Economy

Related: About this forumWeekend Economists Take a Chance and Call a Bluff July 26-28, 2013

As promised, we are exploring games of chance this Weekend: Poker, Bingo, Roulette, Financial Markets...Elections, etc.

From Wikipedia, the free encyclopedia

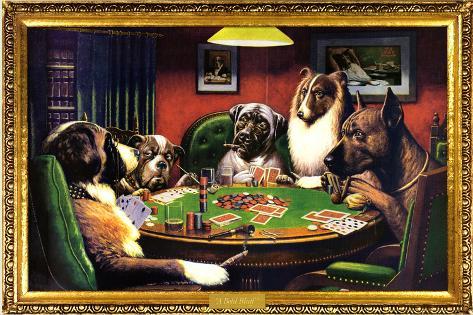

Dogs Playing Poker refers collectively to a series of sixteen oil paintings by C. M. Coolidge, commissioned in 1903 by Brown & Bigelow to advertise cigars. All the paintings in the series feature anthropomorphized dogs, but the nine in which dogs are seated around a card table have become derisively well known in the United States as examples of mainly working-class taste in home decoration. Critic Annette Ferrara describes Dogs Playing Poker as "indelibly burned into ... the American collective-schlock subconscious ... through incessant reproduction on all manner of pop ephemera."

Yes, Wikipedia has a listing for it....there's more detail there, too!

And then, there are the humans....

Most people have no idea what it takes to play poker for a living.

Before deciding to choose this path, let me warn you of the disadvantages first. Poker has many benefits, but it also has many negative consequences that come with playing long hours. This guide will allow you to make the right decision by learning from someone who actually plays for a living.

Poker for a Living

The first thing you need to play any game for a living is patience. Playing every day, all day, can get extremely tiring. Staring at a computer screen for hours on end can literally drive you insane. In addition, your fortunes online are prone to wild swings. You will occasionally sit down at a table and not get any cards for hours. Be prepared to take the worst beats of your life along with huge runs that will make your bankroll soar.

Playing for a living requires extreme mental discipline and a steady game plan. It's a good idea to record how many hours you play each day and what your total profit for the day is. Do this for a month or two before you make the switch to becoming a full-time player. This will allow you to analyze your play and find out how much you make on average.

Drawbacks of Playing Poker for a Living

1. No set income: Some months you'll actually experience a loss in total earnings. You must be able to cope with this and still have the confidence you need to win. You'll encounter some horrible runs along the way so be prepared.

2. Exhaustion: You'll constantly be tired if you're playing all day. If you're playing really high limits, you may not have to play all day to make a living. The fact is that most of us will need to grind it out all day to pay rent and bills and buy food.

3. Reduced family time: Since you must make your money playing poker, you'll tend to spend less time with your family. When a good poker player encounters a bad run, he or she will grind it out until they prevail. This may call for some extremely long hours of play. Be prepared to play poker at any time. On losing months you'll need to spend even more time on the computer or at the casino.

Advantages of Playing Poker for a Living

There are many advantages that help balance out playing poker for a living. I love that you get to choose your own hours to work on any day you wish. You can take off as many days as you want and never be hassled to wake up at 8 a.m. - or, god forbid, earlier. You'll also be playing one of the most intriguing games in the world for money. Who could ask for more? It's a great lifestyle if you're a winning player.

The fact is, most people can't handle the swings that are unavoidable in full-time play. Every time you sit at the table you must change your personality and play with ice water in your veins. When you take a bad beat, you can't let it affect you. You must deal with the swings on a regular basis. You must also be a dedicated soul who will play even when the cards aren't going your way. You must be a very disciplined and winning poker player to play for a living.

I hope this article hasn't discouraged you if you have dreams of playing professionally. If you believe you can do it, you'll buy every book and read everything you can get your hands on to become a winning player.

See you at the tables.

Demeter

(85,373 posts)I'm betting we won't have one tonight....any takers?

bread_and_roses

(6,335 posts)... though the horse-racing version of cognoscenti will tell you that they "handicap" - which means IMHO "educated" as opposed to "uneducated" guesses - but still guesses, horses being the marvelously unpredictable creatures they are ![]()

I'll try to get back - am not likely to have too much to contribute, not being a gamer myself .... I have to get over the impulse to go looking for "Critic Annette Ferrara " to tell her what I think of her snobbery.

Meanwhile, I'm exhausted from following the world - and esp the ecosystem - going to hell in a fast handbasket ....

back later, I hope

bread_and_roses

(6,335 posts)As Detroit Drowns, GOP says: 'Bailouts For Banks, Not People'

With fangs out, Republicans push to codify national abandonment of the city

- Sarah Lazare, staff writer

The Obama administration is making no sign of helping Detroit as its emergency manager and republican governor steer the city towards bankruptcy proceedings.

Yet, that is not enough assurance for some in the GOP who are pushing for passage of a law explicitly banning the bailout of Detroit, and any other municipality for that matter.

At least five republican senators have recently proposed tacking language onto spending bills that would broadly prohibit municipal bailouts.

These proposed measures, which would have far-reaching implications for towns and cities across the US if passed, are aimed towards preventing any federal aid to Detroit.

GOP leaders are attacking the city with notable venom at the moment its 700,000 residents—80 percent of whom are African-American—must contend with deepening crises of poverty and privatization.

I think it was in 2009 that the AFL-CIO was part of a movement calling to "Make the Banks Pay." I have said for years we should have just stuck with that, not moved on to the next campaign, electoral politics, or anything else. No, it didn't catch fire right away ...we had our usual little "actions" and then went on to the next thing .... but that was and is the crux of the matter.

Instead, we GAMBLED on another election ..... and we see where that went (for instance, note the first sentence of the article)

bread_and_roses

(6,335 posts)Published on Thursday, July 25, 2013 by The Nation

No More Second Chances for Larry Summers

by William Greider

Among his other outstanding attributes, Lawrence Summers is perhaps most distinguished by his mendacity. ...

“How can I say this nicely?” I wrote. “Larry Summers is a clumsy public liar. His noxious, condescending manner helps explain why he failed as president of Harvard. But it is the crude mendacity that ought to bother people now. The man is President Obama’s top economic adviser.”

I ticked off some of the self-serving lies he told to cover up his own role in destabilizing the financial system when he was Treasury secretary in the Clinton administration—when he personally blocked tougher regulation on the financial time bombs known as derivatives, when he collaborated with Republicans and the Federal Reserve in dismantling Glass-Steagall and other New Deal protections ...

... the White House propagandists are pushing hard to make Larry Summers the next Federal Reserve chairman. If Obama makes that choice, Wall Street wins again. Summers is their candidate and at home in their money culture. As Fed chair, he would become their main watchdog .

If so, this will be a sick joke on us hopeful voters who re-elected the president last fall.

bread_and_roses

(6,335 posts)AlterNet / By Kristen Gwynne

July 26, 2013 |

Hasbro's classic board game Monopoly has eliminated its jail space [3], freeing up time for young players more interested in what the company is calling "snack toys." Interestingly, Monopoly's doing away with "jail" can also be interpreted as a statement on the state of the American economy. As John Oliver hilariously pointed out last night on the Daily Show, "The game designed to teach children how capitalism works has removed the 'go to jail option' to reflect the financial system they're going to grow up in, presumably replacing it with a 'get bailed out by congress and then go directly to the cayman islands option.'"

“Goldman can bet on the future price of aluminum while simultaneously having the ability to goose the future price of aluminum if that’s something they’d find interesting or profitable,” he said, “In the stock market, that’s what known as insider trading. In the commodities market, that’s known as simply Thursday — or Monday or Tuesday or Friday or Wednesday.”

Like I said ... a sure thing

Demeter

(85,373 posts)Esp. this one, which is so ironic, it makes my teeth hurt....

Demeter

(85,373 posts)WHAT CAN I SAY? FRIEDMAN LIVES IN ANOTHER WORLD...

http://www.nytimes.com/2013/07/21/opinion/sunday/friedman-welcome-to-the-sharing-economy.html?pagewanted=2&pagewanted=all

IT all started with air mattresses.

Brian Chesky’s parents wanted just one thing for him when he graduated from the Rhode Island School of Design — that he get a job with health insurance. He tried that for a while with a design firm in Los Angeles, but he got fed up and packed up his Honda Civic and drove up to San Francisco to crash with his pal, Joe Gebbia, who agreed to split the rental of his house with Chesky. “Unfortunately, my share came to $1,150 and I only had $1,000 in the bank, so I had a math problem — and I was unemployed,” said Chesky. But they did have an idea. The week Chesky got to town, in October 2007, San Francisco was hosting the Industrial Designers Society of America, and all the hotel rooms on the conference Web site were sold out. So Chesky and Gebbia decided, why not turn their house into a bed and breakfast for attendees?

The problem was “we had no beds,” but Gebbia did have three air mattresses. “So we inflated them and called ourselves ‘Airbed and Breakfast,’ ” Chesky, 31, recalled for me in an interview. “Three people stayed with us, and we charged them $80 a night. We also made breakfast for them and became their local guides.” In the process, they made enough money to cover the rent. More important, though, it spawned a bigger idea that has since blossomed into a multimillion-dollar company and a whole new way for people to make money. The idea was to create a global network through which anyone anywhere could rent a spare room in their home to earn cash. In homage to its roots, they called the company Airbnb, which has grown so large, so fast that it is now the equivalent of a major global hotel chain — even though, unlike Hilton, it doesn’t own a single bed. And the new trend it set off is the “sharing economy.”

I first heard Chesky describe his company two years ago and thought it was a quaint idea that would find limited traction with niche travelers. I mean, how many people in Paris really want to rent out their kid’s bedroom down the hall to a perfect stranger who comes to them via the Internet? And how many strangers want to be down the hall? Wrong. Turns out there is an innkeeper residing in all of us! On July 12, Chesky told me, “Tonight we have 140,000 people around the world staying in Airbnb rooms. Hilton has around 600,000 rooms. We will get up to 200,000 people per night by peak this summer.” Airbnb has 23,000 rooms and homes listed in New York City alone, and 24,000 in Paris. Worldwide, “we have listings in 34,000 cities and 192 countries,” added Chesky. “We are the largest short-term rental site of its kind in China today, and we have no office there.”

Chesky then fires up his iPad and shows me on Airbnb.com the rooms and homes being offered for rent: “We have over 600 castles,” he begins. “We have dozens of yurts, caves, tepees with TVs in them, water towers, motor homes, private islands, glass houses, lighthouses, igloos with Wi-Fi; we have a home that Jim Morrison used to live in; we have treehouses — hundreds of treehouses — which are the most profitable listings on our Web site per square footage. The treehouse in Lincoln, Vt., is more valuable than the main house. We have treehouses in Vermont that have had six-month waiting lists. People plan their vacation now around treehouse availability!” In 2011, Prince Hans-Adam II offered his entire principality of Liechtenstein for rent on Airbnb ($70,000 a night), “complete with customized street signs and temporary currency,” The Guardian reported. You can rent any number of Frank Lloyd Wright homes — and even a one-square-meter house in Berlin that goes for $13 a night.

While it sounds like Chesky is just a global rental agent with more scale, there is something much bigger going on here. Airbnb’s real innovation is not online rentals. It’s “trust.” It created a framework of trust that has made tens of thousands of people comfortable renting rooms in their homes to strangers...In a world where, as I’ve argued, average is over — the skills required for any good job keep rising — a lot of people who might not be able to acquire those skills can still earn a good living now by building their own branded reputations, whether it is to rent their kids’ rooms, their cars or their power tools. “There are 80 million power drills in America that are used an average of 13 minutes,” says Chesky. “Does everyone really need their own drill?”...More than 50 percent of Airbnb hosts depend on it to pay their rent or mortgage today, Chesky added: “Ordinary people can now be micro-entrepreneurs.” Jamie Wong, co-founder of Vayable.com, a platform through which locals anywhere can become custom tour guides of their area, told me: “I moved out of my apartment in central San Francisco, rented a cheaper annex in a friend’s home, and ‘airbnb-ed’ my apartment for $200 a night and earned about $20,000 in a year. It enabled me to bootstrap my start-up. Airbnb was our first round of funding!” And just think how much better all this is for the environment — for people to be renting their spare bedrooms rather than building another Holiday Inn and another and another. ... The sharing economy — watch this space. This is powerful.

A RENTIER BY ANY OTHER NAME WOULD BE AS USELESS AND NON-PRODUCTIVE...

EVEN A SURROGATE MOTHER PROVIDES A SERVICE OF GREATER VALUE....HOW IS THIS DIFFERENT FROM PROSTITUTION?

Demeter

(85,373 posts)The Mensa AG held in Detroit a couple years ago.

He looked exhausted, as if he hadn't had enough sleep for YEARS. He had a very unique outlook on life....rather detached from most of it.

Can one be a "real person" if one is living as an addict? I think back upon Maslow's pyramid of last Weekend's topic. Perhaps well-rounded, balanced, "self-actualized" people are an extinct species, or at least, endangered. But then, such is the case for a people at war, and we are at war, even if it was never "officially" declared. And the enemy, that's US: anyone who thinks that war on a nation's principles is more threatening than an invasion from without.

An outside invasion has a definite enemy, and a definite game plan and goal. You know when you have won: the borders are secure, nobody's getting shot up, regular life can resume.

How will we know when the "unofficial" war on the 99%, the people with integrity, the producers, is over?

Perhaps, when every last "useless eater," each parasitical 1% Elitist is hanging from a lamp post, and there's a wealth barrier to public office...you'd have to be no more than median in wealth to hold a government job, and not on anybody's bribe list.

For good measure, I'd confiscate all charitable foundations, too. That money was stolen from the 99% and should go into the public coffers to provide single payer universal health care and Social Security that covers everyone at a level of survival (at least poverty, and preferably median income). There are old people living on $800/ month social security, because they were cheated all their working lives. So, they can live in Section 8 housing, and food stamps, and poverty-subsidized phone and electric (maybe) and Medicaid (maybe).

Would it not be better for us all if that minimum standard of support were a little bit higher?

Demeter

(85,373 posts)Shocking 'Extermination' Fantasies By the People Running America's Empire on Full Display at Aspen Summit

http://www.alternet.org/tea-party-and-right/shocking-extermination-fantasies-people-running-americas-empire-full-display?akid=10733.227380.kAl4eN&rd=1&src=newsletter874206&t=4&paging=off

Seated on a stool before an audience packed with spooks, lawmakers, lawyers and mercenaries, CNN’s Wolf Blitzer introduced recently retired CENTCOM chief General James Mattis. “I’ve worked with him and I’ve worked with his predecessors,” Blitzer said of Mattis. “I know how hard it is to run an operation like this.” Reminding the crowd that CENTCOM is “really, really important,” Blitzer urged them to celebrate Mattis: “Let’s give the general a round of applause.” Following the gales of cheering that resounded from the room, Mattis, the gruff 40-year Marine veteran who once volunteered his opinion that “it’s fun to shoot some people,” outlined the challenge ahead. The “war on terror” that began on 9/11 has no discernable end, he said, likening it to the “the constant skirmishing between the US cavalry and the Indians” during the genocidal Indian Wars of the 19th century.

“The skirmishing will go on likely for a generation,” Mattis declared.

Mattis’ remarks, made beside a cable news personality who acted more like a sidekick than a journalist, set the tone for the entire 2013 Aspen Security Forum this July. A project of the Aspen Institute, the Security Forum brought together the key figures behind America’s vast national security state, from military chieftains like Mattis to embattled National Security Agency Chief General Keith Alexander to top FBI and CIA officials, along with the bookish functionaries attempting to establish legal groundwork for expanding the war on terror. Partisan lines and ideological disagreements faded away inside the darkened conference hall, as a parade of American securitocrats from administrations both past and present appeared on stage to defend endless global warfare and total information awareness while uniting in a single voice of condemnation against a single whistleblower bunkered inside the waiting room of Moscow International Airport: Edward Snowden.

With perhaps one notable exception, none of the high-flying reporters junketed to Aspen to act as interlocutors seemed terribly interested in interrogating the logic of the war on terror. The spectacle was a perfect window into the world of access journalism, with media professionals brown-nosing national security elites committed to secrecy and surveillance, avoiding overly adversarial questions but making sure to ask the requisite question about how much Snowden has caused terrorists to change their behavior. Jeff Harris, the communications director for the Aspen Institute, did not respond to questions I submitted about whether the journalists who participated in the Security Forum accepted fees. (It is likely that all relied on Aspen to at least cover lodging and travel costs). CNN sponsored the forum through a special new website called CNN Security Clearance, promoting the event through Twitter and specially commissioned op-eds from participating national security figures like former CIA director John McLaughlin. Another forum sponsor was Academi, the private mercenary corporation formerly known as Blackwater. In fact, Academi is Blackwater’s third incarnation (it was first renamed “Xe”) since revelations of widespread human rights abuses and possible war crimes in Iraq and Afghanistan threw the mercenary firm into full damage control mode. The Aspen Institute did not respond to my questions about whether accepting sponsorship from such an unsavory entity fit within its ethical guidelines.

'Exterminating People'

John Ashcroft, the former Attorney General who prosecuted the war on terror under the administration of George W. Bush, appeared at Aspen as a board member of Academi. Responding to a question about U.S. over-reliance on the “kinetic” approach of drone strikes and special forces, Ashcroft reminded the audience that the U.S. also likes to torture terror suspects, not just “exterminate” them. “It's not true that we have relied solely on the kinetic option,” Ashcroft insisted. “We wouldn't have so many detainees if we'd relied on the ability to exterminate people…We've had a blended and nuanced approach and for the guy who's on the other end of a Hellfire missile he doesn't see that as a nuance.” Hearty laughs erupted from the crowd and fellow panelists. With a broad smile on her face, moderator Catherine Herridge of Fox News joked to Ashcroft, “You have a way with words.” But Ashcroft was not done. He proceeded to boast about the pain inflicted on detainees during long CIA torture sessions: “And maybe there are people who wish they were on the end of one of those missiles.”

Competing with Ashcroft for the High Authoritarian prize was former NSA chief Michael Hayden, who emphasized the importance of Obama’s drone assassinations, at least in countries the U.S. has deemed to be Al Qaeda havens. “Here's the strategic question,” Hayden said. “People in Pakistan? I think that's very clear. Kill 'em. People in Yemen? The same. Kill 'em.”...“We don’t smoke drug cartel leaders but personally I’d support it,” remarked Philip Mudd, the former deputy director of Bush’s Counterterrorism Center, earning more guffaws from his fellow panelists and from Herridge. Ironically, Mudd was attempting to argue that counter-terror should no longer be a top U.S. security priority because it poses less of a threat to Americans than synthetic drugs and child obesity. Reflection was not on the agenda for most of the Security Forum’s participants. When asked by a former US ambassador to Denmark the seminal question “This is a great country, why are we always the bad guy?,” Mudd replied, “They think that anything the U.S. does in the Middle East, even though we helped Muslim communities in Bosnia and Kuwait, everything is rewritten to make us the bad guys.” The clamoring about U.S. invasions, drone strikes, bankrolling of Israel’s occupation, and general political meddling, could all be written off as fevered anti-Americanism borne from the desert canyons of the paranoid Arab mind.

And the wars could go on.

Delusions of Empire

Throughout the three days of the Security Forum, the almost uniformly white cast of speakers were called on to discuss recent geopolitical developments, from "Eye-rak" and "Eye-ran" to Egypt, where a military coup had just toppled the first elected government in the country’s history. Mattis carefully toed the line of the Obama administration, describing the overthrow of Egypt’s government not as a coup, but as “military muscle saddled on top of this popular uprising.” Warning that using terms like “coup” could lead to a reduction in U.S. aid to Egypt, where the military controls about one-third of the country’s economy, Mattis warned, “We have to be very careful about passing laws with certain words when the reality of the world won’t allow you to.”...Wolf Blitzer mentioned that Egypt’s new military-imposed foreign minister, Nabil Fahmy, had been a fixture in Washington during the Mubarak days. “These are people the West knows, the U.S. knows,” he said of the new cabinet in Cairo. “I assume from the U.S. perspective, the United States is so much more happy with this.”

............................

While participants in the Security Forum expressed total confidence in American empire, they could not contain their panic, outrage, and fear at the mere mention of Snowden. “Make no mistake about it: These are great people who we’re slamming and tarnishing and it’s wrong. They’re the heroes, not this other and these leakers!” NSA chief General Keith Alexander proclaimed, earning raucous applause from the crowd. Snowden’s leaks had prompted a rare public appearance from Alexander, forcing the normally imperious spy chief into the spotlight to defend his agency’s Panopticon-style programs and its dubious mechanisms of legal review. Fortunately for him, NBC’s Pete Williams offered him the opportunity to lash out at Snowden and the media that reported the leaks, asking whether the "terrorists” (who presumably already knew they were being spied on) had changed their behavior as a result of the leaks.

“We have concrete proof that terrorists are taking action, making changes, and it’s gonna make our job harder,” Alexander declared, offering nothing to support his claim. Alexander appeared in full military regalia, with colorful decorations and medallions covering his left breast. Casting himself as a stern but caring father who has the best interests of all Americans at heart, even if he can't fully disclose his methods, he turned to the crowd and explained, “The bad guys…hide amongst us to kill our people. Our job is to stop them without impacting your civil liberties and privacy and these programs are set up to do that....The reason we use secrecy is not to hide it from the American people, but to hide it from the people who walk among you and are trying to kill you,” Alexander insisted. Corporations like AT&T, Google and Microsoft that had been compelled to hand over customer data to the NSA “know that we’re saving lives,” the general claimed. With a straight face, he continued, “And that’s good for business because there’s more people out there who can buy their products.”

...During a panel on inter-agency coordination of counter-terror efforts, Mike Leiter, the former director of the National Counterterrorism Center (NCC), suggested that one of the best means of preserving America’s vast and constantly expanding spying apparatus was “by reinstituting faith among the public in our oversight...”

“Just seeing us here,” he said, “that inspires [public] confidence, because we’re not a bunch of ogres.”

![]() APPLY FREELY

APPLY FREELY

Max Blumenthal is the author of Republican Gomorrah (Basic/Nation Books, 2009). Twitter at @MaxBlumenthal.

AND THERE'S SO MUCH I CUT!

Demeter

(85,373 posts)The American people have suffered a coup d’etat, but they are hesitant to acknowledge it. The regime ruling in Washington today lacks constitutional and legal legitimacy. Americans are ruled by usurpers who claim that the executive branch is above the law and that the US Constitution is a mere “scrap of paper.” ...An unconstitutional government is an illegitimate government. The oath of allegiance requires defense of the Constitution “against all enemies, foreign and domestic.” As the Founding Fathers made clear, the main enemy of the Constitution is the government itself. Power does not like to be bound and tied down and constantly works to free itself from constraints. The basis of the regime in Washington is nothing but usurped power. The Obama Regime, like the Bush/Cheney Regime, has no legitimacy. Americans are oppressed by an illegitimate government ruling not by law and the Constitution, but by lies and naked force. Those in government see the US Constitution as a “chain that binds our hands.”

The South African apartheid regime was more legitimate than the regime in Washington. The apartheid Israeli regime in Palestine is more legitimate. The Taliban are more legitimate. Muammar Gaddafi and Saddam Hussein were more legitimate.

The only constitutional protection that the Bush/Obama regime has left standing is the Second Amendment, a meaningless amendment considering the disparity in arms between Washington and what is permitted to the citizenry. No citizen standing with a rifle can protect himself and his family from one of the Department of Homeland Security’s 2,700 tanks, or from a drone, or from a heavily armed SWAT force in body armor.

...The executive branch coup against America has succeeded. The question is: will it stand? Today, the executive branch consists of liars, criminals, and traitors. The evil on earth seems concentrated in Washington. Washington’s response to Edward Snowden’s evidence that Washington, in total contravention of law both domestic and international, is spying on the entire world has demonstrated to every country that Washington places the pleasure of revenge above law and human rights...

MORE

Demeter

(85,373 posts)One of the major conflicts of the era that is not often highlighted for public debate is whether we want an economy that privatizes government services and public resources and continues to concentrate wealth; or whether we want to develop an economic democracy that invests in the public interest and creates shared prosperity.

Journalist Ted Koppel summarized the privatization trend: “We are privatizing ourselves into one disaster after another…. We’ve privatized a lot of what our military is doing. We’ve privatized a lot of what our intelligence agencies are doing. We’ve privatized our very prison system in many parts of the country. We’re privatizing the health system within those prisons. And it’s not working well.” The alternative, also growing rapidly albeit more quietly without corporate media coverage, is economic democracy. This is based on new models that give people greater control over their economic lives, share wealth in an egalitarian way and allow more influence over the direction of the economy.

We will delve into many of these alternatives in detail in the Economic Democracy Track at the Democracy Convention in Madison, WI from August 7 to August 11. Presenters who are deeply involved in their subjects will speak about big picture topics such as what money is, ending debt and creating a new economy to more hands-on topics such as creating socially-responsible businesses, alternative currencies, affordable housing, public banks, saving the post office, local investment, cooperatives and publicly-owned renewable energy. We encourage you to attend the conference (the price is low to make it possible for many to attend) and will provide reports and videos from the conference on It’s Our Economy for those who cannot make it....

MORE AT LINK

In fact, if the goal of the United States was a stronger economy for all, better services and a fair economy, we would be discussing turning some private functions into public services, accountable to the voters. For example, The Roosevelt Institute reported this week that the United States ranks poorly in Internet services because they are in the hands of private corporations like Verizon and Comcast. Right now, “the U.S. is behind South Korea, the UAE, Hong Kong, Japan, Taiwan, Latvia, Lithuania, Norway, Sweden, Slovakia, Bulgaria, Portugal, Iceland, Denmark, Estonia, Finland, and Norway."...We do know that we are in a time of transition, an era that will define the next economy. The effects of the neo-liberal economic agenda of privatization simultaneous with de-funding of public assets and services are becoming more obvious. People are fighting back in a number of ways. And greater awareness of economic democracy and modern monetary theory is growing. One thing is clear: it is going to take action from below to create an economy that puts people and the planet before profits.

bread_and_roses

(6,335 posts)I avoided reading that article when I saw it on Alternet, then here ... but finally forced myself.

Demeter

(85,373 posts)

jtuck004

(15,882 posts)Now it's Gallup, and only one source, but interesting...

_________

...

Fewer Americans aged 18 to 29 worked full time for an employer in June 2013 (43.6%) than did so in June 2012 (47.0%), according to Gallup's Payroll to Population employment rate. The P2P rate for young adults is also down from 45.8% in June 2011 and 46.3% in June 2010.

...

The percentage of Americans aged 50 to 64 who have a full-time job increased in June 2013, to 48.2%, from 46.6% a year ago and 45.7% in June 2010. Similarly, 8.4% of Americans 65 or older had a full-time job in June 2013, compared with 7.2% in June 2012 and 6.2% in June 2010.

...

Ironically, older part-time workers remaining in or reentering the labor force will be cheaper to hire in many cases than younger workers. The reason is Boomers 65 and older will be covered by Medicare (as long as it lasts) and will not require as many benefits as will younger workers, especially those with families. In effect, Boomers will be competing with their children and grandchildren for jobs that in many cases do not pay living wages.

...

And so here we are. Boomers are competing with their children and grandkids for jobs. Demographics are awful. And the ramifications of an aging workforce with fewer workers than ever vs. retirees puts stress no only on public union pension plans, but also on Social Security.

Here.

Fuddnik

(8,846 posts)There Are Good Alternatives to US Capitalism, But No Way to Get There

Jerry Mander's new book explores the fatal flaws of the "obsolete" capitalist system and strategies for change.

July 24, 2013 |

The following is an excerpt from Jerry Mander's new book The Capitalism Papers: Fatal Flaws of an Obsolete System (Counterpoint, 2013):

Which Way Out?

Let’s start with some good news. There is no shortage of good alternative ideas, plans, and strategies being put forth by activist groups and “new economy” thinkers in the United States and all countries of the world. Some seek to radically reshape the current capitalist system. Others advocate abandoning it for something new (or old). There is also a third option, a merger of the best points of other existing or proposed options, toward a “hybrid” economic model that can cope with modern realities.

Meanwhile, U.S.-style laissez-faire capitalists, who now dominate the politics and economy in this country, continue to argue that all solutions must be determined by the “free market.” But the free market does not focus on the needs of democracy, or the implications of rampant inequity, or the catastrophic problems of the natural world. The free market is interested in one thing: expanding wealth. That is its only agenda. Nothing else matters, at least until the system collapses. Klaus Schwab had it right. And the situation is not much better abroad.

Ecological economist Brian Davey reported from the Beyond Growth Congress in Berlin (2011) that there was “much talk of the need for democratization to facilitate the post-growth economy. However, there was great skepticism for how much could be achieved. . . . The grip of corporate lobby interests over politics at national [U.S.] and European levels is too great. The state is a weak instrument for the kind of change that has to happen.” (Adbusters, December 2011)

In the same issue, Simon Critchley, professor of philosophy at the New School, New York, concurred: “Citizens still believe that governments represent the interests of those who elect them, and have the power to create effective change. But they don’t, and they can’t. We do not live in democracies. We inhabit plutocracies; government by the rich.”

(snip)

Could Americans living in the world headquarters of laissez-faire capitalism do anything like that? Obviously, such changes could happen in the United States only if the powers that be were willing to allow them. They won’t. In the United States, ruled by the most ideologically rigid form of capitalism in the world, any level of government engagement, intervention, or partnership in anything but military adventures quickly gets labeled “socialist” or “communist.” It makes transformation very difficult.

Unless there is an astonishing shift in political realities, or a massive uprising many times larger than the Occupy movement, viable changes would be incremental and politically unlikely. With government and media owned and operated by the super-wealthy, we can’t expect much help from them. They don’t represent us.

So then. What we can do right now is start discussing and creating alternative pathways, so we know what we agree on and what direction to start walking in. Hopefully each new path will fill with walkers and lead to others. Critical mass is the goal.

http://www.alternet.org/books/there-are-good-alternatives-us-capitalism-no-way-get-there?page=0%2C0

xchrom

(108,903 posts)NEW YORK (Reuters) – JPMorgan Chase & Co is exiting physical commodities trading, the bank said in a surprise statement on Friday, as Wall Street’s role in the trading of raw materials comes under unprecedented political and regulatory pressure.

After spending billions of dollars and five years building the banking world’s biggest commodity desk, JPMorgan said it would pursue “strategic alternatives” for its trading assets that stretch from Baltimore to Johor, and a global team dealing in everything from African crude oil to Chilean copper.

The firm will explore “a sale, spinoff or strategic partnership” of the physical business championed by commodities chief Blythe Masters, the architect of JPMorgan’s expansion in the sector and one of the most famous women on Wall Street. The bank said it will continue to trade in financial commodities such as derivatives and precious metals.

Pressured by tougher regulation and rising capital levels, JPMorgan joins other banks such as Barclays PLC and Deutsche Bank in a retreat that marks the end of an era in which investment banks across the world rushed to tap into volatile markets during a decade-long price boom.

bread_and_roses

(6,335 posts)Food prices have been on the rise since 2007, thanks in part to bad weather and increasing demand from biofuels and developing nations. But there's one cause that hasn't gotten much attention: financial speculation in crop markets. Are bankers artificially inflating the price of food?

By Kharunya Paramaguru Dec. 17, 201213 Comments

Correction appended Dec. 17, 2012

Remember the food crisis of 2007 and 2008, when rapid and extreme increases in global food prices led to riots and civil unrest in 28 countries? While we have yet to see unrest on the same level since, the shadow of that crisis, and the debate as to what the systemic causes were, remains. At the end of November, the World Bank warned in its Food Price Watch report that high and volatile prices are the “new normal.” In a world where nearly 1 billion people live in hunger — an estimate that Jomo Sundaram, assistant director general of the U.N. Food and Agriculture Organization (FAO), describes as conservative — high food prices can be fatal.

The shift in prices affects consumers in rich countries, who will see their grocery bills rise at a time when wages in much of the world are stagnant. But the real impact is felt by the global poor, in places like Tajikistan, where individuals spend nearly 80% of their income on food. Price spikes in those places can be devastating, even deadly.

xchrom

(108,903 posts)westerebus

(2,976 posts)having reached a level acceptable to the hedge fund-banking-investment cartel with the blind eye of the CFTC and the dead hand of the SEC winking and waving as an other train load of toxic derivatives passes the miles of destitute burbs, shanties and slums.

xchrom

(108,903 posts)This week marked the four-year anniversary of the last time Congress increased the minimum wage — from $5.15 in 2007 to $7.25 in 2009. Groups demonstrated across the country, demanding increases at both the state and federal level. President Obama pledged that he would continue to press for an increase in his economic policy speech at Knox College.

But there’s another problem: Millions of working Americans make less than minimum wage. In fact, more Americans are exempt from it than actually earn it.

The Pew Research Center examined Bureau of Labor Statistics data and found that about one and a half million Americans earned the minimum wage in 2012, but nearly two million people earned an hourly wage that was even less than $7.25 an hour. These workers, for one reason or another, are exempted from the part of the Fair Labor Standards Act (FSLA) that requires employers to pay at least the minimum wage, and include tipped workers and many domestic workers, as well as workers on small farms, some seasonal workers and some disabled workers.

The largest of these exempted groups is tipped employees, many of whom work in food service. Today, tipped employees earn just $2.13 an hour — the rationale being that tips cover the rest. In fact, some of these workers do earn a reasonable living through their tips, but, as Saru Jayaraman, co-founder and director of the Restaurant Opportunities Centers United, told us, many don’t.

xchrom

(108,903 posts)Women like to date men who make them laugh due to evolutionary differences hard-wired into our brains, according to new research.

Scientists found that women's brains show greater activity than men's in reward-related regions in response to humour.

The finding is consistent with the idea that women have evolved to appreciate humour, whereas men have evolved to produce humour.

According to this view, women use a man's ability to make them laugh as a way to judge his genetic fitness as a suitable partner and potential father.

The new study, by Stanford University School of Medicine, involved scanning the brains of 22 girls and boys aged from six to 13 as they viewed funny videos, such as people falling over and animals performing tricks.

Read more: http://www.businessinsider.com/women-have-evolved-to-date-funny-men-study-suggests-2013-7#ixzz2aFA1tteb

snot

(10,520 posts)Demeter

(85,373 posts)but then, there are not too many men like the kind in my family (or the species would fail to reproduce and die out in 2 generations...this family may yet do so).

snot

(10,520 posts)xchrom

(108,903 posts)BERLIN (AP) -- Germany's finance minister has categorically rejected a second writedown of Greek debt.

Wolfgang Schaeuble told weekly Bild am Sonntag in an interview that Greece would continue to receive support beyond 2014 if needed and provided the country meets the demands of international creditors.

Schaeuble was quoted as saying "it's certain, however, that there will be no second debt writedown for Athens."

Extracts of the interview, to be published Sunday, were released by the paper Saturday and confirmed by the Finance Ministry.

xchrom

(108,903 posts)NEW YORK (AP) -- JPMorgan is considering selling part of its commodities business.

The bank is considering a "full range of options," for the unit, which trades in oil, natural gas and base metals such as copper. The lender is also mulling a spin-off or a partnership as alternatives, the bank said in a statement Friday.

JPMorgan will continue to offer other banking services in the commodities market, in areas such as financial derivatives trading.

Spokesman Brian Marchiony said the decision was driven by several factors including the potential of new regulations.

xchrom

(108,903 posts)

I take back my endorsement, in an earlier post, of the idea that the city of Detroit should ease its financial crisis by selling art works from the collection of the Detroit Institute of the Arts. I also apologize to the many whom my words pained.

I wrote in reaction to this quote in the Times, from a spokesman for the state-appointed emergency manager Kevyn D. Orr: “It’s hard to go to a pensioner on a fixed income and say, ‘We’re going to cut 20 percent of your income or 30 percent or whatever the number is, but art is eternal.’ ”

I retract my hasty opinion for two specific reasons, and because I have a sounder grasp of the issues involved.

First, the facts: I am now persuaded that a sale of the D.I.A.’s art, besides making merely a dent in Detroit’s debt, could not conceivably bring dollar-for-dollar relief to the city’s pensioners. Further, the value of the works would stagger even today’s inflated market. Certainly, no museum could afford them. They would pass into private hands at relatively fire-sale prices.

DemReadingDU

(16,000 posts)Detroit will not be the first city to go bankrupt as this financial crisis deepens. But if there is little money to upkeep the art collections, one wonders if they will go the way of that beautiful old library in Cincinnati.

![]()

xchrom

(108,903 posts)The underlying condition of the US economy is improving, according to the International Monetary Fund (IMF).

However, the IMF added that the recovery from recession has so far been "tepid".

In its regular assessment of the economy, the IMF said the US still faces "powerful headwinds".

But it noted gains on stock markets and in house prices, and predicted that economic growth should gradually accelerate over the next year

xchrom

(108,903 posts)Steve Cohen's hedge fund SAC Capital Advisers has entered a not guilty plea in a New York court, denying insider trading charges.

The plea was entered in Manhattan federal court by Peter Nussbaum, the fund's lawyer.

It comes a day after the company was charged with wire and securities fraud.

Prosecutors say evidence of wrong-doing at the firm is "voluminous", but SAC has said it will continue operating as it fights the charges.

xchrom

(108,903 posts)Italian police have arrested at least 50 people in a big anti-Mafia operation in the coastal region near Rome.

About 500 police officers, backed by dog units, a helicopter and coastal patrol boats are involved.

A police operation was also launched in the southern Calabria region, a hotbed of 'Ndrangheta Mafia crime.

The Rome crackdown, focused on the coastal suburb of Ostia, is said to be the largest yet in or near the capital. Three crime clans are being targeted.

westerebus

(2,976 posts)xchrom

(108,903 posts)President Barack Obama won’t nominate a successor to Federal Reserve Chairman Ben S. Bernanke until at least September, an administration official said, as a group of Democratic senators urged him to choose Fed Vice Chairman Janet Yellen.

Obama hasn’t made a decision, according to the official, who asked not to be identified in discussing internal planning. Bernanke, whose second four-year term ends on Jan. 31, hasn’t indicated whether he would seek or accept a third term.

Last month, Obama said the Fed chairman has stayed in the post “longer than he wanted.” White House officials have begun to focus on how Obama will leave his mark on the central bank. The Associated Press reported the timing earlier.

About a third of the 54-member Senate Democratic caucus signed a letter praising Yellen and encouraging Obama to nominate her, according to three Senate aides who asked not to be identified discussing internal matters. While the letter, sent today and obtained by Bloomberg News, doesn’t identify any other candidate, former Treasury Secretary Lawrence Summers is another potential pick.

Demeter

(85,373 posts)Obama knows EXACTLY whom he "wants" to appoint (whom he is being paid to appoint): Larry "the Bastard" Summers.

HOWEVER, the PARTY FAITHFUL are telling him that he shouldn't even go there...from the grassroots on up to the Nobel Prize winners.

So, delay to get it off the front page, then when there's some other "crisis", stick the Bastard in.

DemReadingDU

(16,000 posts)Be sure to watch the PBS video, Money on the Mind. Included, is an interesting segment about the game of Monopoly.

7/27/13 Yes, Virginia, Rich People Are Not the Same as You and Me. They Cheat More.

When middle class and low income people complain about the lousy ethics among what passes for our ruling classes, they usually shrug it off as jealousy, class warfare, and/or the sensationalism. Guess what? Conventional wisdom is right.

The video below from PBS (hat tip Scott) presents research by Dacher Keltner, Paul Piff, and other academics at UC Berkeley into absolute and relative poverty. They that found in a number of different setting that affluent individuals were more likely to cheat than less well off people, even over things like candy and points in a game of chance. Admittedly, which the plural of anecdote is not data, I’ve had the experience they depict in one of their experiments, that people in fancy cars more likely to enter pedestrian crosswalks when pedestrians are in them than other drivers. I was in Rockport, Maine, which if you’ve been there, is a tourist destination and has lots of pedestrian crosswalks on the major streets. I was about to step into one when an Audi came downhill, and I could see that the driver could clearly see me. But she zoomed through, close enough that I gave her rear bumper a good whack with my trusty shooting stick (if I has wanted to be vindictive, as opposed to just send a message, I could easily have broken her side mirror or dented the side of the car instead). She had the nerve to make a fast U-turn and come back to scream at me that she had been driving too fast to stop and who was I to hit her car? I told her she’d just confessed to her traffic violation in front of a witness (my brother) and allowed me to get her license plate number.

In addition, the researcher replicated the “better off is correlated with worse behavior” even in a game setting. When one participant was given advantages relative to another, they got ruder in subtle and sometimes overt ways.

That does not necessarily mean all rich people behave badly (in fact, I’m surprised at how much another stereotype holds true: that old money types make a point of being gracious, no matter what the status of the other person), but it does confirm the widespread perception that money and status go to some people’s heads. But even more interesting is that the publication of what ought to have been a not terribly controversial finding elicited a firestorm of criticism.

Floyd Norris of the New York Times wrote up new research on a related topic: that CEOs who engage in bad conduct, even speeding, are more likely to commit fraud. So Jon Corzine’s speeding (and resulting accident) could have served as an early warning to MF Global investors.

http://www.nakedcapitalism.com/2013/07/yes-virginia-rich-people-are-not-the-same-as-you-and-me-they-cheat-more.html

6/21/13 Money on the Mind

In a series of startling studies, psychologists at the University of California at Berkeley have found that "upper-class individuals behave more unethically than lower-class individuals." Ongoing research is trying to find out what it is about wealth — or lack of it — that makes people behave they way they do.

Demeter

(85,373 posts)And we tolerate it.

legally.

xchrom

(108,903 posts)Here’s what 629 Vine St. in downtown Cincinnati looks like today…

1. …But It used to be home to one of the prettiest libraries in the country.

2. In 1874 the Public Library of Cincinnati opened in a small building originally intended to be an opera house.

5. The beautiful main hall.

xchrom

(108,903 posts)On Tuesday the Bulgarian capital, Sofia, witnessed a night of violence. After 40 days of protest the National Assembly was besieged amid demands that the government resign, and police stormed the peaceful crowd. A bus full of MPs trying to get away was surrounded and its windows broken, and scores of people were wounded. The next day Mihail Mikov, chair of parliament, said that "looking for solutions within the constitution becomes increasingly difficult".

A brief look back can explain why. The collapse of Bulgaria's centre-right government in February following protests against rising electricity bills led to early elections in May. These produced a coalition of the Bulgarian Socialist Party (BSP) and the Movement for Rights and Liberties – the party supported by the Turkish minority in Bulgaria – under the prime minister, Plamen Oresharski.

Since 14 June protests have demanded Oresharski's resignation. He was elected on a pledge of popular reforms that would benefit the most economically vulnerable, but any trust in him dissipated with the appointment of Delyan Peevski as head of the state agency for national security. In the eyes of most Bulgarians the media monopolist was corruption incarnate.

The peaceful protests – which coincided with more violent events in Brazil, Turkey and Egypt – have been described as "middle class" by international media that have otherwise largely ignored them. This trope eclipses the reality of the people on the ground, who barely make ends meet on average incomes in the EU's poorest member state.

DemReadingDU

(16,000 posts)If the biggest clients are unloading stock, who is buying?

What do the biggest clients know?

7/23/13 The Strongest Bull Market In 65 Years

http://www.businessinsider.com/strongest-bull-market-since-world-war-ii-2013-7

7/23/13 BofA: Our Biggest Clients Haven't Unloaded This Much Stock Since 2008

http://www.businessinsider.com/institutions-sell-most-stock-since-2008-2013-7

12/14/12 Chris Martenson: It's Better to Be a Year Early Than a Day Late

When the next disruptive event happens, it will happen faster than the system can react

http://www.peakprosperity.com/insider/80252/better-year-early-day-late

Demeter

(85,373 posts)Let's hope it waits that long....it didn't, last time.

Demeter

(85,373 posts)I will try to wake up tonight, but if not, tomorrow is only a day away....

Bon Chance!

Buena Suerte!

Viel Gluck!

Nastrovya!

L'Chiam!

Etc!

Excelsior!

Fuddnik

(8,846 posts)hamerfan

(1,404 posts)The Gambler by Kenny Rogers:

Demeter

(85,373 posts)5 hours of sleep, and while I don't feel any sharper, mentally, and I look like I slept on the keyboard anyway, I can at least keep eyes open.

It's COLD out! 60F and still dropping...54F forecast low. I guess summer is over.

I'm going to have to wear clothes!

DemReadingDU

(16,000 posts)Dog days are not over yet

Demeter

(85,373 posts)It's the kind of news site we LIKE to see! It's stated goals are "protest what we do not like and build what we want".

I'll have to ask Tansy to add it to the resource list when she returns from vacation...

Demeter

(85,373 posts)...The U.S. used to be the envy of the world when it came to innovation, making things that dazzled the world and enhanced the lives of millions. But the Information Technology & Innovation Foundation, a bipartisan think-tank that ranks 36 countries according to innovation-based competitiveness, tells us we’re getting pushed aside on the global innovation stage. In 2009, to the surprise of those conducting the study, the U.S. ranked #4 in innovation, behind Finland, Sweden and Singapore. In 2011, the U.S. ranking was unchanged. Worse, the U.S. ranked second to last in terms of progress over the last decade....

...we’re now taking money out of our productive economy instead of investing in it. The shift has happened over time, but the mechanisms of extraction have become dangerously efficient. A giant financial sector and wealthy class are sucking money, vampire-like, out of the productive sector, where the goods, technologies and services that we want are created.

Financiers may appear to be simply “making money out of money,” but if you look closely, you can see that they are really getting rich on the backs of people producing useful things, like consumer electronics, and capital goods like factories and equipment. Good jobs, the health of the overall economy and society, growing incomes for the poor and middle class—all of these things have been put aside in the quest for more financial profits. The game is unsustainable. And it’s turning out badly.

To get the economy humming, argues Lazonick, you want to fuel the kind of growth that allows people to enjoy higher living standards. You want an economy that is stable and allows everyone to share in prosperity. But nowadays, the executives who are running large industrial corporations like GE, Dupont, Cisco and Microsoft are focused on making as much money as they can in the short-term for shareholders, and more importantly, themselves....

Demeter

(85,373 posts)The Declaration of Independence says nothing about a right to cheap labor, but not everyone has noticed. Companies routinely pay market rates for electricity, real estate and legal services. But many find great injustice in market economics, as applied to wages they must pay to attract unskilled labor. When companies can't find people to work for the meager amounts they are offering, a "labor shortage" is declared. And politicians seeking their favor come up with solutions such as the low-skilled visa program tacked onto the immigration reform plan. The so-called "W visa" would admit more immigrants to work in restaurants, stores, hotels and other enterprises.

The bipartisan immigration agreement is most welcome for humanitarian reasons and its measures for seriously enforcing the law against hiring undocumented workers. The provision to bring in more unskilled workers, however, is most unfortunate. But it reflects a national conversation in which Americans without high school degrees play little part. They have no interests of their own in the eyes of those in power. They were put on this earth to make others comfortable.

Under the law of supply and demand, when something is in short supply, the price for it rises. So if there were a shortage of unskilled workers, their pay levels would rise, right? But they have not. On the contrary, they have fallen. The median hourly wage for maids and home health aides fell 5 percent from 2009 to 2012, after inflation, according to an analysis by the National Employment Law Project. In that time, the median wage for restaurant cooks plunged over 7 percent. Even more depressing than the reality is a chief rationale for keeping these wages low — that it makes a whole bunch of services, from restaurant meals to housecleaning, more affordable for other Americans.

It's good for the consumer — assuming, of course, that you ignore how substandard pay affects the purchasing power of the working poor. The real theme here is that low-skilled workers are "not one of us." Restaurant prices could go down if owners paid their accountants less or accepted smaller profits. But somehow those at the bottom of the wage scale have become the group assigned to keep prices low. They're nobodies....

"We see employers in a number of industries act as if there is a third-class labor market that is paid below the minimum wage and are made to suffer all manner of violations of labor law," Nik Theodore, a University of Illinois urban planning expert, told The New York Times.

This kind of thinking has got to stop. An inexhaustible supply of low-paid labor should not be anybody's right.

Demeter

(85,373 posts)The principles they proclaim demand a new Glass-Steagall, and they could give the president a fight. Glass-Steagall prevented a classic conflict of interest that we know frequently arises in the real world. Commercial banks are subsidized through federal deposit insurance. Most economists support providing deposit insurance to commercial banks for relatively smaller depositors. I am not aware of any economists who support federal “deposit” insurance for the customers of investment banks or the creditors of non-financial businesses. It violates core principles of conservatism and libertarianism to extend the federal subsidy provided to commercial banks via deposit insurance to allow that subsidy to extend to non-banking operations. Absent Glass-Steagall, banks could purchase anything from an aluminum company to a fast food franchise and (indirectly) fund its acquisitions and operations with federally-subsidized deposits. If you run an independent aluminum company or fast food franchise do you want to have to compete with a federally-subsidized rival?

Deposit insurance is a material federal subsidy, but it pales in comparison to the implicit federal subsidy we provide to systemically dangerous institutions (SDIs) (so-called “too big to fail” banks). The SDIs are precisely the banks most likely to purchase non-commercial banks. The general creditors of SDIs are protected against all loss so they funds to SDIs at a substantially lower interest rate than smaller competitors. The largest SDIs are commercial banks that get both the explicit subsidy of federal deposit insurance and the larger subsidy unique to SDIs. No conservative or libertarian should want the SDIs to maintain their political and economic dominance. The SDIs’ dominance comes about not due to their efficiency but their size and the size of their lobbying wallet and force that allows them to extort greater federal subsidies than their rivals. If conservatives and libertarians have any uncertainty about their position on Glass-Steagall they should consider these facts: (1) President Obama opposes ending the SDIs, (2) has done nothing effective to end the large federal subsidy provided to the SDIs, and (3) opposes bringing back Glass-Steagall and removing the explicit federal subsidy to banks that indirectly provides a competitive advantage to their commercial affiliates.

William Black is the author of The Best Way to Rob a Bank Is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City. He spent years working on regulatory policy and fraud prevention as executive director of the Institute for Fraud Prevention, litigation director of the Federal Home Loan Bank Board and deputy director of the National Commission on Financial Institution Reform, Recovery and Enforcement, among other positions.

Demeter

(85,373 posts)TUCSON, Ariz. — THIS summer the tiny town of Furnace Creek, Calif., may once again grace the nation’s front pages. Situated in Death Valley, it last made news in 1913, when it set the record for the world’s hottest recorded temperature, at 134 degrees. With the heat wave currently blanketing the Western states, and given that the mercury there has already reached 130 degrees, the news media is awash in speculation that Furnace Creek could soon break its own mark. Such speculation, though, misses the real concern posed by the heat wave, which covers an area larger than New England. The problem isn’t spiking temperatures, but a new reality in which long stretches of triple-digit days are common — threatening not only the lives of the millions of people who live there, but also a cornerstone of the American food supply.

People living outside the region seldom recognize its immense contribution to American agriculture: roughly 40 percent of the net farm income for the country normally comes from the 17 Western states; cattle and sheep production make up a significant part of that, as do salad greens, dry beans, onions, melons, hops, barley, wheat and citrus fruits. The current heat wave will undeniably diminish both the quality and quantity of these foods. The most vulnerable crops are those that were already in flower and fruit when temperatures surged, from apricots and barley to wheat and zucchini. Idaho farmers have documented how their potato yields have been knocked back because their heat-stressed plants are not developing their normal number of tubers. Across much of the region, temperatures on the surface of food and forage crops hit 105 degrees, at least 10 degrees higher than the threshold for most temperate-zone crops.

What’s more, when food and forage crops, as well as livestock, have had to endure temperatures 10 to 20 degrees higher than the long-term averages, they require far more water than usual. The Western drought, which has persisted for the last few years, has already diminished both surface water and groundwater supplies and increased energy costs, because of all the water that has to be pumped in from elsewhere. If these costs are passed on to consumers, we can again expect food prices, especially for beef and lamb, to rise, just as they did in 2012, the hottest year in American history. So extensive was last year’s drought that more than 1,500 counties — about half of all the counties in the country — were declared national drought disaster areas, and 90 percent of those were hit by heat waves as well.

The answer so far has been to help affected farmers with payouts from crop insurance plans. But while we can all sympathize with affected farmers, such assistance is merely a temporary response to a long-term problem. Fortunately, there are dozens of time-tested strategies that our best farmers and ranchers have begun to use. The problem is that several agribusiness advocacy organizations have done their best to block any federal effort to promote them, including leaving them out of the current farm bill, or of climate change legislation at all.

One strategy would be to promote the use of locally produced compost to increase the moisture-holding capacity of fields, orchards and vineyards. In addition to locking carbon in the soil, composting buffers crop roots from heat and drought while increasing forage and food-crop yields. By simply increasing organic matter in their fields from 1 percent to 5 percent, farmers can increase water storage in the root zones from 33 pounds per cubic meter to 195 pounds. And we have a great source of compostable waste: cities. Since much of the green waste in this country is now simply generating methane emissions from landfills, cities should be mandated to transition to green-waste sorting and composting, which could then be distributed to nearby farms. Second, we need to reduce the bureaucratic hurdles to using small- and medium-scale rainwater harvesting and gray water (that is, waste water excluding toilet water) on private lands, rather than funneling all runoff to huge, costly and vulnerable reservoirs behind downstream dams. Both urban and rural food production can be greatly enhanced through proven techniques of harvesting rain and biologically filtering gray water for irrigation. However, many state and local laws restrict what farmers can do with such water. Moreover, the farm bill should include funds from the Strikeforce Initiative of the Department of Agriculture to help farmers transition to forms of perennial agriculture — initially focusing on edible tree crops and perennial grass pastures — rather than providing more subsidies to biofuel production from annual crops. Perennial crops not only keep 7.5 to 9.4 times more carbon in the soil than annual crops, but their production also reduces the amount of fossil fuels needed to till the soil every year. We also need to address the looming seed crisis. Because of recent episodes of drought, fire and floods, we are facing the largest shortfall in the availability of native grass, forage legume, tree and shrub seeds in American history. Yet current budget-cutting proposals threaten to significantly reduce the number of federal plant material centers, which promote conservation best practices.

MORE

Gary Paul Nabhan is a research scientist at the Southwest Center at the University of Arizona and the author of “Growing Food in a Hotter, Drier Land: Lessons From Desert Farmers in Adapting to Climate Uncertainty.”

Demeter

(85,373 posts)Hardware is getting so cheap that it's hardly worth stealing...The cost of a low-end but fully functional PC chipset is $25. Fully functional Android-powered tablets are $40 in China. How long will it take before some manufacturer assembles a low-cost smart phone chipset with a cheap, low-rez screen running Android and sells it for $40? Thieves snatch iPhones out of teens' hands because they cost $500 and have a high street value. Once smart phones with most of the same capabilities as iPhones and Galaxy phones are available for next to nothing, the street value of all but the highest-end phones will be near-zero.

Consider flat-screen televisions. Yes, they're still expensive if you want a 2-meter screen, but if you're OK with a slightly less than 1-meter (32-inch) screen, they're about $200.

Is it really worth breaking into somebody's house for a TV that's worth $25 at the swap meet? That's why smash-and-grab thieves stick to jewelry, laptops and cameras. The price of cameras and tablets are dropping fast, too, and perhaps the days of sub-$200 low-performance but fully functional laptops is closer than most imagine. The form-factor is maybe $25, the chipset $25, the keyboard $5, and the screen maybe $40, and the speaker/camera a few bucks. The abundance and low cost of stuff is reducing the street value of hardware and many goods to next to nothing. Value of particle-board furniture: near-zero. Value of rusty cheap bicycle: near zero. Value of dumb phones: near zero. Value of surplus clothing: near-zero.

Unless the household contains real jewelry, burglars will find precious little worth stealing in the average household once low-cost tablets, cameras and laptops sell for $10 at the swap meets.

Throw in the risk of being caught on camera by cheap security systems and being pursued by a cheap privately operated drone, and much of the thievery game starts losing its appeal.

White-collar crime where the thieves are skimming millions remains lucrative, of course, and the risks of getting prosecuted are near-zero. But that's another post....

Demeter

(85,373 posts)Purchasing power and exposure to real costs are more realistic measures of inflation than the consumer price index.

That the official rate of inflation doesn't reflect reality is easily intuited by anyone paying college tuition and healthcare out of pocket. The debate over the accuracy of the official consumer price index (CPI) and personal consumption expenditures (PCE--the so-called core rate of inflation) has raged for years, with no resolution in sight. The CPI calculates inflation based on the prices of a basket of goods and services that are adjusted by hedonics, i.e. improvements that are not reflected in the price of the goods. Housing costs are largely calculated on equivalent rent, i.e. what homeowners reckon they would pay if they were renting their house...Those claiming the weighting is accurate face a blizzard of legitimate questions. For example, if healthcare is 18% of the U.S. GDP, i.e. 18 cents of every dollar goes to healthcare, then how can a mere 7% wedge of the CPI devoted to healthcare be remotely accurate?

Those claiming that the CPI is more or less accurate point to the inflation rate posted by The Billion Prices Project @MIT as real-world evidence. The Billion Prices Project collects real-world prices from online retailers for thousands of goods. The Project's rate of annual inflation closely tracks the official CPI, though recently it has diverged, climbing above 2.5% annually while the CPI is below 1.5%. The fatal flaw in The Billion Prices Project is that it does not track the real-world cost of big-ticket services such as healthcare or tuition that dominate household budgets for those who have to pay for these services.

Those claiming the CPI grossly underestimates inflation often compare the current CPI with the CPI methodology of the 1980s. Using the old methodology, inflation is more like 9% rather than 1.5%. Critics of this comparison claim the old methodologies were flawed and the new method is statistically superior...Another way to track inflation is via households' actual spending as reflected in their budgets. Intuit collects anonymous spending data from 2 million users of Mint.com and posts the results... This data suggests the cost of daycare, healthcare insurance, kids' activities and tuition have skyrocketed in the past few years, making a mockery of the official annual inflation rate of 1.5% to 2%. Chartist Doug Short recently published this graph plotting college tuition, medical care and the cost of a new car. According to the Bureau of Labor Statistics Inflation Calculator, $1 in 1980 = $2.83 in 2013. For example, the average cost of a new car in 1980 was $7,200, so the inflation-adjusted price in 2013 would be $20,376. The actual average price today is around $31,000, so after adjusting for inflation the current average price of a new car is higher than in 1980.

In my analysis, the debate over inflation misses two key points. What really matters is not the rate of inflation, which can be endlessly debated, but the purchasing power of earned income, i.e. wages. Instead of fruitlessly arguing over hedonic adjustments and the weighting of components, we should ask: how many hours of labor (at the average hourly rate for full-time workers) does it take to buy a loaf of bread, a new car, a gallon of gasoline, a new TV, a new house, college tuition and fees, etc., and compare that to how many hours of labor it took to buy all those goods and services in the past. This methodology eliminates hedonics (i.e. the computer you buy today is much faster than the one you bought 10 years ago), as this adjustment plays no part in the actual costs of manufacture or the consumer's decision: we don't have a choice to buy a computer with 1990-era specs, so the hedonic adjustment is merely a tool for gaming the CPI. We should also recognize that the exposure to inflation differs in each economic class. Government employees who pay a small percentage of their real healthcare insurance costs (or none at all) will experience little of the actual inflation in healthcare costs; it's the government agencies that are exposed to the real costs of healthcare insurance, which is why municipalities and agencies exposed to the skyrocketing costs of healthcare insurance are under financial pressure. A retiree is naturally focused on the out-of-pocket share of medication costs; the soaring cost of college tuition is so remote it might as well be occurring on Mars...

MORE

Demeter

(85,373 posts)The very saddest thing he said was that he didn't enjoy the game any more.

It was just a job: a tedious, stressful, boring job.

In other words, more like an addiction than a calling...

Tansy_Gold

(17,851 posts)"Nothing else gave me the same kind of high I got from gambling. Win or lose, it didn't matter. I did a lot more losing than winning, but the thrill was the same. Maybe even greater when I lost."

xchrom

(108,903 posts)(Reuters) - Cyprus and its international lenders have agreed to convert 47.5 percent of deposits exceeding 100,000 euros in Bank of Cyprus BOC.CY to equity to recapitalize it, banking sources said on Sunday.

Under a programme agreed between Cyprus and lenders in March, large depositors in Bank of Cyprus were earmarked to pay for the recapitalisation of the bank. Authorities initially converted 37.5 percent of deposits exceeding 100,000 euros into equity, and held an additional 22.5 percent as a buffer in the event of further needs.

"There was an agreement concluding at a final figure of 47.5 percent this morning," a source close to consultations told Reuters.

Demeter

(85,373 posts)They will never see that money again. (Unless they buy all the outstanding stock and gut the bank) (or, they could actually run it as a "bank"...nah, that's just crazy talk!).

xchrom

(108,903 posts)(Reuters) - Two years ago, German Finance Minister Wolfgang Schaeuble was on the point of giving up his role as iron fist in the euro zone debt crisis, but the 70-year-old champion of closer European integration now seems likely to remain on Europe's centre stage.

Chancellor Angela Merkel, who made her independent-minded and famously irritable former rival finance minister in 2009, is expected to reappoint him if, as widely forecast, she wins a third term in the September 22 parliamentary poll.

Differences in their visions of Europe may curtail some of his plans, but the enormous clout he wields among European policymakers dealing with the four-year-old euro zone debt crisis shows no sign of waning.

"German hegemony of the Eurogroup has been growing over the last two years and is increasing almost by the day now," said an official who sits with Schaeuble in the 17-member group.

xchrom

(108,903 posts)(Reuters) - Voracious investor demand for the best London property is approaching record levels that could trigger a price crash in popular areas such as upmarket Bond Street, property experts said this week.

The luxury shopping strip that is home to Prada (1913.HK), Louis Vuitton (LVMH.PA) and Cartier (CFR.VX) has ultra-low yields that mark it out as the most in-demand stretch of real estate in Europe.

The price of commercial property is dictated by the yield, which is the annual rent expressed as a percentage of a property's value. Yields fall as investor demand increases and push up real estate prices.

The 2.75 percent yield on Bond Street properties should fall to 2.25 percent by the end of the year and could hit the world-record low of 1.75 percent in 18 months, says David Hutchings, of property consultant Cushman & Wakefield, adding that the record was set by Taipei, Taiwan, in 2011.

bread_and_roses

(6,335 posts)I simply could not post the whole title to this article as subject line ... I think it is way too optimistic. The overview of how we got here is good, though. And though the reign of Consumerism probably doesn't seem "brief" to all of us - after all, it's been this way our whole lives - but in the historical frame (not to even mention in the deep time frame) it surely is. Since it is going to kill us all pretty soon, along with every other living thing on the planet excepting perhaps those that can cannibalize each other for food.

http://www.commondreams.org/view/2013/07/27-0

Published on Saturday, July 27, 2013 by Post Carbon Institute Blog

The Brief, Tragic Reign of Consumerism—and the Birth of a Happy Alternative

by Richard Heinberg

You and I consume; we are consumers. The global economy is set up to enable us to do what we innately want to do—buy, use, discard, and buy some more. If we do our job well, the economy thrives; if for some reason we fail at our task, the economy falters. ...