Economy

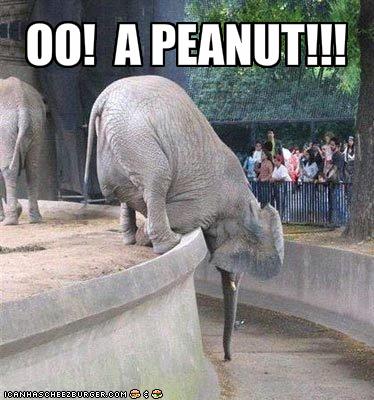

Related: About this forumWeekend Economists Working for Peanuts Friday the 13th, Jan. 13-16, 2012

It looks so weird, typing 2012. I thought 2011 would never end...or maybe, it never actually started for me. ahem....

WE WILL BE HERE MONDAY, SINCE THE MARKETS ARE CELEBRATING MLK DAY....WHICH EXPLAINS WHY THERE WERE NO BANK FAILURES, TOO.

Could one say that members of the GOP should be working for peanuts? Or is that a vicious stereotype?

It's apparent that there's more than nation-wide approval or public service at work, though, when the GOP goes electioneering. Trouble is, that kind of "eyes on the prize" seems to have crossed the aisle nowadays. So, whom can you trust?

I'm putting my trust in the original Peanuts:

Charles Monroe Schulz (November 26, 1922 – February 12, 2000), nicknamed Sparky, was an American cartoonist, whose comic strip Peanuts proved one of the most popular and influential in the history of the medium and is still widely reprinted on a daily basis.

Born in Minneapolis, Minnesota, Schulz grew up in Saint Paul. He was the only child of Carl Schulz, who was born in Germany, and Dena Halverson, who was Norwegian. His uncle called him "Sparky" after the horse Spark Plug in Billy DeBeck's comic strip, Barney Google.

Schulz loved drawing and sometimes drew his family dog, Spike, who ate unusual things, such as pins and tacks. Schulz drew a picture of Spike and sent it to Ripley's Believe It or Not!; his drawing appeared in Robert Ripley's syndicated panel, captioned, "A hunting dog that eats pins, tacks and razor blades is owned by C. F. Schulz, St. Paul, Minn." and "Drawn by 'Sparky'" (C.F. was his father, Carl Fred Schulz.)

Schulz attended St. Paul's Richard Gordon Elementary School, where he skipped two half-grades. When he was in first grade, his mother helped him get valentines for everybody in his class, so that nobody would be offended by not getting one; but he felt too shy to put them in the box at the front of the classroom, so he took them all home again to his mother.

He became a shy, timid teenager, perhaps as a result of being the youngest in his class at Central High School. One episode in his high school life was the rejection of his drawings by his high school yearbook. Much to its irony, a statue of Snoopy was placed in Central's main office sixty years later.

Military service

In 1943, he was drafted into the United States Army and served as a sergeant with the 20th Armored Division in Europe as a squad leader on a .50 caliber machine gun team. The unit saw combat only at the very end of the war. Schulz stated that he only ever had one opportunity to fire his machine gun, but forgot to load it. Fortunately, he said, the German soldier he ran into willingly surrendered. Years later, he proudly spoke of his wartime service.

After discharge in late 1945, he returned to Minneapolis where he took a job as an art teacher at Art Instruction, Inc. — he had taken correspondence courses before he was drafted. Before having his comics published, Schulz did lettering for a Roman Catholic comic magazine, Timeless Topix, while still teaching at Art Instruction.

Career

Schulz's first regular cartoons, Li'l Folks, were published from 1947 to 1950 by the St. Paul Pioneer Press; he first used the name Charlie Brown for a character there, although he applied the name in four gags to three different boys and one buried in sand. The series also had a dog that looked much like Snoopy. In 1948, Schulz sold a cartoon to The Saturday Evening Post; the first of 17 single-panel cartoons by Schulz that would be published there. In 1948, Schulz tried to have Li'l Folks syndicated through the Newspaper Enterprise Association. Schulz would have been an independent contractor for the syndicate, unheard of in the 1940s, but the deal fell through. Li'l Folks was dropped from the Pioneer Press in January 1950.

Later that year, Schulz approached the United Feature Syndicate with his best strips from Li'l Folks, and Peanuts made its first appearance on October 2, 1950. The strip became one of the most popular comic strips of all time. He also had a short-lived sports-oriented comic strip called It's Only a Game (1957–1959), but he abandoned it due to the demands of the successful Peanuts. From 1956 to 1965 he contributed a single-panel strip ("Young Pillars"![]() featuring teenagers to Youth, a publication associated with the Church of God.

featuring teenagers to Youth, a publication associated with the Church of God.

In 1957 and 1961 he illustrated two volumes of Art Linkletter's Kids Say the Darndest Things, and in 1964 a collection of letters, Dear President Johnson, by Bill Adler.

Schulz receiving his star on the Hollywood Walk of Fame at Knott's Berry Farm in June 1996

Charlie Brown, the principal character for Peanuts, was named after a co-worker at the Art Instruction School; Schulz drew much more inspiration from his own life:

Like Charlie Brown's parents, Schulz's father was a barber and his mother a housewife.

Schulz and Charlie Brown were shy and withdrawn.

Schulz had a dog when he was a boy, although unlike Snoopy the beagle, it was a pointer.

References to Snoopy's brother Spike living outside of Needles, California were likely influenced by the few years (1928–1930) that the Schulz family lived there; they had moved to Needles to join other family members who had relocated from Minnesota to tend to an ill cousin.

Schulz's "Little Red-Haired Girl" was Donna Mae Johnson, an Art Instruction Schools accountant with whom he fell in love. When Schulz proposed to her, she turned him down and married another man.

Linus and Shermy were both named for good friends of his (Linus Maurer and Sherman Plepler, respectively).

Peppermint Patty was inspired by Patricia Swanson, one of his cousins on his mother's side.The name came from the candy "Peppermint Patties."

Influences

The Charles M. Schulz Museum counts Milton Caniff (Terry and the Pirates) and Bill Mauldin as key influences on Schulz's work. In his own strip, Schulz regularly described Snoopy's annual Veterans Day visits with Mauldin, including mention of Mauldin's World War II cartoons.

Critics have also credited George Herriman (Krazy Kat), Roy Crane (Wash Tubbs), Elzie C. Segar (Thimble Theater) and Percy Crosby (Skippy) among Schulz's influences. However,

“It would be impossible to narrow down three or two or even one direct influence on Schulz's personal drawing style. The uniqueness of Peanuts has set it apart for years... That one-of-kind quality permeates every aspect of the strip and very clearly extends to the drawing. It is purely his with no clear forerunners and no subsequent pretenders.

— Good Grief: The Story of Charles M. Schulz, Rheta Grimsley Johnson, p. 68 ”

Sparky in 1956, and sometime thereafter....

http://en.wikipedia.org/wiki/Charles_M._Schulz

When Schulz announced his retirement for health reasons in December 1999, Peanuts was in more than 2,600 newspapers worldwide; he died shortly thereafter, on Saturday, February 12, 2000, just hours before the final Peanuts Sunday strip appeared in newspapers.... http://openlibrary.org/authors/OL4361397A/Charles_M._Schulz

Demeter

(85,373 posts)Peanuts ran for nearly 50 years, almost without interruption. During the life of the strip, Schulz took only one vacation, a five-week break in late 1997 to celebrate his 75th birthday; reruns of the strip ran during his vacation. At its peak, Peanuts appeared in more than 2,600 newspapers in 75 countries. Schulz stated that his routine every morning consisted of eating a jelly donut and sitting down to write the day's strip. After coming up with an idea (which he said could take anywhere from a few minutes to a few hours), he began drawing it, which took about an hour for dailies and three hours for Sunday strips. He stubbornly refused to hire an inker or letterer, saying that "it would be equivalent to a golfer hiring a man to make his putts for him." In November 1999 Schulz suffered several small strokes along with a blocked aorta and later it was discovered that he had colon cancer that had metastasized. Because of the chemotherapy and the fact he could not read or see clearly, he announced his retirement on December 14, 1999. This was difficult for Schulz, and he was quoted as saying to Al Roker on The Today Show, "I never dreamed that this would happen to me. I always had the feeling that I would stay with the strip until I was in my early eighties, or something like that. But all of sudden it's gone. I did not take it away. This has been taken away from me."[cite this quote] In his later years, Schulz also suffered from Parkinson's Disease. As a result, he experienced hand tremors that made his linework shaky. He admitted that the tremors sometimes were so bad that while working, he had to hold onto the side of his desk with one hand to steady himself. In addition, he had to reduce the strip from four panels to three (starting on February 29, 1988) to reduce the amount of drawing.

Charles Schulz died in his sleep at home around 9:45 p.m. on February 12, 2000. Although he was dying of cancer, he suffered a fatal heart attack. The last original Peanuts strip was published the very next day, on Sunday, February 13, 2000, just hours after his death the night before. Schulz was buried at Pleasant Hills Cemetery in Sebastopol, California.

Schulz indicated that his family wished for the strip to end when he was no longer able to produce it. Schulz had previously predicted that the strip would outlive him, with his reason being that comic strips are usually drawn weeks before their publication. As part of his will, Schulz had requested that the Peanuts characters remain as authentic as possible and that no new comic strips based on them be drawn. United Features had legal ownership of the strip, but honored his wishes, instead syndicating reruns of the strip to newspapers. New television specials have also been produced since Schulz's death, but the stories are based on previous strips, and Schulz always stated that Peanuts TV shows were entirely separate from the strip.

Schulz had been asked if, for his final Peanuts strip, Charlie Brown would finally get to kick that football after so many decades. His response: "Oh, no! Definitely not! I couldn't have Charlie Brown kick that football; that would be a terrible disservice to him after nearly half a century." Yet, in a December 1999 interview, holding back tears, he recounted the moment when he signed the panel of his final strip, saying, “All of a sudden I thought, 'You know, that poor, poor kid, he never even got to kick the football. What a dirty trick — he never had a chance to kick the football!'”

He was posthumously honored on May 27, 2000, by cartoonists of more than 100 comic strips paying homage to him and Peanuts.

Demeter

(85,373 posts)You're a Good Man, Charlie Brown is a 1967 musical comedy with music and lyrics by Clark Gesner, based on the characters created by cartoonist Charles M. Schulz in his comic strip Peanuts. The musical has been a popular choice for amateur theatre productions because of its small cast and simple staging.

John Gordon was credited with the book of the show, but according to Gesner's foreword in the published script, John Gordon is a "collective pseudonym" that covers Gesner, the cast members and the production staff, all of whom worked together to assemble the script.

During the early 1960s, Gesner had begun writing songs based on Charles Schulz’s Charlie Brown comic strip characters but was unable to get permission from the United Features Syndicate to use the characters in his songs. Eventually Gesner sent Schulz a tape of some of the songs and Gesner soon had permission to record them, which he did in 1966.

At the time, Gesner had no plans for a musical based on this pre-production "concept album." However, producer Arthur Whitelaw, who would later go on to write another musical based on Peanuts, encouraged Gesner to turn the album into a musical.

The stage adaptation of the concept album, entitled You're a Good Man, Charlie Brown, went into rehearsal in New York City on February 10, 1967. Prior to its opening, the musical had no actual libretto; it was several vignettes with a musical number for each one.

Original New York productions and U.S. tour

On March 7, 1967, the musical premiered off-Broadway at Theatre 80 in the East Village, featuring Gary Burghoff (Radar O'Reilly of MASH) as Charlie Brown, Reva Rose as Lucy, Bob Balaban as Linus, Skip Hinnant as Schroeder, Karen Johnson as Patty and Bill Hinnant appearing in person as Snoopy. Joseph Hardy directed and choreographer Patricia Birch was billed as "Assistant to the Director". This production of You're A Good Man, Charlie Brown lasted 1,597 performances, closing on February 14, 1971.

The rest is history.

The rest is history.Fuddnik

(8,846 posts)It's entirely off base.

A vulture has the decency to let you die first, before devouring you.

A rattlesnake on the other hand, kills you first. Then devours you.

Demeter

(85,373 posts)

More Snoopy:

&feature=related

Fuddnik

(8,846 posts)Comparing them to a snake like Romney is beyond civilized.

Po_d Mainiac

(4,183 posts)The boa constrictor squeezes the life outa its prey and has invaded habitats it don’t belong in.

xchrom

(108,903 posts)Demeter

(85,373 posts)No banks have failed in the Eastern Time Zone....check back later for updates in different parts of the country.

Demeter

(85,373 posts)How odd....maybe because they've got their hands full with BofA?

xchrom

(108,903 posts)Rickards, Bacchus on Iran Tensions, Europe Crisis

http://bloom.bg/yTyU7f#ooid=Q1cWVhMzryvmDCeYzao1LnxInT96MhRD

Jan. 13 (Bloomberg) -- James Rickards, senior managing director of Tangent Capital Partners, and James Bacchus, chair of global practice at Greenberg Traurig LLP, talk about tensions between the U.S. and Iran and the possibility of a war. Rickards and Bacchus also discuss Europe's sovereign debt crisis and President Barack Obama's request to streamline the executive branch. They speak with Deirdre Bolton on Bloomberg Television's "Money Moves." (Source: Bloomberg)

Demeter

(85,373 posts)The Federal Reserve last week released a set of proposals for aiding the battered American housing market, including a series of ways to help homeowners who are buried under the weight of unsustainable mortgage payments or who now find themselves significantly underwater on their home (meaning they owe more on their mortgage than their house is worth). New York Federal Reserve President William Dudley added to the list a proposal for reducing mortgage principal (the outstanding amount on the loan) for underwater homeowners.

The Senate GOP, which had obstructed all manner of help for homeowners, reacted with outrage, saying that helping homeowners in such a way would be, in the words of Sen. Bob Corker (R-TN), “completely egregious“:

Hatch, the top-ranking Republican on the Senate Finance Committee, said the housing study sent by Chairman Ben S. Bernanke to Congress last week, along with recent Fed speeches, “intrudes too far into fiscal policy advice and advocacy.” Corker said New York Fed President William C. Dudley’s suggestion last week that Fannie Mae and Freddie Mac reduce the principal of the loans they guarantee was “absolutely egregious.”

Reducing principal is one of the most effective ways to keep troubled borrowers — many of whom are underwater or behind on their mortgage payments through no fault of their own — out of foreclosure, and it would also boost the economy. A report from the The New Bottom Line — a coalition of community, faith-based and labor groups — found that “if banks wrote down all underwater mortgages to market value and refinanced the homeowners into 30-year, fixed-rate loans at current market interest rates, that would pump $71 billion into the national economy.”

The Senate GOP, instead, derides the idea, after filibustering an Obama administration nominee because he may have been sympathetic towards principal reductions. But, perhaps that’s not surprising from a party that thinks foreclosure prevention efforts simply “need to stop.”

Demeter

(85,373 posts)....what happened is very straightforward. We had a huge run-up in house prices that had no basis in the fundamentals of the housing market. After 100 years in which nationwide house prices just kept even with the overall rate of inflation, house prices began to sharply outpace inflation beginning in the late 90s. By 2002, when some of us first noticed the bubble, house prices had already risen by more than 30 percentage points in excess of inflation. By the peak of the bubble in 2006, the increase in house prices was more than 70 percentage points above the rate of inflation. This was a huge problem because this bubble was driving the economy. It drove it directly by creating a boom in residential housing construction. We were building housing at a near-record pace in the years 2002-2006. This was in spite of the fact that we had an aging population and record levels of vacancies at the start of the period. The other way in which the bubble was driving the economy was through its effect on consumption. The bubble created more than $8 trillion in ephemeral wealth in housing. Homeowners thought this wealth was real and spent accordingly. The result was a massive consumption boom that sent the saving rate down to zero in the years from 2004-2006.

When the bubble burst, the building boom went bust. Construction fell to its lowest levels since the 50s as the country waits to gradually work off a glut of housing. Consumption fell back to more normal levels as people came to grips with the fact that they had lost tens of thousands or even hundreds of thousands of dollars of equity in their home. The combined impact of the plunge in construction and consumption spending together with the collapse of a bubble in non-residential real estate is to lower annual demand in the economy by more than $1.2 trillion. This is the reason for the prolonged downturn. There is nothing in the economists’ bag of tricks that will allow the economy to quickly and easily replace $1.2 trillion in lost demand. That is the reason we are still 10 million jobs below full employment four years after the onset of the recession.

...MUCH DISCUSSION OF BANKSTERS AND REGULATORS ACTIONS...

Finally, some quick points on what could have been done. First, the Fed has responsibility for maintaining the stability of the U.S. economy. Alan Greenspan should have recognized the bubble and done everything in his power to burst it before it grew to such dangerous levels. Step one in this process should have been to document its existence and show the harm that its collapse would bring. This means using the Fed’s huge staff of economists to gather the overwhelming evidence of a bubble and to shoot down anyone who tried to argue otherwise. Greenspan should have used his Congressional testimony and other public appearances to call attention to the bubble. This would have put the bubble clearly on everyone’s radar screen. And, the reality was that there were no serious counterarguments. It is difficult to believe that this action by itself would not have slowed the home buying frenzy and curbed the issuance of junk loans, or at least their repurchase for securitization.

Second, the Fed has enormous regulatory power beginning with setting guidelines for issuing mortgages. They first issued draft guidelines in December of 2007. It was not hard to find abusive and outright fraudulent practices in the mortgage industry, if anyone in a position of authority was looking for it. Finally, the Fed could have used interest rate increases as a mechanism to rein in the bubble. This should have been a last resort, since higher rates would have slowed the economy at a time when it was still recovering from the collapse of the stock market bubble. To maximize the impact of any rate increases, Greenspan could have announced that he was targeting the housing market. He could have said that he would continue to raise rates until house prices were brought back to a more normal level. This surely would have gotten the attention of the mortgage industry and potential homebuyers. Would it have been an extraordinary action from a Fed chair? Sure, but so what? It might have prevented the economic devastation that is ruining tens of millions of lives. If this required Alan Greenspan to deviate from the standard script for Fed chairs, that would have been a very small price.

ozone_man

(4,825 posts)But, we don't prosecute Wall Street or FED shysters like Greenspan. Maybe if history is written fairly, he will get his due.

Demeter

(85,373 posts)that justice will be done sometime in this country for the 1%.

Demeter

(85,373 posts)PRIVATIZING THE COMMONS--21ST CENTURY STYLE

Right now, if you want to read the published results of the biomedical research that your own tax dollars paid for, all you have to do is visit the digital archive of the National Institutes of Health. There you’ll find thousands of articles on the latest discoveries in medicine and disease, all free of charge.

A new bill in Congress wants to make you pay for that, thank you very much. The Research Works Act would prohibit the NIH from requiring scientists to submit their articles to the online database. Taxpayers would have to shell out $15 to $35 to get behind a publisher’s paid site to read the full research results. A Scientific American blog said it amounts to paying twice.

Two members of Congress — Reps. Darrell Issa, R-Calif., and Carolyn Maloney, D-N.Y. — introduced the bill. Rebecca Rosen of The Atlantic finds it curious that Issa, a well-known champion of the open Internet whose own website displays the words “keep the web #OPEN,” would back a bill that appears to be the polar opposite of open access. As Michael Eisen, a University of California, Berkeley, biologist and open access supporter, notes, Maloney's support seems no less mystifying since she represents “a liberal Democratic district in New York City that is home to many research institutions.”

Both Issa and Maloney have received campaign contributions from the Dutch company Elsevier, which calls itself the world’s leading publisher of scientific and medical information. According to MapLight, a website that tracks political cash, Elsevier and its senior executives last year made 31 contributions to House members totaling $29,500. Twelve contributions totaling $8,500 went to Maloney; Issa received two for a total of $2,000.

This isn’t the first effort by publishers to push Congress to roll back the NIH’s public access policy, which was enacted in 2008 and applauded by doctors, patients, librarians, teachers and students. Under the policy, all research funded by the NIH was required to be made freely available to the public one year after publication on PubMed Central. (The NIH also runs PubMed, a biomedical research database that includes articles that aren’t federally funded and cost money to access.)...

kickysnana

(3,908 posts)[link:http://ignatz.brinkster.net/crejects.html

Fifty years ago, an editor at the Pioneer Press in St. Paul, Minn., made a legendary blunder. He refused to pay $10 a week to keep publishing a comic strip created by a young employee, a St. Paul artist named Charles Schulz. The newspaper has regretted it ever since, as Peanuts became the most famous strip in history....

...As the story goes, Schulz started out working for nothing, which was customary at the time, but eventually wanted to be paid. Editor Vernon "Doug" Fairbanks thought it was too much for the newsroom budget. So Schulz took his strip to a newspaper syndicate, which began selling it under the name Peanuts.

The rival Minneapolis Tribune bought the exclusive rights to publish "Peanuts" in the Twin Cities. It has never again appeared in the Pioneer Press.

Demeter

(85,373 posts)Last edited Fri Jan 13, 2012, 09:01 PM - Edit history (1)

Penny wisdom and pound foolishness at its best.

Demeter

(85,373 posts)Maybe it's your brother-in-law, who has a new Mercedes and likes to quip that only fools pay all their taxes. Or else a contractor who overcharged for a home renovation and then demanded you make the check payable to "cash." Or perhaps your company's chief tax accountant, who is cutting corners to boost his bonus. If tax cheating sticks in your craw, the Internal Revenue Service has a deal for you: Turn in a lawbreaker and collect some of the proceeds. The bigger the amount recouped, the bigger your take. The agency has two whistleblower programs: The small-awards program is for cases involving less than $2 million of tax, and the award can be as high as 15%, though it often is less. The large-awards program is more generous: For cases involving $2 million or more of tax, the reward can go as high as 30%.

So what's the catch? Among others: The IRS takes relatively few cases, and those it does pick up often take five or more years to resolve. It often takes copious leg work on your part to pique Uncle Sam's interest. And while the IRS tries to protect whistleblowers' privacy, there isn't any legal protection from retaliation by an employer. Still, it can be worth the effort. This spring the IRS made its first award in the large-case program: $4.5 million, to an unnamed retired accountant.

The U.S. has been rewarding people who turn in fellow citizens or companies defrauding government programs since Congress's passage of the False Claims Act in 1863. Whenever there has been an income tax—briefly during the Civil War, and permanently since 1913—the IRS (or its predecessor) has had its own whistleblower program, says tax historian Joseph Thorndike of Tax Analysts, a nonprofit publisher. But payments tended to be small and rare because IRS officials were uncomfortable with "bounty hunting."...The landscape changed in 2006. Heartened by the success of a whistleblower program for nontax issues such as government contracts, Congress overhauled the special tax provisions on whistleblowers and set up the IRS's large-award program. Since then, according to just-released data, the agency has had 1,328 qualified submissions involving nearly 10,000 alleged tax cheats under the large-awards program. (Some cases, such as tax shelters, involve multiple taxpayers.) Scott Knott of the Ferraro Law Firm in Washington says the IRS has accepted from his firm alone cases involving claims of $98.6 billion of unpaid tax, with one case involving unpaid corporate tax of more than $10 billion. The IRS doesn't break out data on pending cases.

In April, tax experts say, the agency paid the first-ever award under this new program: the $4.5 million to a former in-house accountant for a large financial-services firm. The taxpayer's lawyer, Eric Young of Egan Young in Blue Bell, Pa., announced the payment and said it was 22% of the tax collected. Mr. Young, who has won three big nontax whistleblower cases, wouldn't disclose his client's name or firm, but did say the person is retired. The IRS doesn't confirm individual awards out of concern for taxpayer privacy, and won't release data on large awards such as this one until next summer. Experts say other whistleblowers are waiting for what they hope are imminent payments on large issues as varied as payroll tax withholding, tax shelters, illicit foreign accounts or arcane corporate accounting matters like transfer pricing. One is Bradley Birkenfeld, who has a pending claim involving $580 million in fines paid by Swiss banking giant UBS as part of a deferred prosecution agreement involving charges of conspiring to defraud the U.S by providing undeclared offshore accounts to U.S. taxpayers. He also has submitted other whistleblower claims as well, according to his lawyer, Dean Zerbe of the law firm Zerbe, Fingeret, Frank & Jadav in Washington. Notably, the law doesn't prohibit convicted felons from receiving whistleblower awards unless they were architects of the cheating. Mr. Birkenfeld, who was a private banker at UBS, was convicted of conspiring to help a billionaire hide money in UBS accounts. He is serving a 40-month prison sentence. Experts say Mr. Birkenfeld's involvement in UBS's activities will likely lower his award for turning in the big bank, but Mr. Zerbe says he believes he will receive one. "The government made clear that thanks to Brad's coming forward to blow the whistle on UBS and illegal offshore accounts, the Treasury has recovered billions of dollars."

HOW-TO GUIDE FOLLOWS...

Demeter

(85,373 posts)that was probably the ugliest right-wing garbage I ever read....

Demeter

(85,373 posts)AND WHAT ABOUT THE HEDGE FUND LOOPHOLES?

http://crooksandliars.com/jon-perr/gop-war-on-irs-costs-us-billions

For any American concerned about the federal budget deficit, job one must be to collect all of the tax revenue owed to the United States Treasury. That's why supposed Republican deficit hawks simply aren't serious about the national debt. After all, a new report confirmed that steep GOP budget cuts at the Internal Revenue Service (IRS) are hurting customer service, delaying refunds and costing Uncle Sam billions of dollars annually. Thanks to the never-ending Republican war on the IRS dating back to the late 1990's, tax evasion and cheating are now depriving the U.S. of $400 billion each year.

In April, Congressional Republicans extracted $600 million in cuts from the IRS in return for a spending deal with President Obama, reductions which at the time were forecast to cost the Treasury $4 billion in lost revenue. Now, the annual report to Congress from the National Taxpayer Advocate shows, "IRS is not adequately funded to serve taxpayers or collect revenue."

MORE

IT'S A SCANDAL....CORRUPTION PERMEATES THE GOVERNMENT DOWN TO THE LAST PENNY

Demeter

(85,373 posts)YVES SMITH REMARKS: The Fed has been eager to unload this garbage barge for over a year. I take this to mean they think this is as good as the market is gonna get.

Demeter

(85,373 posts)Throughout the European debt soap opera, Europe’s leaders have expressed their willingness to “do whatever it takes” to restore stability and save the euro. This column argues that, too often, policymakers have in fact been “doing whatever it takes” to serve the banks.

After initial denials, Europe’s leaders have started to acknowledge that IMF Chief Christine Lagarde was right. Through their statements and decisions, policymakers are showing their agreement with her assessment in August 2011 at the Federal Reserve’s Jackson Hole symposium that there was an urgent need for recapitalisation of Europe’s banks (Lagarde 2011).

This recognition of reality is the good news. The bad news is the EU’s bank recapitalisation is being handled in a way that will make a recovery from the Europe’s debt crisis more problematic than it needs to be. There are five concerns:

Incentives for deleveraging;

Absence of firm guidelines on dividends and executive compensation;

Omissions of a recession scenario and of an unweighted leverage ratio from the stress tests;

Inequitable burden-sharing during debt restructuring; and

Insufficient measures to permit an escape from the adverse feedback loop between sovereign debt and bank debt.

I address these in turn....MORE AT LINK

Demeter

(85,373 posts)CARTOON IN THE FASHION OF THE TWO BEARS....MUST SEE!

Demeter

(85,373 posts)YVES SMITH REMARKS: Mirabile dictu! The bill comes from a Republican!

http://www.americanbanker.com/issues/176_250/virginia-state-owned-bank-1045240-1.html

A Virginia lawmaker is urging his colleagues in Richmond to consider creating a state-owned bank that would use deposits from residents and state agencies to lend to local businesses and stimulate economic growth.

The Washington Business Journal reported Wednesday that Del. Bob Marshall, a Republican, introduced legislation this week to study the viability of opening a bank that would be modeled after Bank of North Dakota, the only state-owned bank in the country. Marshall introduced a similar bill in 2010, but that bill failed to make it out of committee.

The idea of creating a state-owned bank has been gaining traction in a number of state legislatures of late. Lawmakers in California, Massachusetts, Oregon, Hawaii and several other states all introduced bills last year that sought to establish a state-owned bank or study the idea of creating one and it is expected that similar bills will be reintroduced early this year when state legislatures convene. (Virginia's legislative session begins Jan. 11.)

In introducing bills last year, most lawmakers said that state-owned banks could pick up the slack from traditional banks that have scaled back their lending in the wake of the financial crisis. A state-owned bank could also help states close budget shortfalls because, if it is modeled after the Bank of North Dakota, all profits would be returned to state coffers.

Demeter

(85,373 posts) ?__SQUARESPACE_CACHEVERSION=1319932313720

?__SQUARESPACE_CACHEVERSION=1319932313720

This is a great story FROM OCTOBER, 2011.

By Tripnman

Over the past two weeks, I have been closing down and moving money out of my Bank of America accounts. I have done my personal and business (I own a consulting business) banking there for over ten years but have decided to vote with my wallet and express my displeasure with the system by removing my money from their clutches. One by one, I have zeroed out the balances on various accounts by transferring and consolidating via their website. After each transfer I then called to close the accounts over the phone without issue.

Yesterday was different. I visited a branch to make a business deposit and when I arrived, there were signs on the ATMs indicating that the system was down and that customers should come into the branch. Before I got to the business customers' line, I was stopped by a banking associate and asked the purpose of my visit. I told him I was there to make a deposit and he waved me to a desk. When I sat down the banker first asked for my account number. I don't know it, so I handed him my ATM card. That's when he explained that all of their computers were down, and although they would accept the deposit, without the account number they would have to give me a generic receipt. Say what huh? When I told him that my newly opened accounts at a local (small, community) credit union would like the deposit he insisted that their computers were down too. Fifteen minutes after leaving BoA I found that to not be true and the money was happily deposited into a new account at the CU without issue.

Later in the afternoon I hit up a different branch of BoA and found their computers working just fine. I went in, asked to speak with a banker and was seated in an office. When the young associate came in and asked the purpose of my visit, I handed her my ATM card and requested that she tell me the balance. When she did, I then asked for a cashiers check in that amount. That's when things got wonky. She froze, stumbled over her words and asked why I needed that amount (It was not a small sum). This gave me an opportunity to explain that although I personally would not be affected by their new fees I know plenty of friends and family that would feel the pain. In solidarity with them, I wished to close the account and move on. She unwittingly suggested that if I just use my debit card once a month then there would be no fee. That was good for a belly laugh from me, then I again requested the balance to be issued to me in the form of a cashier's check. She then told me that there would be a $10 fee for this service. Another laugh. I guess it didn't sink in when I told her that I was fee adverse. There was an easy work-around anyway - I requested the cash. That finished my time with this associate banker as the amount I was requesting was "well past" her daily limit for withdrawals. I asked if there would be an issue with securing the cash and she said "I honestly don't know if we have that here" and walked out to get the branch manager.

The manager was pleasant enough and very direct. After introducing herself she flat out asked "What can we do to change your mind?" "We don't want to see you go" she emphasized. This opened a door for me to further explain my decision to leave the bank and why I was doing it. Amazingly, it did not fall on deaf ears. She indicated that understood where I was coming from and actually showed genuine surprise at some of the facts I provided her about the less than consumer friendly policies and machinations of her employer. She did make some feeble counter-arguments and repeatedly asked me if I would change my mind (with a hint of desperation!). I stood firm and by the end of our conversation she asked if I would be willing to put it all in writing so she could send it up the chain.

She shared that management is nervous, they are seeing money leaking out of the bank and realize that they have made mistakes. She even hinted that there has been high-level discussion on reversing the new fess since there has been so much consumer push-back. They are also aware of the growing momentum behind the November 5th move your money movement.

Why do I share all of this with you? For one, I wanted to let people know that it IS still possible to withdraw large sums of cash from BoA and close your accounts - just be ready for them to beg. Two, that management is aware that people are angry (how could they not be!) and have put an ear to the ground.

Demeter

(85,373 posts)...Every study on bank efficiency in the US has found that once banks hit a certain size level (the most commonly found one seems to be ~$5 billion in assets) banks exhibit a slightly positive cost curve, which means they are more, not less, costly to run. Any economies of scale are probably offset by diseconomies of scope...BUT CEO pay is highly correlated with the size of the bank, measured in total assets....So no one should cry at the prospect that Bank of America might have to shrink to if it continues to be in financial and litigation hot water. Those of you who have been in the financial services industry will recall that it was built out of mergers of large regional banks: NCNB (North Carolina National Bank, later Nationsbank) ate First Union, Bank of America, Fleet, and of course, Countrywide and Merrill.

The Wall Street Journal has gotten some details about “emergency moves” the Charlotte bank would take if it condition worsens. This is not its Dodd Frank mandated “living will” but apparently a set of plans prepared at the request of the Fed. Bank of America is on a short leash known as a memorandum of understanding, which is accompanied by more intrusive oversight. What is striking is that it did not contemplate a sale or spinoff of Merrill Lynch, which is the operation which makes it most difficult to resolve. Instead, it would issue a tracking stock as a way to raise money.

In other words, even for a bank developing scenarios on how to cope with serious financial trouble, the priority is to raise dough quickly rather than reconfigure the business into something tidier. Even if still not TBTF, it would be less costly to rescue. But, predictably, the priorities of management and their enablers, the regulators, is to prefer quick fixes to badly needed surgery. Notice that a Countrywide bankruptcy was apparently not included as an option.

From the Wall Street Journal:

Bank of America Chief Executive Brian Moynihan put a possible geographic retrenchment on the list submitted in the middle of last year to Fed officials. Also on the list is a potential sale of a separate class of shares tied to the performance of Merrill Lynch & Co., the securities firm owned by Bank of America, according to people familiar with the matter. Merrill was sinking when Bank of America swooped in to buy the firm in 2008, but has since turned itself around. The Fed, which acts as the company’s primary regulator, asked for documentation about contingency plans last year in response to uncertainty about a U.S. recovery and the downward swing in Bank of America’s share price.

The drastic moves would be seriously considered only if Bank of America needs to raise more capital to cushion itself from mortgage woes and other turmoil. The exercise wasn’t intended to force immediate action but rather to prepare Bank of America if its situation worsened, according to a person familiar with the Fed’s approach….

The bank still is operating under a secret U.S. sanction known as a memorandum of understanding, which puts the bank under stricter oversight, despite steps taken by Mr. Moynihan to consolidate risk controls and shed assets. Regulators have warned the board that the sanction could escalate to a more formal, public enforcement action if they aren’t satisfied with the results of the ongoing shake-up.

The article also devotes a surprising amount of space to CEO Brian Moynihan’s leadership. Needless to say, it portrays him as struggling. This sort of account would normally be a sign that he was on his way out, and the story suggests the board would be rid of him if they thought it could find a better replacement:

As a mortgage investor said to me, “Can you imagine what it’s like being C level at Bank of America? It’s like being in the brace position on an airplane running on one engine.”

Demeter

(85,373 posts)The debate over megabanks and – in the aftermath of the 2008 financial crisis – how to deal with all the problems associated with “too big to fail” in the financial sector has not been easy for many politicians. The problems and potential real solutions do not map readily into the standard left vs. right divide in American politics.

The left generally wants the state to do more, and these days most of the right usually wants the state to do much less. But in this space regulators are “captured”, meaning that too many of them are effectively working to promote the interests of the big banks rather than to limit the dangers to the rest of us – so “more regulation” does not make much sense. And these big banks have a strong incentive to get even bigger – it’s their size that gives them economic and political power. If you leave these banks to their own devices, they will become even bigger and blow themselves up at greater cost to ordinary citizens (see Western Europe for details). So “no regulation” is also not an appealing proposition.

As a matter of presidential year politics, there is a remarkable convergence between President Obama and Mitt Romney, the Republican frontrunner. Both think that we can tweak the rules to keep the banks from becoming dangerous. The Obama administration calls their approach “smart regulation”, while Mr. Romney has spoken of repealing the Dodd-Frank financial reform legislation (although his website is devoid of any further specifics). But as far as anyone can see, their proposed approaches for the next four years are very similar – relying on the state to play a particular oversight role that has not gone well in recent decades. They are both “statist” in this very particular sense.

The way to cut our Gordian financial knot is simple – force the big banks to become smaller. Small banks and other financial institutions can be allowed to fail unencumbered by any kind of government bailout. MF Global failed recently with about $40 billion in total assets; the shock waves did not bring on global panic. A properly functioning market economy involves failure of this kind (although it is traumatic for employees and, in this specific case, also for many customers.)..

MORE--MUST READ

Po_d Mainiac

(4,183 posts)NEW YORK -- Metal tissue holders contaminated with low levels of radioactive material may have been distributed to Bed, Bath & Beyond stores in more than 20 states including New York, federal regulators said Thursday.

http://www.huffingtonpost.com/2012/01/13/bed-bath-beyond-radioactive-tissue-holders_n_1204974.html

Demeter

(85,373 posts)Radioactivity is invisible, has no smell, makes no sound - in fact it cannot be detected by any of our senses.

However, because radioactivity affects the atoms that it passes, we can easily monitor it...

Geiger-Müller tube (alpha, beta and gamma radiation detected)

Geiger detectors are still favored as general purpose alpha/beta/gamma portable contamination and dose rate instruments, due to their low cost and robustness...The current version of the "Geiger counter" is called the halogen counter. It was invented in 1947 by Sidney H. Liebson.[3] It has superseded the earlier Geiger counter because of its much longer life. The devices also used a lower operating voltage.

http://en.wikipedia.org/wiki/Geiger_counter

SEE ALSO

http://www.darvill.clara.net/nucrad/detect.htm

Demeter

(85,373 posts)CITIGROUP is lucky that Muammar el-Qaddafi was killed when he was. The Libyan leader’s death diverted attention from a lethal article involving Citigroup that deserved more attention because it helps to explain why many average Americans have expressed support for the Occupy Wall Street movement. The news was that Citigroup had to pay a $285 million fine to settle a case in which, with one hand, Citibank sold a package of toxic mortgage-backed securities to unsuspecting customers — securities that it knew were likely to go bust — and, with the other hand, shorted the same securities — that is, bet millions of dollars that they would go bust.

It doesn’t get any more immoral than this. As the Securities and Exchange Commission civil complaint noted, in 2007, Citigroup exercised “significant influence” over choosing $500 million of the $1 billion worth of assets in the deal, and the global bank deliberately chose collateralized debt obligations, or C.D.O.’s, built from mortgage loans almost sure to fail. According to The Wall Street Journal, the S.E.C. complaint quoted one unnamed C.D.O. trader outside Citigroup as describing the portfolio as resembling something your dog leaves on your neighbor’s lawn. “The deal became largely worthless within months of its creation,” The Journal added. “As a result, about 15 hedge funds, investment managers and other firms that invested in the deal lost hundreds of millions of dollars, while Citigroup made $160 million in fees and trading profits.”

Citigroup, which is under new and better management now, settled the case without admitting or denying any wrongdoing. James Stewart, a business columnist for The Times, noted that Citigroup’s flimflam made “Goldman Sachs mortgage traders look like Boy Scouts. In settling its fraud charges for $550 million last year, Goldman was accused by the S.E.C. of being the middleman in a similar deal, allowing the hedge fund manager John Paulson to help choose the mortgages and then bet against them without disclosing this to the other parties. Citigroup dispensed with a Paulson figure altogether, grabbing those lucrative roles for itself.” (Last Thursday, the U.S. District Court judge overseeing the case demanded that the S.E.C. explain how such serious securities fraud could end with the defendant neither admitting nor denying wrongdoing.)

This gets to the core of why all the anti-Wall Street groups around the globe are resonating. I was in Tahrir Square in Cairo for the fall of Hosni Mubarak, and one of the most striking things to me about that demonstration was how apolitical it was. When I talked to Egyptians, it was clear that what animated their protest, first and foremost, was not a quest for democracy — although that was surely a huge factor. It was a quest for “justice.” Many Egyptians were convinced that they lived in a deeply unjust society where the game had been rigged by the Mubarak family and its crony capitalists. Egypt shows what happens when a country adopts free-market capitalism without developing real rule of law and institutions...

Demeter

(85,373 posts)....it seems as if the Obama administration has completely lost the plot in what was formerly called the 50 state attorney general negotiations, and that appears to have fed directly into the news today of meetings of a breakaway group interested in concrete results.

Remember that despite the successful effort of by the Feds to make the AG group the face of the effort, this drill is being quietly guided by the Administration (the DoJ, HUD, and other federal regulators are participating in the negotiations). A telling moment occurred when Iowa AG Tom Miller, the leader of the state AGs, practically fawned over then assistant Treasury secretary Michael Barr in Congressional hearings in late 2010.

When the talks started, it was clear that the Administration wanted to get the housing mess out of the headlines, based on the false premise that the use of enough cheap credit, regulatory forbearance (official speak for “extend and pretend”) plus some helpful-around-the-margins programs to distract the peasants, would allow the housing market to heal on its own. The evidence is overwhelmingly to the contrary. Housing credit is entirely dependent on government support, and there is not even a remote chance that this will change any time soon. The authorities are not only oblivious to the way servicers abuse investors, but New York Fed president William Dudley made it clear that he thinks it’s a great idea to reverse the creditor hierarchy and burn first mortgage investors to save second lien investors, who happen to be banks. And the supposedly helpful programs like HAMP turned out to be utter disasters.

But the most remarkable to see federal regulators do the equivalent of sticking fingers in their ears and yelling “Lalala” whenever the issue of servicer and foreclosure mill fraud comes up (they give servicing deficiencies plenty of lip service in testimony and speeches, but their actions convey a completely different message). As Michael Olenick discussed in a recent post, there is a massive overhang of shadow housing inventory. Buyers are reluctant to come into the market if they think (correctly in many locales) that prices have not bottomed. In states that for various reasons now have more teeth in foreclosure documentation requirements (New York, Nevada, and New Jersey), foreclosures have come to a near standstill. That’s a de facto admission that the parties representing creditors (almost always securities trusts) failed to live up to their promises to investors in the pooling & servicing agreements. It also raises the ugly likelihood that the borrower IOU, the note, never made it to the trust, but is in limbo earlier in the transfer chain.

So the Administration’s puppets, the cooperating attorneys general, have been engaged in truly bizarre negotiations. The banks know the real objective is to “reduce uncertainty” which is really “get possible sources of trouble neutralized”. AG suits can be very powerful, as Eliot Spitzer’s prosecutions of big corporate accounting abuses and dubious behavior by sell side analysts demonstrated. They change perceptions of what will be tolerated and also pave the way for private lawsuits. And as we’ve pointed out repeatedly, the banks keep asking for more and more at the negotiating table. That’s a bad faith bargaining strategy, one you pursue only if you are certain the other side is desperate to get a deal done. But the whole process has looked less and less plausible as the banks keep upping their demands and Tom Miller keeps saying, month after month, that a deal is mere weeks away....

Demeter

(85,373 posts)Hotler

(11,420 posts)bread_and_roses

(6,335 posts)... and I say this though I loath "Peanuts." (btw, Demeter, that's NOT a complaint - I don't expect to like every theme, likes and dislikes of any art form are, imho, purely idiosyncratic and so my dislike is not an aesthetic judgement, and besides, your title, "working for peanuts" is BRILLIANT).

http://www.alternet.org/economy/153722/mr._davidson%27s_planet%3A_npr_nyt_guru_adam_davidson%27s_discredited_economic_principles_/

Mr. Davidson's Planet: NPR/NYT Guru Adam Davidson's Discredited Economic Principles

Adam Davidson's economic principles are alien to a just and prosperous society.

January 10, 2012

You’d be hard-pressed to find a discipline that shapes our world more than economics, and yet none has weaker foundations or more misguided evangelists. The rise of economic guru du jour Adam Davidson, the co-founder of NPR’s “Planet Money” and columnist for the New York Times Magazine, is perhaps one of the most disturbing illustrations of this unfortunate fact.

... Mr. Davidson possesses gifts as a storyteller--gifts that make him very dangerous. As an economic observer, he commands an extremely powerful platform. Mr. Davidson wants to make us think that he’s one of us. You know, just a curious guy without formal training in economics who wants to know how things work. But in reality he is what we might call a “One Percent Whisperer”—a salesman for conservative economic philosophy who regurgitates ruinous myths that have led to policies that depress prosperity and chuck justice out the window. Take a quick look at the most recent example of his one percent apologia, “What Does Wall Street Really Do for You?” and you’ll get an idea of where he’s really coming from.

edit to try to use "link" feature which doesn't seem to be working - or I'm doing it wrong - anyway, added link manually

Demeter

(85,373 posts)Real estate in the Republic of Cyprus has been popular with foreigners who own about 100,000 homes—in a country with 803,000 people. The British alone, whose colony this was until 1960, own more than 60,000 homes. Turns out, real estate is Cyprus' national sport sponsored by dumb money. But now it has become a nightmare that is unraveling the finances not only of expat home owners, but also of developers, banks, and the government. Yet it's hushed up. By comparison, the banks' impending losses on Greek sovereign debt, significant as they are, seem outright manageable...."The most common mistake people make when buying property in Cyprus is to use a lawyer who has been introduced or recommended to them by a property developer," says Nigel Howarth who has helped foreign property buyers in Cyprus for more than 10 years. Foreign buyers are sitting ducks. They're unaware of the local business culture and don't suspect that their lawyers are in cahoots with developers--aided and abetted by the banks.

The country acceded to the Eurozone in 2008, but it's already in a heap of trouble. A recent loan agreement with Russia of €2.5 billion will keep it afloat for a few months into 2012. Then it's bailout and haircut time. On October 27, Standard & Poor's cut Cyprus to BBB. The big problem: exposure of its banks to Greek sovereign, corporate, and bank debt. But not a word about the title-deed scandal and the billions that evaporated with it.

As in the U.S., after years of speculative overbuilding, the real estate market is collapsing. Building permits are down 40.2% for the first eight months of the year and 49.4% for August. Home prices have dropped for six consecutive quarters, according to the Central Bank. The steepest declines were in the coastal regions favored by foreigners. Of the 45,000 unsold properties, many are unfinished, and some are essentially abandoned. The Cyprus Property News points out that they "were built for buy-to-flip investors and are unsuitable for permanent living."...Prices would have dropped even more steeply if the banks had dealt with their non-performing loans. But instead of pressuring developers to sell properties to service their loans, they're pressuring appraisers not to reduce values so that loans appear to be adequately secured....These kinds of issues have cropped up in the U.S. as well. What's unique in the collapsing housing bubble in Cyprus is a title-deed scandal of unimaginable proportions. And it has embroiled waves of foreign buyers. "The bulk of the problems stem from the archaic Ottoman land law still in existence in Cyprus which allows these dubious practices," writes the Cyprus Property Action Group. Insufficient industry regulation and lacking enforcement of consumer protection laws also play a role.

The scheme works this way: A developer takes out a mortgage on the land but hides it from foreign buyers. The bank retains the title deed as collateral. When the developer sells the property, the buyers' lawyer, who is in cahoots with the developer, doesn't perform a title search and doesn't "discover" the original mortgage. Buyers, assuming that their part of the property is free an clear, either pay cash or take out a mortgage. The developer pockets the money instead of paying off the original mortgage. The bank goes along because it can collect interest on one or two mortgages. But it retains the title deed as collateral for the original mortgage, and the buyer never sees it. Throughout, buyers are told by everyone, including the government, that a buyer of immovable property is absolutely protected once the sales contract is lodged with the Cyprus Land Registry, and that they don't need the title deed...

NICE WORK IF YOU CAN GET IT

Demeter

(85,373 posts)Standard & Poor’s downgraded the credit ratings of France and eight other European nations Friday, further weakening the region’s finances and potentially raising costs for governments at time when they already face a debt crisis. The downgrade robs France of its prized AAA rating, despite vows by the French government to defend its pristine standing through recent measures to cut spending and raise taxes....The downgrades will likely increase borrowing costs for the affected governments as they try to raise hundreds of billions of dollars on international bond markets this year. France alone needs to borrow about $240 billion to finance its existing debts and annual deficit. Italy and Spain, two large nations that are facing escalating debt problems, were also among the countries downgraded.

The S&P actions could also undermine the effectiveness of the region’s bailout fund, which European leaders have been counting on to help ailing countries such as Greece and stem the crisis from spreading onward to Italy and Spain. The bailout fund’s AAA rating, and its ability to raise money cheaply, depends in part on the credit standing of France, the euro zone’s second largest economy.

...Another top-rated country, Austria, lost its AAA rating. The ratings of Portugal, Cyprus, Malta, Slovakia and Slovenia also were downgraded...The downgrade of France by one notch brings its rating to the same level as that of the United States, which was stripped of its AAA rating by S&P in August amid concerns over Washington’s handling of the federal debt...

The ratings agency said its actions were based on concerns about weak economic conditions in the euro zone, coupled with what it judged as the “insufficient” steps taken by European leaders to address the situation. Despite a plethora of summits, declarations and bailout deals, Europe has “not produced a breakthrough of sufficient size and scope to fully address the euro zone’s financial problems,” the ratings agency concluded. Political leaders, the agency contended, did not even fully appreciate the scope of a crisis that extends far beyond overspending in small countries like Greece to encompass the competitiveness of the euro zone itself.

Demeter

(85,373 posts)...beleaguered Europeans can take some comfort: It could have been worse.

Investors had plenty of time to brace for the bad news. S&P put 15 countries, including Germany and France, on notice last month that they faced potential downgrades. The advance notice means the downgrades likely won’t panic financial markets and drive up European governments’ borrowing costs much higher than they already are.

“People knew it was coming, and it was only one rating agency,” said Marc Chandler, head of global currency strategy at Brown Brothers Harriman. Moody’s and Fitch Ratings have yet to follow S&P. Stocks fell Friday as downgrade rumors reached the trading floors of Europe and the United States. But the declines were nothing like the wrenching swings of last summer and fall, when the debt crisis threw the markets into turmoil.

When the news came Friday, it wasn’t as harsh as it might have been. S&P had threatened last month to knock France’s credit rating down two notches. Instead, it settled for one, demoting France to AA+, just where it put the U.S. credit rating in an August downgrade.

S&P spared Europe’s mightiest economy the indignity of a downgrade, leaving Germany with its AAA rating intact...

Tansy_Gold

(17,857 posts)The textbook for my high school third year Spanish class was titled Leer, Hablar, y Escribir (To Read, To Speak, and To Write), written by Elizabeth Keesee, Gregory G. LaGrone, and Patricia O'Connor and published by Holt, Rinehart and Winston (c) 1963.

Our teacher was the inimitable and irrepressible Charles C. Schlereth, occasionally and affectionately referred to (when he wasn't within hearing) as "Carlitos."

The textbook was structured into nine "issues" of a compiled magazine titled Leer, each issue to correspond with a month out of the typical school year. And each issue of this magazine contained the usual features one would find in such a publication -- articles, essays, news items, advertisements, sports, advice columns -- all of which had actually been published in Spanish and Latin American periodicals. One article was titled "Impressiones de un Estudiante Norteamericano Sobre América Latina" (Impressions of a North American Student about Latin America) and the student was Jeremiah Dodd, son of the late Senator Thomas J. Dodd and brother of Senator Christopher Dodd of Connecticut.

Our favorite part of each "magazine," of course, was the jokes page, which was complete each month with a strip of "Carlitos," aka Charlie Brown.

We "rented" our textbooks each year, but many years later, I happened to be visiting the high school and stopped to see my first and second year Spanish teacher, Mrs. Dietrich. (Why they both had German names, I have no earthly idea) By then Leer, Hablar y Escribir was no longer the current text, but she happened to have several old copies lying around and generously gave me one. I share a page with you all --

Demeter

(85,373 posts)There’s the top 1% of wealthy Americans (bankers, oil tycoons, hedge fund managers) and there’s the top 0.01% of wealthy Americans: the military contractor CEOs.

If you’ve been following the War Costs campaign, you already know that these corporations are bad bosses, bad job creators and bad stewards of taxpayer dollars. What you may not know is that the huge amount of money these companies’ CEOs make off of war and your tax dollars places them squarely at the top of the gang of corrupt superrich choking our democracy. These CEOs want you to believe the massive war budget is about security — it’s not. The lobbying they’re doing to keep the war budget intact at the expense of the social safety net is purely about their greed.

In many areas, including yearly CEO salary and in dollars spent corrupting Congress, these companies are far greater offenders than even the big banks like JP Morgan Chase or Bank of America....MORE

Demeter

(85,373 posts)The world economy is entering a new phase, in which achieving global cooperation will become increasingly difficult. The United States and the European Union, now burdened by high debt and low growth – and therefore preoccupied with domestic concerns – are no longer able to set global rules and expect others to fall into line.

Compounding this trend, rising powers such as China and India place great value on national sovereignty and non-interference in domestic affairs. This makes them unwilling to submit to international rules (or to demand that others comply with such rules) – and thus unlikely to invest in multilateral institutions, as the US did in the aftermath of World War II...

..............................................

Economic policies come in roughly four variants. At one extreme are domestic policies that create no (or very few) spillovers across national borders. Education policies, for example, require no international agreement and can be safely left to domestic policymakers.

At the other extreme are policies that implicate the “global commons”: the outcome for each country is determined not by domestic policies, but by (the sum total of) other countries’ policies. Greenhouse-gas emissions are the archetypal case. In such policy domains, there is a strong case for establishing binding global rules, since each country, left to its own devices, has an interest in neglecting its share of the upkeep of the global commons. Failure to reach global agreement would condemn all to collective disaster.

Between the extremes are two other types of policies that create spillovers, but that need to be treated differently. First, there are “beggar-thy-neighbor” policies, whereby a country derives an economic benefit at the expense of other countries. For example, its leaders restrict the supply of a natural resource in order to drive up its price on world markets, or pursue mercantilist policies in the form of large trade surpluses, especially in the presence of unemployment and excess capacity. Because beggar-thy-neighbor policies create benefits by imposing costs on others, they, too, need to be regulated at the international level. This is the strongest argument for subjecting China’s currency policies or large macroeconomic imbalances like Germany’s trade surplus to greater global discipline than currently exists.

Beggar-thy-neighbor policies must be distinguished from what could be called “beggar thyself” policies, whose economic costs are borne primarily at home, though they might affect others as well. Consider agricultural subsidies, bans on genetically modified organisms, or lax financial regulation. While these policies might impose costs on other countries, they are deployed not to extract advantages from them, but because other domestic-policy motives – such as distributional, administrative, or public-health concerns – prevail over the objective of economic efficiency. The case for global discipline is quite a bit weaker with beggar-thyself policies. After all, it should not be up to the “global community” to tell individual countries how they ought to weight competing goals. Imposing costs on other countries is not, by itself, a cause for global regulation. (Indeed, economists hardly complain when a country’s trade liberalization harms competitors.) Democracies, in particular, ought to be allowed to make their own “mistakes.”

Of course, there is no guarantee that domestic policies accurately reflect societal demands; even democracies are frequently taken hostage by special interests...

Demeter

(85,373 posts)Demeter

(85,373 posts)because THIS is the theme song for our crack economic leadership team!

(the tag line should be: LUCY: "What happened to your kite, Charlie Brown? It looks like it ran into a brick wall! HAHAHAH!)

Demeter

(85,373 posts)Though the recession has thinned the ranks of other generations in the workforce, more people older than 55 are employed than ever before, according to the latest figures from the Bureau of Labor Statistics.

The reasons for the surge of older workers are complex, experts said, but one of the primary economic forces behind it is the growing fear among older Americans that they lack the means to support their retirement needs. The phenomenon is closely linked to the broad shift in the United States that began in the ’80s away from reliance on company pensions toward the adoption of 401(k) plans and other personal savings. That shift in retirement financing, combined with the recession, has dramatically increased the incentives to work into old age and appears to be reshaping how Americans ride out the latter part of their lives.

Like it or not, millions of graying Americans, some past 75 years old, are rejoining the workforce or staying in it longer than once might have been expected...The number of people older than 55 who are working has actually risen by 3.1 million, or 12 percent, since the beginning of the recession, according to the latest figures from the Bureau of Labor Statistics. The phenomenon extends even to people 75 years and older; there are more of them working today than before the recession, too. By contrast, the number of people between the ages of 25 and 54 who are working has shrunk by 6.5 million, for a drop of 6.5 percent...

“Fear is a wonderful motivator,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “Some of these people are just clinging by their fingernails to jobs.”

Tansy_Gold

(17,857 posts)I'd venture to guess that many of those who have left the workforce -- voluntarily or not -- and are returning to it are working low-wage jobs so as not to endanger social security benefits. That's a very different scenario than those who simply remain in their positions past opportunites for "early" or even "normal" retirement.

And many, of course, will never be able to retire at all.

Demeter

(85,373 posts)A European Union embargo on imports of Iranian oil will probably be delayed for six months to let countries such as Greece, Italy and Spain find alternative supplies, two EU officials with knowledge of the talks said. The embargo, which would need to be accepted by the 27- nation bloc’s foreign ministers on Jan. 23, is also likely to include an exemption for Italy, so crude can be sold to pay off debts to Rome-based Eni SpA, Italy’s largest oil company, according to the officials, who declined to be identified because the talks are private.

A ban on petrochemical products would start sooner, about three months after EU ministers agree to the measure, one official said yesterday. Once a decision is made, member states would be barred from concluding new oil contracts with Iran or renewing those that are due to expire, while existing deals will be terminated within six months, according to a second diplomat today. Long-term contracts constitute the bulk of Europe’s purchases of Iranian oil.

“Work by experts from the 27 member states is in a very intensive phase,” Maja Kocijancic, a spokeswoman for the European Commission, said by phone yesterday from Brussels. “They are looking into different options for restrictive measures with a view to adoption on Jan. 23.” She declined to comment on possible phase-in periods or exemptions.

Crude prices dropped on the news, falling 1.8 percent to $99.10 a barrel yesterday on the New York Mercantile Exchange, the lowest settlement since Dec. 30. Oil was at $98.22 today...

Demeter

(85,373 posts)The latest round of American sanctions are aimed at shutting down Iran's central bank, a senior US official said Thursday, spelling out that intention directly for the first time. "We do need to close down the Central Bank of Iran (CBI)," the official told reporters on condition of anonymity, while adding that the United States is moving quickly to implement the sanctions, signed into law last month. IS THAT YOU, TIMMY? WHO ELSE WOULD HAVE THE GALL?

The sanctions, broadly aimed at forcing Tehran to shift course on its nuclear program, targeted Iran's crucial oil sector and required foreign firms to make a choice between doing business with Iran or the United States. Foreign central banks that deal with the Iranian central bank on oil transactions could also face similar restrictions under the new law, which has sparked fears of damage to US ties with nations like Russia and China. "If a correspondent bank of a US bank wants to do business with us and they're doing business with CBI or other designated Iranian banks... then they're going to get in trouble with us," the US official said.

The measures were contained in a mammoth $662 billion defense bill, which President Barak Obama signed on December 31 at a time of rising tension with Tehran, which has threatened to block the Strait of Hormuz -- through which more than a third of the world's tanker-borne oil passes. The United States has warned it will "not tolerate" such an interruption.

There are fears that increased sanctions on Iran's central bank could force the global price of oil to suddenly soar, and actually give Tehran a financial windfall on its existing oil sales. Rising oil prices could also crimp the fragile economic recovery in the United States and inflict pain on American voters in gas stations -- at a time when Obama is running for reelection next year...

THEY ARE ALL INSANE AND RABID

Demeter

(85,373 posts)Federal Reserve chairman Ben Bernanke wants US taxpayers to purchase more of the garbage loans and mortgage-backed securities (MBS) that the big banks still have on their books. (Cash for trash) That’s the impetus behind the Fed’s 26-page white paper that was delivered to Congress last Wednesday. The document outlines the Fed’s plan for ‘stabilizing the housing market’, which is a phrase that Bernanke employs when he wants to provide more buy-backs, giveaways, subsidies and other corporate welfare to big finance. “Restoring the health of the housing market is a necessary part of a broader strategy for economic recovery,” Bernanke opined in a letter to the Senate Banking and House Financial Services committees. Indeed. The housing depression continues into its 5th year with no end in sight, mainly because the people who created the crisis are still in positions of power. And, they’re still offering the same remedies, too, like handing the banks another blank check to save them from losses on their bad bets. That’s what this new “housing stabilization” boondoggle is really all about, bailing out the bankers. Here’s a summary from Bloomberg:

“Bernanke’s Fed study said “more might be done,” including eliminating entirely the reduced fees for risky loans, “more comprehensively” cutting lenders’ put-back risks; and further streamlining refinancing for other Fannie Mae and Freddie Mac borrowers. The U.S. also should consider having Fannie Mae and Freddie Mac refinance loans not already backed by the government, which would add credit risk for the companies, according to the report….” (Bloomberg)

First of all, Fannie and Freddie only return loans (“put-backs”) that don’t meet their standards and which the banks foisted on them so they wouldn’t have to face the losses. The idea that the publicly-funded GSE’s should just “eat the losses” is ridiculous. And, why–in heaven’s name–would congress want to take on more risk when they can keep millions of people in their homes by simply reducing the principle on their mortgages to the present value of the house? (aka–”Cramdowns”) Naturally, the losses would have to be absorbed by the banks who–by everyone’s admission–were responsible for the present crisis due to their lax lending standards and, oftentimes, fraudulent behavior. This would lead to a restructuring of the country’s biggest banks through a Resolution Trust Corporation (RTC) so their toxic assets and backlog of foreclosed properties can be auctioned off as soon as possible. This is a straightforward way to fix the housing market and it should have been done long ago. Bernanke’s solution is not only unreasonable, it’s also deceitful. Here’s more from the Fed’s paper: “Continued weakness in the housing market poses a significant barrier to a more vigorous economic recovery”..(without action)…“the adjustment process will take longer and incur more deadweight losses, pushing house prices lower and thereby prolonging the downward pressure on the wealth of current homeowners and the resultant drag on the economy at large.”

Did it really take Bernanke 5 years to figure out that housing is a “drag on the economy”?

No, of course not. So, what’s going on now that has suddenly spurred him to act?

Well, for one thing, the banks are losing a great deal of money on the mortgage-backed securities (MBS) that they bought in the last few years. Here’s the story in the Wall Street Journal:

“After flickering to life early in 2011, the market for subprime- and other risky residential-mortgage bonds has returned to its comatose state. And many investors believe a revival could be years away.

Prices on some bonds, which are backed by mortgages that don’t meet the standards needed to get backing from government-controlled companies like Fannie Mae and Freddie Mac, plummeted as much as 30% last year. The ABX, an index that tracks the value of subprime bonds, ended the year at 43.44 cents on the dollar, down from 59.90 cents at year-end 2010 and a peak of 62.68 cents in February 2011

While that decline pushed yields up to as much as 17%—bond yields rise as prices fall—many fund managers have pulled out of the market due to worries about further price declines. Moreover, repeated downgrades have left too few investment-grade securities for them to own. Wall Street banks, which traditionally have played a key role in the market matching buyers and sellers, are backing away ahead of new regulations that will make it more expensive to hold riskier assets.” (Investors Sour on Subprime Bonds, WSJ)

So, Wall Street’s financial geniuses got back into the MBS-biz (for a second time) and got whacked again? That’s right; and now they want John Q. Public to pay for it with another bailout. And, there’s more to this story, too. European banks own roughly $100 billion of these mortgage-backed turkeys which they’re presently shedding like crazy in order to meet new capital requirements. That means US bank balance sheets are dripping red as the value of their financial asset-stockpile continues to plunge. That’s why Sugar Daddy Bernanke has stepped in, because it’s time for another multi-billion dollar bank rescue...Look, the Fed has already purchased over $1.25 trillion of these toxic MBS which represents humongous long-term losses for the taxpayer. Do we really need more of this sludge?