Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 6 January 2014

[font size=3]STOCK MARKET WATCH, Monday, 6 January 2014[font color=black][/font]

SMW for 3 January 2014

AT THE CLOSING BELL ON 3 January 2014

[center][font color=green]

Dow Jones 16,469.99 +28.64 (0.17%)

[font color=red]S&P 500 1,831.37 -0.61 (-0.03%)

[font color=black]Nasdaq 4,131.91 0.00 (0.00%)

[font color=black]10 Year 3.00% 0.00 (0.00%)

[font color=green]30 Year 3.93% -0.02 (-0.51%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Warpy

(111,222 posts)Big money seems to be pulling out. Where is that money going?

Interesting, especially since the dollar is also taking a hit.

Demeter

(85,373 posts)because with the great economic recovery we are experiencing, oil consumption has to grow!

(It's the disease nobody dare name: Deflation!)

Warpy

(111,222 posts)and they might be, given the way metals are starting to decline, also, maybe the deriviatives casino will go poof before my kidneys kill me off, something I really didn't want to live long enough to see.

Oh, well, I do know how to be poor. I've certainly had enough practice.

Demeter

(85,373 posts)Demeter

(85,373 posts)You’ve heard of popular sovereignty, right? It’s embodied in the Preamble of the United States Constitution. I’ll quote it for the sheer majesty of the language, archaic though it may seem in these “innovative” days:

A popular website (“We Speak Student”) explains in its Constitution FAQ:

The principle of popular sovereignty is the idea that a government’s power derives only from the consent of the people being governed. The Constitution’s first three words—”We the People…”—establish from the very start that the United States government draws its authority and legitimacy directly from the people. The concept of popular sovereignty differs from the old monarchical belief in the divine right of kings (in which the monarch was said to draw his right to rule directly from God) and also from the British principle of parliamentary sovereignty (in which ultimate authority rested with Parliament rather than with the people directly).

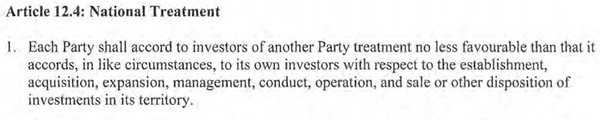

Making it all the more remarkable, or not, that our political class — Barack Obama, Hillary Clinton, Max Baucus and Orrin Hatch, a bipartisan caucus, the Chamber of Commerce, and the Editorial Board of The New York Times, to name a few of the usual suspects — would pursue an agreement, the Trans Pacific Partnership (TPP) that sells out popular sovereignty to transnational investors, and allows them to rule us. I know your friends think this sounds like nutty black helicopter stuff, but it’s true! It’s true! (Tell them to watch Yves on Bill Moyers, in a really sharp transcript.) So bear with me, please, as I work through the thesis. First, I’ll look at how TPP replaces popular sovereignty with transnational investor rule, in two ways. Next, I’ll take a very quick look at the state of play. Finally, I’ll suggest that all is not lost, and in fact the TPP can be defeated.

First, TPP undermines popular sovereignty because it’s being written in secret. I’ll give a few quotes here, mostly to illustrate that the farther away you get from K Street, the more precise the language becomes. First, Campaign for America’s Future:

To bad about the verticals, not to mention the American people, or their elected representatives. CEPR:

And now Expose the TPP, which makes “regulatory structure” just a wee bit more precise while, again, agreeing on the secrecy:

Fortunately, and bringing me to the second and more important reason the TPP undermines popular sovereignty, the investment chapter for the TPP was leaked, and the excellent Public Citizen published it (link to the PDF: tinyurl.com/tppinvestment ). Their summary in relevant part describes the investor-state dispute settlement (ISDS) provisions:

Procedural rights that are not available to domestic investors to sue governments outside of national court systems, unconstrained by the rights and obligations of countries’ constitutions, laws and domestic court procedures (Section B). There is simply no reason for foreign investors to pursue claims against a nation outside of that nation’s judicial system, unless it is in an attempt to obtain greater rights than those provided under national law. Moreover, many of the TPP partners have strong domestic legal systems . For example, TPP partners New Zealand, Australia and Singapore are all ranked by the World Bank as performing at least as well as the United States with regard to control of corruption and adherence to rule of law. Yet in a manner that would enrage right and left alike, the private “investor-state” enforcement system included in the leaked TPP text would empower foreign investors and corporations to skirt domestic courts and laws and sue governments in foreign tribunals. There, they can demand cash compensation from domestic treasuries over domestic policies that they claim undermine their new investor rights and expected future profits. This establishes an alarming two-track system of justice that privileges foreign corporations in myriad ways relative to governments or domestic businesses. It also exposes signatory countries to vast liabilities, as foreign firms use foreign tribunals to raid public treasuries.

So that explains the “new kind of” “regulatory structure,” the “binding international governance system” a lot better than I can. Because this new “governance system” is literally, and not metaphorically, revolutionary[3], I took a look at the actual text of the Investment Chapter, made some screen shots, and added some (really sloppy) yellow magic marker highlighting. I should say that I am by no stretch of the imagination a subject matter expert in the language of international trade treaties, though I do know a “shall” when I see it; my purpose in highlighting the text is simply to show passages that the cynical would characterize as “weasel wording,” or subject to “lawyerly parsing,” or containing, in the vulgate, “loopholes that you could drive a truck through.” Also, you may wish to contrast the majesty of the language of the U.S. Constitution with the fluorescent-lit, Orwellian bureaucratese of the Investment Chapter. Also too, you’ve really got to read this stuff to believe it. So herewith, all from Section 12 and following:

The goal: Equal treatment for investment capital, globally. Does anybody think that’s going to be a race to the top for anybody but the global investor class?

THE DISSECTION CONTINUES AT LINK

Demeter

(85,373 posts)YVES SMITH HITS THE PAGES OF THE NYTIMES!

http://www.nytimes.com/roomfordebate/2013/11/24/what-weve-learned-from-nafta/nafta-successfully-undermined-regulations

Nafta has been effective at helping major corporations at the expense of ordinary American citizens. Most critics have focused on Nafta-related job losses. But they miss the true significance of this and subsequent mislabeled “trade” agreements.

Most of Nafta’s text was devoted to investments, specifically the granting investors rights relative to what Nafta defined as investments. The premise of these provisions in Nafta and similar treaties was that some of the signatory nations had legal systems that might authorize the expropriation of assets, like factories, so foreign investors need recourse to safe venues to obtain compensation. Provisions of this type have been included in subsequent American free trade agreements and are expected to be increased considerably in the pending Trans-Pacific Partnership.

These investor provisions restrict the rights of governments to regulate these investors and their investments. For instance, investors can sue by arguing that if a government changes policies, regulations, or modifies the terms of a contract, such that the investor has suffered a loss of potential profits. A review of cases filed shows they’ve attacked operations at every level of government.

The mechanism for enforcing these sweeping investor rights is “investor-state” arbitration panels, which operate outside of and have been given precedence over domestic court systems. The result has been to give foreign investors greater rights than those of home country citizens and businesses...

MORE PROBING AT LINK

Demeter

(85,373 posts)The mature economies of the modern world, particularly the United States and Britain, are often described as "financialized." The term reflects the ascendancy of the financial sector. Even more important, it conveys the penetration of the financial system into every nook and cranny of society, including housing, education, health and other areas of life that were previously relatively immune.

Evidence that financialization represents a deep transformation of mature economies is offered by the global crisis of 2007-09. The crisis originated in the elephantine U.S. financial system, and was associated with speculation in housing. For a brief period it led to serious questioning of mainstream economic theory and policy: how to confront the turmoil, and what to do about the diseased financial system; are new economic theories needed? However, after six years it is clear that very little has changed. Financialization is here to stay.

Consider, for instance, the policies to confront the crisis. First, public funds were injected into banks to boost capital. Second, public liquidity was made available to banks to sustain their operations. Third, public interest rates were driven to zero to enable banks to make secure profits by lending to their own customers at higher rates.

This extraordinary public largesse towards private banks was matched by austerity and wage reductions for workers and households. As for restructuring finance, nothing fundamental has taken place. The behemoths that continue to dominate the global financial system operate in the knowledge that they enjoy an unspoken public guarantee. The unpalatable reality is that financialization will persist, despite its costs for society.

MORE

Demeter

(85,373 posts)SEE PREVIOUS POST, ABOVE THIS ONE...

http://www.truth-out.org/news/item/21008-why-arent-big-bankers-in-jail

The man in charge of a bank that engaged in massive mortgage fraud chatted with a corporate media host (CNBC Squawk on the Street, 7/12/13) about the fact that virtually none of those who enriched themselves while eviscerating the life savings of many blameless people, derailing the US economy along the way, have faced criminal prosecution:

Jim Cramer: Shouldn't they have indicted somebody who actually did bad things in banking?

JPMorgan Chase CEO Jamie Dimon: I think if someone did something wrong, they should go to jail.

Cramer: Well, who did? Who went to jail?

Dimon: One of the great things about America, failure is not illegal or wrong. You can't just say it failed. But I do think America looked at the crisis—and this is too bad—and there was no, anywhere, Old Testament justice. What they saw is people got overpaid—and some of these people lost all their money, their reputation, all that. If someone did something wrong, they should pay. You've got to be specific. Did they do something wrong, or you just don't like the fact that they failed? You make investments. They don't always pay off. It doesn't mean you're a criminal.

Cramer: Right.

Granted, Cramer is no one's idea of a serious interrogator of the financial system (FAIR Blog, 3/13/09). But much journalism on the question of criminal prosecution of industry leaders amounts to similar apologia.

While there have been substantive inquiries into the wrongdoing of investment banks and auditors, those calling for jail time are often dismissed as irrational, driven by "blood lust" (Washington Post, 9/12/13), "anger" (Chicago Tribune, 11/30/13) or "vengeance" (Washington Post, 11/18/13).

We're told such calls come from the margins: That no "financial industry types" have been jailed is "a recurring theme among Occupy Wall Street protesters and some Democratic politicians" (Christian Science Monitor, 10/11/11) or "the Occupy Wall Street crowd" (New York Times, 3/1/13).

People who believe bankers should go to jail are deflecting blame—from the people: "The real scandal," explained the Washington Post's Charles Lane ("Banks Aren't the Bad Guys," 11/18/13), was "Americans' shared, erroneous belief in ever-rising housing prices and corresponding mania to profit from them."

And maybe they need to move on: "This all happened a really long time ago. What-ever happened to the statute of limitations?" the Washington Post (11/19/13) asked itself in a recent Q&A.

Above all, to advocate prosecution is to be simple-minded, to believe that "public revulsion indicates likely culpability" (Bloomberg Businessweek, 5/12/11) and to "reduce complex historical processes to the machinations of an evil few" (Washington Post, 11/18/13).

Wiser heads must prevail. "The meltdown was multi-causal," concluded Businessweek's Roger Lowenstein. "That explanation will be unsatisfying to armchair prosecutors, but it has the virtue of answering the complex nature of the bubble."

"You're entitled to wonder whether any of the highly paid executives who helped kindle the disaster will ever see jail time," allowed the New York Times' Joe Nocera (2/25/11). "The harder question, though, is whether anybody should."

MORE SPECIAL PLEADING AT LINK

Demeter

(85,373 posts)After weeks of pre-deal chatter about its $13 billion settlement with JPMorgan Chase, the Justice Department finally nailed it down MID-NOVEMBER. And for the first time, the department provided a glimpse of the investigatory findings upon which the settlement was based.

“Without a doubt,” Eric H. Holder Jr., the attorney general, said in a statement, “the conduct uncovered in this investigation helped sow the seeds of the mortgage meltdown.”

Eager to see what the Justice investigation had found, I consulted the statement of facts that accompanied the settlement and that JPMorgan had to acknowledge. There, I reckoned, would be some juicy, new evidence of the bank’s mortgage misdeeds “uncovered” by assiduous investigators armed with subpoena power and other government might.

Perusing the 11-page document, I quickly saw that I’d reckoned wrong. Much of it was the same-old-same-old, a not-very-lively description of a corrupted Wall Street mortgage factory, based largely on some facts that have been in the public domain for years.

In other words, although it took the Justice Department more than five years to pursue a major bank for its role in the mortgage mania, the investigation seems to have unearthed material that, by and large, could have been dug up with a spoon.

“The facts here are all stuff we knew years ago,” said Kurt Eggert, a professor at the Chapman University law school who testified about mortgage woes before the Financial Crisis Inquiry Commission in 2010. “So you have to ask, ‘Why has it taken so long to hold a bank accountable?’ ”

Demeter

(85,373 posts)MORE than two million people have signed up for health insurance coverage under the Affordable Care Act, a tribute to the effectiveness of the “tech surge” the Obama administration deployed to overcome the highly publicized problems with HealthCare.gov that emerged in October. The website’s initial rollout will long stand as a monument to how badly technology contracting can go wrong. But the remarkable recovery also demonstrates what a determined response to such bungling can achieve.

Sadly, food stamp and Medicaid recipients can only look on in envy. Just as disaster-relief agencies keep track of hurricanes, floods and earthquakes, students of anti-poverty programs remember a litany of automation and contracting meltdowns — some of them prolonged, even epic. Florida, 1992-93. Michigan, 1998-99. Colorado, 1998-2002. Texas, 2006-7. Indiana, 2007-9. The Colorado Benefits Management System is particularly memorable: When first implemented, it reportedly refused food stamps to anyone who did not have a driver’s license from Guam.

But finding parallels to the HealthCare.gov meltdown requires no memory at all. Just as HealthCare.gov was filling the headlines, a contractor for the Georgia Department of Human Services was neglecting to send renewal notices to the homes of some 66,000 food stamp recipients and about half that number of Medicaid beneficiaries. On Nov. 1, the state’s computer system — which goes by the Orwellian acronym Success — automatically terminated benefits to all those affected for failure to cooperate with reviews they had never been told were underway.

In December, a Massachusetts contractor sent thousands of people, many of whom were elderly or had disabilities, new electronic food stamp benefit cards and immediately deactivated their old cards — without waiting to see if the new ones had arrived in the mail. Many had not. In mid-October, a contractor’s glitch made food stamps inaccessible to recipients in 17 states...

THIS ISN'T GOVERNMENT, IT'S ABUSE

MORE AT LINK

Demeter

(85,373 posts)Despite the 6.5% stock market rally over the last three months, a handful of billionaires are quietly dumping their American stocks . . . and fast. Warren Buffett, who has been a cheerleader for U.S. stocks for quite some time, is dumping shares at an alarming rate. He recently complained of “disappointing performance” in dyed-in-the-wool American companies like Johnson & Johnson, Procter & Gamble, and Kraft Foods.

In the latest filing for Buffett’s holding company Berkshire Hathaway, Buffett has been drastically reducing his exposure to stocks that depend on consumer purchasing habits. Berkshire sold roughly 19 million shares of Johnson & Johnson, and reduced his overall stake in “consumer product stocks” by 21%. Berkshire Hathaway also sold its entire stake in California-based computer parts supplier Intel.

With 70% of the U.S. economy dependent on consumer spending, Buffett’s apparent lack of faith in these companies’ future prospects is worrisome. Unfortunately Buffett isn’t alone. Fellow billionaire John Paulson, who made a fortune betting on the subprime mortgage meltdown, is clearing out of U.S. stocks too. During the second quarter of the year, Paulson’s hedge fund, Paulson & Co., dumped 14 million shares of JPMorgan Chase. The fund also dumped its entire position in discount retailer Family Dollar and consumer-goods maker Sara Lee. Finally, billionaire George Soros recently sold nearly all of his bank stocks, including shares of JPMorgan Chase, Citigroup, and Goldman Sachs. Between the three banks, Soros sold more than a million shares.

So why are these billionaires dumping their shares of U.S. companies? After all, the stock market is still in the midst of its historic rally. Real estate prices have finally leveled off, and for the first time in five years are actually rising in many locations. And the unemployment rate seems to have stabilized. It’s very likely that these professional investors are aware of specific research that points toward a massive market correction, as much as 90%.

I AM AGNOSTIC ABOUT THIS...FOR ONE THING, THE DATES DON'T MATCH...

Warpy

(111,222 posts)because I'm not in that particular club. My guess is that they act the way other people do, on rumor and guesswork and the fantasy that they'll escape any disaster that comes along.

Dumping US stocks won't work.

Yes, the market is overvalued. However, equities are the only things giving real returns right now with interest rates in the toilet. US equities are still paying well but they won't for much longer if those billionaires keep paying politicians to depress wages.

Most of the money pumped into the market was QE money that ended up in very few hands. How far the bubble will pop is anyone's guess, probably going to less than what it's worth before correcting back up. 90% is a stretch, though.

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Yes, America, we have been here before.

Government surveillance of Americans, in the name of protecting the nation, didn’t start with the National Security Agency’s recently revealed collection of citizens’ telephone records.

Nearly 40 years ago, a year-long investigation by a Senate committee chaired by Frank Church (D-Idaho) uncovered a history of U.S. intelligence agencies scrutinizing Americans engaged in lawful activities. The snooping was both vast and shocking. HISTORY LESSON ENSUES

FLOUNDERING FOR ANSWERS...

Demeter

(85,373 posts)Demeter

(85,373 posts)Have you seen the economic recovery? I haven’t either. But it is bound to be around here somewhere, because the National Bureau of Economic Research spotted it in June 2009, four and one-half years ago.

It is a shy and reclusive recovery, like the “New Economy” and all those promised new economy jobs. I haven’t seen them either, but we know they are here, somewhere, because the economists said so.

Congress must have seen all those jobs before they went home for Christmas, because our representatives let extended unemployment benefits expire for 1.3 million unemployed Americans, who have not yet met up with those new economy jobs, or even with an old economy job for that matter.

By letting extended unemployment benefits expire, Congress figures that they saved 1.3 million Americans from becoming lifelong bums of the nanny state and living off the public purse. After all, who do those unemployed Americans think they are? A bank too big to fail? The military-security complex? Israel?

What the unemployed need to do is to form a lobby organization and make campaign contributions.

Just as economists don’t recognize facts that are inconsistent with corporate grants, career ambitions, and being on the speaking circuit, our representatives don’t recognize facts inconsistent with campaign contributions...

MORE JIBES AT LINK

Demeter

(85,373 posts)kickysnana

(3,908 posts)The Governor closed the schools, shelters are allowed to be open 24 hrs until the cold lets up.

Happy Little Christmas.

Fuddnik

(8,846 posts)That's the warmest it's supposed to be today. In 24 hours, it's forecast to be 32 degrees.

We haven't had a freeze or frost here in a couple of years. I guess we get one tonight. No golf tomorrow.

Tansy_Gold

(17,850 posts)Where I have family -- currently 50 and pouring rain, predicted high 53 and rain, tonight 4 and windy.

Where I am -- currently 50, predicted high 68 and sunny, overnight low 40.

I'm content. ![]()

DemReadingDU

(16,000 posts)About 9:30 last night, rain changed to sleet, overnight we got a couple inches of snow. Temperature is now 1 degree, but with windchill, feels like -22.

I am ready for summer!

Demeter

(85,373 posts)as in, whether I am sticking my nose out at all....

They Closed MI 12 (Michigan Avenue) last night due to blowing and drifting...3 feet on the road.

It's 8 AM and 12F, windchill of ZERO, and still snowing at times. It's supposed to drop 20 Degrees starting now, and tomorrow is supposed to start around -11F.

SO, if I go out, it would be now, I suppose. Just to clear the driveway (yes, I am crazy, but that crazy? I don't know. I suppose it depends on whether the Kid gets on my nerves from being housebound.)

The staff all live in Tecumseh, and the main road between here and there is closed. I doubt they are going to make it in.

Meanwhile, there is serious snow piled up on the garage roof, Snow like we haven't seen in a decade, And Icicles forming. With our new roofs, icicles were a thing of the past (and in the past, they grew down to the garage roof, so it looked like bars on the bedroom windows).

westerebus

(2,976 posts)Demeter

(85,373 posts)Thawed out the car, and fielded phone calls. I'm going to work.

The sun is playing peekaboo, it's finally stopped snowing. The Temperature is down to 8.5F windchill -5F. It's all downhill from here.

There's 3 ft of snow between me and my neighbor, between the plowing, drifting, shovelling and snowing.

xchrom

(108,903 posts)The world’s biggest economies will need to refinance $7.43 trillion of sovereign debt in 2014 as bond yields begin to climb from record lows, threatening to raise borrowing costs while nations struggle to bring down elevated budget deficits.

The amount of bills, notes and bonds coming due for the Group of Seven nations plus Brazil, Russia, India and China is little changed from 2013 after dropping from $7.6 trillion in 2012, according to data compiled by Bloomberg. At $3.1 trillion, representing a 6 percent increase, the U.S. faces the largest tab. Russia, Japan and Germany will see refinancing needs drop, while those of Italy, France, Britain, China and India increase.

While budget deficits in developed nations have fallen to 4.1 percent of their economies from a peak of 7.8 percent in 2009, they remain about double the average in the decade before the credit crisis began. The cost for governments to borrow may rise further after average yields last year rose the most since 2006, as the global economy shows signs of improving and the Federal Reserve pares its unprecedented bond buying.

“Refinancing needs remain elevated in many developed nations, particularly the U.S.,” Luca Jellinek, the London-based head of European rates strategy at Credit Agricole SA, said in a Dec. 30 telephone interview. “The key here is demand rather than supply. If demand drops as growth picks up, and we expect it will, that could put pressure on borrowing costs.”

xchrom

(108,903 posts)Treasuries rose as 10-year yields above 3 percent attracted demand amid an uneven economic recovery and bets the Federal Reserve will maintain its pledge to keep its interest-rate target at record lows.

Benchmark yields dropped from the highest level since July 2011 before reports this week forecast to show U.S. service industries expanded, while employers added fewer jobs. Janet Yellen is poised for confirmation by the Senate today as head of the central bank, which begins reducing its bond-buying program this month and will release minutes of its December policy-makers meeting on Jan. 8. The U.S. will sell $64 billion of Treasuries maturing in three, 10 and 30 years this week.

“The three-percent level in 10s is going to be a key level to breach in a down-trade,” said Ian Lyngen, a government-bond strategist at CRT Capital Group LLC in Stamford, Connecticut. “We haven’t sustainably been able to do that. The minutes may have a hawkish spin to them, keeping in mind the Fed decided to taper at this meeting. We might need a bit more of a setup to take down 10s and 30s at this level.”

The benchmark 10-year yield fell two basis points, or 0.02 percentage point, to 2.97 percent at 8:21 a.m. in New York, according to Bloomberg Bond Trader prices. The 2.75 percent note maturing in November 2023 rose 5/32, or $1.56 per $1,000 face amount, to 98 3/32. The yield climbed to 3.05 percent on Jan. 2, the highest level since July 8, 2011.

xchrom

(108,903 posts)Activist investors determined to shake up the way companies do business are amassing record cash for their campaigns. Now investment banks are advising clients how to anticipate and thwart such vocal investors before they even show up.

Deutsche Bank AG (DBK) offers what it calls a “vulnerability assessment,” while Barclays Plc has developed a “proprietary model” that identifies companies most at risk for activism. Banks including Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co. (JPM) pitch similar services to head off activists like Bill Ackman and Dan Loeb who undertake campaigns aimed at shaking up management, increasing dividends, or spurring asset sales.

“It’s literally a matter of career life and death for management teams and directors who are subjected to activism,” said Chris Young, head of contested situations at Credit Suisse Group AG. (CSGN) “Many CEOs and directors have decided they’d rather go through the unpleasant process of taking a harsher look at themselves in private than a very unpleasant process in public.”

The preemptive services come amid a surge in activist campaigns that last year reached America’s biggest corporations, including Apple Inc., Microsoft Corp., PepsiCo Inc. and DuPont Co.

xchrom

(108,903 posts)***SNIP

Largest Company

It has 800,000 students, up from 243,000 seven years ago, making it America’s largest for-profit college company by enrollment. Since going private in 2007, Laureate’s annual revenue has more than tripled to $4 billion.

Though Laureate isn’t well-known in the U.S., it employs one of the country’s most recognizable figures: former President Bill Clinton. In 2010, the company hired Clinton to serve as its honorary chancellor. In this paid position, Clinton has trekked to Laureate’s campuses in countries such as Malaysia, Peru and Spain, making more than a dozen appearances on its behalf.

Laureate is backed by several of the biggest names in finance, including Henry Kravis, George Soros, Steve Cohen and Paul Allen. When Laureate’s founder and chief executive officer, Doug Becker, convinced these investors’ firms to take his company private in a deal worth $3.8 billion, Kravis’s firm, KKR & Co., took a $487.5 million stake.

By 2010, according to a KKR memo to investors, its investment had increased in value to $710.8 million.

DemReadingDU

(16,000 posts)1/6/14 Germany's Angela Merkel fractures pelvis in skiing accident

German Chancellor Angela Merkel fractured her pelvis in a skiing accident in Switzerland over the holidays, her spokesman told reporters Monday. Merkel was cross-country skiing when the accident occurred. Spokesman Steffen Seibert did not disclose the date of the incident, but said her injuries are not thought to be serious and it is thought she will make a full recovery.

.

.

The news of Merkel's fall comes just eight days after her fellow countryman Michael Schumacher, the most successful driver in Formula One history, was critically injured while skiing in the French Alps. Schumacher, who fell and hit his head on rocks while skiing off-piste on December 29 in Meribel, has undergone two operations and is in a medically induced coma. The German racing legend remains in a critical but stable condition, according to his manager.

http://www.cnn.com/2014/01/06/world/europe/germany-angela-merkel-ski-accident/

xchrom

(108,903 posts)Czech parties signed an agreement to form a government that will face a dispute over whether to raise corporate taxes to finance increased state spending after a record-long recession.

Leaders of the Social Democrats, the ANO party and the Christian Democrats signed the deal in Prague today, ending negotiations following an Oct. 25-26 snap election. The Social Democrats nominated their Chairman Bohuslav Sobotka to become the country’s eighth prime minister in the past decade, while billionaire businessman Andrej Babis, the head of the ANO party, is poised to take the reins at the Finance Ministry.

The new government, which Sobotka predicts will take power by mid-January, will aim to end the policy paralysis triggered by the collapse of former Prime Minister Petr Necas’s cabinet in a spying and corruption scandal in June. ANO, a two year-old party, opposes the Social Democrats’ call for higher corporate taxes. Babis has said he sees a “tough debate” on the issue.

“The probability that the government program will be fulfilled isn’t high,” Jiri Pehe, director of New York University in Prague, said in a Jan. 1 note on his website. “The coalition will be unstable, because it’s formed by two parties and one anti-political movement. There is a risk that the crisis of the basic institutions of the state and politics may continue.”

xchrom

(108,903 posts)Europe’s appetite for cheaper electricity is reviving mines that produce the dirtiest type of coal, threatening to boost pollution and raze villages that have survived since medieval times.

Across the continent’s mining belt, from Germany to Poland and the Czech Republic, utilities such as Vattenfall AB, CEZ AS and PGE SA are expanding open-pit mines that produce lignite. The moist, brown form of the fossil fuel packs less energy and more carbon than more frequently burned hard coal.

The projects go against the grain of European Union rules limiting emissions and pushing cleaner energy. Alarmed at power prices about double U.S. levels, policy makers are allowing the expansion of coal mines that were scaled back in the past two decades, stirring a backlash in the targeted communities.

“It’s absurd,” said Petra Roesch, mayor of Proschim, a 700-year-old village southeast of Berlin that would be uprooted by Vattenfall’s mine expansion. “Germany wants to transition toward renewable energy, and we’re being deprived of our land.”

Tansy_Gold

(17,850 posts)Lignite is basically one step removed from peat. Civilization (?) is going backwards.

xchrom

(108,903 posts)Asian stocks fell, with the regional benchmark index headed for its biggest loss in more than three weeks, as a gauge of China’s services industries dropped and Japanese shares slumped on a stronger yen.

SoftBank Corp., a Japanese mobile-phone operator, slid 3.5 percent after the rating of Sprint Corp. (S), which SoftBank acquired last year, was cut at Cowen and Company. Fast Retailing Co., Asia’s biggest apparel chain, lost 5.8 percent in Tokyo as the Nikkei 225 (NKY) Stock Average slipped from a six-year high. China Railway Group Ltd. slumped 4.1 percent in Hong Kong after China’s second-largest rail builder said its president died.

The MSCI Asia Pacific Index slipped 0.9 percent to 139.12 as of 5:18 p.m. in Tokyo, with all of its 10 industry groups falling. The gauge is headed for the biggest loss since Dec. 12. Telecommunication shares led the drop.

This year “is going to be a year of consolidation,” Matthew Sherwood, head of investment markets research in Sydney at Perpetual Investments, which manages about $25 billion, said by telephone. “China’s growth is slowing down structurally. Our expectation out of China’s economy is it will grow just over 7 percent this year.”