Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 7 May 2015

[font size=3]STOCK MARKET WATCH, Thursday, 7 May 2015[font color=black][/font]

SMW for 6 May 2015

AT THE CLOSING BELL ON 6 May 2015

[center][font color=red]

Dow Jones 17,841.98 -86.22 (-0.48%)

S&P 500 2,080.15 -9.31 (-0.45%)

Nasdaq 4,919.64 -19.68 (-0.40%)

[font color=red]10 Year 2.24% +0.06 (2.75%)

30 Year 2.99% +0.08 (2.75%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)The top U.S. securities regulator is considering making public how it decides whether a case is handled by a federal court or by its in-house judge, after some defendants claimed the in-house court violates their rights.

In testimony on Tuesday, Securities and Exchange Commission Chair Mary Jo White told a U.S. Senate appropriations panel she takes such concerns seriously and is weighing action to address them.

"I do believe the appearance of fairness is important," White said. "One of the things that I am considering is whether we should do public guidelines to make that clear and transparent."

I THINK SHE SHOULD RE-THINK WHAT SHE SAID....

Demeter

(85,373 posts)

Tom Hayes, a scruffy, blond 35-year-old former trader who worked at banks including UBS Group AG and Citigroup Inc., has pleaded not guilty to eight counts of conspiracy to manipulate Libor over a four-year period from 2006 through September 2010. Photographer: Matthew Lloyd/Bloomberg

When Thomas Hayes walks into a London courtroom next week, he will be the first person to face trial for allegedly rigging the benchmark interest rates used to value $350 trillion of loans and securities.

It only took seven years to get here.

That’s how long regulators on three continents have been looking into allegations that traders at the world’s biggest banks were manipulating Libor, the London interbank offered rate. More than $9 billion in fines have been levied, including a $2.5 billion penalty for Deutsche Bank AG last month, without a single trader going before a judge.

A lot is riding on the case for the U.K.’s Serious Fraud Office, which has been criticized for waiting until public outcry over the scandal reached a fever pitch in 2012 before beginning criminal proceedings...

Demeter

(85,373 posts)It could be a bloodbath of historic proportions...

I don't think I'll be able to sleep a wink for the next 18 months.

Demeter

(85,373 posts)Congressional Republicans scored a major legislative victory on Tuesday as the Senate adopted the first bicameral GOP budget agreement in a decade. The 51-48 vote capped weeks of work by Republican leaders in the House and Senate, who shepherded the blueprint through a messy debate over defense spending that at times threatened to split their conferences. The blueprint passed the House last week, and will not require a signature from President Obama.

Passing a budget, which is always a heavy lift, was particularly important for Senate Republicans, who are seeking to demonstrate their ability to govern in a difficult 2016 election cycle — they are defending 24 seats. Senate Majority Leader Mitch McConnell had ripped Democrats for years over their failure to pass a budget, and said Tuesday’s vote shows his GOP majority is getting the Senate working again.

“No budget will ever be perfect, but this is a budget that sensibly addresses the concerns of many different members. It reflects honest compromise from many different members with many different priorities,” the Kentucky Republican said on the Senate floor.

Still, the budget vote split the Senate’s GOP presidential hopefuls, with Sens. Ted Cruz (Texas) and Rand Paul (Ky.) voting against the agreement and Sens. Marco Rubio (Fla.) and Lindsey Graham (S.C.) voting in favor. Democrats, who voted in unison against the budget in both chambers of Congress, said Republicans would come to regret calling for trillions of dollars in cuts to federal spending.

"We know there's only one bit of good news. Our colleagues, when they're forced to actually put real numbers to these budget numbers in the appropriations process, won't be able to do it. They won't dare do it," Sen. Charles Schumer (D-N.Y.) said.

The White House signaled in statement Tuesday evening that the budget has no chance of getting Obama’s approval.

"The president has made clear that he will not accept a budget that locks in sequestration going forward, nor one that reverses sequestration for defense – whether explicitly or through backdoor gimmicks – without also reversing sequestration for non-defense,” the White House said.

"There is bipartisan support for a commonsense deal,” the statement added. “The administration looks forward to working with Congress on an agreement that will allow us to invest in our economy and protect our national security."

The non-binding resolution approved Tuesday sets the top-line numbers that appropriators will use to craft 12 bills funding the government in fiscal 2016. The plan calls for balancing the budget in 10 years by cutting more than $5 trillion from spending.

THIS IS MADNESS PERSONIFIED

MORE MADNESS AT LINK

Demeter

(85,373 posts)Here's to Sergey Aleynikov, the former Goldman Sachs programmer convicted Friday of stealing the bank's high-frequency trading code, for accepting no compromises and persisting with a legal battle that still could put him in prison. By having the U.S. court system recycle the shaky six-year-old case, he is showing others like him the absurdity of working for old Wall Street banks in an era when a tiny startup, or even a guy trading from his home, can run circles around them.

Lawyers can have fun arguing about the legal aspects of Aleynikov's case. There's plenty to gnaw on: the use of a pre-computer statute on "unlawful use of secret scientific material" to convict him, the spirit and the letter of double-jeopardy law (Aleynikov was cleared of federal charges in the same case before the state of New York pursued him), and whether a judge should dismiss a case when the jury clearly struggles to understand the subject matter. There's the separate matter of whether a company should be allowed to slap its own copyright on open-source code that its programmers barely change, which is what Goldman apparently did with the code Aleynikov downloaded on one of his last days at the bank.

But all that has to do with law, not finance or programming -- the two areas for which Aleynikov's case is especially important.

Here's how the coverage of Aleynikov's trials reads to such a programmer: A big bank offers a decent salary to a coder. When he takes the job, he's confronted with a legacy system so bloated, it can't really compete with more nimble upstarts in the same business. (Goldman Sachs wasn't among the top high-frequency trading firms in 2009, and it still isn't. The top ones aren't household names.) He is encouraged to use open-source code to achieve results faster, but he's not allowed to give anything back to the community that developed it. His grander ideas are shelved, because the bank just wants quick fixes to its old, messy platform. When someone offers him a better job, free of the legacy system's constraints -- one that pays four times as much, as Aleynikov's new job with Teza Technologies did -- the bank enlists the FBI's help in going after him for saving some code on an outside server. Then, after the coder spends a year in jail and the case against him collapses on appeal, the bank keeps going after him, using its considerable political clout.

This is hardly a legal interpretation of what happened, but it tells a programmer that joining an established Wall Street bank is a bad idea. It's better to sell one's skills to a startup built by refugees from such banks. Many HFT firms started that way, because their founders hated the banks' slow, rigid systems. Such Wall Street escapees are more inclined to trust and cooperate with their programmers.

Aleynikov's case resonates beyond the small HFT world to the finance industry as a whole, which is undergoing a technological revolution akin to the one that's reshaped the news media. This revolution is being carried out by programmers, and they need employers who understand the nature of their work and how likely they are to be headhunted and asked to reproduce their best work elsewhere -- a frequent occurrence in tech. Traditional banks tend not to be such smart employers. That, and the fact that startups begin with a clean slate rather than oodles of legacy code, accounts for the increasing competition that banks face from tech-based outsiders -- including high-frequency trading outfits, robotized asset management firms, app-based retail banks, money transfer companies and payment systems.

Global investment in financial technology ventures tripled to $12.2 billion last year. That's not much money by Wall Street standards, but startups can do much more with it than traditional banks can, because it's often easier to build from the ground up and they have no need for armies of lawyers and managers.Banks that don't want to end up obsolete, like print newspapers, need to be friendlier to tech professionals. They need to listen to them when they say legacy systems need to be ditched, not patched. And banks should definitely avoid trying to put programmers in jail for doing what they always do. Goldman may be hoping Aleynikov's case will set an example to others like him, teach them to respect the bank's rules. Instead, it will tell good programmers to go elsewhere and perhaps, sooner than necessary, make Goldman obsolete.

Demeter

(85,373 posts)Gov. Rick Snyder and lawmakers will be forced to consider another alternative to address Michigan's deteriorating roads after voters' resounding rejection of a ballot measure that would have increased taxes to pump $1.2 billion a year more into transportation infrastructure.

The long-running debate will again center on whether to hike taxes or reduce other government spending to boost funding for a network of highways, streets and bridges described as the country's worst and whose major source of revenue, fuel taxes, is not keeping pace with construction and snow-plowing costs.

But given the bipartisan ballot proposal's overwhelming defeat a 4-1 ratio Tuesday, according to final unofficial returns higher taxes could be a nonstarter in a Legislature that's more conservative than the one that voted in December to put the constitutional amendment on Tuesday's ballot.

Republican House Speaker Kevin Cotter, a Proposal 1 supporter, said Wednesday he would propose a Plan B within days that is "very heavily dependent" on existing revenue to improve roads. He hinted at restricting additional spending in the $9.6 billion general fund and diverting economic development money to road repairs. "The cost curve (of doing nothing) is going up by the day," said Cotter, who largely rejected the possibility of again sending a road plan to voters.

Snyder, a potential Republican presidential candidate who had urged passage of the measure, conceded that significantly boosting transportation spending this construction season is a lost cause. He failed last year to persuade enough lawmakers to approve fuel tax and vehicle registration fee increases through legislation. They also balked at his later push for an either/or option among tax hike proposals that would have let voters pick which way taxes would be increased.

Asked if there is now a no-tax hike mandate from voters, Snyder said he "wouldn't view it that way" and "people know we need better roads. The question is where do you get the resources to do that?"

The centerpiece of Proposal 1 was a 1-percentage point sales tax increase that would have eliminated the sales tax on fuel, restructured and doubled per-gallon fuel taxes, and hiked vehicle registration fees to boost the state's $3.7 billion transportation budget to $5 billion, an increase of a third.

Voters crushed the ballot initiative for a number of reasons an aversion to higher taxes, its complexity, angst that the Legislature passed the buck, concerns about disproportionately hurting the poor with the sales tax increase and unhappiness that more than $500 million in additional tax revenue would have gone to public transit, schools and law enforcement.

"They've been taking from us for years saying they're going to fix the roads," said Cheryl Mask, a 56-year-old state worker from Lansing who voted against the ballot measure. She said the plan was confusing and the extra school funding was a "setup" to attract votes.

Snyder pledged to continue seeking a comprehensive, long-term solution. The Legislature last increased the 19-cents-a-gallon gasoline tax in 1997.

Michigan spends less on highways per capita than all but one other state.

Republican Senate Majority Leader Arlan Meekhof, another backer of the ballot initiative, said his first priority is passing the next state budget but added that he believes the measure's defeat shows voters want the Legislature to solve the problem.

"It took decades to come up with a compromise, and it will take time to come up with an alternative," he said in a statement.

Some supporters cautioned that voters want a proposal involving only road and bridge repairs and are not OK with cutting deeply elsewhere in the budget to free up money for transportation.

Democratic leaders, meanwhile, said businesses should pay their fair share for smooth roads after benefiting under a GOP tax overhaul four years ago declining to detail specifics. Democrats worry Republicans will revive a 2014 House plan, opposed by Snyder, to divert money from schools and local governments for road and bridge repairs without hiking fuel taxes beyond inflationary increases.

Read more at: http://www.monroenews.com/news/2015/may/06/michigan-house-speaker-to-propose-alternative/

MIDGET-MINDS IN ACTION...A MICHIGAN CIRCUS!

Demeter

(85,373 posts)"...$10 million is really just a drop in the bucket when looking at a $1 billion road problem..."

While the state says it will reimburse local officials for the cost of holding the election, Detroiters will still get stuck with hundreds of thousands for expenses that won't be reimbursed.

City Clerk Janice Winfrey says those costs include supplies, clerical help, mailings encouraging detroiters to vote, and advertising, which includes those billboards you've seen all over town.

Demeter

(85,373 posts)If allies are weak, am I not best alone?

If allies are strong with power to protect me,

Might they not protect me out of all I own?"

PUZZLEMENT--The King and I, Rogers and Hammerstein

Athens must take major steps to compromise with its international creditors but a Greek exit from the euro zone is not an option, European Commission President Jean-Claude Juncker said on Monday.

Greek negotiators and representatives of the European Commission, the European Central Bank and the International Monetary Fund have been holding talks since last Thursday on an interim deal to address Greece's debt problems. Wide differences over pension and labour reforms remain as the country's cash position becomes increasingly critical.

Speaking at the University of Leuven in Belgium, Juncker said Greece had "to take major steps in our direction and we have to be ready to respond in an adequate way to these steps (that) they don't have the choice not to take."

Everyone should understand that European economic and monetary union was irreversible. "That's why ... Grexit isn't an option," he said.

If Greece left the euro zone, the "Anglo-Saxon world" would try everything to break up the single currency area, he added.

Demeter

(85,373 posts)In our coverage of the Greek government’s efforts to end austerity and negotiate a debt restructuring and a shift to pro-growth policies, we’ve stressed how unlikely the ruling coalition was to succeed. That meant it has been frustrating for readers to see the new government make unforced errors and reduce its already low odds of success. But even worse is the specter of Syriza now taking steps to wring money out of a long-sufffering population in order to make payments to creditors. As reader Ned Ludd wrote:

Since the end goal was always a deal with the Troika, though, PASOK would have gotten a better deal than Varoufakis ever could. “If you can’t bite, better not show your teeth.” ~ Yiddish Proverb.

As we discussed yesterday, would the old mainstream coalition have dared to pilfer pension funds, local government deposits, and university surplus cash, particularly when the odds are high that the government will soon be forced to capitulate or default? Nevertheless, some readers have been unhappy that we have not been harsher critics of the creditors. It is a mystery to us why the Troika is willing to risk turning Greece into a failed state to a make a point about the cost of defying its authority. And we’ve chronicled over the years how austerity policies have failed. However, the Greek government has exposed how deeply wedded not only the Eurocrats, but also the governments that have been forced to wear the austerity hairshirt are to economic faith healing. The Latvian government actually believes its program is a success, when that “success” was achieved through a 14% decline in the population as the youngest and most energetic departed, leaving Latvia with an aging population. And as we and other commentators observed years ago, the contractionary policies inflicted on the periphery countries would eventually infect the core, and that is starting to occur as deflation takes hold in Europe.

A new paper by Dutch economist Servass Storm znd C.W.M. Naastepad, embedded at the end of this post, does a deft job of shredding the two key beliefs that underlie austerity policies: that government profligacy and insufficiently competitive labor markets caused the crisis, so the remedy is to crack down on government spending and wage rates. In contrast to most economic papers, this one is not just well documented but also well written. The authors give themselves license to decry these intellectually bankrupt policies. The abstract:

The raw numbers show how badly the orthodox policies have performed. European GDP has yet to reach its precrisis level, and the average unemployment level is 12%, and the social costs are high as well:

As Storm and Naastepad debunk what they depict as the central myths of the Eurozone crisis:

- The first is that the meltdown was the direct result of the famed “profligacy” of nation-states, and was thus always a sovereign crisis. As Naked Capitalism readers know well, the sovereign debt crisis was the result of the banking system implosion. Governments were hit with a collapse in tax revenues as GDP fell and higher levels of spending as payments under social safety net programs like unemployment insurance rose. In addition, governments also bore the cost of bank bailouts, and in some countries, notably Ireland, they were particularly costly.

As the paper shows, government debt to GDP ratios in the eight years preceding the crisis actually fell by an average of 6%. And most of the periphery countries were among the ones who had improved debt to GDP ratios: Italy’s fell by 7%, Ireland’s by 8% and Spain’s by as much as 27%. Even supposed wastrel Greece saw its debt to GDP ratio rise by 4%, lower than the 5% increase posted by France and Germany. Greek debt traded at spreads as low as 30 basis points over Germany’s in 2007. The authors show that there was indeed a runup in debt before the crisis, namely, private debt and in particular, the debt of financial corporations:Growing private-sector debts dwarf the changes in sovereign debts—particularly so in the crisis countries. In Greece, household indebtedness rose by 32 percentage points, corporate indebtedness by 13 percentage points, and financial sector indebtedness by 41 percentage points—trivializing the 4-percentage point increase in public debt. Spain experienced a massive increase in the debts of non-financial corporations (of 78 percentage points during 2000-07), of banks (of 74 percentage points) as well as households (of 34 percentage points)—all participants in Spain’s massive property bubble—in a period when sovereign indebtedness was sharply reduced. Undeniably, the Eurozone crisis was triggered by a gigantic unsustainable increase in indebtedness—but why would one single out trifling increases in sovereign debts as the main factor, while neglecting the significant growth in private indebtedness?

For the statistically-minded, the paper has several analyses that lend further support for this argument. Storm and Naastepad point out that the IMF has ‘fessed up that fiscal multipliers are typically higher than one, meaning a cut in government spending results in an even greater fall in GDP, making the debt level even worse. The authors stress that the IMF estimates are conservative, so the damage of misguided austerity policies is likely to be greater than they indicate. - The second big myth is that inefficient labor markets (meaning too well paid and pampered workers) were another primary cause of the crisis. This belief is why European authorities become outraged at Greece’s plans to raise the minimum wage and strengthen labor bargaining rights.

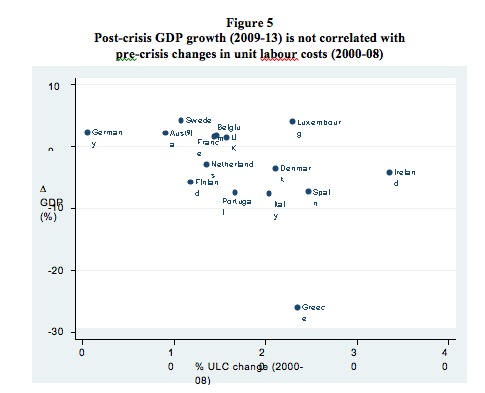

Storm and Naastepad contend that orthodox thinkers naively equate low labor costs with greater competitiveness, when labor is only one factor in costs, and cost is far from the only aspect of competitiveness: The problem with the “labour cost competitiveness” explanation is not that the data—as given in Figure 5—prove Mr. Bini Smaghi wrong, as there is no statistically significant correlation between pre-crisis increases in unit labour costs (ULC) and post-crisis growth performance for Europe and the Eurozone. The problem is a much deeper one as it concerns a leap of logic, a misleading use of the term “competitiveness” which philosophers would label equivocation, by which the—broad—concept of “competitiveness” is reduced, with remarkable sleight of hand, to competitiveness in terms of only relative unit-labour costs (or RULC). This is no trivial issue, as, firstly, it is no secret that economics lacks an agreed definition and measure of “international competitiveness” (Wyplosz 2013; Storm and Naastepad 2015a), and, secondly, often-used competitiveness indicators, such as RULC and/or current account imbalances, are known to be weak predictors of future export and import performance….. Instead, we (and others) find that

The problem with the “labour cost competitiveness” explanation is not that the data—as given in Figure 5—prove Mr. Bini Smaghi wrong, as there is no statistically significant correlation between pre-crisis increases in unit labour costs (ULC) and post-crisis growth performance for Europe and the Eurozone. The problem is a much deeper one as it concerns a leap of logic, a misleading use of the term “competitiveness” which philosophers would label equivocation, by which the—broad—concept of “competitiveness” is reduced, with remarkable sleight of hand, to competitiveness in terms of only relative unit-labour costs (or RULC). This is no trivial issue, as, firstly, it is no secret that economics lacks an agreed definition and measure of “international competitiveness” (Wyplosz 2013; Storm and Naastepad 2015a), and, secondly, often-used competitiveness indicators, such as RULC and/or current account imbalances, are known to be weak predictors of future export and import performance….. Instead, we (and others) find that

1. most goods & services imported into the Eurozone are “non-competing” imports used as intermediate inputs in manufacturing or for consumption—hence imports depend almost completely on domestic income (see also Bussière et al. 2011).

2. export performance by Eurozone members is overwhelmingly determined by world income growth (see also European Commission 2010; Danninger and Joutz 2007; Schröder 2015). Countries (such as Germany) exporting to fast-growing markets (such as China) experienced rapid export growth, whereas countries (such as Greece, Italy and Portugal) catering to slowly-growing markets had much lower export growth (ECB 2009).

3. Eurozone current account imbalances are not statistically significantly affected by changes in RULC (see also Gaulier and Vicard 2012; Diaz Sanchez and Varoudakis 2013; Gabrisch and Staehr 2014).

Wage costs don’t matter that much, in other words…However, all this does not mean that “competitiveness” is unimportant. It is non-price or technological competitiveness which matters—not price or cost competitiveness

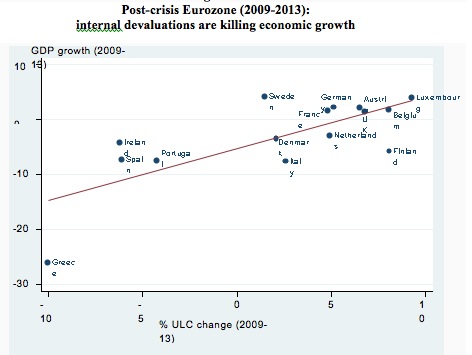

The misguided fixation on labor costs (which are visible and easy to measure, while an assessment of technological competitiveness isn’t readily relegated to a spreadsheet) leads to bad policy:Cutting wages (internal devaluation) and deregulating labour markets undermines a country’s competitiveness and stall export growth; combined with fiscal austerity this policy cocktail is lethal.

Here are some of the negative competitive consequences of pushing to reduce wage rates and lower labor bargaining power:Moreover, in more flexible labour markets, firms will invest less in workers’ firm-specific human capital and this hurts productivity as well (Lee and McCann 2011; Kleinknecht et al. 2013). Labour market deregulation may affect productivity through its impact on worker motivation and effort, as it erodes social capital and trust in the labour relation (Storm and Naastepad 2012). Likewise, lower wages and more flexible labour slow down the process of capital deepening, enable inefficient firms to stay in the market and discourage structural change. Finally, lower wage and demand growth reduce the pace at which older vintages of capital stock are being scrapped and new equipment, embodying the latest more productive technologies, is being installed. Taken together, lower wage growth gets reflected in lower labour productivity growth and weaker export performance (for reviews of the evidence, see Storm and Naastepad 2012; Kleinknecht, Naastepad, Storm & Vergeer 2013).

Post-crisis policies have strengthened Germany’s position relative to the periphery; the authors treat that as a terrible mistake; one has to wonder whether it is actually a feature:This brings us to the real problem of the Eurozone: the widening differentials in labour productivity and technological capabilities between members of the Eurozone. Productive asymmetries have increased within the Eurozone after monetary union. In the pre-crisis years, Germany managed to strengthen its production structure, but the Eurozone periphery lost ground—both their manufacturing activities and export bases became relatively more narrow and technologically stagnant

Germany’s rising trade surplus, now at over 7% of GDP, is widely regarded as unsustainable, particularly since Germany refuses to continue financing its trade partners.

It’s been remarkable to see how long Europe has been able to keep a broken economic model going well beyond its sell-by date. How long they can keep this up is still very much open to question. However, Storm’s and Naastepad’s paper is an important addition to a now robust literature on the contractions and failures of Europe’s post-crisis economic policies. When the day of reckoning finally arrives, no on in authority can claim they were not warned.

http://www.nakedcapitalism.com/wp-content/uploads/2015/05/The-Eurozone-Crisis.pdf

Ghost Dog

(16,881 posts)everything to break up the single currency area, beginning with its control of so much widely-influential financial propaganda media.

Demeter

(85,373 posts)When will Greece run out of money? The question has been vexing European capitals and the markets for months, as the stand-off between the new government in Athens and its eurozone creditors remains unresolved. So far, Greece has managed to both service its external debt and pay for wages and pensions. But the worst kept secret in the country is that for thousands of people, businesses and institutions relying on government pay cheques, in every practical sense, Greece is already out of money.

Greece has not received any loans from the eurozone or the IMF since August 2014. There is €7.2bn (£5.3bn;$8bn) left in the country's bailout program, but creditors refuse to release the money before their demands for further reforms, spending cuts and tax increases are satisfied by Athens. The Greek government, led since January by the leftist Syriza party of Prime Minister Alexis Tsipras, is refusing to "violate its anti-austerity mandate".

Without loans from official creditors or access to the international bond markets, Greece has so far covered its financing needs by resorting to extraordinary and controversial measures. These have included the forced transfer of the cash reserves of public sector entities such as regional governments and pension funds to the central government's coffers.

Pension scare

Pensioners were alarmed to discover last week that they could not make their usual withdrawals from ATMs on the day their accounts were supposedly credited. The money became available with several hours' delay. The government attributed the delay to a "technical problem". But reports in the Greek press and the Financial Times gave a less benign explanation: government pension funds had struggled until the last minute to find enough cash to cover pension claims.

For several categories of employees working for the wider public sector, the feeling of finding zero balance on your payroll account is all too familiar. "We are now running one month behind on our salaries. Until only recently we were two months behind, and no-one would tell us if and when we would get our next pay cheque," an office employee at a cultural institution funded by the state budget told the BBC.

The cash crunch is felt even even by public institutions as sensitive as hospitals. A junior doctor told the BBC that although wages were paid regularly to medical staff, the government was more than four months behind on payments for on-call time. "Last week we got paid on-call time for the month of December," she said.

Hospital suppliers that provide healthcare units with everything from bandages to dialysis machines warned last week that they may be forced to stop supplying hospitals. "In the past four months we are experiencing an undeclared suspension of payments," their associations said in a recent statement. Greece's de facto domestic default extends to most sectors, from academic book publishers to military contractors. "Payments are long overdue. Before, there was at least a regular flow of payments from the education ministry. Now, we are told to wait," a publishing house executive told the BBC. And the chief executive of an army food contractor said his company had not received any money for products it had delivered to Greece's armed forces some time ago. "Everyone in my sector used to fight hard to do business with the state: it was profitable and safe. Now, the government is the worst customer."

Even industrial conglomerates are feeling the pain caused by liquidity shortages, increasing borrowing costs and frozen credit lines. Firms are postponing much-needed investment and are pleading for a resolution, says Theodore Fessas, chairman of the Hellenic Federation of Enterprises (SEV), which represents companies from most branches and sectors of the Greek economy. "Uncertainty is the greatest problem today. It is now threatening even the healthiest businesses, those that managed, despite the crisis, to pay wages and taxes on time, and fulfil all their obligations."

THAT'S NO WAY TO RUN A COUNTRY...AS WE IN US KNOW, HAVING FLIRTED WITH THE SEQUESTER, WHICH THE GOP LEGISLATURE IS EVIDENTLY TRYING TO RENEW...

IT LOOKS LIKE HAVING TOO MUCH MONEY CRACKS THE BRAIN EVEN WORSE THAN HAVING TOO LITTLE....

Demeter

(85,373 posts)CONSIDERING HOW MUCH OF THE EU IS UNEMPLOYED, THIS FIGURE IS PROBABLY MUCH HIGHER.

http://www.dw.de/german-labor-costs-one-third-above-eu-average/a-18426579

... It said that in Europe's economic powerhouse 31.8 euros ($35.5) were paid on average per working hour, while the EU average stood at just 24.4 euros.

But the fact employers paid that much more than the average didn't mean Germany ended up at the top of the table. In fact, Germany only ranked eighth, far behind the three nations leading the field - Denmark, Belgium and Sweden....

Demeter

(85,373 posts)THIS IS HOW MUCH "FUNNY MONEY" IS FLOATING AROUND THE WORLD...PAPER ASSETS WITH NO INTRINSIC VALUE WHATSOEVER. ADD TO THAT THE BOND MARKET...

http://asia.nikkei.com/Markets/Equities/Global-stock-market-cap-reaches-record-75-trillion

The total market value of stocks traded across the globe hit a record $74.7 trillion at the end of April, helped by the gusher of money flowing into financial systems under monetary stimulus by major central banks.

Combined global market cap, based on data from the World Federation of Exchanges and stock indexes worldwide, roughly matches the size of the world economy for 2015, or $74.5 trillion, estimated by the International Monetary Fund.

Monetary easing has propelled stock prices to historic highs in Japan, the U.S. and Germany. Lately, Chinese shares are surging in light of additional easing measures.

The global stock market cap peaked at $64 trillion in October 2007 and declined before setting a new record in November 2013. The market cap topped GDP in 1999 during the dot-com bubble and again during 2006-2007, before the financial crisis.

The percentage of total market cap relative to the world's GDP is seen as an indicator of market overheating. Closely followed by U.S. investor Warren Buffett, it is also known as the "Buffett index."

The kind of stock craze seen before is absent in the current market, says Yoshinori Shigemi of J.P. Morgan Asset Management. But concern is mounting over stock market rallies led by easy money policy.

Demeter

(85,373 posts)The Pimco Total Return Fund, launched by Bill Gross, has lost its title as the world's biggest bond mutual fund, following two years of withdrawals. On Monday, Pacific Investment Management Inc said investors yanked another $5.6 billion from its flagship Pimco Total Return Fund last month, bringing its assets to $110.4 billion at the end of April. Cash withdrawals in April marked the fund's 24th consecutive month of net outflows.

By comparison, the Vanguard Total Bond Market Index Fund had $117.3 billion as of April 30, according to a Vanguard spokesman.

"We do not view this as an asset gathering horse race," said John S. Woerth, spokesman at the Valley Forge, Pennsylvania-based Vanguard Group. "It is, however, representative of the popularity of low-cost, broadly diversified index funds."

The Pimco Total Return Fund hit a peak of $292.9 billion in assets under management in April 2013. The Pimco Total Return Fund delivered a net after fee return of 1.62 percent year-to-date through April, outperforming its benchmark by 38 basis points, Pimco said.

Gross, the legendary bond manager long known as the 'Bond King,' exited Pimco suddenly last September for smaller rival Janus Capital Group Inc (JNS.N). Pimco has seen about $130 billion of net withdrawals from its open-ended funds since Gross' departure even as performance has improved. Outflows from the flagship Pimco Total Return Fund, which Gross managed since 1987, have slowed to an average of $7 billion to $8 billion a month recently from $23.5 billion in September.

Pimco, which oversees $1.59 trillion in assets as of March 31, announced last week that former Federal Reserve chairman Ben Bernanke was joining the Newport Beach, Calif.-based firm as a senior adviser, as Pimco seeks to bolster its star power following the departure of Gross.

Demeter

(85,373 posts)By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Two weeks ago, when I wrote about the Shanghai Containerized Freight Index (SCFI), the index had fallen so far so fast that it seemed to be a statistical fluke, something that would instantly bounce back. The SCFI tracks the spot rates from Shanghai to various destinations around the world. At the time, the SCFI component for Northern Europe had plunged 14% from the prior week to $399 per twenty-foot container equivalent unit (TEU), down 67% from a year ago. An all-time low. There was a lot of handwringing because, even with the lower bunker fuel costs, the break-even rates for these routes were $800 per TEU, according to a report by Drewry Maritime Research. Over twice the spot shipping rates!

The question was how much lower could rates drop?

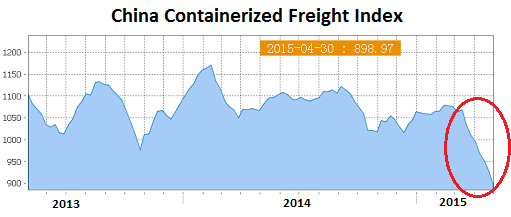

A lot lower. Over the two weeks since, the SCFI for Northern Europe plunged another 14% to $343, setting a new all-time low. A terrific 68% collapse from the same week a year ago. Something big is going on in the China-Europe trade. Carriers have tried to impose big rate increases, with UASC pushing for an increase of $1,300 per TEU, and a gaggle of others going for an increase of $1,000 per TEU, according to the Journal of Commerce. None of them were able to make them stick. The swooning rates came as bunker fuel costs have been rising off their January lows. Higher input costs are hitting container carriers just as revenues are collapsing. A toxic mix. Now the hope is that planned rate increases for June are going to stick….On some other routes, carriers have succeed in raising rates, and so not all routes from China suffered the same relentlessly brutal fate. Rates ticked up recently to the Mediterranean, South America, and the US West Coast. But that doesn’t say much. On the routes from Shanghai to the US West Coast, carriers tried to impose rate increases effective April 1. But after rising by nearly $300 to $1,932 per forty-foot container equivalent unit (FEU) in the first week, the spot rate plunged to $1,623 in the second week, and to $1,596 in the third week. In the week just ended, the index jumped to $1,783. It’s still down 8% from early April, and about back where it was a year ago...Rates lost ground on other routes, such as to Australia/New Zealand and the US East Coast (those rates had been inflated by the labor dispute at West Coast ports that had caused shippers to bypass them). And so the composite SCFI for all routes rose to 761, from 702 which had been the lowest level in years! The index is down 34% from a year ago and far below the multi-year range between 900 and 1,200. The much broader China Containerized Freight Index (CCFI), which is sponsored by the Chinese Ministry of Communications, paints a similar picture.

While the SCFI tracks spot rates from Shanghai to global markets and can be very volatile, the CCFI tracks spot and contractual rates for all Chinese container ports, is much less jumpy, doesn’t react as quickly to changes in spot rates, and is “more comprehensive and macroeconomic,” as the Shanghai Shipping Exchange, which operates it, explains. It’s considered “the second world freight index” after the Baltic Dry Index. And it has skidded 16% since mid-February to a multi-year low of 899. This is what the 2-month plunge looks like:

Another index, the Worldwide Container Index for routes from Asia to the Americas and Europe, which Drewry cites, has plummeted 41% since January to below $1,300 per FEU (ugly chart). Clearly, something is going on in the east-west container business – and beyond – to create this sort of gloom. On top of the list of reasons is weak demand for imports in Europe, particularly the Eurozone, whose currency has been purposefully massacred by the ECB to achieve just that sort of effect: reducing imports and goosing exports as part of the currency war. Imports measured in euros may actually rise, since the same imports are now more expensive. But the number of containers would drop, since the same amount of euros now buys a lot less in China, whose currency is pegged to the dollar...In the US, there has been a monstrous buildup of business inventories. Inventories tie up cash. Eventually businesses try to bring them back in line by cutting orders. And that comes on top of a really crummy first quarter. On the Chinese side, the impact has already shown up, however foggy the figures may be. China’s “official” manufacturing PMI, which was released on Friday, came in at 50.1, barely in expansion mode, and the worst reading for an April since 2005. But it captures the state-owned giants that are less engaged in manufacturing for exports. The HSBC manufacturing PMI, released today, fell to 48.9 in April, solidly in contraction mode, the worst level since April last year. The new-orders sub-index, which points at what the near future might look like, dropped to 48.7. The March PMI had also been in contraction mode. It’s the HSBC PMI that captures the private-sector companies that are heavily export-oriented. These companies are struggling with very lackluster global demand for their products.

In terms of shipping, on the supply side, carriers have been adding new and ever larger ships, now that money is nearly free. Decision makers had been bamboozled into thinking that QE and interest rate repression would stimulate actual demand! And they’d expanded their fleets to meet this illusory demand. Cheaply borrowed money gets plowed into creating overcapacity: Investors desperately chase yield, and companies become over-optimistic believers in the fallacy that central-bank asset-price inflation can create actual demand for everyday goods needed or wanted by real people. This happened in the global resource sector, in the US oil-and-gas sector, in the global shipping business…. These are among the places where money now goes to die.

There are other places where money goes to die as investors who’d bought into the hype get crushed. Read… Stocks in This Totally Hyped Sector Are Crashing

Demeter

(85,373 posts)It started here in Cochabamba, Bolivia, in April 2000, when citizens rebelled against the takeover of their public water system by a foreign corporation.

In what became known as the Cochabamba Water Revolt, thousands of Bolivians faced down bullets and batons to take back their water from Bechtel, the California engineering giant. Within weeks of taking over the local public water system, Bechtel's Bolivian company had hit water users with price increases averaging more than 50 percent, and often far higher. Families faced stark choices between keeping water running from the tap or food on the table.

So they rebelled.

Protesters shut down this city of half-a-million people three times with blockades and general strikes. The right-wing government sent in soldiers and police to defend Bechtel's contract, killing a teenage boy and leaving hundreds of others wounded. But the protests only increased, and finally Bechtel was forced to flee Bolivia, returning the water to public hands.

A year later, however, Bechtel struck back - this time in a World Bank trade court. The company demanded not only the $1 million it had invested in the country, but a full $50 million - the rest being the future "profits" the company claimed it had forgone by leaving.

Bechtel's case against Bolivia sparked a second rebellion. This one was global and just as powerful, a citizen action campaign that stretched worldwide. In the end, Bechtel would walk away not with the $50 million that it demanded from Bolivians, but just 30 cents and a badly damaged public image. The case also ripped the mask off a system of secret trade courts that today sits at the heart of the trade debate.

The Case That Blew the Lid Off the World Bank's Secret Courts

Demeter

(85,373 posts)Hotler

(11,416 posts)I have no hope. I see no future.

DemReadingDU

(16,000 posts)In lots of time, likely after I am in the ground.

Revolt will happen when people have lost everything.

edit

What we could do is to have a nationwide strike, everyone sit in the streets across America and particularly in Washington, D.C. But we won't for all the usual reasons/excuses.

Demeter

(85,373 posts)By Adam Johnson, a freelance journalist; formerly a founder of the hardware startup Brightbox. You can follow him on Twitter at@adamjohnsonnyc. Originally published at Alternet

After raising more in 24 hours than each of the declared GOP candidates individually, Vermont senator and self-described democratic socialist Bernie Sanders went on ABC’s This Week to let America—and the D.C. pundit class that has already written him off—know he’s a real player in 2016. Right out of the gate, when Stephanopoulos asked why he would be a good president, Sanders doubled down on his populist themes:

After a bit of half-snark from Stephanopulous over his embrace of the “S” word, Sanders went on to defend democratic socialism and explain, in detail, why America should be trying to emulate Northern European countries rather than belittle them. The ABC host and former Bill Clinton advisor tried to pin the Vermont senator down, musing aloud, “I can hear the Republican attack ad now: Sanders wants America to look like Sweden,” to which Sanders deadpanned in response, “That’s right. And what’s wrong with that?” Throughout the interview however, the Democratic senator went out of his way not to attack Hillary Clinton outright, repeating his broader themes about runaway inequality and corrupt elections, painting her more as a symptom than a disease:

Watch the entire video below:

http://www.nakedcapitalism.com/2015/05/shocking-fundraising-totals-bernie-sanders-defends-european-style-socialism.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Demeter

(85,373 posts)And assuming I survive Thursday, that means the Weekend will be starting late....and we will devote this Weekend to...

mahatmakanejeeves

(57,393 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/eta20150852.pdf

News Release

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL 8:30 A.M. (Eastern) Thursday, May 7, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending May 2, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 3,000 from the previous week's unrevised level of 262,000. The 4-week moving average was 279,500, a decrease of 4,250 from the previous week's unrevised average of 283,750. This is the lowest level for this average since May 6, 2000 when it was 279,250.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending April 25, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending April 25 was 2,228,000, a decrease of 28,000 from the previous week's revised level. This is the lowest level for insured unemployment since November 11, 2000 when it was 2,161,000. The previous week's level was revised up 3,000 from 2,253,000 to 2,256,000. The 4-week moving average was 2,271,500, a decrease of 20,000 from the previous week's revised average. This is the lowest level for this average since December 9, 2000 when it was 2,266,500. The previous week's average was revised up by 750 from 2,290,750 to 2,291,500.

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending April 18 was 2,334,281, a decrease of 105,948 from the previous week. There were 2,832,693 persons claiming benefits in all programs in the comparable week in 2014.