Economy

Related: About this forumWeekend Economists' Sumer Is Icumen In June 20-22, 2014

"Sumer Is Icumen In" is a medieval English rota of the mid-13th century. It is also known as "The Cuckoo Song".

The title translates approximately to "Summer Has Come In" or "Summer Has Arrived". The song is composed in the Wessex dialect of Middle English. Although the composer's identity is unknown today, it may have been W. de Wycombe. The year of composition is estimated to be c. 1260.

This rota is the oldest known musical composition featuring six-part polyphony (Albright, 1994), and is possibly the oldest surviving example of independent melodic counterpoint.

It is sometimes called the Reading Rota because the earliest known copy of the composition, a manuscript written in mensural notation, was found at Reading Abbey; it was probably not drafted there, however. The British Library now retains this manuscript.

Middle English lyrics

Sumer is icumen in,

Lhude sing, cuccu;

Groweth sed

and bloweth med,

And springth the wode nu;

Sing, cuccu!

Awe bleteth after lomb,

Lhouth after calue cu;

Bulluc sterteth,

Bucke uerteth,

Murie sing, cuccu!

Cuccu, cuccu,

Wel singes thu, cuccu;

Ne swic thu naver nu.

Sing, cuccu, nu; sing, cuccu;

Sing, cuccu; sing, cuccu, nu!

Demeter

(85,373 posts)The 13 branches of Valley Bank will reopen as branches of Great Southern Bank during their normal business hours. ...As of March 31, 2014, Valley Bank had approximately $456.4 million in total assets and $360.0 million in total deposits. In addition to assuming all of the deposits of Valley Bank, Great Southern Bank agreed to purchase approximately $375.4 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $51.4 million. Compared to other alternatives, Great Southern Bank's acquisition was the least costly resolution for the FDIC's DIF. Valley Bank is the 10th FDIC-insured institution to fail in the nation this year, and the third in Illinois. The last FDIC-insured institution closed in the state was AztecAmerica Bank, Berwyn, on May 16, 2014.

Valley Bank, Fort Lauderdale, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Landmark Bank, National Association, Fort Lauderdale, Florida, to assume all of the deposits of Valley Bank.

The four branches of Valley Bank will reopen as branches of Landmark Bank, National Association during their normal business hours...

As of March 31, 2014, Valley Bank had approximately $81.8 million in total assets and $66.5 million in total deposits. In addition to assuming all of the deposits of Valley Bank, Landmark Bank, National Association agreed to purchase essentially all of the failed bank's assets...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.7 million. Compared to other alternatives, Landmark Bank, National Association's acquisition was the least costly resolution for the FDIC's DIF. Valley Bank is the 11th FDIC-insured institution to fail in the nation this year, and the first in Florida. The last FDIC-insured institution closed in the state was Bank of Jackson County, Graceville, on October 30, 2013.

Demeter

(85,373 posts)Demeter

(85,373 posts)It's 58F and lightly raining...

Demeter

(85,373 posts)Demeter

(85,373 posts)In 2008, the sprawling global bank, Citigroup, created under the controversial repeal of the Glass-Steagall Act, blew itself up with toxic debt hidden in the dark in the Cayman Islands in an exotic framework called Structured Investment Vehicles or SIVs. The unwilling taxpayer was forced into servitude to bail out this hubris that had occurred at the hands of captured regulators, infusing $45 billion in equity, over $300 billion in asset guarantees, and $2.5 trillion in below-market loans.

At the time of its implosion, Citigroup had over 2,000 subsidiaries, affiliates or joint ventures, many of which operated in the dark in foreign locales.

Flash forward to today: in March, the Federal Reserve said Citigroup had flunked its stress test and the Fed prevented it from boosting its dividend. (The so-called stress test is how the Fed measures a mega bank’s ability to withstand a major economic upheaval.) In rejecting Citigroup’s capital plan for 2014, the Fed said that Citigroup “reflected a number of deficiencies in its capital planning practices, including in some areas that had been previously identified by supervisors as requiring attention, but for which there was not sufficient improvement. Practices with specific deficiencies included Citigroup’s ability to project revenue and losses under a stressful scenario for material parts of the firm’s global operations.”

Most Americans, and, sadly, members of Congress, believe that Citigroup is the parent of all those branch banks holding FDIC-insured deposits across America and bearing that angelic red halo over the word “Citi.” But Citigroup is far more than that. A recent record search by Wall Street On Parade suggests that Citigroup may be operating one of Wall Street’s largest collections of dark pools, trading stocks 24/7 around the globe in de facto unregulated stock exchanges which it operates under a dizzying array of different names...MORE...The ability to rig markets is always so much easier in the dark. And until Congress brings sunshine into the nether world of Wall Street’s dark pools, public confidence is not coming back any time soon.

Demeter

(85,373 posts)Ghost Dog

(16,881 posts)Catalunya.

Demeter

(85,373 posts)

http://apnews.excite.com/article/20140619/us--harley-electric_motorcycles-1639e8d2c8.html

Harley-Davidson will unveil its first electric motorcycle next week, and President Matt Levatich said he expects the company known for its big touring bikes and iconic brand to become a leader in developing technology and standards for electric vehicles.

Harley will show handmade demonstration models Monday at an invitation-only event in New York. The company will then take several dozen riders on a 30-city tour to test drive the bikes and provide feedback. Harley will use the information it gathers to refine the bike, which might not hit the market for several more years.

The venture is a risk for Harley because there's currently almost no market for full-size electric motorcycles. The millions of two-wheeled electric vehicles sold each year are almost exclusively scooters and low-powered bikes that appeal to Chinese commuters. But one analyst said investment by a major manufacturer could help create demand, and Levatich emphasized in an interview with The Associated Press that Harley is interested in the long-term potential, regardless of immediate demand.

"We think that the trends in both EV technology and customer openness to EV products, both automotive and motorcycles, is only going to increase, and when you think about sustainability and environmental trends, we just see that being an increasing part of the lifestyle and the requirements of riders," Levatich said. "So, nobody can predict right now how big that industry will be or how significant it will be." At the same time, Levatich and others involved in creating the sleek, futuristic LiveWire predicted it would sell based on performance, not environmental awareness. With no need to shift gears, the slim, sporty bike can go from 0 to 60 mph in about 4 seconds. The engine is silent, but the meshing of gears emits a hum like a jet airplane taking off.

"Some people may get on it thinking, 'golf cart,'" lead engineer Jeff Richlen said. "And they get off thinking, 'rocket ship.'"

MORE

Demeter

(85,373 posts)Fuddnik

(8,846 posts)But, I'll keep my noisy old V-Twin.

I did e-mail the article to a few people, and they liked the idea, and were interested in the range per charge.

Demeter

(85,373 posts)It would be the only motorcycle I'd even consider riding. I hate the noise.

I've never even ridden a moped, but I did bike in my youth.

antigop

(12,778 posts)In that September 4 email, whose contents were obtained by Newsweek, Cole added this eyebrow-raising detail: “I got a call from Broderick Johnson who says the CEO wants to get this resolved.”

Broderick Johnson would be a lawyer and former lobbyist close to President Barack Obama. Last January, Obama named him assistant to the president and cabinet secretary—his job is to liaise with various government agencies, including the Justice Department. Cole’s email was of interest in part because Johnson’s former K Street lobbying firm, Collins Johnson Group, was representing Credit Suisse. But it was also notable because of the timing: The Justice Department had just finalized a deal for most of Switzerland’s banking industry, more than 300 banks, to pay fines for enabling tax evasion for American clients. That agreement, the capstone of the Justice Department’s seven-year crusade against offshore tax evasion through Swiss private banks, didn’t include more than a dozen Swiss banks under criminal investigation, most notably, Credit Suisse.

Johnson’s intervention appears to have worked: After some 18 months of stalemate, the bank started serious negotiations with the Justice Department. On May 19, Credit Suisse pleaded guilty to a single count of conspiring to aid tax evasion over decades, up to 2009, and agreed to pay the largest criminal tax fine in U.S. history—$2.6 billion—for having deceived the Justice Department, the Internal Revenue Service, the Federal Reserve and the Securities and Exchange Commission (SEC).

Big win for the Justice Department, right? Some say no. Despite that record-setting fine, many argue that Credit Suisse got off easy because it wasn’t forced to reveal the names of what a Senate subcommittee said were 22,000 tax-dodging Americans hiding up to $12 billion offshore through the bank.

Crewleader

(17,005 posts)New research takes a look at decades of corruption convictions to find the crookedest states in the union.

When we think of government corruption (as one tends to do), our biased minds often gravitate to thoughts of military juntas and third world governments. But, of course, corruption is everywhere, in one form or another. And it’s costing U.S. citizens big time.

A new study from researchers at the University of Hong Kong and Indiana University estimates that corruption on the state level is costing Americans in the 10 most corrupt states an average of $1,308 per year, or 5.2% of those states’ average expenditures per year.

The researchers studied more than 25,000 convictions of public officials for violation of federal corruption laws between 1976 and 2008 as well as patterns in state spending to develop a corruption index that estimates the most and least corrupt states in the union. Based on this method, the the most corrupt states are:

1. Mississippi

2. Louisiana

3. Tennessee

4. Illinois

5. Pennsylvania

6. Alabama

7. Alaska

8. South Dakota

9. Kentucky

10. Florida

http://fortune.com/2014/06/10/most-corrupt-states-in-america/?xid=ob_rss

Demeter

(85,373 posts)Since they did prosecute a FEW of their white collar criminals.....unlike, say, Michigan, which has a Statehouse FULL of them, walking around free....

Crewleader

(17,005 posts)Have a safe and good summer friend. ![]()

Demeter

(85,373 posts)and nothing worse.

Warpy

(111,222 posts)Our temporary break in the weather is now over and we'll be up to typical June temperatures in the high 90s this weekend. Maybe I'll get the swamper running, maybe not. It's been 20 years since the last time I toughed out a NM summer without a cooler, I'll just have to see how it goes.

The cat needs another bath, her fur is starting to spike again and she looks like Sid Vicious. She really doesn't mind baths as long as the water is about 104F and she doesn't get chilled afterward.

Things chez Bundy are likely heating up, as well. Someone speculated earlier that the militia has probably eaten a quarter of his herd by now. Temperatures above 120 will get the temps in their campers around 150 so I doubt they'll be peaceful for long. Most will leave quietly, at night when it's cool enough to put miles between them and the rest of the loons. The rest will probably go cuckoo and start blasting away at cactus and then at each other.

The economy will sink into the doldrums as people nervously eye the price of oil futures and how quickly they show up at the pump and wonder if the bicycles have air in their tires. Bus ridership is already increasing around here, a sign that many gas guzzlers are staying parked because their owners can't afford to feed 'em.

About the only thing to do now is make book on how long before the election Congress finally bites the bullet and raises the minimum wage, with the Republicans taking 100% of the credit, of course. My Spidey sense says it'll go up by a magnificent buck an hour. They don't dare raise it to what it should be, their bosses are terrified that paying people enough to live on will cause inflation.

Hotler

(11,412 posts)I must have been about ten years old. It was a battle of wills and my mom finally one, but not before there was blood drawn (my mom's). That was the last she time tried to give the cat a bath. The sounds were horrible and the screams loud. The dogs ran and hid. Mom yelled for me to come help. I said no way. It was quite the deal. ![]()

Warpy

(111,222 posts)I put the cat's front paws up and out of water and don't get anywhere near her face. That illusion of control seems to be all she needs. If the water's too cold or too hot, I expect to have her claw marks on the top of my head as she goes flying out of harm's way. A bucket would be better than the sink, but the sink is more convenient.

Well, for me, not the cat.

hamerfan

(1,404 posts)Summertime, by George Gershwin, performed by Ella Fitzgerald and Louis Armstrong:

hamerfan

(1,404 posts)Now for something completely different.

In The Summertime by Mungo Jerry:

MattSh

(3,714 posts)If the answer to this question was "somewhere in the EU", the original DU post would have gotten 30 recs...

Which Country Leads in Proportion of Women in Senior Management?

Instead, it only got three. Look at the image to see why...

Yes, Russia leads the world in the proportion of women in senior management. And the USA is in the bottom ten.

http://www.internationalbusinessreport.com/files/IBR2014_WiB_report_FINAL.pdf

original DU link... http://www.democraticunderground.com/10025122676

Demeter

(85,373 posts)That's nearly 100 years of affirmative action!

The more I learn about nations, the more I envy you, Matt. You got out in time.

MattSh

(3,714 posts)so there's plenty to export. We received a big dose of that this year.

Demeter

(85,373 posts)Have you noticed "the powers that be" employ an entirely different standard for measuring the health of America's job market than they use for the stock market? They're currently telling us that, "The job market is improving." What do they mean? Simply that the economy is generating an increase in the number of jobs available for workers. But when they say, "The stock market is improving," they don't mean that the number of stocks available to investors is on the rise. Instead, they're measuring the price, the value of the stocks. And isn't value what really counts in both cases? Quality over quantity. Employment rose by 217,000 jobs in the month of May, according to the latest jobs report -- and that brought us up to 8.7 million. That is how many new jobs the American economy has generated since the "Great Recession" officially ended in 2009 -- and it also happens to be the number of jobs that were lost because of that recession. You can break out the champagne, for the American economy is back, baby -- all of the lost jobs have been recovered!

You say you don't feel "recovered"? Well, it's true that the U.S. population has kept growing since the crash, so about 15 million more working-age people have entered the job market, meaning America still has millions more people looking for work than it has jobs. And it's true that long-term unemployment is a growing crisis, especially for middle-aged job seekers who've gone one, two or more years without even getting an interview, much less an offer -- so they've dropped out of the market and are not counted as unemployed. Also, there are millions of young people who are squeezed out of this so-called recovery -- the effective unemployment rate for 18- to 29-year-olds is above 15 percent, more than double the national rate of 6.3 percent. But take heart, people, for economists are telling us that full employment may be right around the corner. Is that because Congress is finally going to pass a national jobs program to get America working again? Or could it be that corporate chieftains are going to bring home some of the trillions of dollars they've stashed in offshore tax havens to invest in new products and other job-creating initiatives here in the USA? No, no -- don't be silly. Economists are upbeat because they've decided to redefine "full" employment by -- hocus pocus! -- simply declaring that having 6 percent of our people out of work is acceptable as the new normal. And you thought American ingenuity was dead.

Now, let's move on to the value of those jobs that have economists doing a happy dance. As a worker, you don't merely want to know that 217,000 new jobs are on the market; you want to know what they're worth -- do they pay living wages, do they come with benefits, are they just part-time and temporary, do they include union rights, what are the working conditions, etc.? In other words, are these jobs ... or scams?

So, it's interesting that the recent news of job market "improvement" doesn't mention that of the 10 occupation categories projecting the greatest growth in the next eight years, only one pays a middle-class wage. Four pay barely above poverty level and five pay beneath it, including fast-food workers, retail sales staff, health aids and janitors. The job expected to have the highest number of openings is "personal care aide" -- taking care of aging baby boomers in their houses or in nursing homes. The median salary of an aid is under $20,000. They enjoy no benefits, and about 40 percent of them must rely on food stamps and Medicaid to make ends meet, plus many are in the "shadow economy," vulnerable to being cheated on the already miserly wages...To measure the job market by quantity -- with no regard for quality -- is to devalue workers themselves. Creating 217,000 new jobs is not a sign of economic health if each worker needs two or three of those jobs to patch together a barebones living -- and millions more are left with no work at all.

MattSh

(3,714 posts)While the endless propaganda regurgitated from every media outlet will have the average American believe (in-between trips to collect and cash unemployment checks) that in the first quarter the economy crashed due to weather, or that millions of Americans are bailing on the labor force - oddly enough, most of those Americans are in in the 16-19 age group: retiring early, right?...

... the reality is far, far simpler: the myth of the US economic recovery is nothing more than a lie of mythic proportions.

Take Generation X: those millions of Americans born between 1960 and 1980 who in a truly recovering and thriving economy would be at the forefront of career opportunities and of wealth creation. Instead, as an extended Bloomberg profile of Gen X shows, there has hardly been a generation in worse shape than Americans between their mid-30s and mid-40s... perhaps with the exception of Gen Y, and the Millennials of course.

So propaganda aside, what is life really like for a group of people that in a parallel universe, one with a truly vibrant, growing economy, should have never been better? Sadly, "life" as it is lived and not shown on TV makes one wonder if X stands for Exterminate.

http://www.zerohedge.com/news/2014-06-10/generation-xterminate-only-third-gen-x-households-had-more-wealth-their-parents-held

Demeter

(85,373 posts)A few weeks ago I was visited in my office by the chairman of one of the country’s biggest high-tech firms who wanted to talk about the causes and consequences of widening inequality and the shrinking middle class, and what to do about it.

I asked him why he was concerned. “Because the American middle class is the core of our customer base,” he said. “If they can’t afford our products in the years ahead, we’re in deep trouble.”

MattSh

(3,714 posts)Sort of inspires confidence, doesn't it?

(Finally at 2000 posts (this one). Wonder if I'll hit 2014 in 2014)?

![]()

Demeter

(85,373 posts)as for the White House, we have the daughters sent out to minimum wage jobs....

the visuals on that are appalling.

Instead of lifting up American children, he's oppressing his own. In solidarity, no doubt. Like sending the women and children out as a political shield against GOP sniping....

xchrom

(108,903 posts)AMSTERDAM (AP) -- European Central Bank President Mario Draghi says current rules limiting European Union member states' budgetary policies - notably deficit spending - are not sufficient, and states should surrender some sovereignty in some economic policy areas, notably labor laws.

In an interview with Dutch newspaper De Telegraaf published Saturday, Draghi said "economic policy cannot be a purely national matter" because of the impact European countries' policies have on each other.

Draghi's office confirmed the remarks were accurate.

In the same interview, Draghi said that a further decline in price inflation in the eurozone could be a reason for his office to begin buying government debt, as well as private loans, in a so-called "quantitative easing" program similar to those undertaken in the U.S. and Japan.

Demeter

(85,373 posts)...Today, 19 June, marks two years since Julian Assange was ... permanently confined to the apartment that houses the Ecuadorian embassy in London. Were he to step out of the apartment, he would be arrested immediately. What did Assange do to deserve this? In a way, one can understand the authorities: Assange and his whistleblowing colleagues are often accused of being traitors, but they are something much worse (in the eyes of the authorities).

Assange designated himself a "spy for the people". "Spying for the people" is not a simple betrayal (which would instead mean acting as a double agent, selling our secrets to the enemy); it is something much more radical. It undermines the very principle of spying, the principle of secrecy, since its goal is to make secrets public. People who help WikiLeaks are no longer whistleblowers who denounce the illegal practices of private companies (banks, and tobacco and oil companies) to the public authorities; they denounce to the wider public these public authorities themselves.

We didn't really learn anything from WikiLeaks we didn't already presume to be true – but it is one thing to know it in general and another to get concrete data. It is a little bit like knowing that one's sexual partner is playing around. One can accept the abstract knowledge of it, but pain arises when one learns the steamy details, when one gets pictures of what they were doing. When confronted with such facts, should every decent US citizen not feel deeply ashamed? Until now, the attitude of the average citizen was hypocritical disavowal: we preferred to ignore the dirty job done by secret agencies. From now on, we can't pretend we don't know....

MORE

xchrom

(108,903 posts)NEW YORK (AP) -- The U.S. stock market is back to setting records.

After treading water for most of March and April, stocks are nudging deeper into record territory and are closing in on milestones with lots of zeros attached to them. The Dow Jones industrial average is within 53 points of 17,000 while the Standard & Poor's 500 is just shy of 2,000 after rising 6 percent this year.

A harsh winter in the U.S. that hobbled growth made investors cautious. There were also worries about the conflict in Ukraine and slowing growth in China, the world's second-biggest economy.

But now the economy appears to be on track again, and investors are rediscovering their appetite for stocks.

xchrom

(108,903 posts)DETROIT (AP) -- An effort by deep-pocketed philanthropists to save the bankrupt city of Detroit's art treasures began with a chance meeting last year and culminated Friday when Michigan Gov. Rick Snyder signed a bill authorizing millions in state help.

But all parties excited about the bill signing know that work could be for naught if the city's pensioners and workers, who are nearing a deadline for a historic vote on Detroit's plan to get out of bankruptcy, reject what has been dubbed the Grand Bargain.

"It is really not in our hands," said Rip Rapson, president of the Kresge Foundation, which has pledged $100 million toward the plan. "We fully understand that the pensioners have to make very hard decisions as to whether this is something they can support."

The state's contribution of $195 million, along with $366 million from foundations and a $100 million pledge from the Detroit Institute of Arts, would replace hundreds of millions being cut from retiree pensions, while stopping bond insurers and other creditors from forcing the sell-off of city-owned art such as Van Gogh's "Self Portrait." The money would come over 20 years, placing the value at about $816 million.

Demeter

(85,373 posts)because their pensions are protected by the State Constitution and they have no reason to give away their economic survival, will Snyder take it back?

To tell the truth, I was astonished that Snyder signed the bill prior to the election close and results.

And I wouldn't for a moment expect the State to honor its agreement over 20 years...Michigan's legislature isn't that honorable. Ditto all those "pledges". We know how that always works.

Cash up front, you 1% deadbeats!

Demeter

(85,373 posts)http://www.mlive.com/news/detroit/index.ssf/2014/06/detroit_retiree_representative.html

The city's retirees are being urged by some of their representatives to vote in favor of a plan that would cut their monthly pension checks at far lower rates than initially proposed. Gov. Rick Snyder on Friday signed legislation that would send $194.8 million in state funds and $466 million in private donations to Detroit's underfunded pension systems -- but only if city employees and retirees approve the plan in a vote taking place as part of the bankruptcy process. AHA! I KNEW IT!--DEMETER

The money would cap reductions in monthly pension checks at 20 percent (!) and keep most cuts at 4.5 percent for non-uniformed former workers, and less for police and fire retirees. Without approval of the settlement, in which retiree groups would give up the right to fight cuts, pensioners could lose 30 cents on the dollar, Detroit Emergency Manager Kevyn Orr said Friday.

State Rep. Thomas Stallworth said he's been hearing from retirees who feel betrayed and fearful, and that he shares some of their frustration. But he still urged a vote in favor of the shallower cuts.

"In many ways, we failed the citizens of Detroit," Stalworth said.

UNDERSTATEMENT OF THE YEAR, THE CENTURY, THE MILLENIUM!

"... But this package of bills really does represent the best possible option under the circumstances that we face."

Shirley Lightsey, president of the Detroit Retired City Employees Association and a member of the federally appointed committee representing Detroit's retirees in bankruptcy court, said pensioners have only one rational choice.

"Even now," she said on stage with the governor as he prepared to sign the legislation Friday, "we are not happy to give up some of our promised benefits and legal rights."

"But it's now time to use the wisdom and discernment we all have. I now know that the only way to vote is yes. When you look at a 4.5-percent reduction vs. 27 percent, just look at the money."

She said many retirees have vowed a 'no' vote as a matter of principle.

"We can't eat principles and uncertainty does not pay the bills," she said.

"... If you give that money up, you will have no sympathy from anybody."

Don Taylor, president of the Retired Detroit Police and Fire Fighters Association, also urged approval

"The decision that retirees are now making will determine the conditions many of us will be under for the remainder of our lives," he said.

Retiree Renetta Major, 53, of Southfield said this week she begrudgingly voted in favor of the plan.

"If I took a chance on not voting at all or voting no, they would have been able to take whatever they want," she said.

She said she did janitorial work for the city for 11 years before retiring due to illness. She now collects a $612 monthly pension check.

"I didn't work as long as them, but I'm thing about the ones who put in 30 years," she said. "You were told that you work 30 years and you've got something down at the end of the tunnel for you, and you find out they're going to take some that... I have a problem with that."

Another retiree Mary Highgate takes a harder line against the cuts. She told the Associated Press she plans to return her ballot July 1 with a 'no' vote.

"Everybody I know is voting 'no' because we don't trust them," said Highgate, 69. "I'm voting No! No! No!"

"All they care about is the art. Do you really think they care about the little people? Have they ever?"

Demeter

(85,373 posts)... Detroit's Grand Bargain continues to defy expectations and make forward progress. A significant step today: A big press conference as Governor Snyder signed the necessary bills. ... Shirley Lightsey, President of the association, produced the slogans: You Can't Eat Principles, and Uncertainty Doesn't Pay the Bills. Of the speakers at the press conference today who advocated for the Grand Bargain, Ms Lightsey was the most persuasive. And practical too. Some retirees are skeptical, but it is hard to imagine retirees will do financially better by voting no or abstaining and hoping for an appellate court victory on the Michigan Constitution questions. Voting is not, though, the last hurdle for the Grand Bargain - a point lost in the shuffle of the bill-signing press conference.

Regular readers of Detroit's major newspapers know the facts: Detroit's plan cannot go into effect until the bankruptcy court finds that it satisfies all federal law requirements... Federal court approval is the ticket to get extraordinary relief: binding holdouts to a different deal. The State of Michigan and other Grand Bargain participants and advocates need the bankruptcy court to hoist the ship over the mountain, as much as they need the vote of retirees.

And so, solid as Detroit's plan of adjustment may or may not be, Judge Rhodes will face enormous pressure, implicitly and perhaps explicitly, to okay the plan - reminiscent, perhaps, of the pressure to approve lightning quick sales in GM, Chrysler, and Lehman Brothers. Indeed, the mediator whom Judge Rhodes appointed - Chief District Judge Gerald Rosen - attended and spoke at the Governor's press conference, leaving no doubt that he wants the Grand Bargain to be implemented, even as other aspects of the plan remain highly contested by several types of creditors.

Backbones are not lacking here. Earlier this year, Judge Rhodes rejected the interest rate swap settlement that the mediators endorsed. (A revised deal was ultimately approved). Judge Rhodes also has emphasized his independent duty to assess the plan's feasibility even if creditors do not object - a position consistent with language in several U.S. Supreme court decisions. None of this means the bankruptcy court should or will reject the plan, or condition approval on amendments. Evidence must be presented, legal issues argued persuasively and resolved. Maybe more settlements will roll in, easing the path to confirmation...

YOU CAN'T EAT EMPTY PROMISES, EITHER, WHICH IS WHAT THE CITIZENS OF DETROIT HAVE BEEN FED FOR 45 YEARS....

I THINK THE JUDGE IS NOT CORRUPT, AND PERHAPS THE ONLY HONEST PERSON IN THE DEAL. THAT MAY BE THE SAVING GRACE FOR RETIREES.

xchrom

(108,903 posts)NEW YORK (AP) -- A powerful U.S. House of Representatives committee was ordered on Friday to appear before a judge next month to explain why it should not be required to turn over documents in an insider-trading probe.

U.S. District Judge Paul Gardephe in Manhattan set a July 1 hearing for the Ways and Means Committee to appear. He also required a committee staffer, Brian Sutter, to appear. He said the committee must show why it should not be ordered to produce documents demanded by the Securities and Exchange Commission in May.

In court papers, the SEC said its probe relates to whether secrets were passed to certain members of the public surrounding an April 2013 announcement by the U.S. Centers for Medicare and Medicaid Services about a Medicare program.

Sutter, the health subcommittee's staff director, disclosed on May 9 to House Speaker John Boehner, a Republican, that he had received a subpoena from the SEC for documents and testimony along with a grand jury subpoena from federal prosecutors in Manhattan, according to the congressional record of that day.

xchrom

(108,903 posts)NEW YORK (AP) -- Regulators have closed two lenders in Illinois and Florida, bringing U.S. bank failures this year to 11 after 24 closures in all of 2013.

The Federal Deposit Insurance Corp. said Friday that it has taken over Valley Bank in Moline, Illinois. The bank had 13 branches, assets of $456.4 million and deposits of $360 million.

Great Southern Bank of Reeds Spring, Missouri, will assume all of the deposits of Valley Bank. It's the 10th bank to fail this year, and the third in Illinois.

The FDIC also is taking over another Valley Bank, this one based in Fort Lauderdale, Florida. It has four branches, assets of $81.8 million and deposits of $66.5 million. Landmark Bank N.A. of Fort Lauderdale is assuming all of the deposits of Valley Bank. Valley Bank of Fort Lauderdale is this year's first bank failure in Florida.

Demeter

(85,373 posts)Last Tuesday, Rep. Eric Cantor learned the hard way that crony capitalism comes at a political cost. In a decisive 10-point upset, Cantor's Republican primary opponent David Brat defeated the Virginia congressman after charging that he was "trying to buy this election with corporate cash." Few inside Washington thought charges like this would stick; for decades they've opened their campaign coffers to millions of dollars from Fortune 500 firms without fearing any consequences at the ballot box.

Since arriving on Capitol Hill in 2001, Cantor has received corporate contributions extending from Bank of America to Verizon and beyond. Only four other lawmakers took in more corporate cash during the most recent election cycle. In exchange, Cantor became big businesses' "ace in the hole." According to TIME, big banks, energy and defense industries, insurance firms, and phone and cable companies knew they could rely on Cantor to put their interests before those of his constituents back in Virginia's 7th District.

..............................

But what distinguishes crony capitalists ... is not the fact that they take corporate money -- every member of Congress does -- but the degree to which they shape shift to earn it, molding their views in a way only their benefactors could love. The Center for Responsive Politics website is a good place to discover whether your member of Congress is also a crony capitalist. First, find who his or her biggest corporate donors are. Then check his or her record on policies that may impact the bottom lines of those companies. Does she support or oppose financial-sector reform? Has he recently signed a letter or released a statement opposing EPA curbs to coal-plant emissions? Do those positions match those of his or her largest corporate donors? Yes? If that doesn't bother you, it should. And you should let your members of Congress know whom they really work for.

For decades our elected officials have shrugged off grassroots concerns about the corrupting influence of corporate cash. After Cantor's defeat last week, many should be having second thoughts.

THAT WEBSITE?

https://www.opensecrets.org/

xchrom

(108,903 posts)DEMOCRATS PAY DOWN DEBT

The Democratic National Committee is making progress at whittling down a once-enormous debt, trimming its red ink to less than $5 million for the first time since mid-2012.

The DNC amassed significant debt as it spent heavily on President Barack Obama's re-election bid in 2012. At the end of July 2012, the DNC reported almost $4.8 million in red ink, but that number ballooned to a high of almost $23 million in March 2013 as bills came due and donors tired of giving.

Despite raising $107 million this election cycle, the DNC is still carrying $4.9 million in debt. The biggest of the 44 outstanding bills is for Obama pollster Joel Benenson. The Benenson Strategy Group is owed $824,000.

---

RNC CONTINUES STEADY FUNDRAISING

The Republican National Committee again posted steady fundraising, bringing in another $8.2 million in May.

Although the DNC raised slightly more - $8.8 million - the RNC has been a reliable fundraising operation that sends donors dollars out to state affiliates. The RNC has outraised the DNC in 10 of the last 17 months.

xchrom

(108,903 posts)World’s Richest Gain $16 Billion as U.S. Stocks Hit Highs

http://www.bloomberg.com/news/2014-06-20/world-s-richest-gain-16-billion-as-u-s-stocks-hit-highs.html

The world’s 300 wealthiest people added $15.6 billion to their collective net worth this week as the Standard & Poor’s 500 Index (SPX) and Dow Jones Industrial Average (INDU) closed at record highs amid optimism that the economic recovery will accelerate.

One of the week’s biggest gainers was Tesla Motors Inc. (TSLA) chairman Elon Musk, who added $1.1 billion, according to the Bloomberg Billionaires Index. The Palo Alto, California-based company has soared 17.5 percent since May 20, driving up Musk’s fortune to $10.9 billion. Earnings for the electric carmaker are forecast to increase 46 percent this year, based on the average analyst estimate from a Bloomberg survey.

The comeback in technology shows that an appetite for risk is returning as investors overcome concern about the economy and stock valuations.

“Stocks continue to melt up,” Walter “Bucky” Hellwig, a senior vice president at BB&T Wealth Management, said in a phone interview. “The real story is that there’s more money on the sidelines than there are opportunities in risk assets.”

Demeter

(85,373 posts)Federal Reserve chief Janet Yellen signaled that rational exuberance is just fine. That, at least, is how some of America's largest money managers interpreted her comments on Wednesday suggesting interest rates will remain low through 2016. It reinforced their views that easy money means the U.S. stock market rally has further to run despite notching a series of record highs already this year. That could easily put the S&P 500 benchmark on track to surpass 2000 for the first time, and to do so well before the end of the year.

Such a gain for 2014, after a 30 percent rise in 2013, would surprise those who worried that stocks might be getting overvalued and were due for a sizable pullback. One reason for increasing confidence is that the resilience of the market has been very strong in the face of various shocks this year. A combination of an improving economy, rising earnings, and the cheap borrowing costs, has made that possible. Stock investors have shaken off last year's budget uncertainty in Washington, a sharp drop in high-growth technology companies and biotech shares, the conflict in Ukraine, and more recently the apparent tearing apart of Iraq that resulted in a spike in oil prices.

"What I have is a sweet combination of a self-sustaining, long lasting economic expansion joined with a long-lasting monetary accommodation," said Steven Einhorn, vice chairman of Leon Cooperman's hedge fund Omega Advisors Inc, which has $10.5 billion in assets under management..

"I don't think this bull market is over," he said, adding he estimates stocks could rise another 3 to 5 percent this year

That may sound modest but when added to an average S&P 500 dividend yield of 2 percent, it looks pretty attractive against the 2.62 percent yield of a 10-year Treasury note.

MORE PUFFERY AT LINK

MY GOD! ARE THEY MAD?

xchrom

(108,903 posts)President Cristina Fernandez de Kirchner said Argentina will go ahead with talks to resolve a dispute with holdout creditors, sending the country’s bonds to the biggest gains in emerging markets.

“We want to meet our obligations with 100 percent of our creditors,” she said in a nationally televised address. “We only ask that they give us fair conditions for negotiation that are in line with the Argentine constitution and national laws.”

Fernandez’s comments provided some clarity to investors whipsawed this week by conflicting statements from government officials about the nation’s next steps after a U.S. court decision this week compelling it to pay holders of defaulted debt in full. Wall Street banks from JPMorgan Chase & Co. to Nomura Holdings Inc. had said Argentina was bluffing with threats to walk away from talks with billionaire Paul Singer that could end the decade-long dispute.

“After having no strategy with this whole holdout situation, the government is finally realizing that they need to negotiate,” Juan Carlos Rodado, head of Latin America research at Natixis, said in an e-mail. “She needs to show in the end that she is responsible.”

Demeter

(85,373 posts)There’s a lot to be said for watching demographic shifts as you craft your long-term investing strategy. And while Baby Boomer stocks like health care and insurance get a lot of attention, long-term investors should also consider the impact Millennials will have on businesses — and their portfolios. There are about 80 million Americans who were born between 1980 and 1995. And while much has been made about the challenges for Millennials to get good jobs or contribute to the economy, that is sure to change. As the Boomer population starts its inevitable decline, the power of this age group will grow substantially in the years ahead. Some of that will be good, as the tech talents of younger Americans are put to work in the economy and as they grow into a powerful consumer class....here are five specific businesses that Millennials are shunning, which could cause a lot of pain for investors over the long-term if current trends continue.

- Cars Cruising around in my rusty Chevrolet Cavalier with the sunroof open and the radio up was the very definition of freedom to me at 18 years old. But these days, there’s simply not the interest in cars like there used to be. Consider that in 2010, a mere 28% of 16-year-olds had driver’s licenses, compared with 44% in 1980, according to another study from the University of Michigan Transportation Research Institute. Car sales in America have rebounded in recent years thanks, in part, to pent-up demand after the Great Recession, but the sad reality is that the U.S. love affair with the automobile may be coming to an end. That’s in large part due to a lack of interest among Millennials who look to live in walkable, urban locations and prefer car-sharing services like ZipCar or ride sharing services like Uber. A car is just an expensive hassle for the younger generation, as technology equals freedom in 2014...

JOBS, INCOME, DEBTLOAD, GAS PRICES, AND WHERE IS THERE TO GO, ANYWAY?--DEMETER - Cable TV. It’s unclear where streaming video is headed in the next several years. But it’s clear that the future is likely with Netflix or Google property YouTube and not an old-guard cable company. Consider that for the first time ever, the number of pay-TV lines in the U.S. fell last year — with a drop of about 250 million subscriptions over the calendar year. That’s a big number, and a number that seems to be growing at an alarming rate... Part of the problem is “cord cutting” as folks with cable TV find options on Netflix or other streaming providers at a fair price. But increasingly, traditional cable-TV businesses are going to face the big pressure of Millennials and so-called “ cord nevers ” who haven’t ever had an affinity to cable and see no reason to start anytime soon when so much of their entertainment is consumed via laptop, tablet or smartphone...

OBSCENE PRICING, BUNDLING, INANE PROGRAMMING, AND FIXED SCHEDULING--DEMETER - Brick-and-mortar retail. In the short term, I think retail is in big trouble. But folks blaming bad first-quarter weather are missing the broader long-term pressure of e-commerce that is reshaping the entire sector as more shoppers go online instead of to the mall. Broadly, online sales continue to outpace brick-and mortar results. Online retail sales grew about 17% in 2013 , with total overall retail sales up only a fraction of that. So it’s no surprise that some of the biggest laggards in retail are stores that simply can’t get their online acts together...Brick-and-mortar retailers that can’t change with the times and evolve to a digital-sales platform are going to continue to feel the pain as more retail sales go online in the years to come.

THE BRICK AND MORTAR HAVE NOTHING IN STOCK, OR NOTHING WORTH BUYING, GAS IS TOO EXPENSIVE FOR WINDOW-SHOPPING, AND THE PARKING IS AS BAD AS EVER, AS MOBS ROAM THE MALLS AS A GATHERING PLACE, NOT A COMMERCIAL PLACE--DEMETER - Homebuilders. By now, you’ve certainly seen all the stories about why Millennials are a drag on the housing recovery. The reasons are numerous, but the biggest one-two punch tends to focus on the personal desire to live urbanely and the financial practicalities of less income and a lot of student-loan debt. Consider that about half of home-buying Millennials lately are asking mom and dad to shoulder their down payments, according to a recent Trulia survey. Others are so spooked by the Great Recession and mountains of student-loan debt that they have no desire to take on a mortgage at all considering other financial concerns. Homebuilders like PulteGroup and Toll Brothers have been under pressure for the last year or so as the rebound in housing has petered out and construction has tapered off. But just imagine what would happen if interest rates tighten and the cost of borrowing climbs even higher! Millennials don’t want to live in surburbia, and either can’t or won’t take on a mortgage payment. And that trend is not going away.

- Soft drinks

Sugary, carbonated beverages like Coca-Cola and Pepsi seem like the staple junk food of any young American. But not anymore, thanks to a focus on fighting childhood obesity and a rise of healthier alternatives. As a result, Millennials drink much less soda (or pop or whatever you want to call it). And that number is declining every year. A recent Morgan Stanley report illustrates how the shift to energy drinks and sports drinks in the past decade is partially to blame. But while that’s good news for America’s health, it’s very bad news for investors like Warren Buffett, who have always considered Coca-Cola the gold standard of consumer staples. Sure, Coca-Cola has tried to hedge its bets with lines like its Odwalla juices and Powerade sports-drink lines. But the flagship soda brands of Coke and Sprite are facing real headwinds in the years ahead. Perhaps companies like Coca-Cola and Pepsi can continue to diversify and evolve, both at home and abroad. But investors need to know what they are getting into with these consumer-staples companies that are increasingly less popular with younger Americans.

OVER-PRICED, AGAIN. WHEN THESE ARE USED AS LOSS-LEADERS AT $1/2 LITER, THEY SELL.--DEMETER

xchrom

(108,903 posts)Americans who have been hunting for employment for more than six months are finally catching a break.

Among them is Tracey Mutz, who landed a job this month as director of project management for 1st Money Center Inc. after being out of work since March 2013. “It was terrible,” said Mutz, 52. “I wasn’t getting any responses.”

Now, she’s “happy” with the position she found. The specialty financing company is located a mile from her home in Hurst, Texas, and has “a great office environment.”

Mutz isn’t alone in experiencing better times. Faced with a shrinking pool of available workers and incipient wage pressures, companies are starting to give the longer-term unemployed a second look. The number of Americans without a job for 27 weeks or more fell to 3.37 million in May from 4.35 million a year earlier, though some of that drop reflects people leaving the workforce.

xchrom

(108,903 posts)Inflation exceeded the Bank of Canada’s target last month for the first time in more than two years, an unexpected acceleration led by energy costs that sparked increases in the currency and bond yields.

The consumer price index rose 2.3 percent in May from a year ago following April’s 2 percent pace, Statistics Canada said today from Ottawa. The core rate, which excludes eight volatile products, increased 1.7 percent after a gain of 1.4 percent the prior month. Both increases were higher than all forecasts in Bloomberg economist surveys that called for total inflation of 2 percent and core prices to rise 1.5 percent.

Bank of Canada Governor Stephen Poloz kept his key lending rate at 1 percent on June 4 with a neutral bias, and said the risk of persistent low inflation remains after a rise in energy costs. The Canadian dollar and bond yields jumped after today’s report suggested Poloz may change his view that core inflation will remain below 2 percent.

“We have pretty clearly seen the lows for inflation, at least for some time,” said Robert Kavcic, a Bank of Montreal senior economist in Toronto. For the central bank, “I don’t think it’s going to change the policy path, but they won’t explicitly be talking about downside risks to inflation.”

hamerfan

(1,404 posts)Summer In The City by The Lovin' Spoonful:

xchrom

(108,903 posts)The recovery in the eurozone is not strong enough, according to the International Monetary Fund (IMF).

That's the assessment IMF head Christine Lagarde is delivering to eurozone finance ministers at a meeting in Luxembourg.

The IMF also says the European Central Bank (ECB) should consider buying financial assets with newly created money, if inflation remains low.

But the IMF's regular eurozone health check sees some signs of progress.

Demeter

(85,373 posts)ARE YOU FIT TO JOIN THE 1% ELITE?

http://psychcentral.com/quizzes/narcissistic.htm

DemReadingDU

(16,000 posts)6/20/14 Buying Up the Planet: Out-of-control Central Banks on a Corporate Buying Spree by Ellen Brown

When the US Federal Reserve bought an 80% stake in American International Group (AIG) in September 2008, the unprecedented $85 billion outlay was justified as necessary to bail out the world’s largest insurance company. Today, however, central banks are on a global corporate buying spree not to bail out bankrupt corporations but simply as an investment, to compensate for the loss of bond income due to record-low interest rates. Indeed, central banks have become some of the world’s largest stock investors.

This is a rather alarming development. Central banks have the power to create national currencies with accounting entries, and they are traditionally very secretive. We are not allowed to peer into their books. It took a major lawsuit by Reuters and a congressional investigation to get the Fed to reveal the $16-plus trillion in loans it made to bail out giant banks and corporations after 2008.

What is to stop a foreign bank from simply printing its own currency and trading it on the currency market for dollars, to be invested in the US stock market or US real estate market? What is to stop central banks from printing up money competitively, in a mad rush to own the world’s largest companies?

As former Federal Reserve Chairman Alan Greenspan quipped, “Quite frankly it does not matter who is president as far as the Fed is concerned. There are no other agencies that can overrule the action we take.”

That is how “independent” central banks operate, but it evidently not the US central bank that is gambling in the stock market. After extensive quantitative easing, the Fed has a $4.5 trillion balance sheet; but this sum is accounted for as being invested conservatively in Treasuries and agency debt (although QE may have allowed Wall Street banks to invest the proceeds in the stock market by devious means).

Which central banks, then, are investing in stocks? The biggest player turns out to be the People’s Bank of China (PBoC), the Chinese central bank.

more...

http://ellenbrown.com/2014/06/20/buying-up-the-planet-out-of-control-central-banks-on-a-corporate-buying-spree/

Demeter

(85,373 posts)Or is the month immaterial?

One thing about the Chinese...they don't have to do any counterfeiting of their currency. They already have ours.

Demeter

(85,373 posts)

Ha-Joon Chang also recently posted another list at Huffington Post, which he covers in more detail in a lecture thats embedded below:

1. Economics was originally called ‘political economy’

2. The Nobel Prize in Economics is not a real Nobel Prize

3. There is no single economic theory that can explain Singapore’s economy

4. Britain and the US invented protectionism, not free trade

5. Free trade first spread mostly through un-free means

6. It was arch-conservative Otto von Bismarck who introduced the first welfare state in the world

7. Capitalism did best between the 1950s and the 1970s, an era of high regulation and high taxes

8. The internet was invented by the US government, not Silicon Valley

9. Before tax and welfare spending, Germany and Belgium are more unequal than the US

10. Finland, one of the most equal countries in the world, has grown faster than the US

11. The ‘lazy’ Greeks are the hardest working people in the rich world after South Koreans

12. Switzerland and Singapore are not living off banking and tourism alone

13. Most poor people don’t live in poor countries

http://www.macrobusiness.com.au/2014/06/understanding-economics-without-economists/

Demeter

(85,373 posts)There’s new data on income inequality out from the OECD Thursday, so we thought we’d take a look to see how the U.S. compares against the group’s 33 other countries — and its upcoming World Cup matches (more on that in a bit).

When we look at income, the U.S. has had a wider gap — meaning less equal distribution of income — than the OECD average for at least the past 30 years.

Gini CoefficientIncome InequalityThe Gini Coefficient is a measure of income inequality. Zerorepresents equal distribution of income across the population, and 1represents a single person has all the income. Thus, a higher scorerepresents greater income inequality.

INTERACTIVE GRAPH AT LINK

The data also shows that lower-income households across the OECD were hit harder by the financial crisis — the poor either lost more during the crisis or benefited less from the recovery than did their higher-income neighbors.

While real household income hasn’t changed much (stagnated) across the 34 member countries, young adults have been hit the hardest since the financial crisis. By age, 18- to 25-year-olds “suffered the most severe income losses,” while those 65 and older “were largely shielded from the worse effects of the crisis,” according to the release. The young also continue to beat the elderly for greater risk of poverty, a trend the OECD has tracked for at least 25 years.

While the report doesn’t give much explanation as to why this is, high youth unemployment and more generous social services for those 65 and older are likely to have something to do with it.

In the U.S., poverty has averaged around 26.92 percent of the population with an income less than 50 percent of the country’s median income, after taxes and benefits are added (how the OECD defines “relative income poverty”). For years with data available since 1983, it maxed at just under 18 percent in 1989; the lowest was 16.5 percent in 2009. In fact, the U.S. poverty rate in 2011 was higher compared to all other OECD countries other than Israel, Mexico and Turkey.

MORE

Demeter

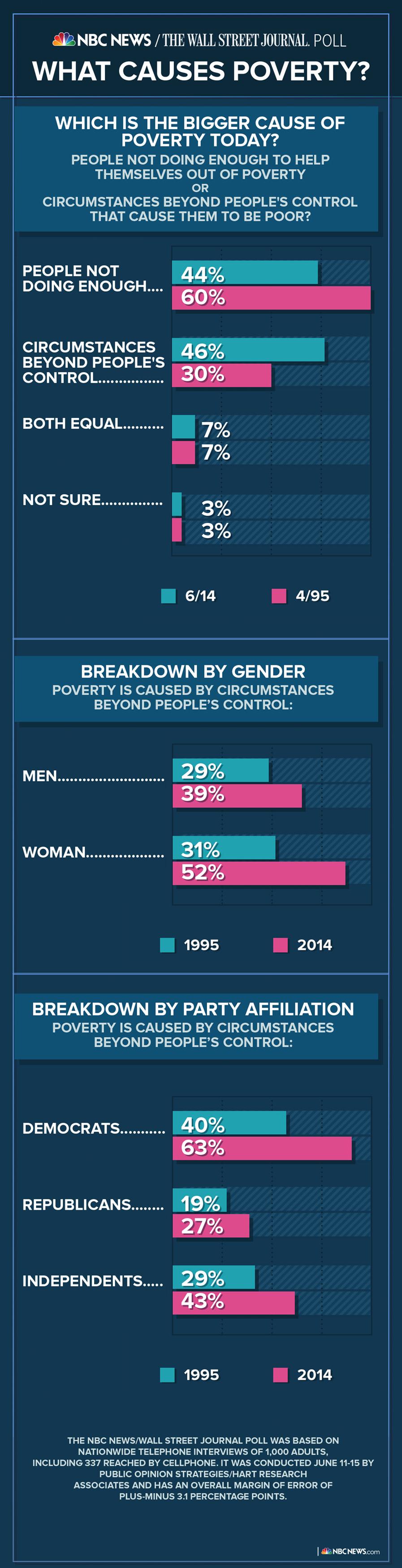

(85,373 posts)As millions of Americans continue to struggle in a sluggish economy, a growing portion of the country says that poverty is caused by circumstances beyond individual control, according to a new NBC News/Wall Street Journal poll.

The poll shows a significant shift in American opinion on the causes of poverty since the last time the question was asked, nearly 20 years ago. In 1995, in the midst of a raging political debate about welfare and poverty, less than a third of poll respondents said people were in poverty because of issues beyond their control. At that time, a majority said that poverty was caused by "people not doing enough." Now, nearly half of respondents, 47 percent, attribute poverty to factors other than individual initiative.

“In hard economic times, people become more sympathetic to the poor,” says Martin Gilens, Ph.D., a political scientist at Princeton University. “In 1995, we were in a period of economic expansion. Even the less well-off benefitted considerably. Now we’re in the most visible period of dire economic circumstances for Americans. If you look around and you see that there’s high unemployment and a generally poor economy, you’re more likely to explain poverty through those factors.”

Demeter

(85,373 posts)http://dealbreaker.com/2014/06/the-only-things-standing-between-bank-of-america-and-a-17-billion-justice-department-fine-are-brian-moynihans-negotiating-skills-latent-charisma/

So, that’s something.

Representatives of Bank of America Corp have asked U.S. Attorney General Eric Holder to meet with Moynihan, its chief executive officer, in an attempt to resolve differences over a possible multibillion-dollar settlement involving shoddy mortgage securities sold by the second-largest U.S. bank and its units, according to people familiar with the negotiations. Negotiators for Bank of America and the Justice Department have not met in more than a week and have no plans to do so after a flurry of meetings did not bring them close to a settlement amount, sources said…The Department of Justice has not yet responded to Bank of America about the possibility of the meeting, sources said. The bank requested the meeting late last week, the people said…

Sources said the Justice Department’s silence about a meeting between Moynihan and Holder suggested Bank of America’s request was premature. Bank of America has discussed paying about $12 billion, including more than $5 billion to help struggling homeowners, to resolve a range of federal and state probes, primarily into whether the company and its units defrauded mortgage bond investors in the run-up to the financial crisis, people familiar with the matter said. The Justice Department suggested a $17 billion settlement in the latest round of negotiations and did not view Bank of America’s offer as a serious one, one source said last week.

By Bess Levin I'M TOLD IT'S SATIRE...

Demeter

(85,373 posts)The S&P 500 stock index bumbles to new highs no matter what. But it has been a slog: serial GDP downward revisions forward and backward, unceremonious abandonment of “escape velocity” for the fifth year in a row, wars or civil wars in Ukraine and Iraq with consequences for gas supplies to Europe and oil supplies to the world, US inflation heating up. And stocks nevertheless rise because.... The Fed Rules, Metrics and Ratios Are Just for Decoration.

In the Business Roundtable’s second quarter CEO survey, the chiefs of the largest US corporations weren’t exactly in an ecstatic mood either. They lowered their GDP growth forecast for the year to 2.3%; among other tidbits, they also expected to spend less money on capital investments...Capital investments are crucial to the economy. One, they crank up GDP when the money is spent. And two, investing in productive assets creates future growth. But only 44% of these CEOs are planning to increase capital investment, down from 48% last quarter.

Companies axe capital investments brutally when dark clouds appear at the horizon. It started in early 2000 as the stock market was blowing up and lasted through the recession that followed. Then capex recovered and peaked in the summer of 2008, even as the financial crisis was spreading. In either case, that sudden cut in corporate investment deepened the recessions. This chart of new orders of non-defense capital goods (St. Louis Fed) shows the brutality of the cuts – for example, slashing them by a third from $69 billion in August 2008 to $46 billion in April 2009:

?__SQUARESPACE_CACHEVERSION=1403242517912

?__SQUARESPACE_CACHEVERSION=1403242517912

But note how the chart has stayed within its range over the last two decades – a time when the US population has soared 19% and GDP, adjusted for inflation, 51%. Turns out, corporations had found other things to do with their money: stock buybacks. Which have been skyrocketing. In the first quarter, buybacks jumped 50% from a year ago to $154.5 billion, according to FactSet‘s report released yesterday. It was the third-largest in the data series, behind only 2007 when in Q2 and Q3 $161.8 billion and $177.9 billion were spent on buybacks, while the financial crisis was already fermenting underneath. Tech blew $47.4 billion on buybacks, a record in the data series, up 175% from a year ago. A cool $18.6 billion of that came from Apple. IBM was in second place with $8.3 billion. Industrials, up 119% from a year ago, also set an all-time high. Overall, Apple and IBM led the pack, followed by FedEx, Boeing, Abbott Laboratories, Corning, and eBay. For the trailing 12 months, our corporate heroes bought back $535 billion – funded largely with borrowed money – a notch below the $603 billion record set during the trailing twelve months ended in Q3 2007, on the eve of the financial crisis (chart by FactSet):

?__SQUARESPACE_CACHEVERSION=1403242584122

?__SQUARESPACE_CACHEVERSION=1403242584122

IF YOU DON'T FEEL QUEASY YET, THERE'S MORE AT THE LINK

Demeter

(85,373 posts)Analysis: Every big wave of mergers has ended with a drop in equities

NOT TO MENTION AN ECONOMIC CRASH AND WHOPPING UNEMPLOYMENT...

Medtronic has offered $43 billion to buy Covidien, a medical-device competitor.

Here’s one sign a significant stock market decline might occur sooner rather than later: the rapid acceleration of recent merger and acquisition activity.

This past week saw news of another big deal, led by medical-device maker Medtronic’s /quotes/zigman/233680/delayed/quotes/nls/mdt MDT -1.25% announcement of its $43 billion bid to acquire rival Covidien /quotes/zigman/4475320/delayed/quotes/nls/cov COV -1.24%

At the current pace, M&A deals could reach $3.51 trillion this year, the most since 2007, according to data provider Dealogic.

It wasn’t a fluke that a surge in M&A activity coincided with that year’s market top, according to Matthew Rhodes-Kropf, a professor at Harvard Business School and an expert in the field. “Each of the last five great merger waves on record” — going back more than 125 years — “ended with a precipitous decline in equity prices,” he says.

Some experts have found that merger activity surges when stocks are richly priced, at least in part because companies can use their inflated shares to pursue acquisitions.

Demeter

(85,373 posts)ANOTHER RUBINITE. 3RD WAY NEOLIBERAL NEOCON? TIMMY'S UNDERSTUDY?

WHERE DO THEY GET THESE PEOPLE, OUT OF 3-D PRINTERS?

http://thehill.com/policy/finance/209626-obamas-housing-nominee-open-to-ending-fannie-and-freddie

President Obama’s nominee for Housing secretary on Tuesday told the Senate Banking Committee he is open to shuttering the mortgage giants Fannie Mae and Freddie Mac. Senators expressed little opposition to San Antonio Mayor Julián Castro’s nomination for secretary for Housing and Urban Development (HUD), a job that would give him a major role in the push for reforms to the housing system. Though he declined to endorse any specific legislative proposals, Castro said he supports ending the federal backstop that Fannie and Freddie now enjoy.

"I absolutely believe that there are better alternatives than what we have in place with this duopoly and with the conservatorship," Castro said.

That was enough for Sen. Bob Corker (Tenn.), who said he will support Castro’s nomination.

"You will be involved in what happens with Freddie and Fannie," Corker told Castro at the hearing. "You were a little vague on your support of the bill, and you should be at this point, but relative to {Fannie and Freddie status quo] you agree with that 100 percent."

Corker and Sen. Mark Warner (D-Va.) put forward a housing finance proposal that became the foundation for a bipartisan bill from Banking Committee Chairman Tim Johnson (D-S.D.) and Sen. Mike Crapo (Idaho), the committee’s ranking Republican.

"I believe that reform would be preferable to what we have in place now," Castro said in response to a question from Sen. Jon Tester (D-Mont.). "If the nation were to experience another downturn and another housing crisis as we just experienced, for that reason I commend the committee for working toward a housing finance model that takes the taxpayers out of their position of first loss and puts the private sector in that position."

The committee approved the Johnson-Crapo bill last month on a 13-9 vote, with liberal Sens. Charles Schumer (D-N.Y.), Sherrod Brown (D-Ohio), Jeff Merkley (D-Ore.) and Elizabeth Warren (D-Mass.) opposing it because of concerns the legislation did not do enough to address affordable housing. The lack of liberal support likely killed the bill’s chances of receiving a floor vote this year.

"I fully understand though, as well, the concerns of folks with regards to the other part of the balance, which is access to credit," Castro continued in his response to Tester. "We have had a housing finance system in place that seeks to ensure opportunity for Americans with modest means who are credit borrowers."

Housing finance reform has been one of the largest financial regulatory issues left unresolved from the 2008 economic crisis. The government took control of Fannie and Freddie in September 2008 and gave them a $187.4 billion taxpayer bailout. Now, eight years after the crisis, the government is still conservator. Further complicating the issue is that Fannie and Freddie have become profitable again and have paid back the bailout money.

Johnson asked Castro about a 2012 HUD inspector general report that found San Antonio had mishandled $8.6 million in HUD allocations to the city. Castro said the city returned $125,000 of that money, and that he had personnel removed who were involved with the decision. Castro, a rising Democratic star who is often named as a potential vice presidential 2016 contender, had a packed crowd of about 50 people inside the Dirksen Senate Building, which is unusual for a Banking Committee confirmation hearing. He was introduced by Sen. John Cornyn (R-Texas). Castro was joined by his family, including his twin brother, Rep. Joaquín Castro (R-Texas), who arrived late the hearing.

President Obama nominated Castro for HUD secretary because the current chief, Shaun Donovan, has been nominated to lead the Office of Management and Budget.

Demeter

(85,373 posts)AND THAT IS HOW THEY PUT THE SQUEEZE ON FRANCE...

http://www.euractiv.com/sections/euro-finance/france-endeavours-revive-paris-stock-exchange-302902

Finance minister Michel Sapin has launched a new committee aimed at reviving the Paris stock exchange whose competitiveness is increasingly undermined by European rivals. EurActiv France reports.

Sapin revealed a new committee titled "Place de Paris 2020" on Tuesday (16 June). According to Sapin, its goal is to increase financial support for the real French economy and to revive competitiveness of the Place de Paris (Parisian Financial market) that is running out of steam.

"Developing a financial industry which ensures financing to all sections of the economy, especially companies, in a competitive and certain way is very important for France," Sapin said.

This initiative comes as Euronext will be listed on the stock exchange. Euronext is a pan-European exchange whose major shareholder is the bourse of Paris. In 2007, it merged with the NYSE group which was then acquired by IntercontinentalExchange (ICE) in 2013. ICE will pursue an initial public offering (IPO) of Euronext on 20 June.

The French government is ready to intervene in order to prevent other big players from moving in when it enters the market. BNP Paribas and Société Générale, two of France's biggest banks, have been assigned to secure a blocking minority of 33%.

MORE

Demeter

(85,373 posts)General Electric (GE) has sweetened its offer to buy the power generation business of France's Alstom. The US engineering giant hopes the proposal will convince Paris and beat off a rival bid by Germany's Siemens... General Electric's revised bid offered $17 billion (12.48 billion euros) in cash for Alstom's power business and provided new guarantees on jobs and decision-making structures, the US-based company said in a statement released Thursday.

While leaving the overall value of the deal unchanged, GE Chief Executive Jeff Immelt said in a statement the revised offer would create jobs, establish headquarters in France and ensure that the Alstom name would endure.

MORE QUIBBLING AT LINK

hamerfan

(1,404 posts)Summertime Blues by Eddie Cochran:

xchrom

(108,903 posts)WARSAW, Poland (AP) -- A Polish magazine says it has obtained recordings of a conversation in which Foreign Minister Radek Sikorski says the country's strong alliance with the U.S. "isn't worth anything" and is "even harmful because it creates a false sense of security."

A short transcript of the conversation was released on Sunday by Wprost, a weekly magazine that set off a political storm last weekend with the publication of secret recordings of other top officials making compromising remarks.

In the transcript, a person that Wprost identifies as Sikorski tells former finance minister, Jacek Rostowski, that Poles naively believe the U.S. bolsters their security.

The Foreign Ministry says it won't comment until the entire conversation has been released. Wprost says it will publish the sound files of the recording Monday.

Demeter

(85,373 posts)Only took....since Reagan? That's when being an ally meant being screwed all began.

xchrom

(108,903 posts)In the New York and London markets brokers and bankers explain that they are being discreetly called by US Treasury officials with this message: buying Russian equity or debt paper is legal, but in the event there is a new round of sanctions, it will be illegal to re-sell them, so there can be no profit in Russian assets.

The market is calling this campaign “stealth sanctions”. It is an attack on the international market for Russian corporations, and on the international currency and security clearance systems on which the market depends.

According to the highest UK and European courts — reported here on March 25 — the type of formal sanctions which the US and the EU have already introduced are likely to be found illegal, if they are challenged in court. Stealth sanctions are more difficult to substantiate in court -– and also financially much more damaging. Until now, there has been no Russian retaliation for the sanctions, and no litigation.

Yesterday, Igor Sechin, chief executive of Rosneft, said in a television interview with a New York network: “The sanctions have been discussed a lot and I would like us to abstain from this discussion because the more we talk about the sanctions, the more important they seem. I am trying to put myself in the shoes of those people who introduce sanctions and I believe that there should be some purpose of the sanctions and some justification of them.” The reference to purpose and justification is also a discreet reference to the court judgements in London and Strasbourg.

“I cannot understand any justification or basis for taking the sanctions. I don’t think that my active cooperation with the American companies that is aimed at ensuring mutual profit could be a basis for sanctions…serious people should not take any serious decisions under pressure.”

Read more: http://johnhelmer.net/?p=11015#ixzz35MeFFgcw

Demeter

(85,373 posts)Which does seem to be the hallmark of this particular Administration...

Consider it comic relief.

xchrom

(108,903 posts)The government has announced income tax relief for Spaniards, who can expect it to kick in next year.

Under the tax reform presented by the Popular Party (PP) administration on Friday, income tax on wages will go down an average 12.5 percent over the course of two years, said Deputy Prime Minister Soraya Sáenz de Santamaría.

Santamaría added that for 62 percent of taxpayers – those earning less than €24,000 a year – the income tax rebate will be an average 23.5 percent in 2016.

The deputy prime minister also denied there would be any further hikes to value-added tax (VAT), save those on certain sanitary products to comply with orders from Brussels.

xchrom

(108,903 posts)Hartmut Mehdorn, CEO of Berlin's still unfinished new airport, isn't one for transparency. "This isn't a sandbox where everyone can just snoop around," he said in March. In other words, comptrollers looking into his project's finances are decidedly unwelcome, and indeed, when federal auditors from the Bundesrechnungshof, Germany's Federal Court of Auditors, recommended an independent audit, Mehdorn wanted none of it, and the public officials backed down.

But because the EU provided some of the funding for the problem-plagued airport, the 71-year-old Mehdorn was unable to prevent comptrollers from the European Court of Auditors from digging around in his sandbox last year, in an effort to find out what had happened to that money.

Now, the group has completed a report critical of the multi-billion euro project in Berlin. Even the cover letter addressed to Siim Kallas, the European Commission vice president responsible for the Mobility and Transport portfolio, notes "manifold errors" and a "weakness of management and monitoring systems."

Generally, the European Commission reacts to these kinds of findings by demanding that its subsidies be reimbursed, which would mean that Berlin's airport consortium, already short of cash, might be forced to send €30 million ($41 million) back to Brussels.

xchrom

(108,903 posts)French President Francois Hollande and German Vice-Chancellor Sigmar Gabriel signaled they are ready to back former Luxembourg Prime Minister Jean-Claude Juncker to head the European Commission.

Hollande and Gabriel met in Paris, along with Italian Prime Minister Matteo Renzi, Belgian Premier Elio di Rupo and five other heads of governments from European Union countries to stake out a common socialist position before all EU leaders gather in Ypres June 26. The summit is being held in the Belgian town as part of World War I centenary commemorations.

The endorsement of Juncker to run the EU’s executive arm next year sets up a clash with U.K. Prime Minister David Cameron, who is refusing to drop his opposition to appointing the Luxembourg politician, a British government official said yesterday. Parties backing center-right Juncker won the most seats in elections to the European Parliament last month.

“We said, let’s respect the spirit of the European elections, which is to say that the party that came in first should propose the candidate that was presented -- in this case Mr. Juncker,” Hollande said today in Paris, adding that the group would like socialist candidates considered for other commission jobs.

Demeter

(85,373 posts)xchrom

(108,903 posts)Polish central bank Governor Marek Belka has been caught on tape asking a government official to dismiss the finance minister, in return for engineering an economic rebound to help the government win re-election. If he doesn't resign, the government should fire him.

Poland's Wprost magazine last week published transcripts of a July 2013 conversation between Belka and Polish Interior Minister Bartlomiej Sienkiewicz, in which Belka effectively asks for the ouster of Jacek Rostowski, the finance minister at the time. Although media attention has focused on some salacious comments the governor made about one of his fellow Monetary Policy Council members, it's the besmirching of the independence of his office that makes Belka's position untenable.

The implication is that Belka would have been unwilling to rescue a slowing economy if he didn't get his way. The idea of a central banker blackmailing the elected representatives in government, using monetary policy as a weapon or bribe, is unacceptable, as is the idea that the governor might favor one political party over another.

The central bank's decision to keep Polish interest rates at a record low of 2.5 percent since July 2013 may be judicious and appropriate, and have nothing to do with ensuring the current government retains office in elections scheduled for 2015. And Rostowski's subsequent dismissal in November may have been a coincidence, unrelated to Belka's demands. But Belka's recorded comments cast doubts that can't be easily dismissed.

Demeter

(85,373 posts)xchrom