Economy

Related: About this forumWeekend Economists' Demeter Film Award Reveal January 23-25, 2015

Last edited Sat Jan 24, 2015, 12:48 PM - Edit history (1)

The Envelope please....

TCM’s Rob Nixon on the film:

Jewison recounts the eventful preview screening for a Russian audience in This Terrible Business Has Been Good to Me: An Autobiography:

As the film ran, a Russian interpreter gave a simultaneous translation over the sound system. I had been told that if a Russian audience didn’t like something, they would make a “chuh-chuh-chuh” sound, so throughout the screening, I prayed I wouldn’t hear it. They laughed at the jokes in Russian that the Americans didn’t get, and everything was fine until Theo Bikel, the Russian sub captain, threatens to blow up the town. You could feel the tension in the theater, then the “chuh-chuhing” began. I thought, “Oh God, they think they’re going to be made to look like the villains again.” But when the stand-off is broken by the little boy falling from the church belfry and the Russians help save him, the audience began a rhythmic clapping and many burst into tears. Directors Sergei Bondarchuk and Grigory Chukhrai were on their feet clapping and crying.

I was sitting next to Vladimir Posner, the Brooklyn-born editor of Soviet Life. “Why are they crying?” I asked.

“Because they didn’t make it first,” he replied.

I realized then that the film, although made primarily for an American audience, expressed the hopes and fears felt by people in both countries at that period in the Cold War. What the Russians of course couldn’t believe, and were blown away by, was the fact that I had been allowed to make the film at all.

http://altscreen.com/05/25/2011/thursday-editors-pick-the-russians-are-coming-the-russians-are-coming-1966/

Tony Shaw for the journal Film History:

Alan Arkin recalls his work on the film:

Robert Alden was enraptured upon the film’s initial release, as he wrote in The New York Times:

The Russians Are Coming the Russians Are Coming is a credit to those who made it. By personalizing a dangerous confrontation between Russians and Americans, it reveals, through broad farce, the good and bad in both, the strengths and weaknesses of people under stress and the fundamental fact that, after all, Russians and Americans are basically human beings and, therefore, share basic human qualities. And not one whit of this lesson is accomplished by preaching, but rather by a hilarious troupe of actors telling a hilarious tale in a hilarious way.

…Everyone will find favorite comic bits: Mr. Reiner’s efforts to prove to his son that he is not a Benedict Arnold; Mr. Arkin, barely able to speak English himself, teaching English to his crew of invaders; Mr. Reiner’s and the amply proportioned Tessie O’Shea’s attempts to free themselves after the Russians have bound them together, and Brian Keith, the police chief, meeting a wildly improbable situation with the only practical solution that would occur to a police chief: he takes out his book and proceeds to write a ticket for the offending Russian submarine. After all, it is illegally parked in United States territory.

There is also great satirical fun in Johnny Mandel’s musical score.

The wild comedy turns grim at the end, grim and suspenseful, and is only saved by a deus ex machina. But forget that. Go to the theater to enjoy this farce. The cold war has owed us all a good laugh for a long, long time.

Demeter

(85,373 posts)xchrom

(108,903 posts)WASHINGTON (AP) -- Regulators have closed a small lender in Chicago, making it the second U.S. bank failure of 2015 following 18 closures last year.

The Federal Deposit Insurance Corp. said Friday that it has taken over Highland Community Bank, which operated two branches.

The bank had $54.7 million in assets and $53.5 million in deposits as of Dec. 31.

United Fidelity Bank, based in Evansville, Indiana, agreed to assume all of Highland Community Bank's deposits and to buy essentially of the failed bank's assets.

The failure of Highland Community Bank is expected to cost the federal deposit insurance fund $5.8 million.

U.S. bank failures have been declining since peaking at 157 in 2010 following the financial crisis and the Great Recession.

Demeter

(85,373 posts)Instead of the common practice of making the entire picture revolve around one starring actor, Jewison let each and every actor shine. Every person is there for a reason--there are no faceless crowds that could be computer synthesized.

The second striking fact is that it is authentic Americana.

The Russian Lieutenant Yuri Rozanov (Alan Arkin) ties up the NYC playwright Walt Whittaker (Carl Reiner, who serves as narrator/observer/witness) and the authentic New England Northern Belle who operates the antiquated party-line phone system (I had a neighbor that could have done the same role, when I lived in the hinterlands of Massachusetts, a dear lady who spoke exactly as Tessie O'Shea does)

The VFW-obsessed ex-military blowhard, a forerunner for the Tea Party Fendall Hawkins (Paul Ford)

the hunky sailor Alexei Kolchin (John Phillip Law), who looks more Dutch than anything, but is a basso to die for....and his sweet-young-thing American love interest Alison Palmer (Andrea Dromm), with whom he wants a "peaceful coexistence"...

And of course, there's Jonathon Winters, an original who never fit into any category...

and we haven't even scratched the surface!

MattSh

(3,714 posts)Though I try not to overdo it, I do try on occasions to correct some of the more glaring "misconceptions" about this part of the world here on DU. And Thursday I was thinking I needed something more humorous to counter some of the deliberate paranoia here. Then I thought of this film. Then I saw your post.

Some of the "misconceptions" I took on this week...

http://www.democraticunderground.com/1014995508

http://www.democraticunderground.com/10026105748

http://www.democraticunderground.com/1017238943

Then the thought occurred to me that Yatsenyuk and Col. Klink have a few similarities too. What do you think? I do have some photoshop skills; maybe I can do a mashup of the two. Although that monocle will be a bit of a headache to work with. And there's not that may photos of Colonel Klink of a suitable image size to work with.

Demeter

(85,373 posts)I guess great minds think alike! I had similar responses to the rumblings on DU.

I'd rather that you refer to it as keeping one's sanity.

![]()

![]()

![]()

![]() Whoops, I just lost it there for a moment. Now it's back.

Whoops, I just lost it there for a moment. Now it's back. ![]()

That's quite important when everybody else is losing theirs.

Demeter

(85,373 posts)It is based on the Nathaniel Benchley novel The Off-Islanders, and was adapted for the screen by William Rose.

Plot

The Soviet submarine Спрут (pronounced "sproot" and meaning "octopus"![]() draws too close to the New England coast one morning when its captain (Theodore Bikel) wants to take a good look at America and runs aground on a sandbar near an island off Cape Ann, Gloucester. Rather than radio for help and risk an embarrassing international incident, the captain sends a nine-man landing party, headed by his zampolit (Political Officer) Lieutenant Yuri Rozanov (Alan Arkin), to find a motor launch to help free the submarine from the bar. The men arrive at the house of Walt Whittaker (Carl Reiner), a vacationing playwright from New York City. Whittaker is eager to get his wife Elspeth (Eva Marie Saint) and two children, obnoxious nine and half-year-old Pete (Sheldon Collins) and three-year-old Annie (Cindy Putnam), off the island now that summer is over.

draws too close to the New England coast one morning when its captain (Theodore Bikel) wants to take a good look at America and runs aground on a sandbar near an island off Cape Ann, Gloucester. Rather than radio for help and risk an embarrassing international incident, the captain sends a nine-man landing party, headed by his zampolit (Political Officer) Lieutenant Yuri Rozanov (Alan Arkin), to find a motor launch to help free the submarine from the bar. The men arrive at the house of Walt Whittaker (Carl Reiner), a vacationing playwright from New York City. Whittaker is eager to get his wife Elspeth (Eva Marie Saint) and two children, obnoxious nine and half-year-old Pete (Sheldon Collins) and three-year-old Annie (Cindy Putnam), off the island now that summer is over.

Pete tells his dad that "Russians with machine guns" dressed in black uniforms are near the house, but Walt is met by the men who identify themselves as Norwegian fisherman. Walt buys this, and to teach Pete a lesson about judging others, asks if they are "Russians with machine guns", which startles Rozanov into admitting that they are Russians and pulling a gun on Walt.

Rozanov promises no harm to the Whittakers if they hand over their station wagon and provide information on the military and police forces of their island. Although Walt and Elspeth provides the keys, the sailors are perplexed as to why there are no military personnel on the island, and only a small police force. Before the Russians depart, Rozanov orders one of the sailors, Alexei Kolchin (John Phillip Law), to prevent the Whittakers from fleeing. An attractive 18-year-old neighbor, Alison Palmer (Andrea Dromm), who works as a babysitter for Annie, expected to work that day and finds herself captive as well.

The Whittakers' station wagon quickly runs out of gasoline, forcing the Russians to walk. They steal an old sedan from Muriel Everett (Doro Merande), the postmistress; she calls Alice Foss (Tessie O'Shea), the gossipy telephone switchboard operator, and before long, wild rumors throw the entire island into confusion.

As level-headed Police Chief Link Mattocks (Brian Keith) and his bumbling assistant Norman Jonas (Jonathan Winters) try to squelch an inept citizens' militia led by blustering Fendall Hawkins (Paul Ford), Walt, accompanied by Elspeth, manages to overpower Kolchin, because the Russian is reluctant to hurt anyone.

During the commotion Kolchin flees, but when Walt and Elspeth leave to find help, he reappears, saying that although he does not want any fighting, he must obey his superiors in guarding the residence. Alexei promises he will not harm anyone and offers to surrender his submachine gun as proof. Alison tells Kolchin that she trusts him and does not need to hand over his firearm, and Alexei chooses to walk along the beach with Alison and Annie to build rapport. Kolchin becomes fond of Annie, giving her Russian translations of various words, as well as Alison, with whom he finds commonality with despite their different cultures and backgrounds.

Trying to find the Russians on his own, Walt is re-captured by them in the telephone central office. After subduing Mrs. Foss and disabling the island's telephone switchboard, seven of the Russians appropriate civilian clothes from the dry cleaners, manage to steal a cabin cruiser belonging to a U.S. Senator, and head to the Octopus, still aground on the sandbar.

Back at the Whittaker house, Kolchin is by now falling in love with Alison. At the phone exchange, Walt manages to free himself. He and Elspeth return to the house and almost shoot Rozanov, who arrives there just before they do. With the misunderstandings cleared up, the Whittakers, Rozanov and Kolchin decide to head into town together to explain to everyone just what is going on.

As the tide rises, the Octopus floats off and proceeds on the surface to the island's main harbor. Chief Mattocks arrives with the rest of the villagers and the militia force, the men armed with everything from a harpoon and a bow and arrows to .22s, Winchester lever actions, 12 gauge shotguns, and military surplus rifles.

With Political Officer Rozanov acting as translator, the Russian captain threatens to open fire on the town with his deck gun and machine guns unless the seven missing sailors are returned to him, his crew facing upwards of a hundred armed, apprehensive, but determined townspeople.

Chief Mattocks warns the Soviet officer, "You come in here, scaring people half to death, you steal cars and motorboats, and you cause damage to private property and you threaten the whole community with grievous bodily harm and maybe murder. Now, we ain't going to take any more of that, see? We may be scared, but maybe we ain't so scared as you think we are, see? Now you say you're going to blow up the town, huh? Well, I say, all right! You start shooting, and see what happens!"

As the Captain and Chief Mattocks glare at each other, two small boys go up in the church steeple to see better. With tension approaching the breaking point, one of the boys (Johnny Whitaker) slips and falls from the steeple, but his belt catches on a gutter, leaving him precariously hanging forty feet in the air. Immediately uniting to save the child, the American islanders and the Russian submariners form a human pyramid and Kolchin rescues him.

Peace and harmony is established between the two parties, but unfortunately the over-eager Hawkins has contacted the Air Force by radio. In a joint decision, the submarine heads out of the harbor with a convoy of villagers in small boats protecting it.

Kolchin says goodbye to Alison, the stolen boat with the missing Russian sailors aboard intercepts the group shortly thereafter, and the seven board the submarine, just before two Air Force F-101B Voodoo jets arrive. They break off after seeing the escorting flotilla of small craft, and the submarine is free to proceed to deep water and safety.

Demeter

(85,373 posts)Although set on the fictional "Gloucester Island" off the coast of Massachusetts, the movie was filmed on the coast of Northern California, mainly in Mendocino. The harbor scenes were filmed in Noyo Harbor, a small town south of Fort Bragg, California. Because of the filming location on the West Coast, the dawn scene at the beginning of the film was actually filmed at dusk through a pink filter.

The submarine used was a fabrication. The United States Navy refused to loan one for the production and barred the studio from bringing a real Russian submarine, forcing the studio to create their own. It was segmented into four parts, each having its own motor to power it.

The planes used were actual F-101 Voodoo jets from the 84th Fighter-Interceptor Squadron, located at the nearby Hamilton Air Force Base. They were the only Air Force planes that were based near the location of the supposed island.

The title alludes to Paul Revere's Ride, as does the subplot in which the town drunk (Ben Blue) rides his horse to warn people of the "invasion".

According to Norman Jewison, the film — released at the height of the Cold War — had considerable impact in both Washington and Moscow. It was one of the few films of the time to portray the Russians in a positive light. Senator Ernest Gruening mentioned the film in a speech in Congress, and a copy of it was screened in the Kremlin. According to Jewison, when screened at the Soviet film writers' union, Sergei Bondarchuk was moved to tears.

Pablo Ferro created the main title sequence, using the American flag's red, white and blue colors and the Soviet hammer and sickle as transitional elements, zooming into each to create a montage, which ultimately worked to establish the tone of the film. The music in the sequence alternates between the American "Yankee Doodle" march and a Russian marching song called "Polyushko Pole" (Полюшко Поле, usually "Meadowlands" in English).

Much of the dialog was spoken by the Russian characters, and few American actors of the era were proficient in a Russian accent. Musician and character actor Leon Belasco, who was born in Russia, spoke fluent Russian and specialized in foreign accents during his 60-year career, was the dialog director.

John Phillip Law's consistently, magnificently incorrect pronunciation of difficult English phonemes, most notably in his slow, careful, hopeless struggle to master Alison Palmer's name (ah-LYEE-sown PAHL-myerr), was remarkably authentic by the standards of the day. Arkin, a Russian speaker, did so well as Rozanov that he would be sought for both American characters and a few ethnic ones.

Another star of the film, Theodore Bikel, was able to pronounce Russian so well, despite not actually being able to speak it, that he won the role of the submarine captain.

Demeter

(85,373 posts)calikid

(583 posts)not a city south of Fort Bragg.

Hugin

(33,039 posts)Thanks for the trip down memory road. ![]()

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Forrestal allegedly uttered those words while suffering from mental illness, not long before purportedly committing suicide. The allegation originated with Forrestal's bitter political enemy, columnist Drew Pearson, and has been verified by no other person. This is what Townsend Hoopes and Douglas Brinkley have to say about the episode in their 1992 book, Driven Patriot, the Life and Times of James Forrestal:

– pp. 455–456.

James Vincent Forrestal (February 15, 1892 – May 22, 1949) was the last Cabinet-level United States Secretary of the Navy and the first United States Secretary of Defense.

His death by falling was ruled a suicide, and was controversial.

Demeter

(85,373 posts)MattSh

(3,714 posts)Demeter

(85,373 posts)but that was nicely done!

Demeter

(85,373 posts)and the assassination of MLK, Jr. in 1968 finished the brief hope that shone on the world: Vietnam became more of a quagmire, inflation soared, and so many unlikely things transpired.

but this goal of "peaceful coexistence" has not left our hearts, dreams, mythology.

Demeter

(85,373 posts)A lawyer’s error -- not caught by bankers or more senior attorneys at two firms -- could result in a huge loss for JPMorgan Chase Bank NA.

A federal appeals court in Manhattan on Wednesday ruled that creditors of the predecessor to General Motors Co. (GM) may be entitled to $1.5 billion stemming from a mistake in the recording of security interests in JPMorgan’s financing.

An associate at Mayer Brown LLP, using information from a paralegal, made the initial error, but it went undiscovered by senior lawyers at the firm as well as attorneys at Simpson Thacher & Bartlett LLP, which represented JPMorgan, according to the appeals court. Employees at the bank also didn’t find the error.

While the blunder isn’t surprising, the potential size of the fallout is startling. It’s not the first time a seemingly simple error by a big-firm lawyer could prove costly for a client. ...

MORE EXAMPLES AT LINK

JPMORGAN CAN'T CATCH A BREAK, CAN THEY?

Demeter

(85,373 posts)Russia may have to spend more than $40 billion this year to avert a banking crisis, as the growing likelihood of a sharp recession threatens to pile extra costs on a sector suffering from Western sanctions over Ukraine and a plunge in the rouble. Russian banks are seeing a deterioration in their loan quality, a rise in their risk management costs and increase in their cost of funding, and banking executives and analysts predict things are going to get worse. This represents a major challenge to President Vladimir Putin, who took power 15 years ago in the ashes of a crisis that wiped out the financial system, and whose popularity partly rests on his reputation for restoring stability.

"We expect a contraction in the number of small, medium and large banks this year," Mikhail Zadornov, head of VTB 24, the retail arm of No. 2 bank VTB, said on Thursday. "It will be hard for all banks. The weakest will leave the market," he said.

Russia's central bank has already relaxed regulation of banks, and the government has pledged support of more than 1.2 trillion roubles ($19 billion) this year after spending more than 350 billion roubles in 2014. But analysts say this is a fraction of what is needed. The anti-crisis measures will significantly add to pressures on Russia's international reserves and the budget, which is already forecast to run a deficit of up to 3 percent of gross domestic product this year, hurt most by a collapse in oil prices which is withering the country's export revenues.

"To preserve the status quo, banks may need far more capital than 1 trillion roubles," said Yaroslav Sovgyra, associate managing director for Moody's ratings agency in Russia.

MattSh

(3,714 posts)Capital outflow crisis does not exist. Companies are solvent and in the process of repaying debt. Contrary to doom-mongering from outside the country, in Russia there is perfect calm

Following the prophecies of doom that were going the rounds in December the rouble appears to have stabilised, the Central Bank's reserves are intact and the government looks calm and in control.

This appearance of calm appears to have annoyed some of the government's Western critics.

The economist Anders Aslund sees it as evidence that "Putin is in denial".

Most remarkably, the Economist sees the government's "Zen-like calm" as "proof" "the economic crisis has officially arrived".

This rather begs the question of what the Economist would make of signs of panic. Would that be proof the crisis is officially over?

Nobody denies Russia faces a difficult year. The sanctions are obliging Russian companies to pay off their foreign debts at the same time as the dollar price of oil - Russia's main export commodity - has halved, making repayment more difficult.

The rouble as a result has come under serious pressure and has halved in value. Investment and spending as a result are being cut back.

The rouble's fall is causing inflation this year to be significantly higher than it has been over the last few years or that the authorities had planned for. This in turn will cause real incomes to drop.

Complete story at - http://www.sott.net/article/291629-Despite-western-propaganda-Russia-is-not-in-economic-crisis

Demeter

(85,373 posts)and then a little child calls out: "But the Emperor has no clothes on!"

And the name of that child? Edward Snowden.

MattSh

(3,714 posts)Last edited Sat Jan 24, 2015, 09:29 AM - Edit history (1)

Russia's overall foreign debt fell by nearly $130 billion in 2014, Central Bank data showed on Tuesday, with total debt standing at $599.5 billion on Jan. 1, 2015.

Foreign debt has been falling rapidly in recent months as companies pay off foreign loans. Western sanctions imposed over the Ukraine conflict are making it harder for them to borrow abroad and refinance their debt.

However, much of the decline was a nominal effect. The ruble's devaluation has reduced the dollar value of foreign debts denominated in rubles.

Foreign exchange reserves have also been falling rapidly, declining last year to $385.5 billion from $509.6 billion.

The Central Bank said external debt of companies and banks at the start of 2015 stood at $547.6 billion, down from $651.2 billion a year earlier and from $659.4 billion on July 1.

Complete story at - http://russia-insider.com/en/2015/01/21/2581

Demeter

(85,373 posts)au·tar·ky

ˈôˌtärkē/

noun

noun: autarky; noun: autarchy

economic independence or self-sufficiency.

a country, state, or society that is economically independent.

plural noun: autarkies; plural noun: autarchies

Origin

early 17th century: from Greek autarkeia, from autarkēs ‘self-sufficiency,’ from autos ‘self’ + arkein ‘suffice.’

It's a word that came into use just before WWII.

Autarky is the quality of being self-sufficient. Usually the term is applied to political states or their economic systems. Autarky exists whenever an entity can survive or continue its activities without external assistance or international trade. If a self-sufficient economy also refuses all trade with the outside world then it is called a closed economy.

Autarky is not necessarily an economic phenomenon; for example, a military autarky would be a state that could defend itself without help from another country, or could manufacture all of its weapons without any imports from the outside world.

Autarky can be said to be the policy of a state or other entity when it seeks to be self-sufficient as a whole, but also can be limited to a narrow field such as possession of a key raw material. For example, many countries have a policy of autarky with respect to foodstuffs and water for national security reasons.

Modern examples

Mercantilism was a policy followed by empires, especially in the 17th and 18th centuries, forbidding or limiting trade outside the empire. In the 1930s, autarky as a policy goal was sought by Nazi Germany, which maximized trade within its economic bloc and minimized external trade, particularly with the then world powers such as Great Britain, the Soviet Union, and France, with which it expected to go to war and consequently could not rely upon.

The economic bloc wherein trade was maximized comprised countries that were economically weak—namely, those in South America, the Balkans and eastern Europe (Yugoslavia, Romania and Hungary)—and had raw materials vital to Germany's growth. Trade with these countries, which was negotiated by then Minister of Economics Hjalmar Schacht, was based on the exchange of German manufactured produce directly for these materials rather than currency, allowing Schacht to barter without reliance on the strength of the Reichsmark. However, although food imports fell significantly between 1932 and 1937, Germany's rapid rearmament policy after 1935 proved contradictory to the Nazi Party autarkic ambitions and imports of raw materials rose by 10% over the same period.

Today, complete economic autarkies are rare.

A possible example of a current attempt at autarky is North Korea, based on the government ideology of Juche (self-sufficiency), which is concerned with maintaining its domestic localized economy in the face of its isolation. However, even North Korea has extensive trade with the Russian Federation, the People's Republic of China, Syria, Iran, Vietnam, and many countries in Europe and Africa. North Korea has also had to import food during the 1990s due to widespread famine.

Bhutan, seeking to preserve a manorialist economic and cultural system centered around the dzong, had until the 1960s maintained an effective economic embargo against the outside world, and has been described as an autarky. With the introduction of roads and electricity, however, the kingdom has entered trade relations as its citizens seek modern, manufactured goods.

Historical examples

- Afghanistan under the Taliban, from 1996 to 2001.

- Albania became a near-autarky in 1976, when Communist Party leader Enver Hoxha instituted a policy of what he termed "self-reliance". Outside trade increased after Hoxha's death in 1985, though it remained severely restricted until 1991.

- Burma followed a policy of autarky known as the Burmese Way to Socialism under dictator Ne Win, who ruled the country from 1962 to 1988.

- Cambodia under the Khmer Rouge, 1975–1979.

- Classical Greece idealized economic self-sufficiency at the level of oikos and city-state. This ideal broke down over time, and was redundant by the Hellenistic period.

- Nazi Germany under Adolf Hitler attempted to end international trade and considered economic self-sufficiency to be ideal. However, tasked with establishing full autarky in Germany as part of the Four Year Plan, (beginning in 1936) Hermann Göring failed to close the German economy.

- Guyana under Forbes Burnham's PNC dictatorship, from 1970 to 1985

- India had a policy of near-autarky that began after its establishment as an independent state, around 1950; it increased until 1980 and ended in 1991 due to imminent bankruptcy.

- Italy, Benito Mussolini claimed to be an autarky,[8] especially after the 1935 invasion of Abyssinia and subsequent trade embargoes. However, it still conducted trade with Germany and elsewhere.

- Japan was partially an autarky during the era known as the "Edo period", prior to its opening to the west in the 1850s, as part of its policy of sakoku. There was a moderate amount of trade with China and Korea; trade with all other countries was confined to a single port on the island of Dejima.

- North Korea's official state ideology, Juche, is somewhat based on autarky, though North Korea is not a genuine autarky as it conducts principles of trade with a few nations, as well as benefits on Chinese capital and trade.

- Romania in the 1980s. Nicolae Ceaușescu proposed such goals as paying the entire foreign debt and increasing the number of items produced in the country and their quality. The aim of these policies was to reduce dependency on foreign imports, as the relationship of Ceaușescu with both Western and Communist leaders was worsening.

- South Africa was a partial autarky during the later Apartheid era, when the country faced ever increasing economic sanctions from the international community, including an increasing oil embargo that motivated the state to embark on a successful coal-to-oil project and also establish its own military industries, including the creation of its own atomic bomb.

- Spain, under dictator Francisco Franco, was an autarky from 1939 until Franco allowed outside trade again in 1959, coinciding with the beginning of the Spanish miracle.

- The United States, while still emerging from the American Revolution and wary of the economic and military might of Great Britain, came close to complete autarky in 1808 when President Jefferson declared a self-imposed embargo on international shipping. The embargo lasted from December 1807 to March 1809.

- In the Dominican Republic, the rural peasants, escaped slaves, and freed slaves that lived in the sparsely populated woodland interior of the island nation between the 1600s and early 1900s. The weak Dominican government had no control on these autonomous subsistence agriculture based communities.

Demeter

(85,373 posts)Urban Homesteading and Integral Urban House

Mutualism (movement)

Commune

Kibbutz Movement

Utopian Socialism

Survivalism

National Autarky

Left-Wing proponents of Autarkic Principles:

Statist:

Syndicalism

Social corporatism and Neo-Corporatism

Anti-Statist:

Anarcho-syndicalism, De Leonism, Solidarity Unionism,

Anarchist Communism, Council Communism, Collectivist Anarchism

Solidarity Economy

Left-Wing opponents of Autarkic Principles:

Proletarian Internationalism,

World Communism,

Stateless Communism,

World Revolution,

Permanent Revolution

Trotskyism,

Fourth International

Right-Wing proponents of Autarkic Principles:

Fascism, State Capitalism

Business Nationalism

Producerism

Right-Wing opponents of Autarkic Principles:

Classical Liberalism, Neoliberalism

Neoconservatism

Libertarianism, Libertarian conservatism

Liberal Internationalism

Anarcho-capitalism

Autarkic principles without political affiliation:

Nationalism

Isolationism

Macroeconomic Theory of Autarky

Proponents or Partial-Proponents of Autarky:

Mercantilism, Alexander Hamilton

Protectionism, Friedrich List

Infant Industry Argument

Nationalization

Import Substitution Industrialization

Raúl Prebisch, Hans Singer, Celso Furtado

Structuralist economics

Anti-Globalization Movement

Core-Periphery Model

Singer-Prebisch thesis

Opponents of Autarky:

Economic liberalism

Neoclassical Economics

Austrian School of Economics

Privatization

Free Trade

Free trade agreement

Globalization

Milton Friedman

Relevant Microeconomic Theory Topics

Robinson Crusoe economy

Fundamental theorems of welfare economics

MattSh

(3,714 posts)Indeed, why should Russia continue to pretend that it is "business as usual," when the West tries to depose the Russian government and is making normal relations impossible? Why should Russia's obligations be kept as usual, when the West is making it clear that it is free to discard any rules and any of its own obligations?

Indeed, why should Russia pay debts which the West makes under sanctions much harder to pay back, in addition to freezing (and seizing) selected Russian assets? But with the one exception of agricultural products, Moscow tried to make virtue out of weakness (or incompetence? or impotence?) by "not responding," that is, by boasting of not taking any systemic defensive and much needed counter-measures, thus letting the West to play the game of progressive intimidation in which the West was promising possible future softening of actions that hurt Russia in exchange for real, major present concessions on the ground (principle already tried with Milosevic and Yanukovich: you retreat or disarm now and we will think about our reciprocity once the situation on the ground has radically changed as a result of you making the first step or "you shoot yourself first and we will then think whether we should do something similar as we make you believe that we have promised"

... removed one line here...

Jon Hellevig: "If this goes forward then hell is loose. Law initiative aims at terminating of payments of Russian debt to foreign countries that have imposed sanctions on Russia. This would be done by amending the civil law provision of force majeure by adding sanctions among such conditions. - The law initiative stems from a known radical lawmaker, so we cannot know if it will fly. But the respected paper Izvestia already wrote about it. Maybe testing the reactions?"

Complete story at - http://vladimirsuchan.blogspot.com/2015/01/russias-duma-mulls-bill-that-would-let.html

Demeter

(85,373 posts)But even though the US is drowning in its own greed at the moment and dissipating its might on countless fruitless imperial wars, I wouldn't want to chance it.

After all, we need a shining example of a nation for the rest of humanity to admire...

Demeter

(85,373 posts)http://www.buzzfeed.com/miriamelder/russian-elite-warns-of-war-with-the-us?utm_term=4ldqpia#.liX8rOVZdY

DAVOS, Switzerland — The head of a leading Kremlin-owned bank warned on Friday that further banking sanctions would lead Russia and the U.S. to the “brink of war.” Andrei Kostin, the head of VTB, reacted angrily when asked what the consequences would be if Russia were excluded from the Swift banking system, a secure means of moving money across borders. If it were to happen, Kostin told a session on the Russian economy at the World Economic Forum in Davos,

“ambassadors can leave capitals. It means Russia and America might have no relationship after that.”

“If there is no banking relationship, it means the countries are on the verge of war, or definitely in the cold war,” he said in English, growing increasingly red in the face. “It will be a very dangerous situation.”

He said that if Russia were excluded from the Swift system, it would make the U.S.–Russia relationship akin to the U.S.–Iran one. He made the comments after noting that Russia had recently created its own alternative to Swift. The U.S. and EU have imposed numerous sanctions on Russia, including against VTB. (Kostin is not on the sanctions list, and recently spoke to the Wall Street Journal about vacationing in Aspen, Colorado.) Igor Shuvalov, a deputy prime minister and the head of Russia’s delegation to Davos, issued a stern warning to those who would imagine Russia without President Vladimir Putin.

“I support my president 100%,” Shuvalov said. “When people ask that, they don’t understand the Russian character, they don’t know Russian history.”

“If we think someone from the outside wants to change our leader, to go against our will … we will be united like never before.”

He brushed off questions about Ukraine and warned the West that it must treat Russia like an equal partner rather than having the country “sit in the corner.” If it failed to treat Russia equally, Shuvalov warned, Ukraine “will be a huge wound for the next 10 years.”

Both Kostin and Shuvalov lamented the current economic situation, which has seen Russia burn through its reserves as the ruble plummets. The ruble has lost almost 50% of its value in the past few months and Russia is facing recession following years of oil-fueled growth.

“There is nothing good in the current situation,” Shuvalov said. “It’s very difficult. I think it will get worse.”

He said the key now was to “teach people — from state corporations to citizens — to live differently.”

SO, THE BANKERS ARE UNHAPPY...NEVER ANGER A BANKER, EVEN IF HE'S NOT IN YOUR COUNTRY!

MattSh

(3,714 posts).....

Russia's Alternative to SWIFT Would Cause Big Problems for the West - Russia Insider

The Inevitable Blowback of Russia’s New Interbank System

Iran isn’t in a position to challenge the United States. But when the U.S.’ most loyal ally in Europe, the United Kingdom, called for Russian banks to be ejected from SWIFT during the height of the Ukraine crisis, the two Anglo countries met their match.

A few weeks ago, Russia announced its intention to launch an alternative to SWIFT by May 2015. Russia’s new interbank system would dominate transactions in rubles, with conversion to and from U.S. dollars at either end.

For example, an Iranian government agency could use dollars to buy rubles, transmit them via the Russian system, and have them paid to a supplier in Europe who then converted them back to dollars.

Short of hacking into the Russian system, the U.S. would have no way of knowing who was paying what to whom or for what reason.

Opportunity or Curse?

It’s not hard to imagine the opportunities this could present — and I’m dead sure the IRS and other U.S. agencies are doing so right now. One relates to “terrorist” financing and sanctions-evasion. But there are others.

For example, “U.S. persons” could send funds to a FATCA-compliant bank overseas, withdraw them, convert into rubles, and have them sent across the Russian interbank system to a non-compliant bank. They would then be outside the international tax reporting system the U.S. is trying so desperately to construct.

Complete story at - http://russia-insider.com/en/2014/12/15/1890

This will also highly complicate the matter of the west imposing sanctions anytime somebody displeases them. This may be as big a challenge to US hegemony as dropping the petrodollar. This may be the proverbial 1-2 punch.

Demeter

(85,373 posts)How hysterically funny and delicious is that?!

MattSh

(3,714 posts)Anders Aslund proves me wrong, over and over again. Every time I think I’ve seen the stupidest, most pedantic, most off-the-wall leap for mediocrity from the atrophied pecan in his head, he surpasses his previous foamy wild-eyed assessment of reality.

Rodeo clown dressed as economist. All of it delivered in that whiny Swedish accent that makes him sound like he needs to be changed, and put straight to bed for a nap. I hasten to add that the Swedish accent is not annoying in all its speakers – pretty much only Aslund and the Swedish Chef from “The Muppets”, to whom he bears an astonishing resemblance.

And it doesn’t end with physiognomy; they share a similar grasp of economics and government.

I can’t wait, I’m lowering interest rates, my people say:

“King, how are you such a genius?

There’s a roof overhead and food on our plates!”

It’s laissez-faire, I don’t even care

Let’s make Friday part of the weekend.”

– Moxy Fruvous, from “King of Spain”

Hey, remember when Aslund was president of that country; Jeez, what was it called?

Anyway, he became president way back in the late 90’s, almost further back than pterodactyls can remember, it’s not surprising that the details are a little fuzzy.

I do remember that when he became president, the country was on the ropes: the inflation rate was around 27% (now it’s 11.4%), the unemployment rate was 12% (now it’s 5.2%), and per-capita GDP was about $3,500.00 USD (now it’s $7,000.00 USD).

Adjusted for PPP, it’s about $25,000.00 per year, the highest it’s ever been. Personal income tax rate was a flat rate of 13%, and it still is.

In how many other countries has the electorate seen its tax rates remain the same for 14 years?

Complete story at - http://russia-insider.com/en/2015/01/17/2488

Demeter

(85,373 posts)long story.

"the atrophied pecan in his head"

I will have to memorize that one, should I ever again encounter MY "stupidest, most pedantic, most off-the-wall" Swede.

MattSh

(3,714 posts)Earlier this month, Target announced it would close all of its 133 stores in Canada, laying off the 17,600 employees north of the border.

As CBC reports, Target's "employee trust" package for its Canadian workers, announced last week, amounts to around $56 million, providing each worker with 16 weeks of pay.

But - what is perhaps more stunning is that, depending on who’s doing the calculation, the golden handshake "walk-away" package handed to ex-CEO Gregg Steinhafel last May is in roughly the same ballpark at around $61 million, including severance of $15.9 million.

It appears underperforming is the new killing it...

Complete story at - http://www.zerohedge.com/news/2015-01-22/17600-laid-canadian-target-workers-stunned-ex-ceos-walk-away-package

MattSh

(3,714 posts)Ukraine is a big country. After Russia it is the second largest in Europe. It is also a very populous country. It numbers 45 million people. I'm told that is more than lived in the entire Roman Empire.

In economic terms, however, Ukraine is sadly a minnow. Its GDP is about $180 billion.

In other words, its economy is smaller than that of Peru, Romania, Kazakhstan, Portugal and Greece — all of whom have far smaller populations and none of whom are known for exceptional wealth.

Ukraine’s budget in recent years has hovered at just under $60 billion. That is a small number.

Primarily due to a drastic fall in the exchange rate of its currency, its 2015 budget only amounts to $30 billion.

By comparison Slovenia is a post-Communist country in Central Europe of 2 million people. It has a budget of $20 billion.

Russia’s 2015 budget is $390 billion (3-4 times Ukraine’s population but 12 times the budget).

.....

As said Ukraine looks big on a map, and $40 billion is in some ways a laughable amount of money (say if you’re China, or the Pentagon), but we’re talking about a state which now collects less than $30 billion per annum in revenue.

Rather than help, any aid packages are looking a lot like signing up Ukrainians for a life of debt slavery.

Complete story at - http://russia-insider.com/en/2015/01/22/2650

Whoomp there it is

Of course, I understand that letting Ukraine default is out of the question. ![]()

George Soros in particular stands to lose billions should Ukraine default. That's why he recently called on the USA and the EU to come up with an additional bailout package of $50 billion. And that's over and beyond anything the IMF should authorize.

Demeter

(85,373 posts)and has enough for a small country.

His story is interesting...I will feature him next weekend, if nothing more worthy surfaces.

xchrom

(108,903 posts)Pride of place in this week's Houston Auto Show goes to "Texas Edition" trucks: hulking vehicles, selling for $50,000 and upwards, specially designed for the Lone Star state's expansive tastes. Allout Offroad customises them further, lifting the chassis to fit outsize wheels and tyres. They are selling "like crazy", says the firm's boss, Chance Kamp. "People can afford to put gas in them now."

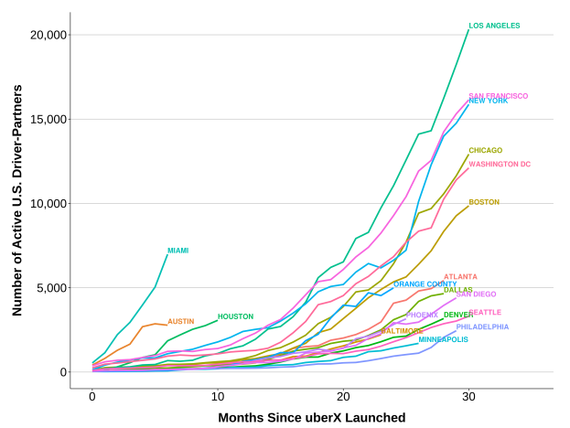

Houston, America's fourth-largest city, is poised between the joys of cheap fuel and the pain of the industry which produces it. Dave Lesar, chief executive of Halliburton, which provides drilling and pumping services, says its customers are cutting spending by 25-30%. On January 21st BHP Billiton, a giant miner and oil producer, said it would cut the number of its onshore oil rigs in America by 40%. A so-far modest fall in the total number of active rigs (see first chart) is set to accelerate.

A survey of 225 companies by Barclays, a bank, forecasts that if crude settles in a range of $50-60 a barrel (it was below $50 in the middle of this week) the industry worldwide will cut its capital spending by 9% this year, to around $620 billion.

Consolidation has been under way for months. Last year, before the oil price's latest tumble, Halliburton, which is the world's second-biggest oil-services firm, agreed a merger with the third-biggest, Baker Hughes. The intention is to save $2 billion a year in costs. Both firms announced strong profits on January 20th, while warning of hard times ahead. Baker Hughes said it would cut 7,000 jobs and a fifth of its capital spending; Halliburton has already cut 1,000 outside America, and says it will shed more labour at home in the weeks ahead. Total, an integrated oil giant from France, this week said it would speed up a cost-cutting programme.

Read more: http://www.economist.com/news/business/21640328-amid-gloom-and-cutbacks-industry-strong-will-get-stronger-tough-get-going#ixzz3PjvmPz98

Demeter

(85,373 posts)xchrom

(108,903 posts)The carnage from low oil prices is about to get even uglier.

Conway Mackenzie, the largest restructuring firm in the US, says that oil drillers will begin shutting down as soon as the second quarter, followed closely by explorers, according to Bloomberg's Joe Carroll.

The game changed when on Jan. 5 crude broke $50 per barrel for the first time since April 2009, when the economy was in recession. Here's what Conway's John T. Young told Bloomberg:

"When I saw WTI hit $65, I thought we're going to be really busy with restructurings ... When it hit the $40s, I knew we were looking at outright liquidations."

Young also said oil drillers needed to check whether the producers they worked for had a financial plan in case their future cash flow faltered.

Read more: http://www.businessinsider.com/oil-drillers-going-bust-2015-1#ixzz3PjwWVlu8

xchrom

(108,903 posts)- Mario Polegato, billionaire chairman of Italian shoe company Geox SpA:

Polegato feels the ECB's stimulus will help companies like his by bolstering consumers' confidence in the economy and holding down the euro's value, thereby making exports more affordable overseas.

- Elpida Yiannaka, co-owner of wine bar, Nicosia, Cyprus:

Yiannaka opened the 50-seat Vini Platea a couple of months ago in the historic center of old Nicosia within the Cypriot capital's Venetian-built walls. The summer will be pivotal to deciding whether it would be wise to expand.

- Joao Felix, CEO of a Lisbon startup that operates a car-sharing system for company fleets and private owners:

"It's a turning point, no doubt about it," Felix says at his small downtown office, where his four staffers sat at computers and a Lisbon city map covered one wall.

Demeter

(85,373 posts)Yves here. The ECB is set to announce the details of its QE program tomorrow. Many analysts and investors have been trying to puzzle out how its operations might work, since those details will make a difference in what impact if any it has.

Frankly, we are hugely skeptical of this initiative. The US version, which is bizarrely touted as a success, further zombified the economy. It goosed asset prices, which widened wealth and income inequality. Now respectable economists are decrying the widening gap between rich and poor and the lack of class mobility as a brake on growth, yet they also refused to endorse debt restructuring and much more aggressive fiscal spending. And some experts contend that the reason the Fed decided to end QE last summer was that it came to recognize the costs outweighed what if anything it produced in the way of benefits. Of course, they can never admit that publicly or even privately if true.

In Europe, there is even more reason to be expect QE to be at best ineffective. Unlike the US, where as a matter of policy, a lot of financing takes place through the capital markets (for instance, credit card debt, subprime auto loans, home loans are all securitized to a large degree), in Europe, far more credit is on bank balance sheets, and small to medium sized corporate lending is far more important than in the US. Thus, while as we have repeatedly explained, putting money on sale is unlikely to result in more borrowing unless the cost of money is the biggest cost of running your business (ie, you are a bank or a speculator), in Europe you have the added layer that reducing investment yields is unlikely to change how credit officers view lending to small/medium sized enterprises (assuming they even want to borrow) in a weak, deflationary economy.

This Bruegel post describes the major options that the ECB has in designing its QE program, which will help readers benchmark tomorrow’s announcement. One might politely describe the choices as bad and less bad.

By Guntram B. Wolff, Director of Bruegel and former member of the European Commission, Marcel Fratzscher, and Michael Hüther, a German economist and director of the Institut der deutschen Wirtschaft. Originally published at Bruegel

Authors: Guntram B. Wolff, Marcel Fratzscher, Michael Hüther

German opposition to government-bond purchases by the European Central Bank is solidifying ahead of the programme’s likely announcement on January 22. Elections in Greece that could bring a government that will seek to negotiate the country’s debt with official creditors puts the ECB’s decision under even greater scrutiny. The fact that the ECB did not share losses in the previous round of Greek debt restructuring highlights the problem of sovereign QE, which is not feasible or will be ineffective if fiscal implications are excluded. The design of the programme is therefore crucial.

ECB is falling far short of fulfilling its mandate of keeping inflation below but close to 2%

With the euro-area inflation rate at minus 0,2% and an increasing de-anchoring of inflation expectations, the ECB is falling far short of fulfilling its mandate of keeping inflation below but close to 2%. Many German economists and politicians downplay this failure by trying to re-define price stability as an inflation rate above zero. This is wrong for a number of reasons. A third of the sectors in the euro area, including in Germany, is in deflation. Low inflation is harmful because it makes price adjustment harder, undermines investment and renders debt service more difficult.

Monetary policy alone cannot fix all the problems of low growth and low inflation as many Germans rightly point out. Significant structural reforms and investment to stimulate higher demand will pay off rather quickly. A strong commitment to such reforms is essential for exiting the crisis. Nevertheless, the ECB should not and cannot hide behind slow government progress on reform, but should instead fulfill its mandate.

The more and longer that inflation expectations remain unanchored, the harder it will become for the ECB to regain credibility

The reason for the growing German opposition to a sovereign QE programme is the fear that it could result in illicit monetary financing of governments. A QE programme would have to be combined with an implicit understanding that the ECB accepts losses on the same terms as private creditors in case of a debt restructuring. Otherwise, the purchase of low-rated government debt would be largely ineffective and could even lead to an increase in sovereign yields.The ECB has four options.

The first is to wait and hope for the best. This is the preferred strategy of many Germans, but would be dangerous and irresponsible. The more and longer that inflation expectations remain unanchored, the harder it will become for the ECB to regain credibility and achieve price stability, and the higher will be the real economic costs for the euro area and for Germany.

The second option would be to allocate the potential losses from purchases to the individual national central banks in the euro area. This might sound like an attractive option, but would be counter-productive by increasing sovereign spreads and worsening financial fragmentation within the euro area. And it would send a devastating signal that the single monetary policy would be single in name only.

The third option is to focus government bond purchases on highly rated debt only to limit the balance sheet risks to the ECB. This strategy could succeed, but the ECB would have to buy large amounts of already low-yielding, “safer” euro area sovereign debt and hope that private investors subsequently rebalance their portfolios towards riskier euro-area countries.

The fourth option– while accepting that the founding fathers of the euro might not have foreseen that monetary policy has to accept some fiscal risks – would be for the ECB to purchase sovereign debt according to the capital key of individual euro-area countries, with adjustments for those without sufficient amounts of privately held sovereign debt. The Treaty does not prohibit such purchases in secondary bond markets. The ECB’s governing council has expressed its intention to expand the balance sheet by €1 trillion. As this will hardly be possible with private sector assets only, the ECB could buy a portfolio of government debt combined with a portfolio of private debt.

The ECB needs to urgently show its uncompromising determination to fulfil its mandate and repair monetary transmission in the euro area.

The ECB needs to urgently show its uncompromising determination to fulfil its mandate and repair monetary transmission in the euro area. Accepting some fiscal risks is reasonable and unavoidable. The fourth option is the most promising strategy for the ECB to raise inflation expectations credibly and durably, avoid stagnation and help end the debt crisis. It is a risky strategy, but the other strategies are riskier.

xchrom

(108,903 posts)NEW YORK (AP) -- McDonald's isn't lovin' it, and it's going to do something about it.

The world's largest hamburger chain reported falling earnings and sales for its fourth quarter on Friday and says it is going to take action this year to save money and bring customers back. This includes slowing down new restaurant openings in some markets.

It's also making changes to its menu and looking to offer customers more options to customize their burgers.

But the fast-food giant said its problems won't be fixed overnight: It expects sales to remain weak through the first half of this year while it deals with the fallout from a food-safety scandal in China, global economic uncertainty and shifting tastes among diners.

Demeter

(85,373 posts)the fries were terrible! I was at an unfamiliar outlet, so it could have been franchise incompetence.

The bacon cheese burger was good, because of the bacon, I suspect, which covers up a lot of inadequacies....

xchrom

(108,903 posts)DAVOS, Switzerland (AP) -- The World Economic Forum held in the Swiss ski resort of Davos has the official goal of "improving the state of the world." In practice, it's a massive networking event that brings together 2,500 heads of state, business leaders, philanthropists and artists.

Here are some glimpses of what's happening and being discussed at Davos on Saturday, the forum's last day:

STATE OF MIND

Sitting in silence on a chair and thinking of nothing is not something you'd think people come to do at Davos.

But that's what dozens of business leaders, politicians and power brokers do every morning at a meditation session that kicks off the daily schedule.

xchrom

(108,903 posts)How did they know you needed a $25 Mounted Squirrel Head while hurtling toward Antigua at 600 miles an hour?

And a $500 Volkswagen Camper Tent to go with it.

In the end it was a shaky bet for SkyMall, especially as the in-flight catalog of absurd gadgets and gimmicky home goods was passed over for online retailers and the fun to be found on your tablet or phone. The FAA loosened the rules on using devices on takeoff and landing, and now SkyMall has filed for bankruptcy protection.

Founded in 1990, SkyMall succeeded by peddling weird wares to a captive audience of bored airline passengers with money to burn, as they browsed the seat pockets for anything to pass the time. It touted itself as a purveyor of “unique merchandise” and never had to defend that claim against vigorous dispute. Around 650 million people a year viewed the catalog, according to the company’s website.

Demeter

(85,373 posts)Perhaps recovery of one's senses, if not recovery of one's economic firepower.

xchrom

(108,903 posts)Federal prosecutors in New York asked an appeals court to reverse a sweeping ruling making it harder for them to win insider-trading cases.

The Dec. 10 decision by a three-judge panel overturned the convictions of two former hedge fund managers and may lead to the dismissal of charges against others found guilty in a multiyear insider-trading probe.

It’s rare for appellate courts to agree to reconsider a ruling, especially when the original decision was decided unanimously. In last month’s 3-0 decision, the U.S. Court of Appeals in New York said recipients of inside tips are guilty only if they knew the data came from someone who had a duty to keep it secret and got a benefit for leaking it.

Prosecutors Friday asked for a rehearing by the panel and a hearing by the full court.

Demeter

(85,373 posts)xchrom

(108,903 posts)Mario Draghi has delivered a classic European compromise. It even has a chance of working.

With a headline value of 1.14 trillion euros ($1.28 trillion), the bond-buying plan unveiled by the ECB president on Thursday was welcomed by investors, even with its concessions to critics and a flurry of fine print. Draghi pledged to spend until there’s a “sustained adjustment” in inflation and Italy’s Ignazio Visco said the program is open-ended.

The euro fell to an 11-year low and bonds rose after the long-awaited arrival of a mode of stimulus that central banks in the rest of the developed world adopted years ago. Draghi said the plan will help return inflation to the ECB’s goal, while still giving a nod to the German-led concerns that defined much of the region’s response to the financial crisis.

xchrom

(108,903 posts)A three-year winning streak for sales of previously owned homes in the U.S. ended in 2014 as some investors stepped out of the market and first-time buyers failed to fill the void.

Purchases totaled 4.93 million last year, down 3.1 percent from the 5.09 million houses sold in 2013, figures from the National Association of Realtors showed Friday in Washington.

The share of American homebuyers making their first purchase dropped in 2014 to its lowest level in almost three decades, according to the Realtors group. At the same time, employment gains, growing consumer confidence, mortgage rates at historically low levels and government efforts to lower purchasing costs probably will help bolster demand in 2015.

“Demand has been pretty sideways,” said Jay Feldman, an economist at Credit Suisse in New York. “There are various positives and I don’t see any big negatives for housing. The improving labor market and low mortgage rates will support the housing recovery.”

kickysnana

(3,908 posts)xchrom

(108,903 posts)New York Attorney General Eric Schneiderman’s 10-month investigation into high-speed trading has so far led to one big target: Barclays Plc. (BARC)

Almost a year after New York’s top cop made a splash with subpoenas of six high-frequency trading operations, the names of some of these firms cropped up in documents filed this week in the state court in Manhattan. The firms aren’t defendants, though. They are listed as part of Schneiderman’s proposed updated complaint against Barclays, which ran the private trading venue, or dark pool, where these firms traded.

Schneiderman’s suit doesn’t allege any wrongdoing by the high-frequency trading firms. Its focus, instead, is whether Barclays lied to its customers about what HFT firms were doing inside Barclays’s dark pool, one of Wall Street’s largest in-house trading platforms.

“High-frequency trading and dark pools are legal businesses and can be beneficial to the market,” said Deborah Meshulam, a partner at DLA Piper who specializes in securities enforcement. “Unless there are changes in the regulations, then it is hard to say just how many high-frequency-trading related cases will come to light.”

xchrom

(108,903 posts)Little is going right for California’s oil industry.

Turns out the state’s shale formation holds less promise than producers expected. Aging conventional wells are drying up. And a rebound in output that cost drillers as much as $3 billion annually to create has been overshadowed by shale oil gushing from wells in North Dakota and Texas.

Then, of course, came the collapse in oil prices -- a seven-month, 57 percent drop that was exacerbated by OPEC’s refusal to cut output in order to squeeze the U.S. shale drillers. No state is feeling that pressure more than California. Drillers there have idled more rigs -- on a proportional basis -- than those in any other part of the country.

“We spent a lot of money to go out and drill and use new technologies just to stop production from depleting in our mature fields,” Rock Zierman, chief executive officer of trade group California Independent Petroleum Association, said by phone. “It took us a lot of capital to basically run in place and now we’re looking at crude prices under $40 a barrel.”

magical thyme

(14,881 posts)in a region facing a megadrought. Dumbasses. ![]()

MattSh

(3,714 posts)Submitted by Pater Tenebrarum via Acting-Man blog,

Only the Sheeple Are Sane

This post is about an issue that is by now a bit dated (though the topic as such certainly isn’t), but we have only just become aware of it and it seemed to us worth rescuing it from the memory hole. In late 2013, the then newest issue of the American Diagnostic and Statistical Manual of Mental Disorders (DSM for short) defined a new mental illness, the so-called “oppositional defiant disorder” or ODD.

As TheMindUnleashed.org informs us, the definition of this new mental illness essentially amounts to declaring any non-conformity and questioning of authority as a form of insanity. According to the manual, ODD is defined as:

[…] an “ongoing pattern of disobedient, hostile and defiant behavior,” symptoms include questioning authority, negativity, defiance, argumentativeness, and being easily annoyed.

In short, as Natural News put it: According to US psychiatrists, only the sheeple are sane.

Every time a new issue of the DSM appears, the number of mental disorders grows – and this growth is exponential. A century ago there were essentially 7 disorders, 80 years ago there were 59, 50 years ago there were 130, and by 2010 there were 374 (77 of which were “found” in just seven years). A prominent critic of this over-diagnosing (and the associated over-medication trend) is psychologist Dr. Paula Caplan. Here is an interview with her: (interview at link)

As MindUnleashed notes:

“Are we becoming sicker? Is it getting harder to be mentally healthy? Authors of the DSM-IV say that it’s because they’re better able to identify these illnesses today. Critics charge that it’s because they have too much time on their hands.

New mental illnesses identified by the DSM-IV include arrogance, narcissism, above-average creativity, cynicism, and antisocial behavior. In the past, these were called “personality traits,” but now they’re diseases. And there are treatments available.”

Complete story at - http://www.zerohedge.com/news/2015-01-21/if-you-question-authority-you-are-mentally-ill-report-finds

“I see before me words you should not have written…”, by Raymond Pettibone, the cover artist of punk band “Black Flag”.

Demeter

(85,373 posts)Last edited Sun Jan 25, 2015, 11:00 AM - Edit history (1)

Somehow, I doubt drugs and/or talk therapy will be effective. Electroshock is too horrible for anyone.

We have time-honored, effective means of dealing with arrogance--a good pounding (physical or other) however, is therapeutic for both the inflictor and the afflicted.

VIDEO INTERVIEW WELL WORTH WATCHING:

Demeter

(85,373 posts)I recently had the opportunity to see Norman Jewison’s extremely silly and sometimes smart 1966 comedy The Russians Are Coming, the Russians Are Coming for the first time in about 20 years when it played on TCM. When I was a kid The Russians Are Coming, the Russians Are Coming was one of my favorite comedies for reasons I can’t really explain, except it seemed to portray adults as I saw them then – easily frightened big kids who projected their fears onto their children and conformed to every bad idea that society and the government tossed their way.

I was afraid the film wouldn’t hold up after such a long period of time between my last viewing so my expectations were extremely low going into the movie but once it ended my appreciation for it remained. I really admire its undeniable charm and the way it manages to cram complex ideas into easily digested entertainment that the whole family can enjoy. Simply put, it’s a lightweight version of Kubrick’s brilliant Dr. Strangelove (1964) and it works.

...

There are some standout performances in The Russians Are Coming, the Russians Are Coming, including Carl Reiner’s terrific turn as a comedy writer trying to calm the paranoid town and the very funny Alan Arkin playing a smart Russian Lieutenant who’s trying to get a handle on the slowly escalating events all around him. Brian Keith is also very good as the town Sheriff who can’t believe the situation he’s found himself in. Arkin’s Russian Lieutenant and Keith’s small town Sheriff could have been roles written purely for easy laughs but they’re not. Viewers are asked to sympathize with both men in some ways and we do. The gorgeous John Philip Law also shows up as a Russian solider who speaks a little bit of English and ends up falling for a perky American blond played by Andrea Dromm. The two young lovebirds make a cute couple and their romance echoes themes found in Shakespeare’s classic play Romeo and Juliet, which gives the film an emotional core that I personally found rather sweet and appealing.

The beauty of The Russians Are Coming, the Russians Are Coming seems perfectly clear today as we deal with some vaguely defined idea of an enemy we’re supposed to fear enough to give up our Constitutional Freedoms and basic human compassion for. The film has often been unfairly criticized for its dated jokes, simple plot and silly slapstick style humor. But if the ideas presented in Norman Jewison’s film are so dated, simple and silly, why are people still making the same absurd mistakes outlined in a movie made some 40 years ago? If anything, the film’s basic premise and themes are as pertinent as ever. Underneath all the movie’s jokes and gentleness, The Russians Are Coming, the Russians Are Coming knows that war is a nasty business and there are rarely any victors.

Demeter

(85,373 posts)The US Dollar rally, combined with the ECB’s policies are at risk of blowing up a $9 trillion carry trade.

When the Fed cut interest rates to zero in 2008, it flooded the system with US Dollars. The US Dollar is the reserve currency of the world. NO matter what country you’re in (with few exceptions) you can borrow in US Dollars. And if you can borrow in US Dollars at 0.25%... and put that money into anything yielding more… you could make a killing. A hedge fund in Hong Kong could borrow $100 million, pay just $250,000 in interest and plow that money into Brazilian Reals which yielded 11%... locking in a $9.75 million return.

This was the strictly financial side of things. On the economics side, Governments both sovereign and local borrowed in US Dollars around the globe to fund various infrastructure and municipal projects...Simply put, the US Government was practically giving money away and the world took notice, borrowing Dollars at a record pace. Today, the global carry trade (meaning money borrowed in US Dollars and invested in other assets) stands at over $9 TRILLION (larger than the economy of France and Brazil combined). This worked while the US Dollar was holding steady. But in the summer of last year (2014), the US Dollar began to breakout of a multi-year wedge pattern:

Why does this matter? Because the minute the US Dollar began to rally aggressively, the global US Dollar carry trade began to blow up. It is not coincidental that oil commodities, and emerging market stocks took a dive almost immediately after this process began.

This process is not over, not by a long shot. As anyone who invested during the Peso crisis or Asian crisis can tell you, when carry trades blow up, the volatility can be EXTREME. The market drop in October was just the start. Once the US Dollar rally really begins picking up steam, we could very well see a crash.

Demeter

(85,373 posts)The European Central Bank will have to win a battle for bonds as it seeks to meet its balance-sheet target by buying sovereign debt. Banks and pension funds are already competing with investors for a dwindling supply of conventional German bunds. Add ECB purchases and prices may rise so far they cancel out all interest payments on Europe’s benchmark government securities. The central bank will buy 60 billion euros ($68 billion) of public and private bonds a month, starting in March, President Mario Draghi said in Frankfurt on Thursday.

Of that, about 45 billion euros probably would be sovereign debt, according to a central bank official, equating to more than 100 billion euros of German securities this year, based on purchases being conducted in proportion to euro-zone members’ contributions to the ECB’s capital. That would shrink the tradable market for German bonds in a year when the debt agency already planned to reduce the amount of conventional bonds outstanding by 8 billion euros.

“It’s going to cause a huge shock to the supply-demand balance in the European government-debt market,” Anthony Doyle, investment director at M&G Group Plc in London, said before the ECB’s decision was announced. “We might not be too far off the German bund market looking like the Swiss one, with a negative yield out to 10 years. It’s pretty crazy.”

A rally in German securities pushed yields on 10-year bonds lower in 11 of the past 12 months as investors accepted ever-diminishing payments to own the securities. Prices on notes due in as much as four years are already so high that yields have turned negative, meaning buyers get back less than they pay to buy the securities if they hold them to maturity...ECB buying will be carried out in line with the capital key, Draghi said, which is a measure roughly in proportion to the size of each nation’s economy. Adjusted for non-euro-region central banks, that works out as a 25.6 percent share for Germany, according to calculations based on data on the ECB’s website.

If the ECB purchases about 450 billion euros of sovereign bonds over 10 months, about 115 billion euros would be earmarked for German debt. The exact amount has yet to be officially specified because the ECB plans to include debt of agencies and European institutions, as well as asset-backed securities and covered bonds in its purchases. As of Dec. 31, Germany had 1.16 trillion euros of tradable securities. The difficulty for the ECB may be flushing out sellers and getting them to buy other assets instead. Banks and insurers need Germany’s AAA securities to bolster their balance sheets and pension funds mop up bunds to match their liabilities. In a low-growth environment with scant inflation, investors are sticking with bonds, particularly when the ECB is levying charges on its overnight deposit facility. Meanwhile, supply is shrinking. The German debt agency plans to sell 147 billion euros of conventional bonds this year, compared with redemptions of 155 billion euros, according to its outlook published in December. As much as 14 billion euros of inflation-linked bonds, which are also eligible for ECB purchase, will also be issued.

“The euro-zone banks own something like 30 percent of their countries’ bonds,” said Markus Allenspach, head of bond research at Julius Baer Group Ltd. in Zurich. “New issues are relatively limited so it’s a question of the price -- at what level will the banks decide to sell the paper?”

....

“Global central banks are petrified of deflation,” said M&G’s Doyle, whose firm oversees the equivalent of about $389 billion. “The real effectiveness of QE is through the portfolio-rebalancing effect. The world is running out of positive-yielding government bonds.”

Demeter

(85,373 posts)King Salman, Saudi Arabia’s new ruler, will keep Oil Minister Ali Al-Naimi in his post, bolstering expectations that he will continue the policy of maintaining crude output to preserve market share even as prices have plunged. Salman, 79, issued a royal decree to retain current ministers, according to the official Saudi Press Agency. Al-Naimi led OPEC’s Nov. 27 decision to maintain its crude production even as shale supplies spurred U.S. output to the highest in three decades. Salman said on Saudi national television that he will maintain the policies of his predecessor.

With production of 9.5 million barrels a day and exports of 7 million, Saudi Arabia accounts for more than a 10th of global supply and a fifth of crude sold internationally. The country’s refusal to surrender market share to rising U.S. output has contributed to the worst slump in prices since the global credit crisis of 2008...

In theory, Saudi oil decisions are made by a Supreme Petroleum Council headed by the king and made up of senior members of the royal family, ministers and industry leaders. In practice, decisions seem to have been left in Al-Naimi’s hands, said Simon Henderson in an October research note for the Washington Institute. “Although he is in his late seventies and said to be looking forward to retirement, Naimi retains a firm grip,” Henderson said. Al-Naimi, who has driven decision-making since 1995, has said he’d like to devote more time to his other job, chairman of the science and technology university named after the late sovereign. While no member of the ruling Al-Saud clan has ever served as oil minister, Prince Abdulaziz bin Salman, a son of the new king, is assistant oil minister and a regular participant in OPEC meetings.

Demeter

(85,373 posts)Demeter

(85,373 posts)Alan Taylor

Since his debut in the 1977 movie Star Wars, Darth Vader has been a rather busy Sith Lord. Apart from appearing in several movies since, Vader has also taken time out to participate in many other activities. For example, in recent months, he has shown a keen interest in Ukrainian politics. Over the years, news photographers have captured Lord Vader at premieres, rallies, promotional events, conferences, and sporting events, and even caught him at some low points, including a bank robbery. Gathered here are a handful of images of Vader's offscreen appearances around the world (Earth).

I HAVE SELECTED THE UKRAINIAN SIGHTINGS--FOR THE REST, SEE LINK

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/#img06

A common sight in Kiev, Ukraine. Kiev's mayoral candidate for the Internet Party arrives to speak to the media on Volodymyrska Hill on May 22, 2014 in Kiev./Dan Kitwood/Getty Images

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/#img09

Lord Vader speaks in front of Ukraine's Central Election Commission building. A man wearing the outfit of Darth Vader, who announced he was running for president as the official candidate of the Ukrainian Internet Party, speaks as he takes part to a protest action in Kiev on April 3, 2014./Sergei Supinsky/AFP/Getty Images

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/#img14

Impressive. Most impressive. A man wearing the outfit of Darth Vader, who announced he was running for president as the official candidate of the Ukrainian Internet Party (UIP), grabs a piece of meat from a market stall in front of the Central Election Commission building in Kiev on April 3, 2014./Sergei Supinsky/AFP/Getty Images

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/#img18

You may dispense with the pleasantries. Kiev's mayoral candidate for the Internet Party arrives to speak to the media on Volodymyrska Hill on May 22, 2014 in Kiev, Ukraine./Dan Kitwood/Getty Images

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/#img21

All too easy. Darth Vader, previously known as Viktor Shevchenko, waits to receive his ballot papers at a polling station during parliamentary elections in Kiev, Ukraine, on October 26, 2014.

http://www.theatlantic.com/photo/2014/10/the-many-lives-of-darth-vader/100842/#img24

Obi-Wan never told you what happened to your father. A candidate representing the Internet Party of Ukraine kneels in front of a crying boy during a meeting with supporters and voters in Kiev on October 22, 2014./Reuters/Valentyn Ogirenko

SEEN THE SITH LORD AROUND, MATT?

Demeter