Economy

Related: About this forumWeekend Economists: Labor Not In Vain September 4-7, 2015

King James Bible

Therefore, my beloved brethren, be ye steadfast, unmovable, always abounding in the work of the Lord, for as much as ye know that your labor is not in vain in the Lord.

Is there any phrase in the English language that did not come from the Bible? In any event, even the stoutest atheist can agree that labor in a righteous cause is never wasted, although the fruit of its seed may take generations to come to bear. When he look back into history, we can see the pattern, how one inspired spark bursts into a comforting flame (or a raging wildfire) in ages to come.

When we are in the midst of the planting, as we are today and for the next few years, the outcome isn't certain, nor the timing thereof. But faith that we labor not in vain gets us through.

I found this labor rights blog of interest, and wish to share a bit with you:

LABOR IS NOT A COMMODITY

Supporting Workers at Home and Abroad this Labor Day By Hunter King

Labor Day weekend is a bittersweet marker of the end of summer and the beginning of the school year. It is also a commemoration of labor rights struggles in the United States and a time to reflect on how far we have yet to go. This Labor Day, in addition to enjoying barbecues, picnics, and the beach, let us remember all the workers who don’t get the day off and take time to learn about how workers who are fed up with increasing inequality are standing up to fight back.

http://laborrightsblog.typepad.com/.a/6a00d8341bf90b53ef019aff0d1612970b-320wi

Here at the ILRF, we stand in solidarity with workers internationally AND in the United States.

This blog ran for 8 years, but is currently abandoned, or at least on hold...but the material is timeless: http://laborrightsblog.typepad.com/international_labor_right/

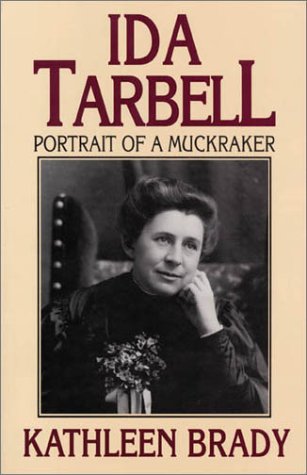

One hard worker I wish to focus upon is Ida Tarbell.

Female journalists, though few, were originally relegated to "society" events. Such oddities might include riding elephants or brushing a hippopotamus's teeth to provide "gee whiz" feature stories. But as time went on, women left a more substantial mark on newsrooms. Their insightful writing and determination won them acclaim. One of these writers was Tarbell. She worked as an editor for the Chautauqua Literary and Scientific Circle.

Tarbell moved to Paris in 1891 where she researched and wrote for several American publications. S.S. McClure, editor of McClure's Magazine in which Tarbell published 19 articles, noted: "Capitalists, workingmen, politicians, citizens -all breaking the law, or letting it be broken. Who is left to uphold it?.... There is no one left; none but all of us." He hired Tarbell in 1894, and in 1904 she documented the rise of John D. Rockefeller's monopolistic Standard Oil Company and its unfair business practices.

Coined "muckrakers" by Theodore Roosevelt, Tarbell and others unearthed the wrongdoings and abuses by corporations. Muckraking, so named because it uncovered dirt, was a major part of journalism from 1902 to 1912.

But Roosevelt didn't fully support it. Said Tarbell: "Theodore Roosevelt ... had become uneasy at the effect on the public of the periodical press's increasing criticisms and investigations of business and political abuses."

Tarbell and her fellow journalists persisted, which led to reforms, such as anti-trust laws...

http://www.csmonitor.com/1999/0316/p14s3.html

And we see that the trend has come around again....with investigative journalism and whistleblowers, and replacing the fire-breathing newspaper editors, we have the Internet, where every person owns a press, and exercises the freedom of it.

May the anti-trust laws be dusted off, refurbished and strengthened, soon!

Demeter

(85,373 posts)DJIA DOWN 272 PTS

Other markets in similar state.

On a positive note, we haven't lost a bank since July 10th. If the Federal Reserve does raise interest rates, I expect that will change, and not for the better.

Demeter

(85,373 posts)and the last one was incredibly fragrant....I have to make pie again: a real one, this time, not a cooked filling in a graham cracker crust.

Demeter

(85,373 posts)In the beginning was the word, the sacred text celebrating the end of arbitrary colonial government and the creation of a constitutional republic. Then there was the redemptive war, a punishment for the original sin of slavery and whose reward was the Union reborn. The new United States declared the primacy of the national state, declared free labor the foundation of its economy, and established national citizenship. Finally, the third deed put a human face on the capitalism that the Civil War unleashed...This, anyhow, is how the standard undergraduate syllabus is arranged. It is how publishing houses organize their books; it is how the typical historical survey punctuates the American story. To be sure, other moments, like the Civil Rights Movement and the Reagan revolution get honorable mentions. But they receive their meaning primarily as decorative fabric stretched across the tripartite scaffolding: the Founding, the Civil War, the New Deal. We are supposed to believe that there is nothing to remember in those historical voids. If we go looking, all that we will discover is a series of errors, like Jim Crow, that we have since corrected.

How then to think about the fall of 1887, when a small group of labor organizers connected to the Knights of Labor, started agitating among sugar cane workers deep in the Louisiana bayou? In August, the Knights started talking to the mostly black cane-cutters who were now working for their former slave masters. They promised higher wages, an end to payment in “scrip” rather than money, and even the hope of running a plantation “on the co-operative plan” instead of under the thumb of a boss. By September thousands had joined the Knights, by October they were ready to stop working if the local planters refused to raise wages, by the first of November they were on strike.

Three weeks later they were slaughtered. With the aid of a judge and state militia leader, white vigilantes disarmed the strikers, corralled them into the town of Thibodaux, Louisiana and unleashed a three-day orgy of violence. “No credible official count of the victims of the Thibodaux massacre was ever made,” writes historian Rebecca Scott, but “bodies continued to turn up in shallow graves outside of town for weeks to come.” Precise body counts were beside the point. The question of who ruled town and country, plantation and courthouse, had been answered. As a mother of two white vigilantes put it, “I think this will settle the question of who is to rule, the nigger or the white man? For the next fifty years. . . .”

Where does an event like this fit in our national history? Who were the Knights? What was their vision of society? What was the threat they posed? These are questions we cannot answer by reference to the “holy trinity” narrative. That is because between Reconstruction and Jim Crow was a forgotten time in which the emancipation of slaves inspired a further movement to emancipate workers from the domination of the labor market. It was a moment of promise and of danger — the promise of freedom, the danger of challenges to class power. If we want to understand our history, rather than just congratulate ourselves about it, we have to abandon the prevailing, comforting narrative of progress that carefully extrudes those moments that do not fit with America’s national image as a self-correcting liberal democracy. Looking back at forgotten labor struggles is therefore not just an exercise in setting the record straight, it is an exercise in emancipating our own thinking from attempts to discipline and control it. Reconstruction and its aftermath is an especially fertile period because it is when the language of liberty began to take new form, but had not yet been thinned out into the libertarian discourses that we know today.

MUCH MORE TO THIS STORY AT LINK

Demeter

(85,373 posts)Nancy Folbre is a professor emerita of economics at the University of Massachusetts-Amherst. She is the author of numerous books—including Who Pays for the Kids? Gender and the Structures of Constraint (1994), The Invisible Heart: Economics and Family Values (2001), and Valuing Children: Rethinking the Economics of the Family (2008)—related to household and caring labor. She is the director of the new Political Economy Research Institute (PERI) Program on Gender and Care Work and the author of the blog Care Talk.

Dollars & Sense: You’ve written about the tendency in economics to view household labor (and especially women’s labor) as “unproductive.” Can you explain how this is reflected in conventional macroeconomic measures.

Nancy Folbre: Non-market household services such as meal preparation and childcare are not considered part of what we call “the economy.”This means they literally don’t count as part of Gross Domestic Product, household income, or household consumption.

This is pretty crazy, since we know that these services contribute to our living standards and also to the development of human capabilities. They are all at least partially fungible: time and money may not be perfect substitutes, but there is clearly a trade-off. You can, in principle, pay someone to prepare your meals (as you do in a restaurant), or to look after your kids.

If you or someone else in your household provides these services for no charge (even if they expect something in return, such as a share of household earnings) that leaves more earnings available to buy other things. In fact, you could think of household income after taxes and after needs for domestic services have been met as a more meaningful definition of “disposable income” than the conventional definition, which is simply market income after taxes.

D&S: What is the practical consequence of not measuring household labor and production? Are economic policies and institutions different, especially in their impact on women, than what they would be if household labor were fully reflected in statistics on total employment or output?

NF: One macroeconomic consequence is a tendency to overstate economic growth when activities shift from an arena in which they are unpaid to one in which they are paid (all else equal). When mothers of young children enter paid employment, for instance, they reduce the amount of time they engage in unpaid work, but that reduction goes unmeasured. All that is counted is the increase in earnings that results, along with the increase in expenditures on services such as paid childcare.

As a result, rapid increases in women’s labor force participation, such as those typical in the United States between about 1960 and the mid-1990s, tend to boost the rate of growth of GDP. When women’s labor force participation levels out, as it has in the United States since the mid 1990s, the rate of growth of GDP slows down. At least some part of the difference in growth rates over these two periods simply reflects the increased “countability” of women’s work.

Consideration of the microeconomic consequences helps explain this phenomenon. When households collectively supply more labor hours to the market, their market incomes go up. But they have to use a substantial portion of those incomes to purchase substitutes for services they once provided on their own—spending more money on meals away from home (or pre-prepared foods), and child care. So, the increase in their money incomes overstates the improvement in their genuinely disposable income.

A disturbing example of policy relevance emerges from consideration of the changes in public assistance to single mothers implemented in the United States in 1996, which put increased pressure on these mothers to engage in paid employment. Many studies proclaimed the success because market income in many of these families went up. But much of that market income had to be spent paying for services such as child care, because public provision and subsidies fell short.

MORE ABOUT NON-MONETIZED WORK AT LINK

Demeter

(85,373 posts)Labor Day is a holiday that has outlived its time. Like Christmas, Labor Day has become a time-out period. As Christmas has become a shopping spree, Labor Day has become the last summer holiday...The holiday originated in 1887 to celebrate the contribution made by American workers to the strength and prosperity of the United States. The first Monday in September was chosen by President Grover Cleveland to avoid a May date that would keep alive the memory of the previous year’s Haymarket Massacre in which workers striking for an eight-hour day suffered casualties from the Chicago police.

As time passed union leadership became a career rather than a movement in behalf of a cause, but the labor movement in its initial years was reformist. It brought safer working conditions into industry and manufacturing. Unions served as a countervailing power and constrained the exploitative power of capital. An industrial or manufacturing job was a ladder of upward mobility that made the US an opportunity society and stabilized the socio-political system with a large middle class. A large and thriving industrial and manufacturing sector provided many white collar middle class jobs for managers, engineers, researchers and designers, and American universities flourished as did their graduates. The labor unions provided the Democratic Party with a financial base in labor that served as a countervailing power to the Republican base in manufacturing and finance. Whether it was a plot or unintended consequence, jobs offshoring wrecked the industrial and manufacturing unions and destroyed the Democrats’ independent financial base. The two-party system that had maintained a reasonable balance was transformed into a one-party system in which both parties were dependent on the same monied interests and thus answered to the same masters...The consequence was the demise of the middle class and rise of the One Percent. Today the US has the most unequally distributed income and wealth of all developed economies and one of the worst in the entire world. Few Americans other than the One Percent have a stake in the American economic and political system.

The imbalance in the distribution of income and wealth cannot be corrected through the tax system. The imbalance is due largely to the loss of the jobs that provided the economic basis for the middle class. Correction requires a retreat from globalism and the return to a largely self-sufficient economy, which the US economy was during its glory decades. Globalism is a scheme for impoverishing First World labor and taking power and influence from the hands of the many and putting them in the hands of the few. The champions of globalism are the champions of America’s destruction.

Today the Republicans are demolishing the public sector unions. These jobs can’t be outsourced, but public schools can be replaced with charter schools, prisons can be privatized, and many public services can be contracted out to private businesses. Public sector unions never had as strong a case for their existence as manufacturing and industrial unions. Moreover, strikes by firemen, police forces, school teachers, and trash collectors undermined public support for public sector unions as did many unpleasant experiences with the licensing bureaucracies of state and local government departments. Nevertheless, public sector unions could serve as a check on ambitious executive and legislative power.

Whether one has a favorable or unfavorable opinion of unions, their demise is also the demise of countervailing power. A system in which there is no countervailing power is a tyranny in which power is unconstrained and unaccountable. The American people have been subdued and turned into a flock of sheep. Will they ever rise again?

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West and How America Was Lost.

Demeter

(85,373 posts)In 1928, famed British economist John Maynard Keynes predicted that technology would advance so far in a hundred years – by 2028 – that it will replace all work, and no one will need to worry about making money.

“For the first time since his creation man will be faced with his real, his permanent problem – how to use his freedom from pressing economic cares, how to occupy the leisure, which science and compound interest will have won for him, to live wisely and agreeably and well.”

We still have thirteen years to go before we reach Keynes’ prophetic year, but we’re not exactly on the way to it. Americans are working harder than ever...Keynes may be proven right about technological progress. We’re on the verge of 3-D printing, driverless cars, delivery drones, and robots that can serve us coffee in the morning and make our beds. But he overlooked one big question: How to redistribute the profits from these marvelous labor-saving inventions, so we’ll have the money to buy the free time they provide? Without such a mechanism, most of us are condemned to work ever harder in order to compensate for lost earnings due to the labor-replacing technologies.

Such technologies are even replacing knowledge workers – a big reason why college degrees no longer deliver steadily higher wages and larger shares of the economic pie. Since 2000, the vast majority of college graduates have seen little or no income gains...The economic model that predominated through most of the twentieth century was mass production by many, for mass consumption by many. But the model we’re rushing toward is unlimited production by a handful, for consumption by the few able to afford it. The ratio of employees to customers is already dropping to mind-boggling lows. When Facebook purchased the messaging company WhatsApp for $19 billion last year, WhatsApp had fifty-five employees serving 450 million customers.

When more and more can be done by fewer and fewer people, profits go to an ever-smaller circle of executives and owner-investors. WhatsApp’s young co-founder and CEO, Jan Koum, got $6.8 billion in the deal...This in turn will leave the rest of us with fewer well-paying jobs and less money to buy what can be produced, as we’re pushed into the low-paying personal service sector of the economy. Which will also mean fewer profits for the handful of billionaire executives and owner-investors, because potential consumers won’t be able to afford what they’re selling.

What to do? We might try to levy a gigantic tax on the incomes of the billionaire winners and redistribute their winnings to everyone else. But even if politically feasible, the winners will be tempted to store their winnings abroad – or expatriate. Suppose we look instead at the patents and trademarks by which government protects all these new inventions. Such government protections determine what these inventions are worth. If patents lasted only three years instead of the current twenty, for example, What’sApp would be worth a small fraction of $19 billion – because after three years anybody could reproduce its messaging technology for free.

Instead of shortening the patent period, how about giving every citizen a share of the profits from all patents and trademarks government protects? It would be a condition for receiving such protection. Say, for example, 20 percent of all such profits were split equally among all citizens, starting the month they turn eighteen. In effect, this would be a basic minimum income for everyone. The sum would be enough to ensure everyone a minimally decent standard of living – including money to buy the technologies that would free them up from the necessity of working. Anyone wishing to supplement their basic minimum could of course choose to work – even though, as noted, most jobs will pay modestly.

This outcome would also be good for the handful of billionaire executives and owner-investors, because it would ensure they have customers with enough money to buy their labor-saving gadgets. Such a basic minimum would allow people to pursue whatever arts or avocations provide them with meaning, thereby enabling society to enjoy the fruits of such artistry or voluntary efforts. We would thereby create the kind of society John Maynard Keynes predicted we’d achieve by 2028 – an age of technological abundance in which no one will need to work.

Happy Labor Day.

JUST ONE THING, MR. REICH. WHY SHOULD THERE BE ANY BILLIONAIRES?

Demeter

(85,373 posts)After years of roiling tension, New York Attorney General Eric Schneiderman will announce a settlement between Cooper Union's board of trustees and a group of alumni and faculty who sued the school over alleged mismanagement. And free tuition may be back in play.

In 2013, the school announced that students entering in 2014 would start to pay tuition, reversing the explicit wishes of Peter Cooper when he founded the school in 1859. However, critics cited poor fiscal decisions—from its new $100+ million Thom Mayne building to spending $350,000 on a former university president's inaugural celebration to not charging market-rate rent for its Chrysler Building property (yes, the school owns that land!)—as the school's real undoing. The complaints prompted Schneiderman to investigate the school's finances, and Cooper Union's president resigned after the AG's office started its work.

The NY Times described the problems with the new building:

Then the market crashed in 2008. The $35 million was lost, and the financial plan collapsed, leaving the college with rising loan payments and deficit spending that threatened its endowment.

Schneiderman said of the deal, "It’s my job to promote and protect New York’s nonprofit sector, but we also have to step in to help institutions like Cooper Union when they face fiscal and governance problems. We’ll continue to monitor the school’s progress to make sure it’s on a path to long-term sustainability — and, I hope, free tuition."

The Committee to Save Cooper Union released these details about the settlement:

The confidential investigation by the Attorney General came about as a result of the CSCU’s lawsuit and has culminated in today’s announcement. According to the cy pres, the Attorney General intervened “to safeguard Peter Cooper’s irreplaceable gift to the people of New York.”

The Consent Decree and cy pres provide far more power to the community and genuine oversight than CSCU could have possibly gained with its lawsuit alone. Equally important, we can begin the process of restoring the mission of Cooper Union today—not after years of legal battles and appeals.

The Consent Decree and cy pres include the following provisions:

- Cooper Union’s Board of Trustees, together with the community, will work to return Cooper Union to a high-quality, sustainable, tuition-free model as soon as practical. A special committee of the Board will be dedicated to development of a strategic plan to return the school to its traditional tuition-free policy;

- Alignment of the trust and charter of the school, through the cy pres petition, to reflect the evolution of the institution into its modern form and provide for judicial oversight of the effort to return to a full tuition scholarship model;

- Expansion of the Board to include student trustees (2), additional alumni trustees (2), and faculty and staff representatives (6);

- Establishment of the Council of the Associates of Cooper Union—comprised of the alumni, student, and faculty trustees—with the charge to develop a full plan and proposal for The Associates of Cooper Union.

- Appointment of an independent financial monitor who will be responsible for evaluating and reporting on the financial management of Cooper Union, including compliance with the Consent Decree;

- Transparent disclosure of Board materials, budget documents, and investment results;

- Formation of a board committee to further reform the school’s governance; and

An inclusive search committee to identify the next full-term president.

Cooper Union Alumni Association president Nils Folke Anderson said, "In the spirit of Peter Cooper’s ‘Union,’ the CUAA stands united with the entire community, willing and ready to commence work on the immense challenge before us. We welcome this opportunity to provide additional alumni representation on the Board of Trustees, and pledge to do our part on the road ahead to restore the full scholarship model at Cooper Union.”

The efforts to challenge the administration's positions were the result of years of organizing and protests. Last year, one protester, 2013 graduate Casey Gollan, said of the new students who were the first to pay tuition, "In the past few years, there’s a culture that’s built up. The freshmen that came in this year, a lot of them came in knowing what Free Cooper was, knowing about actions, knowing about the administration, knowing about the lawsuit."

One Class of 2018 freshman said to us, "Even if our class never is given free tuition, the point isn’t about our individual problems. It’s more about the larger story and preserving the legacy of the school."

Demeter

(85,373 posts)...Challenger reported August job cuts, which at 41,186 were a 60% drop from the 115,730 reported last month (the highest since September 2011), which however was driven by a one-time mass layoffs last month in military staffing. Putting August in its correct perspective, the number was 2.9% higher than the same month a year ago, when 40,010 planned job cuts were announced. What is troubling is that this marks the seventh month this year that the job-cut total was higher than the comparable month from 2014. What is worse is that for all the euphoria about initial claims printing at or near record lows, the reality as measured from the bottom-up, is far different and as Challenger notes, so far in 2015 employers have announced 434,554 job cuts: that is up 31 percent from the 332,931 planned layoffs in the first eight months of 2014. What is worst, and what reveals the true picture of the economy, is that with monthly totals averaging 54,319, 2015 job cuts are on track to exceed 650,000 for the year, which would be the highest year-end tally since 2009 (1,272,030).

In other words, not only is the economy no longer growing at its previous pace, but due to the ongoing oil rout, tens of thousands of highly-paid workers mostly in the oil space are getting pink slips just as the Fed is preparing to tighten. Putting a number to that estimate, Challenger says that "since the beginning of the year, oil prices have been blamed for 82,268 layoffs, mostly in the energy sector, but also among industrial goods manufacturers that supply equipment and materials for oil exploration and extraction."

FIGURE 1

Curiously, the biggest culprit for August job cuts was not the energy sector (expect many more layoffs here), but retail. The retail sector saw the heaviest job cutting in August, with 9,601 planned layoffs reported during the month. Most of those were related to bankruptcy of east coast supermarket chain A&P, which is closing more than 100 stores and laying off a reported 8,500 workers by Thanksgiving. The retail sector has announced 57,363 job cuts so far this year, which is a 90 percent increase over the 30,109 job cuts announced by this point in 2014.

“Overall, retail is relatively healthy, but we have seen some big layoffs this year, particularly from long-time players that simply have not been able to keep up with changing consumer trends. These retailers somehow manage to survive, but only through multiple bankruptcies, such as A&P. Earlier this year RadioShack announced 5,400 job cuts,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

The industrial goods sector saw the second heaviest downsizing activity in August, announcing 7,949 layoffs during the month. That is the largest number of job cuts for this sector since March, when 9,163 job cuts were announced.

Finally, going back to oil, Challenger was optimistic, however this optimism is misplaced. This is what it said:

“The stream of job cuts related to oil prices appears to be ebbing. The majority of these cuts came in the first four months of 2015, when we saw more than 68,000 layoffs related to oil. Since May, fewer than 14,000 job cuts have been attributed to oil prices,” noted Challenger.

There is a problem: as ConocoPhillips just announced two days ago when it fired 10% of its global workforce, oil companies, which had been betting on an oil rebound, all got flatfooted by the second drop in oil price. This will lead to tens of thousands of more highly paid jobs being pink slipped in the coming months.

“It is too soon to say if we have seen the last of the big oil cuts. As we head into the final months of 2015, there are definitely some red flags that suggest we may see more layoffs from the energy sector, as well as in other areas of the economy. The problems that China is facing could send shockwaves throughout the global economy, including the United States,” Challenger continued.

Finally, one thing that is certain: of all states, Texas continues to bear the brunt of the layoff pain. And if oil continues trading in the $30/$40 range, the pain is far from over.

FIGURE2

GO TO THE LINK FOR THE GRAPHS...THEY HAVE MADE THEM IMPOSSIBLE TO LINK

Demeter

(85,373 posts)The latest U.S. jobs report was not definitively good or bad enough to help the Federal Reserve decide whether to raise interest rates later this month, leaving the decision hanging on volatility in financial markets over the next couple of weeks.

The economy added 173,000 jobs in August, quite a bit fewer than expected. But employment growth in June and July were revised higher, wage gains last month were better than expected, and the unemployment rate fell to a seven-year low of 5.1 percent.

With global stock and currency markets reeling over the last two weeks, the report is probably the best and last direct reading on the economy as Fed officials weigh whether to hike rates at a much-anticipated meeting on Sept. 16-17.

But the report disappointed those looking for clarity.

"With this jobs report ... the Fed finds itself in a real uncertainty jam when it comes to a September interest rate hike," Mohamed El-Erian, chief economic adviser at Allianz, in Newport Beach, California, said in an email.

"In the run-up to its policy meeting, the Fed will pay even greater attention to global market developments."

MORE

Demeter

(85,373 posts)...According to Fed policymakers gathered in Jackson Hole, Wyoming last week, not only would the August jobs report need to be decent but market gyrations would need to dissipate for them to act, despite sustained strength in both the labor market and the broader economy.

The Fed is concerned not so much with employment but with the possibility that inflation, which has remained below a 2.0-percent target for a few years, will not rebound any time soon given the downward pressure that China could put on commodity prices and global growth....

Demeter

(85,373 posts)U.S. stock indexes dropped almost 2 percent on Friday as a mixed August jobs report did little to quell investor uncertainty about whether the Federal Reserve will increase interest rates this month.

Trepidation about the first U.S. rate hike in almost a decade added to worries among investors already on edge about a stumbling Chinese economy and a recent market selloff.

"Markets are confused. It was an okay jobs report, but there's worry about China going into the weekend," said John Augustine, chief investment officer, Huntington Trust in Columbus, Ohio.

Nonfarm payrolls increased 173,000 last month, fewer than the 220,000 that economists polled by Reuters had expected. But the unemployment rate dropped to 5.1 percent, its lowest in more than seven years, and wages accelerated. Many investors viewed those data points as contradictory signals about the urgency to increase interest rates.

"The Federal Reserve finds itself in a real uncertainty jam when it comes to a September interest rate hike," said Mohamed El-Erian, chief economic adviser at Allianz....

Demeter

(85,373 posts)NOSTALGIA, ANYONE?

Will Uncle Sam Confiscate Gold Again?

Investors suffered financial losses in recent weeks as stocks globally came under pressure in August and had their worst month in the last three years. In one of the most volatile trading periods since the global financial crisis, August saw a massive $5.7 trillion erased from the value of stocks worldwide. No major stock market was left unscathed and the risk of financial and economic contagion became evident again.

There are growing concerns internationally that in the event of another Wall Street or global stock market crash and a new systemic crisis – a Eurozone debt crisis or another Lehman Brothers collapse – there could be enforced bank closures or extended bank holidays in the EU and U.S. as seen in Greece recently.

In this scenario, deposit boxes and vaults in U.S. banks and financial institutions could be sealed and gold confiscated again.

There is a legal precedent for this. April 5th, 1933 – at the height of the Great Depression – was the day when U.S. President Franklin Delano Roosevelt instructed all American citizens to hand over all their gold coins and bars to the Federal Government.

Demeter

(85,373 posts)The blogosphere is rife with talk of the “death of the US Dollar.”

The US Dollar will eventually die, as all fiat currencies do. But the fact remains that everyone on the planet has been borrowing in US Dollars for decades, or leveraging up using Dollars and that process needs to unwind.

When you borrow in US Dollars you are effectively shorting the US Dollar. So when leverage decreases through defaults or restructuring, the number of US Dollars outstanding diminishes.

And this strengthens the US Dollar.

With that in mind, it looks as though we are in the early stages of a massive, multi-year Dollar deleveraging cycle. Indeed, the greenback is now breaking out against EVERY major world currency...The fact that we are getting major breakouts of multi-year if not multi-decade patterns against every major world currency indicates that this US Dollar bull market is the REAL DEAL, not just an anomaly.

With that in mind, I continue to believe the US Dollar is in the beginning of a multi-year bull market. And this will result in various crises along the way. Globally there is over $9 trillion borrowed in US Dollars and invested in other assets/ projects. This global carry trade is now blowing up and will continue to do so as Central Banks turn on one another. This will bring about a wave of deleveraging that will see the amount of US Dollars in the system shrink. This in turn will drive the US Dollar higher...Any entity or investor who is using aggressive leverage in US Dollars will be at risk of imploding. Globally that $9 trillion in US Dollar carry trades is equal in size to the economies of Germany and Japan combined.

Indeed, few investors remember that the US Dollar rallied hard in 2008 as a precursor to the meltdown. Is today's US Dollar rally a similar warning?

Demeter

(85,373 posts)Perhaps a New Deal moment is at hand. Fight for 15, the campaign to raise the minimum wage of fast-food employees, has rocked the country. Hillary Clinton now touts collective bargaining—a subject on which leading Democrats have been silent for years. The National Labor Relations Board has just threatened the “new” U.S. corporate model—it held that big companies could be liable for employees of all the little subcontractors they use. And Scott Walker’s anti-labor populism is losing out to Donald Trump’s populism, which doesn’t target labor. Meanwhile, Ms. Clinton’s primary opponent, Bernie Sanders, is running openly as a socialist. TECHNICALLY, HE'S A DEMOCRATIC SOCIALIST....IN THE FDR STYLE

The right to join a union is still a long way from a civil right—that is, one as effective as the rights protected in the Civil Rights Act, with the same kind of penalties. That is truly what labor needs. Meanwhile, stepping off the barricades here, I’d like to make a pitch for labor to those who may regard it as a threat.

First, we need a labor movement just as an instrument of economic policy; we need a right to bargain to keep up a decent level of aggregate economic demand. After all, how has it worked without labor? We go from bubble to bubble, from shock to shock. Sooner or later, many Americans have to take on way too much debt. And while one might scoff at the moment, there is trouble ahead. The young leverage themselves for college diplomas like the way their parents took on mortgages. And even if they weren’t running up debt, there are other danger signs. We have far more children born in poverty than we did 10 years ago. They aren’t going to spend.

How long can this continue without a wage increase?

Second, we need a labor movement to force companies to invest in skills. Look at the workforce we are creating—the freelancing, the temps, the independent contractors. No one is training them—they’re at entry level forever. There is no career ladder to climb. In the end, that means lower productivity and lower growth.

And without a skill-based economy, there will be less innovation, whether or not an occasional Steve Jobs appears. Our idea of innovation now is Uber, but the only true innovation here is just a new and innovative way of exploiting people who have no rights. If Uber is a taste of the “innovation” of the future, this country is going to be a miserably Dickensian and low-wage place...

Read more at: http://tr.im/Tn4Kg

Demeter

(85,373 posts)Federal appeals court revives Miami’s lawsuit against TBTFs... A U.S. appeals court revived three lawsuits filed by the City of Miami against Wells Fargo (WFC), Bank of America (BAC) and Citigroup (C), alleging predatory mortgage lending practices against minority borrowers.

In a unanimous vote, the 11th U.S. Circuit Court of Appeals reversed a lower court’s dismissal of the city's claims under the federal Fair Housing Act.

Miami’s lawsuit alleges the three banks engaged in a long-term lending discrimination in its residential housing market programs.

"It is clear that the harm the city claims to have suffered has a sufficiently close connection to the conduct the statute prohibits," Circuit Judge Stanley Marcus wrote.

Other cities like Baltimore, Chicago, Los Angeles and Memphis have met with mixed results attempting to bring suits against the lenders for what they call predatory lending targeted at black and Hispanic homebuyers.

The lawsuit in Miami charged that the three banks steered black and Hispanic borrowers toward higher-cost loans....

Demeter

(85,373 posts)Five years ago, Congress decided to take action on the bloated, price-fixed fees that banks charge merchants every time a customer makes a purchase with a debit card. It ordered the Federal Reserve to bring competition to the market by lowering fees to a reasonable sum.

Unfortunately, the Fed was swayed by heavy bank lobbying as it wrote the rules to implement the new law, settling on language that allows Visa and MasterCard to keep fees that are way too high. Now, according to a Richmond Fed study released in August, only 10% of 420 retailers surveyed reported that their fees had dropped two years after the law went into effect in October 2011. The other 90% saw no change, were uncertain of the impact or actually faced higher fees.

This clearly goes against congressional intent. The survey offers proof that the Fed made a mistake in appeasing big banks and credit card companies.

In fact, even the least efficient banks are making a 500% profit on the fees they charge merchants to process debit card transactions, according to figures the banks report to the Fed and analyzed by the Merchant Advisory Group, a trade association. Our own analysis of the numbers banks report shows thatabout 90% of banks impacted by the rule (the 100 or so with more than $10 billion in assets) areactually making twice that profit margin. By contrast, retailing is among the least profitable industries as merchants struggle to make margins of 1% to 3%.

Moreover, these are just the margins on the rates regulated by the Fed. Most banks aren’t covered by the regulations — and credit cards aren’t covered at all. So, the real profit margins from so-called swipe fees are actually many times higher than 1,000%.

MORE

Hotler

(11,394 posts)"The survey offers proof that the Fed made a mistake in appeasing big banks and credit card companies."

Hell! Appeasing the big banks and credit card companies (big banks) is their job.

"500% profit on the fees " If the Fed and and the bankers needed reason to be broken up this is one.

Demeter

(85,373 posts)The top securities regulator of Massachusetts said on Friday he is investigating the computer glitch at BNY Mellon Corp (BK.N) that last month disrupted pricing on more than $400 billion worth of mutual fund and exchange-traded fund assets. Secretary of the Commonwealth William Galvin said he has asked BNY Mellon and six of the largest fund companies affected how the technical glitch in fund accounting impacted individual investors.

“In the warp-speed of trading these days computer problems can happen,” Galvin said in a press release. "But the fallout that seems only to affect large financial institutions can hit the average investor looking at his and her retirement money.”

BNY Mellon roiled about 5 percent of the U.S. fund industry last month when one of the accounting systems it relies on to generate prices for mutual funds and exchange-traded funds collapsed. The problems lasted a week, but the root cause has not been determined. BNY Mellon declined to comment on Galvin's investigation.

Galvin said his inquiry was initially focused on Goldman Sachs, Deutsche Bank, First Trust Advisors, Guggenheim Investments, Prudential Investments and Federated Investors Inc. Goldman Sachs, Guggenheim and Deutsche declined to comment. Prudential, Federated and First Trust did not immediately respond to requests for comment.

The investigation asks that BNY Mellon and the investment companies detail the scope of the problem and type of corrective action that is being taken to address individual investor harm, according to the press release from Galvin's office.

Demeter

(85,373 posts)Five former Geneva wealth managers have paid "substantial compensation" to settle criminal complaints brought by clients whose assets they had invested with U.S. fraudster Bernard Madoff, the Geneva prosecutor's office said on Friday. The case was launched in 2009 against five directors of Aurelia Finance, a Geneva-based private bank that prosecutors said had lost up to $800 million of clients' money by investing in Madoff's "Ponzi" scheme, which used money from new investors to pay existing clients.

The five men - Vladimir Stepczynski, Pascal Cattaneo, Olivier Ador, Laurent Mathysen-Gerst and Jean-Marc Wenger - were charged with criminal mismanagement of client money by putting too many assets into a Madoff "feeder fund". All five resigned from Aurelia's board and their assets were frozen.

Prosecutors told a Geneva court at the time that the directors had enriched themselves on management fees, finder fees and commissions paid for fictitious returns that were never verified. The Swiss newspaper Le Temps reported last month that the five defendants had been due in court on Oct. 12.

The financial institutions that lost money in the fraud, through asset management units, include Spain's Santander (SAN.MC), Italy's UniCredit (CRDI.MI) and Swiss-based EFG International. Swiss asset managers were among the biggest investors in Madoff's scheme, with firms based in Geneva particularly hard hit.

Demeter

(85,373 posts)MattSh

(3,714 posts)Like pretty much everything in the modern U.S. economy, wealthy and connected people fleecing taxpayers in order to earn even greater piles of money is also the business model when it comes to sports stadiums. Many cities have tried to make voter approval mandatory before these building boondoggles get started, but in almost all cases these efforts are thwarted by a powerful coalition of businessmen and corrupt politicians. Sound familiar? Yep, it a microcosm for pretty much everything else in America these days.

To get you up to speed, here are a few excerpts from an excellent Pacific Standard magazine article:

Over the past 15 years, more than $12 billion in public money has been spent on privately owned stadiums. Between 1991 and 2010, 101 new stadiums were opened across the country; nearly all those projects were funded by taxpayers. The loans most often used to pay for stadium construction—a variety of tax-exempt municipal bonds—will cost the federal government at least $4 billion in taxpayer subsidies to bondholders. Stadiums are built with money borrowed today, against public money spent tomorrow, at the expense of taxes that will never be collected. Economists almost universally agree that publicly financed stadiums are bad investments, yet cities and states still race to the chance to unload the cash. What gives?

To understand this stadium trend, and why it’s so hard for opponents to thwart public funding, look to Wisconsin. Last month, Governor Scott Walker signed a bill to spend $250 million on a new basketball arena for the Milwaukee Bucks. (The true cost of the project, including interest payments, will be more than $400 million.)

Isn’t Scott Walker supposed to be “Mr. Fiscal Conservative?”

The story of what’s happening in Milwaukee is remarkable, if not already familiar. Step one: A down-on-its-luck team is purchased by a group of billionaire investors. Step two: The owners nod to their “moral responsibility” to keep the team in its hometown,while simultaneously lobbying for a new stadium. Step three: The team threatens to abandon its hometown for greener pastures—and newer facilities—in another city. Step four: The threat scares up hundreds of millions of public dollars in stadium financing. Step five: The new stadium opens, boosting the owners’ investment, while sloughing much of the financial risk onto taxpayers. As New York Times columnist Michael Powell wrote, “From start to desultory end, Milwaukee offered a case study in all that is wrong with our arena-shakedown age.”

Complete story at - http://www.zerohedge.com/news/2015-09-04/bread-circuses-shady-slimy-corrupt-world-taxpayer-funded-sports-stadiums

MattSh

(3,714 posts)The characteristic feeling of the post-2008 world has been one of anxiety. Occasionally, that anxiety breaks out into fear as it did in the last two weeks when stock markets around the world swooned and middle class and wealthy investors had a sudden visitation from Pan, the god from whose name we get the word "panic." Pan's appearance is yet another reminder that the relative stability of the globe from the end of World War II right up until 2008 is over. We are in uncharted waters.

Here is the crux of the matter as expressed in a piece which I wrote last year:

The relentless, if zigzag, rise in financial markets for the past 150 years has been sustained by cheap fossil fuels and a benign climate. We cannot count on either from here on out....

Another thing we cannot necessarily count on is the remarkable geopolitical stability that the world experienced for two long stretches during the fossil fuel age. The first one lasted from the end of the Napoleonic Wars in 1815 to the beginning of World War I in 1914 (interrupted only by the brief Franco-Prussian War). The second lasted from the end of World War II in 1945 until now.

Following the withdrawal of U.S. military forces from Iraq, the Middle East has experienced increasing chaos devolving into a civil war in Syria; the rapid success of forces calling themselves the Islamic State of Iraq and Syria which are busily reshaping the borders of those two countries; and now the renewed chaos in Libya. We must add to this the Russian-Ukrainian conflict. It is no accident that all of these conflicts are related to oil and natural gas.

Complete story at - http://oilprice.com/Latest-Energy-News/World-News/End-Of-Cheap-Fossil-Fuels-Could-Have-More-Severe-Consequences-Than-Thought.html

MattSh

(3,714 posts)Last edited Sat Sep 5, 2015, 08:23 AM - Edit history (1)

Oh my. This artist has something to offend just about everybody!

https://www.flickr.com/photos/expd/

MattSh

(3,714 posts)That's not a misspelling...

LIBOR

The London Interbank Offered Rate is the average interest rate estimated by leading banks in London that the average leading bank would be charged if borrowing from other banks.

In June 2012, multiple criminal settlements by Barclays Bank revealed significant fraud and collusion by member banks connected to the rate submissions, leading to the Libor scandal.[6][7][8] The British Bankers’ Association said on 25 September 2012 that it would transfer oversight of LIBOR to UK regulators, as proposed by Financial Services Authority managing director Martin Wheatley's independent review recommendations.[9] Wheatley's review recommended that banks submitting rates to LIBOR must base them on actual inter-bank deposit market transactions and keep records of those transactions, that individual banks' LIBOR submissions be published after three months, and recommended criminal sanctions specifically for manipulation of benchmark interest rates.[10] Financial institution customers may experience higher and more volatile borrowing and hedging costs after implementation of the recommended reforms.[11] The UK government agreed to accept all of the Wheatley Review's recommendations and press for legislation implementing them.[12]

https://en.wikipedia.org/wiki/Libor

MattSh

(3,714 posts)ANTIMEDIA) Author A.J. Jacobs and a team of researchers with genealogy web sites myheritage.com and geni.com have recently developed a family tree showing that Hillary Clinton and Donald Trump are distant cousins. They share royal blood that runs deep in their family lines.

Jacobs told Extra in a recent interview that “Their 19th great grandfather is King Edward III so there is precedent for ruling a country, it’s in their genes.”

The family tree, which can be seen and verified below (courtesy of myheritage.com/geni.com), is comprised of a long line of aristocracy on both ends.

When you take a close look at how global events have progressed over the ages, you will find that many of the families who dominate politics and economics today have bloodlines that trace back to the feudal lords of the Middle Ages. In Middle Eastern and third world countries, this is painfully obvious because there are still royal dynasties that openly claim it is their birthright to rule over their country. While in the West the aristocrats are a bit less open, the same principle still applies.

Complete story at - http://theantimedia.org/it-turns-out-hillary-clinton-and-donald-trump-are-distant-cousins/

Admit it: You suspected this all along, didn't you? ![]() Bigger image at the source...

Bigger image at the source...

Demeter

(85,373 posts)It starts with light-headedness, and the sinuses go into production....and my brain not only hurts, it doesn't work well, either. And today is supposed to be worse than Friday, and Friday I punted.

If there's anything left tonight, I'll squeeze out some more posts, but I'm taking some pain relief and going back to bed...

Demeter

(85,373 posts)and couldn't bear to get wet above the waist...just feel so crummy. Curses!

hamerfan

(1,404 posts)Sixteen Tons performed by Eric Burdon:

MattSh

(3,714 posts)MattSh

(3,714 posts)MattSh

(3,714 posts)Damn, that voice! Paul Robeson.

antigop

(12,778 posts)Demeter

(85,373 posts)U.S. stocks ended Friday’s session sharply lower, as a highly anticipated monthly jobs report intensified the debate about the Federal Reserve’s decision to raise interest rates in September.

Widely seen as the last notable economic report before the Federal Reserve decides whether to raise interest rates at its two-day meeting on Sept. 16-17, the jobs data showed that the U.S. economy added a weaker-than-estimated 173,000 nonfarm jobs last month, while the unemployment rate dropped to 5.1%—marking its lowest level since April 2008.

The employment report began a downbeat day for the market as investors seemed to read the data as signaling that the Fed may soon decide to end its ultraloose monetary policy in two weeks.

“The Fed has been clear about wanting to raise rates this year and at least now they have a green light if they decide to do so,” said Kate Warne, investment strategist at Edward Jones.

Friday’s losses capped another brutal week for the main indexes, which suffered their second-largest weekly losses this year.

The S&P 500 SPX, -1.53% closed 29.91 points, or 1.5% lower at 1,921.22 and fell 3.4% over the week. Among the biggest decliners this week were utilities stocks, which shed 5.2% since, while health-care and financials stocks lost 4.4% and 4.3% respectively.

The Dow Jones Industrial Average DJIA, -1.66% dropped 272.38 points, or 1.7%, to 16,102.38, recording a 3.3% loss over the week. Among the blue-chip stocks, 29 out of 30 posted weekly losses, with the Dow losing more than 1,550 points over the past two weeks.

The Nasdaq Composite COMP, -1.05% ended the day down 49.58 points, or 1.1% at 4,683.92 and posted a 3% weekly loss. Highflying biotechnology stocks were the biggest losers, with the iShares Nasdaq Biotechnology ETF IBB, -0.45% posting a 4.6% weekly decline.

Meanwhile, implied volatility on the S&P 500 as measured by the CBOE Volatility index VIX, +8.55% rose 6.7% over the week, closing at 27.8 on Friday, above the historical average of 20.

Demeter

(85,373 posts)U.S. stock indexes dropped more than 1 percent on Friday after a mixed August jobs report did little to quell investor uncertainty about whether the Federal Reserve will increase interest rates this month.

Trepidation about the first U.S. rate hike in almost a decade added to worries among investors already on edge about a stumbling Chinese economy and a recent market selloff.

"Markets are confused. It was an okay jobs report, but there's worry about China going into the weekend," said John Augustine, chief investment officer, Huntington Trust in Columbus, Ohio.

Nonfarm payrolls increased 173,000 last month, fewer than the 220,000 that economists polled by Reuters had expected. But the unemployment rate dropped to 5.1 percent, its lowest in more than seven years, and wages accelerated. Many investors viewed those data points as contradictory signals about the urgency to increase interest rates.

Near-zero rates have allowed the U.S. stock market to almost triple from the depths of the financial crisis in 2009. Many on Wall Street hope recent global market turmoil and worries about China's economy will lead the Fed to hold off raising rates when it meets on Sept. 16-17....MORE

Demeter

(85,373 posts)Slowing growth in emerging markets and currency fluctuations in anticipation of a U.S. interest rate hike may push third-quarter revenue and earnings estimates lower this month.

Wall Street expects a 3.4 percent decline in earnings for the S&P 500 .SPX for the quarter. Estimates have already fallen for 9 out of 10 of the benchmark index's sectors so far this year, according to Thomson Reuters data.

S&P revenue is expected to fall 2.8 percent for the quarter, led by steep declines in the energy and materials sectors. As companies tend to revise guidance around the end of the quarter, estimates may become even less optimistic.

"Analysts will likely be pulling in their reins going into the quarterly reports and the pre-announcement season. This could happen fairly quickly," said Tim Ghriskey, chief investment officer of Solaris Group in Bedford Hills, New York.

MORE

Demeter

(85,373 posts)A district court judge has asked Credit Suisse Group AG to pay $287.5 million in damages to an affiliate of Highland Capital Management, as part of a long drawn breach of contract case.

The judge asked the bank to pay about $211.9 million in damages and restitution and $75.6 million in prejudgment interest on the damages.

The damages are related to the event in which the Zurich-based bank was found to have used inflated appraisals to convince an affiliate of Highland Capital Management in 2007 to refinance the Nevada resort community, which sought Chapter 11 bankruptcy a year later.

A Texas jury found in December that Credit Suisse had fraudulently enticed investors to back a $540 million loan for Lake Las Vegas resort, only to have the borrower quickly default.

Highland Capital Management and Credit could not be reached for comment.

Demeter

(85,373 posts)Nomura Holdings Inc and Royal Bank of Scotland Group Plc (RBS.L) have agreed to pay up to $33 million (£21.8 million) on top of $806 million that a U.S. judge ordered them to pay for making false statements in selling mortgage-backed securities. The agreement with the Federal Housing Finance Agency was disclosed in court papers filed on Friday in Manhattan federal court and covers legal costs the regulator incurred taking the banks to trial earlier this year.

The FHFA had sued the banks in its role as conservator for mortgage giants Fannie Mae (FNMA.OB) and Freddie Mac (FMCC.OB), which had bought $2 billion in securities from them ahead of the 2008 financial crisis. Following a non-jury trial, U.S. District Judge Denise Cote in Manhattan in May found Nomura, the securities' sponsor, and RBS, an underwriter on some of them, liable. Cote awarded $806 million to the FHFA and also awarded the regulator its costs and attorneys fees, sums that Friday's agreement covers.

Under the agreement, the banks will pay $33 million if after an appeal they pay at least $413 million for state law violations asserted by the FHFA. Should that amount shrink to above $272 million, the parties will let Cote decide how much up to $33 million should be paid.

Anything less than $272 million makes the agreement void...

Demeter

(85,373 posts)Demeter

(85,373 posts)bread_and_roses

(6,335 posts)... bread & roses.

Thank you! Seeing that message gave me a real smile, something too rare these days.

More and more, I think the heart of that song is in that one phrase, "the sharing of life's glories."

Thinking of the post above, talking about deriving a minimum income from the patent profits - the problem is, the earth simply cannot sustain production and consumption at the current levels of the West. Especially when so much of it is based on plastics.

Searching for something the other day I came across a title of an article on the "sharing economy" titled something like "my house was trashed my car was wrecked and ..."

I didn't read it but could tell it was about the rise of such services as car share and air b&B ...

And I was thinking, well, the problem is really the concept of "mine." Of ownership.

Related to your question above - "why should there be billionaires?" Why, indeed.

We have mostly forgotten the socialist bent of much of the early labor struggle. And without it, we are left with the scrabbling over scraps we see today.

Demeter

(85,373 posts)“Yes,” replied Hemingway. “They have more money.”

He didn’t remind Fitzgerald that the poor are different, too: they have less money. Hemingway presumably considered this too self-evident to mention, but today many seem to have lost sight of this seemingly obvious fact. Over the last five decades, pundits and policymakers have instead fretted endlessly over the “culture of poverty,” blaming American poverty on everything from the decline of marriage to high rates of substance abuse among the poor. Meanwhile, federal and state governments have spent an estimated $22 trillion on anti-poverty programs, many focused either on addressing the presumed causes of poverty (inadequate job search skills, poor parenting practices, etc.) or on paternalistic efforts to help the needy while at the same time preventing them from behaving disreputably.

Thus, federal law prohibits the use of food stamps to purchase cigarettes — bad for you! — or “hot food,” which is presumably less morally nourishing than food the poor have to cook themselves. Similarly, most states subject the needy to a variety of humiliating and intrusive requirements, from drug testing to criminal background checks, before permitting them to access public assistance. But most anti-poverty programs ignore the obvious: the best way to help the poor is to give them money. That’s it. Give them money — then leave them alone. Don’t give them drug tests; don’t require them to purchase only approved food items, don’t force them to take parenting classes or resume-writing classes or abstinence-based sex education classes.

Just. Give. Them. Money. Preferably, a lot of it: enough to transform their lives.

No, it’s not a crazy idea. On the contrary: it’s been tried already in nations around the world, and international development experts increasingly acknowledge the value of direct, unconditional cash transfers over more indirect and paternalistic anti-poverty programs.

But wait, you say: how can that be? If you just give money to poor people, won’t they squander it? Waste it on drugs or alcohol, fritter it away on wide-screen TVs, blow it on feckless get-rich-quick scams?

ROSA BLOWS THAT ONE OUT OF THE WATER WITH ACTUAL DATA...FROM HOME AND ABROAD

SEE LINK FOR THE REST

Rosa Brooks is a law professor at Georgetown University and a Schwartz senior fellow at the New America Foundation. She served as a counselor to the U.S. defense undersecretary for policy from 2009 to 2011 and previously served as a senior advisor at the U.S. State Department.

Demeter

(85,373 posts)http://www.salon.com/2015/09/05/americas_silent_but_deadly_billionaires_how_our_tight_lipped_overlords_are_waging_stealth_campaigns_against_the_middle_class/

...While billionaires rarely go on the record discussing Social Security and taxes, they work behind the scenes to oppose policies favored by average Americans. Often, there are deep disconnects between what billionaires say regarding policies and which organizations they fund.

The new study examines an even smaller and more insular group than the previous work of Page and Seawright: the richest 100 American billionaires. Together, the billionaires were worth $1,291 billion (more than the entire GDP of Mexico). Obviously, the billionaires weren’t going to sit down for lengthy interviews on policy priorities. Instead, the authors combed through nearly every public statement by the billionaires on two subjects: tax policy and Social Security. The project required a massive amount of work: Lacombe spent nearly 400 hours conducting the related searches. One of the first things the authors find is that even the politically active wealthy rarely take overt public stances. They write, “The Koch brothers (David and Charles) are a leading example of this: they generally combine public silence about policy with large financial contributions to political causes.” Though they intend to contribute nearly a billion dollars to influence the 2016 election cycle, they “generally make only vague political comments, if any comment at all.”

The authors dub this “stealth politics.” Indeed, only 26 billionaires (a quarter) made any statements on tax policy over the last 10 years. Of these, the vast majority of statements came from a small but politically active and visible group: Michael Bloomberg, Warren Buffett, Bill Gates and George Soros, who made 65 comments in total. Even those statements tended to be vague and rather brief. More strikingly, only three of the billionaires made statements regarding Social Security. When billionaires do make statements, they appear to be a rather diverse and moderate group. As the chart shows, when speaking on most key issues, billionaires are split pretty evenly (although they tend to favor more carbon taxes, and fewer corporate taxes). But that billionaires were largely silent and moderate doesn’t mean they aren’t concerned with more radical policies.

The billionaires the authors examined were rather active politically. One-third either hosted a political fundraiser or bundled contributions for a candidate (this compares to one-fifth of the top 1 percent of the wealthiest and very few if any average Americans). A whopping 82% of the billionaires in the sample gave to political candidates in 2011-2012, and they gave, on average, $74,982 (that’s $20,000 more than the median household income in the United States)...

MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)...For months now, they’ve been umming and ahhing about whether to start raising short-term interest rates, which they have kept at close to zero per cent since December, 2008. Last week, Stanley Fischer, Yellen’s deputy, indicated that the Fed wanted to see August’s job figures before making a decision about whether to go ahead with a rate hike later this month.

The Labor Department released the new figures on Friday morning, but they didn’t make the Fed’s job much easier. The headline jobless rate dipped from 5.3 per cent to 5.1 per cent, which is the lowest mark since April of 2008. A year ago, the number of people who were searching for a job but couldn’t find one was about nine and a half million. In August, the figure was just more than eight million. That’s obviously good news, although it doesn’t account for the large number of people who have left the workforce. In August, 62.6 per cent of non-institutionalized people aged sixteen to sixty-five were working or looking for work, compared to 65.8 per cent in August of 2007, before the Great Recession. As I’ve noted many times, the fall in the so-called participation rate has been huge, and there’s still no sign that it is reversing course.

Still, steady U.S. job growth confirms that the long recovery from the slump is proceeding. Since the start of the year, employers have added nearly 1.7 million jobs. August’s payroll figure of a hundred and seventy-three thousand was a bit lower than Wall Street had been expecting, but the month-to-month figures always jump around quite a bit, and it always pays to take a longer view. Since September, 2010, when total employment bottomed out, the U.S. economy has generated about twelve million jobs, the vast majority of them in the private sector. As the White House points out on a regular basis, the recent run of private-sector job creation is virtually unprecedented. On this basis, there appears to be a reasonable argument for the Fed to start raising rates. After all, the policy of keeping interest rates close to zero per cent was introduced as a temporary response to an economic emergency. Now that the emergency is well behind us, isn’t it time for policy makers to start normalizing things? Not necessarily. The Fed’s dilemma is that there is an equally plausible—perhaps more plausible—argument for standing pat.

Under the Federal Reserve Act, the Fed is obliged to pursue two targets: price stability and maximum employment. As the Fed interprets this mandate, its task is to achieve the highest level of employment growth (and G.D.P. growth) consistent with its inflation target of two per cent. Economic theory says that higher rates of employment and lower rates of unemployment eventually lead to higher rates of inflation. At some point, therefore, the Fed, in order to prevent inflation from overshooting its target, will be obliged to tap the brakes by raising rates.

However, the data suggests that we are still well short of reaching the point at which inflation becomes a threat. Indeed, inflation, far from picking up, has been falling sharply. In July, the latest month for which we have figures, the prices paid by consumers didn’t rise at all. Yes, that’s right: there wasn’t any inflation. The consumer price index, which measures the prices of a broad basket of items purchased by people living in urban areas, rose by 0.0 per cent. And July wasn’t an aberration. In the twelve months from July, 2014, to July, 2015, the C.P.I. rose by just 0.2 per cent. That’s one of the lowest rates of inflation we’ve seen in decades...

Demeter

(85,373 posts)There is a shared belief among the members of the Group of 20 leading economies in the need to "double down" against competitive currency devaluation and avoid it in both policy and language, a senior U.S. Treasury official said on Saturday.

Speaking to reporters on the sidelines of the G20 meeting of central bankers and finance ministers in the Turkish capital Ankara, the official said the final communique from the meeting was expected to address competitive devaluation, where countries attempt to drive down a currency to boost exports.

"You can make policy decisions that lead to competitive devaluation, (or) you can say things that lead to talking down a currency," the official said.

"There is a shared sense that the G20 needs to double down on its principle that competitive devaluation is a bad thing."

MORE

Demeter

(85,373 posts)Financial leaders from the world's 20 biggest economies agreed on Saturday to step up reform efforts to boost disappointingly slow growth, saying reliance on ultra-low interest rates would not be enough to accelerate economic expansion.

But they also said they were confident growth would pick up and, as a result, interest rates in "some advanced economies" -- code for the United States -- would have to rise.

"Monetary policies will continue to support economic activity consistent with central banks' mandates, but monetary policy alone cannot lead to balanced growth," the communique of the G20 finance ministers and central bankers said.

"We note that in line with the improving economic outlook, monetary policy tightening is more likely in some advanced economies."

The wording defied pressure from emerging markets to brand an expected U.S. rate rise as a risk to growth....

Demeter

(85,373 posts)...The initial furor that the Panthers caused cannot be overstated. Less than a year after the armed Panther Patrols emerged, the California governor Ronald Reagan signed the Mulford Act, put forward by the California State Assembly with the explicit desire to prevent the Panthers from carrying loaded firearms in public. In protest, on May 2, 1967, twenty-six armed Panthers, led by the co-founder Bobby Seale, invaded the State Assembly chamber, with shotguns and pistols drawn. The group’s ranks and prestige exploded in the wake of the incident. The nascent notion of “black power,” first coined two years before by the S.N.C.C.’s Stokely Carmichael, on the back of a truck in the Deep South, had its most visible standard bearer yet.

The Panthers, in the second issue of their newspaper, laid out a ten-point program, one which called for full employment, decent housing, historically conscious education, as well as the end of black imprisonment, service in the armed forces, subjugation to police brutality, and “the robbery by the white men of our Black Community.” Although the men who delivered these messages to the public, largely Huey P. Newton and Eldridge Cleaver, were mocked by white conservatives such as William F. Buckley and Tom Wolfe, a look at the 1972 Democratic Party platform tells you that their ideas were taken far more seriously by the political establishment (and were far more concrete) than those of the Occupy Movement, two generations later.

Newton and Cleaver were both involved in gun battles with police officers in the late sixties. Cleaver, a literary celebrity for his 1968 memoir “Soul on Ice,” fled to Algeria after his shoot-out, which followed in the wake of the assassination of Martin Luther King, Jr., and was largely seen as a foolhardy ambush on the police, one which left one of the youngest and earliest members of the Panthers, Bobby Hutton, dead. Newton was initially jailed for his gun battle, which grew out of a mysterious traffic stop, and in short order he became a cause célèbre for much of the American left. (“Free Huey!” is still, just barely, part of the national nomenclature.)

As Nelson tells it, the early-seventies decline of the Panthers was brought about by the outright war waged against them by the F.B.I.’s COINTELPRO unit, which frequently raided Panther headquarters and, as in the case of Fred Hampton, the chairman of the Illinois chapter of the Panthers, assassinated group leaders. Yet decadence and dissension amongst the party’s leadership, and the ascendance of a black middle class with more access to the economic and social mainstream, are perhaps equally to blame for the Panthers’ decline. While the documentary doesn’t give as detailed account of these matters as it does the F.B.I.’s dirty tricks, Nelson doesn’t shy away from the less heroic elements of the Panther story nearly as much as Van Peebles’s “Panther” does. That film places the blame for the group’s demise almost solely on the intransigence of the F.B.I., who allegedly colluded with the mafia and local law enforcement to flood the black community with drugs, necessitating the drug violence and addiction that Van Peebles saw as the real reason behind the continued malaise of black communities in 1995, the year the film was made...

Demeter

(85,373 posts)

The debate over the federal minimum wage in the nascent presidential campaign is really two debates: one among Democrats and one among Republicans.

Democrats are divided on how much to raise the minimum, currently $7.25 an hour. Hillary Rodham Clinton has spoken favorably of a Democratic bill for a raise to $12 by 2020. Senator Bernie Sanders and Martin O’Malley, the former governor of Maryland, as well as several congressional Democrats, support $15 an hour by 2020. Is $12 adequate to ensure a minimally decent living? Would $15 be economically feasible?

Going to $12 by 2020 would bring the minimum more in line with historical benchmarks, including wage and price inflation. But it is a stretch to believe that $12 an hour in 2020 would provide a minimally decent living. In 14 states and Washington, D.C., the cost of living for one person is already near or above $12 an hour, according to data compiled by economists at M.I.T. In most of the remaining states, one person now requires an hourly wage of $10 to $11 to eke out a living.

Fifteen dollars, phased in gradually, is the better option. It would be adequate and feasible, assuming that policy makers also take steps to raise middle-class wages, which would include tough enforcement of updated laws on overtime, scheduling, worker classification and other labor issues....MORE

Demeter

(85,373 posts)Of all the BRICS, Brazil would seem, on the face of it, to be in the worst shape...Inflation? It is closing in on 10 percent. Its currency? The real’s value has dropped nearly in half against the American dollar. Recession? It’s arrived. The consensus view is that the Brazilian economy will shrink by some 2 percent in 2015. Meanwhile, “between 100,000 and 120,000 people are losing their jobs every month,” says Lúcia Guimãraes, a well-known Brazilian journalist.

Compounding the economic problems, many a result simply of poor economic stewardship, a huge corruption scandal has swept up both Brazilian politicians and a number of prominent businesspeople. The scandal centers on the country’s biggest company, Petrobras, whose success had been an object of real pride during the go-go years. Although the details are complicated, as its core the scandal is “an old-fashioned kickback scheme,” as The Times’s David Segal put it in a fine story last month — a kickback scheme that has been estimated at a staggering $2 billion. Politicians and members of the business elite alike have been arrested. The country’s president, Dilma Rousseff, who was the chairwoman of Petrobras while much of the scheme was taking place, hasn’t been accused of anything, but her approval rating is in the single digits. People have taken to the streets to call for her impeachment, though there are really no grounds yet to impeach her. Political corruption has long been a fact of life in Brazil, but rarely has it been on such vivid, and nauseating, display.

The double whammy of scandal and recession has created a mood that combines outrage, anguish and resignation. But there is something else, too. “People feel betrayed,” says Guimãraes. Rousseff’s party, the Partido dos Trabalhadores (PT) — or Workers’ Party — came to office in 2003 promising, idealistically, to create social programs that would help the poor join the middle class. Between 2003 and 2011, according to one estimate, some 40 million people have climbed from abject poverty to the lowest rung on the middle class.

“The worst thing,” a Brazilian friend of mine wrote in an email recently, “is this feeling of disappointment with the … PT, which brought so much hope to the middle class. I’d call this feeling a kind of political depression.”

And yet, as I look over the BRICS, I think there is more hope for Brazil than some of its fellow members. Admittedly, I am a lover of Brazil, and want to see it succeed, and so was pleased when, as I made phone calls and emails for this column, a surprising silver lining emerged. It is this: For all the pain Brazilians are going through right now, its democracy and its judicial institutions are working.

MORE

Demeter

(85,373 posts)By Andrew K. Rose, Professor of International Business, in the Economic Analysis and Policy Group, Haas School of Business, University of California, Berkeley.