Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 13 October 2014

[font size=3]STOCK MARKET WATCH, Monday, 13 October 2014[font color=black][/font]

SMW for 10 October 2014

AT THE CLOSING BELL ON 10 October 2014

[center][font color=red]

Dow Jones 16,544.10 -115.15 (-0.69%)

S&P 500 1,906.13 -22.08 (-1.15%)

Nasdaq 4,276.24 -102.10 (-2.33%)

[font color=green]10 Year 2.28% -0.03 (-1.30%)

30 Year 3.01% -0.03 (-0.99%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)ASIDE FROM THE FACT THAT THAT NUMBER IS MEANINGLESS AND MISLEADING?

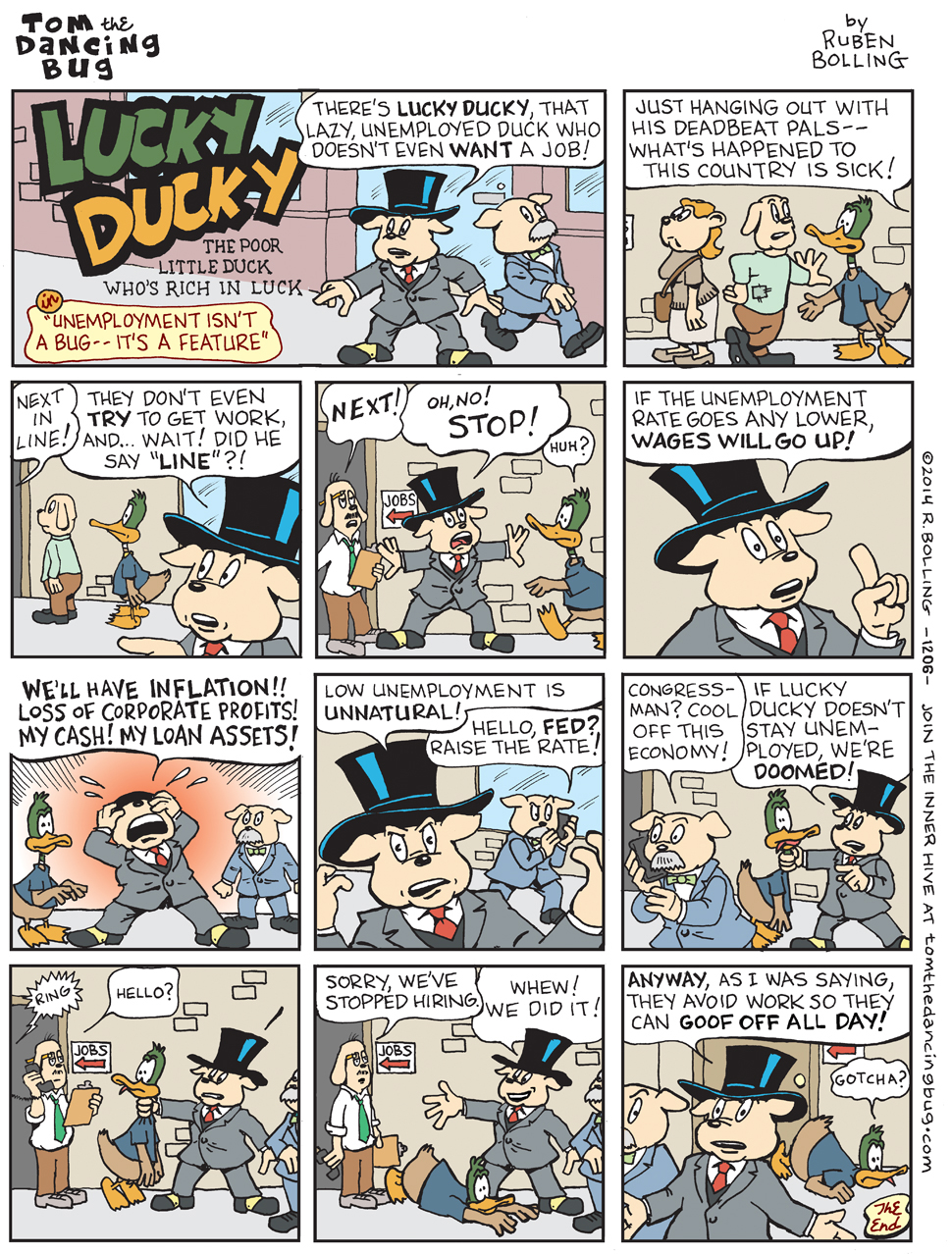

Some powerful folks want to see interest rates rise to prevent people from getting jobs and demanding higher wages.

http://www.alternet.org/economy/unemployment-dropped-below-6-so-whats-bad-news?akid=12344.227380.4tcdm9&rd=1&src=newsletter1022549&t=23

The jobs report on Friday showed the economy created 248,000 jobs in September and the unemployment rate fell below 6.0 percent for the first time since the early days of the recession. This is good news for workers. While we are still far from anything resembling full employment, it is getting easier for people to find jobs. If the economy keeps creating jobs at this pace, workers will finally have enough bargaining power to see some real wage gains, thereby getting their share of the benefits of economic growth. But this is also the bad news in the story. There are many powerful people who want to keep these wage gains from happening.

Immediately after the jobs report was released, James Bullard, the president of the St. Louis Federal Reserve Bank, was on television insisting that the Fed had to start raising interest rates. Bullard complained that the Fed was behind schedule and needed to slow the economy to prevent inflation. There should be no ambiguity about what Bullard was saying. He knows that higher interests will keep people from getting jobs. If the Fed raises interest rates it will discourage people from buying homes and cars. Fewer people will refinance mortgages, which has been a way for tens of millions of people to free up money for other spending over the last few years. Higher interest rates will also have some effect in reducing investment. They will also make it more difficult for state and local governments to finance bond issues for building or repairing infrastructure. And they will increase the value of the dollar, which makes our goods less competitive internationally, thereby increasing the trade deficit.

Bullard wants to see the economy slow because he doesn't want to see more workers get jobs. This is because when more workers get jobs, it will increase their bargaining power and they will be in a position to demand higher wages. This is exactly the inflation that worries Bullard. If workers are getting higher wages then we will see more inflation than in a situation where wages are stagnant. Bullard wants the Fed to slow the economy so that wages remain stagnant. If Bullard were just an obscure voice in the wilderness, we could all have a good laugh and get on to real issues. Unfortunately, he is a member of the Fed's 19 person Open Market Committee that decides interest rate policy. Several of the other district bank presidents who sit on this committee have expressed similar views. More importantly, there are many prominent economists and business people outside of the Fed who press the same concerns as Bullard. As many reports on the better than expected jobs numbers said, the September jobs report will make the Fed's job more difficult. There will be more pressure on Fed chair Janet Yellen and other inflation doves to start raising interest rates.

This is where the political realities of the Fed's policymaking process really matter. The Fed has been structured in a way that gives the financial industry, with its obsessive concern about inflation, excessive control over Fed policy. The twelve district bank presidents who comprise the bulk of the open market committee (only five vote at any one time) are appointed through a process that is dominated by the banks in the district. The seven governors (only five seats are currently filled) who make up the rest of the committee are appointed by the president and subject to congressional approval. These governors serve 14-year terms; which is supposed to insulate them from political pressure. But the governors also tend to be unduly deferential to the concerns of the financial industry. Traditionally many of the governors have also had backgrounds in finance. For example, Stanley Fischer, who is currently vice-chair, had a stint as a top executive at Citigroup after a long career as an academic economist.

Thus far Yellen has been a strong voice for staying the course, arguing that the risks of an inflationary spiral are still remote. Her position enjoys strong support in the data. Inflation continues to come in below the Fed's 2.0 percent target. And since this is an average, not a ceiling, the Fed can allow inflation to be above 2.0 percent for some time and still be keeping to its target - which is not itself written in stone. But in Washington, reality always takes a back seat to politics. And there is a real danger that the political power of the financial sector will force Yellen to start slowing the economy and stopping job growth long before workers gain any bargaining power. This risk will be greater if the public sits back and leaves Fed policy to the "experts."

Dean Baker is the co-director of the Center for Economic and Policy Research (CEPR). He is the author of "The Conservative Nanny State: How the Wealthy Use the Government to Stay Rich and Get Richer" and the more recently published "Plunder and Blunder: The Rise and Fall of The Bubble Economy." He also has a blog, Beat the Press, where he discusses the media's coverage of economic issues.

Demeter

(85,373 posts)Federal Reserve officials want to tie an interest-rate rise to U.S. economic progress, but the minutes of their last policy meeting show they are struggling with how to come to grips with the dual threats of a stronger dollar and a global slowdown.

The minutes expressed concern the rising dollar could slow a needed rebound in inflation. They also highlighted economic turmoil in Europe and Asia, another factor behind the bank's keeping policy accommodation in place for the near future.

The minutes of the Sept. 16-17 meeting, released on Wednesday after the usual three-week lag, revealed concern the financial markets are slightly out of sync with the Fed, and that dropping the current policy guidance could send unintended signals...

HOW DARE THE FINANCIAL MARKETS GET OUT OF SYNC WITH THE FEDERAL RESERVE! OR IS IT THE FED IS THE ONE OUT OF SYNC?

WORSE YET....PERHAPS BOTH ARE FANTASIES OF SOME DISEASED MIND, WHILE THE REAL WORLD CAREENS ON ITS OWN, HERDED BY EVENTS BEYOND ANYONE'S CONTROL, AND WAR.

Demeter

(85,373 posts)OBAMA ONLY BECAME CONCERNED LAST WEEK?

http://www.reuters.com/article/2014/10/06/us-financial-regulations-whitehouse-idUSKCN0HV1PY20141006

U.S. President Barack Obama is urging the country's top financial market regulators to find additional ways to "prevent excessive risk-taking across the financial system," White House spokesman Josh Earnest said on Monday.

Obama spoke about his concerns in a closed-door meeting convened earlier with the heads of regulators at the Federal Reserve, Securities and Exchange Commission, Commodity Futures Trading Commission and Consumer Financial Protection Bureau, among others.

Earnest said that regulators can take steps to reduce excessive risk-taking as they work to finalize rules targeting compensation structures and capital standards.

Hugin

(33,059 posts)

Eerily similar to actual events.

Demeter

(85,373 posts)Demeter

(85,373 posts)As for solutions, Herbert says, “People need to start voting against the excessive power of the great moneyed interests. But more than that, we need a movement, a grass-roots movement that will fight for the interests of ordinary men and women…”

Herbert is a senior distinguished fellow at the public policy and analysis think tank, Demos. He is also a board member of the Schumann Media Center, from which he is presently on leave working on a major documentary...

But what we've done as a result, is with this alliance of the banks and the big corporations and the government, they're working against the interests of working people. They want to pay as little as possible to their employees. They don't want to provide benefits. Job security has become a thing of the past, even for people with very good jobs. So what happens is you don't have that virtuous cycle. You don't have people with terrific jobs spending all kinds of money that powers the economy and creates more jobs. So that's the Catch-22. If we don't understand that you have to pay a decent wage to working Americans for the economy to work for everybody, then we're going to lose in the long run. And that's what's been happening.

...To me, if you can't afford to pay your workers, it's the same as if you can't afford to pay your rent. It means you can't afford to be in business. And if you're making-- if you're paying your workers what the minimum wage is right now that means to me that either you can't afford to pay your workers, or you're just unwilling to pay your workers, what you should be paying them. We should have accepted, as a society, that the minimum wage is an insufficient wage.

MORE

xchrom

(108,903 posts)France's CAC 40 is down 0.79%

Spain's IBEX is down 0.65%

Italy's FTSE MIB is up down 0.66%

Britain's FTSE 100 is down 0.61%

Germany's DAX is down 0.7%

The Hang Seng closed up 0.60% overnight. The Nikkei was closed for a national holiday, after falling 1.15% on Friday.

U.S. futures are down a little, with Dow futures and S&P futures dropping 0.19% and 0.25%, respectively.

Today’s only significant economic event is a speech from Fed policymaker Charles Evans, which comes at 12.30 p.m. ET.

Trade data out from China overnight significantly exceeded analyst expectations, with exports up 15.3% in the year to September, and imports up 7% in the same period.

Read more: http://www.businessinsider.com/market-update-oct-13-2013-2014-10#ixzz3G1C7s2CX

xchrom

(108,903 posts)A new report shows that four out of five purchases in Sweden are paid for electronically or by card.

The Local reports Swedes are using electronic payments 260 times per person, per year. Electronic payments systems such as Swish are bypassing the need for people to use ATMs for cash, while at street level, even retailers of Sweden’s version of The Big Issue, Situation Stockholm, are accepting card payments.

It’s not a Europe-wide trend, either. In Italy, cash is still king, accounting for three-quarters of all purchases.

While going cash-free comes with an increase in security costs, it’s more than offset by the drop in cash-handling costs. In Sweden, cash-handling costs are estimated to be around $1.2 billion, or 0.3% of the country’s GDP.

Read more: http://www.businessinsider.com.au/sweden-is-already-four-fifths-of-the-way-to-becoming-a-genuine-cashless-society-2014-10#ixzz3G1CYzSgP

Demeter

(85,373 posts)xchrom

(108,903 posts)BEIJING (Reuters) - China's exports rose more than expected in September while imports unexpectedly improved, data showed on Monday, bringing the trade surplus to $31 billion.

Exports rose 15.3 percent in September compared with a year ago, the General Administration of Customs said, beating a median forecast in a Reuters poll for a rise of 11.8 percent.

Imports rose 7 percent in terms of value, compared to a Reuters estimate for a 2.7 percent fall.

That led to a trader surplus of $31 billion, lagging forecasts for a surplus of $41 billion.

China's economy, the world's second largest, has had a bumpy ride this year. Activity has been dampened by unsteady exports and a slowdown in domestic demand that has been compounded by a cooling housing market.

Read more: http://www.businessinsider.com/r-china-september-exports-imports-beat-forecasts--2014-10#ixzz3G1CzvLdr

xchrom

(108,903 posts)1. Federal health officials express deep concern after a healthcare worker becomes the second person to be diagnosed with Ebola in the US. The female employee at Texas Health Presbyterian hospital is the first case of Ebola transmission in the US and the second outside Africa.

2. Liberian health officials are appealing to nurses and medical assistants not to go ahead with a national strike over the country's handling of the Ebola epidemic. The health workers are asking for an increase in the monthly risk fee paid to those treating Ebola. So far ninety-five of their colleagues have died.

3. Hundreds of men, some wearing masks, attempted to break through barricades erected by Hong Kong pro-democracy protesters on Monday, as the protests enter their third week. Angry truck and cab drivers in the city clashed with police as they attempted to open blocked roads.

4. European stocks stumble to new lows as worries about a eurozone slowdown intensify. A combination of worsening economic data out of the region and the tapering of Federal Reserve stimulus measures are casting a dark could over markets, the FT reports.

5. ECB President Mario Draghi and Jens Weidmann, the German central bank president, have renewed hostilities. Weidmann responded curtly to Draghi's call to aggressively expand the ECB's balance sheet by as much as 1 trillion euros ($1.3 trillion).

Read more: http://www.businessinsider.com/the-10-most-important-things-in-the-world-right-now-2014-10#ixzz3G1DVPBgH

Demeter

(85,373 posts)there's a word for idiots like these, but it's too early in the morning to get that angry...

xchrom

(108,903 posts)http://static4.businessinsider.com/image/543ba275eab8eaa410bc821d-960/chart%20(3)-1.png

The vice-president of Russia's state-owned oil behemoth Rosneft has accused Saudi Arabia of manipulating the oil price for political reasons. Mikhail Leontyev was quoted in Russian media as saying:

Prices can be manipulative. First of all, Saudi Arabia has begun making big discounts on oil. This is political manipulation, and Saudi Arabia is being manipulated, which could end badly.

The news comes as Reuters reports Saudi officials have been privately admitting to oil market participants that they are comfortable with lower oil prices. According to the news service, officials are signaling that the larger members of the Organization of the Petroleum Exporting Countries (OPEC) are willing to accept prices as low as $80 a barrel for as much as the next two years.

Falling prices are of particular concern to Russia, which has seen its economic performance slow under the weight of sanctions over the Ukraine and a weakening domestic demand outlook. Russia needs high oil prices to buoy its economy. The Russian Central Bank forecasts growth over 2014 to be a meager 0.4%, improving marginally to between 0.9%-1.1% in 2015.

The problem is that Russia's latest budget requires oil prices to average at least $100 a barrel in order to cover the government's spending promises. The government already needs to borrow around $7 billion from foreign investors next year and as much as 1.1 trillion rubles ($27.2 billion) from domestic investors. Given the country's sanctions-imposed isolation from international bond markets, any additional borrowing would be a big concern for policymakers in Moscow.

Read more: http://www.businessinsider.com/russia-saudi-arabia-and-oil-prices-2014-10#ixzz3G1E2cqoV

Demeter

(85,373 posts)The Russians are experts at surviving privation.

The Saudis are useless eaters, who have sucked the blood of their captive citizens to the point of violent revolt. Let's see if they can live without diamond-studded, gold-plated limos...

xchrom

(108,903 posts)With the market selling off, conversations about the economy have turned gloomy (that's how it works, the market feeds the perception of the economy, not the other way around).

But Joachim Fels of Morgan Stanley has three pieces of good news for you:

Also true, the continuing sell-off in equities and other risky assets risks feeding back negatively into economic sentiment and could induce companies and consumers to postpone spending. However, as I already pointed out last week, there is also some good news in some of the recent market moves. First, lower oil prices bolster households' real incomes, which is particularly welcome as nominal wage growth in the US and elsewhere has been broadly flat so far. Second, lower risk-free bond yields in the advanced economies benefit those EM economies that are dependent on external financing and buy time for them to continue to rebalance and reduce external vulnerabilities. Third but not least, the trend towards a stronger dollar versus the euro and yen is exactly what the doctor ordered for the ailing European and Japanese economies.

Fels also notes that in recent days, expectations for the first Fed rate hike have been pushed back.

Read more: http://www.businessinsider.com/heres-three-pieces-of-good-news-in-the-global-economy-2014-10#ixzz3G1EWVeIX

xchrom

(108,903 posts)SYDNEY (Reuters) - Dubai stocks crashed on Sunday and Asian stocks got off to shaky start on Monday in step with a steep decline on Wall Street as worries about global economic growth sapped confidence, keeping crude oil prices stuck near four-year lows.

Stocks in Dubai fell 6.5% on Sunday, the biggest drop in four months to bring the Dubai Financial Market General Index to its lowest level since July 20.

Dubai, which like many Middle East exchanges is open from Sunday to Thursday, led a broad sell-off in Middle East stocks, as markets in Israel, Qatar, and Saudi Arabia also sold off on Sunday.

Hisham Khairy, the Dubai-based head of institutional trade at Mena Corp. Financial Services, told Bloomberg that, "Global markets are all selling off and it’s that weakness we’re tracking. There’s still more blood to come."

Read more: http://www.businessinsider.com/r-asian-stocks-oil-skid-on-growth-anxiety-yen-firms-2014-10#ixzz3G1F4u0hL

Demeter

(85,373 posts)xchrom

(108,903 posts)Sen. Elizabeth Warren of Massachusetts harshly criticized President Obama and his economic advisers during a long interview with Salon that focuses on economic issues. At one point, the interviewer, Thomas Frank, mentions how he and his friends “are pretty disappointed” with Obama’s track record on protecting the little guy from moneyed interests. Warren said she “understands” the frustration, making it clear she feels the same way.

“He picked his economic team and when the going got tough, his economic team picked Wall Street,” Warren said. Frank answers that it seems the economic team “just about every time” sided with Wall Street.” Warren agrees:

That’s right. They protected Wall Street. Not families who were losing their homes. Not people who lost their jobs. Not young people who were struggling to get an education. And it happened over and over and over.

At the same time, Warren does have some praise for Obama, saying she’s convinced that if he hadn’t been president “we would not have a Consumer Financial Protection Bureau” because “he was the one who refused to throw the agency under the bus and made sure that his team kept the agency alive and on the table.”

Read more: http://www.slate.com/blogs/the_slatest/2014/10/12/elizabeth_warren_obama_protected_wall_street.html#ixzz3G1Fe8EGo

Demeter

(85,373 posts)Russia, holder of the world's fifth largest stash of foreign currencies, is increasing its gold purchases. One reason for this is the country's increasing wariness of the dollar and euro now that Russia has come under U.S. and European sanctions over the Ukraine crisis. Another reason is that these currencies are becoming increasingly risky to hold due to the swelling debts of the governments that back them.

According to data compiled by the International Monetary Fund, Russia increased its gold holdings for the fifth straight month in August, overtaking China and Switzerland to become the world's fifth-biggest buyer of the metal. Russia had 1,112.5 tons of gold in its foreign reserves at the end of August, up roughly 77 tons, or 7%, since January. The ratio of gold to foreign reserves has risen from 8.3% to 9.8%.

Worsening relations with the U.S. and European countries have contributed to the rise in Russia's gold holdings. The U.S. and European Union imposed economic sanctions against Russia after Moscow in March annexed Ukraine's Crimean Peninsula. The sanctions have made it difficult for Russia's arms industry to make settlements in U.S. dollars. And dollar-based energy exports, the backbone of Russia's economy, could also be affected, depending on any future sanctions.

Dollars and euros are said to make up more than 70% of Russia's foreign currency reserves. A senior official at Russia's Ministry of Energy, however, said President Vladimir Putin's administration has reviewed the country's foreign currency reserves from the view that Russia needs to break away from its dollar and euro dependence to counter the sanctions.

MORE

Demeter

(85,373 posts)http://uk.reuters.com/article/2014/10/06/uk-aig-bailout-trial-paulson-idUKKCN0HV1Y920141006

Former Treasury Secretary Henry "Hank" Paulson told a packed courtroom on Monday that AIG shareholders were singled out for punishment as part of the U.S. government's attempt to contain the contagion of the 2008 financial crisis. The testimony from Paulson appeared to bolster some claims contained in a lawsuit brought by former AIG Chief Executive Hank Greenberg, who contends the terms of a government loan to AIG cheated its shareholders.

"AIG, either fairly or unfairly, ... became a symbol for all that is bad on Wall Street," Paulson said as he testified about the U.S. government's bailout of the insurance giant, which began with a $85 billion loan from the New York Federal Reserve in September 2008.

Paulson, who appeared relaxed as he testified in federal court in Washington, said he supported the loan as appropriate for the circumstances, especially because officials needed to send a message that any bailout would come with strings attached. But he did not shed much light on how the terms of the loan were selected, which is at the heart of the case. Paulson was one of the chief architects of the U.S. government's response to the unprecedented global credit crisis of 2007-2009, and he has since written a book about the experience. Monday's courtroom setting put Paulson on the hot seat in a way he has not experienced since Congress wrapped up its hearings on the subject years ago.

Legal experts have doubted the strength of the lawsuit, which is seeking as much as $50 billion from the government. The outcome of the lawsuit may affect how much flexibility regulators will have when they respond to future financial crises.

MORAL HAZARD

In the case of AIG, the Fed initially charged a high interest rate for the first loan and required a nearly 80 percent stake in the company in exchange, which Greenberg's lawyers have said was illegal. While Paulson said he was not involved in setting the specific terms, he said the provisions were necessary to protect against "moral hazard," or concerns that other companies would take reckless risks under the belief that the government would bail them out with few consequences. But in response to questions from a government lawyer, Paulson said Citigroup Inc's (C.N) shareholders were not subject to similar terms when the bank also started to falter during the crisis. Paulson said Citigroup was different, in part because policymakers were concerned about short sellers who were exerting pressure on Citi's stock and would profit if the rescue targeted Citi's shareholders. Paulson said he was worried the traders would take the same strategy to the next bank, a concern he said he did not have about any of AIG's peers. AIG's problems stemmed from insurance it wrote on $79 billion worth of shoddy mortgage securities; Citigroup and other banks facing mounting losses on toxic assets they held.

....................

On Monday Paulson also said he had spoken in 2008 to then-presidential candidates John McCain and Barack Obama about the AIG bailout, and had informed them that AIG shareholders would be treated harshly. Paulson said he hoped that assurance would help convince the two candidates to avoid criticizing the deal in public.

Paulson, who served as President George W. Bush's Treasury secretary from 2006 to 2009, was previously the chief executive of Goldman Sachs Group Inc (GS.N) and now runs an institute that focuses on climate change and other issues.

AIG Failure Might Have Caused ‘Mass Panic’, Geithner Says

http://www.bloomberg.com/news/2014-10-07/aig-failure-would-ve-caused-mass-panic-geithner-thought.html

Timothy Geithner backed away from two of his more provocative assessments of the 2008 bailout of American International Group Inc. (AIG), in a day of courtroom testimony marked by careful answers and a lack of recollection about the details of the financial rescue he helped oversee.

Geithner, who headed the Federal Reserve Bank of New York at the time of the bailout, shed little new light on how he set the interest rate for AIG’s rescue loan, a key question in a lawsuit by Maurice “Hank” Greenberg’s Starr International Co. challenging the terms of the government’s assistance to AIG.

Greenberg claims the bailout terms, including the government taking an 80 percent of the insurer’s stock, cheated AIG shareholders and is seeking at least $25 billion in damages. Geithner, as the second of three major architects of the bailout to testify in the federal court trial in Washington, was preceded on the stand by former Treasury Secretary Henry Paulson and will be followed by former Federal Reserve Chairman Ben Bernanke.

Geithner’s testimony covered what Starr lawyer David Boies called “an extortion rate” of 14 percent on an $85 billion government loan to AIG.

Responding to Boies’s questions, Geithner acknowledged, “Ultimately I was the one responsible for setting that rate.” He testified that it was modeled in part on a contemplated though never completed private rescue of AIG to be led by JPMorgan Chase & Co. (JPM) and Goldman Sachs Group Inc. (GS)

Boies asked Geithner if he ever saw anything in writing describing a rationale for the rate.

“I don’t believe so. We were moving kind of quickly,” Geithner said.

He responded “I don’t know” or “I don’t recall” to a series of questions about who drafted the proposed terms for AIG, whether he had ever seen a term sheet from private lenders and whether the terms were shared with AIG.

Geithner said his information about the proposed terms for AIG were conveyed to him verbally by “someone I deemed authoritative” at the New York Fed whose name he could not recall....

I SMELL A COVER-UP! IS NIXON STILL DEAD? GEITHNER IS GONNA TAKE A FALL FOR SOMEONE...WHO? RUBIN? BLANKFEIN? WISH I COULD BE A FLY ON THE COURTROOM WALL...

Demeter

(85,373 posts)Crude oil prices fell to the lowest levels since 2012 Thursday, as concerns about oversupply and a weak global economy weighed on traders...

Demeter

(85,373 posts)Saudi Aramco sharply cut official oil prices for Asian customers in November, the state-run company said on Wednesday in the clearest sign yet the world's largest exporter is trying to compete for crude market share. The move comes amid calls from some within the Organization of the Petroleum Exporting Countries (OPEC) for action to shore up prices, as international benchmark Brent crude oil has slumped to a two-year low. But the price cuts on Wednesday indicate Saudi is likely to follow its long-stated policy of supplying enough oil to world markets, while at the same time quietly competing with countries like Iraq and Iran to be the top supplier to fast-growing economies like China.

International benchmark Brent crude oil futures reversed course after the Saudi prices were released, turning negative in late trade. At 1835 GMT they were trading down 0.45 percent at $94.25 a barrel. "Brent is going down hard," one trader said. "It's going to retrace most of the gains from today on this." Another trader said the fourth-straight monthly reduction made it appear Saudi Arabia may be trying to start a "price war" with rival producers. Regional oil rival Iran may face a budget deficit due to lower prices and Western sanctions.

Saudi slashed its flagship Arab Light selling price by $1 a barrel versus October to a discount of $1.05 a barrel to the Oman/Dubai average. Traders had been expecting a cut no bigger than 70 cents. Saudi also cut prices to Europe and the United States by 40 cents a barrel. Traders are now anticipating a tense OPEC meeting when the group next convenes in Vienna this November, to see if the group can respond to ample supplies coming from the shale oil boom in North America and the recovery in output in Libya, which has pushed oil below $95 a barrel for the first time since 2012.

OPEC STAND-OFF

Gulf OPEC members have so-far argued that oil prices will likely recover in the fourth quarter of this year due to stronger demand. Iran's oil minister has urged OPEC to stop the oil price slide. But a Reuters poll on Wednesday showed the sharpest downward revision to energy analyst oil price forecasts for two years, posing a challenge to the group as most expect Brent to remain weak into 2015. Saudi Arabia, as the world's top exporter and holder of the world's largest spare capacity, has said it trimmed its output in August, a move analysts seen as playing its role as the world's swing producer. But the amount of crude supplied to the market - both domestically and for export - inched up to 9.688 million bpd, compared to around 9.66 million bpd in July, an industry source said last week. A Reuters survey of OPEC output on Tuesday also showed rising supplies from Saudi Arabia and other members of the group, despite a glut of crude weighing on prices.

OPEC secretary-general Abdullah al-Badri said last month he expected the group to lower its output target when it meets in late November. Other countries, including Iran and Venezuela that generally argue for higher prices, may put pressure on the group to take action...

DETAILS ON PRICING AT LINK

AND NOW, TO ADD TO THE CONFUSION, AN OIL WAR....A CLEAR SIGN THAT THE GLOBAL ECONOMY IS TANKING.

Demeter

(85,373 posts)http://www.commondreams.org/views/2012/06/16/spanish-austerity-savage-point-sadism

Nobel Laureate economist Joseph Stiglitz characterizes the Spanish bank bailout as “voodoo economics” that is certain “to “fail.” New York Times economic analyst Andrew Ross Sorkin agrees: “By now it should be apparent that the bailout has failed—or at least on its way to failing.” And columnist and Nobel Prize-winning economist Paul Krugman bemoans that Europe (and the U.S.) “are repeating ancient mistakes” and asks, “why does no one learn from them?”Spanish prime minister -- and bailout apologist -- Mariano Rajoy. Indeed, at first glance, the European Union’s response to the economic chaos gripping the continent does seem a combination of profound delusion, and what a British reporter called “sado-monetarism”—endless cutbacks, savage austerity, and widespread layoffs.

But whether something “works” or not depends on what you do for a living.

If you work at a regular job, you are in deep trouble. Spanish unemployment is at 25 percent—much higher in the country’s southern regions—and 50 percent among young people. In one way or other, those figures—albeit not quite as high—are replicated across the Euro Zone, particularly in those countries that have sipped from Circe’s bailout cup: Ireland, Portugal, and Greece.

But if you are Josef Ackermann heading up the Deutsche Bank, you earned an 8 million Euro bonus in 2012, because you successfully manipulated the past four years of economic meltdown to make the bank bigger and more powerful than it was before the 2008 crash. In 2009, when people were losing their jobs, their homes, and their pensions, Deutsche Bank’s profits soared 67 percent, eventually raking in almost 8 billion Euros for 2011. The bank took a hit in 2012, but the Spanish bailout will help recoup Deutsche Bank’s losses from its gambling spree in Spanish real estate...

So, the answer to Krugman’s question, “why are they repeating ancient mistakes?”

Because they are making out like bandits.

A GOOD READ, WORTH REVIEWING

http://cluborlov.blogspot.co.uk/2012/06/fragility-and-collapse-slowly-at-first.html#more

I have been predicting collapse for over five years now. My prediction is that the USA will collapse financially, economically and politically within the foreseeable future... and this hasn’t happened yet. And so, inevitably, I am asked the same question over and over again: “When?” And, inevitably, I answer that I don’t make predictions as to timing. This leaves my questioners dissatisfied, and so I thought that I should try to explain why it is that I don’t make predictions as to timing. I will also try to explain how one might go about creating such predictions, understanding full well that the result is highly subjective.

You see, predicting that something is going to happen is a lot easier than predicting when something will happen. Suppose you have an old bridge: the concrete is cracked, chunks of it are missing with rusty rebar showing through. An inspector declares it “structurally deficient.” This bridge is definitely going to collapse at some point, but on what date? That is something that nobody can tell you. If you push for an answer, you might hear something like this: If it doesn’t collapse within a year, then it might stay up for another two. And if it stays up that long, then it might stay up for another decade. But if it stays up for an entire decade, then it will probably collapse within a year or two of that, because, given its rate of deterioration, at that point it will be entirely unclear what is holding it up.

You see, the timing estimates are inevitably subjective and, if you will, impressionistic, but there are objective things to pay attention to: how much structure is left (given that large chunks of concrete are continuing to fall out of it and into the river below) and the rate at which it is deteriorating (measurable in chunks per month). Most people have trouble assessing such risks. There are two problems: the first is that people often think that they would be able to assess the risk more accurately if they had more data. It does not occur to them that the information they are looking for is not available simply because it does not exist. And so they incorporate more data, hoping that they are relevant, making their estimate even less accurate.

The second problem is that people assume that they are playing a game of chance, and that it’s a fair one: something Nassim Nicholas Taleb calls the “ludic fallacy.” If you drive over a structurally deficient bridge every day, it could be said that you are gambling with your life; but are you gambling, exactly? Gambling normally involves games of chance: roll of the dice, flip of the coin, unless someone is cheating. Fair games form a tiny, insignificant subset of all possible games, and they can only be played in contrived, controlled, simplified circumstances, using a specially designed apparatus that is functioning perfectly. Suppose someone tells you that he just flipped a coin 10 times and all 10 were heads? What is the probability that the next flip will be heads too? If you think 50%, then you are discounting the very high probability that the game is rigged. And this makes you a sucker.

Games played directly against nature are never fair. You could say that nature always cheats: just as you are about to win the jackpot, the casino gets hit by an asteroid. You might think that such unlikely events are not significant, but it turns out that they are: Taleb’s black swans rule the world. Really, nature doesn’t so much cheat as not give a damn about your rules. But these rules are all you have go by: a bridge is sound if it corresponds to the picture in the head of its designer. The correspondence is almost perfect when it’s new, but as it ages a noticeable divergence takes place: cracks appear and the structure decays. At some more or less arbitrary point it is declared unsafe. But there is no picture in anyone’s head of it collapsing, because, you see, it wasn’t designed to collapse; it was designed to stay up. The information as to when it will collapse does not exist. There is a trick, however: you can observe the rate of divergence; when it goes from linear to exponential (that is, it begins to double) then collapse is not far, and you might even be able to set an upper limit on how long it will take. If the number of cement chunks falling out of your bridge keeps doubling, you can compute the moment when every last piece of the bridge will be in the river, and that is your upper bound....

ALSO LONG AND WORTHY OF REVIEW...ON THE TIMING OF PREDICTIONS

DemReadingDU

(16,000 posts)10/7/14 Report scores: Brent Spence in decline

The 51-year-old Brent Spence Bridge really is showing its age. Worsening grades in 10 years of inspection reports shows it. An Enquirer analysis of annual reports over the past decade finds that inspectors have given the heavily trafficked bridge worsening scores in major categories of upkeep, maintenance and structural integrity.

The bridge's overall "sufficiency" rating, on a scale from 1 to 100, was 59 in last year's report, the equivalent of a C-. The bridge rated a 78 in 2006, the equivalent of a B+. While the bridge is still considered structurally sound and state highway officials maintain it's safe, its declining state concerns some experts. Last month, falling concrete from a ramp on the Ohio side crushed and totaled a Ford Fusion parked underneath, while its owner attended a Bengals football game.

Inspection reports for 2003-2013 obtained through open records requests show that:

• The bridge hasn't been painted since 1991, causing more than cosmetic problems. Old and peeling paint has contributed to increased rust and minor cracking that could lead to larger cracks on steel trusses and rivets.

• Concrete has decayed, exposing internal steel on major deck joints and creating potential for further corrosion, especially on the northbound bottom deck. Once internal "rebar" steel starts rusting, it can force further cracking and crumbling of the surrounding concrete.

• Drains are continually clogged, and drainpipes have rusted through. That allows water to pool on the bridge during heavy rains and fall in waves between joints from the top to the bottom deck, creating a driving hazard. Some drivers have likened the phenomenon to driving through a car wash.

Nearly everyone agrees that the Brent Spence Bridge – one of the nation's most critical highways – needs to be replaced. It is designated "functionally obsolete" for design deficiencies including narrow lanes and lack of emergency pull-over lanes.

The problem continues to be lack of a funding plan or construction start date for the $2.4 billion replacement job. Key legislators from Kentucky, which owns the bridge, are adamantly opposed to using tolls to help cover the cost.

more...

http://www.cincinnati.com/story/news/your-watchdog/2014/10/06/report-scores-brent-spence-decline/16841309/#sthash.wTmJihC5.dpuf

Demeter

(85,373 posts)Saudi Arabia is quietly telling oil market participants that Riyadh is comfortable with markedly lower oil prices for an extended period, a sharp shift in policy that may be aimed at slowing the expansion of rival producers including those in the U.S. shale patch.

Some OPEC members including Venezuela are clamoring for urgent production cuts to push global oil prices back up above $100 a barrel. But Saudi officials have telegraphed a different message in private meetings with oil market investors and analysts recently: the kingdom, OPEC’s largest producer, is ready to accept oil prices below $90 per barrel, and perhaps down to $80, for as long as a year or two, according to people who have been briefed on the recent conversations.

The discussions, some of which took place in New York over the past week, offer the clearest sign yet that the kingdom is setting aside its longstanding de facto strategy of holding prices at around $100 a barrel for Brent crude in favor of retaining market share in years to come.

The Saudis now appear to be betting that a period of lower prices – which could strain the finances of some members of the Organization of the Petroleum Exporting Countries – will be necessary to pave the way for higher revenue in the medium term, by curbing new investment and further increases in supply from places like the U.S. shale patch or ultra-deepwater, according to the sources, who declined to be identified due to the private nature of the discussions....

MORE....POLITICS AND ECONOMICS APPEAR TO HAVE DIFFERENT GOALS (EXCEPT THAT THE BIG FISH WANT TO EAT THE LITTLE FISH)

Demeter

(85,373 posts)The big Wall Street banks have now agreed that they won’t be able to flee the scene when another big financial institution undergoes a resolution proceeding. Other large investors might also be reluctantly dragged along. This leaves ordinary corporations as the only ones who will be subject to the safe harbors. How does that make any sense?

The safe harbors is a catch-all name for various bits of the bankruptcy code that exempt derivative contracts from three of the main engines of the bankruptcy process: the automatic stay, the power to assume and reject contracts and the prohibition on termination of a contract solely because of a bankruptcy filing.

The original justification for the safe harbors was systemic risk. The fear was that a small dealer or fund could file for bankruptcy, and the entire system would grind to a halt because nobody would know precisely what the status was of their trades with the debtor. But the problem was that the creation of the safe harbors also created an incentive to run. It is an incentive that several legal scholars, including myself, have noted for a while. Finance types tended to ignore this literature, painting it as the work of a bunch of bankruptcy fanatics, and the safe harbors arguably grew even broader in 2005, just before the crisis. Three years later, when American International Group was on the brink of collapse, it became quite clear that this was a serious drawback to the bankruptcy code.

So now we don’t have safe harbors for the big broker-dealers anymore. So what precisely is the justification for having them? After all, one would presume that any big dealer’s exposure to a single end user should not be the cause of any systemic risk — assuming some normal risk management, of course. One of the fundamental problems is that now that the safe harbors are in the bankruptcy code, even sensible refinements to those provisions are hard to pass because the status quo looks pretty good for the bulk of the derivatives traders. Sure, they will concede that they never intended to cover standard supply contracts, but why should they change what they have unless you can show them some new language that leaves them exactly as they are now, while still achieving your desired change. And they really have no interest in working on that language, because, after all, things are pretty good as they are right now. One way to level the playing field is to simply repeal the safe harbors. I’ve argued for this in past, not so much because I think there should be no safe harbors, but because it would mean that everyone negotiates the new safe harbors from a position of equality...

IN OTHER WORDS, STILL BROKEN FOR US, "FIXED" FOR THE DERIVATIVES TRADERS

xchrom

(108,903 posts)WHEN it was discovered in 2000, the Kashagan oilfield in Kazakhstan's waters in the northern Caspian Sea was the world's biggest oil find in three decades. By now it was supposed to be pumping out 1.2m barrels a day (mbd), enough to meet Spain's entire consumption.

But the project, whose name sounds unfortunately like "cash all gone", went spectacularly awry. A year ago, when the first trickle of crude briefly flowed, it was already eight years behind schedule. Having cost $43 billion, it was $30 billion over budget. And production lasted only a few weeks before leaks of poisonous gas forced its suspension. Earlier this month a government minister admitted it would not restart until at least 2016.

Undeterred by the Kashagan fiasco, this week the government said it would approve a plan to expand the onshore Tengiz oilfield, another huge budget-buster. Tengiz was first expected to cost $23 billion but the government said this week that the bill had risen to $40 billion.

Each of the two oilfields is owned by a different consortium of foreign firms and the state oil company, KazMunaiGaz. In Kashagan's case they include Exxon, Shell, Total and ENI. In part the project's setbacks are due to unexpected technical problems. Corrosive and poisonous hydrogen sulphide gas, pumped up from the seabed along with the oil, has eaten through pipes bringing it onshore.

Read more: http://www.businessinsider.com/one-of-the-worlds-biggest-oil-projects-is-a-total-fiasco-2014-10#ixzz3G1K7Ek29

xchrom

(108,903 posts)Oil prices have fallen again amid renewed worries about low global growth with Brent crude near four-year lows.

Brent crude dropped to $87.74 a barrel, its lowest since December 2010, before recovering some ground to $88.12.

US light crude oil was down $1.40 at $84.42, close to a two-year low.

The prospect of weak economic growth cutting demand for oil has hit prices. In addition, key Opec producer Saudi Arabia has signalled it could cope with lower prices.

xchrom

(108,903 posts)The U.S. economy looks better able to withstand the hit from a stronger dollar and weaker global growth than the stock market did last week.

Foreign sales last year accounted for 46.3 percent of revenues for companies in the Standard & Poor’s 500 Index in 2013, leaving them prone to a rising greenback and the recent slowdowns in Europe and Asia, according to S&P Dow Jones Indices in New York. By contrast, U.S. exports compose just 13.5 percent of the economy.

“The U.S. economy is less open than the S&P revenue base,” said Jan Hatzius, chief economist at Goldman Sachs Group Inc. in New York. “There are good reasons to think growth will continue to be above trend.”

Hatzius sees the U.S. poised to expand 3.2 percent next year, outpacing the average annual rate of 2.2 percent since the recession ended in June 2009. The brighter outlook helped soothe nerves at the weekend’s annual meeting of the International Monetary Fund in Washington, otherwise dominated by renewed concern over Europe’s economy.

xchrom

(108,903 posts)Investors have had enough of Europe.

Amid a global selloff that has sent the Standard & Poor’s 500 Index down 5.2 percent in three weeks, losses have been almost twice as big in the Euro Stoxx 50 Index, where last week’s 4.5 percent retreat was the largest since 2012. A record $1 billion was withdrawn from an exchange-traded fund tracking Europe in the period as Mario Draghi, the central-bank president, warned of signs the recovery is losing momentum.

Investors are bailing as the economy threatens to fall back into another recession just after ending the longest contraction in its history last year. Equity losses approaching $1.6 trillion since September mark a reversal for markets that fund managers named as the favorites as recently as July.

“Last week really shook markets, and Europe found itself in the spotlight for all the wrong reasons,” said Jeremy Gaudichon, who manages European equities at KBL Richelieu Gestion in Paris. “It’s crazy that we’re even talking about the risk of recession again. Of course international investors would want to cut their exposure.”

The Euro Stoxx 50 has tumbled for three consecutive weeks, the longest streak since June 2013. Valuations are failing to provide a floor, with companies in the gauge trading at 13.6 times projected profits, up 84 percent from a low in September 2011 and 20 percent higher than the five-year average.

xchrom

(108,903 posts)Mario Draghi’s latest strategy for the euro area is failing to win over economists.

More than 60 percent of the respondents in Bloomberg’s monthly survey say the European Central Bank president’s plan to steer its balance sheet toward early-2012 levels is set to fall short and a growing number predict he’ll resort to large-scale government-bond buying. Two-thirds are unhappy with the lack of details for an asset-purchase program that will start this month after the ECB declined to say how big it will be.

The survey points to possible battles ahead in the Governing Council with some officials already opposing the plan to buy asset-backed securities and covered bonds. At the International Monetary Fund’s annual meetings in Washington, Draghi again signaled that he intends to expand the ECB’s balance sheet by as much as 1 trillion euros ($1.3 trillion) to stave off deflation in the euro area.

“The ECB remained utterly vague about the details, especially about the size of the purchase program,” said Duncan de Vries, an economist at NIBC Bank in The Hague. “The advantage for the ECB from not providing all the details is that it keeps flexibility. The disadvantage is clearly that financial markets keep on questioning the ECB’s ability and willingness to fight disinflation.”

xchrom

(108,903 posts)Royal Bank of Scotland Group Plc says lenders in Sweden have chosen the “worst” moment to tighten lending standards in Scandinavia’s biggest economy.

A decision by the Swedish Bankers’ Association last week to force homeowners to amortize all new mortgages worth more than 50 percent of their properties risks hurting demand in an economy already grappling with disinflation and its associated risks, according to Par Magnusson, RBS’s chief economist in Stockholm.

“I can’t envision a worse timing when we have an economy with such low inflation, a depleted monetary policy, a big output gap in the economy,” Magnusson said by phone. “Tightening is exactly the opposite of what this economy needs.”

Inflation has missed the Swedish Riksbank’s 2 percent target for almost three years, prompting Nobel LaureatePaul Krugmanin April to warn that Sweden faces a Japan-like deflation trap. Three months later, the Riksbank cut its main interest rate by 50 basis points to 0.25 percent as policy makers signaled declining consumer prices pose a greater threat than the risk of overheated credit and housing markets.

xchrom

(108,903 posts)Two of Francois Hollande’s top ministers sent differing signals on how quickly to revamp the unemployment-benefits system, keeping alive a debate the French president sought to suppress.

For Finance Minister Michel Sapin, the matter can wait until the scheduled talks between labor unions and business in mid-2016. Economy Minister Emmanuel Macron indicated more urgency, saying the government can move faster.

The issue was raised last week by Prime Minister Manuel Valls, who said the wasteful system needs to be fixed in the “short term.” Hours later, Hollande shot down the suggestion, saying the government “has enough on its plate.” Sapin is siding with the president.

“The year 2015 should be used to think about an improvement of the unemployment insurance mechanism that would increase the incentive to resume work,” Sapin said in an interview with Bloomberg Television in Washington.

Demeter

(85,373 posts)U.S. regulators are asking banks for more detail on their autos financing exposure, as rapid growth in the lending has prompted officials to seek to better assess the risks, according to a person familiar with the matter.

Balances remaining on auto loans have risen by about a third since April 2011, reaching an all-time high of $924.2 billion in August, according to credit reporting bureau Equifax. About a fifth of the loans are subprime.

Banking regulators fear that reckless lending may be at least helping to fuel that growth, and there are early signs that delinquencies are increasing in the sector.

The Consumer Financial Protection Bureau said in September that it is taking steps to oversee auto lenders that have previously been less regulated, and companies like GM Financial and Santander Consumer USA Holdings Inc disclosed earlier this year that the Department of Justice is looking into their auto finance practices...

YOU MEAN, NOBODY'S BEEN PAYING ANY ATTENTION? AND THEY CALL THIS REGULATING?

xchrom

(108,903 posts)Bank of America Corp., the third-largest U.S. mortgage lender, refused to give Paul Mataska the loan amount he needed last year after he had a six-month layoff from his job in 2012. That setback didn’t prevent a Canadian lender from providing the electrician the loan this year.

The U.S. unit of Toronto-Dominion Bank (TD) approved a mortgage for Mataska through its new program with flexible income and low down payment requirements. He’s scheduled to close on his $269,000, three-bedroom bungalow in Bayville, New York, this week.

“I got lucky with TD -- there was no primary insurance I had to pay, rates were lower and it was a lower percentage down,” Mataska, 33, said.

Borrowers like Mataska with minor imperfections on their applications, such as a brief loss of employment or a temporary drop in a credit score, have mostly been turned away by lenders since the 2008 housing crash. That’s starting to change, with at least 15 smaller firms this year offering slightly riskier mortgages, sometimes at higher interest rates or requiring larger down payments, that aren’t backed by the government. The mortgages are being held on balance sheets or sold to investment funds as the securitization market has been slow to recover.