Economy

Related: About this forumDerivatives, Credit Default Swaps, etc: how much of a problem now ?

From what I've read, they are as big of a problem now as in 2008. Is the situation worse now ? Thanks for your input.

Steve

msongs

(67,381 posts)steve2470

(37,457 posts)louis-t

(23,284 posts)or something like that.

steve2470

(37,457 posts)arcane1

(38,613 posts)Foreign ones too.

CincyDem

(6,346 posts)This issue with derivatives in general (CDS, interest rate swaps, options, etc) is that they can be created simply by connecting two sides of a trade - a buyer and a seller. There's nothing that really exists to put a limit on the interdependence.

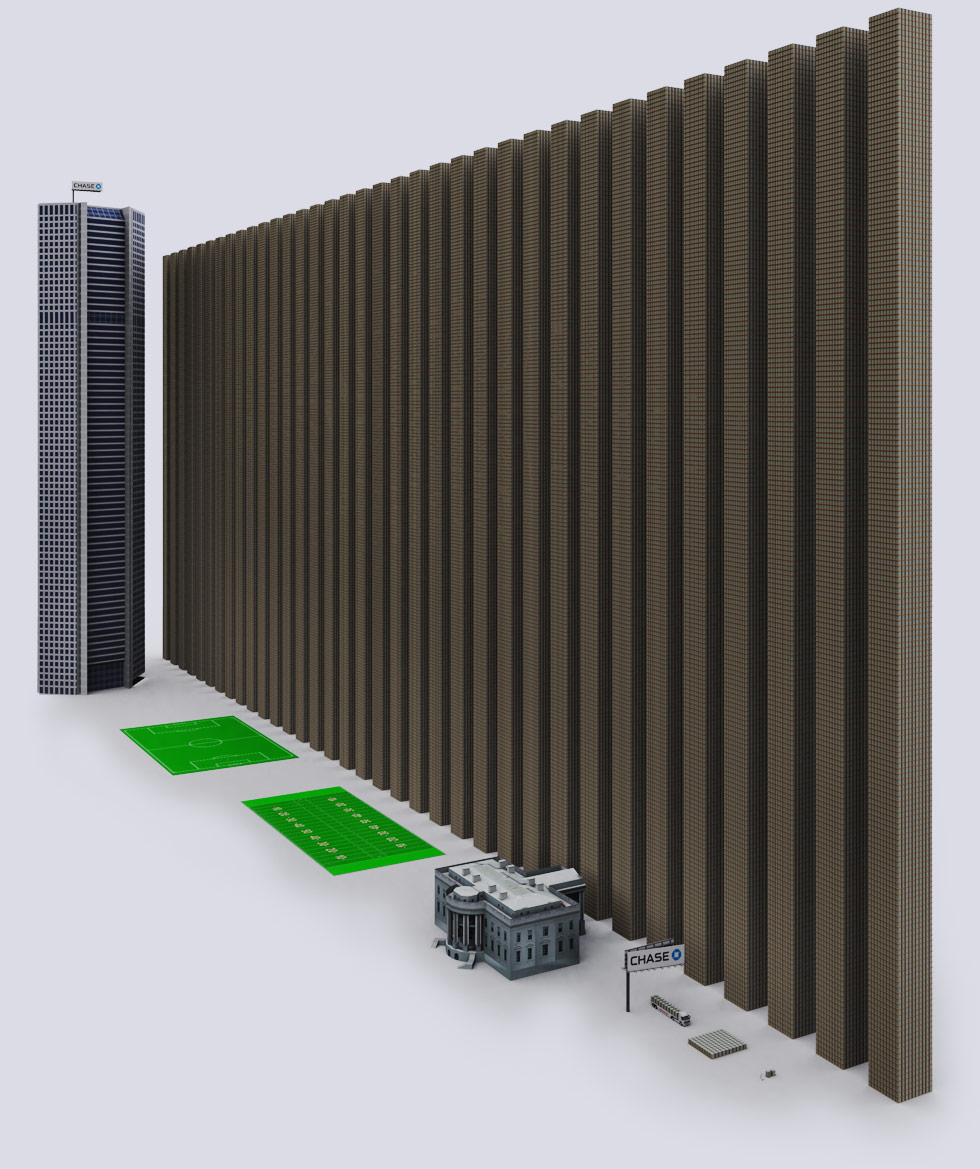

According to the attached article, the current value of these interdependent contracts is 20x the global GDP. I don't have the reference but IIRC it was about 12x during 2008. Remember, it was this interdependency that created the "too big to fail" mantra. Banks like JPM or BofA and insurance companies like AIG were a party to so many derivative contracts that their failure was predicted to so upset the delicate balance of the market that we (the people) had to drop in a shore them up.

This results in the concept of privatizing reward and socializing risk. When the derivatives go right, someone makes a shit-ton of money, and when they go wrong it's "hello - taxpayer, collect call from AIG".

http://www.globalresearch.ca/financial-implosion-global-derivatives-market-at-1-200-trillion-dollars-20-times-the-world-economy/30944

steve2470

(37,457 posts)mbperrin

(7,672 posts)Despite slow economic growth in the United States and most of Europe still in or hovering around recession, global derivatives markets are 20 percent larger than in 2007. The Bank for International Settlements announced late last week that the global derivatives market is about $710 trillion.

from: http://dealbook.nytimes.com/2014/05/13/derivatives-markets-growing-again-with-few-new-protections/?_php=true&_type=blogs&_r=0

The entire article is not terribly long and worth the read.

steve2470

(37,457 posts)Warpy

(111,222 posts)so the ones out there have had nearly 6 years to get bigger and uglier.

The next crash is going to wipe a lot of people out completely.

snot

(10,515 posts)I saw a mind-boggling graphic somewhere during the past 2 or 3 yrs., which I'm looking for. But the general idea is that the risks are enormous.

snot

(10,515 posts)Esp. scrolling down to, e.g.,

It concludes:

* * * * *

There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse.

If you don't want to bank with these banks, but want to have access to free ATM's anywhere-- most Credit Unions in USA are in the CO-OP ATM network, where all ATM's are free to any COOP CU member and most support depositing checks. The Credit Unions are like banks, but invest all their profits to give members lower rates and better service. They don't have shareholders to worry about or have derivatives to purchase and sell.

Keep an eye out in the news for "derivative crisis", as the crisis is inevitable with current falling value of most real assets.

Derivative Data Source: [link:

|ZeroHedge]

|ZeroHedge] (Emphasis supplied.)

steve2470

(37,457 posts)sendero

(28,552 posts).... "financial weapons of mass destruction", he wasn't blowing smoke.