picture meltdown of the American university are those people who, in the 1960s, saw those vibrant college campuses as a threat to their established power. They are the same people now working feverishly to dismantle other social structures, everything from Medicare and Social Security to the Post Office.

Looking at this wreckage of American academia, we have to acknowledge: They have won.

xchrom

(108,903 posts)

xchrom

(108,903 posts)Pickup trucks lined a stretch of gravel road where 150 farmers mingled between 7-foot tall cornstalks and shimmering soybeans to see which of their wealthy brethren would bid on a swath of Iowa’s richest cropland. This was a farm -- table-flat and 314 acres -- so coveted that it drew three times the usual land-sale crowd.

“They ain’t making any more of this, boys,” auctioneer Rich Vander Werff barked into a microphone, his voice slicing through the rising July heat. “This is about as good as it gets.”

Thirty minutes later the bidding stopped at $14,300 an acre, more than four times the average for U.S. cropland. That meant about $4.5 million for the Schoenemans, a pioneering Iowa family that owned the property for generations.

Farmland auctions in Iowa now resemble a dressed-down spectator sport with Sotheby’s prices, a reflection of the yawning divide that has opened in some of the most bountiful stretches of rural America. Farm earnings in the state and throughout the U.S. increased at eight times the rate of nonfarm wages from 2008 to 2011, fueling resentment and straining the social fabric of places with deep egalitarian roots.

xchrom

(108,903 posts)The 100 richest people on the planet added $12.7 billion to their collective net worth this week after worse-than-forecast corporate earnings in the U.S. wiped out most of the gains global stocks had posted earlier in the week.

Mexican Carlos Slim, 72, increased his fortune $1.8 billion after Telmex, the land-line unit of his Mexico City-based telecommunications company America Movil (AMXL) SAB, said on Wednesday it will begin offering high-speed Internet service without binding it with a phone line package. Slim remains the world’s richest person with a $77.6 billion fortune, according to the Bloomberg Billionaires Index.

“These disappointing earnings announcements are finally weighing on investors,” Jack Ablin, chief investment officer at BMO Harris Private Bank in Chicago, which oversees about $60 billion of assets, said in a phone interview.

U.S. stocks slid the most since June yesterday as General Electric Co. (GE), McDonald’s Corp. (MCD) and Microsoft Corp. (MSFT) posted results that missed estimates and euro-area leaders failed to discuss aid for Spain at a European Union summit in Brussels. The slide in equities was tempered by housing starts in the U.S., which surged 15 percent in September to the highest level in four years.

xchrom

(108,903 posts)

Securities and Exchange Commission (SEC) Chair Mary Schapiro testifies on Capitol Hill in Washington in this file photo.

What Mary Schapiro considered her most important task had just run aground, a symbol of the aspirations and missed opportunities of her tenure as head of the U.S. Securities and Exchange Commission.

Schapiro worked for two years on a plan to head off what she calls the “terrifying” prospect of a run on money-market mutual funds like one that forced a U.S. rescue in 2008. After fellow commissioners refused to follow her lead, she teared up as she worked on a statement accusing opponents of having their heads “in the sand,” two people involved in the process said.

It’s not surprising that Schapiro’s frustrations boiled over that August evening. She has told friends that the late nights and almost constant policy battles have left her exhausted and eager to depart after the November election.

Admirers and critics agree Schapiro rescued the agency from the threat of extinction when she was appointed by President Barack Obama four years ago. Still, she hasn’t fulfilled her mission -- to overcome the SEC’s image as a failed watchdog by punishing those who steered the financial system toward disaster and by proving regulators can head off future breakdowns.

xchrom

(108,903 posts)Internet giant Google has warned it would exclude French media sites from its search results if France adopts a law forcing search engines to pay for content, in the latest confrontation with European governments.

A letter sent by Google to several French ministerial offices this month said it "cannot accept" such a move and the company "as a consequence would be required to no longer reference French sites," according to a copy obtained by AFP.

France's new Socialist government, which is open to helping struggling media companies, warned Google that it should not threaten democratic governments.

Google said a law which would require it to make payments to media sites for displaying links to their content, would "threaten (Google's) very existence".

xchrom

(108,903 posts)

Sylvain Huet, a 42-year-old graphic designer from the Parisian suburb of Poissy, spent the past two years studying the history of saké in order to receive official recognition from the Japanese Saké Brewers’ Association in Kyoto on Friday.

“For me it’s more than recognition, but a reward,” he told AFP on Friday. “After all, samurai means servant.”

Huet has actually spent a lifetime devoted to all things Japanese, and has already been recognised as an expert on sado (Japanese tea) and aikido (a Japanese martial art). “I remember when I was a kid, I would collect all sorts of pictures of Japan,” he said.

"An elegant Japanese wine"

He became interested in saké, which he describes “wonderful and elegant Japanese wine” during his first visit to Japan in 2001. Since then, he has visited some 40 sakakura (saké producers) across Japan and read “every possible” piece of literature on the subject.

Demeter

(85,373 posts)I've never been able to taste it.

Fuddnik

(8,846 posts)I got drunk on it once about 30 years ago.

Never again!

xchrom

(108,903 posts)made of bamboo...![]()

xchrom

(108,903 posts)German Chancellor Angela Merkel ruled out the possibility of Spain benefitting retroactively from allowing the euro zone’s rescue fund to directly recapitalize banks.

That means that the loan of up to 100 billion euros Spain will receive from its European partners will remain on the government’s books at a time when it is already struggling to tame the budget deficit and put a cap on public debt.

“There will not be any retroactive direct recapitalization,” Merkel told a news conference at the end of a European Union summit in Brussels. “If recapitalization is possible, it will only be possible in the future, so I think that when the banking supervisor is in place we won’t have any more problems with the Spanish banks; at least I hope not.”

The summit agreed to move toward a banking union for the euro zone under the direct supervision of the European Central Bank next year and to eventually allow the European Stability Mechanism (ESM) to directly inject capital into ailing banks. Spain and France had lobbied for quicker implementation of a banking union. Merkel denied delaying the move had anything to do with the German elections next year.

xchrom

(108,903 posts)

Today I continue to explore the theme that Japan's two decades of economic stagnation may offer guidelines for what lies ahead "for the rest of us" as the global malaise deepens in the years ahead. I have been a student of Japan for 40 years, having studied the language, history, literature, geography and art/film, in university and thereafter. We have many Japanese friends and have visited a number of times. (I have also been a student of the Chinese and Korean cultures.)

Japan is quite different from the U.S. and Europe, with a homogeneous populace and a culture rooted in Confucian values and social hierarchies. Despite the many differences, including definitions of depression, I think it is self-evident that the rising insecurity and workplace changes in Japan result from long-term economic stagnation.

I suspect "new-type depression" may have some universal aspects, as rising insecurity and new demands in the workplace characterize Western economies as well.

New-type depression--NTD--(also called modern-type) is not a classic depression. It does not respond to anti-depressant medications, and it is triggered by events in the workplace--usually criticism from superiors. Those who exhibit the symptoms--difficulty focusing at work, physical symptoms of stress, etc.--tend to be in their 20s and 30s.

Tansy_Gold

(17,846 posts)And is it unique to Japan?

Maybe not.

I went through something similar about 10 years ago, and I recognize the same symptoms plaguing me occasionally now, too.

Then the doctor prescribed Zoloft but told me it would work in 24-48 hours if my problem was "ordinary" depression. If I didn't feel significantly better in two to three days -- and he told me I would definitely notice if I did -- then the problem was "situational depression" and had external causes that pills couldn't fix: A job I hated, a boss who took unfair advantage, lack of fair compensation, threats of being fired, etc. etc. etc. After three days I felt no better and discontinued the drug.

The point being, of course, that these external factors are not immutable. Someone caused them, and someone can fix them. Or the sufferer can (if it's possible/feasible) get out of the situation, and many of the symptoms disappear quickly.

xchrom

(108,903 posts)We seem to be building a world with those factors in play.

xchrom

(108,903 posts)

Trust is one of the most (if not the most) important values to build, grow and maintain in any type of relationship, whether professional or personal. It is one of those values that, once broken, can never be fully repaired. Unfortunately, for some time now the world has been in a “Zero Trust Economy," which has been growing and spreading around the world.

Today, if you speak to any well-experienced business person whose career spanned the 1980s and before, you will hear a number of themes connected by threads of confusion, disappointment and depression. You hear of days when things were easier, when people respected and looked out for one another’s interests. Not to say that there weren’t exceptions of betrayal, corruption and conflict; but it was not as widespread as what we see today.

The general atmosphere is that nobody trusts anybody anymore. Instead of one’s values following the business trends of partnerships, globalization and world-level purposes and goals, our values have recoiled internally to the individual and, in some cases, forgotten.

Today, not only may economies around the world be declining, but our values are also in a recession. It is extremely rare to find anyone who does not put their own personal interests ahead of anything or anyone else. The value of trust now comes with the questions, “What’s in it for me?” and “What do they get out of it?” It is a system of checks and balances.

Read more: http://www.businessinsider.com/were-living-in-a-no-trust-economy-2012-10#ixzz29qS8Mfhq

Demeter

(85,373 posts)but I can't fault the argument.

xchrom

(108,903 posts)xchrom

(108,903 posts)GREEN BAY, Wis. — Here in Green Bay tonight, Bill Clinton roused a crowd of 2,200 at the University of Wisconsin-Green Bay for a speech that lasted almost a full hour.

One of his best moments that got the crowd fired up was a simple metaphor that explained how he thought the Romney-Ryan budget plan was hypocritical.

The metaphor involves hiring someone to "fill in a hole."

"Consider this: What if you got hired to fill in a hole. I've got a six foot hole here, I want you to fill it in for me, and I'll pay you $25 an hour to do it," Clinton said.

Read more: http://www.businessinsider.com/bill-clinton-romney-ryan-budget-tax-plan-budget-obama-election-2012-10#ixzz29qSs8gnz

bread_and_roses

(6,335 posts)I watched the movie "Anonymous" on TV the other night and enjoyed it for the wonderful visuals - the costumes, the lighting, the sets - it was visually very rich. And there were some good actors. Now, while I love it when I can "suspend disbelief" for a film, I generally disregard that suspension once I leave the theater, so to speak - even if the theater in my own TV room. Art is neither life nor history. So I did not end the film thinking it presented a "true" version of history. However, my interest was piqued about the disputes over Shakespeare's identity - which I knew existed but knew nothing about, not being a Shakespearean or any other sort of Scholar. So I went browsing on our wonderful internet - so amazing, that we can indulge these passing interests, maybe learn something, maybe just broaden our perspective a bit - for a "Generalist" (as I too generously like to term myself - "Dilettante" would be more accurate) it is heaven.

So I came across this article, which was interesting, and I was particularly struck by this:

http://www.nytimes.com/2011/10/23/magazine/wouldnt-it-be-cool-if-shakespeare-wasnt-shakespeare.html

The Shakespeare controversy, which emerged in the 19th century (at that time, theorists proposed that Francis Bacon was Shakespeare), was one of the origins of the willful ignorance and insidious false balance that is now rotting away our capacity to have meaningful discussions. The wider public, which has no reason to be familiar with questions of either Renaissance chronology or climate science, assumes that if there are arguments, there must be reasons for those arguments. Along with a right-wing antielitism, an unthinking left-wing open-mindedness and relativism have also given lunatic ideas soil to grow in. Our politeness has actually led us to believe that everybody deserves a say.

The problem is that not everybody does deserve a say. Just because an opinion exists does not mean that the opinion is worthy of respect. Some people deserve to be marginalized and excluded.

emphasis added

Now, I have quarrels with some of the above. But the sentence I bolded struck me as important. It is absolutely true that ordinary people cannot be expected to have the knowledge base to evaluate the methodologies of climate science, or the models of economic theory, or the intricacies of monetary policy, or the sub-clauses of the Vampire insurance companies plans. I myself, reasonably well-read and well-educated, probably "understand" on about 10% of what is posted in SMW and WEE.

But ordinary people do understand values. The understand the Macro picture. And the problem with the author of the above's reverence for "experts" is that our "experts" have so completely failed to articulate the different values and different Macro outcomes of various "sides" in our most important debates. Chris Hedges illustrates this better than anyone else I've read. http://www.truthdig.com/arts_culture/item/the_death_of_the_liberal_class_20101029/

Two issues, I think, illustrate this very well. One being climate change and the other protecting our food and drug supply.

People might not understand the details of climate science, but they do understand the importance of protecting our environment and of clean air and water. They understand that our food and drug supply should be monitored for safety and that the Corps who profit can't be trusted to do that. But the "elites" on "our side" have succumbed so totally to the Neo-Liberals, are so supinely obsequious to the virtues of "free markets," have been so giddily embracing of "The Death of History,"* that they've utterly failed to articulate the role of "the Commons" (government, in it's legitimate role) to provide protections for its citizens on these (and other) fronts.

A pox on our "elites" and intellectuals. They have utterly failed in their trust, and now wonder and sneer at the populace falling into superstition and fanaticism to try to make sense of the world.

* I saw over at Commondreams that there's a new book - "The Revenge of History" - about the various collapses so far of the 21st Century. Love the title.

xchrom

(108,903 posts)by the time i left highschool -- lo these many years ago -- i kept up with events in the world.

and while no expert -- i read. read about science{had basic comprehension}, read about medicine, read about world events.

i think we've done ourselves a disservice by expecting the masses not to know anything -- now we have masses of Know Nothings.

bread_and_roses

(6,335 posts)It's about not expecting them to know everything. "Everything" is just too complicated. Even were we all not trying to live our lives - work, keep house, raise children, fulfill other familial and friend and social obligations, we could not understand everything. And that everything is so complicated is, itself, in service to Capitalism, which would not be borne were its inevitable rapacious outcomes understood.

When we acquiesce to the demand that we "understand" multiple disciplines - everyone of which requires a lifetime of study in itself - we are defeated before we begin.

Ordinary people can understand that we need clean air, water, and food. That hunger amid abundance is wrong. That killing children is wrong.

The failure of our "elites" to articulate how these values are or are not reflected in labyrinthine policies leaves ordinary people to rely on intuition, appearance, superstition, "strong men" and other ghouls and vampires.

Demeter

(85,373 posts)That's if you have a mind trained to sort through masses of input, organize, evaluate, summarize, and retain it. A certain amount of general knowledge helps to speed up the process, and the ability to discern fact from fiction, authority from BS artist, etc.

Mental training in this country being nothing like what it was, this is a dying skill. and when it was more common, it was only on the "college track" and only on the elite college track...where one got something to think about, and the tools to use while thinking.

The trades people got by on personal experiences, shrewdness, and cynicism, and networking. And Party machines serviced the working people, as opposed to gutting and quartering them as is now done.

This is not the world today. It's the world we were born into, but never inherited.

xchrom

(108,903 posts)That our fellow citizens seem a little frighteningly ignorant of some basic stuff.

I'm not sure that's a good option for building our civilization.

I don't think we have to know everything but basics better understood I think would be a plus.

Demeter

(85,373 posts)But that's the way the 1% want it.

bread_and_roses

(6,335 posts)and Demeter nailed it.

Tansy_Gold

(17,846 posts)Read Charlie Pierce's "Idiot America."

There are other books about the (deliberate) dumbing down of America, but Pierce's has the anger and bite and sarcastic humor to make the lessons stick.

Also Wendy Kaminer's "Sleeping with Extraterrestrials."

bread_and_roses

(6,335 posts)I will check them out - in all honesty I never heard of either - or maybe the Pierce book, in passing somewhere. I do tend to fall behind on my reading. For years I could not read fiction - after being a glutton for it all my life - because it just didn't seem to reflect anything of reality any more. Now, I've swung back - but I'll check them out - especially the Pierce, from your description.

xchrom

(108,903 posts)Demeter

(85,373 posts)bread_and_roses

(6,335 posts)Over 100,000 March in London for 'A Future That Works'

No to Austerity!

- Common Dreams staff

Over 100,000 marched in a boisterous anti-austerity demonstration in London, with similar protests underway in Glasgow and Belfast.

British union leaders have said they will call for a country-wide general strike to be held as soon as possible after today's protests.

... union leader Brendan Barber said today's massive turnout showed how unpopular the Government's policies were.

"We are sending a very strong message that austerity is simply failing. The Government is making life desperately hard for millions of people because of pay cuts for workers, while the rich are given tax cuts." [...]

The protesters carried banners which read: 'Cameron Has Butchered Britain', '24 Hour General Strike Now' and 'No Cuts' as they marched through Whitehall towards Hyde Park.

They booed at Downing Street and shouted "pay your taxes" as they passed a Starbucks coffee shop.

Great photo of a sea of red at the article - also a link to live twitter feed from event.

I want a "Red Monday" worldwide - stop the machine.

DemReadingDU

(16,000 posts)Most think that austerity would never happen over here so there is no need to march or protest.

![]()

or maybe Americans are too busy texting to pay attention to what is going on around the world

![]()

Hotler

(11,392 posts)Too many have the attitude "I have mine. Fuck the rest of you." I've said it before and I'll say it again. Let the repugs have 2012 and the pain will come. As long as NASCAR and the NFL continue to sell out, there is not enough pain yet. I dare you to go over to GD and mention mass protest. Oh the excuses that come forward.

DemReadingDU

(16,000 posts)Ha, the fix is in. One way or another, the repugs will take 2012.

I'm in Ohio and I remember 2004.

Demeter

(85,373 posts)By the pricking of my thumbs,

Something wicked this way comes. [Knocking]

Open locks,

Whoever knocks!

After conjuring up "double, double toil and trouble", the three witches admit a visitor to their cave—King Macbeth of Scotland. "Something wicked this way comes," indeed, and they're delighted. Macbeth—at least, the wicked Macbeth—is in part their own creation. The first time around, they came looking for him, to deliver the enticing prophecy that set off the whole chain of events which has included Macbeth's regicide and subsequent bloody events. Now, Macbeth comes looking for them, and the witches summon apparitions to tell Macbeth exactly what he wants to hear: that he's invulnerable. This news is purposely ambiguous; it is calculated only to make Macbeth act more wickedly before he is finally finished off.

http://www.enotes.com/shakespeare-quotes/by-pricking-my-thumbs

This is precisely the point in time we have reached...for the 1%, it's all downhill from here. There is no force to sustain the inequity, no natural power to draw upon. That which cannot continue, will not.

I have a shiver down my back this weekend, and it's not just the weather. It's the anguished truth pouring through the posts these days. The blinders are off, the BS is washing away, dare I say it: The End Is Near.

bread_and_roses

(6,335 posts)From your lips to the Goddess' ears, Demeter. May it be so. We have very little time.

Demeter

(85,373 posts)Let it go viral. We'll have an American Spring yet.

Demeter

(85,373 posts)

hamerfan

(1,404 posts)I Don't Like Mondays. The Boomtown Rats:

hamerfan

(1,404 posts)Manic Monday. The Bangles. (the tune was written by Prince).

mother earth

(6,002 posts)contributing to these threads show us positively despite how superior the citizens of this country feel they are, they are completely and unabashedly being screwed over on a constant basis. It isn't just rMoney who has romnesia, masses of us do. As a nation, WE just don't get it...still...the illusion of fairness,

accountability and honesty...still has a majority thinking somehow we will pull through GW's depression & Obama should have been able to do more during his time. If you don't get the sheer magnitude of the screw-over to this country, you really need to wake the fuck up.

The fact of the matter is it will take years for this flippin mess to be cleaned up, if it is possible for it to ever be cleaned up without trashing it all, clearing the slate and starting anew. I suspect that is exactly what it will take.

I cannot fathom for the life of me, how any sane person could vote for a rethug in this coming election after the carnage that was wrought with the exit of the two biggest criminals ever leaving us in this mess, nor can I fathom how we were able to "forget" and move on with the new admin, four years ago. I knew then how deep this hole is, when the top level is afraid to call it what it was/is.

The destruction of our economy was, indeed, an inside job, and ahead of us lies two roads. One that will take us immediately into hell with a romnesia prerequisite, and the other that will involve years of clean up duty, reform and work and still may not be accomplished four more years from now. Centrism and middle of the road is stagnation. Bipartisanship be damned.

Do we have it in us to realize exactly what our country has become & deal with it effectively to ensure this road is never visited again?

Hell, the jury is out on that one. The only positive to take away is that day by day we are seeing proof of our collective enabling of this illusion. What's it going to take to snap us out of this nightmare? The entitlement and greed is at the top, the trickle down is their urine, plain and simple.

xchrom

(108,903 posts)

xchrom

(108,903 posts)

I got a chuckle from the biz blogs and TV yesterday with the rehash of the 1987 stock crash. Twenty-five years is a very long time. I’d forgotten most of the events of that day.

I was at Drexel, and at that time, Drexel was a powerhouse. The firm had plenty of capital and huge capacity to borrow money to fund positions. Money was rolling in; risk taking was encouraged. I was working with a small group of people on one of the screwier sub-sets of the high yield bond market. It was referred to as LDC debt (Less Developed Country debt). These were the busted bank loans of all of the countries in South America.

You might wonder why anyone would spend time mucking around with the debts of Brazil, Mexico, Argentina and Chile. Actually, it was a great business. We were coining money. The key to our (and others) success was the ability to make a price on illiquid assets. If some regional bank needed to sell $25Mn of Brazilian debt, we would make a bid on the phone. If a company were in need of some Mexican debt that would be used in a debt for equity transaction, we would offer the paper to the buyer, even though we did not own it.