Economy

Related: About this forumWeekend Economists Note a Time to Mourn, January 31-February 2, 2014

The whole world lost another giant, another lion, another leader by birth. Nelson Mandela left us December 5th. Pete Seeger departed January 27th. This is Pete's commemorative thread:

Who was Pete Seeger? He was a man of many parts. Let some of his acquaintance show us:

From Dorkzilla of DU, posted earlier this week:

dorkzilla (1,525 posts)

My Pete Seeger story...

MANY years ago--30 now that I think of it, I was 18 at the time--I was on my way up to Albany for the weekend to visit some pals who were attending SUNY Albany; I had to work full time to support myself and wasn't lucky enough to attend college at that time, so trips to visit girlfriends at University was as close as I got. The train stopped in Beacon, a tall, older man with a gig bag and a smile got on. He sat next to me and I looked up from my book and said "Wow! Pete Seeger!". He chuckled and said "yes, young lady, I'm afraid so!" and I told him I was absolutely delighted to meet him. He looked at me quizzically and said "you're far too young to know who I am…how is it that you knew me? Were your parents hippies?" he asked with a laugh, and i said "Noooo, it wasn't my parents!" "Don't tell me, it was your grandparents?!" he asked me with a note of disappointment in his voice. "Nope!" I responded at last, "I used to watch you on Sesame Street!!" He laughed so hard that he got turned beet red in the face.

As luck would have it, the book I had in my hand was "Walden" and we spent the trip talking about the environment and philosophy, and it was one of the most wonderful train trips of my life. He was kind, open-minded and big-hearted.

When we were parting company he said "well, I'm sure happy that Channel 13 did such a splendid job with your education".

RIP Mr. Seeger. You had a big influence on my young mind, and you'll leave a big hole in my middle aged heart.

I have a Pete Seeger story, too

Last edited Wed Jan 29, 2014, 03:39 AM - Edit history (1)

I was a high school student in 1991, sitting outside of the Emory University main auditorium, practicing my banjo ahead of a performance as the opener for the opener for the opener for ... etc. the Indigo Girls. An old dude came up and listened, and started humming along. (It was an old-time-style song I had written, "Bury Me at Sea"

"Huh?"

"You aren't playing the whole song. You're playing each bar. Can I?" he reached out.

I was worried (this was just some random old dude to me), but I figured what the hell, and I reluctantly handed it to him, and he played it pitch perfect, clawhammer-style (I had been playing bluegrass-style, with fingerpicks; he just translated it). "Did you write this?" he asked.

"Yeah"

"Not bad. But you aren't playing what you wrote. Do you know the whole song in your head?"

"Yeah, I do."

"Then why are you afraid of it? Stop being afraid, and start playing. Play through the measures; don't be afraid of them. Heck, hold your left hand longer than you need to. It's your song." Then he looked straight through me. "Whatever music you make, it was what you meant to make, you got it, kid? Don't be afraid. If it's your music, you can play it. Now go out there."

He handed the banjo back to me and walked off. Some roadie who had been running in explained to me whom I had just talked to (I knew my dad liked him, and my dad generally had good taste in music, so I was suitably impressed). In the inevitable anticlimax of life, I still had two hours before I went on, but Pete's words, and his particular voice, still stay with me whenever I perform. It's your music. Don't be afraid of it.

Don't be afraid of it. Pete surely wasn't. He marched politely into that Congressional Star Chamber, August 18th, 1955, and told Joe McCarthy, in the most innocuous language possible, to go *******...

...MR. SEEGER: I have already told you, sir, that I believe my associations, whatever they are, are my own private affairs...

Read the whole thing at the link. It's instructive, and who knows when we will need to know it?

Everybody encountered Pete in a different time, or a different context, and yet his heroism always shown through, clear and bright as Venus rising this morning. May his star shine forever. He is forever, America singing.

Demeter

(85,373 posts)Peter "Pete" Seeger (May 3, 1919 – January 27, 2014) was an American folk singer and left-wing activist. A fixture on nationwide radio in the 1940s, he also had a string of hit records during the early 1950s as a member of the Weavers, most notably their recording of Lead Belly's "Goodnight, Irene", which topped the charts for 13 weeks in 1950. Members of the Weavers were blacklisted during the McCarthy Era. In the 1960s, he re-emerged on the public scene as a prominent singer of protest music in support of international disarmament, civil rights, counterculture and environmental causes.

A prolific songwriter, his best-known songs include "Where Have All the Flowers Gone?" (with Joe Hickerson), "If I Had a Hammer (The Hammer Song)" (with Lee Hays of the Weavers), and "Turn! Turn! Turn!" (lyrics adapted from Ecclesiastes), which have been recorded by many artists both in and outside the folk revival movement and are sung throughout the world. "Flowers" was a hit recording for the Kingston Trio (1962); Marlene Dietrich, who recorded it in English, German and French (1962); and Johnny Rivers (1965). "If I Had a Hammer" was a hit for Peter, Paul & Mary (1962) and Trini Lopez (1963), while the Byrds had a number one hit with "Turn! Turn! Turn!" in 1965.

Seeger was one of the folksingers most responsible for popularizing the spiritual "We Shall Overcome" (also recorded by Joan Baez and many other singer-activists) that became the acknowledged anthem of the 1960s American Civil Rights Movement, soon after folk singer and activist Guy Carawan introduced it at the founding meeting of the Student Nonviolent Coordinating Committee (SNCC) in 1960. In the PBS American Masters episode "Pete Seeger: The Power of Song", Seeger stated it was he who changed the lyric from the traditional "We will overcome" to the more singable "We shall overcome".

Demeter

(85,373 posts)Seeger was born at the French Hospital, Midtown Manhattan. His Yankee-Protestant family, which Seeger called "enormously Christian, in the Puritan, Calvinist New England tradition", traced its genealogy back over 200 years. A paternal ancestor, Karl Ludwig Seeger, a physician from Württemberg, Germany, had emigrated to America during the American Revolution and married into an old New England family in the 1780s. Pete's father, the Harvard-trained composer and musicologist Charles Louis Seeger, Jr., was born in Mexico City, Mexico, to American parents. Charles established the first musicology curriculum in the U.S. at the University of California in 1913, helped found the American Musicological Society, and was a key founder of the academic discipline of ethnomusicology. Pete's mother, Constance de Clyver (née Edson), raised in Tunisia and trained at the Paris Conservatory of Music, was a concert violinist and later a teacher at the Juilliard School.

In 1912, Charles Seeger was hired to establish the music department at the University of California, Berkeley, but was forced to resign in 1918 because of his outspoken pacifism during World War I. Charles and Constance moved back east, making Charles' parents' estate in Patterson, New York, northeast of New York City, their base of operations. When baby Pete was eighteen months old, they set out with him and his two older brothers in a homemade trailer, on a quixotic mission to bring musical uplift to the working people in the American South. Upon their return, Constance taught violin and Charles taught composition at the New York Institute of Musical Art (later Juilliard), whose president, family friend Frank Damrosch, was Constance's adoptive "uncle". Charles also taught part-time at the New School for Social Research. Career and money tensions led to quarrels and reconciliations, but when Charles discovered Constance had opened a secret bank account in her own name, they separated, and Charles took custody of their three sons. Beginning in 1936, Charles held various administrative positions in the federal government's Farm Resettlement program, the WPA's Federal Music Project (1938–1940), and the wartime Pan American Union. After World War II, he taught ethnomusicology at the University of California and Yale University.

Charles and Constance divorced when Pete was seven, and in 1932 Charles married his composition student and assistant, Ruth Crawford Seeger, now considered by many to be one of the most important modernist composers of the 20th century. Deeply interested in folk music, Ruth had contributed musical arrangements to Carl Sandburg's extremely influential folk song anthology the American Songbag (1927) and later created significant original settings for eight of Sandburg's poems.

Pete's eldest brother, Charles Seeger III, was a radio astronomer, and his next older brother, John Seeger, taught in the 1950s at the Dalton School in Manhattan and was the principal from 1960 to 1976 at Fieldston Lower School in the Bronx. Pete's uncle, Alan Seeger, a noted poet ("I Have a Rendezvous with Death"![]() , had been one of the first American soldiers to be killed in the World War I. All four of Pete's half siblings from his father's second marriage – Margaret (Peggy), Mike, Barbara, and Penelope (Penny) – became folk singers. Peggy Seeger, a well-known performer in her own right, was married for many years to British folk singer and activist Ewan MacColl. Mike Seeger was a founder of the New Lost City Ramblers, one of whose members, John Cohen, married Pete's half-sister Penny — also a talented singer who died young. Barbara Seeger joined her siblings in recording folk songs for children. In 1935, Pete attended Camp Rising Sun, an international leadership camp held every summer in upstate New York that influenced his life's work. He visited most recently in 2012.

, had been one of the first American soldiers to be killed in the World War I. All four of Pete's half siblings from his father's second marriage – Margaret (Peggy), Mike, Barbara, and Penelope (Penny) – became folk singers. Peggy Seeger, a well-known performer in her own right, was married for many years to British folk singer and activist Ewan MacColl. Mike Seeger was a founder of the New Lost City Ramblers, one of whose members, John Cohen, married Pete's half-sister Penny — also a talented singer who died young. Barbara Seeger joined her siblings in recording folk songs for children. In 1935, Pete attended Camp Rising Sun, an international leadership camp held every summer in upstate New York that influenced his life's work. He visited most recently in 2012.

In 1943, Pete married Toshi-Aline Ōta, whom he credited with being the support that helped make the rest of his life possible. The couple remained married until Toshi's death in July 2013. Their first child, Peter Ōta Seeger, was born in 1944 and died at six months, while Pete was deployed overseas. Pete never saw him. They went on to have three more children: Daniel (an accomplished photographer and filmmaker), Mika (a potter and muralist), and Tinya (a potter), as well as grandchildren Tao (a musician), Cassie (an artist), Kitama Cahill-Jackson (a filmmaker), Moraya (a graduate student married to the NFL player Chris DeGeare), Penny, and Isabelle. Tao is a folk musician in his own right, who sings and plays guitar, banjo, and harmonica with the Mammals. Kitama Jackson is a documentary filmmaker who was associate producer of the PBS documentary Pete Seeger: The Power of Song.

When asked about his religious or spiritual views, Seeger replied: "I feel most spiritual when I’m out in the woods. I feel part of nature. Or looking up at the stars. I used to say I was an atheist. Now I say, it’s all according to your definition of God. According to my definition of God, I’m not an atheist. Because I think God is everything. Whenever I open my eyes I’m looking at God. Whenever I’m listening to something I’m listening to God.". He was a member of a Unitarian Universalist Church in New York.

Seeger lived in Beacon, New York. He remained engaged politically and maintained an active lifestyle in the Hudson Valley region of New York throughout his life. He and Toshi purchased their land in 1949 and lived there first in a trailer, then in a log cabin they built themselves. Toshi died in Beacon on July 9, 2013 and Pete died in New York City on January 27, 2014.

Demeter

(85,373 posts)At four, Seeger was sent away to boarding school, but came home two years later, when his parents learned the school had failed to inform them he had contracted scarlet fever. He attended first and second grades in Nyack, New York, where his mother lived, before entering boarding school in Ridgefield, Connecticut. Despite being classical musicians, his parents did not press him to play an instrument. On his own, the otherwise bookish and withdrawn boy gravitated to the ukulele, becoming adept at entertaining his classmates with it, while laying the basis for his subsequent remarkable audience rapport. At thirteen, Seeger enrolled in the Avon Old Farms prep school in Avon, Connecticut from which he graduated in 1936. He was selected to attend Camp Rising Sun, the George E. Jonas Foundation's international summer leadership program. During the summer of 1936, while traveling with his father and stepmother, Pete heard the five-string banjo for the first time at the Mountain Dance and Folk Festival in western North Carolina near Asheville, organized by local folklorist, lecturer, and traditional music performer Bascom Lamar Lunsford, whom Charles Seeger had hired for Farm Resettlement music projects. The festival took place in a covered baseball field. There the Seegers

For the Seegers, experiencing the beauty of this music firsthand was a "conversion experience". Pete was deeply affected and, after learning basic strokes from Lunsford, spent much of the next four years trying to master the five-string banjo. The teenage Seeger also sometimes accompanied his parents to regular Saturday evening gatherings at the Greenwich Village loft of painter and art teacher Thomas Hart Benton and his wife Rita. Benton, a lover of Americana, played "Cindy" and "Old Joe Clark" with his students Charlie and Jackson Pollock; friends from the "hillbilly" recording industry; as well as avant-garde composers Carl Ruggles and Henry Cowell. It was at one of Benton's parties that Pete heard "John Henry" for the first time. Seeger enrolled at Harvard College on a partial scholarship, but as he became increasingly involved with politics and folk music, his grades suffered and he lost his scholarship. He dropped out of college in 1938. He dreamed of a career in journalism and took courses in art, as well. His first musical gig was leading students in folk singing at the Dalton School, where his aunt was principal. He polished his performance skills during a summer stint of touring New York State with The Vagabond Puppeteers (Jerry Oberwager, 22; Mary Wallace, 22; and Harriet Holtzman, 23), a traveling puppet theater "inspired by rural education campaigns of post-revolutionary Mexico". One of their shows coincided with a strike by dairy farmers. The group reprised its act in October in New York City. An article in the October 2, 1939, Daily Worker reported on the Puppeteers' six-week tour this way:

"They fed us too well," the girls reported. "And we could live the entire winter just by taking advantage of all the offers to spend a week on the farm."

In the farmers' homes they talked about politics and the farmers’ problems, about antisemitism and Unionism, about war and peace and social security—"and always," the puppeteers report, "the farmers wanted to know what can be done to create a stronger unity between themselves and city workers. They felt the need of this more strongly than ever before, and the support of the CIO in their milk strike has given them a new understanding and a new respect for the power that lies in solidarity. One summer has convinced us that a minimum of organized effort on the part of city organizations—unions, consumers’ bodies, the American Labor Party and similar groups—can not only reach the farmers but weld them into a pretty solid front with city folks that will be one of the best guarantees for progress.

That fall Seeger took a job in Washington, D.C., assisting Alan Lomax, a friend of his father's, at the Archive of American Folk Song of the Library of Congress. Seeger's job was to help Lomax sift through commercial "race" and "hillbilly" music and select recordings that best represented American folk music, a project funded by the music division of the Pan American Union (later the Organization of American States), of whose music division his father, Charles Seeger, was head (1938–53). Lomax also encouraged Seeger's folk singing vocation, and Seeger was soon appearing as a regular performer on Alan Lomax and Nicholas Ray's weekly Columbia Broadcasting show Back Where I Come From (1940–41) alongside of Josh White, Burl Ives, Lead Belly, and Woody Guthrie (whom he had first met at Will Geer's Grapes of Wrath benefit concert for migrant workers on March 3, 1940). Back Where I Come From was unique in having a racially integrated cast, which made news when it performed in March 1941 at a command performance at the White House organized by Eleanor Roosevelt called "An Evening of Songs for American Soldiers," before an audience that included the Secretaries of War, Treasury, and the Navy, among other notables. The show was a success but was not picked up by commercial sponsors for nationwide broadcasting because of its integrated cast. During the war, Seeger also performed on nationwide radio broadcasts by Norman Corwin.

In 1949, Seeger worked as the vocal instructor for the progressive City and Country School in Greenwich Village, New York.

Demeter

(85,373 posts)In 1936, at the age of 17, Pete Seeger joined the Young Communist League (YCL), then at the height of its popularity and influence. In 1942 he became a member of the Communist Party USA (CPUSA) itself. He eventually "drifted away" (his words) from the Party in the late 1940s and 1950s.

In the spring of 1941, the twenty-one-year-old Seeger performed as a member of the Almanac Singers along with Millard Lampell, Cisco Houston, Woody Guthrie, Butch and Bess Lomax Hawes, and Lee Hays. Seeger and the Almanacs cut several albums of 78s on Keynote and other labels, Songs for John Doe (recorded in late February or March and released in May 1941), the Talking Union, and an album each of sea chanteys and pioneer songs. Written by Millard Lampell, Songs for John Doe was performed by Lampell, Seeger, and Hays, joined by Josh White and Sam Gary. It contained lines such as, "It wouldn't be much thrill to die for Du Pont in Brazil," that were sharply critical of Roosevelt's unprecedented peacetime draft (enacted in September 1940). This anti-war/anti-draft tone reflected the Communist Party line after the 1939 Molotov-Ribbentrop Pact, which maintained the war was "phony" and a mere pretext for big American corporations to get Hitler to attack Soviet Russia. Seeger has said he believed this line of argument at the time—as did many fellow members of the Young Communist League (YCL). Though nominally members of the Popular Front, which was allied with Roosevelt and more moderate liberals, the YCL's members still smarted from Roosevelt and Churchill's arms embargo to Loyalist Spain (which Roosevelt later called a mistake), and the alliance frayed in the confusing welter of events.

A June 16, 1941, review in Time magazine, which under its owner, Henry Luce, had become very interventionist, denounced the Almanacs' John Doe, accusing it of scrupulously echoing what it called "the mendacious Moscow tune" that "Franklin Roosevelt is leading an unwilling people into a J. P. Morgan war." Eleanor Roosevelt, a fan of folk music, reportedly found the album "in bad taste," though President Roosevelt, when the album was shown to him, merely observed, correctly as it turned out, that few people would ever hear it. More alarmist was the reaction of eminent German-born Harvard Professor of Government Carl Joachim Friedrich, an adviser on domestic propaganda to the United States military. In a review in the June 1941 Atlantic Monthly, entitled "The Poison in Our System," he pronounced Songs for John Doe "...strictly subversive and illegal," "...whether Communist or Nazi financed," and "a matter for the attorney general," observing further that "mere" legal "suppression" would not be sufficient to counteract this type of populist poison, the poison being folk music, and the ease with which it could be spread.

At that point, the U.S. had not yet entered the war but was energetically re-arming. African Americans were barred from working in defense plants, a situation that greatly angered both African Americans and white progressives. Black union leaders A. Philip Randolph, Bayard Rustin, and A. J. Muste began planning a huge march on Washington to protest racial discrimination in war industries and to urge desegregation of the armed forces. The march, which many regard as the first manifestation of the Civil Rights Movement, was canceled after President Roosevelt issued Executive Order 8802 (The Fair Employment Act) of June 25, 1941, barring discrimination in hiring by companies holding federal contracts for defense work. This Presidential act defused black anger considerably, although the United States Army still refused to desegregate, declining to participate in what it called "social engineering."

Roosevelt's order came three days after Hitler broke the non-aggression pact and invaded the Soviet Union, at which time the Communist Party quickly directed its members to get behind the draft and forbade participation in strikes for the duration of the war (angering some leftists). Copies of Songs for John Doe were removed from sale, and the remaining inventory destroyed, though a few copies may exist in the hands of private collectors. The Almanac Singers' Talking Union album, on the other hand, was reissued as an LP by Folkways (FH 5285A) in 1955 and is still available. The following year the Almanacs issued Dear Mr. President, an album in support of Roosevelt and the war effort. The title song, "Dear Mr. President," was a solo by Pete Seeger, and its lines expressed his lifelong credo:

Now, as I think of our great land . . . / I know it ain't perfect, but it will be someday, / Just give us a little time. // This is the reason that I want to fight, / Not 'cause everything's perfect, or everything's right. / No, it's just the opposite: I'm fightin' because / I want a better America, and better laws, / And better homes, and jobs, and schools, / And no more Jim Crow, and no more rules like / "You can't ride on this train 'cause you're a Negro," / "You can't live here 'cause you're a Jew,"/ "You can't work here 'cause you're a union man."//

So, Mr. President, / We got this one big job to do / That's lick Mr. Hitler and when we're through, / Let no one else ever take his place / To trample down the human race. / So what I want is you to give me a gun / So we can hurry up and get the job done.

Seeger's critics, however, have continued to bring up the Almanacs' repudiated Songs for John Doe. In 1942, a year after the John Doe album's brief appearance (and disappearance), the FBI decided that the now-pro-war Almanacs were still endangering the war effort by subverting recruitment. According to the New York World Telegram (February 14, 1942), Carl Friedrich's 1941 article "The Poison in Our System" was printed up as a pamphlet and distributed by the Council for Democracy (an organization that Friedrich and Henry Luce's right hand man, C. D. Jackson, Vice President of Time magazine, had founded "...to combat all the nazi, fascist, communist, pacifist..." antiwar groups in the United States) and was shown to the Almanac's employers in order to keep them off the air. Coincidentally, defamatory reviews and gossip items appeared in New York newspapers whenever they performed in public, and ultimately the Almanacs had to disband.

His critics have also tried to downplay the sincerity of Seeger's “anti-war” sentiments, and even to suggest that he was a supporter of Nazi Germany, by asserting that Seeger was only anti-war in the early 1940s because at the time the Soviet Union had a non-aggression pact with Nazi Germany, and that he immediately became pro-war after the USSR was invaded. They support this assertion by pointing out, incorrectly, that the Weavers' album Dear Mr. President (supporting the war effort) was released “shortly” after Germany invaded the Soviet Union in June 1941. However, Dear Mr. President was actually released a year later, in June 1942, six months after the Japanese attack on Pearl Harbor and the United States’ entry into the war.

Seeger served in the U.S. Army in the Pacific. He was trained as an airplane mechanic, but was reassigned to entertain the American troops with music. Later, when people asked him what he did in the war, he always answered "I strummed my banjo." After returning from service, Seeger and others established People's Songs, conceived as a nationwide organization with branches on both coasts and designed to "Create, promote and distribute songs of labor and the American People" With Pete Seeger as its director, People's Songs worked for the 1948 presidential campaign of Roosevelt's former Secretary of Agriculture and Vice President, Henry A. Wallace, who ran as a third-party candidate on the Progressive Party ticket. Despite having attracted enormous crowds nationwide, however, Wallace won only in New York City, and, in the red-baiting frenzy that followed, he was excoriated (as Roosevelt had not been) for accepting the help in his campaign of Communists and fellow travelers such as Seeger and singer Paul Robeson.

Demeter

(85,373 posts)Seeger had been a fervent supporter of the Republican forces in the Spanish Civil War. In 1943, with Tom Glazer and Bess and Baldwin Hawes, he recorded an album of 78s called Songs of the Lincoln Battalion on Moe Asch's Stinson label. This included such songs as "There's a Valley in Spain called Jarama," and "Viva la Quince Brigada." In 1960, this collection was re-issued by Moe Asch as one side of a Folkways LP called Songs of the Lincoln and International Brigades. On the other side was a reissue of the legendary Six Songs for Democracy (originally recorded in Barcelona in 1938 while bombs were falling), performed by Ernst Busch and a chorus of members of the Thälmann Battalion, made up of refugees from Nazi Germany. The songs were: "Moorsoldaten" ("Peat Bog Soldiers", composed by political prisoners of German concentration camps), "Die Thaelmann-Kolonne," "Hans Beimler," "Das Lied Von Der Einheitsfront" ("Song of The United Front" by Hanns Eisler and Bertolt Brecht), "Der Internationalen Brigaden" ("Song Of The International Brigades"

As a self-described "split tenor" (between an alto and a tenor), Pete Seeger was a founding member of two highly influential folk groups: The Almanac Singers and the Weavers. The Almanac Singers, which Seeger co-founded in 1941 with Millard Lampell and Arkansas singer and activist Lee Hays, was a topical group, designed to function as a singing newspaper promoting the industrial unionization movement, racial and religious inclusion, and other progressive causes. Its personnel included, at various times: Woody Guthrie, Bess Lomax Hawes, Sis Cunningham, Josh White, and Sam Gary. As a controversial Almanac singer, the 21-year-old Seeger performed under the stage name "Pete Bowers" to avoid compromising his father's government career.

In 1950, the Almanacs were reconstituted as the Weavers, named after the title of an 1892 play by Gerhart Hauptmann about a workers' strike (which contained the lines, "We'll stand it no more, come what may!"

The Weavers' performing career was abruptly derailed in 1953 at the peak of their popularity when blacklisting prompted radio stations to refuse to play their records and all their bookings were canceled. They briefly returned to the stage, however, at a sold-out reunion at Carnegie Hall in 1955 and in a subsequent reunion tour, which produced a hit version of Merle Travis's "Sixteen Tons" as well as LPs of their concert performances. "Kumbaya," a Gullah black spiritual dating from slavery days, was also introduced to wide audiences by Pete Seeger and the Weavers (in 1959), becoming a staple of Boy and Girl Scout campfires.

In the late 1950s, the Kingston Trio was formed in direct imitation of (and homage to) the Weavers, covering much of the latter's repertoire, though with a more buttoned-down, uncontroversial, and mainstream collegiate persona. The Kingston Trio produced another phenomenal succession of Billboard chart hits and in its turn spawned a legion of imitators, laying the groundwork for the 1960s commercial folk revival.

In the documentary film Pete Seeger: The Power of Song (2007), Seeger states that he resigned from the Weavers when the three other band members agreed to perform a jingle for a cigarette commercial.

Demeter

(85,373 posts)In 1948, Seeger wrote the first version of his now-classic How to Play the Five-String Banjo, a book that many banjo players credit with starting them off on the instrument. He went on to invent the Long Neck or Seeger banjo. This instrument is three frets longer than a typical banjo, is slightly longer than a bass guitar at 25 frets, and is tuned a minor third lower than the normal 5-string banjo. Hitherto strictly limited to the Appalachian region, the five-string banjo became known nationwide as the American folk instrument par excellence, largely thanks to Seeger's championing of and improvements to it. According to an unnamed musician quoted in David King Dunaway's biography, "by nesting a resonant chord between two precise notes, a melody note and a chiming note on the fifth string", Pete Seeger "gentrified" the more percussive traditional Appalachian "frailing" style, "with its vigorous hammering of the forearm and its percussive rapping of the fingernail on the banjo head." Although what Dunaway's informant describes is the age-old droned frailing style, the implication is that Seeger made this more acceptable to mass audiences by omitting some of its percussive complexities, while presumably still preserving the characteristic driving rhythmic quality associated with the style.

From the late 1950s on, Seeger also accompanied himself on the 12-string guitar, an instrument of Mexican origin that had been associated with Lead Belly, who had styled himself "the King of the 12-String Guitar". Seeger's distinctive custom-made guitars had a triangular soundhole. He combined the long scale length (approximately 28"

In 1956, then "Peter" Seeger (see film credits) and his wife, Toshi, traveled to Port of Spain, Trinidad, to seek out information on the steelpan, steel drum or "Ping-Pong" as it was sometimes called. The two searched out a local panyard director Isaiah, and proceeded to film the construction, tuning and playing of the then new, national instrument of Trinidad-Tobago. He was attempting to include the unique flavor of the steel pan into America Folk music.

Tansy_Gold

(17,851 posts)to be the first rec

Because I had a dream once

Of a better place.

And I dreamed it because

Other dreamers made me believe

Not only that it was possible

But that it was to be.

It would be.

It had to be.

And dreams do not die.

Because there are always dreamers.

defacto7

(13,485 posts).....

![]()

Demeter

(85,373 posts)Once we work through all the grief, I'm sure we'll get back to business...

defacto7

(13,485 posts)Demeter

(85,373 posts)Rather than sleeping on the keyboard, I shall bid you goodnight and ask that you feel free to post theme or economic stuff. Many hands make light work. (well, actually, many electrons make light work...)

xchrom

(108,903 posts)Canal Expansion

These bigger vessels will be loaded with as many as 12,600 20-foot containers, 2.5 times what a ship like the Zim Shanghai can handle. The canal expansion will also make room for ships that carry commodities such as liquefied natural gas. Touring the project in November, U.S. Vice President Joe Biden emphasized this last point.

“This is a very important thing for the United States,” Biden said as workers pounded away on the 10-story-tall concrete blocks that will hold the gates for the new locks. “And as the energy production throughout the Americas grows, Panama is going to play a critical role in bridging energy supplies in the Atlantic with a growing demand in the Pacific.”

The Panamanian economy has been on a tear: Gross domestic product has risen an average of 8 percent annually for the past five years, to $36 billion in 2013. The canal project is both a big reason for this growth and the linchpin of Panama’s plan for sustaining it. The country ranks sixth among emerging markets in investment outlook, according to BLOOMBERG MARKETS’ annual ranking.

Centennial Year

In projected GDP growth, Panama ranks second, behind only China, at 6.7 percent for 2014 through 2015. The Panama Canal Authority, the agency that operates the canal, began the expansion project in 2007, with the goal of completing it in 2014, the waterway’s centennial year. That won’t happen, for reasons including an early foul-up with the concrete mix for the locks, a number of strikes and a still-raging fight between the canal authority and contractors over cost overruns.

xchrom

(108,903 posts)Detroit’s proposal to restructure its $18 billion of debt by paying pensioners at more than twice the rate of some municipal bondholders threatens to increase borrowing costs for localities throughout Michigan.

The draft plan given to creditors this week by Emergency Manager Kevyn Orr offers different recovery rates for classes of unsecured creditors. Pensions would get 45 to 50 cents on the dollar, though retiree health-care liabilities would recoup just 13 cents, according to the plan. By comparison, those who loaned $1.4 billion to shore up the two pension funds would receive 20 percent of their claims. Holders of $369 million in unlimited-tax general obligations would recover 46 percent.

Detroit’s latest proposal reinforces concerns in the $3.7 trillion municipal market about what Fitch Ratings called an “us versus them” mentality, favoring retired state workers over bondholders. Republican Governor Rick Snyder proposed the state pay $350 million over 20 years specifically for pensioners in its most populous city.

“If you’re a bondholder in the state of Michigan, every pledge should be viewed as a subordinate pledge going forward,” said Adam Mackey, head of munis at PNC Capital Advisors LLC in Philadelphia. “Ultimately you’re going to see Michigan debt be penalized.”

Demeter

(85,373 posts)from a really bogus regime

Here's hoping for the kind of failure that leads to real success.

xchrom

(108,903 posts)Argentine dollar bonds tumbled the most in emerging markets on concern government measures from devaluation to rate increases aren’t enough to improve the country’s deteriorating debt payment capacity.

Argentine government dollar bonds due 2015 fell 3.88 cents on the dollar to 85.75 cents, driving yields up to 19.12 percent, the highest since June 2012. The extra yield investors demand to own Argentine bonds over U.S. Treasuries widened 75 basis points to 1,142 basis points, while the average spread on emerging-market bonds rose 11 basis points at 10:28 a.m. in New York, according to JPMorgan Chase & Co.’s EMBIG index.

Argentina is losing foreign currency reserves at the fastest pace in more than a decade as estimated 28 percent inflation and currency controls spur capital flight. The funds, which the country relies on to pay debt and finance energy imports, dropped to a seven-year low of $28.3 billion. The government devalued the peso 15 percent last week and raised benchmark interest rates as much as 6 percentage points. The moves, coupled with less risk appetite for emerging market assets, haven’t settled investor concerns.

“There is fear and panic about the emerging markets and the news has not been good out of Argentina with reserves dropping $250 million yesterday,” said Russell Dallen, the head trader at Caracas Capital.

xchrom

(108,903 posts)The yen extended monthly gains against emerging-market currencies as growing volatility amid a selloff spurs investors to reverse carry trades while seeking haven assets.

The euro fell to its lowest level versus the dollar since Nov. 22 as a report showed U.S. consumer spending climbed more than forecast in December, diverging from European inflation data as the region’s monetary policy makers meet next week. The currencies of Chile and Hungary dropped against the greenback, extending an emerging-markets rout that began Jan. 23.

“Risk-off bias is again more prevalent heading into the weekend, supporting the Japanese yen and the U.S. dollar,” Robert Lynch, a currency strategist at HSBC Holdings Plc in New York, wrote in a client note. In emerging-market currencies, “there’s been no real improvement and, on the contrary, increasing indications of contagion into other currencies such as the Hungary’s forint, Polish zloty, Chilean peso, which are making new lows.”

The yen strengthened 0.7 percent to 102.04 per dollar at 5 p.m. in New York for a 3.1 percent monthly advance that was the biggest since April 2012. The dollar rose 0.5 percent to $1.3486 per euro, pushing monthly gains to 1.9 percent, the most since February. Japan’s currency appreciated 1.2 percent to 137.63 per euro, having strengthened 5.2 percent since Dec. 31.

xchrom

(108,903 posts)Russia’s economy grew at less than half the previous year’s pace in 2013, missing economist forecasts as investment fell amid a record slump in Europe. Officials warned the outlook remains weak for this quarter.

Gross domestic product advanced 1.3 percent, the least since a 2009 recession, compared with 3.4 percent in 2012, the Moscow-based Federal Statistics Service reports its first estimate in an e-mailed statement. That fell short of the median 1.5 percent forecast of 19 economists in a Bloomberg survey and the Economy Ministry estimate of 1.4 percent.

The $2 trillion economy decelerated for a fourth year as consumer spending, the mainstay of Russia’s recovery, failed to make up for sagging investment and a drop in global demand for oil and natural gas. The slowdown may extend through the first quarter, Deputy Economy Minister Andrei Klepach told reporters in Moscow today.

“This destroys any hope left about a consumption-driven economy in Russia,” Vladimir Miklashevsky, an economist at Danske Bank A/S in Helsinki, said by e-mail. “Sustainable economic growth in Russia will be possible through expansion of private investments only.”

xchrom

(108,903 posts)The largest banks in Europe will have to show their capital won’t dip below 5.5 percent of their assets in an economic crisis, the European Union’s top banking regulator said.

The exercise, which will examine a sample of 124 banks that cover more than half of each EU member state’s banking industry, is scheduled to begin around the end of May, the European Banking Authority said in a statement today. Results will be published at the end of October.

The tests will be the first in Europe since the EBA told banks in December 2011 to raise 114.7 billion euros ($155 billion) in fresh capital to respond to the area’s sovereign-debt crisis. The EBA’s so-called core-equity Tier 1 requirement is less than the 6 percent proposed by the European Central Bank, according to two euro-area officials with knowledge of the discussions earlier this month.

It’s not clear “if the EU-wide methodology of the EBA for its stress test is identical to that of the ECB’s stress test,” Michael Kemmer, managing director of the Association of German Banks, said in an e-mail.

xchrom

(108,903 posts)European stocks fell, posting their worst start to the year since 2010, as companies from Electrolux AB to Vedanta Resources Plc dropped after reporting results.

Electrolux slid the most since August 2011 after earnings missed analysts’ estimates. Vedanta Resources Plc lost 3.6 percent after saying copper output in Zambia, Australia and India declined. LVMH Moet Hennessy Louis Vuitton SA jumped 7.9 percent after reporting growth in fashion and leather-goods sales rebounded in the fourth quarter.

The Stoxx Europe 600 Index slipped 0.3 percent to 322.52 at the close of trading, paring earlier losses of as much as 1.7 percent. The equities measure declined 1.8 percent this month as emerging-market currencies tumbled, a Chinese manufacturing gauge contracted and the Federal Reserve slowed its pace of bond buying. The index fell 0.7 percent this week.

“Markets were ripe for consolidation,” Christian Stocker, a senior strategist at UniCredit Bank AG in Munich, said by phone. “This week, we’ve seen synchronized volatility in the markets, with very weak currencies and disappointing Chinese manufacturing figures. We need an increase in earnings momentum to see stock prices go higher.”

xchrom

(108,903 posts)Real wages have been dropping consistently since 2010 - the longest period of falls since at least 1964, official figures show.

Real wages calculate earnings when the rising cost of living, or inflation, is taken into account.

The Office for National Statistics said real wages had fallen by 2.2% annually since the first three months of 2010.

Shorter working hours and reduced output were factors behind falling wages, it added.

xchrom

(108,903 posts)Calls for European Central Bank action to help protect the eurozone's fragile recovery have grown after the release of inflation and jobless data.

Official figures showed that eurozone inflation fell to 0.7% in January, down from 0.8% in December and further below the ECB's 2% target.

It has fuelled worries about whether the euro bloc could suffer deflation, potentially de-railing economic growth.

Separate data showed the unemployment rate in December was unchanged at 12%.

Demeter

(85,373 posts)QE4EVER IS THE PERFECT REASON WHY NATIONS NEED CAPITAL CONTROLS ON THEIR ECONOMIES...TO STOP HOT MONEY AT THE BORDER AND ALLOW MEASURED, APPROPRIATE GROWTH OF THE MONEY SUPPLY. BUT THE GLOBALISTS WOULDN'T LIKE THAT...THEY WANT TO COME IN WITH THEIR COUNTERFEIT CURRENCY AND BUY UP ANYTHING WORTH BUYING

http://news.yahoo.com/fed-draws-criticism-abroad-emerging-markets-still-reeling-203252252--business.html

The Federal Reserve's decision to keep trimming its economic stimulus drew fire on Friday as India's central bank chief said Americans should be more attuned to the global impact of their policies, and the IMF called for vigilance given strains in financial markets. The push-back came on Fed Chairman Ben Bernanke's last day on the job and two days after the U.S. central bank reduced the pace of its huge asset purchase program. The Fed made the move on Wednesday despite a bruising selloff in emerging markets that was prompted in part by the prospect of less U.S. monetary support.

With the turmoil in currencies and stocks spreading into more emerging markets on Friday, Fed officials, addressing the rout for the first time, offered no hint the sell-off would influence their policy stance unless the U.S. economy were threatened.

But in Mumbai, Reserve Bank of India Governor Raghuram Rajan said the United States

"should worry about the effects of its policies on the rest of the world."

"We would like to live in a world where countries take into account the effect of their policies on other countries and do what is right, rather than what is just right given the circumstances of their own country," he said at an event on organized by The Times of India newspaper.

Financial markets in India, Turkey, Argentina and elsewhere have boomed in recent years as the Fed's measures to bolster economic growth at home - including asset purchases and ultra-low interest rates - encouraged investors to seek higher returns in emerging economies. As the Fed began to talk of unwinding its policy last year, the money began to flow back out, a trend that ramped up again in the last two weeks on signs that China's economy is slowing.

Rajan, a former chief economist at the International Monetary Fund, is well respected by central bankers globally as being among the few who spoke out about signs of trouble in markets well before the 2007-09 financial crisis set off the Great Recession. His comments were echoed by the IMF, which on Friday called on central banks to ensure that a financial market rout in the developing world does not lead to an international funding crunch.

"The turbulence also underscores the need for vigilance among central banks over liquidity conditions in international capital markets," an IMF spokesman said.

FED UNMOVED

The pressure, however, is unlikely to dissuade the Fed from ramping down its asset purchases by later this year unless the turbulence starts to derail recent momentum in the U.S. economy. Fed policymakers did not mention emerging markets in a statement on Wednesday, when they unanimously decided to trim bond-buying by another $10 billion per month. Indeed, all 70 economists polled by Reuters expect the central bank to keep paring the purchases at that rate at subsequent meetings, shuttering the program before year-end.

MORE BRUTALITY AT LINK

Demeter

(85,373 posts)"Epic in scale, unprecedented in world history . " That is how William K. Black, professor of law and economics and former bank fraud investigator, describes the frauds in which JPMorgan Chase (JPM) has now been implicated. They involve more than a dozen felonies, including bid-rigging on municipal bond debt; colluding to rig interest rates on hundreds of trillions of dollars in mortgages, derivatives and other contracts; exposing investors to excessive risk; failing to disclose known risks, including those in the Bernie Madoff scandal; and engaging in multiple forms of mortgage fraud. So why, asks Chicago Alderwoman Leslie Hairston, are we still doing business with them? She plans to introduce a city council ordinance deleting JPM from the city's list of designated municipal depositories. As quoted in the January 14th Chicago Sun-Times:

A similar move has been recommended for the City of Los Angeles by L.A. City Councilman Gil Cedillo. But in a January 19th editorial titled "There's No Profit in L A. Bashing JPMorgan Chase," the L.A. Times editorial board warned against pulling the city's money out of JPM and other mega-banks -- even though the city attorney is suing them for allegedly causing an epidemic of foreclosures in minority neighborhoods. "L.A. relies on these banks," says The Times, "for long-term financing to build bridges and restore lakes, and for short-term financing to pay the bills." The editorial noted that a similar proposal brought in the fall of 2011 by then-Councilman Richard Alarcon, backed by Occupy L.A., was abandoned because it would have resulted in termination fees and higher interest payments by the city. It seems we must bow to our oppressors because we have no viable alternative -- or do we? What if there is an alternative that would not only save the city money but would be a safer place to deposit its funds than in Wall Street banks?

The Tiny State That Broke Free

There is a place where they don't bow. Where they don't park their assets on Wall Street and play the mega-bank game, and haven't for almost 100 years. Where they escaped the 2008 banking crisis and have no government debt, the lowest foreclosure rate in the country, the lowest default rate on credit card debt, and the lowest unemployment rate. They also have the only publicly-owned bank. The place is North Dakota, and their state-owned Bank of North Dakota (BND) is a model for Los Angeles and other cities, counties, and states. Like the BND, a public bank of the City of Los Angeles would not be a commercial bank and would not compete with commercial banks. In fact, it would partner with them -- using its tax revenue deposits to create credit for lending programs through the magical everyday banking practice of leveraging capital. The BND is a major money-maker for North Dakota, returning about $30 million annually in dividends to the treasury -- not bad for a state with a population that is less than one-fifth that of the City of Los Angeles. Every year since the 2008 banking crisis, the BND has reported a return on investment of 17-26%. Like the BND, a Bank of the City of Los Angeles would provide credit for city projects -- to build bridges, restore lakes, and pay bills -- and this credit would essentially be interest-free, since the city would own the bank and get the interest back. Eliminating interest has been shown to reduce the cost of public projects by 35% or more.

........................

Minimizing Risk

Beyond being a money-maker, a city-owned bank can minimize the risks of interest rate manipulation, excessive fees, and dishonest dealings. Another risk that must now be added to the list is that of confiscation in the event of a "bail in." Public funds are secured with collateral, but they take a back seat in bankruptcy to the "super priority" of Wall Street's own derivative claims. A major derivatives fiasco of the sort seen in 2008 could wipe out even a mega-bank's available collateral, leaving the city with empty coffers. The city itself could be propelled into bankruptcy by speculative derivatives dealings with Wall Street banks. The dire results can be seen in Detroit, where the emergency manager, operating on behalf of the city's creditors, put it into bankruptcy to force payment on its debts. First in line were UBS and Bank of America, claiming speculative winnings on their interest-rate swaps, which the emergency manager paid immediately before filing for bankruptcy. Critics say the swaps were improperly entered into and were what propelled the city into bankruptcy. Their propriety is now being investigated by the bankruptcy judge.

MORE

Ellen Brown is an attorney, president of the Public Banking Institute, and author of 12 books, including WEB OF DEBT and its newly-released sequel, THE PUBLIC BANK SOLUTION. Her websites are http://WebofDebt.com, http://PublicBankSolution.com, and http://PublicBankingInstitute.org.

Demeter

(85,373 posts)

Demeter

(85,373 posts)THAT'S WHAT HAPPENS WHEN YOU SHUT OUT YOUR OWN BASE, OBAMA

http://www.ringoffireradio.com/2014/01/reid-opposed-tpp-fast-track-bill/

Senate Majority Leader Harry Reid (D-NV) announced this week his opposition to a trade deal fast track bill made to streamline trade bills’ passage through Congress, namely the Trans-Pacific Partnership (TPP). Reid’s announcement and the actions of Democrats have placed the party on the populist-progressive side of the TPP issue.

President Obama, a centrist Democrat, now has the Senate’s top Democrat and the majority of House Democrats lined up against him on the TPP and fast track bill issue. Frustrations not only stem from the president keeping his party out of TPP draft discussions, but also the threat that the trade deal poses to workers’ rights and its corporate protection provisions. Reid and fellow Democrats finally showed some gall and collectively took a stand against the fast-track bill and TPP. Here’s a few reasons why:

The TPP and fast-track bill have been championed by Obama and some Republicans, with Tea Partiers opposing anything that Obama supports, like Sen. Orrin Hatch (R-UT). However, Hatch did criticize Obama for his lukewarm, almost blase public support of the TPP and fast-track bill. But this sort of gumption exuded by Reid and the Democrats is just the staunch opposition to bad policy they need to exercise, should they want to be successful this year. Applause to Reid for finally showing some backbone. And to his own party’s president, no less.

Demeter

(85,373 posts)In the 1950s and, indeed, consistently throughout his life, Seeger continued his support of civil and labor rights, racial equality, international understanding, and anti-militarism (all of which had characterized the Wallace campaign) and he continued to believe that songs could help people achieve these goals. With the ever-growing revelations of Joseph Stalin's atrocities and the Hungarian Revolution of 1956, however, he became increasingly disillusioned with Soviet Communism. In his PBS biography, Seeger said he "drifted away" from the CPUSA beginning in 1949 but remained friends with some who did not leave it, though he argued with them about it.

On August 18, 1955, Seeger was subpoenaed to testify before the House Un-American Activities Committee (HUAC). Alone among the many witnesses after the 1950 conviction and imprisonment of the Hollywood Ten for contempt of Congress, Seeger refused to plead the Fifth Amendment (which would have asserted that his testimony might be self incriminating) and instead, as the Hollywood Ten had done, refused to name personal and political associations on the grounds that this would violate his First Amendment rights: "I am not going to answer any questions as to my association, my philosophical or religious beliefs or my political beliefs, or how I voted in any election, or any of these private affairs. I think these are very improper questions for any American to be asked, especially under such compulsion as this."

Seeger's refusal to answer questions that violated his fundamental Constitutional rights led to a March 26, 1957, indictment for contempt of Congress; for some years, he had to keep the federal government apprised of where he was going any time he left the Southern District of New York. He was convicted in a jury trial of contempt of Congress in March 1961, and sentenced to ten 1-year terms in jail (to be served simultaneously), but in May 1962 an appeals court ruled the indictment to be flawed and overturned his conviction.

In 1960, the San Diego school board told him that he could not play a scheduled concert at a high school unless he signed an oath pledging that the concert would not be used to promote a communist agenda or an overthrow of the government. Seeger refused, and the American Civil Liberties Union obtained an injunction against the school district, allowing the concert to go on as scheduled. Almost 50 years later, in February 2009, the San Diego School District officially extended an apology to Seeger for the actions of their predecessors.

AN UGLY TIME...BUT IT NEVER GOT FIXED. WE ARE STUCK IN IT AGAIN, LIKE A TIME WARP. ONLY THE IDEOLOGY HAS BEEN CHANGED, TO PROTECT THE FASCISTS.

Demeter

(85,373 posts)A longstanding opponent of the arms race and of the Vietnam War, Seeger satirically attacked then-President Lyndon Johnson with his 1966 recording, on the album Dangerous Songs!?, of Len Chandler's children's song, "Beans in My Ears". Beyond Chandler's lyrics, Seeger said that "Mrs. Jay's little son Alby" had "beans in his ears," which, as the lyrics imply, ensures that a person does not hear what is said to them. To those opposed to continuing the Vietnam War, the phrase implied that "Alby Jay", a loose pronunciation of Johnson's nickname "LBJ," did not listen to anti-war protests as he too had "beans in his ears".

Seeger attracted wider attention starting in 1967 with his song "Waist Deep in the Big Muddy", about a captain—referred to in the lyrics as "the big fool"—who drowned while leading a platoon on maneuvers in Louisiana during World War II. In the face of arguments with the management of CBS about whether the song's political weight was in keeping with the usually light-hearted entertainment of the Smothers Brothers Comedy Hour, the final lines were "Every time I read the paper/those old feelings come on/We are waist deep in the Big Muddy and the big fool says to push on." The lyrics could be interpreted as an allegory of Johnson as the "big fool" and the Vietnam War as the foreseeable danger. Although the performance was cut from the September 1967 show, after wide publicity it was broadcast when Seeger appeared again on the Smothers' Brothers show in the following January.

At the November 15, 1969, Vietnam Moratorium March on Washington, DC, Seeger led 500,000 protesters in singing John Lennon's song "Give Peace a Chance" as they rallied across from the White House. Seeger's voice carried over the crowd, interspersing phrases like, "Are you listening, Nixon?" between the choruses of protesters singing, "All we are saying ... is give peace a chance".

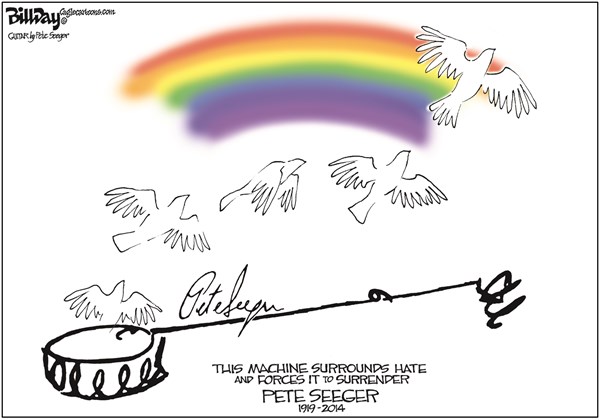

Inspired by Woody Guthrie, whose guitar was labeled "This machine kills fascists",photo Seeger's banjo was emblazoned with the motto "This Machine Surrounds Hate and Forces It to Surrender."

In the documentary film The Power of Song, Seeger mentions that he and his family visited North Vietnam in 1972.

Demeter

(85,373 posts)Seeger was involved in the environmental organization Hudson River Sloop Clearwater, which he co-founded in 1966. This organization has worked since then to highlight pollution in the Hudson River and worked to clean it. As part of that effort, the sloop Clearwater was launched in 1969 with its inaugural sail down from Maine to South Street Seaport Museum in New York City, and thence to the Hudson River. Amongst the inaugural crew was Don McLean, who co-edited the book Songs and Sketches of the First Clearwater Crew, with sketches by Thomas B. Allen for which Seeger wrote the foreword. Seeger and McLean sang "Shenandoah" on the 1974 Clearwater album. The sloop regularly sails the river with volunteer and professional crew members, primarily conducting environmental education programs for school groups. The Great Hudson River Revival (aka Clearwater Festival) is an annual two-day music festival held on the banks of the Hudson at Croton Point Park. This festival grew out of early fundraising concerts arranged by Seeger and friends to raise money to pay for Clearwater's construction.

Seeger wrote and performed "That Lonesome Valley" about the then-polluted Hudson River in 1969, and his band members also wrote and performed songs commemorating the Clearwater.

The 106-foot-long sailboat, Clearwater, was built to conduct science-based environmental education aboard the sailing ship. Clearwater has education programs with many colleges and institutions, including SUNY New Paltz, and Pace University. The sail ship has become recognized for its role in the environmental movement. The Clearwater Festival brings Hudson Valley residents together to enjoy music, their cultural heritage, and support a cause.

Demeter

(85,373 posts)In 1982, Seeger performed at a benefit concert for Poland's Solidarity resistance movement. His biographer David Dunaway considers this the first public manifestation of Seeger's decades-long personal dislike of communism in its Soviet form. In the late 1980s Seeger also expressed disapproval of violent revolutions, remarking to an interviewer that he was really in favor of incremental change and that "the most lasting revolutions are those that take place over a period of time." In his autobiography Where Have All the Flowers Gone (1993, 1997, reissued in 2009), Seeger wrote, "Should I apologize for all this? I think so." He went on to put his thinking in context:

In a 1995 interview, however, he insisted that "I still call myself a communist, because communism is no more what Russia made of it than Christianity is what the churches make of it." In recent years, as the aging Seeger began to garner awards and recognition for his lifelong activism, he also found himself criticized once again for his opinions and associations of the 1930s and 1940s. In 2006, David Boaz—Voice of America and NPR commentator and president of the libertarian Cato Institute—wrote an opinion piece in The Guardian, entitled "Stalin's Songbird" in which he excoriated The New Yorker and The New York Times for lauding Seeger. He characterized Seeger as "someone with a longtime habit of following the party line" who had only "eventually" parted ways with the CPUSA. In support of this view, he quoted lines from the Almanac Singers' May 1941 Songs for John Doe, contrasting them darkly with lines supporting the war from Dear Mr. President, issued in 1942, after the United States and the Soviet Union had entered the war.

In 2007, in response to criticism from a former banjo student—historian Ron Radosh, a former Trotskyite who now writes for the conservative National Review—Seeger wrote a song condemning Stalin, "Big Joe Blues": "I'm singing about old Joe, cruel Joe. / He ruled with an iron hand. /He put an end to the dreams / Of so many in every land. / He had a chance to make / A brand new start for the human race. / Instead he set it back / Right in the same nasty place. / I got the Big Joe Blues. / Keep your mouth shut or you will die fast. / I got the Big Joe Blues. / Do this job, no questions asked. / I got the Big Joe Blues."The song was accompanied by a letter to Radosh, in which Seeger stated, "I think you’re right, I should have asked to see the gulags when I was in U.S.S.R [in 1965]."

I CANNOT FIND A PERFORMANCE OF BIG JOE BLUES...

Demeter

(85,373 posts)To earn money during the blacklist period of the late 1950s and early 1960s, Seeger worked gigs as a music teacher in schools and summer camps, and traveled the college campus circuit. He also recorded as many as five albums a year for Moe Asch's Folkways Records label. As the nuclear disarmament movement picked up steam in the late 1950s and early 1960s, Seeger's anti-war songs, such as, "Where Have All the Flowers Gone?" (co-written with Joe Hickerson), "Turn! Turn! Turn!", adapted from the Book of Ecclesiastes, and "The Bells of Rhymney" by the Welsh poet Idris Davies (1957), gained wide currency. Seeger also was closely associated with the 1960s Civil Rights movement and in 1963 helped organize a landmark Carnegie Hall concert, featuring the youthful Freedom Singers, as a benefit for the Highlander Folk School in Tennessee. This event and Martin Luther King's March on Washington in August of that year brought the Civil Rights anthem "We Shall Overcome" to wide audiences. A version of this song, submitted by Zilphia Horton of Highlander, had been published in Seeger's People's Songs Bulletin as early as in 1947.

By this time, Seeger was a senior figure in the 1960s folk revival centered in Greenwich Village, as a longtime columnist in Sing Out!, the successor to the People's Songs Bulletin, and as a founder of the topical Broadside magazine. To describe the new crop of politically committed folk singers, he coined the phrase "Woody's children", alluding to his associate and traveling companion, Woody Guthrie, who by this time had become a legendary figure. This urban folk-revival movement, a continuation of the activist tradition of the 1930s and 1940s and of People's Songs, used adaptations of traditional tunes and lyrics to effect social change, a practice that goes back to the Industrial Workers of the World or Wobblies' Little Red Song Book, compiled by Swedish-born union organizer Joe Hill (1879–1915). (The Little Red Song Book had been a favorite of Woody Guthrie's, who was known to carry it around.)

Seeger toured Australia in 1963. His single "Little Boxes", written by Malvina Reynolds, was number one in the nation's Top 40s. That tour sparked a folk boom throughout the country at a time when popular music tastes, post-Kennedy assassination, competed between folk, the surfing craze, and the British rock boom which gave the world the Beatles and The Rolling Stones, among others. Folk clubs sprung up all over the nation, folk performers were accepted in established venues, and Australian performers singing Australian folk songs - many of their own composing - emerged in concerts and festivals, on television, and on recordings, and overseas performers were encouraged to tour Australia.

The long television blacklist of Seeger began to end in the mid-1960s, when he hosted a regionally broadcast, educational, folk-music television show, Rainbow Quest. Among his guests were Johnny Cash, June Carter, Reverend Gary Davis, Mississippi John Hurt, Doc Watson, the Stanley Brothers, Elizabeth Cotten, Patrick Sky, Buffy Sainte-Marie, Tom Paxton, Judy Collins, Donovan, Richard Fariña and Mimi Fariña, Sonny Terry and Brownie McGhee, Mamou Cajun Band, Bernice Johnson Reagon, The Beers Family, Roscoe Holcomb, Malvina Reynolds, and Shawn Phillips. Thirty-nine hour-long programs were recorded at WNJU's Newark studios in 1965 and 1966, produced by Seeger and his wife Toshi, with Sholom Rubinstein. The Smothers Brothers ended Seeger's national blacklisting by broadcasting him singing "Waist Deep in the Big Muddy" on their CBS variety show on February 25, 1968, after his similar performance in September 1967 was censored by CBS.

In November 1976, Seeger wrote and recorded the anti-death penalty song "Delbert Tibbs", about the eponymous death-row inmate, who was later exonerated. Seeger wrote the music and selected the words from poems written by Tibbs.

Seeger also supported the Jewish Camping Movement. He came to Surprise Lake Camp in Cold Spring, New York, over the summer many times. He sung and inspired countless campers.

Demeter

(85,373 posts)Demeter

(85,373 posts)MANY MORE EPISODES ON YOUTUBE....I WON'T LIST THEM ALL HERE. GO FIND AND ENJOY!

Demeter

(85,373 posts)They were too ignorant to understand the power was in the songs...I am amazed that my music teachers got away with teaching the songs.....

Demeter

(85,373 posts)Demeter

(85,373 posts)THIS LOOKS LIKE MY NEIGHBORHOOD IN DETROIT, 40 YEARS AGO...

Demeter

(85,373 posts)Demeter

(85,373 posts)It makes today's political leaders look like the slackers they are.

Demeter

(85,373 posts)The six former branches of Syringa Bank will reopen as branches of Sunwest Bank during their normal business hours...As of September 30, 2013, Syringa Bank had approximately $153.4 million in total assets and $145.1 million in total deposits. Sunwest Bank will pay the FDIC a premium of 0.75 percent to assume all of the deposits of Syringa Bank. In addition to assuming all of the deposits of the Syringa Bank, Sunwest Bank agreed to purchase essentially all of the failed bank's assets...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.5 million. Compared to other alternatives, Sunwest Bank's acquisition was the least costly resolution for the FDIC's DIF. Syringa Bank is the 3rd FDIC-insured institution to fail in the nation this year, and the first in Idaho. The last FDIC-insured institution closed in the state was First Bank of Idaho, FSB, Ketchum, on April 24, 2009.

THREE IN A MONTH! THIS IS HARKENING BACK TO THE GO-GO DAYS OF 2009....

FOR THOSE INTERESTED IN BITCOIN: Bitcoin's real-time chart: http://realtimebtc.com/

Demeter

(85,373 posts)On January 19, 2014 I posted a column entitled “Deflation: The Failed Macroeconomic Paradigm Plumbs New Depths of Self-Parody” that discussed the insanity of the Eurozone’s approach to “the threat of deflation.” The EU’s troika cannot understand that deflation is produced by inadequate demand and that the way to prevent it is to use fiscal policy to fill the gap in demand rather than waiting for deflation to hit and then trying to check it through “quantitative easing (QE).”...My January 25, 2014 column (“Spain Rains on Rehn’s Austerity Victory Parade: Unemployment Rises to 26%”) explained how a few weeks after the troika cited Spain as its success story proving the wisdom of austerity, unemployment in Spain – already above Great Depression levels – increased to 26%.

The Eurozone has decided to ring out January with more bad news about the economy, but the New York Times and the Wall Street Journal both end their articles with claims that things are actually going pretty darn well. The NYT refers to the eurozone “recovery” as “nascent.”

The reality of both news reports is that that they show that “recovery” belongs in quotation marks and that what the data actually “display” are “signs of future weakness.”

That kind of fall in bank lending during the “recovery” phase is very bad news. Banks aren’t lending because corporations believe that consumer demand is inadequate to buy increased goods.

The WSJ adds that consumer purchases fell slightly in France. The two largest economies using the euro are suffering from falling consumer purchases.

Demeter

(85,373 posts)... a former Senior Deutsche Bank manager, William Broeksmit, was found hanged at his house. He was the retired Head of Risk Optimization for the bank and a close personal friend of Deutsche’s Co-Chief Executive, Anshu Jain. Mr Broeksmit became head of Risk Optimization in 2008. He retired in February 2013... Gabriel Magee, a Vice President of CIB (Corporate and Investment Banking) Technology at JP Morgan jumped to his death from the top of the bank’s 33 story European Headquarters in Canary Wharf. As a VP of CIB Technology Mr Magee’s job would have been to work closely with the Bank’s senior Risk Managers providing the technology which monitored every aspect of the bank’s exposure to financial risk... These deaths could well be completely unrelated and just terribly sad for their respective families. On the other hand neither of these men had any obvious problems and both were immensely wealthy. So why would two senior bankers commit suicide within a couple of days of each other?

One place to start is to note that JP Morgan Chase had, at the end of 2012, a mind boggling, but only silver medal, $69.5 Trillion with a ‘T’ gross notional Deriviatives exposure . While the gold medal for exposure to Derivative risk goes to …Deutsche Bank, with $72.8 or €55.6 Trillion Gross Notional Exposure. Gross Notional means this is the face value of all the derivative deals it has signed. Which the bank would be very quick to tell you would Net Out to far, far less. Netting Out, for those of you who do not know just means that a bet/contract in one direction is considered to balance or cancel out a similar sized bet/contract betting the other way. But as I wrote in Propaganda War – Risk Weighted Lies and further in Propaganda Wars – Balance Sheet Instabilities …this sort of cancelling out is fine on paper but in reality is more akin to people trying to swap sides in a rowing boat.

Both of the men who killed themselves were intimately concerned with judging and safeguarding their bank from risk. To give you an idea what sort of risk that size of a derivatives book is consider that the entire GDP of Germany is €2.7 Trillion. Remember that Derivatives are what Warren Buffet dubbed “weapons of financial mass destruction.” Next question might be, when do these weapons become dangerous? The answer obviously varies in accordance with the type of derivative you are considering. One huge group of derivatives that both JP Morgan and Deutsche both deal very heavily in are currency and interest rate swaps. They become dangerous when there are large moves in currency values and interest rates.

At the moment The Tukish Lira has been in free fall for days. The Turkish central bank tried to defend it and could not stem an unstoppable tide. It then stunned everyone by raising its over-night lending rate (the interest rate it charges to lend to banks over-night) from 4.25% to 12 %! This did not work either and today the Lira continues to be in crisis, as is the whole Turkish stock market. The Hungarian Forint is also crashing. As is the entire Argentinian economy. The Peso fell 10% in a single day recently. At the same time there is massive uncertainty surrounding Ukraine as there is also surrounding the interest rates and stability of South Africa...So imagine you are a large bank with huge derivatives business much of which covers bets in your equally large Foreign Exchange business. Essentially that boat in which you are hoping you can ‘net out’ about 70 Trillion dollar’s worth of derivatives positions is now being bounced about by several large storms. Many of those derivatives contracts would have been entered into during Mr Broeksmit’s tenure at Deutsche, while Mr Magee would have been overseeing and advising on his bank’s risk exposure as it swayed about over at JP Morgan. All in all I don’t think it is far fetched to think both these men may have been under huge strain and possibly more afraid than the rest of us, because they were in prime position to know much more than the rest of us.

All of which brings to mind yet another banker who recently fell to his death. Just under a year ago, in March of 2013, David Rossi, head of communications at one of Itay’s largest and most catastrophically insolvent banks, Monte dei Paschi, fell from the balcony of his third story office at the bank’s head-quarters. How a man who isn’t drunk and who, as far as I am aware, left no suicide note just ‘falls’ from a balcony is a mystery. But the Italian authorities, I have no doubt, did a bang up job. It turns out that,

Now what I find strange about this man’s death is that as Head of Communications he would not have done any banking himself. Therefore, he would not have been guilty of any wrongdoing. So why would he kill himself? It seems to me the worst that could have happened to him is that he became aware of rather serious wrongdoing that other people and other banks even, might have not wanted brought to light….

And then I remembered one more death. Pierre Wauthier, the former Chief Financial Officer (CFO) of Zurich Insurance Group hung himself last year, at his home. Now this death you might think has no possible connection with the others. In fact it has two. Both are, as with the rest of what I freely admit is a speculative piece, circumstantial.

The CEO of Zurich Insurance group at the time of Mr Wauthier’s suicide was Josef Ackermann, former CEO of Deutsche Bank. Mr Ackermann resigned shortly after it was revealed that Mr Wautheir, in his suicide note, had named Mr Ackermann. According to Mr Wauthier’s widow it was Ackermann who had placed her husband under intolerable strain. Of course we don’t know what the issue was that caused the ‘intolerable strain’. But let’s look a little closer at what tied these two men together.

Mr Ackermann stepped down as CEO of Deutsche Bank in 2012 after ten years at the helm. During that time he had transformed Germany’s largest bank from a large but slightly dull national player into one of the very largest and most agressive of the global banks. One of the ways Ackermann had grown Deutsche so spectacularly was to make it the world’s largest player in the derivatives market. Nearly all of that 72 Trillion dollars’ worth of derivative exposure was accumulated under his leadership.

Mr Ackermann had built a derivatives position 18 times larger than the GDP of Germany itself.

A year and a half after Mr Ackermann took over at Zurich Insurance Group, Zurich announced it was going to start offering banks a way of holding less capital against their risky assets/loans by offering to insure or ‘buy’ the risk from them. This is know as Regulatory Capital Trade. As one of the archtiects of the trade was quoted at the time,

“We are looking at products where banks would buy insurance for their operational risks issues. These are normally risks that are not covered by traditional insurance.”

This new insurance venture was, on the one hand, in response to the European regulators insisting that banks had to hold more capital against their risky assets and on the other, a result of the dire need of Insurers to find products that could yield them a profit. The trade is a classic result of a period of extended low interest rates where traditionally safe investments like Soveriegn bonds and vanilla loans and securities just don’t pay enough to cover insurers’ needs let alone let them make a tidy profit. In other words those insurers who understood what banks were exposed to and were willing to take the risk on themselves – because they thought they were cleverer – could find yield where others feared to tread. And of course one of the largest pots of risky assets on bank books is derivatives. All those lovely foreign exchange bets and interest rate bets, and derivative trades which underpin the rapidly growing European ETF market (in which guess who is a massive palyer? Yes, that’s right, Deutsche) – they would all have levels of risk the banks would love to off-load.

Holding more capital against risk might be prudent but it is hell on bank growth and bonuses. Regulatory Capital Arbitrage, is how you game (quite legally, of course) that particuar regulation. The bank gets to keep the underlying asset, while the risk is ‘sold’ to or insured by (depends on how you account for it at both ends) someone else. In this case Ackermann’s Zurich Insurance Group.

In some ways it was a creative move – in the way finance is creative , like making a better land mine I suppose – since Zurich already ran the world largest derivative trading exchange, Eurex. With the new trade Zurich would not just be running the exchange but would now become a major player in the risk trade. Of course this is fine so long as the risk never materializes. Which brings us back to the present spreading turbulence in markets from Ukraine, to Argentina and Turkey. It is also worth noting Zurich also offers insurance against about 50 or so emerging market banks going under. Might not seem quite so safe a market to be in just at the moment.

As Chief Financial Officer Mr Wauthier would have had to be on side with Mr Ackermann about the wisdom of this bank-risk insurance trade.

Now I realize, as I said above, that this is all circumstantial and speculative. But derivatives are, as Warren Buffett said, very dangerous. Deutsche is sitting on the world’s biggest pile of them and J P Morgan the second biggest pile. And right now global events are making those risks sweat. When HSBC tries to limit cash withdrawals and so does one of Russia’s largest banks then something somewhere is not healthy. We are , I think, circling around another Morgan Stanley moment.

*******************************