Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 14 August 2014

[font size=3]STOCK MARKET WATCH, Thursday, 14 August 2014[font color=black][/font]

SMW for 13 August 2014

AT THE CLOSING BELL ON 13 August 2014

[center][font color=green]

Dow Jones 16,651.80 +91.26 (0.55%)

S&P 500 1,946.72 +12.97 (0.67%)

Nasdaq 4,434.13 +44.88 (1.02%)

[font color=green]10 Year 2.42% -0.01 (-0.41%)

30 Year 3.24% -0.02 (-0.61%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

tclambert

(11,084 posts)Tansy_Gold

(17,846 posts)We don't need any more.

Hugin

(33,042 posts)Sigh. ![]()

Demeter

(85,373 posts)Even though there has been a big uptick in news stories on rising economic inequality, and more chatter among economists about the idea that high levels of inequality are associated with lower growth, much of the messaging has come from the Democrats desperate to use the one dog whistle that might rally their badly abused base. Even though inequality has risen under Obama, thanks to policies that favored rescuing banks and enriching the medical-industrial complex over helping ordinary citizens, the Democrats are all too willing to rely on their perceived lesser-evilism relative to the Republicans. After all, it was only Romney’s billionaire warts that kept Obama from what would otherwise have been a well-deserved 2012 defeat.

But while the Administration has been pushing inequality as a useful campaign theme (the signal was inviting Thomas Piketty to meet with Treasury Secretary Jack Lew), in parallel, it also appears that some of the expressions of concern about inequality among the policy classes are genuine. Not that they care about the lot of the lower orders per se, but at least some wonks are on board with the idea that high levels of income and wealth inequality are bad for growth. The tell that the interest is real is that economists are starting to identify mechanisms by which greater income disparity is a drag on commercial activity.

The lead story in the neoliberal-leaning Financial Times is an example: “Record income gap fuels US housing weakness.” It goes without saying that the state of residential real estate is of particular concern, since every post-World-War-II recovery has been led by housing. The article dutifully notes that prices don’t tell the whole story, since purchases by rental investors have distorted the averages. From the Financial Times:

The gap has narrowed and widened in past cycles, but the rebound from the most recent financial crisis has seen the ratio hit its most unequal since data collection began 45 years ago, fuelling policy makers’ concerns…

A patchy labour market recovery has meant significant variations in job and income growth between regions across the US, which in turn has intensified the divergences across the country’s housing markets…

While some areas are experiencing bubble-like conditions, others are flailing. In Austin, Texas, a surge in technology jobs has driven demand. But in Akron, Ohio, which is struggling to boost employment through a new manufacturing base, house purchases have been more muted. In the government town of Sacramento, California, anxious homebuyers are waiting on the sidelines after being priced out by investors…

Stanley Fischer, Janet Yellen’s deputy chairman at the Federal Reserve, highlighted the central bank’s concern about housing in a speech this week. “The housing sector was at the epicentre of the US financial crisis and recession and it continues to weigh on the recovery,” he said.

In contrast to previous recoveries, he noted “residential construction [has been] held back by a large inventory of foreclosed and distressed properties and by tight credit conditions for construction loans and mortgages”…

But job and income growth are playing an outsized role, [Fannie Mae economist] Mr [Mark] Palim added, particularly as mortgage interest rate rises and home price increases affect affordability.

The number of Americans in work has surpassed the pre-recession peak. But there has been little lower and middle wage growth, constraining demand for houses across much of the country.

The rebound in construction, led by apartments, has been concentrated in pockets of the country where incomes are among the greatest.

Yves here. I know this may seem like weak beer, but this is actually progress of sorts. The Fed is finally beginning to understand after years of trying, its program to revive the economy through the confidence fairy and the wealth effect has failed. Admittedly, the overview in the article falls well short of recognizing the full dimensions of the problem: short job tenures and a high proportion of employment growth in part-time jobs; persistent high unemployment levels among the young; a large proportion of college graduates wearing the yoke of student debt. Not only has the Fed been a key architect of a lousy labor market by since Volcker relying on creating ample labor market slack so as to keep inflation low, but it also appears to recognize that it has painted itself in a corner. A rate increase will make housing even less “affordable” measured in consumer of borrowing capacity. Of course, Dean Baker has pointed out that this notion is absurd, since lower housing prices also make housing more “affordable.” But the central bank doesn’t want to push asset prices much if at all in the wrong direction due to the impact that will have on homeowner psychology, as well as on investors who recently invested in mortgage products.

The issue remains, to invoke a Venezuelan saying, that while policymakers have changed their minds, they have not changed their hearts. Central bankers and economists may finally be coming to grips with the depth and extent of our economic wounds. But they are still unlikely to be able to accept that all the evidence shows that we are at the end of an economic paradigm, and even worse, one designed by orthodoxy economists that has proved to be an abject failure. Thirty years of relying on deregulation to spur “innnovation,” giving more of the benefits of productivity growth to capitalists rather then labor, masking stagnant wage growth with higher borrowing levels, and the resulting financialization of the economy, has produced underinvestment, more frequent and severe financial crises, declining educational attainment. But it’s inconceivable that the incumbents will face up to the full dimensions of their misrule. First, it is well nigh impossible for people to admit mistakes of this magnitude. Second, and at least as important, no new paradigm has emerged to replace the failed orthodoxy. Recognition that the old precepts have failed and understanding some of the critical elements of that failure still falls well short of being able to map a new, effective course of action. Thus what one can anticipate is greater incoherence and inconsistency: more and more official admissions of the nature of festering economic and increasingly social ailments, coupled with either pathetically small course changes or doubling down on failed policies.

The upcoming few years will make for fascinating theater. Too bad we have to live with the outcomes.

TO SUM IT UP, NEW ENGLAND STYLE: LIGHT DAWNS ON MARBLEHEAD.

Demeter

(85,373 posts)The Wall Street Journal reports that banks have become much less active participants in the repo market, which is a critical source of short-term liquidity for big investors...Repo was a major focus of concern during the crisis. The Fed halted a run on the repo market when it provided guarantees to money market funds in September 2008 after the Reserve Fund “broke the buck,” leading customers to pull funds out of other money market funds...

For newbie, large investors use repo rather than park funds with banks. Deposits are guaranteed only up to $250,000 per account, and even though there are services that will break up deposits and distribute them among small banks, those can handle wealthy individuals, not major institutional players.

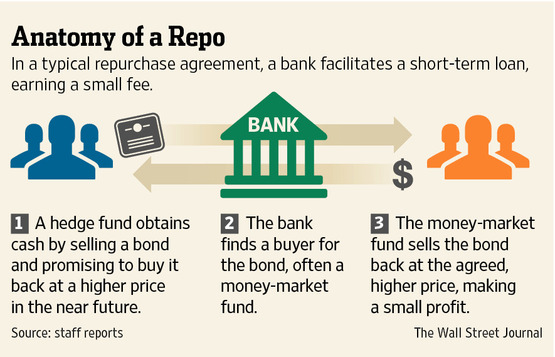

With “repo,” which is short for “sale with agreement to repurchase,” an investor with securities can turn them into cash on a short-term basis by selling them (say overnight or for a week) with the said agreement to buy them back at a higher price, which amounts to getting a short-term loan, with the bonds pledged as collateral. The reason this arrangements appeals to lenders like money market funds is that they see the loan with collateral (a high quality bond, ideally Treasuries) as more secure than an deposit at a bank in excess of the guaranteed level. The graphic from the Wall Street Journal gives a simplified idea of how this arrangement normally works:

Even before the Reserve Fund blowup, the repo market was under great stress during the crisis. There was so much concern about counterparty risk that tenors collapsed to overnight. And during the very worst periods, as Wall Street denizen put it, the sixth seal had been opened, and you couldn’t even repo Treasuries. However, despite the troubling historical significance of lower liquidity in the repo market, the Wall Street Journal story presents evidence that shows that this outcome was a predictable outcome of moves taken by the Fed. And it also serves to illustrate one of the key warnings of Richard Bookstaber, a former Wall Street risk manager and author of the book The Demon of Our Own Design: that in tightly coupled (as in overly interconnected) systems, the most important risk reduction measure is to reduce the interconnectedness first. Taking steps to reduce specific exposures without reducing the tight coupling first is almost certain to make matters worse. Here, the Fed has been “experimenting” with intervening directly in the repo market directly, as both a way to drain liquidity from the market and to allow it to step in and stabilize the market as needed in a crisis. The wee problem is that even in good times, there is counterparty risk in the repo market. The Fed is the best counterparty imaginable. So given the choice between doing a repo with a bank versus doing a repo with the Fed on the same terms, anyone with an operating brain cell will go to the central bank. And the Fed was willing to experiment in size, so it’s now become a big part of the repo market. This comes from the end of the Journal article (emphasis ours):

The central bank is sitting on more than $4 trillion in bonds as part of a program to stimulate the economy and has been testing borrowing against some of those bonds in return for cash to drain money from the economy.

The New York Fed’s repo-trading desk accepted a daily average of $121.3 billion of repurchase agreements in July, up from $73 billion in January. Money-market mutual funds have been especially big players in this “reverse repo” pilot program, giving funds a safe place to park cash.

Large market participants like money-market funds are increasingly trading from the Fed, rather than with banks—a move Fitch Ratings attributes to comfort with the central bank, better terms and regulatory changes that are altering how financial firms participate in the market.

There are signs the Fed is growing uncomfortable with its repo market presence.

At a Senate hearing last month, Fed Chairwoman Janet Yellen voiced concerns that the Fed could “become too large or play too prominent a role” and could provide “a safe haven that could cause flight from lending to other participants in the money markets.”

Now keep in mind that the article prior to this section was presenting the bank pullback from the repo market as Seriously Not Good as well as a possible result of Evil New Regulations. There admittedly was some concern about repo market failures, which also was not an uncommon occurrence in the runup to the crisis:

Bank of America Corp. and Citigroup Inc. made first-half reductions in repo lending of about $11.4 billion and about $8 billion, respectively. J.P. Morgan Chase & Co.’s repo lending stayed roughly flat….

Banks said privately they don’t intend to abandon clients in repo markets. But there are signs their reluctance to facilitate huge amounts of repo activity is contributing to increased volatility.

In June, a relatively high number of repo transactions tied to U.S. Treasurys “failed,” or didn’t close because one of the parties didn’t provide the bond, according to research firm Wrightson ICAP.

Cynically, your humble blogger wonders whether the Fed’s presence in the market is allowing banks to pull back from a product that was not a big money-maker for them. Indeed, the Fed offering better terms is a sign that crowding out the bank was a feature, not a bug:

New rules are “a constraint, but one that facilitates financial stability in the long run,” said Federal Deposit Insurance Corp. Vice Chairman Thomas Hoenig.

The Wall Street Journal also points out that some investors have been scrambling to find enough “good collateral”. We’ve always been bothered by this construction, since the big use of collateral is to secure derivatives positions. Derivative experts like Satyajit Das attest that the main uses of derivatives aren’t for socially productive hedging (and related trading to make enough in the way of markets) but speculation, and accounting, tax, and regulatory arbitrage. It would be preferable for the authorities to have addressed the issue of derivatives directly. But making collateral less available (or more costly) is another way to crimp derivatives activity. So the inability to find enough collateral, assuming the squeeze is gradual rather than sudden, could also have salutary effects. From the Journal:

Investors said there is such high demand for certain types of bonds that some firms are accepting negative interest rates on the cash they are lending in exchange for the in-demand collateral. As of Tuesday, the rate to borrow five-year Treasury notes maturing in 2019 in the repo market was minus 0.25 percentage points—in other words, financial firms were willing to pay bondholders for the privilege of lending them cash.

In other words, the central bank appears, whether by accident or design, to have shoved the banks to the side in the repo market, and have also contributed to the scarcity of collateral. They’d pretend this was intentional whether or not they’d goofed. So I’d be curious to get insider readings as to whether the Fed is being clever or has outsmarted itself.

Demeter

(85,373 posts)Preliminary reports say that a $16 to $17 billion settlement will soon be announced between the Justice Department and Bank of America. That would break the record for the largest bank settlement in history, set less than a year ago by a $13 billion agreement between Justice and JPMorgan Chase...And yet, these settlements do not require banks to provide principal relief for these underwater homeowners. They don't ask banks to return homes that they wrongfully took from their owners. They don't ask banks to forfeit every penny of earnings received through forgery or perjury. They don't even ask them to restore the credit ratings of defrauded customers. On a broader scale, these settlements don't ask banks to invest in job creation, increase their lending to job-creating enterprises, or refrain from other forms of consumer fraud. Instead they're limited to addressing a very limited set of harmful activities - and don't even fully compensate victims for the harm those activities caused.

Less Than Meets the Eye

What's more, there's very little reason to believe that these large sums will be paid in full. Much of the "consumer relief" in past deals has turned out to be nothing more than gamesmanship with numbers. Banks modify loans in ways that are advantageous to them, offer deals they almost certainly would've offered anyway, and then count them against their "settlement" obligations. That's the kind of thing that happened with the much-hyped "$25 billion" foreclosure fraud deal announced in 2012. Subsequent settlements (including last month's "$7 billion" Citigroup deal) have been vulnerable to the same kind of abuse.

Now the Wall Street Journal reports that $7 billion to $8 billion from the Bank of America deal will be allocated for "consumer relief, such as reducing mortgage balances for struggling homeowners," while $9 billion will go to "the federal government, states and other government entities." Only the $9 billion is a sure thing - and most of that money will go to government agencies that have a poor record of providing relief to wronged homeowners. What's more, it hasn't been announced whether this deal, like Citigroup's recent settlement, will be tax-deductible. If so, Americans will get shortchanged at the federal level, too.

Worst of all, nothing in these settlements is likely to dissuade bankers from engaging in similar misadventures in the future....

Demeter

(85,373 posts)By Editorial Board August 10

JUSTICE IS being done to Bank of America — rough justice. The bank last week reportedly buckled to the Justice Department’s threat of litigation over alleged misdeeds in the mortgage-backed securities market, offering to pay upward of $16 billion to settle the matter, more than half of it as a cash fine. (The rest may be in the form of future relief to borrowers.) If the deal goes through, it would amount to the largest such exaction related to the Great Recession.

Bank of America would not quite be paying for its own sins but rather for allegedly faulty mortgage securities sold by two companies — Countrywide and Merrill Lynch — that the bank absorbed, with government encouragement, during the crisis. It’s not exactly a case of no good deed going unpunished; though it pleased Washington by bailing out those firms, B of A also intended to make a profit, and it knew it was buying the firms’ legal liabilities as well as their assets. Still, the wrongdoing, if any, involved securities sold to sophisticated institutions, not hapless widows and orphans.

The bank quit fighting the Justice Department after a federal court in New York ordered a fine of more than $1 billion in another case, signaling that litigation risks were much higher than it anticipated — and that its real interest lay in legal finality, which it now apparently has.

Just or not, no one should confuse this pending settlement with a solution to the deeper problem of the U.S. financial system — namely that Bank of America and other institutions remain too big to fail. The prospect of a taxpayer rescue in the next crisis still threatens the U.S. government’s finances and may distort the flow of capital by implicitly subsidizing the giants. To be sure, the biggest banks have raised capital and are on a much sounder footing than they were before the crisis. Also, the degree of implicit subsidy remains disputed. A new Government Accountability Office report suggests that large bank holding companies had no advantage in funding costs in recent years — i.e., a period of relative financial calm — but that they would enjoy an advantage over smaller institutions during crises...And, according to the logic of a recent joint decision by the Federal Deposit Insurance Corp. and the Federal Reserve, that is precisely the problem: Any crisis large enough to threaten one bank would probably be large enough to jeopardize them all, making a government bailout inevitable....

MORE

Demeter

(85,373 posts)IF YOU HAVE TO SELL YOUR SOUL AND YOUR CHANCE FOR HAPPINESS, IS IT WORTH IT?

http://www.alternet.org/economy/not-everyone-has-tools-become-rich-how-our-childhood-shapes-our-ability-succeed?akid=12115.227380.VeHFP1&rd=1&src=newsletter1015103&t=18&paging=off¤t_page=1#bookmark

...In the early 1990s, a team of psychologists set out to determine how a mother's attentiveness affects her children as they grow up. They took two groups of monkeys and placed them in two different environments. In the first environment, the mother always had access to food. She could focus all her attention on her baby instead of constantly looking for food. In the second environment, the food was harder to find. The mother had to spend so much time looking for food she often neglected her child. The results were tragic. The second group of babies grew up with noticeable despair and anxiety issues. Their brains literally looked different. Their brain cells couldn't regulate emotions like their healthier peers'. Once they became adults, the second group of monkeys was shy, clingy, weak and socially awkward. They had trouble making friends, and they never became leaders. They were forever scarred—and their potential forever stunted—by their distracted mothers.

In a way, the same experiment is taking place in American society today. Some mothers have easy access to the basic necessities of life —food, shelter, clothing, transportation, healthcare—but many do not. Millions of mothers live paycheck to paycheck, working multiple jobs and long hours, leaving them too busy and too exhausted to give their children the same attention as their wealthier peers. The difference is so drastic that children raised in poverty have brain activity that looks like it's been damaged by a stroke. Study after study show that these early scars last long into adulthood, affecting everything from job prospects to marital happiness. It would be cruel and illogical to argue that these children are responsible for their lot in life, but every time I write about income inequality, that's exactly what I hear. "I strongly disagree with your statement that more people 'deserve' the opportunity to succeed," one reader told me recently. "Success is in everyone's face. One has to reach out and grab it."...Psychologists have spent decades studying the different attitudes people develop by living in different social classes. According to a recent article in the Annual Review of Psychology, they've come to some striking conclusions.

First, higher-income parents encourage their children to follow their dreams. They encourage critical thinking and support expression of likes, dislikes, feelings, and thoughts, and then give them opportunities to pursue those interests. Lower-income parents tend to emphasize toughness and pride in the face of adversity. They emphasize rules that must not be broken, and then let the children figure out the rest on their own. From there, the children go to school, where higher-income children are given opportunities to work independently, think creatively and ask questions. Their parents take an active role, challenging practices that they disagree with. Their teachers treat them like adults and reward students who speak up and take initiative.

Lower-income children usually find themselves in a more regimented environment. They walk through metal detectors and aren't trusted with basic classroom equipment. Their parents want to be involved, but they don't assert themselves. Their teachers demand respect and reward students who show deference. By the time they enter the workforce, it isn't hard to see how these two groups have been ingrained with two different attitudes toward success. The higher-income children have learned leadership skills like taking initiative, treating authorities as equals, and thinking outside the box, while their lower-income peers have learned to keep their heads down and do only what they're told.

For those Americans who have been materially successful, it may seem like everyone else simply chose not to follow the same path, but the reality is that most Americans don't know how to find that path. And in the greatest tragedy of all, for many Americans in today's economy, the path may not even exist as long as they live.

Anthony W. Orlando is a lecturer in the College of Business and Economics at California State University, Los Angeles.

Demeter

(85,373 posts)WITH SKYNET, THE TERMINATOR BECAME OBSOLETE...

http://www.businessinsider.com/clearpath-robotics-joins-campaign-to-stop-killer-robots-2014-8

Waterloo-based robotic vehicle manufacturer Clearpath Robotics is the first robotics company to sign on with the Campaign To Stop Killer Robots, "an international coalition of non-governmental organizations working to ban fully autonomous weapons." The aptly-named Campaign To Stop Killer Robots seeks legislation and regulation that would block people from having access to or creating robotic weapons that can make decisions to kill without human intervention. As the main conceit behind the campaign goes, "giving machines the power to decide who lives and dies on the battlefield is an unacceptable application of technology."

Meghan Hennessey, marketing communications manager at Clearpath, told Business Insider, "I came across the campaign, and company CTO and co-founder Ryan Gariepy was on board with their ideas. We're the first company in the robotics industry to step forward on this issue."

Clearpath is a five-year-old company gaining massive traction in research and development for unmanned robotics. Its client list is impressive, boasting names like the Canadian Space Agency, Google, and MIT. Most interestingly, this list also includes the Department of National Defense and the Navy — exactly the entities that might want a fully autonomous weapon that can function without a human operator.

"Even though we're not building weapons now, that might become an opportunity for us in the future," said Hennessey. "We're choosing to value our ethics over potential future revenue."

Cofounder Ryan Gariepy has written an open letter to express the company's stance on the issue. It appears in its entirety below.

***

This technology has the potential to kill indiscriminately and to proliferate rapidly; early prototypes already exist. Despite our continued involvement with Canadian and international military research and development, Clearpath Robotics believes that the development of killer robots is unwise, unethical, and should be banned on an international scale.

The Context

How do we define “killer robot”? Is it any machine developed for military purposes? Any machine which takes actions without human direction? No. We’re referring specifically to “lethal autonomous weapons systems (LAWS)”; systems where a human does not make the final decision for a machine to take a potentially lethal action.

Clearpath Robotics is an organization that engineers autonomous vehicles, systems, and solutions for a global market. As current leaders in the research and development space for unmanned vehicles, making this kind of statement is a risk. However, given the potentially horrific consequences of allowing development of lethal autonomous robots to continue, we are compelled to insist upon the strictest regulation of this technology.

The Double-Edged Sword

There are, of course, pros and cons to the ethics of autonomous lethal weapons and our team has debated many of them at length. In the end, however, we, as a whole, feel the negative implications of these systems far outweigh any benefits.

Is a computer paired with the correct technology less likely to make rash, stress-driven decisions while under fire? Possibly. Conversely, would a robot have the morality, sense, or emotional understanding to intervene against orders that are wrong or inhumane? No. Would computers be able to make the kinds of subjective decisions required for checking the legitimacy of targets and ensuring the proportionate use of force in the foreseeable future? No. Could this technology lead those who possess it to value human life less? Quite frankly, we believe this will be the case.

This is an incredibly complex issue. We need to have this discussion now and take a stance; the robotics revolution has arrived and is not going to wait for these debates to occur.

Clearpath’s Responsibility

Clearpath Robotics strives to improve the lives of billions by automating the world’s dull, dirty, and dangerous jobs. This belief does not preclude the use of autonomous robots in the military; we will continue to support our military clients and provide them with autonomous systems - especially in areas with direct civilian applications such as logistics, reconnaissance, and search and rescue.

In our eyes, no nation in the world is ready for killer robots – technologically, legally, or ethically. More importantly, we see no compelling justification that this technology needs to exist in human hands. After all, the development of killer robots isn’t a necessary step on the road to self-driving cars, robot caregivers, safer manufacturing plants, or any of the other multitudes of ways autonomous robots can make our lives better. Robotics is at a tipping point, and it’s up to all of us to decide what path this technology takes.

Take Action

As a company which continues to develop robots for various militaries worldwide, Clearpath Robotics has more to lose than others might by advocating entire avenues of research be closed off. Nevertheless, we call on anyone who has the potential to influence public policy to stop the development of killer robots before it’s too late.

We encourage those who might see business opportunities in this technology to seek other ways to apply their skills and resources for the betterment of humankind. Finally, we ask everyone to consider the many ways in which this technology would change the face of war for the worse. Voice your opinion and take a stance. #killerrobots

Ryan Gariepy

Cofounder & CTO, Clearpath Robotics

I HEAR THE SOUND OF ONE HAND CLAPPING...

Demeter

(85,373 posts)Last week the Federal Reserve released a disturbing report (PDF http://www.federalreserve.gov/econresdata/2013-report-economic-well-being-us-households-supplemental-appendix-201407.pdf ) on the financial state of U.S. households. The report’s main findings, that Americans don’t save very much, weren’t that surprising. For the last few decades middle- and lower-middle-class families have been pinched by stagnant incomes and higher spending. But even the many members of the upper middle class are hardly saving. Low or no savings leaves them, and everyone else, in a risky position. Just 45 percent of upper-middle-class households (income from $75,000 to $99,999) saved anything in 2012, according to the Fed study. That means the other 55 percent didn’t save for a house, retirement, or education. About 16 percent spent more than they earned and went further into debt. The report highlights the consequences of these hand-to-mouth habits: Only half of these households had enough savings to finance three months of living expenses if they lost their job or couldn’t work. A $400 emergency would force about 20 percent of them into months of debt.

The upper middle class may be less vulnerable than lower earners, because of their access to credit—or at least, they feel safer. Even though only half have saved enough to finance three months of unemployment, most higher earners (about 70 percent) feel confident they could get by if they borrowed, often with a credit card. Counting on debt may be fine for the occasional emergency. But it’s a lousy way to finance a long spell of unemployment or a major health-care disaster. The low rate of saving and thin emergency cushion wouldn’t be so worrying if it were just a hangover from the Great Recession. Households normally cut back on saving when someone in their household loses their job or takes a pay cut. It can take several years to make it up. But the low-saving trend predates the recession. The chart below shows the percent of upper-middle-class nonsaving households over the last 20 years:

Even in the go-go mid-Aughts about 30 percent of upper-middle-class households didn’t save. In 2007, right before the recession, the median liquid savings of this group was only about $7,000. That’s not much of a financial cushion when you’re used to earning $90,000.

There are several reasons why higher-income households didn’t save in better times: The ample supply of credit, credit cards, and home equity loans diminished the incentive to save, and households may not have fully understood the risks they were taking. Until the recession, a long stretch of unemployment was rare; a three-month emergency fund may not have seemed necessary. There’s also evidence that the increase in home prices, which we now know were artificially inflated, made people feel richer and they spent more.

Low savings partly explains why the recession was so severe. It made households of all income levels more sensitive to economic setbacks. One way to read the Fed study is to assume many American households haven’t learned from our most recent history, and that may well be the case. It may also be true that, at least in expensive cities such as New York and San Francisco, upper-middle-class incomes aren’t as ample as they once were, and that’s another problem entirely.

Demeter

(85,373 posts)More than half of all Americans still aren’t saving enough for retirement, according to the latest National Retirement Risk Index from the Center for Retirement Research. This is not a new problem, although it’s gotten worse since the recession. It’s also not hard to see why we continue to fall short.

The report claims that the average 35-year-old needs to save 15 percent of his income each year to ensure a comfortable retirement. Lower-income people need to save less, higher earners more, but regardless, that savings must be devoted just to retirement. Most people are also trying to save for emergencies, education, down payments, home improvements, etc. According to the 2010 Survey of Consumer Finances, only 53 percent of Americans save anything at all, let alone 15 percent for retirement.

But the 15 percent recommended saving rate assumes retirement at age 65. Work until age 70, and you only need to save a far more manageable 6 percent...MORE

antigop

(12,778 posts)Crewleader

(17,005 posts)This is the summer of our discontent. Almost everyone I know is angry -- with politics, with government, with the media, with their work, with their employer, with people who hold different views. Why? Not since the 1930s have so many Americans been on a downward escalator economically and faced so much financial insecurity. That we're supposed to be in an economic recovery makes it all the worse. I think this the root of our anger, and it has a lot to do with fear. I sense it in the way the anger is expressed -- with bitterness and resentment, cynicism, often in ad hominem attacks and personal insults. Yet if we're to improve the situation we've got to turn the anger in a constructive direction, work hard to change things, disagree respectfully, and use argument instead of invective. Is the widespread discontent causing us to forget how much we depend on common sense and decency?

https://www.facebook.com/RBReich

Demeter

(85,373 posts)xchrom

(108,903 posts)

The euro zone (EA 18) is going nowhere

Growth in the euro zone has stalled.

The 18-country euro area showed 0.0% GDP growth in Q2, down from 0.2% in Q1 and worse than the 0.1% expected by economists.

This follows disappointing GDP reports from Germany, which declined by 0.2%, and France, which showed no growth.

"The poor figure is chiefly driven by downside surprises in Italy, France and Germany which all failed to grow in the second quarter," noted Pantheon Macroeconomics' Claus Vistesen. "On an annualised basis, eurozone growth is now running at a disappointing 0.4% in the first half of this year."

This follows disappointing inflation reports, which showed that price growth remain unusually low in the region.

Read more: http://www.businessinsider.com/euro-zone-gdp-2014-8#ixzz3AMVyo1n6

xchrom

(108,903 posts)A slew of ugly data has come out this morning.

The German economy shrank 0.2%. And the Eurozone as a whole didn't grow at all.

But there's more than just bad growth going on.

Inflation numbers are going in the wrong direction, and there's a growing risk of deflation.

Here's the chart of Eurozone inflation, via Claus Vistesen of Pantheon Macro.

http://static2.businessinsider.com/image/53ec87746da8111008c340e9-751-418/eurozone%20final%20inflation,%20july%20(2).jpg

Read more: http://www.businessinsider.com/eurozone-inflation-2014-8#ixzz3AMWQtJzd

xchrom

(108,903 posts)

The yield on the German 10-year bond fell below 1% for the first time in history.

This bond rally (yields fall when bond prices rise) occurred shortly after we learned that real GDP contracted by 0.2% in Q2, down from +0.7% in Q1.

Economists were forecasting a more modest 0.1% decline.

"The German economy hit a wall in the second quarter," Pantheon Macroeconomics' Claus Vistesen said.

Low yields in Europe remind us that the current 2.4% yield on the 10-year U.S. Treasury note is actually relatively high. In other words, those European bonds actually make U.S. bonds look cheap, meaning that yields have room to go lower.

Here's a three-year look at the German 10-year yield.

Read more: http://www.businessinsider.com/germany-10-year-yield-below-1-2014-8#ixzz3AMX46VmM

Read more: http://www.businessinsider.com/germany-10-year-yield-below-1-2014-8#ixzz3AMWxvPJl

Demeter

(85,373 posts)She wants something "lighter", more uplifting, cheerful, even.

I am open to suggestions. Cudgel your brains and give me some guidance, folks!

xchrom

(108,903 posts)There's a lot of ugly data out this morning, but markets just took off.

Here's a chart of Germany's DAX index, whipping from red to green. Other markets are doing similar things, including US futures.

Read more: http://www.businessinsider.com/market-jump-august-14-2014-8#ixzz3AMhSyERA

xchrom

(108,903 posts)(Reuters) - Mortgage applicants who can't provide tax returns or pay stubs to show their income are getting stated income loans again as companies such as Unity West Lending and Westport Mortgage chase customers they can no longer afford to ignore.

Lenders say these aren't the same products as the so-called "liar loans" that were pervasive before the housing bust. Instead, the loans are going to borrowers such as small business owners or investors buying properties they intend to rent who can demonstrate an ability to repay, verifiable through bank or brokerage statements. Lenders said they look for enough assets to pay six to 12 months of payments, while also demanding high down payments to reduce the chance of default.

"This is not a return to the wild and wooly days of, if you fogged the mirror, you can have a loan," said Paul Lebowitz, founder of Westport Mortgage. "They have a smarter edge to them now."

Some rival lenders said the stated income loans on offer could be abused if borrowers fudge bank statements or don't have enough money to repay the loan. None of the three biggest banks offer them. Sam Gilford, a spokesman for the Consumer Financial Protection Bureau, said the agency is concerned, though he wouldn't say whether it is investigating them.

Read more: http://www.businessinsider.com/r-stated-income-loans-make-comeback-as-mortgage-lenders-seek-clients-2014-14#ixzz3AMiDRZJI

xchrom

(108,903 posts)SACRAMENTO Calif. (Reuters) - California Governor Jerry Brown approved on Wednesday a $7.6 billion plan to improve water supplies in the drought-striken state that will be put before voters in November, ending a year of political wrangling over the measure.

California is in the throes of a devastating multi-year drought that is expected to cost its economy $2.2 billion in lost crops, jobs and other damages.

On the last possible day to approve the ballot measure, Democrats and Republicans fought over what projects to include, with Republicans arguing for more funding for reservoirs and Democrats saying that damming rivers and flooding canyons to build them is damaging to the environment.

Last-minute intervention by Brown, a fiscal moderate, brought the sides together.

Read more: http://www.businessinsider.com/r-california-lawmakers-finally-reach-deal-on-water-plan-amid-drought-2014-13#ixzz3AMjN8OCs

Demeter

(85,373 posts)- Bernard Madoff's surviving son and the estate of his other son asked a U.S. judge to stop the trustee seeking money for the swindler's victims from adding claims accusing the brothers of aiding and profiting illegally from their father's Ponzi scheme.

The trustee Irving Picard contended last month that Andrew and Mark Madoff obstructed a 2005 U.S. Securities and Exchange Commission probe by deleting emails that linked them to fraud at Bernard L. Madoff Investment Securities LLC, and took out sham loans to buy pricey Manhattan apartments. In a Tuesday filing with the U.S. Bankruptcy Court in Manhattan, defense lawyers called it "simply too late" for Picard to amend for a third time his 2009 lawsuit, and seek $153.3 million from Andrew Madoff, Mark Madoff's estate and Mark's widow Stephanie Mack. They also said Picard does not deserve "another bite at the apple" after the U.K. High Court of Justice in a related case last October said neither son "knew of, or suspected" fraud. That case had been brought by a liquidator for an affiliate of Madoff's firm, Madoff Securities International Ltd.

"This court should not countenance the trustee's belated efforts to reinvent his pleading - especially after the trustee lost on this very theory after a full trial in the U.K.," the defense lawyers wrote.

.....

Amanda Remus, a spokeswoman for Picard, called the U.K. case "a narrow action" addressing director liability for specific transactions set up by Bernard Madoff. She said the U.S. case is "completely different," in that it concerns "a history of fictitious trading and sham loans" and arises from Picard's fiduciary responsibility to former Madoff customers.

Picard has recovered $9.83 billion for Madoff customers who lost roughly $17.5 billion of principal. Madoff, 76, is serving a 150-year prison term.

The case is Picard v. Estate of Mark D. Madoff et al, U.S. Bankruptcy Court, Southern District of New York, No. 09-ap-01503.

xchrom

(108,903 posts)BERLIN/PARIS (Reuters) - Germany's economy shrank in the second quarter and France again managed to conjure up no growth, data showed on Thursday, snuffing out any signs of a recovery in the euro zone which is now weighed down by tit-for-tat sanctions with Russia.

Europe's largest economy contracted by 0.2 percent on the quarter, undercutting Bundesbank forecasts that it would stagnate, with foreign trade and investment notable weak spots, the Statistics Office said.

With so much uncertainty surrounding Russia and Ukraine, a quick rebound is unlikely.

France fared little better, flatlining for the second successive quarter.

That forced the French government to confront reality, saying it would miss its budget deficit target again this year and cutting its 2014 forecast for 1 percent growth in half.

Read more: http://www.businessinsider.com/r-german-slump-stagnant-france-paint-dismal-eurozone-picture-2014-14#ixzz3AMkJftGF

Demeter

(85,373 posts)A former Massachusetts Institute of Technology professor and his son agreed to plead guilty to running a $500 million hedge-fund scam that was uncovered by investigators probing Bernard Madoff’s Ponzi scheme.

Gabriel Bitran, who was a professor and associate dean at MIT’s Sloan School of Management, and his son, Marco, wooed investors to GMB Capital Management LLC with fake claims of success in managing family and friends’ accounts using a trading model based on the father’s research, according to a copy of a charging document provided by federal prosecutors in Boston.

The men, who raised more than $500 million from 2005 to 2011, meanwhile put money into “funds of funds,” which rely on investments by other hedge funds, and fed money to Madoff’s firm and Madoff feeder funds, according to prosecutors.

The Bitrans’ funds suffered losses of more than $140 million. The men paid themselves as much as $16 million in management fees over the life of the businesses and recovered $12 million of their own investments when the funds were doing poorly, the U.S. said, adding that the two discussed their scheme in e-mail exchanges.

“A person with experience and knowledge of the financial sector and a veteran professor of MIT should not have engaged in this type of behavior,” Gabriel Bitran said in an e-mail to his son in July 2009 that was cited by prosecutors. “I feel very embarrassed because we told them a story that was not true!”

more

http://www.bloomberg.com/news/2014-08-13/ex-mit-professor-son-to-plead-guilty-in-hedge-fund-scam.html

xchrom

(108,903 posts)South Korea's central bank cut interest rates for the first time in 15 months Thursday, under growing government pressure including warnings of recession from the new finance minister.

The Bank of Korea (BOK) cut its benchmark overnight inter-bank loan rate by 25 basis points to 2.25 percent. It was the first rate cut since May 2013.

The largely-expected move came after the finance ministry last month unveiled a $40 billion stimulus package and revised its 2014 economic growth forecast down from 4.1 percent to 3.7.

At the time, Finance Minister Choi Kyung-Hwan warned that the national economy stood at a crossroads between "making a leap forward and falling into a recession".

Read more: http://www.businessinsider.com/south-korea-cuts-interest-rate-to-225-2014-8#ixzz3AMkwHUAn

xchrom

(108,903 posts)SYDNEY (Reuters) - Asian shares pushed higher on Thursday after a flood of soft economic data led investors to wager on a ceaseless fountain of stimulus from major central banks, sending bond yields tumbling across the globe.

An economic contraction in Japan, a shock fall in Chinese loans, a surprisingly dovish turn by the Bank of England and a sluggish reading on U.S. retail sales all combined to make any tightening in policy seem a very distant prospect.

Indeed, investors suspect further action will be needed from the European Central Bank after data showed the German economy shrank by 0.2 percent last quarter, while France failed to grow at all for a second straight quarter. <ECONEUROPE>

Yields on Germany's two-year debt <DE2YT=RR> actually went negative, meaning investors were paying for the privilege of lending Berlin money.

Read more: http://www.businessinsider.com/asian-markets-are-up-2014-8#ixzz3AMlMPJ7Q

xchrom

(108,903 posts)OAKLAND, United States - Mostly unreported as the Ukraine conflict captures headlines, international financing has played a significant role in the current conflict in Ukraine.

In late 2013, conflict between pro-European Union and pro-Russian Ukrainians escalated to violent levels, leading to the departure of president Viktor Yanukovych in February 2014 and prompting the greatest East-West confrontation since the Cold War.

A major factor in the crisis that led to deadly protests and eventually Yanukovych's removal from office was his rejection of

an EU association agreement that would have further opened trade and integrated Ukraine with the European Union. The agreement was tied to a US$17 billion loan from the International Monetary Fund (IMF). Instead, Yanukovych chose a Russian aid package worth $15 billion plus a 33% discount on Russian natural gas.

The relationship with international financial institutions changed swiftly under the pro-EU government put in place at the end of February 2014 which went for the multi-million dollar IMF package in May 2014.

xchrom

(108,903 posts)Banks including JPMorgan Chase & Co. (JPM), Citigroup Inc. (C) and Morgan Stanley (MS) have been notified regulators are preparing enforcement actions on currency rigging, people familiar with the investigation said.

Talks are progressing between banks, the U.S. Federal Reserve and the Office of the Comptroller of the Currency to settle investigations into alleged manipulation of foreign-exchange markets, according to two people, who asked not to be identified because the discussions are private. Some firms have received so-called 15-day letters outlining the agencies’ findings and warning that enforcement actions are likely, the people said.

Enforcement actions can range from cease-and-desist orders to fines to banning bankers from the industry. The letters typically detail the investigators’ findings and give recipients about 15 days to offer a written defense. Such notices usually open a final stage of settlement negotiations.

U.S. regulators are coordinating with the U.K.’s Financial Conduct Authority to settle some of the probes by November, according to two people. The FCA is in settlement talks with firms including Barclays Plc, Citigroup, HSBC Holdings Plc, JPMorgan, Royal Bank of Scotland Group Plc and UBS AG. It scheduled meetings with some banks for as soon as next month to discuss penalties, the people said.

xchrom

(108,903 posts)Wal-Mart Stores Inc. (WMT), the world’s largest retailer, reported stagnant same-store sales and cut its earnings forecast for the year, hurt by higher health-care costs and slow traffic at its supercenters.

Earnings for the year will now be $4.90 to $5.15 a share, down from a previous range of as much as $5.45, the Bentonville, Arkansas-based company said today in a statement. Sales at U.S. Wal-Mart and Sam’s Club stores open at least 12 months were little changed last quarter, which ended Aug. 1.

Chief Executive Officer Doug McMillon, who took the post in February, is struggling to revive U.S. growth in the face of a slow economic recovery. The retailer hasn’t posted a same-store sales gain for six quarters, and customers are making fewer trips to big-box retailers. Cuts in government assistance also are leaving low-income shoppers with less money to spend.

“Lower-middle-income households have participated much less in the economic recovery than other groups,” Patrick McKeever, an analyst from MKM Partners in New York, said in a note before the earnings release. “About 20 percent of Wal-Mart’s customers are on government assistance,” and a reduction in food-stamp payments is harming U.S. sales, he said.

xchrom

(108,903 posts)

“Stocks look cheap relative to corporate profits” by at least one barometer of U.S. shares, according to James W. Paulsen, Wells Capital Management Inc.’s chief investment strategist.

The CHART OF THE DAY shows his gauge: the ratio of the Standard & Poor’s 500 Index to after-tax earnings for all U.S. companies, as compiled quarterly by the Commerce Department, in billions of dollars.

Since 1947, the S&P 500 has averaged 1.3 times profit on this basis. The ratio at the end of this year’s first quarter, the most recent period for which earnings are available, was 1.08. Yesterday’s close for the index equaled 1.12 times the first-quarter total.

“The stock market may still have considerable potential” based on this comparison, Paulsen wrote in a report three days ago. Prices are no higher than they were in 1952 and 1985 amid bull markets, the Minneapolis-based strategist wrote.