Economy

Related: About this forumWeekend Economists Go Muckraking September 11-13, 2015

Summer's heat and humidity are broken. We plunged straight into fall: cool, damp, rainy. Hacking and wheezing, wishing I weren't sick...the usual routine!

So, who was Ida Tarbell, and why should we care?

John D. Rockefeller, the man so despised and reviled, his agent told him to hand out dimes to children to improve his image...

Tarbell was born in Erie County, Pennsylvania, on November 5, 1857 to Esther Ann (née McCullough) and Franklin Summer Tarbell, a teacher and a joiner by trade. She was born in the log cabin home of her maternal grandfather, Walter Raleigh McCullough, a Scots-Irish pioneer, and his wife. Her father's distant immigrant ancestors had settled in New England in the 17th century.

In 1860 Ida's father moved the family to Titusville, Pennsylvania, a new center of oil production. There he built a house, which was her mother's first home of her own. The Tarbell family lived in the western region of the state in the period as new oil fields were being developed in the 1860s, utterly changing the regional economy. Her father first used his trade to build wooden oil storage tanks. He later became an oil producer and refiner in Venango County. Her father's business, along with those of many other small businessmen, was adversely affected by the South Improvement Company scheme (circa 1872) between the railroads and larger oil interests. Later, Tarbell would vividly recall this event in her writing, in which she accused the leaders of the Standard Oil Company of using unfair tactics to put her father and many small oil companies out of business.

The Tarbells converted to Methodism when Ida was a child. They were socially active, entertaining prohibitionists and women's suffragists. Tarbell graduated at the head of her high school class in Titusville and went on to study biology at Allegheny College in 1876, where she was the only woman in her class of 41. She lived separately in a house with the few other upper class women at the college and graduated in 1880.

Career

Tarbell began her career as a teacher at Poland Union Seminary in Poland, Ohio. She taught classes in geology, botany, geometry and trigonometry as well as languages, Greek, Latin, French and German. After two years, she realized teaching was too much for her and that she enjoyed writing more. As a suffragist, Tarbell had determined never to marry and so instead pursued a journalism career.

Tarbell returned to Pennsylvania, where she met Theodore L. Flood, editor of The Chautauquan, a teaching supplement for home study courses at Chautauqua, New York. She was quick to accept Flood's offer to write for the publication. She later wrote, “I was glad to be useful, for I had grown up with what was called the Chautauqua movement.” In 1886 she became managing editor. Her duties included proofreading, answering reader questions, providing proper pronunciation of certain words, translating foreign phrases, identifying characters, and defining words. “Doing this job I began to think about facts and reading proofs. It was an exacting job which never ceases to worry me. What if the accent was in the wrong place? What if I brought somebody into the world in the wrong year?”

In 1890 Tarbell moved to Paris to do postgraduate work in historical research. She already wanted "to rescue women from the obscurity of history." Specifically, she intended to write a biography of Madame Roland, the leader of an influential salon during the French Revolution, and was able to make use of sources that had never been used, such as family letters. While in France, she wrote short features on prominent Frenchwomen and Parisian life for the syndicate affiliated with Samuel McClure's magazine. He offered her the position as editor for his eponymous magazine. While working for McClure's Magazine, Tarbell wrote a popular series on Napoleon Bonaparte.

While based in Washington, D.C., Tarbell conducted research to support her 20-part series on President Abraham Lincoln. This was highly popular, attracting enough new readers to double the magazine's circulation. The articles were collected in a book, giving Tarbell a national reputation as a major writer and the leading authority on the slain president. Her research in the backwoods of Kentucky and Illinois uncovered the true story of Lincoln's childhood and youth. As she continued to write about Lincoln, she publishing a series of articles and books about him and traveled on the lecture circuit, recounting her discoveries to large audiences.

In 1898, Tarbell moved to New York where McClure's was based. In 1902, she began publishing serialized articles in McClure's that were later collected in the book, The History of Standard Oil (1904).

While Tarbell established her reputation in a field dominated by men, her articles and novels about women began to change starting in 1909. The feminism appeared to fade as she recommended that women embrace home life and the family, saying they had a "true role as wives, mothers and homemakers." She held this position until her death. Former allies among suffragists were dismayed at her change and her speaking to anti-suffragist organizations. Helen Keller described Tarbell as "getting old." Historian Robert Stinson believes that she was making new public statements about an ambiguity she had lived in her own life.

Influence on the oil industry

In 1900 Tarbell began to research the Standard Oil trust with the help of an assistant, John Siddall. Tarbell began her interviews with Henry H. Rogers, who she was first introduced to by writer Mark Twain. Rogers had begun his career during the American Civil War in western Pennsylvania oil regions where Tarbell had grown up. In 1902 she conducted detailed interviews with the Standard Oil magnate.

Rogers, wily and normally guarded in matters related to business and finance, may have been under the impression her work was to be complimentary. He was apparently unusually forthcoming. However, Tarbell's interviews with Rogers formed the basis for her negative exposé of the business practices of industrialist John D. Rockefeller and the massive Standard Oil organization. Her investigative journalism was serialized from 1902 to 1904 in McClure's Magazine; her first article on Standard Oil was published with pieces by Lincoln Steffens and Ray Stannard Baker. Together these articles ushered in the era of muckraking journalism. The series was later published as a book in 1904, The History of the Standard Oil Company.

Tarbell's biggest obstacle, however, was neither her gender nor Rockefeller's opposition. Rather, her biggest obstacle was the craft of journalism as practiced at the turn of the twentieth century. She investigated Standard Oil and Rockefeller by using documents—hundreds of thousands of pages scattered throughout the nation—and then amplified her findings through interviews with the corporation's executives and competitors, government regulators, and academic experts past and present. In other words, she proposed to practice what today is considered investigative reporting, which did not exist in 1900. Indeed, she invented a new form of journalism. And then, in an inspirational tale for journalists, Ida Tarbell went to work. Her History of the Standard Oil Company spotlighted Rockefeller's practices and mobilized the public. Readers nationwide awaited each chapter of the story, serialized in 19 installments by McClure's between 1902 and 1904.

Her stories on Standard Oil began in the November 1902 issue of McClure's and lasted for nineteen issues. She was meticulous in detailing Rockefeller's early interest in oil and how the industry began. After the series was over, she wrote a profile of Rockefeller, perhaps the first CEO profile ever, though she never met or even talked to Rockefeller.

Tarbell developed investigative reporting techniques, digging into public documents across the country. Separately, these documents provided individual instances of Standard Oil's strong-arm tactics against rivals, railroad companies and others that got in its way. Organized by Tarbell into a cogent history, they became a damning portrayal of big business. A subhead on the cover of Weinberg's book encapsulates it this way: "How a female investigative journalist brought down the world's greatest tycoon and broke up the Standard Oil monopoly."

Tarbell's exposé of Standard Oil was the first corporate coverage of its kind, and it attacked the business operations of Rockefeller, the best-known businessman in the country at the time. He had retired from the oil business several years before, and was devoting his time to philanthropy.

Tarbell disliked the muckracker label and wrote an article, "Muckraker or Historian," in which she justified her efforts for exposing the oil trust. She referred to

this classification of muckraker, which I did not like. All the radical element, and I numbered many friends among them, were begging me to join their movements. I soon found that most of them wanted attacks. They had little interest in balanced findings. Now I was convinced that in the long run the public they were trying to stir would weary of vituperation, that if you were to secure permanent results the mind must be convinced.

Representation in other media

Charles Klein's political play, The Lion and the Mouse (1905), opened soon after Tarbell's series on Standard Oil had been published in McClure's Magazine, and the plot was thought to be based on her campaign. (Its title is that of an Aesop's fable.) Its 686 continuous performances set a record for any American play in New York, and four road companies took the play on the road.

Death and legacy

Ida Tarbell died of pneumonia at Bridgeport Hospital in Bridgeport, Connecticut on January 6, 1944, after being in the hospital since December 1943. She was 86.

Tarbell has been well remembered in the decades since her death. In 1993, half a century later, the Ida Tarbell House in was declared a National Historic Landmark. In 2000 she was inducted posthumously into the National Women's Hall of Fame in Seneca Falls, New York.

On September 14, 2002, the United States Postal Service issued a commemorative stamp honoring Tarbell as part of a series of four stamps honoring women journalists.

So I would posit that Ida Tarbell was the philosophical mother of Edward Snowden.

(about John D. Rockefeller)And he calls his great organization a benefaction, and points to his church-going and charities as proof of his righteousness. This is supreme wrong-doing cloaked by religion. There is but one name for it -- hypocrisy.

Rockefeller and his associates did not build the Standard Oil Co. in the board rooms of Wall Street banks. They fought their way to control by rebate and drawback, bribe and blackmail, espionage and price cutting, by ruthless ... efficiency of organization.

― Ida Tarbell, The History Of The Standard Oil Company

http://www.qotd.org/portraits/Tarbell,Ida.jpg

Photo by J. E. Purdy studio, Boston (1904)

http://www.qotd.org/sigs/Tarbell,Ida.sig.jpg

Demeter

(85,373 posts)By David Kotz, a professor of economics at the University of Massachusetts-Amherst and the author of The Rise and Fall of Neoliberal Capitalism (Harvard University Press, 2015). This is the first installment of a two-part series based on his book.

Part 1: What is Neoliberal Capitalism?

“Neoliberalism,” or more accurately neoliberal capitalism, is a form of capitalism in which market relations and market forces operate relatively freely and play the predominant role in the economy. That is, neoliberalism is not just a set of ideas, or an ideology, as it is typically interpreted by those analysts who doubt the relevance or importance of this concept for explaining contemporary capitalism. Under neoliberalism, non-market institutions – such as the state, trade unions, and corporate bureaucracies – play a limited role. By contrast, in “regulated capitalism” such as prevailed in the post-World War II decades – in the United States and other industrial capitalist economies – states, trade unions, and corporate bureaucracies played a major role in regulating economic activity, confining market forces to a lesser role.

A few clarifications are in order. First, capitalism cannot function without a state. After all, private property is a creation of the state, and market exchange requires contract law and associated enforcement that can only be provided by a state. However, in neoliberal capitalism the state economic role tends to be largely confined to protection of private property and enforcement of contracts. In regulated capitalism the state’s economic role expands significantly beyond those core functions of the capitalist state.

Second, the dominant role of market relations and market forces in neoliberal capitalism is embodied in a set of institutions and reinforced by particular dominant ideas. The transition from regulated capitalism to neoliberal capitalism starting in the 1970s was marked by major changes in economic and political institutions. This will be explored below.

Third, the institutions of neoliberal capitalism, while promoting an expanded role in the economy for market relations and market forces, simultaneously transform the form of the main class relations of capitalism. Most importantly, the capital-labor relation assumes the form of relatively full capitalist domination of labor. This contrasts with the capital-labor compromise that characterized the regulated capitalism of the post-World War II decades. Neoliberalism also brought change in the relation between financial and non-financial capital, as will be considered below.

Economic Developments in the Neoliberal Era

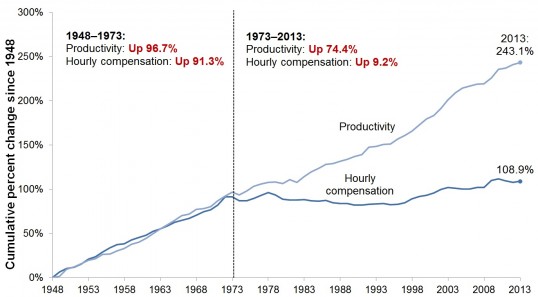

The most talked about economic development in the neoliberal era is rapidly rising inequality. While Thomas Piketty’s now-famous book, Capital in the 21st Century, documented the relentless rise of the income share of the top 1%, he did not provide a convincing explanation of that development. The neoliberal form of capitalism supplies a clear explanation. As neoliberal restructuring undermined labor’s bargaining power, the real wage stagnated while profits rose rapidly. Figure 1 shows the big gap after 1979 between the growth rate of profit and of wages and salaries (which include managerial salaries). That gap jumped sharply upward after 2000. Another feature of neoliberal capitalism, the development of a market in corporate CEOs, drove CEO pay in large corporations up from 29 times that of the average worker in 1978 to 352 times as great in 2007.

HIS DEVELOPMENT CONTINUES AT LINK

Demeter

(85,373 posts)

Assuming the collective wisdom of economists is right—which is a generous assumption given that predicting business cycles isn't exactly a cakewalk—it puts the current expansion on track to have a lifespan of about nine years. That's a pretty good run, though the honor of the longest expansion on record would still belong to the decade that ended in March 2001.

The current recovery has already beaten the postwar average of just under five years, mostly because improvement in the economy has been so slow. Payrolls only started to really pick up last year, and growth, while steady, hasn't been anything to write home about. Economists expect the U.S. to expand at a 2.5 percent annualized rate this year, just a tick above last year and much slower compared with growth in other recoveries.

The survey also suggests that the next U.S. president will have just one calendar year to get settled before a downturn occurs. They may want to solicit some advice from Obama, who took office in January 2009, during the deepest recession in the post-World War II era.

Economists said there's a 10 percent chance of a U.S. recession within the next 12 months, according to the median of the survey. While the median is usually a good gauge because it's less influenced by outlier responses, the survey's average showed an interesting uptick. Looking at that metric, the odds of a U.S. recession in the next year climbed to an average 13 percent, the highest since economists were surveyed in December 2013.

That may have something to do with the volatility that's been roiling global markets of late, not to mention the Federal Reserve's first interest rate increase since 2006 coming as soon as next week. Some economists worry that it's too early to start tightening policy, which carries the risk of crimping growth.

Meanwhile China, the world's second-largest economy, is slowing, and other emerging markets such as Brazil, South Africa and Russia are also struggling. Commodity prices, trade and inflation are all sluggish. And growth in developed economies may not be strong enough to help keep the world from slipping into a contraction. All that was enough to prompt Citigroup Inc.'s chief economist, Willem Buiter, to assign a 55 percent chance to some form of global recession in the next couple years.

Demeter

(85,373 posts)GOLDMAN IS BETTING ON A GREATER DEPRESSION....

http://www.bloomberg.com/news/articles/2015-09-11/-20-oil-possible-for-goldman-as-forecasts-cut-on-growing-glut

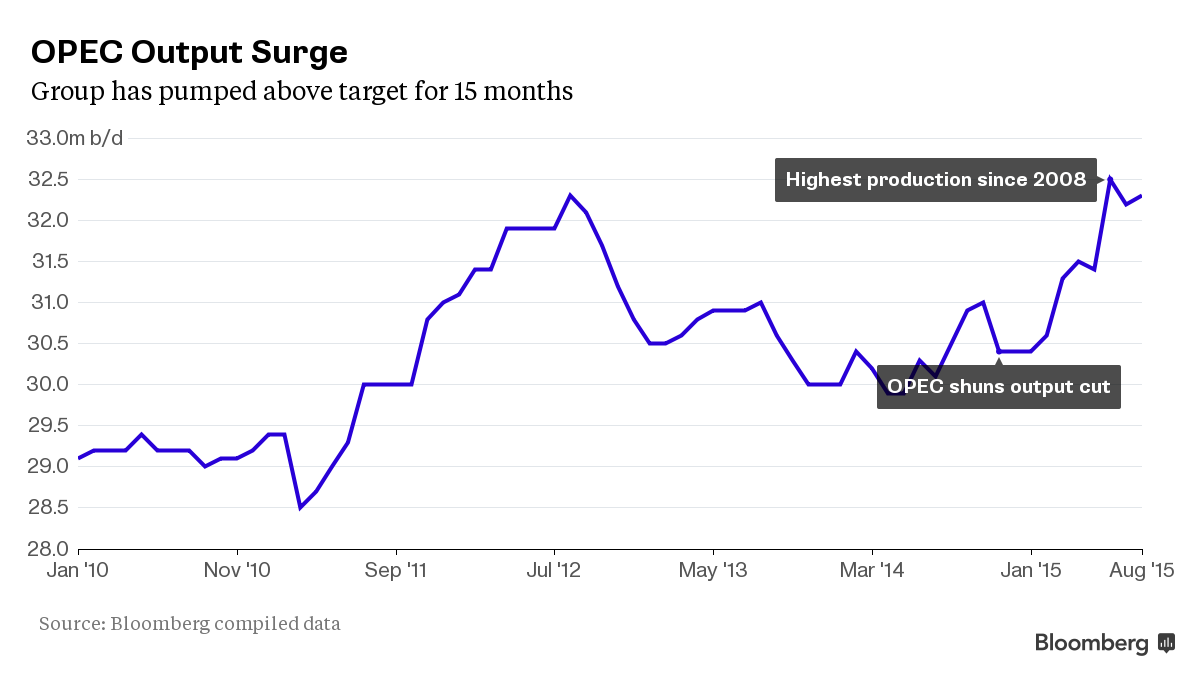

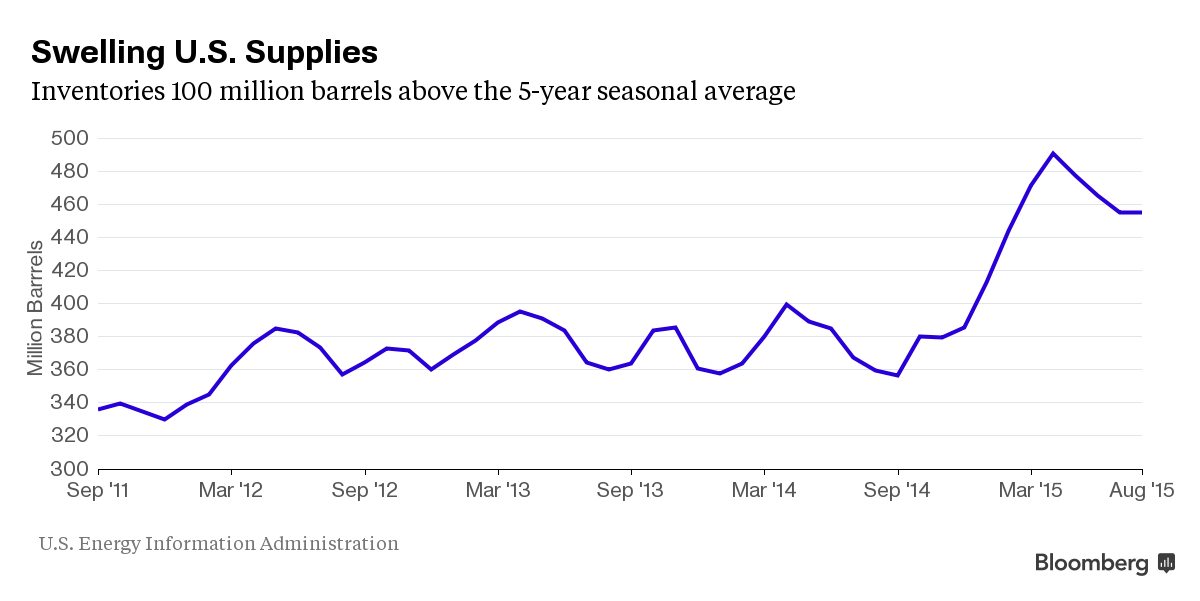

The global surplus of oil is even bigger than Goldman Sachs Group Inc. thought and that could drive prices as low as $20 a barrel.

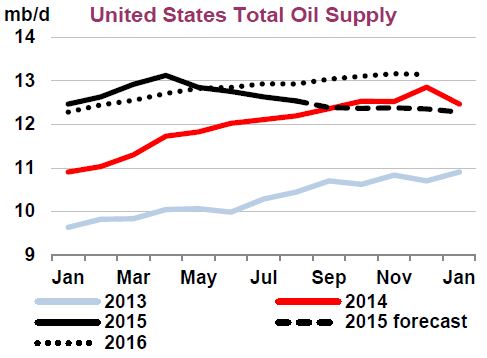

While it’s not the base-case scenario, a failure to reduce production fast enough may require prices near that level to clear the oversupply, Goldman said in a report e-mailed Friday while cutting its Brent and WTI crude forecasts through 2016. The International Energy Agency predicted that crude stockpiles will diminish in the second half of next year as supply outside OPEC declines by the most since 1992.

“The oil market is even more oversupplied than we had expected and we now forecast this surplus to persist in 2016,” Goldman analysts including Damien Courvalin wrote in the report. “We continue to view U.S. shale as the likely near-term source of supply adjustment.”

MORE

Demeter

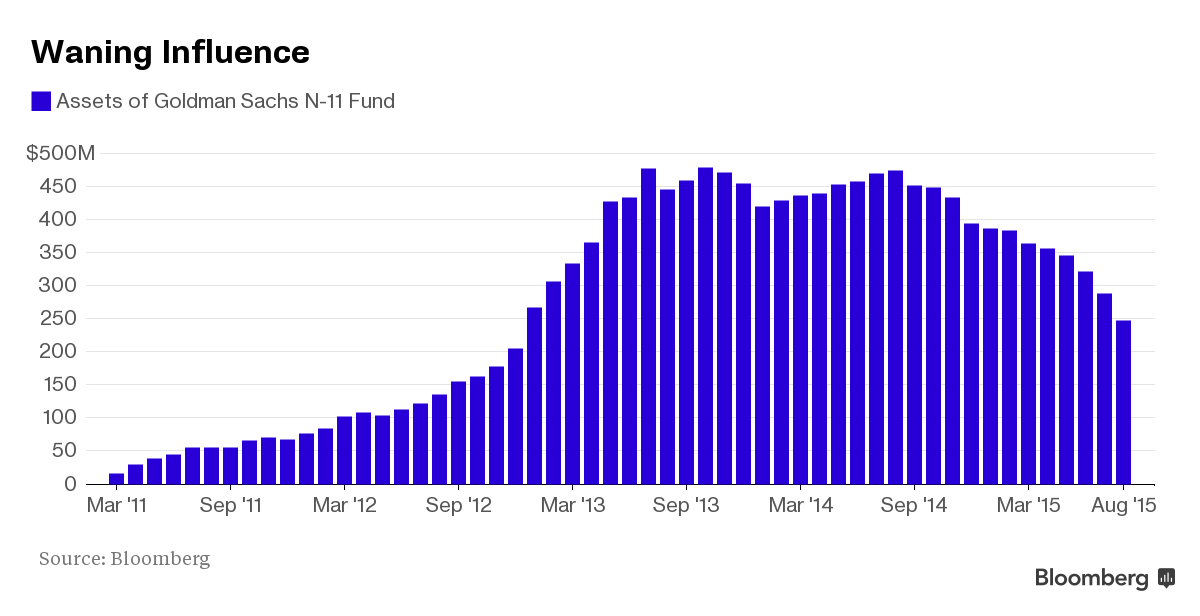

(85,373 posts)This time last year, it looked like Goldman Sachs Group Inc.’s selection of emerging market up-and-comers was ready to fill the void left by shrinking investment returns in Brazil, Russia, India and China.

Share prices in these “Next 11” countries -- places like the Philippines, Turkey and Mexico -- were trading at all-time highs as foreign investors flooded their markets with cash. Inflows into Goldman Sachs’s U.S.-domiciled Next 11 equity fund sent assets under management to twice the level of the firm’s BRICs counterpart.

Now, though, the Next 11 countries are looking even worse for investors than the larger markets they were supposed to supplant. MSCI Inc.’s Next 11 equity gauge has tumbled 19 percent this year, versus a 14 percent slump for the BRIC index. Foreign capital is rushing out, with the Goldman Sachs fund shrinking by almost half as losses deepened to 11 percent since its inception four years ago...

Demeter

(85,373 posts)Brazil's downgrade had long been expected following recent scandals and its slump towards recession, but it has sharpened the focus on who could be next...Financial markets are betting that Russia, South Africa, Turkey and Colombia could all be next in line for "junk" debt status after Standard and Poor's stripped Brazil of its investment grade...Slumping commodity prices and the prospect of rising global interest rates are adding to some liberal helpings of ugly national politics and laying bare a number of countries' failure to reform in the good times.

S&P's Capital IQ unit has what it calls Market Derived Signal (MDS) models that show credit default swap markets currently expecting a major wave of EM downgrades, a number of which would see the big names mentioned going into junk status.

- Russia, which only Fitch of the three main agencies at BBB- still rates as investment grade (IG), is currently trading as if it were at least a three notches into junk.

- Turkey, which both Moody's and Fitch currently have on the lowest investment grade rung, is trading as if were two steps into junk while for South Africa it is one.

- Colombia, which is being hit hard by the fall in its main export oil and a rift with neighbour Venezuela, is also expected to slide back into junk according to the Market Derived Signal model.

The difference between investment grade and junk status can be huge for countries because many global investors tend to steer away from those with lower ratings. The downgrades currently being seen are also reversing the roughly 200 upgrades emerging markets have earned since 2007, nearly half of them to the top "investment grade" category.

As well as those now teetering on the investment grade/junk cusp, China, Chile, Malaysia, South Africa, Mexico, Indonesia, Thailand, Israel, Saudi Arabia and much of the Middle East are also priced for rating cuts according to the data.

Historically, though, the gloomy view of markets does not always turn into reality...

MORE

Demeter

(85,373 posts)Federal Reserve policy makers may take a pass on raising rates next week if they decide the market has already done the tightening for them.

The recent stock market sell-off, an increase in corporate borrowing costs and the rise of the dollar have contributed to a tightening of financial conditions roughly equivalent to three 25 basis-point hikes in the central bank's benchmark federal funds rate, according to a Goldman Sachs Group Inc. report published late Thursday in New York.

The Goldman Sachs Financial Conditions Index -- a measure that incorporates variables like stock prices, credit spreads, interest rates, and the exchange rate -- rose to the highest level in five years at the end of August amid the most acute phase of the turmoil....

Demeter

(85,373 posts)Demeter

(85,373 posts)By Bill Black, the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City.

By issuing its new memorandum the Justice Department is tacitly admitting that its experiment in refusing to prosecute the senior bankers that led the fraud epidemics that caused our economic crisis failed. The result was the death of accountability, of justice, and of deterrence. The result was a wave of recidivism in which elite bankers continued to defraud the public after promising to cease their crimes. The new Justice Department policy, correctly, restores the Department’s publicly stated policy in Spring 2009. Attorney General Holder and then U.S. Attorney Loretta Lynch ignored that policy emphasizing the need to prosecute elite white-collar criminals and refused to prosecute the senior bankers who led the fraud epidemics.

It is now seven years after Lehman’s senior officers’ frauds destroyed it and triggered the financial crisis. The Bush and Obama administrations have not convicted a single senior bank officer for leading the fraud epidemics that triggered the crisis. The Department’s announced restoration of the rule of law for elite white-collar criminals, even if it becomes real, will come too late to prosecute the senior bankers for leading the fraud epidemics. The Justice Department has, effectively, let the statute of limitations run and allowed the most destructive white-collar criminal bankers in history to become wealthy through fraud with absolute impunity. This will go down as the Justice Department’s greatest strategic failure against elite white-collar crime.

The Obama administration and the Department have failed to take the most basic steps essential to prosecute elite bankers. They have not restored the “criminal referral coordinators” at the banking regulatory agencies and they have virtually ignored the whistleblowers who gave them cases against the top bankers on a platinum platter. The Department has not even trained its attorneys and the FBI to understand, detect, investigate, and prosecute the “accounting control frauds” that caused the financial crisis. The restoration of the rule of law that the new policy promises will not happen in more than a token number of cases against senior bankers until these basic steps are taken.

The Justice Department, through Chris Swecker, the FBI official in charge of the response to mortgage fraud, issued two public warnings in September 2004 — eleven years ago. First, there was an “epidemic” of mortgage fraud. Second it would cause a financial “crisis” if it were not stopped. The Department’s public position, for decades, was that the only way to stop serious white-collar crime was by prosecuting the elite officials who led those crimes. For eleven years, however, the Department failed to prosecute the senior bankers who led the fraud epidemic. The Department’s stated “new” position is its historic position that it has refused to implement. Words are cheap. The Department is 4,000 days late and $24.3 trillion short. Economists’ best estimate is that the financial crisis will cause that massive a loss in U.S. GDP — plus roughly 15 million jobs lost or not created.

Americans need to come together to demand that the Department act, not just talk, to restore the rule of law and prosecute the bankers that led the fraud epidemics that drove the financial crisis. There is very little time left to prosecute, so the effort must be vigorous and urgent and a top priority....

Demeter

(85,373 posts)Demeter

(85,373 posts)Here are two facts:

1) we’ve been adding jobs at an average rate of about 220,000 a month in recent months and

2) we’re not at full employment, by which I mean a very tight matchup between the number of job seekers and the number of jobs.

So, a natural question growing out of these facts would be: when might we get to full employment, assuming we keep up the pace of payroll growth. We answer that question in the figure above. Here’s the recipe:

First, we use Andy Levin’s total employment gap, which accounts for unemployment, the “missing workforce” (the number of people out of the labor force who’d likely come back in with stronger labor demand), and the underemployed (those working fewer hours than they’d like). That gap stands at about 3.6 million FTE’s right now (full-time-equivalents).

Second, we use the historical relationship between payrolls and FTEs to get a comparable payroll number. Since there are a bunch of part-time jobs out there, we estimate that one FTE equals about 1.08 payroll jobs. Then the miracle of long division occurs and we’re done (1.08*3.6/number of payroll jobs).

Suppose something really bad happens and the pace of job gains gets cut by half. Maybe the Fed goes nuts and doesn’t just tap the breaks but slams them. Maybe we default on the national debt, or some financial bubble implodes. That would push out the time-to-full-employment until at least Dec. 2018, which would mean about a decade of slack labor markets. At the current pace, we’re potentially looking at the spring of 2017, and if job growth were to significantly accelerate, we could be talking about the end of next year.

Obviously, there are different ways to cut this, but this approach seems the most realistic to us because it deals with various sources of labor market slack. Were one to merely reference the unemployment rate, you’d incorrectly conclude we were already at full employment, and if you were a Fed governor, that might lead you to mistakenly raise interest rates.

Under any of these scenarios, we don’t reach full employment until at least year seven of this expansion, and more likely year eight. That, in a nutshell, is the failure of macroeconomic policy both here and abroad. How to fix it is the subject for another day, not to mention a recent book you might find useful: http://jaredbernsteinblog.com/wp-content/uploads/2015/04/The-Reconnection-Agenda_Jared-Bernstein.pdf

Demeter

(85,373 posts)Consistent with section 202(d) of the National Emergencies Act, 50 U.S.C. 1622(d), I am continuing for 1 year the national emergency previously declared on September 14, 2001, in Proclamation 7463, with respect to the terrorist attacks of

September 11, 2001, and the continuing and immediate threat of further attacks on the United States.

Because the terrorist threat continues, the national emergency declared on September 14, 2001, and the powers and authorities adopted to deal with that emergency must continue in effect beyond September 14, 2014. Therefore, I am continuing in effect for an additional year the national emergency that was declared on September 14, 2001, with respect to the terrorist threat.

This notice shall be published in the Federal Register and transmitted to the Congress.

BARACK OBAMA

Demeter

(85,373 posts) ~original

~originalDemeter

(85,373 posts)By the early 1900s, John D. Rockefeller, Sr. had finished building his oil empire. For over 30 years, he had applied his uncanny shrewdness, thorough intelligence, and patient vision to the creation of an industrial organization without parallel in the world. The new century found him facing his most formidable rival ever -- not another businessman, but a 45-year-old woman determined to prove that Standard Oil had never played fair. The result, Ida Tarbell's magazine series "The History of the Standard Oil Company," would not only change the history of journalism, but also the fate of Rockefeller's empire, shaken by the powerful pen of its most implacable observer.

Born in a log home in Hatch Hollow, northwestern Pennsylvania, on November 5, 1857, Ida Minerva Tarbell grew up amid the derricks of the Oil Region. Her father, Frank Tarbell, built wooden oil storage tanks and later became an oil producer and refiner. "Things were going well in father's business," she would write years later. "There was ease such as we had never known; luxuries we had never heard of. ...Then suddenly our gay, prosperous town received a blow between the eyes." The 1872 South Improvement scheme, a hidden agreement between the railroads and refiners led by John D. Rockefeller, hit the Pennsylvania Oil Region like a tidal wave. It hit the Tarbells too, leaving behind painful memories that would be rekindled 30 years later. "Out of the alarm and bitterness and confusion, I gathered from my father's talk a conviction to which I still hold -- that what had been undertaken was wrong."

After graduating from Allegheny College, the sole woman in the class of 1880, Tarbell moved to Ohio to teach science, but resigned after two years. She would find her true calling just months later back in Pennsylvania, when she met the editor of a small magazine...It was this work that got the attention of editor Samuel Sidney McClure, then looking for writers for his new monthly. Tarbell was hired as an editor in 1894, and soon became McClure's Magazine's most successful writer when her series on Abraham Lincoln nearly doubled the circulation of the magazine. Another serialized biography followed, this time on Napoleon, establishing her as a gifted historical writer and an insightful judge of character. But events and trends far more immediate were calling for attention. The rapidly changing economic landscape and the rise of monopolistic trusts was "disturbing and confusing people," wrote Tarbell. A new generation of investigative journalists, later dubbed "muckrakers" by President Theodore Roosevelt, had set out to wage a campaign to expose corruption in business and political lawlessness. Tarbell latched onto the idea of using the story of Standard Oil to illustrate these troubling issues, persuading McClure to agree to a three-part series on the oil trust.

Tarbell's father, fearing that Rockefeller would retaliate against the magazine, advised her not to do it. But she dove into the work with a zeal that matched her antagonist’s. For almost two years, she painstakingly looked through volumes of public records, including court testimony, state and federal reports and newspaper coverage. From these, she gathered a mind-boggling wealth of information on Rockefeller's ascent and the methods used by Standard Oil. The breadth of her research was remarkable, but even more impressive was her ability to digest Rockefeller's complicated business maneuvers into a narrative that would be accessible and engaging to the average reader.

Although always modest about her prose, Tarbell was an eloquent writer, able to combine her keen analytical skills with a sense of drama. "Now, it takes time to secure and to keep that which the public has decided it is not for the general good that you have," she wrote in July of 1903. "It takes time and caution to perfect anything which must be concealed. It takes time to crush men who are pursuing legitimate trade. But one of Mr. Rockefeller's most impressive characteristics is patience. There never was a more patient man, or one who could dare more while he waited. … He was like a general who, besieging a city surrounded by fortified hills, views from a balloon the whole great field, and sees how, this point taken, that must fall; this hill reached, that fort is commanded. And nothing was too small: the corner grocery in Browntown, the humble refining still on Oil Creek, the shortest private pipe line. Nothing, for little things grow."

MORE

DemReadingDU

(16,000 posts)I was looking for a PBS video biography of Ida Tarbell, not having any luck.

Demeter

(85,373 posts)IN ITS DAY, STANDARD OIL WAS THE ANSWER TO THAT QUESTION...

http://www.fool.com/investing/general/2015/09/10/what-are-the-biggest-companies-in-the-world.aspx?source=eogyholnk0000001

Numbers may not lie, but they also don't always tell the whole story. Thus, there can be several different answers to the simple question of what WHICH is the biggest company in the world. The fact is that the answer depends on the metric used to measure it -- whether it's revenue, profits, assets, or market value.

The biggest company in the world by revenue

If revenue is our guide, Wal-Mart Stores (NYSE:WMT) would be king, as it generated $484.7 billion in sales over the past year. It leads the pack by a wide mark as its sales are $57.1 billion, or 13.3% higher than Sinopec, which is second. Sales, however, don't tell the whole story as Wal-Mart's sales are lower margin. Because of this its profit is much smaller (ranked 18th) as well as its market value (ranked 12th ), which is why a case can be made for other companies being the world's biggest.

The biggest company in the world by profit

As I mentioned at the opening, numbers don't lie, but they certainly don't always tell the whole story. That's the case when looking at the largest company in the world by profit. Taking that honor is Vodafone, which tallied an astronomical $70.4 billion in profit over the past year. What's remarkable about that number is the fact it did this on just $66.3 billion in sales. What story isn't being told by these numbers is the fact that Vodafone's profit is inflated by the sale its 45% stake in Verizon Wireless to Verizon, resulting in an enormous net profit.

Because Vodafone's profitability was due to a one-time item, it's probably best to dismiss it and move down the list. That would elevate Chinese bank ICBC to the top spot as its $44.8 billion in profit was just ahead of Apple's (NASDAQ:AAPL) $44.5 billion in profit.

The biggest company in the world by assets

Another common metric that is used to measure size is to look at assets. By that measure, ICBC would again lead the pack as it holds $3.322 trillion in assets. That's almost $100 billion in assets more than Fannie Mae, which is second in assets. The problem with using assets as a metric for the world's largest company is that it really favors banks and other financial institutions. In fact, there aren't any non-banks in the top 50 companies in the world that are ranked by assets and the first non-bank on the list is GE, which isn't entirely non-bank due to its financial services division.

The biggest company in the world by market value

A final measurement of company size is its market value. Here, the clear leader is Apple as its market value is currently larger than its next two rivals, Google and ExxonMobil, combined. That being said, market value only measures publicly traded companies. One of the largest non-public companies is Saudi Aramco, which is the national oil company of Saudi Arabia. It currently produces two-and-a-half times as much oil as Exxon, suggesting it would be more than double Exxon's size and, despite the fact that the price of oil is half of what it was, the case could be made that it would be larger than Apple if it were publicly traded.

Putting it all together

Because no metric is perfect and each gives a different answer, it is hard to label a winner. However, as it has done for the past 13 years, Forbes puts out its Global 2000 listing of the largest companies in the world. It uses all four of the above metrics and scores companies to get a composite score. As a result of its methodology, it ranks ICBC as the biggest company in the world. So, that's the easy answer for a question that could have any number of correct answers.

Demeter

(85,373 posts)Test your knowledge of the ins and outs of home loans with this quick six-question quiz. AT LINK

Demeter

(85,373 posts)A divided U.S. appeals court on Thursday made it easier for some corporate whistleblowers to sue over alleged retaliation, raising the prospect that the U.S. Supreme Court may need to address the issue.

By a 2-1 vote, the 2nd U.S. Circuit Court of Appeals in New York revived a lawsuit in which Daniel Berman, a former finance director at the Neo@Ogilvy digital media unit of advertising company WPP Plc, claimed he was fired because he reported accounting irregularities to his superiors.

Circuit Judge Jon Newman accepted the U.S. Securities and Exchange Commission's view that Berman could seek whistleblower protection under the 2010 Dodd-Frank financial reforms, despite not having reported his concerns to the SEC before his firing.

That marked a departure from the 5th U.S. Circuit Court of Appeals in New Orleans, which in 2013 found a reporting requirement. The Supreme Court often reviews matters where circuit courts are split.

"From the employer perspective, it raises the stakes and the importance of avoiding retaliation claims," said Jill Rosenberg, an employment law partner at Orrick, Herrington & Sutcliffe in New York. "This is an issue the Supreme Court will have to decide."

MORE: http://www.reuters.com/article/2015/09/10/wpp-whistleblower-idUKL1N11G13620150910

Demeter

(85,373 posts)IT'S SEPTEMBER, WHICH MEANS STRUGGLING WITH THE FEDERAL BUDGET

http://www.reuters.com/article/2015/09/10/usa-debt-limit-idINKCN0RA2N620150910

U.S. Treasury Secretary Jack Lew on Thursday maintained his forecast that U.S. borrowing capacity would last at least until late October, and added that the Treasury's cash balance would temporarily rise with Sept. 15 tax payments.

In a letter to U.S. congressional leaders, Lew urged them to raise the debt limit as soon as possible to avoid unnecessary risks to financial markets, to business and consumer confidence, and the U.S. credit rating.

"On July 29, I wrote to inform you that the extraordinary measures we have been employing to preserve borrowing capacity would not be exhausted before late October, and that they likely

would last for at least a brief additional period of time. That continues to be our view, based upon our best and most recent information," Lew wrote.

Lew said the Treasury may again meet its goal of maintaining a $150 billion cash balance briefly in mid-September.

"We anticipate that it will rise temporarily after the September 15 deadline for corporate and individual tax receipts-possibly above $150 billion-and then will decline again," he wrote.

Demeter

(85,373 posts)The European Central Bank is likely to extend its asset-purchase program by up to two quarters into 2017 and buy an extra 360 billion euros of bonds as it tries to push up inflation, Goldman Sachs says...ECB President Mario Draghi said for the first time last week that the 1-trillion-euro plus program may run beyond September 2016 and that its size and composition may be adjusted. That came after the ECB cut its euro zone growth and inflation targets, citing fading momentum in emerging markets, particularly China. It also warned that falling prices could drag the bloc back into deflation in coming months.

In a possible precursor to further moves, the ECB increased the share of any sovereign bond issue it could buy to 33 percent from 25 percent, provided that did not give the central bank a blocking minority among bondholders.

Goldman Sachs analysts said they expected an announcement on the details in coming weeks. Dutch bank ABN Amro strategists said an announcement was likely as soon as October.

"The extension of the QE policy we now forecast is between one and two quarters, which, at a pace of 60 billion euros per month, amounts to, at most, 360 billion euros, or around a third of the current program," Goldman analysts said in a note. "Consistently, we think the shift in ECB policy mostly supports higher quality EMU issuers, and will not have a material first-order effect on EMU spreads – on which we remain neutral."

Under that assumption, they expect central bank purchases to absorb 80 to 85 percent of debt issued by Germany - the euro zone's benchmark issuer - between now and the end of 2016 and 50 percent of French government bond issuance. Among peripheral bonds, they expect the ECB to absorb 42 to 48 percent of the gross supply of Italian and Spanish medium- and long-term bonds.

MONETIZING THE DEBT, BY ANY OTHER NAME...

Demeter

(85,373 posts)John D. Rockefeller Sr. epitomized Gilded Age capitalism. Ida Tarbell was one of the few willing to hold him accountable...At the age of 14, Ida Tarbell witnessed the Cleveland Massacre, in which dozens of small oil producers in Ohio and Western Pennsylvania, including her father, were faced with a daunting choice that seemed to come out of nowhere: sell their businesses to the shrewd, confident 32 year-old John D. Rockefeller, Sr. and his newly incorporated Standard Oil Company, or attempt to compete and face ruin. She didn’t understand it at the time, not all of it, anyway, but she would never forget the wretched effects of “the oil war” of 1872, which enabled Rockefeller to leave Cleveland owning 85 percent of the city’s oil refineries.

Tarbell was, in effect, a young woman betrayed, not by a straying lover but by Standard Oil’s secret deals with the major railroads—a collusive scheme that allowed the company to crush not only her father’s business, but all of its competitors. Almost 30 years later, Tarbell would redefine investigative journalism with a 19-part series in McClure’s magazine, a masterpiece of journalism and an unrelenting indictment that brought down one of history’s greatest tycoons and effectively broke up Standard Oil’s monopoly. By dint of what she termed “steady, painstaking work,” Tarbell unearthed damaging internal documents, supported by interviews with employees, lawyers and—with the help of Mark Twain—candid conversations with Standard Oil’s most powerful senior executive at the time, Henry H. Rogers, which sealed the company’s fate.

She became one of the most influential muckrakers of the Gilded Age, helping to usher in that age of political, economic and industrial reform known as the Progressive Era. “They had never played fair,” Tarbell wrote of Standard Oil, “and that ruined their greatness for me.”

MORE

NOW, THERE'S A WOMAN WHO KNEW HOW TO HOLD A GRUDGE!

Demeter

(85,373 posts)There are a couple of current obvious efforts to pull the wool off our eyes: 9/11 and Edward Snowden; previous efforts include the Kennedy and MLK assassinations, Watergate, and the Pentagon Papers. Results have been mixed...

Edward Snowden: The Untold Story/The Most Wanted Man In The World By James Bamford

http://www.informationclearinghouse.info/article39399.htm

Demeter

(85,373 posts)If you’ve been following the markets for the last three weeks, you’ve probably figured out that something is wrong. The markets are no longer behaving the way they should, and that has people worried. Very worried. In the last 15 trading days, the Dow Jones has experienced an unprecedented 13 triple-digit days, which means that stocks have been sharply rising and falling without any rhyme or reason. The financial media has tried to explain-away the extreme volatility by pointing to slower growth in China, troubles in the Emerging Markets or various dismal data-points. But none of these adequately explain what’s going on. What’s really going on is a tug-of-war between current high stock valuations–which are the product of Fed intervention–and much lower valuations, which are based on fundamentals. Some analysts think that the volatility indicates that the Fed’s zero rates policy has damaged the market’s price-setting mechanism, that six years of overmedication has spawned an unresponsive, drug-addled system that can no longer perform its primary function. This is a persuasive argument, but it’s wrong. In fact, stock valuations are not really inflated at all given the colossal amount of support they’ve gotten from QE and zirp. (Zero interest rate policy) Since 2009, the Fed has made it clear that it is committed to asset-price inflation as a way create the “wealth effect” which is supposed to stimulate growth. Naturally, investors followed the Fed’s lead and took on more credit risk, reached for more yield, and loaded up on stocks and bonds confident that the Fed had their back. And the Fed did have their back. The “Bernanke Put” is a term that reflects investors confidence that the Fed would prevent stocks from falling too fast or too sharply. And the Fed has honored that commitment. Stocks have more than doubled in a six year, Fed-fueled “monster” rally.

The point is, the Fed’s policy is the issue not the market. The market is not a sentient being. It merely responds to input, the buying and selling of paper and the reporting of prices. But the market DOES send signals, and the signal it’s sending now is that there is a vast disparity between stock prices with Fed support and stock prices without Fed support. You see, investors are still uncertain about the way this is all going to shake out. Is the Fed going launch a cycle of rate hikes or keep rates at zero? That’s what everyone wants to know. One group of investors think the Fed will move ahead and start to “normalize” rates while the other thinks the Fed will stand pat. The group that anticipates a rate hike, thinks stocks are overpriced and will drop precipitously. Conversely, the group that thinks the Fed will stand pat, believes stocks are fairly priced and could go higher still. It’s the competing expectations of these two main groups that’s causing the extreme volatility. Each group thinks they know what stocks are worth, but they’ve based their calculations on ‘what they think the Fed will do’.

Does the Fed understand this? Does the Fed realize that investors have already repriced stocks according to their own assumptions about rate hikes? Does the Fed see the vast disparity between stock prices “with” a rate increase and stock prices “without” a rate increase? And is the Fed prepared to initiate a cycle of rate increases (in the name of “normalization”) that could send stocks plunging by 50 or 60 percent? I don’t think so. The Fed is so blinded by fear, it doesn’t seem to know whether its coming or going. Sure, they talk about normalization, but are they really going to end the meddling and allow the markets to function according to normal supply-demand dynamics? Not a chance. What the Fed wants is normalization on its own terms, that is, permanent high stock valuations and a free market where prices are determined by fundamentals. Unfortunately, the two are mutually exclusive, which is why the Fed is in such a quandary. There’s simply no way to undo the extreme accommodating policies that tripled the value of stocks and created the biggest bond bubble in history without reversing their impact on the market. The Fed isn’t prepared for that. No one is. So there’s not going to be any return to normal, not in the foreseeable future at least.

Yes, the Fed can (probably) safely raise rates by a .25 basis points without too much risk. But if the Fed indicates its determination to normalize rates via a cycle of rate increases, the stock market will crash before the increases ever go into effect. That much is certain. The Fed is probably aware that its meddling has greatly effected the credibility of US markets, but it simply doesn’t have the guts to put things back in order. The pain would just be too much to bear. That’s why the volatility will persist while more and more investors head for the exits.

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

THIS QUALIFIES, IN MY BOOK, AS ANOTHER CONSPIRACY. WHAT WERE THEY THINKING??!!

Demeter

(85,373 posts)China’s wealthiest classes have secured their recent fortunes through various means, both legal and illegal: These include (1) the privatization of public enterprises; (2) the savage exploitation of cheap labor after destroying workers rights , protections and social welfare legislation; (3) large-scale, long-term corruption of government officials; (4) the often violent state-sponsored land-grabs from towns, villages and farmers and the land transfer to private investors; (5) real estate speculation; (6) changes in state regulatory policies leading to oligopolistic control of markets; (7) large-scale tax evasion, money laundering and offshore transfers of profits and (8) state policies dictating low wage and salaries and repressing workers collective action.

ALSO COMPLETE DESTRUCTION OF THE ENVIRONMENT...

China’s capitalist development was based on a triple alliance of national, foreign and state capitalists, all of whom depended on the widespread, massive corruption of state-party officials...

Faced with a major loss of political legitimacy, the stagnation of its global export markets, a real estate bubble and stock market volatility, the Chinese government launched a wide-reaching rectification campaign which featured:

- A massive anti-corruption campaign was launched to restore morality to the government and to win back public respect. Over 250,000 corrupt officials were identified, investigated and tried. Many were imprisoned or dismissed and some were executed.

- Reform of wage and income policies was designed to reduce inequalities and encourage domestic consumption. As a result wages rose 10% annually.

- The investigation and prosecution of speculators, including investors connected to foreign hedge funds and big oligarchs who had gained gaining billions by “defrauding” retail investors, was initiated by the judiciary.

- The Chinese currency, the renminbi, was devalued to promote exports.

- The government increased military spending in order to confront the US naval encirclement, including upgrading its of most sophisticated weapons systems, which were on display recently during China’s massive ‘Victory over Japan’ parade.

- Two new international investment-financial organizations was set up to counter the US dominated IMF and World Bank and to encourage the participation of regional trade partners as a response to Washington’s Asia Pacific trade arrangements which specifically excluded China.

- Greater emphasis is now placed on providing domestic government services, enforcing tax collection, broadening social welfare legislation and social accountability.

- Measures are being implemented to prevent the flight of Chinese capital by oligarch families as they flee criminal prosecution for their illicit business activities.

MUCH MORE

Demeter

(85,373 posts)...it is not us, as a collective, who is responsible for this catastrophic state of affairs. It is a relatively small number of people, each of whom is quite insane. And it is these people who drive the decisions being made in our world that have, for example, created the current refugee crisis in Europe.

These people seek power, profit and personal privilege at the expense of the rest of us. They decide to destroy countries or regions because, in their insane worldview, it 'benefits' them to do so. The military destruction of a region might give them the power to share in the control of a resource or market. It might make them a profit. It might privilege them in relation to others in their (very limited) social world. The discourse in which these people are engaged is incredibly limited. It is always about control.

And the reason for this is simple: They are utterly terrified. They had all of their control taken from them as children and now seek it endlessly as highly dysfunctionalised adults. Adults who are insane: devoid of the love, compassion, empathy and sympathy that makes those of us who are normal respond with genuine concern to the plight of refugees and others who suffer.

So when you hear people – whether it be politicians, corporate figures, academics, military leaders or media personnel – justify policies and actions, such as military violence, that lead to greater human suffering, remember that you are listening to someone who is seriously psychologically damaged. Conflict is not always easily resolved but it requires listening and understanding, as well as talking.

MORE

Demeter

(85,373 posts)WikiLeaks founder Julian Assange has opened up about his new book, 'The WikiLeaks Files', saying that Washington had plans to overthrow Syria's government long before the 2011 uprising began, the Russia Today channel reported on Thursday.

Assange referred to the chapter on Syria, which goes back to 2006. In that chapter is a cable from US Ambassador William Roebuck - who was stationed in Damascus - which apparently discusses a plan for the overthrow of the Assad government in Syria.

“That plan was to use a number of different factors to create paranoia within the Syrian government; to push it to overreact, to make it fear there's a coup...so in theory it says 'We have a problem with extremists crossing over the border with Iraq, and we're taking actions against them to take this information and make the Syrian government look weak, the fact that it is dealing with extremists at all,'” he said.

He added that the most serious part of the plan was to “foster tensions between Shiites and Sunnis. In particular, to take rumors that are known to be false...or exaggerations and promote them – that Iran is trying to convert poor Sunnis, and to work with Saudi and Egypt to foster that perception in order to make it harder for Iran to have influence, and also harder for the government to have influence in the population”.

MORE

Demeter

(85,373 posts)Mental manipulation can be backed by good intentions – but when used with stealth, it is deceitful and wrong...A couple of decades ago, a class of psychology undergraduates played a mean trick on their lecturer. The students on the right side of the room gently nodded, smiled, and looked thoughtful, while those on the left seemed bored and glum. Before long, the unsuspecting lecturer was addressing the “right” students with enthusiasm, with only the odd uncomfortable glance to the rest. On some secret sign, the students changed roles – and the lecturer duly switched to addressing students to the left. Memories are vague on how often the hapless lecturer was pushed to and fro.

The students’ hilarity was no doubt considerable, especially as the trick used one of the key principles they were being taught: that pigeons, rats or lecturers do more of what is rewarded, and less of what is punished. But how did the lecturer feel when the trick was revealed? In his shoes, I imagine myself trying to summon a brave laugh, but feeling pretty dreadful. Even where no malice is intended, the sense of having been manipulated is hurtful indeed.

So what is manipulation, and why do we hate it? I think it is best viewed as behaviour with the purpose of influencing another person, but which works only if that purpose is concealed. For example, the secret planning of the students’ smiles and frowns was crucial to their scheme’s success. It is the secrecy that really outrages us (with a tinge of humiliation, perhaps, because we were taken in). Manipulation is a form of deceit.

I was reminded of this in a recent talk by the guru of persuasion research, Professor Robert Cialdini of Arizona State University. He eloquently summarised the key forces that persuade us, including the principle that we tend to believe people we like. At the end of his talk, he said he had deliberately begun his presentation with a broad smile: to make us like us like him and, crucially, therefore to believe him....MORE

Demeter

(85,373 posts)So the upshot is: let’s say no to manipulation – that is, to influence by stealth or deception. This should apply to how governments treat us, and to how we treat each other. (And, just in case any of my students are reading this, it also means no tricks on lecturers.)

Demeter

(85,373 posts)WHAT THE F*** ARE THEY THINKING, ANNOUNCING THIS? DO THEY WANT TO BE BOMBED OUT OF EXISTENCE?

http://www.reuters.com/article/2015/09/12/us-iran-nuclear-uranium-idUSKCN0RC0A020150912?feedType=RSS&feedName=topNews

Iran has discovered an unexpectedly high reserve of uranium and will soon begin extracting the radioactive element at a new mine, the head of Iran's Atomic Energy Organisation said on Saturday.

The comments cast doubt on previous assessments from some Western analysts who said the country had a low supply and would sooner or later would need to import uranium, the raw material needed for its nuclear program.

Any indication Iran could become more self-sufficient will be closely watched by world powers, which reached a landmark deal with Tehran in July over its program. They had feared the nuclear activities were aimed at acquiring the capability to produce atomic weapons - something denied by Tehran.

"I cannot announce (the level of) Iran's uranium mine reserves. The important thing is that before aerial prospecting for uranium ores we were not too optimistic, but the new discoveries have made us confident about our reserves," Iranian nuclear chief Ali Akbar Salehi was quoted as saying by state news agency IRNA.

Salehi said uranium exploration had covered almost two-thirds of Iran and would be complete in the next four years...

THE ISRAELIS ARE GOING TO GO APE

Demeter

(85,373 posts)European leaders narrowly avoided seeing Greece crash out of the euro zone this summer with a last-minute third bailout deal, but with a snap election in just over a week, the Aegean nation is once again dominating the continent's political and economic agenda.

Euro zone finance ministers, better known as the Eurogroup, are meeting in Luxembourg on Saturday to discuss the latest developments in Greece, and how they could affect the first review of the country's 86 billion euro ($97.4 billion) bailout due in October.

Speaking ahead of the meeting, Jeroen Djisselbloem, president of the Eurogroup, told reporters in Luxembourg that work needed to continue on the bailout despite political uncertainty in Greece.

"I think it's important in Greece that the preparations continue while the political situation is of course unclear at the moment," Djisselbloem said...MORE

PREPARATIONS FOR WHAT, ONE MIGHT ASK...HAVEN'T THEY DONE ENOUGH, YET?

Demeter

(85,373 posts)THE 1% ARE GETTING VERY, VERY NERVOUS--THIS IS FROM FORBES, THEIR VANITY PRESS

http://www.forbes.com/sites/billwhalen/2015/09/11/is-socialism-here-to-stay-or-is-sanders-just-another-dean/

From September 1972 to March 1973 – the same time Hillary Clinton was attending Yale Law and the only servers she knew were the ones ladling out grub at the school cafeteria – CBS ran a situation comedy called Bridget Loves Bernie. The show was controversial as it involved a wealthy Irish girl settling down with a Jewish cab driver, And it was short-lived – yanked from network’s powerhouse Saturday night lineup after only 24 episodes despite solid ratings....As we’re now under five months to the Iowa caucuses, the question is: does America love Bernie? As in: Vermont Sen. Bernie Sanders, who last week inched ahead of Mrs. Clinton in one Iowa poll while also enjoying a lead in New Hampshire. This raises two questions:

1) Has either of the major parties ever nominated someone who wasn’t a credentialed member of said party (Sanders being a “Democratic socialist”)?

2) Should we interpret Sanders’ surge as an indication that Americans are comfortable with the notion of socialism?

About that latter point: here’s a story from Voice of America suggesting that socialism is all-of-a-sudden chic. It builds on a Gallup Poll from earlier this year which found that 69% of respondents ages 18-29 were cool with voting for a socialist presidential candidate. And there’s this Politico article which explains Sanders as an ideological heir to Eugene Debs, the oft-time Socialist candidate of a century ago, albeit with a realpolitik twist: “Sanders is running as a Democrat because he understands that his hopes lie not in creating an alternative to the Democratic Party, but rather in getting the party’s leaders, including likely nominee Hillary Clinton, to embrace the left-liberal policies he favors. It’s significant, too, that rather than offering grand plans to nationalize private industries or impose confiscatory taxes, Sanders is pushing what are essentially liberal policies like breaking up big banks, funding infrastructure and taxing financial transactions. After years of Republicans complaining about Barack Obama being a “socialist,” Sanders is making clear just how moderate the incumbent administration is.”

There’s another way to view Bernie Sanders and it’s a one-word description – a four-letter word, actually: D-e-a-n. Before Sanders disrupted this year’s Democratic contests, there was 2003 and the summer of Howard Dean, the former governor of Vermont. Like Sanders, Dean was a novelty act (arguably the first presidential candidate to harness the Internet; and like Sanders, he had the luxury of running as a fiery liberal to the milquetoast alternative of John Kerry). Now the big question: does Sanders have the kind of legs that Dean didn’t (Dean dropping out of the 2004 race after crashing and burning in Iowa, New Hampshire and Wisconsin).

The Vermont senator’s campaign shows signs of being more than a summer fling – its hiring staff, figuring a delegate strategy and developing a volunteer corps (cue the Eugene McCarthy parallels). And he’s received some kind words (sort of) from Dean: “People like Bernie are always attractive, as I was. They speak truth to power. The problem with candidates like that – and like me – is that as you get closer to election time, you’re more careful about how your vote’s going to be used. You’re going to tend to want to see somebody who thinks looks presidential as the nominee of your party. That’s one of the things that sank me. I know that as an insurrectionist, I wasn’t going to get elected by my party to be the nominee. I just had a lot of trouble turning a corner from being an insurrectionist to being somebody who people could see as president.”

In other words, Bernie the Socialist is pretty much the same flawed, enjoy-him-while-you-can guy as Donald the Capitalist? Well, not exactly. Sanders’ effort is policy-rich; Trump’s diet is ideas-lite. If there were such a thing as a national primary and it were held next week, Trump likely would prevail on the GOP side, with Sanders would lose to Clinton.

But one thing Sanders can boast: his super PAC just got a check from 007. That puts Daniel Craig on the same team with Danny DeVito, Mia Farrow, Mark Ruffalo and Susan Sarandon – a better cast than Weekend At Bernie’s.

Shall we call the Democratic race “shaken, not stirred”?

SINCE BERNIE DOESN'T HAVE A SUPER PAC, I HAVE NO IDEA WHAT THIS AUTHOR HAS BEEN DRINKING....VODKA MARTINIS?

Demeter

(85,373 posts)Daniel Craig donated almost $50,000 to a super PAC that claims to support Democratic presidential candidate Bernie Sanders, but a Washington public interest group has raised questions about the organization’s legitimacy.

Craig’s publicist, Laura Symons, confirmed to Variety that he had made a donation.

But the investigative organization Center for Public Integrity, in a report posted on Thursday, is questioning whether Craig and many other donors may have been “duped” into giving to the super PAC, Americans Socially United, citing its failure to file forms with the Federal Election Commission and requests from Sanders’ official campaign to cease their activities.

Sanders himself has criticized the role of super PACs in the election, even if his campaign cannot stop such independent groups from working in support of his candidacy...

Fuddnik

(8,846 posts)It's an automatic monthly deduction. But, not $50,000 worth. Not even $50 worth monthly.

mother earth

(6,002 posts)which case, I'm guessing those billionaires donate what they will.

Demeter

(85,373 posts)...in a bureaucratic system – where revenues are determined not by customer satisfaction, but by complicated payment formulas – they tend to wake up and ask: How can I get more money out of the payment formulas today? In the Medicare Advantage program you can find both types of entrepreneurship.

Imagine that UnitedHealth care or Humana or Cigna discovered away to cut health care costs in half – with no reduction in quality or in access to care. The stock price of the company that made this discovery would go through the roof. Right? Not quite. Under rules imposed by the Obama administration, the company would be forced to give virtually all of its newfound profit back to Medicare. Here’s why. Under the “Medical Loss Ratio” requirement, a health plan is required to spend at least 85 percent of its premium income on health care. Let’s say a health plan was doing that. After the discovery of a way to cut those costs in half, it would be spending only 42.5 percent of premium income on health care. Not only would the health plan be forced to give all of its savings back to Medicare, it could actually be fined and kicked out of the Medicare Advantage program for spending so little!

With those incentives in place, do you think any of the MA plans are going to be discovering ways to realize huge cost savings anytime soon?

Here is what the heath plans are doing instead. Increasingly, they are contracting with independent doctor associations, typically managed by entrepreneurs. There is no medical loss ratio rule governing these entities. If they find a way to cut health care costs in half they can take the savings right to the bank. Not only that, they can actually share the savings with the health plan that farmed out the business to them – and Medicare doesn’t get any of that.

Demeter

(85,373 posts)Twenty-First Century America is so weirdly prodigal of resources, and yet so ancien regime with systems, that we have not one, not two, not three, not four, but five single payer systems, none of them integrated with each other, and directed at different siloed populations:

The truth is that the United States already uses single-payer systems to cover over 47% of all medical bills through Medicare, Medicaid, the Veterans Administration, the Department of Defense and the Bureau of Indian Affairs.

In this post, I want to look at the “Veterans Choice Card,” a partial privatization effort at the Department of Veterans Administration (VA) under the “Choice Program,” more formally the “The Veterans Access, Choice and Accountability Act,” introduced and rapidly passed in response to the 2014 patient wait time scandal, and brokered by Senators John McCain (R-AZ) and Bernie Sanders (I-VT). As a caveat, this is the first time I’ve looked at the VA, which is why I’m limiting the scope of this post to the Veterans Choice Card, instead of trying to understand the entire VA and all its problems. I’ll start by taking a high-level look at the VA, then look at the Choice Program and the Veterans Choice Card, and finally at privatization as in issue in the coming 2016 campaign....

SEE LINK

Demeter

(85,373 posts)By Joram Mayshar, Professor Emeritus in Economics, Hebrew University of Jerusalem, Omer Moav, Professor of Economics, University of Warwick and Interdisciplinary Center Herzliya, Zvika Neeman, Professor of Economics at the Berglas School of Economics, Tel Aviv University, and Luigi Pascali, Assistant Professor, University of Warwick and Pompeu Fabra University.

ABSTRACT: Conventional theory suggests that hierarchy and state institutions emerged due to increased productivity following the Neolithic transition to farming. This column argues that these social developments were a result of an increase in the ability of both robbers and the emergent elite to appropriate crops. Hierarchy and state institutions developed, therefore, only in regions where appropriable cereal crops had sufficient productivity advantage over non-appropriable roots and tubers.

What Explains Underdevelopment?

One of the most pressing problems of our age is the underdevelopment of countries in which government malfunction seems endemic. Many of these countries are located close to the Equator.1 Acemoglu et al. (2001) point to extractive institutions as the root cause for underdevelopment. Besley and Persson (2014) emphasise the persistent effects of low fiscal capacity in underdeveloped countries. On the other hand, Diamond (1997) argues that it is geographical factors that explain why some regions of the world remain underdeveloped. In particular, he argues that the east-west orientation of Eurasia resulted in greater variety and productivity of cultivable crops, and in larger economic surplus, which facilitated the development of state institutions in this major landmass. Less fortunate regions, including New Guinea and sub-Saharan Africa, were left underdeveloped due to low land productivity.

In a recent paper (Mayshar et al. 2015), we contend that fiscal capacity and viable state institutions are conditioned to a major extent by geography. Thus, like Diamond, we argue that geography matters a great deal. But in contrast to Diamond, and against conventional opinion, we contend that it is not high farming productivity and the availability of food surplus that accounts for the economic success of Eurasia.

We propose an alternative mechanism by which environmental factors imply the appropriability of crops and thereby the emergence of complex social institutions.

To understand why surplus is neither necessary nor sufficient for the emergence of hierarchy, consider a hypothetical community of farmers who cultivate cassava (a major source of calories in sub-Saharan Africa, and the main crop cultivated in Nigeria), and assume that the annual output is well above subsistence. Cassava is a perennial root that is highly perishable upon harvest. Since this crop rots shortly after harvest, it isn’t stored and it is thus difficult to steal or confiscate. As a result, the assumed available surplus would not facilitate the emergence of a non-food producing elite, and may be expected to lead to a population increase.

Consider now another hypothetical farming community that grows a cereal grain – such as wheat, rice or maize – yet with an annual produce that just meets each family’s subsistence needs, without any surplus. Since the grain has to be harvested within a short period and then stored until the next harvest, a visiting robber or tax collector could readily confiscate part of the stored produce. Such ongoing confiscation may be expected to lead to a downward adjustment in population density, but it will nevertheless facilitate the emergence of non-producing elite, even though there was no surplus...

Demeter

(85,373 posts)...recent discoveries suggest that the adoption of agriculture, supposedly our most decisive step toward a better life, was in many ways a catastrophe from which we have never recovered. With agriculture came the gross social and sexual inequality, the disease and despotism, that curse our existence.

At first, the evidence against this revisionist interpretation will strike twentieth century Americans as irrefutable. We're better off in almost every respect than people of the Middle Ages, who in turn had it easier than cavemen, who in turn were better off than apes. Just count our advantages. We enjoy the most abundant and varied foods, the best tools and material goods, some of the longest and healthiest lives, in history. Most of us are safe from starvation and predators. We get our energy from oil and machines, not from our sweat. What neo-Luddite among us would trade his life for that of a medieval peasant, a caveman, or an ape?

For most of our history we supported ourselves by hunting and gathering: we hunted wild animals and foraged for wild plants. It's a life that philosophers have traditionally regarded as nasty, brutish, and short. Since no food is grown and little is stored, there is (in this view) no respite from the struggle that starts anew each day to find wild foods and avoid starving. Our escape from this misery was facilitated only 10,000 years ago, when in different parts of the world people began to domesticate plants and animals. The agricultural revolution spread until today it's nearly universal and few tribes of hunter-gatherers survive.

From the progressivist perspective on which I was brought up, to ask "Why did almost all our hunter-gatherer ancestors adopt agriculture?" is silly. Of course they adopted it because agriculture is an efficient way to get more food for less work. Planted crops yield far more tons per acre than roots and berries. Just imagine a band of savages, exhausted from searching for nuts or chasing wild animals, suddenly grazing for the first time at a fruit-laden orchard or a pasture full of sheep. How many milliseconds do you think it would take them to appreciate the advantages of agriculture? The progressivist party line sometimes even goes so far as to credit agriculture with the remarkable flowering of art that has taken place over the past few thousand years. Since crops can be stored, and since it takes less time to pick food from a garden than to find it in the wild, agriculture gave us free time that hunter-gatherers never had. Thus it was agriculture that enabled us to build the Parthenon and compose the B-minor Mass.

While the case for the progressivist view seems overwhelming, it's hard to prove. How do you show that the lives of people 10,000 years ago got better when they abandoned hunting and gathering for farming? Until recently, archaeologists had to resort to indirect tests, whose results (surprisingly) failed to support the progressivist view. Here's one example of an indirect test: Are twentieth century hunter-gatherers really worse off than farmers? Scattered throughout the world, several dozen groups of so-called primitive people, like the Kalahari bushmen, continue to support themselves that way. It turns out that these people have plenty of leisure time, sleep a good deal, and work less hard than their farming neighbors. For instance, the average time devoted each week to obtaining food is only 12 to 19 hours for one group of Bushmen, 14 hours or less for the Hadza nomads of Tanzania. One Bushman, when asked why he hadn't emulated neighboring tribes by adopting agriculture, replied, "Why should we, when there are so many mongongo nuts in the world?"

While farmers concentrate on high-carbohydrate crops like rice and potatoes, the mix of wild plants and animals in the diets of surviving hunter-gatherers provides more protein and a bettter balance of other nutrients. In one study, the Bushmen's average daily food intake (during a month when food was plentiful) was 2,140 calories and 93 grams of protein, considerably greater than the recommended daily allowance for people of their size. It's almost inconceivable that Bushmen, who eat 75 or so wild plants, could die of starvation the way hundreds of thousands of Irish farmers and their families did during the potato famine of the 1840s.

So the lives of at least the surviving hunter-gatherers aren't nasty and brutish, even though farmes have pushed them into some of the world's worst real estate. But modern hunter-gatherer societies that have rubbed shoulders with farming societies for thousands of years don't tell us about conditions before the agricultural revolution. The progressivist view is really making a claim about the distant past: that the lives of primitive people improved when they switched from gathering to farming. Archaeologists can date that switch by distinguishing remains of wild plants and animals from those of domesticated ones in prehistoric garbage dumps...

Besides malnutrition, starvation, and epidemic diseases, farming helped bring another curse upon humanity: deep class divisions. Hunter-gatherers have little or no stored food, and no concentrated food sources, like an orchard or a herd of cows: they live off the wild plants and animals they obtain each day. Therefore, there can be no kings, no class of social parasites who grow fat on food seized from others. Only in a farming population could a healthy, non-producing elite set itself above the disease-ridden masses. Skeletons from Greek tombs at Mycenae c. 1500 B. C. suggest that royals enjoyed a better diet than commoners, since the royal skeletons were two or three inches taller and had better teeth (on the average, one instead of six cavities or missing teeth). Among Chilean mummies from c. A. D. 1000, the elite were distinguished not only by ornaments and gold hair clips but also by a fourfold lower rate of bone lesions caused by disease...

Demeter