Fed Survey of Consumer Finances Shows Americans Understand Their Lousy Economic Condition

Fed Survey of Consumer Finances Shows Americans Understand Their Lousy Economic Condition

Posted on September 5, 2014 by David Dayen

By David Dayen, a lapsed blogger, now a freelance writer based in Los Angeles, CA. Follow him on Twitter @ddayen

The Fed’s Survey of Consumer Finances came out yesterday, and it offered a pretty good answer for why the country won’t just snap out of it and admit that Recovery Summer is here. The survey covers 2010 to 2013 and it’s stocked with interesting data, but the main point is the continued breaking away of top income earners from the rest of their counterparts. McClatchy summarizes:

Americans’ average income of grew by 4 percent from 2010 to 2013, a misleading number since it was pulled up by the richest Americans who grew wealthier during the period, according to a Federal Reserve report released Thursday.

In its Survey of Consumer Finances, conducted every three years, the Fed found that while average income rose by 4 percent, the midpoint income for American families actually fell 5 percent “consistent with increasing income concentration during this period.”

Translation: The growing wealth of the richest Americans pulled up the average. It’s the same phenomenon as if you and Microsoft founder Bill Gates pooled your salaries, you too would be a billionaire.

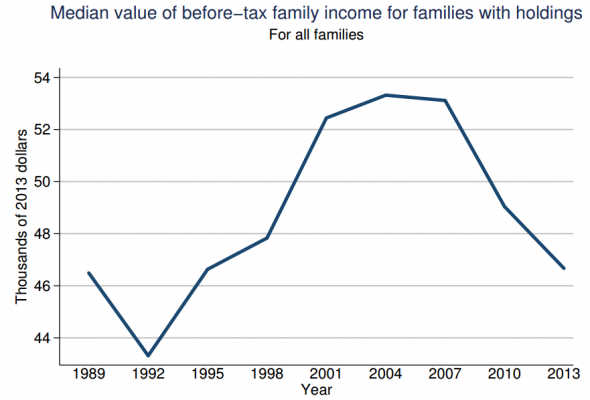

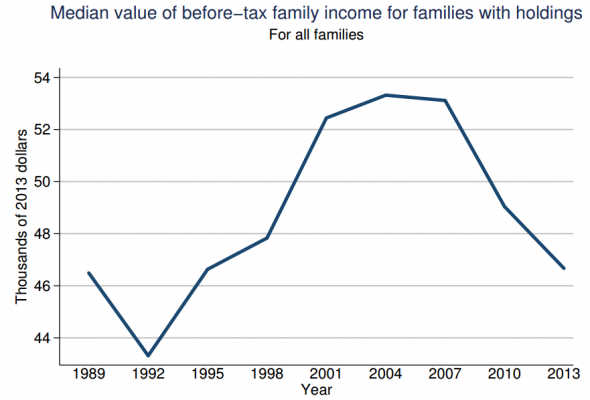

Matthew C. Klein supplies the charts, and they’re quite striking. Median income has dropped 12.4 percent since 2004, a dramatic decline in fortunes:

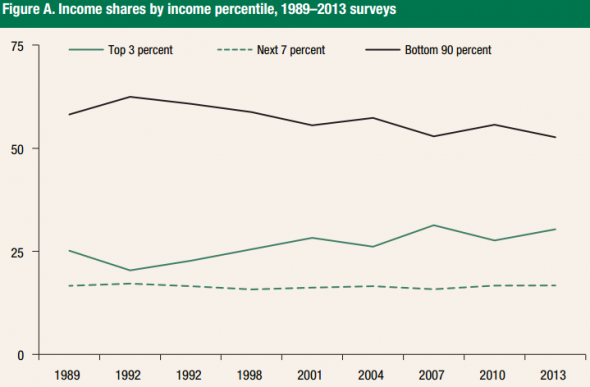

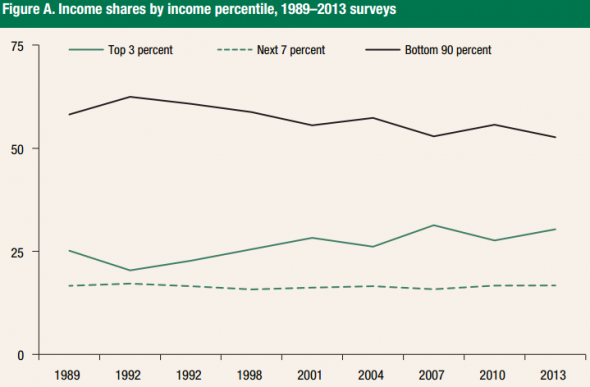

Good news, the gains are not only accruing to the top 1 percent of the distribution. More like the top 3 percent:

Looks like the rest of the top 10 percent have flatlined, while the bottom 90 percent have a lower income share than they did in the late 1980s. Median net worth is down at early-1990s levels. ......................(more)

The complete piece is at:

http://www.nakedcapitalism.com/2014/09/fed-survey-consumer-finances-shows-americans-well-informed-economic-well.html