Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 28 May 2015

[font size=3]STOCK MARKET WATCH, Thursday, 28 May 2015[font color=black][/font]

SMW for 27 May 2015

AT THE CLOSING BELL ON 27 May 2015

[center][font color=green]

Dow Jones 18,162.99 +121.45 (0.67%)

S&P 500 2,123.48 +19.28 (0.92%)

Nasdaq 5,106.59 +73.84 (1.47%)

[font color=green]10 Year 2.13% -0.02 (-0.93%)

30 Year 2.87% -0.04 (-1.37%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)America’s retirement security policies are facing a major crisis. No, not the problem that Pete Peterson, Alan Simpson and Erskine Bowles and other so-called deficit hawks have become famous for exaggerating — the relatively minor mismatch between promised Social Security benefits and scheduled Social Security payroll taxes in the 2030s. The real crisis facing current and future retirees in America’s aging society is the failure of the private components of America’s mixed public-and-private retirement system. When Social Security was created in 1935, it was not intended to be the sole source of retirement income for most Americans. It was assumed that employer-provided defined benefit pensions with guaranteed payouts would supplement Social Security checks for many workers after they retired. Unfortunately, employers have been abandoning defined benefit pensions for decades. The number of private sector workers with defined benefit pensions has fallen from around 40 percent in 1980 to a mere 15 percent today. At the same time, among public sector workers, poor management by state governments, combined with years of economic trouble, has created a crisis for public pension systems in many states.

In order to save money and shift risks to individual workers, employers in the last generation have been switching from defined benefit plans to defined contribution plans like 401Ks. 401K retirement plans and other defined contribution plans, including individual retirement accounts (IRAs), now cover about 42 percent of the workforce as opposed to only about 17 percent in 1979. In these defined contribution plans, savings by individual workers received favorable tax treatment. But the risks, including risks from poor investments and the chance that you will retire during a stock market downturn, fall entirely on the individual. Even worse, many working-class and middle-class Americans with 401Ks are stealthily fleeced by money managers, who charge high and often difficult-to-find fees for allocating retirement money among stocks, bonds and other assets.

Other savings cannot make up for the failure of employer pensions and 401K-type plans. One in four Americans, lacking other liquid savings, has been forced to pay for emergencies by withdrawing prematurely from 401Ks or other retirement accounts. Nearly a third of Americans have no savings account and nearly half do not have enough savings to pay their bills if they lost their jobs. House values, the main source of wealth for most Americans, have been hit hard by the collapse of regional housing bubbles in the U.S. And selling your house to pay for your retirement is like burning down the house to roast the pig, in Charles Lamb’s classic fable.

The failure of the private alternates like defined benefit pensions and 401Ks has made Social Security by far the most important source of income for most American retirees. According to the U.S. Social Security Administration in 2101, 84.3 percent of the income for Americans over 65 in the bottom income quintile comes from Social Security. Even for the middle quintile, Social Security provides 65.7 percent. It is only in the top two quintiles, the income categories in which are found almost all American political donors, politicians, pundits, journalists and policy wonks, that Social Security provides less than half of retirement income — a mere 17.3 percent for members of the top quintile and a microscopic smidgen for elderly members of the 1 percent. In 2013, the federal government will spend $164.5 billion in the form of tax expenditures to subsidize individual retirement savings — with the top 20 percent of American earners reaping 80 percent of the benefits. No wonder there is a bipartisan elite consensus on cutting Social Security, which is of secondary importance to the well-off. Nor is it a wonder that there is no elite movement focused on cutting tax-favored private retirement plans whose benefits chiefly go to members of the top two income quintiles.

To be sure, it is possible to devise tax-favored private retirement savings plans that reduce the risks to individuals from a volatile stock market and lower management fees somewhat. Teresa Ghilarducci has done this with her thoughtful proposal for Guaranteed Retirement Accounts, as has Sen. Tom Harkin, with his smart proposal for Universal, Secure, and Adaptable (USA) Retirement Funds. Either would be an improvement on the present system. If private retirement savings are to be subsidized at all, then 401Ks and IRAs ought to be replaced by less risky plans like these. But to talk about replacing one kind of tax-sheltered private retirement savings plan with another is to play by the rules of the game that the bipartisan elite has set for the Elite Entitlement Debate — the first rule of which is that increases in Social Security, as opposed to cuts, cannot even be considered. But America’s bipartisan elite, through its mismanagement of the economy and its crass selfishness, has forfeited its moral and political authority. The bottom 80 percent and their allies among affluent dissidents need to have a conversation among themselves about the future of American retirement security policy.

If we were allowed to have a genuine, uncensored debate about the future of retirement policy in the United States, the first question we would ask is: Instead of expanding failed private savings programs while cutting Social Security, why don’t we cut private savings programs and expand Social Security? Why don’t we downsize unjust and inefficient programs that shelter the private retirement savings of the rich and affluent from taxation, while boosting benefits paid through the fair and efficient Social Security system? Once the question is framed in this way, the answer will appear obvious to many if not most Americans: We should cut back 401Ks and IRAs and expand Social Security. Until recently, such a suggestion has been unthinkable in the corridors of power in Washington. But expanding Social Security is not only thinkable. It is eminently doable.

Demeter

(85,373 posts)Nowhere is the gap between the needs of the majority and the preferences of the 1 percent greater than in public discussion of Social Security. The rules of the national debate rig the discussion in advance, to the detriment of most Americans and to the benefit of the rich and the financial industry.

The first rule of the rigged retirement security debate is that we, the people, and our elected representatives are allowed only to debate purely public retirement benefits, like Social Security and, for the poor, Supplemental Security Income. According to the rules of the game, we are not allowed to mention or criticize the oceans of money in tax-sheltered private savings accounts that disproportionately benefit the rich — nothing to see here, folks, move along!

The rigged rules of the Social Security debate, furthermore, do not allow any participant to suggest expanding rather than cutting public retirement benefits — why, that’s crazy talk! Only cutting Social Security or, at most, maintaining promised benefits will even be considered as policy options. At the same time, players in the Elite Entitlement Debate game are allowed, indeed, encouraged to propose further expansions in our already-enormous tax-favored private retirement savings programs like 401Ks and IRAs. Calling for combining cuts in Social Security with more tax giveaways for savings, mostly to the rich, proves that politicians are Very Serious People to their Wall Street donors and to the mainstream media pundits who lionize the conservative deficit hawks Alan Simpson and Erskine Bowles.

This rigged elite game explains the perverse political situation we find ourselves in. The conservatives and libertarians demand that Social Security be completely abolished. Progressives reply, “Please don’t abolish Social Security completely — would you please consider letting us help you cut it instead?” Playing the role of the wimpy progressive begging for mercy from the hard right, President Barack Obama reportedly may call for cutting Social Security for 80- and 90-year-olds by means of “chained CPI” in his forthcoming budget.

FixtheDebt, one of the “astroturf” (faux-grass roots) anti-entitlement front groups created by right-wing billionaire Pete Peterson and funded by corporations, many of them in the finance industry, is spending tens of millions of dollars in a short time to pressure the public and lawmakers into cutting Social Security and Medicare. Medicare has genuine long-term cost problems (best addressed by means of all-payer price regulation), but why the pressure from Peterson and many of his fellow plutocrats to cut Social Security? If you want to know the answer, follow the money. As Felix Salmon noted of the FixtheDebt manifesto by the front group’s allied CEOs, “the letter basically just says ‘please cut our taxes, raise taxes on everybody else, and cut the benefits they get from Medicare, Medicaid, and Social Security, which are programs we individually don’t rely upon’. It’s gross self-interest masquerading as public statesmanship.” But the money trail doesn’t stop there.

Cutting Social Security is backdoor privatization — and a bonanza for Wall Street money managers. Cuts in promised Social Security benefits, whether from chained CPI, a higher retirement age, or means-testing, will force middle-class and working-class Americans to try to save even more money in the tax-favored private savings accounts like 401Ks so beloved by the Wall Street financiers who fund both Democrats and Republicans. Working Americans will be invited to do so, by means of tax incentives, or forced to do so, by means of compulsory savings mandates (a possibility opened up by Obamacare’s individual mandate forcing Americans to purchase private health insurance from for-profit companies). The result: enormous torrents of money from middle-class and working-class Americans would be steered into for-profit mutual funds, for-profit annuities, and other for-profit private retirement savings vehicles, from which the financial middlemen can skim off even more fees and bonuses. In the for-profit money management industry, the mere prospect of cuts in Social Security triggers the sweet sound of cash registers: Ka-ching, ka-ching, ka-ching.

MORE

AUTHOR Michael Lind is the author of Land of Promise: An Economic History of the United States and co-founder of the New America Foundation.

Demeter

(85,373 posts)President Obama reportedly is unveiling a budget using the chained CPI inflation measure to cheat elderly Americans out of the benefits they were promised. In two previous posts I’ve explained the perversity of the current debate about Social Security. The tax-favored private components of America’s mixed private-public retirement system — programs like employer pensions, 401Ks and IRAs — are inefficient, volatile and subject to manipulation by overcompensated, fee-extracting money managers. In contrast, the Social Security program is simple and efficient, and has low overhead costs. And yet the bipartisan establishment, including many “progressive” Democrats as well as Republicans, wants to cut Social Security — the part that works — and expand tax-favored private savings, the inefficient, unstable and inequitable part.

While cutting Social Security makes no sense at all in terms of economics or public policy, it makes excellent sense in terms of the selfish class interests of the super-rich. They have extracted about half the gains from economic growth in the U.S. in the last half-century and recycle some of their profits to fund politicians, and lobbyists, as well as mercenary propagandists who pose as neutral think tank experts. Social Security’s contribution to the retirement income of the rich is negligible, while the top 20 percent receives around 80 percent of the income from tax-favored private retirement savings accounts like 401Ks. Naturally many of America’s oligarchs want the public discussion to be solely about cutting Social Security benefits for the bottom 80 percent, rather than 401Ks for the top 20 percent. To paraphrase Leona Helmsley, Social Security is for the little people. And if we cannot afford all of our present public-plus-private retirement system … well, as the saying in Tsarist Russia had it, let any shortage be shared among the peasants.

Elite discourse on this subject is radically at odds with public opinion. According to a February 2013 Pew poll, only 10 percent of Americans want to cut Social Security while 41 percent want to increase Social Security benefits. It’s time to change the public conversation about retirement security in America to reflect the beliefs and interests of the struggling many, not the fortunate few. We need to change the subject from cutting Social Security while subsidizing luxury retirements for the elite to cutting retirement subsidies for upper-income groups while expanding Social Security benefits for the majority of American retirees.

The simplest way to expand Social Security would be simply to expand the present Social Security program: Old Age and Survivors Insurance (OASI). But OASI is paid for solely by the payroll tax, a regressive tax that falls most heavily on lower-income workers. Today individuals pay the payroll tax only on wages up to$113,700. Raising the payroll tax cap could contribute to reducing the shortfall between payroll tax revenues and promised Social Security benefits that is expected to open up in the 2030s. Lifting the cap entirely might eliminate the shortfall entirely.

But even if the present system’s future funding needs are met, Social Security as it now exists is inadequate to compensate for the rapid disappearance of traditional pensions and the failure of 401Ks, IRA(s) and other tax-expenditure-subsidized private retirement savings. And Social Security is not very generous, by international standards. In the Natixis Global Retirement Index, the U.S. ranks 19th — behind countries like Slovakia and the Czech Republic. The gross replacement rate for the average earner (how much pre-retirement income is replaced by public or publicly mandated benefits) is only around 40 percent, while the average in the European Union is more than 60 percent.

In response to the failure of the private retirement system, we should go beyond merely maintaining the public share of retirement income to expanding it. In a new paper, “Expanded Social Security: A Plan to Increase Retirement Security for All Americans,” Steven Hill, Robert Hiltonsmith, Joshua Freedman and I propose boosting public benefits from 40 percent to 60 percent of pre-retirement income for the medium earner, making reliance on failed and inequitable private savings programs less necessary. We would do so by fully funding the existing OASI program, which would be renamed Social Security A, and adding an additional universal, flat benefit called Social Security B.

As a thought experiment, we calculated how big Social Security B would have to be in 2035, if Social Security A and B combined were to add up to 60 percent of pre-retirement income for the average earner instead of today’s 40 percent for today’s Social Security alone (the thought experiment is not wholly realistic, as it leaves out transitions from the present system and other complications). Strikingly, the inflation-adjusted number that resulted from this back-of-the-napkin thought experiment, $11,699 a year, is very close to what a poverty-level, universal basic income for the elderly would be; in 2013 the official poverty level for a single individual is $11,490.

Because Social Security B, like Social Security A, would be universal, all economic classes would benefit, although in diminishing degrees as their other sources of retirement income rose. While the biggest winners would be low earners, who would enjoy nearly 100 percent pre-retirement replacement rates from public funding in the new system, high earners would benefit somewhat as well.

To pay for the two components of Expanded Social Security — fully funded Social Security A and the new flat benefit, Social Security B — we would have to raise an additional 5 percent of GDP a year in taxation. While that sounds like a lot, the only relevant number is the percent of GDP that would be disbursed to retirees by all government-sponsored programs — a category in which we include defined benefit pensions, 401Ks and IRAs as well as today’s Social Security program. Under our scenario, in 2035 a slightly lower portion of the economy would be devoted to government-backed public and private retirement plans than would be the case if our present system continues unchanged.The funding of Expanded Social Security would also be far more progressive than today’s system.

The present OASI program, although it is funded by a regressive payroll tax, is moderately redistributive in its benefits formula. The additional Social Security B benefit we propose would be a universal basic income for the elderly paid for by taxes other than payroll taxes, such as general revenues, or a dedicated tax, such as a portion of a new federal value-added tax. Either general revenues or a VAT from which necessities were exempted would be far more progressive than the payroll tax, increasing the progressivity of the new two-tier Social Security system on the revenue side. While our plan devotes no more money to spending on retirement, as a share of the overall American economy, than does the present system, the well-off minority of American would take a big hit, notwithstanding the small benefit they derive from Social Security B.If the present system continues, then tax-sheltered private savings plans will pay out more in retirement income in 2035 (7.5 percent) than unreformed Social Security (5.6 percent). Most of that 7.5 percent will go to the affluent and the rich.

What possible public interest can there be in having all American taxpayers subsidize the retirement savings of the rich? If any tax-favored private savings plans are to exist at all, there should be strict contribution limits — say, $5,000 per year — to prevent the rich from squirreling away money and benefiting from compound interest at the taxpayer’s expense. The wealthy supporters of Social Security cuts say Americans should compensate by saving more. Well, let the rich set an example by saving more if they want to, once we take away most of their retirement savings tax breaks.

Needless to say, in today’s money-soaked Washington the chances that our Expanded Social Security plan will be enacted are slim to none. Our purpose in putting forth this plan is to change the debate by moving the goal posts. Today the “progressive” position is merely paying for promised benefits; the “conservative” position is abolishing Social Security completely; and the “moderate” or “centrist” position is cutting Social Security.

In the new debate — foreshadowed not only by our plan, but by influential thinkers like Josh Barro, Matthew Yglesias and Duncan Black, who might not endorse our particular proposal — the new “progressive” position, as it were, would be dramatically expanding Social Security; paying all promised benefits would be the new “center”; and cutting Social Security, by means of a higher retirement age, means-testing, or using inflation to rob seniors of promised benefits (“chained CPI), would be the right-most position. President Obama, in reportedly proposing to cut benefits for the elderly with chained CPI, should be careful, or he will end up looking as right-wing in retrospect as President Clinton does now for signing rather than vetoing the Defense of Marriage Act.

Until now, the debate about the future of Social Security has been rigged by the rich and right wing and their minions. It’s time for a genuine debate to begin.

This is the third in a three-part series. Read parts I and II POSTED ABOVE

Demeter

(85,373 posts)By Gaius Publius. Cross posted from AmericaBlog

Bottom line first, since this is turning long. For the owners of the country (and their paid national managers), the real emergency associated with Social Security isn’t the day the last dollar will leave the Trust Fund. It’s the day the first dollar will leave. That’s a whole different problem, and a whole different timeline, for them.

How did I come to that conclusion? Read on.

Why are benefit cuts one of Obama’s must-have goals?

In 2010, I started working on a thesis here at La Maison about the Social Security Trust Fund and have decided to both resurrect it and see what the numbers around it look like.

Some background: I’ve written about Obama’s (and neoliberalism’s) four big economic goals for his two tours of duty. For me, they are:

Health care “reform” — a privatized alternative to Medicare expansion [done]

A “grand bargain” in which social insurance benefits are rolled back [in work]

Plentiful oil & gas and passage of the Keystone Sludgepipe (KXL pipeline) [in work]

Passage of the Trans-Pacific Partnership (TPP) trade agreement [in work]

One of them doesn’t look like the others — item 2.

You can see the obvious benefit to billionaires and owners of the political system of a public-private health care “partnership” that enriches insurance and Pharma CEOs (item 1). On the oil front, Keystone will make David Koch and the other carbon lords even wealthier, and plentiful oil will extend the carbon regime from which so much wealth is extracted (“drilled”) out of the economy (item 3). Finally, TPP is just a geo-political wet dream for corps and their CEO owners, a one-stop international treaty that would elevate corporate power above sovereign power everywhere it’s implemented. New World Order indeed (item 4).

But benefit cuts? Why are both parties so hell-bent on eliminating or cutting Social Security benefits? Is there really that much at stake — for them? I’m going to slow-walk the answer in this post, and follow up later with numbers (this is turning into a research project on the numbers side). Let’s start with this …

The push to gut Social Security is real in both parties

First, make no mistake, both parties want to gut or kneecap Social Security. On the right (which is to say, among the rulers of the Republican party, not the voters) the Trust Fund is a big fat fruit, ripe for plucking and eating — $2.7 trillion and counting. That’s a lot of money to divert into the stock market, as Bush II tried to do in 2005. He was beaten back, partly because he was a Republican (keep that part in mind); but he gave it the college try.

On the “left” (as the Neoliberal rulers of the Dems like to brand themselves), the push is no less strong, but with slightly different changes on offer. The Wall Street billionaires would love to steal the Trust Fund outright, but you can’t sell that to Democratic voters, so when the “left” is in power, they don’t try to kill it so much as kneecap it, hobble it, cut its little hamstrings to keep it from walking.

The first Neoliberal president — the man who led the corporatization of the Democratic party — was Bill Clinton. He was also the first Democrat to rule after 12 years of Republican “revolution” that started in 1980, the year when everything changed. (Yes, you could call Carter a proto-neoliberal and be right, but that’s a tweak for this discussion.)

Clinton started the push to “fix” Social Security from the “left.” My earliest pieces written at this site addressed Clinton, Social Security and the Trust Fund. About Clinton, from May 2010:

Like Nixon to China: Obama and Social Security

Just like it takes a Republican to open Communist* China, it takes a Democrat to kill Social Security. … If you thought the corporate gifts in the so-called Health Care bill were bad, just wait till Obama’s so-called Deficit Commission gets its claws into Social Security.

Jane Hamsher put up a must-read article earlier this week that serves as a intro to her online salon with Steven Gillon, author of The Pact: Bill Clinton, Newt Gingrich, and the Rivalry that Defined a Generation.

In her intro, Hamsher discusses how Clinton worked with Newt Gingrich to pass pass a “fix” to Social Security. There were secret meetings and everything. (It almost looks like a club, doesn’t it.) The plan included the usual witches’ brew — cutting benefits, raising the retirement age, and fiddling with the cost of living increase. Even privatization was on the table, according to Gillon.

That effort failed, thanks to Clinton’s wandering mind . . . and Monica Lewinski. According to Gillon, the Monica scandal forced Gingrich back into the loving arms of his base, and killed the deal they were cooking up.

About those attempts, Hamsher wrote (my emphasis):

Clinton had been trying to deal with Social Security for some time. In 1994, HHS Secretary Donna Shalala had appointed the 13-member Danforth Commission to advise on Social Security. She appointed three members from labor (including Richard Trumka), Republican Alan Simpson (appointed by Obama to co-chair his Deficit Commission with Bowles) and Pete Peterson (the hedge-fund billionaire funding much of the current economic work being used to justify dismantling Social Security).

Pete Peterson was a member of the commission Clinton appointed to “fix” Social Security. Let that sink in. This is why Clinton regularly speaks at big-deal Pete Peterson events (well, that and the potentially lucrative speaking fees).

Click through for the details — Erskine Bowles was Clinton’s reach-out man to Gingrich.

Clinton, Peterson, Simpson, Bowles in 1994. Obama, Peterson, Simpson, Bowles in 2010. If the complicit corporate media weren’t so silent (that’s you, MSNBC), this would all be seen as one big push on the Dem side, just like Bush II in 2005 and Paul Ryan privatization today is one big push on the Republican side.

Your must-remember takeaway — Bill Clinton was as eager a benefit-cutter then as Barack Obama is now, and for the same reason. It’s a two-party effort and always has been. But what’s the reason? To answer that, we have to look at the Social Security Trust Fund, created during the Reagan years by the Greenspan Commission.

What’s the real purpose of the Trust Fund?

As a follow-up to the “Nixon to China” piece quoted above, I tried to tease out just what Social Security and the Trust Fund were, from the standpoint of the billionaires (then mere multi-millionaire pups) and their minions in the 1980s (new emphasis and some reparagraphing):

How to kill Social Security: Be ignorant about it

… It seems that despite years of public discussion — from the Bush push of 2005, to Obama’s suspected embrace of a Peterson cat food future — many of us still don’t know what Social Security is and how it’s been used. And that’s how they’ll kill Social Security — by turning our ignorance against us. So in the interest of actual information, a few basics:

1. You don’t contribute to your own retirement. You never did. No one did. Your parents’ money went to your grandparents. Your money goes to your parents. Your kid’s money goes to you. It’s an inter-generational contract. It always was.

This is not a program that’s designed to manage your money for you. It’s a program that’s designed to do “good works” — every generation keeps its parents off of cat food. Period. That’s the whole goal. …

2. You already “fixed” Social Security, in 1983. In that fix, Ronald Reagan and the Greenspan Commission (yep, Alan Greenspan) recommended increasing Social Security taxes on the middle class, but not on the Big Boys, the wealthy. The declared goal was to put tons of cash into the Social Security Trust Fund — create a huge rainy day stash — for when Boomers started retiring. (If you click the Trust Fund link, watch what happens to the last column, the total amount, starting in 1984.) … They robbed you once, so they wouldn’t have to do it twice. … [And they failed to adjust for this, which made things worse for us going forward.]

3. Reagan used that earlier “fix” to hide much of his massive deficit, to make it look smaller. That was the real goal (or if you’re feeling kind, the other real goal) of beefing up the Trust Fund. … [D]o you think either of them cared two twits about fixing … a future in which they themselves would be dead? The facts show just the opposite. What they really cared about was destroying the future — “starving the beast” in politer terms — while making it look like the beast was partially fed. …

The Reagan tax cuts steadily lowered the rate on the top dollars earned (keep that “top dollar” point in mind; mere mortals never saw those rates) from 70% to 50%, then to 28%. Those tax cuts, plus his massive spending, made the deficit rocket skyward. Mission accomplished; beast starving.

But how to make that deficit look smaller to the easily fooled? Simple. Grab a huge pile of cash from the middle class, invest that cash in Treasuries, and declare those Treasuries off-budget. Voilà — beast looks partially fed. …

4. The real goal of [the Clinton, Obama] fix is to hide the looting of the last fix. Just like the last time, the goal isn’t [fixing] Social Security itself. The last fix hid the mounting deficit in off-budget Treasuries. But soon those Trust Fund Treasuries might actually get cashed. Since the government would have to borrow to replace them, that transfers the off-budget numbers back on-budget. Oops. …

[T]he deficit hawks aren’t worried about spending the last dollar of the Trust Fund. They’re worried about spending the first dollar. They’re searching for what they can take from you, the impotent many, so that no dollar of the Trust Fund gets spent [and the powerful few never see another tax increase]. …

And there’s your answer. They used your money to patch and paper a hole. The cover-up of that patch job keeps them all in office; keeps them all from looking like thieves and you from looking like dupes and patsies; keeps the rube wallets open for the next round.

Bottom line

You could answer the headline question above (“What’s the real purpose of the Trust Fund?”) in either of the ways indicated above:

▪ You could be generous and say that someone somewhere in this mess — someone at the decider level — actually cared about Social Security, as well as about the looting, that there were perhaps good and bad goals intermixed. In the 1980s that may have been true; I’m not sure. Is it true today?

▪ Or you could say that no one at the decider level really cares about the program itself. They care about the political effect of having (but not ever spending) the Trust Fund’s $2.7 trillion.

When I see people talking today about “protecting Social Security” while (a) starting to dismantle it, and (b) ignoring one of the biggest sources of real revenue — removing the income & salary cap — I can only pick the second choice above, certainly for the post-1980s crowd. Heck, if Clinton had looked at wealth inequality and simply raised the salary cap to its original level — to capture 90% of all income, as it did in 1984 — the Trust Fund would have $1.2 trillion more today. But that wasn’t going to be his solution. Pete Peterson and Alan Simpson were on Clinton’s commission for a reason, and we all know what Peterson and Simpson want — dismantlement and benefit cuts. The knife.

It’s one thing to say you need revenue and then misallocate it. It’s another to start cutting the program itself. At the level of the deciders today (and them only, not the great economists and experts lower down), this is not at all about Social Security; it’s about the political effect of having and using the Trust Fund, and only that.

Note that I twice said “political effect” of the Trust Fund. This is not about numbers either; numbers are just the shell game, the fog. It’s about power, staying in power, keeping people who keep them in power happy. It’s about not raising taxes while screaming about the deficit. Manipulating the Trust Fund has a role to play.

The Republican Party’s owners (their donors) want to loot the Fund and will say so. Again, recall the Bush Push of 2005. The present owners of the Democratic Party includes Wall Street, and they too would like to confiscate the Trust Fund (by “investing” it for you and depleting it with fees). But Democrats can’t say they are looting, because “starve the beast” (and feeding on the flesh) has to be sold differently to Democratic voters.

Democratic voters have to be told they’re “helping,” serving the interests of the next generation. So from the “left” the idea that cutting benefits (shrinking the program itself) trumps cashing in any of the Trust Fund … that has to look like “reform,” not just straight theft, or it won’t begin to fly.

So we’re back to the beginning. Like Nixon to China, it takes a Democrat to put the first knife into Social Security and reduce its actual size. That’s why “benefit cuts” is high on the must-have list of each Democrat who takes the post-Reagan princely throne. Each one … including the next one, in case Obama fails.

Next up in this series

This is theory, explanation, and needs to be fleshed out. I’m going to see if I can get some numbers. The size of the Trust Fund is known, but this is also about dates. The Bigs (who love you and want you to be happy) tell you that the care-about date is 2035 (or whenever), the day the Trust Fund runs dry. That deadline induces yawns, one of the problems that its eager promoters have.

But if I’m right, the real deadline is when the first dollar leaves. When is that? Right now, I don’t know. And when that occurs, what’s the rate of decay? What does that graph look like? Again, I don’t know, but it matters. That’s the rate at which the general fund has to make up for the loss, somehow.

I’d love to find out both data pieces, wouldn’t you? Especially the date when the Trust Fund starts cashing those Treasuries. I’d bet money that this is the cause that’s making the Bigs panic and sweat. Stay tuned.

Demeter

(85,373 posts)Hotler

(11,412 posts)Demeter

(85,373 posts)WITH OBJECT LESSONS FOR THE US--GOOD READ

http://www.nakedcapitalism.com/2015/05/corruptionomics-in-italy.html#comment-2448749

As reader Li, an international road warrior, says, “America is getting to be just like Italy, except without the attractive men.” While the US has always had some corruption (and it’s been rampant at points in our history), it’s been striking to see how conduct that would have been deemed thirty years ago as unacceptable within the ruling class is now seen as business as usual. And in keeping with increased social acceptance of chicanery (at least among the upper classes) has come a spate of economic articles that contend that corruption can spur growth. This post argues that “corruptionomics” is costly. While Italy is a standout case, NC regulars will not doubt see the parallels here and in other advanced economies.

By Alessio Terzi, an Affiliate Fellow at Bruegel. He was formerly a Research Analyst in the EMU governance division of the European Central Bank and has also worked for the macroeconomic forecasting unit of DG ECFIN (European Commission), the Scottish Parliament’s Financial Scrutiny Unit, and Business Monitor International, a country risk and forecasting firm in the City of London. Originally published at Bruegel

In line with its National Reform Programme for the period 2015-16, Matteo Renzi’s government obtained parliament’s approval on a new anti-corruption law on May 21. We document the sheer size of corruption in Italy and argue that tackling it is not only a matter of fairness, but also crucial to boost the country’s potential output after three years of recession and almost two decades of stagnation. Experience from past success cases suggests that only forceful and comprehensive actions will succeed in bringing corruption under control...

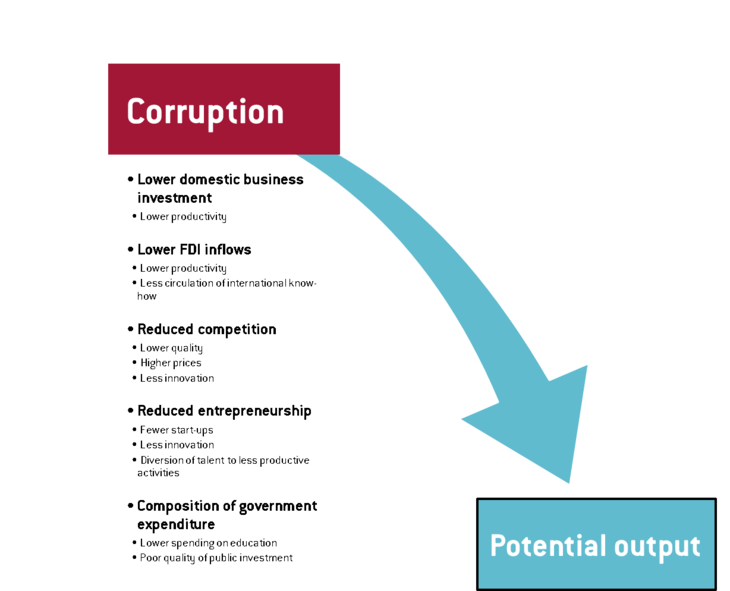

However, dynamically, corruption also distorts economic incentives and, in turn, weighs on potential output. The literature has identified several channels through which corruption affects a country’s medium- and long-term growth potential. The most relevant ones for an advanced economy like Italy are:

1. Domestic investment: Corruption not only reduces investment profitability, but also generates uncertainty in the returns to investment. This in turn will affect a country’s total factor productivity and potential output. Empirically, Mauro (1996), Dreher and Herzfeld (2005), Pellegrini and Gerlach (2004), only to mention a few, test this channel and all find a statistically significant negative effect of corruption (however measured) on investment.

2. Foreign Direct Investment: for the same reasons mentioned in point 1, corruption also directly reduces inward FDI, as argued by OECD (2013a). This is particularly problematic as the latter is associated with the international transfer of technology and management know-how, and hence the rate of technical progress – all crucial contributors to long-term growth.

3. Competition: Corruption can weaken antitrust enforcement, create barriers to new entry, or generate other barriers that preserve the privileges of established firms, as documented by OECD (2010). Weaker competition will affect productivity growth and innovation, as spelled out in Mariniello et al (2015).

4. Entrepreneurship: As rewards from entrepreneurial activity shrink, potential entrepreneurial talents might be diverted to alternative carriers in rent-seeking activities, as argued by Murphy et al (1999). The result will be less entrepreneurs, less start-ups, less innovation, and ultimately, lower growth. The validity of this channel in developed economies was recently tested and confirmed by Avnimelech et al (2011) by using a unique LinkedIn-based dataset.

5. Quality of government expenditure: Corruption will impact the level and composition of government expenditure. Firstly, it will increase the cost of goods and services purchased by the public sector, reducing the funds available for productive government use. Secondly, it will affect the composition of expenditure, as resources will be diverted to headings where corruption can be more easily concealed (see IMF, 1998).

Figure 1. Transmission channels of corruption on potential output

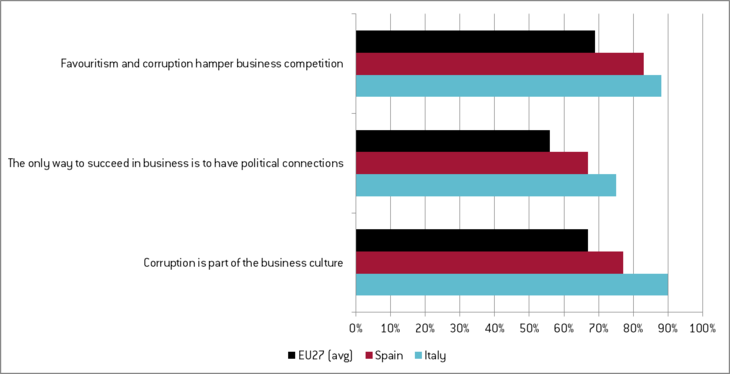

Figure 2. Share of affirmative answers in a 2014 Eurobarometer Survey

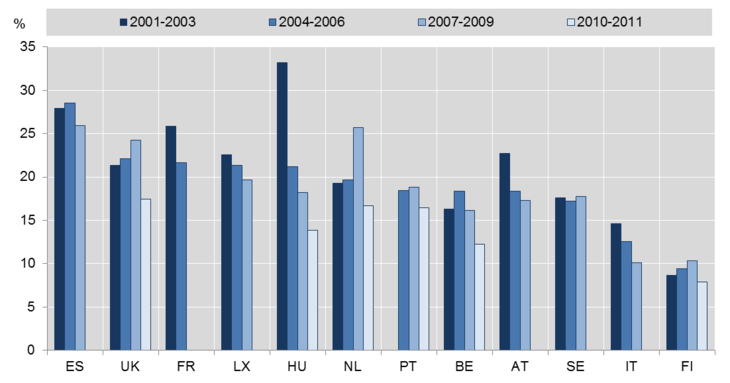

Figure 3. Fraction of start-ups (less than 3 year old) among all firms

Demeter

(85,373 posts)www.nakedcapitalism.com/2015/05/americas-first-black-president-throwing-slaves-under-the-bus-on-tpp.html

Huffington Post has reconfirmed its reporting from over the past weekend, namely, that the Administration has a hairball to untangle to get Malaysia to sign the TransPacific Partnership. Basically, Malaysia needs to have an anti-slavery provision that was inserted in the bill in committee watered down. And the reason that that has to happen, as our reader Antifa pointed out in comments, is that Malaysia controls the Straits of Malacca, a critical shipping choke point. One of the major objectives of the pact is to strengthen America’s position in the region relative to China. Thus Malaysia’s location makes it a critically important signatory to the pact.

From the Huffington Post account (emphasis ours):

The provision, which bars countries that engage in slavery from being part of major trade deals with the U.S., was written by Sen. Bob Menendez (D-N.J.). At the insistence of the White House, Menendez agreed to modify his language to say that as long as a country is taking “concrete” steps toward reducing human trafficking and forced labor, it can be part of a trade deal. Under the original language, the country that would be excluded from the pending Trans-Pacific Partnership pact is Malaysia.

But because the Senate is the Senate, it was unable to swap out the original language for the modification. (The chamber needed unanimous consent to make the legislative move, and an unknown senator or senators objected.) So the trade promotion authority bill that passed Friday includes the strong anti-slavery language, which the House will now work to take out to ensure that Malaysia (and, potentially, other countries in the future) can be part of the deal.

Observers are left with a deeper question: Why, in the year 2015, is the White House teaming up with Republican leaders essentially to defend the practice of slavery?

Cue Antifa:

Which would neuter the US Navy in that part of the world, reducing them to observer status. When people at the Pentagon talk about America’s role as the world’s policeman, they are talking about the Navy’s ability to project overwhelming force wherever and whenever needed. The three little chokepoints world trade and shipping depend on are the Strait of Hormuz, the Straits of Malacca, and the Panama Canal. Taking one of those and giving control of it to China and Friends — or to anyone but the US Navy — puts the world’s policeman in a clown suit.

And Andrew Watts added yesterday:

The only reason why business and intellectual property rights is apart of the deal is because Obama needs to bribe as many domestic power centers as possible to pass it. This is straight outta his Obamacare playbook. The reason for the secrecy is probably due to the military nature of the pact. in any case nobody wants the perception that this is preparation for some future Sino-American war.

But if I were a Chinese political leader in Beijing I would not trust any assurances to the contrary that come from Washington.

Strait of Malacca control was also one of the domino theory issues that contributed to the Vietnam War.

Correct. Which proves that the US military has always had it in it’s sights AND they’re willing to go to war for control over it.

Of course, one might ask why we are now working so hard against China after having made the US dependent on her by allowing, even encouraging, US multinationals to outsource and offshore manufacturing in China.

A Malaysian government official effectively confirmed that the government expects Fast Track authority to include the watering-down language in the amendment that the Senate failed to pass:

“TPP is still being discussed and nothing has been finalised yet,” Mustapa told Malay Mail Online.

“In the event discussions are concluded, the outcome of these discussions will go to Cabinet and Parliament for approval. Regarding our Tier 3 position on human trafficking, this could be resolved if a Tier 3 country is seen to be taking concrete steps to implement recommendations in the Trafficking in Persons report,” he added.

Mustapa was referring to the US State Department’s annual Trafficking in Persons report that downgraded Malaysia last year to Tier 3, its worst ranking on human trafficking abuses globally.

Notice that same “taking concrete steps” phrase? That’s straight from that failed amendment.

As the Huffington Post’s Ryan Grim said in his initial report over the weekend:

Since Obama has had the embarrassing spectacle of having set a ministerial meeting for the TPP this week at which the other intended signatories were to give their final offers, based on the assumption that Obama would have Fast Track authority in hand. the negotiators increasingly doubt that Obama can get the bill passed this year, and the general assumption is that Congresscritters won’t touch this issue in 2016, an election year.

I strongly urge you to keep calling your Senators and Representatives. Concentrate on the slavery issue, since there is opposition on the right and left, and the folks on the Hill are likely not well prepared for voter pressure on this aspect of the sausage-making, since the MSM has pointedly ignored it. I’d also call Hillary Clinton’s office, and tell her staffers how deeply disappointed you are that she clearly supports the TPP (see this Gaius Publius post for details), even though she has tried to keep that under wraps. Tell her that anything less than vocal opposition is a dealbreaker for you as far as her presidential candidacy is concerned. Thanks for keeping the pressure up!

Demeter

(85,373 posts)It was never a marriage of love. China’s heart was always with that handsome dashing young man (Russia) who unfortunately was too poor at the time (90ies). She went with her head and chose the older but rich man whom she thought would build her a better future. But, after years of bitter hard work where she gave him her best years, she discovered that he never intended to leave her his fortune. It will all go to his children from a previous marriage. She will get nothing, nothing for her good looks disfigured by the unremitting toil, nothing for the anguish of nights spent worrying about the menage’s finances. And now, two decades later, with the flower of her youth gone, she is clumsily trying to win back her first love, the dashing young man who in the meantime inherited an immense fortune and is swarmed with proposals by the most attractive parties.

*****************************************

That’s a rather strange analogy and way to think of it, given the fact that China has our fortune now ( our vast massive offshored industries held captive in a foreign land) and we have nothing.

I think the ChinaGov is much more pragmatic and less sentimental than to think in these terms.

They will stay interwoven with America as long as America still has industry and technology and science left to steal. When China has squeezed all the profitable juice out of America, China will figure out how to cast America aside like an old shoe.

*****************************************

The top 10 Reasons why Malaysia’s Slaves Get Thrown under the Bus

Reason #10

They’re not slaves, they just have limited career opportunities.

Reason #9

A job without pay is still a jawb!

Reason #8

Hey, it’s the tropics! People pay good money to go boating down there.

Reason #7

Some studies show they’ll be even worse off if China takes over.

Reason #6

Well, if they’re willing to work hard, someday they can be a captain themselves.

Reason #5

All they need is access to consumer credit and they can buy their way out.

Reason #4

After a tough day in the office, working up a sweat on a boat deck sounds like fun.

Reason #3

That’s why they call it the Straits of Macaca.

Reason #2

if slavery is where market wages clear, then who are we to judge?

And Reason #1 why Malaysia’s slaves get thrown under the bus . . . drum roll please . . .

Because then they’ll get taken to an emergency room, and we all know poor people get free healthcare, a bed and hospital food whenever they want, right? whoa!

Demeter

(85,373 posts)Senators who voted last week to Fast Track ratification of the Trans-Pacific Partnership (TPP) call it a free trade deal, but really, it’s forced trade imposed on protesting American workers who have endured its damaging effects for decades.

Under the free trade regime, rich and powerful corporate interests have hauled in ever-higher profits as they shipped manufacturing overseas to low-wage, no-environmental-regulation countries. Meanwhile, American workers lost jobs, health benefits, income and all sense of stability.

For the past 50 years, the government provided compensation to some American workers who suffered because of trade deals. They got Trade Adjustment Assistance, a little bit of money to help them subsist and retrain after losing their jobs. Now, the wealthy beneficiaries of free trade, and the Republicans they fund, contend that senior citizens should pay the cost of Trade Adjustment Assistance. That Republicans feel it’s appropriate to cut Medicare to cover the cost of Trade Adjustment Assistance illustrates how deeply flawed American trade policy is. It is based on the philosophy that workers and the retired should suffer to facilitate the rich getting richer....MORE

Demeter

(85,373 posts)Bangladesh

Bolivia

The central bank of Bolivia, El Banco Central de Bolivia said in a statement:

“It is illegal to use any currency that is not issued and controlled by a government or an authorized entity.”

China

Ecuador

The ban by Ecuador makes the most sense of any ban, as they are building a national electronic cash system, so they feel the need to protect their new currency from something clearly superior. A decentralized currency of finite production that cannot be manipulated by governments or banks might dim the lights on their new program in the eyes of the public, which offers none of those benefits.

Iceland

As of March 19, 2014 the Central Bank of Iceland issued a statement explaining the legal status of digital currency in Iceland. Purchasing them may violate the Icelandic Foreign Exchange Act, which specifies that Icelandic currency cannot leave the country. A nebulous designation, but it sounds like it is banned, in effect.

India

Russia

Sweden

Thailand

Vietnam

MattSh

(3,714 posts)Russian Court Overturns Bitcoin Website Ban

Russian Bitcoin supporters have something to celebrate after a regional court decided to overturn an earlier decision to ban a number of websites linked to the cryptocurrency, although it remains to be seen if the federal government will go along with the ruling, Kommersant reports.

Russia has taken a tough stance against Bitcoin in contrast to other nations that have been more open to the technology. Last year, the government decided to ban Bitcoin-related activity, and promptly blocked access to several of the most popular Russian-language Bitcoin sites.

The decision was taken by the Russian telecommunications regulator Roskomnadzor in January of last year. At the time, the agency said the ruble was the only legal currency in Russia, and that anyone using alternative currencies could face penalties.

As a result of this decision, bitcon.org, indacoin.com, coinspot.ru, hasbitcoin.ru, bitcoinconf.ru, bitcoin.it, and BTCsec.com were all blocked in Russia, while several other Russian Bitcoin startups decided to relocate outside of the country in an effort to avoid any legal problems.

Complete story at - http://russia-insider.com/en/technology/russian-court-overturns-bitcoin-ban/ri7161

Demeter

(85,373 posts)Ascension Health, which owns a chain of medical facilities across the country, has announced plans to raise its minimum wage to $11 an hour, nearly four dollars over the federal minimum wage of $7.25. The change, which will take effect in July, will raise the wages of 10,500 people. The Tennessean looked at the impact at one major hospital in Tennessee, Saint Thomas Health. At that hospital, 521 people will see wage increases – in a state that leads the country in minimum wage jobs (7.4 percent of Tennessee workers work at or below the minimum wage, 117,000 workers in all).

The paper interviewed one CEO of a hospital about the logic behind the wage hike, and he explained that the operations of the entire hospital depend on paying the workers more money:

"All of a sudden your hospital is brought to its knees by not having the minimum wage staff," Davis told The Tennessean following the last ice storm in early March.

“Our Mission is to advocate for a compassionate and just society, and the first principle of a just society is the common use of goods, which individuals access primarily through wages,” said Anthony R. Tersigni, Ascension's CEO. “We believe our associates deserve a socially just wage that acknowledges the dignity of the human person and the spiritual significance of the care they provide every day to those we serve and to their fellow associates.”

http://www.alternet.org/hospital-chain-lifts-its-minimum-wage-nearly-11000-employees?akid=13145.227380.elchVi&rd=1&src=newsletter1036981&t=18

MattSh

(3,714 posts)Who'd have thunk that?

Demeter

(85,373 posts)for example

Demeter

(85,373 posts)mahatmakanejeeves

(57,376 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/eta20151036.pdf

News Release

TRANSMISSION OF MATERIALS IN THIS RELEASE IS EMBARGOED UNTIL 8:30 A.M. (Eastern) Thursday, May 28, 2015

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS

SEASONALLY ADJUSTED DATA

In the week ending May 23, the advance figure for seasonally adjusted initial claims was 282,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 274,000 to 275,000. The 4-week moving average was 271,500, an increase of 5,000 from the previous week's revised average. The previous week's average was revised up by 250 from 266,250 to 266,500.

There were no special factors impacting this week's initial claims.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending May 16, an increase of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending May 16 was 2,222,000, an increase of 11,000 from the previous week's unrevised level of 2,211,000. The 4-week moving average was 2,221,250, a decrease of 8,500 from the previous week's unrevised average of 2,229,750. This is the lowest level for this average since November 25, 2000 when it was 2,211,250.

UNADJUSTED DATA

....

The total number of people claiming benefits in all programs for the week ending May 9 was 2,126,837, a decrease of 68,872 from the previous week. There were 2,553,581 persons claiming benefits in all programs in the comparable week in 2014.

MattSh

(3,714 posts)A coup d’état like no other before in history. What the US pulled off today regarding FIFA has bizarre parallels to the US coup d’état in Ukraine. You know when John McCain pops up something fishy is going on.

No doubt FIFA was/is a corrupt organisation…we all knew/know this.

Presidential elections are right around the corner…actually in just two days.

John McCain sent a letter yesterday:

…encouraging Fédération Internationale de Football Association (FIFA) Congress to reconsider its support for President Sepp Blatter’s fifth term as FIFA President in light of his continued support for Russia’s hosting the 2018 FIFA World Cup.

The US wants Sepp Blatter out and their puppet, yes man, Mr. Jordanian Prince Ali bin al-Hussein in as FIFA President. The Jordanian “Oligarch” Prince would make sure to answer exclusively to the US.

Resources to plunder…tons!

Controlling FIFA means controlling and influencing the sporting world. Gambling and match fixing would now flow through Washington. Corruption would flow through Washington. Sponsorship, advertising revenue, TV rights, and all massive contracts associated with FIFA would fall to US companies, and under US control.

FIFA is Ukraine, Ukraine is FIFA…think about it:

“Sudden, shocking corruption” scandal blasted all over MSM media…CHECK

Presidential elections where the incumbent was slated to win…CHECK

Pro US candidate waiting in the wings to take control…CHECK

John McCain…CHECK

FBI in one instance and CIA in the other…CHECK

Lots of money, power, and plunder…CHECK

And of course, RUSSIA and Vladimir Putin…CHECK

What happened today was textbook regime change in action.

The fact that the regime change had nothing to do with a nation state, but a massive, sporting organisation, is a real breakthrough in America’s regime change model.

Complete story at - http://russia-insider.com/en/upcoming-elections-russia-2018-john-mccain-corruption-did-us-just-execute-fifa-coup-detat/ri7498

Fuddnik

(8,846 posts)Demeter

(85,373 posts)and that's pretty sad to admit.