Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 21 October 2014

[font size=3]STOCK MARKET WATCH, Tuesday, 21 October 2014[font color=black][/font]

SMW for 20 October 2014

AT THE CLOSING BELL ON 20 October 2014

[center][font color=green]

Dow Jones 16,399.67 +19.26 (0.12%)

S&P 500 1,904.01 +17.25 (0.91%)

Nasdaq 4,316.07 +57.64 (1.35%)

[font color=red]10 Year 2.19% +0.01 (0.46%)

30 Year 2.97% +0.02 (0.68%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

12 replies, 1890 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (13)

ReplyReply to this post

12 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

STOCK MARKET WATCH -- Tuesday, 21 October 2014 (Original Post)

Tansy_Gold

Oct 2014

OP

Demeter

(85,373 posts)1. Yesterday I had my car recall fix

They modified the KEY to fix the ignition switch problem....

and then there was a second recall on the passenger airbag announced that afternoon!

Sigh. This modern method of car ownership is educational...

xchrom

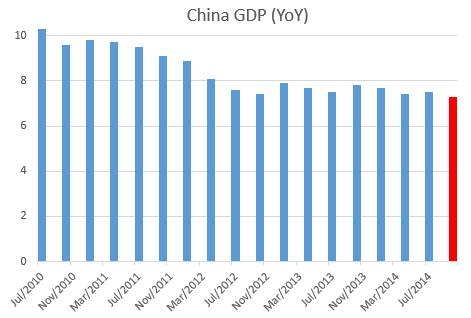

(108,903 posts)2. China Is Slowing

http://www.businessinsider.com/china-is-slowing-2014-10

There should be no doubt — China is slowing. Data released Tuesday showed GDP grew by 7.3% in the third quarter of 2014 compared to a year earlier, its slowest pace since the first quarter of 2009.

Despite maintaining an enviable growth rate, the recent slowdown has been driven primarily by a weakening real estate market that has pulled down investment and is starting to weigh on consumer spending.

The weakness of the property market is of particular concern since land sales provide nearly 50% of local government revenues. As the IMF reported last year, the risk is that "a correction in real estate prices could hurt the debt servicing ability of local governments...and impair banks’ asset quality" leading to the threat of a transfer of problems in the financial sector to the Chinese government if left unchecked.

Commenting on the Q3 figure Barclays said:

The out-turn was better than our (7.1%) and consensus (7.2%) forecasts, but remains consistent with our view that relatively weaker data in Q3 reflects the government’s shift towards tolerating lower growth...We continue to expect the government to set a lower growth target of 7.0-7.5% for 2015, from c.7.5% in 2014, and maintain our below-consensus 2015 GDP growth forecast of 6.9%.

Slower growth will put pressure on the Chinese government to intervene to prop up the country's growth rate in order to hit its official target of 7.5% growth in 2014.

Read more: http://www.businessinsider.com/china-is-slowing-2014-10#ixzz3GmGm2hie

There should be no doubt — China is slowing. Data released Tuesday showed GDP grew by 7.3% in the third quarter of 2014 compared to a year earlier, its slowest pace since the first quarter of 2009.

Despite maintaining an enviable growth rate, the recent slowdown has been driven primarily by a weakening real estate market that has pulled down investment and is starting to weigh on consumer spending.

The weakness of the property market is of particular concern since land sales provide nearly 50% of local government revenues. As the IMF reported last year, the risk is that "a correction in real estate prices could hurt the debt servicing ability of local governments...and impair banks’ asset quality" leading to the threat of a transfer of problems in the financial sector to the Chinese government if left unchecked.

Commenting on the Q3 figure Barclays said:

The out-turn was better than our (7.1%) and consensus (7.2%) forecasts, but remains consistent with our view that relatively weaker data in Q3 reflects the government’s shift towards tolerating lower growth...We continue to expect the government to set a lower growth target of 7.0-7.5% for 2015, from c.7.5% in 2014, and maintain our below-consensus 2015 GDP growth forecast of 6.9%.

Slower growth will put pressure on the Chinese government to intervene to prop up the country's growth rate in order to hit its official target of 7.5% growth in 2014.

Read more: http://www.businessinsider.com/china-is-slowing-2014-10#ixzz3GmGm2hie

xchrom

(108,903 posts)3. Britain's Finances Are An Astonishing Mess Compared To The US

http://www.businessinsider.com/uk-us-deficit-borrowing-government-spending-2014-10

Figures released a week ago show that the US government deficit is back below 3% of GDP, an amazing turnaround that went without much celebration. That is down to less than a third of the levels it reached during the worst of the recession.

In comparison, Britain's deficit-cutting has been awful: At 5.7% of GDP in the most recent fiscal year, the government has not even reduced borrowing by half. When the Coalition came into office, they expected to eliminate the deficit by 2015.

Just a few weeks ago, British Chancellor George Osborne said that the UK is the "most deficit reducing of any major advanced economy on earth". It wasn't true at the time, but sounds even more ludicrous today.

Borrowing disappointments have been one of the only constant and reliable things in the last few years in British politics. Crises come and go, but the government has almost constantly missed its own deficit targets.

Read more: http://www.businessinsider.com/uk-us-deficit-borrowing-government-spending-2014-10#ixzz3GmHFPSMc

Figures released a week ago show that the US government deficit is back below 3% of GDP, an amazing turnaround that went without much celebration. That is down to less than a third of the levels it reached during the worst of the recession.

In comparison, Britain's deficit-cutting has been awful: At 5.7% of GDP in the most recent fiscal year, the government has not even reduced borrowing by half. When the Coalition came into office, they expected to eliminate the deficit by 2015.

Just a few weeks ago, British Chancellor George Osborne said that the UK is the "most deficit reducing of any major advanced economy on earth". It wasn't true at the time, but sounds even more ludicrous today.

Borrowing disappointments have been one of the only constant and reliable things in the last few years in British politics. Crises come and go, but the government has almost constantly missed its own deficit targets.

Read more: http://www.businessinsider.com/uk-us-deficit-borrowing-government-spending-2014-10#ixzz3GmHFPSMc

xchrom

(108,903 posts)4. Cheap Oil Isn't Free

http://www.businessinsider.com/the-price-we-will-pay-for-cheap-oil-2014-10

The world price of oil – Brent Crude – fell below $84 per barrel on October 15. This was 26% less than the $115 it had reached in June, just four months before. The rise during the spring had many explanations: global tensions in Ukraine, the South China Sea and especially the Middle East with the emergence of the Islamic State, plus a capital crunch challenging the health of the U.S. shale fracking boom. Then suddenly in June, prices started dropping, reaching levels unseen since 2010 (though still high by historical standards – twice that of 10 years ago).

What is going on? Why does the price of oil matter to financial advisors? What might these fluctuations mean to the price and supply of oil for the rest of the decade? Isn’t oil just another commodity?

A primer on oil prices

Oil is unique. There is a tight relationship between energy supplies, especially affordable quantities of oil, and the level of overall economic activity. Simply put, economies stop growing when their use of energy stops growing. The world moves with oil, and petroleum lubricates the global economy. It is not simply a natural resource, but the substance that allows all other systems – from food to cities to (unfortunately) war – to exist at the massive scales of today.

For most of the 20th Century, the world’s supply of oil grew steadily, while the price generally declined and remained low1. This enabled the world’s GDP to expand by a factor of 15, a rate vastly greater than at any time in human history. The opening years of the 21st century have broken with these trends. The price of oil is higher (even adjusted for inflation) than it has been since the opening days of the oil age (except for a few brief periods), but global supplies of oil are growing very slowly, if at all, and economic growth is stalling all over the world.

The booming story of American shale oil development and the prospect of “energy independence” had been a defining narrative driving optimism about our economy since 2009. Many advisors have bought into this story, which depended on enjoying both our new oil and high world energy prices. The current price collapse could be a threat to that part of our prosperity.

Read more: http://www.advisorperspectives.com/newsletters14/The_Price_We_Will_Pay_for_Cheap_Oil.php#ixzz3GmHkhW4n

The world price of oil – Brent Crude – fell below $84 per barrel on October 15. This was 26% less than the $115 it had reached in June, just four months before. The rise during the spring had many explanations: global tensions in Ukraine, the South China Sea and especially the Middle East with the emergence of the Islamic State, plus a capital crunch challenging the health of the U.S. shale fracking boom. Then suddenly in June, prices started dropping, reaching levels unseen since 2010 (though still high by historical standards – twice that of 10 years ago).

What is going on? Why does the price of oil matter to financial advisors? What might these fluctuations mean to the price and supply of oil for the rest of the decade? Isn’t oil just another commodity?

A primer on oil prices

Oil is unique. There is a tight relationship between energy supplies, especially affordable quantities of oil, and the level of overall economic activity. Simply put, economies stop growing when their use of energy stops growing. The world moves with oil, and petroleum lubricates the global economy. It is not simply a natural resource, but the substance that allows all other systems – from food to cities to (unfortunately) war – to exist at the massive scales of today.

For most of the 20th Century, the world’s supply of oil grew steadily, while the price generally declined and remained low1. This enabled the world’s GDP to expand by a factor of 15, a rate vastly greater than at any time in human history. The opening years of the 21st century have broken with these trends. The price of oil is higher (even adjusted for inflation) than it has been since the opening days of the oil age (except for a few brief periods), but global supplies of oil are growing very slowly, if at all, and economic growth is stalling all over the world.

The booming story of American shale oil development and the prospect of “energy independence” had been a defining narrative driving optimism about our economy since 2009. Many advisors have bought into this story, which depended on enjoying both our new oil and high world energy prices. The current price collapse could be a threat to that part of our prosperity.

Read more: http://www.advisorperspectives.com/newsletters14/The_Price_We_Will_Pay_for_Cheap_Oil.php#ixzz3GmHkhW4n

xchrom

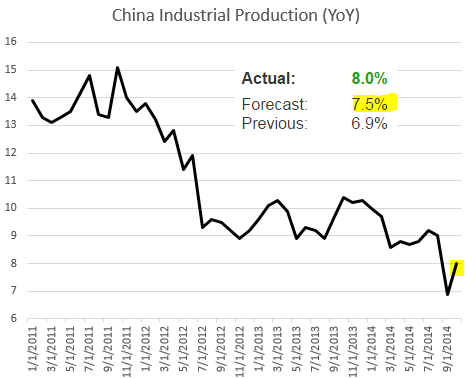

(108,903 posts)5. The State Of China In 4 Downward-Sloping Charts

http://www.businessinsider.com/china-in-4-downward-sloping-charts-2014-10

China's GDP growth is gradually slowing as expected - at least according to the official reports.

Growth is now at the lowest level since 2009, but so far the Bloomberg China GDP Tracker forecast of a sharp correction this quarter has not materialized.

In fact, the nation's industrial production growth, which continues to decline, came in better than expected.

Fixed asset investment growth shows a similar slowing pattern - now growing at 16% per year.

China's GDP growth is gradually slowing as expected - at least according to the official reports.

Growth is now at the lowest level since 2009, but so far the Bloomberg China GDP Tracker forecast of a sharp correction this quarter has not materialized.

In fact, the nation's industrial production growth, which continues to decline, came in better than expected.

Fixed asset investment growth shows a similar slowing pattern - now growing at 16% per year.

xchrom

(108,903 posts)6. Japan Prime Minister Abe's Woes Are Just Beginning

http://www.businessinsider.com/r-japan-pms-woes-may-not-end-despite-resignations-of-two-ministers-2014-10

Japanese Prime Minister Shinzo Abe is facing increased pressure from a newly energized opposition over potential scandals within his cabinet even though he swiftly jettisoned two ministers this week in a bid to calm the storm.

Three other cabinet members - Defense Minister Akinori Eto, Agriculture Minister Koya Nishikawa and Health Minister Yasuhisa Shiozaki - have already publicly faced questions over alleged influence peddling, improper donations or problems in reporting on political funds. All three have denied wrongdoing.

But the opposition, routed by Abe's Liberal Democratic Party (LDP) in the last national elections, is scenting blood.

"They see this as an opportunity to turn things around," said a former opposition Democratic Party lawmaker who did not want to be identified.

Read more: http://www.businessinsider.com/r-japan-pms-woes-may-not-end-despite-resignations-of-two-ministers-2014-10#ixzz3GmKGQHgE

Japanese Prime Minister Shinzo Abe is facing increased pressure from a newly energized opposition over potential scandals within his cabinet even though he swiftly jettisoned two ministers this week in a bid to calm the storm.

Three other cabinet members - Defense Minister Akinori Eto, Agriculture Minister Koya Nishikawa and Health Minister Yasuhisa Shiozaki - have already publicly faced questions over alleged influence peddling, improper donations or problems in reporting on political funds. All three have denied wrongdoing.

But the opposition, routed by Abe's Liberal Democratic Party (LDP) in the last national elections, is scenting blood.

"They see this as an opportunity to turn things around," said a former opposition Democratic Party lawmaker who did not want to be identified.

Read more: http://www.businessinsider.com/r-japan-pms-woes-may-not-end-despite-resignations-of-two-ministers-2014-10#ixzz3GmKGQHgE

xchrom

(108,903 posts)7. European Markets Are Surging

http://www.businessinsider.com/markets-are-climbing-2014-10

Here's the scorecard, so far:

France's CAC 40 is up 1.91%

Spain's IBEX is down 1.95%

Italy's FTSE MIB is up 2.45%

Britain's FTSE 100 is up 0.86%

Germany's DAX is up 1.47%

The Nikkei ended down 2.03%, with no repeat of Monday's impressive climb. Hong Kong’s Hang Seng index is currently down 0.30%

US stock futures have taken a hit: Both Dow and S&P futures are down 0.43%.

UK public borrowing figures will be released at 4:30 a.m. ET, with analysts expecting a deficit of £9.2 billion ($14.9 billion). The figures are increasingly important as Britain heads toward its 2015 general election, with public spending a major issue.

Read more: http://www.businessinsider.com/markets-are-climbing-2014-10#ixzz3GmKdc18l

Here's the scorecard, so far:

France's CAC 40 is up 1.91%

Spain's IBEX is down 1.95%

Italy's FTSE MIB is up 2.45%

Britain's FTSE 100 is up 0.86%

Germany's DAX is up 1.47%

The Nikkei ended down 2.03%, with no repeat of Monday's impressive climb. Hong Kong’s Hang Seng index is currently down 0.30%

US stock futures have taken a hit: Both Dow and S&P futures are down 0.43%.

UK public borrowing figures will be released at 4:30 a.m. ET, with analysts expecting a deficit of £9.2 billion ($14.9 billion). The figures are increasingly important as Britain heads toward its 2015 general election, with public spending a major issue.

Read more: http://www.businessinsider.com/markets-are-climbing-2014-10#ixzz3GmKdc18l

xchrom

(108,903 posts)8. The ECB Is Thinking About Buying Corporate Bonds, Sources Say

http://www.businessinsider.com/r-exclusive-ecb-looking-at-corporate-bond-buys-could-move-as-soon-as-december---sources-2014-10

FRANKFURT (Reuters) - The European Central Bank is considering buying corporate bonds on the secondary market and may decide on the matter as soon as December with a view to begin buying early next year, several sources familiar with the situation told Reuters.

The ECB has already carried out work on such purchases, which would widen out the private-sector asset-buying program it began on Monday - stimulus it is deploying to try to foster lending to businesses and thereby support the euro zone economy.

"The pressure in this direction is high," said one person familiar with the work inside the ECB, speaking on condition of anonymity.

Asked about the possibility of making such purchases, an ECB spokesman said: "The Governing Council has taken no such decision."

Read more: http://www.businessinsider.com/r-exclusive-ecb-looking-at-corporate-bond-buys-could-move-as-soon-as-december---sources-2014-10#ixzz3GmL9pv8z

FRANKFURT (Reuters) - The European Central Bank is considering buying corporate bonds on the secondary market and may decide on the matter as soon as December with a view to begin buying early next year, several sources familiar with the situation told Reuters.

The ECB has already carried out work on such purchases, which would widen out the private-sector asset-buying program it began on Monday - stimulus it is deploying to try to foster lending to businesses and thereby support the euro zone economy.

"The pressure in this direction is high," said one person familiar with the work inside the ECB, speaking on condition of anonymity.

Asked about the possibility of making such purchases, an ECB spokesman said: "The Governing Council has taken no such decision."

Read more: http://www.businessinsider.com/r-exclusive-ecb-looking-at-corporate-bond-buys-could-move-as-soon-as-december---sources-2014-10#ixzz3GmL9pv8z

xchrom

(108,903 posts)9. World Bank Chief: China Must Deliver On Its Reform Promises Or Face A Growth Crunch

http://www.businessinsider.com/r-china-must-accelerate-reforms-not-rely-on-fiscal-and-monetary-policy-to-drive-growth-world-bank-chief-2014-10

BEIJING (Reuters) - China needs to accelerate reforms and not rely solely on its central bank or government spending to drive growth, the head of the World Bank said Tuesday.

"I would recommend not really relying more on their macro policy, specifically on the monetary and fiscal side, because it's been done before, especially post the global financial crisis," Managing Director Sri Mulyani Indrawati told Reuters in an interview in Beijing.

"It is now time for really deepening and doing the reforms in a much faster way."

Indrawati made the comments in the run-up to the Asia-Pacific Economic Cooperation (APAC) conference of finance ministers held in Beijing on Tuesday and Wednesday.

Read more: http://www.businessinsider.com/r-china-must-accelerate-reforms-not-rely-on-fiscal-and-monetary-policy-to-drive-growth-world-bank-chief-2014-10#ixzz3GmPDBUiC

BEIJING (Reuters) - China needs to accelerate reforms and not rely solely on its central bank or government spending to drive growth, the head of the World Bank said Tuesday.

"I would recommend not really relying more on their macro policy, specifically on the monetary and fiscal side, because it's been done before, especially post the global financial crisis," Managing Director Sri Mulyani Indrawati told Reuters in an interview in Beijing.

"It is now time for really deepening and doing the reforms in a much faster way."

Indrawati made the comments in the run-up to the Asia-Pacific Economic Cooperation (APAC) conference of finance ministers held in Beijing on Tuesday and Wednesday.

Read more: http://www.businessinsider.com/r-china-must-accelerate-reforms-not-rely-on-fiscal-and-monetary-policy-to-drive-growth-world-bank-chief-2014-10#ixzz3GmPDBUiC

xchrom

(108,903 posts)10. CHINA RELIEF HELPS SHORE UP MARKET

http://hosted.ap.org/dynamic/stories/F/FINANCIAL_MARKETS?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT&CTIME=2014-10-21-07-55-47

KEEPING SCORE: European stock markets largely recouped the previous day's losses. The FTSE 100 index of leading British shares up 0.9 percent at 6,323 while Germany's DAX rose 1.4 percent to 8,843 and the CAC-40 in France spiked 1.7 percent to 4,058. Futures pointed to gains on Wall Street, with the Dow Jones industrial average and the S&P 500 index expected to rise 0.6 percent at the open.

CHINA RELIEF: The world's second biggest economy was the main focus of attention in financial markets as traders assess whether the recent weakness in stock markets would represent a more substantial correction. Chinese growth fears have been one of the reasons why markets have been volatile. In the event, the news that China's economy expanded by 7.3 percent in the third quarter from a year earlier, helped ease concerns. Though down from the previous quarter's 7.5 percent tick, some analysts had expected a more marked slowdown to 6.9 percent. However, the modest deceleration is unlikely to convince China's leaders to embark on another stimulus.

THE QUOTE: "After last week's volatility in the financial markets, the last thing investors needed was bad news out of China," said Neil MacKinnon, global macro strategist at VTB Capital. "In the event, the latest GDP data just published for China did not provide any upsets."

FOCUS ON US HOUSING: The U.S. has also been in focus over the past couple of weeks and traders will be monitoring existing home sales data for September soon after the markets open. Most economists expect a snapback following last month's surprise 1.8 percent decline.

EURO FALL RESUMES: Speculation that the European Central Bank will embark on a new ambitious stimulus program involving the purchase of corporate bonds weighed on the euro. Europe's single currency was down 0.3 percent at $1.2753, prompting talk that the currency would resume its drift lower. The euro has been in retreat for much of this year as the ECB has cut interest rates and backed further stimulus to help shore up the eurozone economy and to prevent prices from falling.

KEEPING SCORE: European stock markets largely recouped the previous day's losses. The FTSE 100 index of leading British shares up 0.9 percent at 6,323 while Germany's DAX rose 1.4 percent to 8,843 and the CAC-40 in France spiked 1.7 percent to 4,058. Futures pointed to gains on Wall Street, with the Dow Jones industrial average and the S&P 500 index expected to rise 0.6 percent at the open.

CHINA RELIEF: The world's second biggest economy was the main focus of attention in financial markets as traders assess whether the recent weakness in stock markets would represent a more substantial correction. Chinese growth fears have been one of the reasons why markets have been volatile. In the event, the news that China's economy expanded by 7.3 percent in the third quarter from a year earlier, helped ease concerns. Though down from the previous quarter's 7.5 percent tick, some analysts had expected a more marked slowdown to 6.9 percent. However, the modest deceleration is unlikely to convince China's leaders to embark on another stimulus.

THE QUOTE: "After last week's volatility in the financial markets, the last thing investors needed was bad news out of China," said Neil MacKinnon, global macro strategist at VTB Capital. "In the event, the latest GDP data just published for China did not provide any upsets."

FOCUS ON US HOUSING: The U.S. has also been in focus over the past couple of weeks and traders will be monitoring existing home sales data for September soon after the markets open. Most economists expect a snapback following last month's surprise 1.8 percent decline.

EURO FALL RESUMES: Speculation that the European Central Bank will embark on a new ambitious stimulus program involving the purchase of corporate bonds weighed on the euro. Europe's single currency was down 0.3 percent at $1.2753, prompting talk that the currency would resume its drift lower. The euro has been in retreat for much of this year as the ECB has cut interest rates and backed further stimulus to help shore up the eurozone economy and to prevent prices from falling.

xchrom

(108,903 posts)11. CHINA ECONOMY GROWS AT SLOWEST PACE IN 5 YEARS

http://hosted.ap.org/dynamic/stories/A/AS_CHINA_ECONOMY?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT&CTIME=2014-10-21-05-49-59

BEIJING (AP) -- China's economic growth waned to a five-year low of 7.3 percent last quarter, raising concerns of a spillover effect on the global economy but falling roughly in line with Chinese leaders' plans for a controlled slowdown.

The third quarter figures, released Tuesday, put China on course for annual growth somewhat lower than the 7.5 percent targeted by leaders, though they have indicated there is wiggle-room in their plan. The world's No. 2 economy grew 7.5 percent from a year earlier in the previous quarter and 7.4 percent in the first quarter.

Communist leaders are trying to steer China toward growth based on domestic consumption instead of over-reliance on trade and investment. But the slowdown comes with the risk of politically dangerous job losses and policymakers bolstered growth in the second quarter with mini-stimulus measures.

Employment, however, remained strong through the third quarter and the service industries such as retailing that leaders want to promote have done well this year despite the downturn, which has been focused largely in the property market, said economist Julian Evans-Pritchard of Capital Economics.

BEIJING (AP) -- China's economic growth waned to a five-year low of 7.3 percent last quarter, raising concerns of a spillover effect on the global economy but falling roughly in line with Chinese leaders' plans for a controlled slowdown.

The third quarter figures, released Tuesday, put China on course for annual growth somewhat lower than the 7.5 percent targeted by leaders, though they have indicated there is wiggle-room in their plan. The world's No. 2 economy grew 7.5 percent from a year earlier in the previous quarter and 7.4 percent in the first quarter.

Communist leaders are trying to steer China toward growth based on domestic consumption instead of over-reliance on trade and investment. But the slowdown comes with the risk of politically dangerous job losses and policymakers bolstered growth in the second quarter with mini-stimulus measures.

Employment, however, remained strong through the third quarter and the service industries such as retailing that leaders want to promote have done well this year despite the downturn, which has been focused largely in the property market, said economist Julian Evans-Pritchard of Capital Economics.

Crewleader

(17,005 posts)12. Today's cartoon